From $10,000 to 90x Returns: James Wynn's Roll-Over Legend and the Harsh Reality of Crypto Contract Trading

Turning $10,000 into $910,000 with just a few months—James Wynn's story of using rebate income to roll over profits and go long on PEPE and BTC reignited the crypto market's fantasy of high-leverage contracts. But behind these astonishing numbers, what trading secrets and hidden risks are lurking? In the current market environment of "liquidity fragility but resilient prices," how replicable are his strategies?

90x Roll-Over Myth: The Ultimate Leveraged Compound Interest

According to on-chain analyst Ember's monitoring, James Wynn's trading trajectory is essentially a "contract trading roller coaster history." Starting with just $10,000 in rebate income, he used floating profits to roll over (adding to positions with unrealized gains) pushing his account to $910,000, achieving 90x returns. The core of this strategy is compound interest combined with leverage—whenever floating profits increase, he adds margin to expand his position, creating a "profit generating profit" spiral.

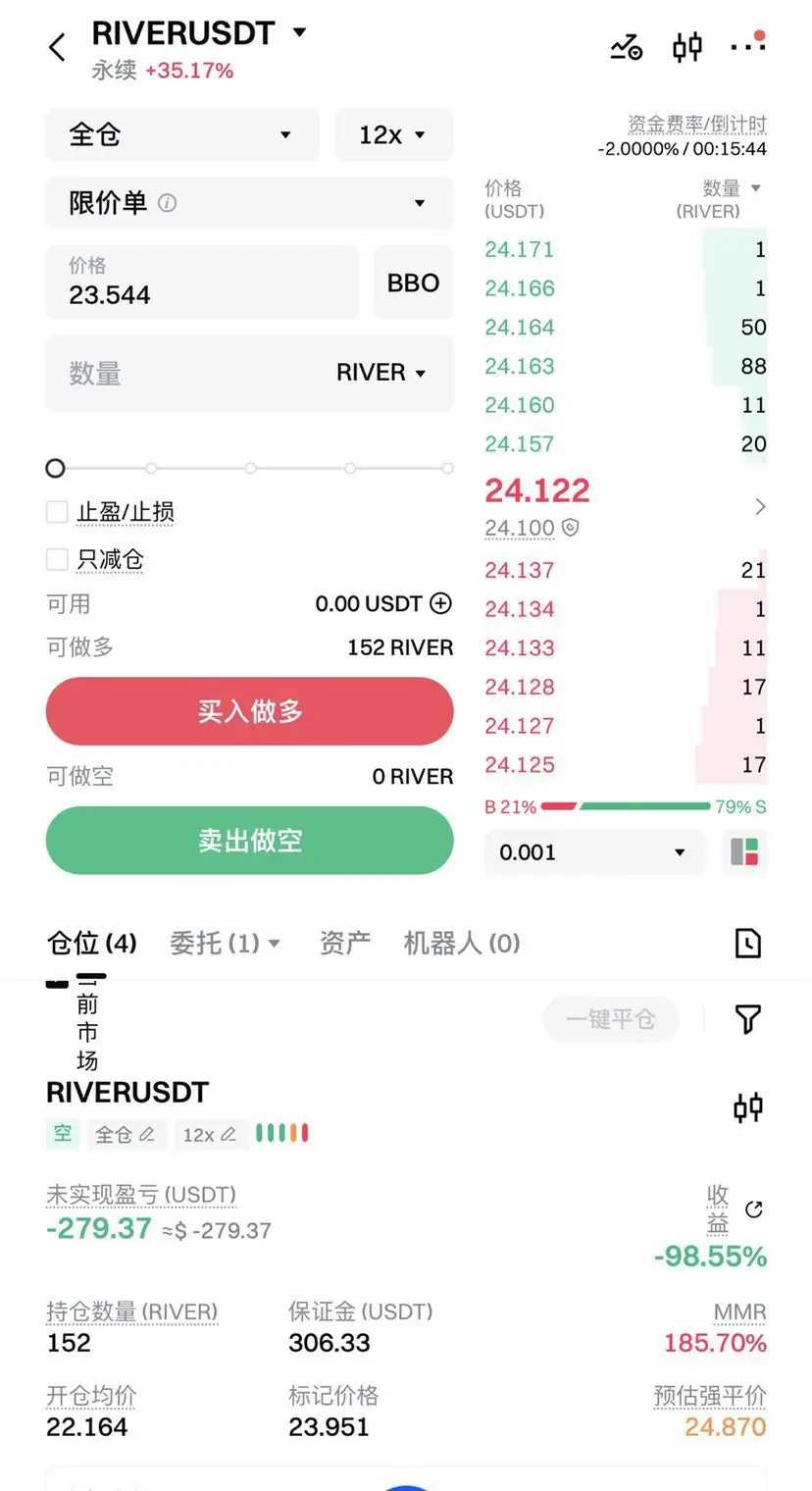

However, this is only the first half of the story. Timeline data shows that in May 2025, he hit a peak with floating profits exceeding $85 million, but by the end of the month, nearly all was given back; in July, his account dropped to a low of $450,000, nearly bankrupt; early 2026, he miraculously turned $20,000 into $600,000. This "get rich quick—liquidation—rebirth" cycle exemplifies the high-risk nature of contract trading.

Decoding the Trading Secrets: 40x Leverage and the Deadly Meme Coin Combo

James's key operational traits are clear:

1. Extremely high leverage preference: going long BTC with 40x leverage, and PEPE with 10x leverage. This means a mere **2.5%** adverse move in BTC can trigger liquidation, while Meme coins like PEPE often fluctuate 10% intraday as routine.

2. High-frequency rebalancing and emotional trading: he has been known to open positions and stop out within a single day, indicating reliance on short-term momentum rather than fundamentals. This "chasing highs and selling lows" can amplify gains in trending markets but quickly erode capital in sideways markets.

3. Aggressive capital management: he rarely withdraws profits, instead going all-in for reinvestment. This explains how his account value can surge to $85 million in a short time but also how a lack of risk buffers can wipe him out overnight.

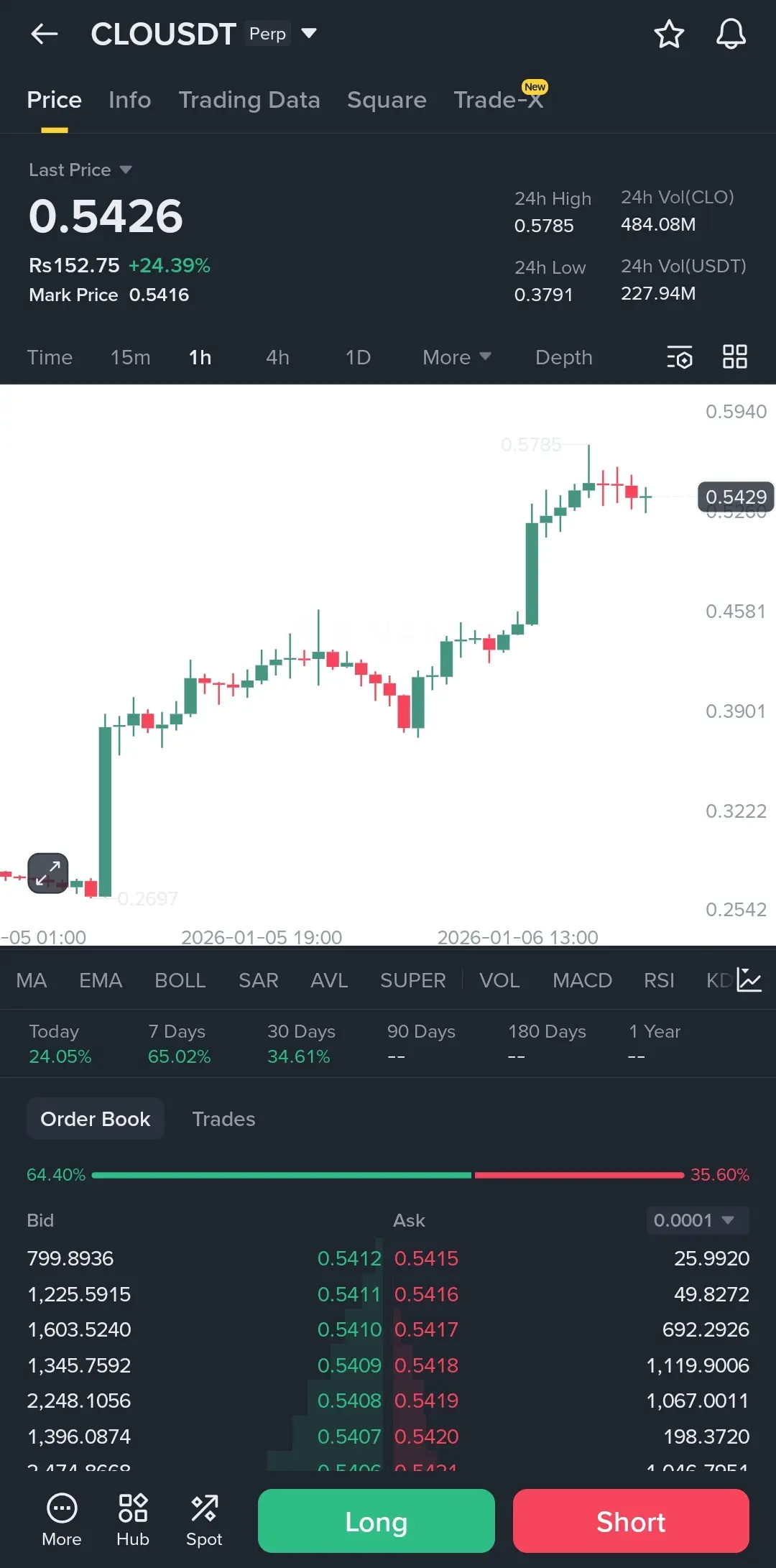

It's worth noting that the current market environment actually provides a "breeding ground" for such strategies—CoinDesk data shows Meme coins are rallying collectively in early 2026, with DOGE, SHIB, BONK all rebounding significantly, and CME crypto derivatives trading volume hitting a record average of $12 billion daily in 2025, indicating highly active speculation.

Current Market Environment: Liquidity Traps Beneath Price Frenzy

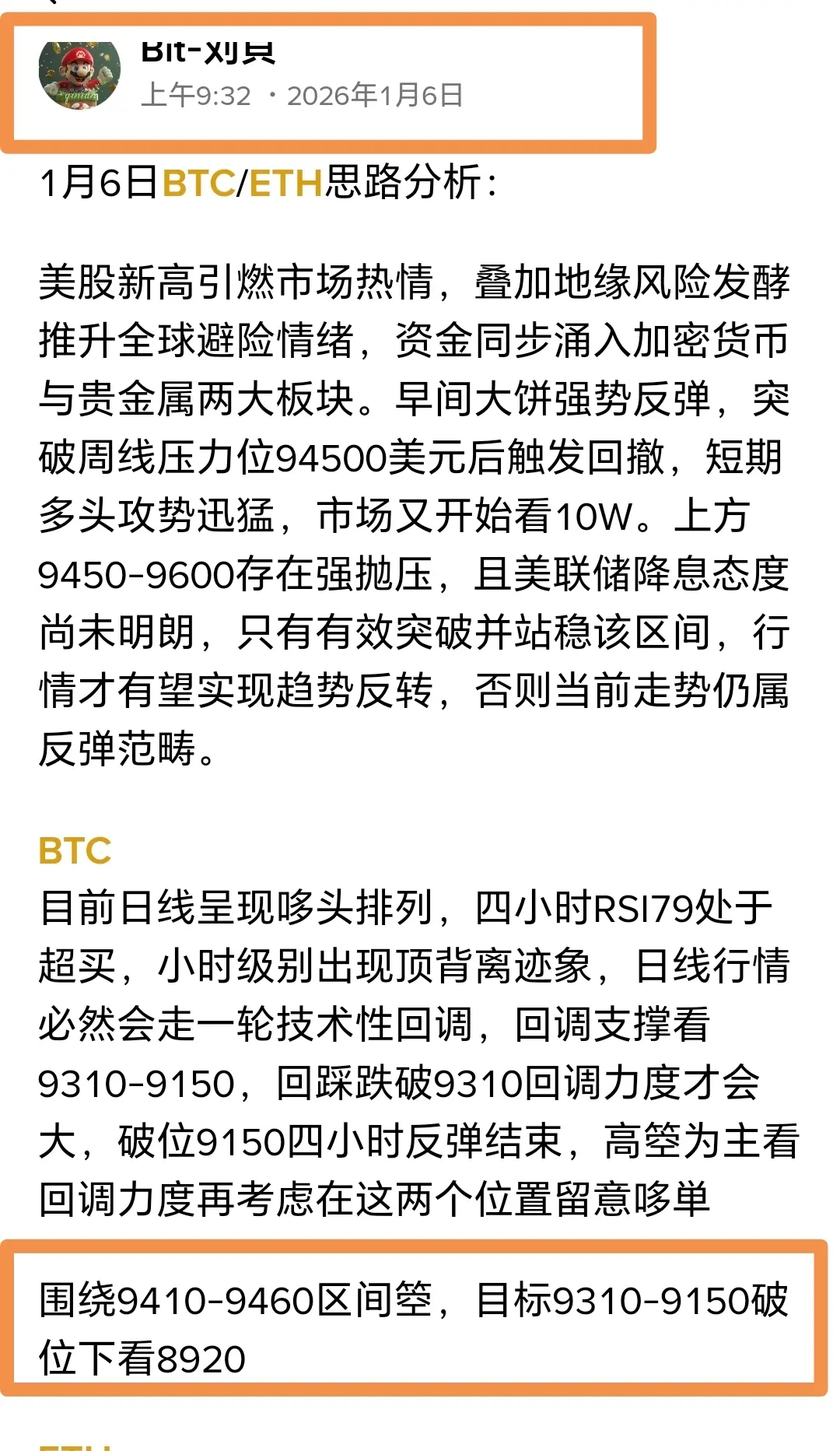

James's trading myth occurred under a special market backdrop. As of January 6, 2026, BTC hovers around $94,000, with analysts like Tom Lee predicting a new all-time high in January, but hidden dangers lurk in the market structure:

Liquidity crises are imminent: Glassnode data shows spot trading volume has fallen to its lowest since 2023. This indicates insufficient market depth, where large orders could cause severe slippage. For traders like James who roll over positions, profits are hard to realize, and sudden liquidation risks are high.

Split between institutions and retail: Goldman Sachs reports that regulatory clarity is driving institutional adoption, but data from platforms like Robinhood shows a surge in users of advanced trading tools, suggesting retail traders are being forced to "professionalize" to cope with volatility. James's public calls for trades may further attract follow-on orders, exacerbating market distortions.

ETF funds continue to flow out: physical Bitcoin ETF has seen four consecutive weeks of net outflows of $1.2 billion, indicating traditional funds are taking profits. Meanwhile, the booming derivatives market is mostly a zero-sum game of "handing assets from one side to the other."

Deadly Lessons: Survival Rules for High-Leverage Trading

James's case reveals a brutal reality: in crypto contracts, 90x returns do not mean a 90% win rate but could be a prelude to 100% liquidation.

Three reasons why this is non-replicable:

4. Survivor bias: countless traders using $10,000 to open 40x leverage positions have already been wiped out—99% are gone. Only James is monitored because he is still "alive" and astonishingly profitable.

5. Rebate cost advantage: his principal comes from rebate income, effectively "risk-free startup capital," whereas ordinary investors use their hard-earned money, with vastly different psychological resilience.

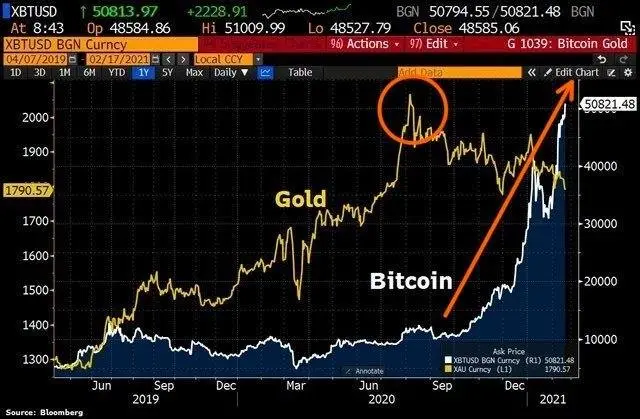

6. Timing cannot be recreated: the 2025 trend of BTC rising from $50,000 to $90,000 is the lifeline of the roll-over strategy, but current market volatility (Tom Lee warns of "extreme turbulence" in 2026) could make the same strategy fatal.

Strict rules if you insist on using leverage:

• Limit single-loss to no more than 2% of total funds: James's daily losses of tens of millions violate this principle.

• Leverage ratio ≤ 5x: beyond 5x, the probability of liquidation increases exponentially.

• Profit withdrawal mechanism: force a 30% withdrawal after every 50% profit, locking in gains.

• Never add to losing positions against the trend: roll-over only when floating profits exist; never add when in loss.

Conclusion: Legends Are for Admiration, Not Imitation

James Wynn's 90x gains are like witnessing someone walk a tightrope successfully at the edge of a cliff, leading others to believe they can copy. But in reality, every legend created in the contract market is backed by thousands of accounts blown up. The current market, fragile at $94,000, can trigger chain liquidations at any black swan event.

For 99% of investors, dollar-cost averaging in spot and strict stop-loss are the right paths. If you truly want to speculate, treat James's story as a cautionary tale—learn his market intuition but reject his risk management.

#加密货币 #合约交易 #风险管理 #BTC #PEPE *Found this article useful? Don't forget to:

• Follow us for more in-depth market analysis

• Like and support original content

• Comment and share your contract trading experiences (or painful lessons)

• Forward to that friend who always wants to open 50x leverage

• Leave a message telling us: do you think BTC will break $100,000 in 2026 or will it undergo a significant correction?

Investing involves risks. Enter the market cautiously. This article does not constitute investment advice. Please make decisions rationally.

$BTC