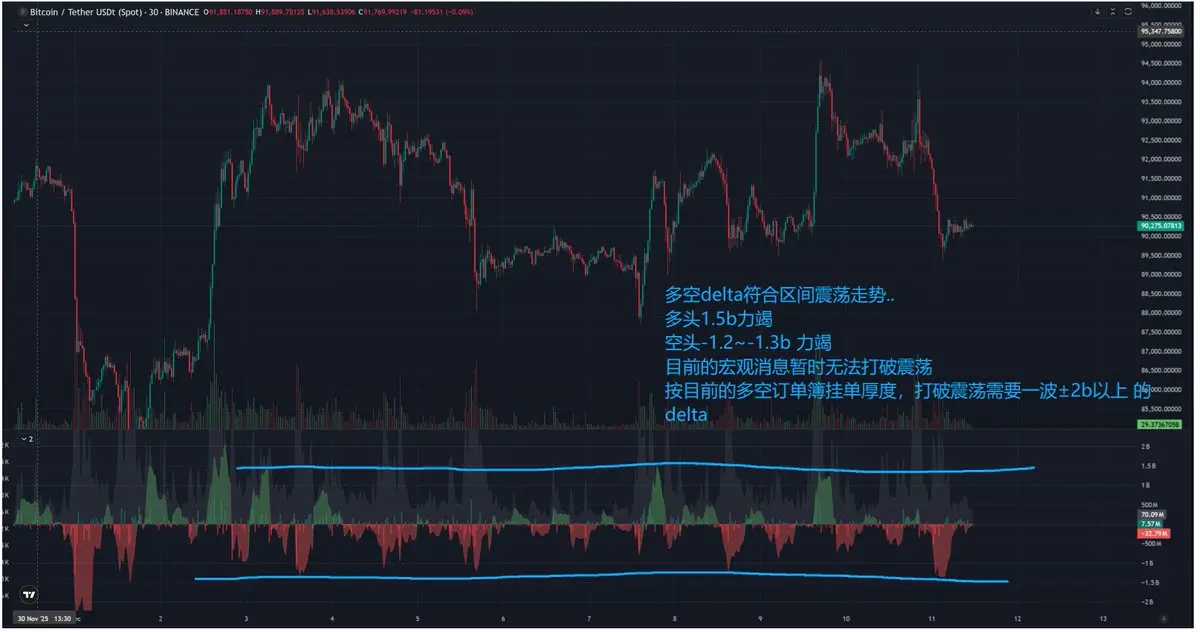

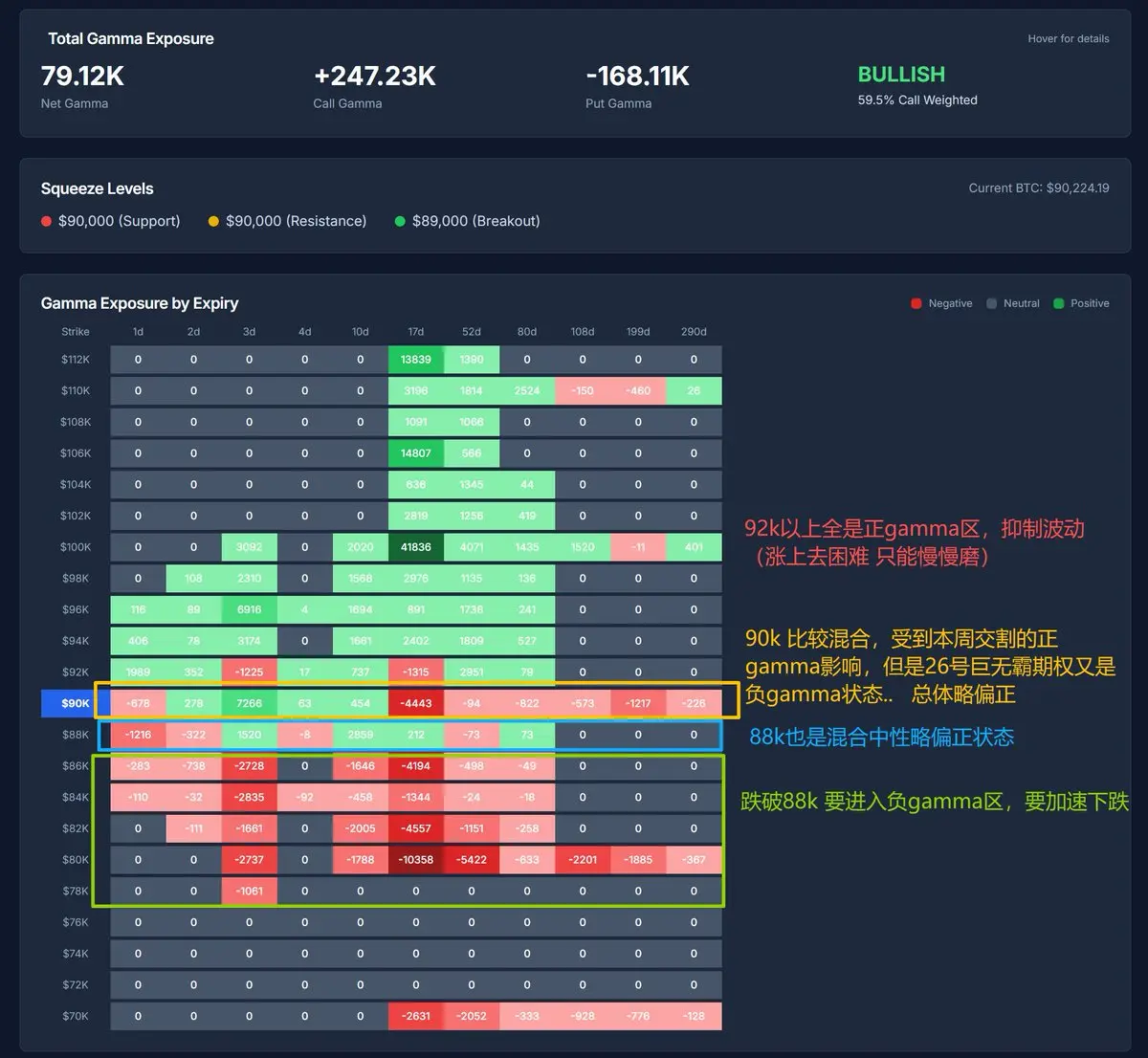

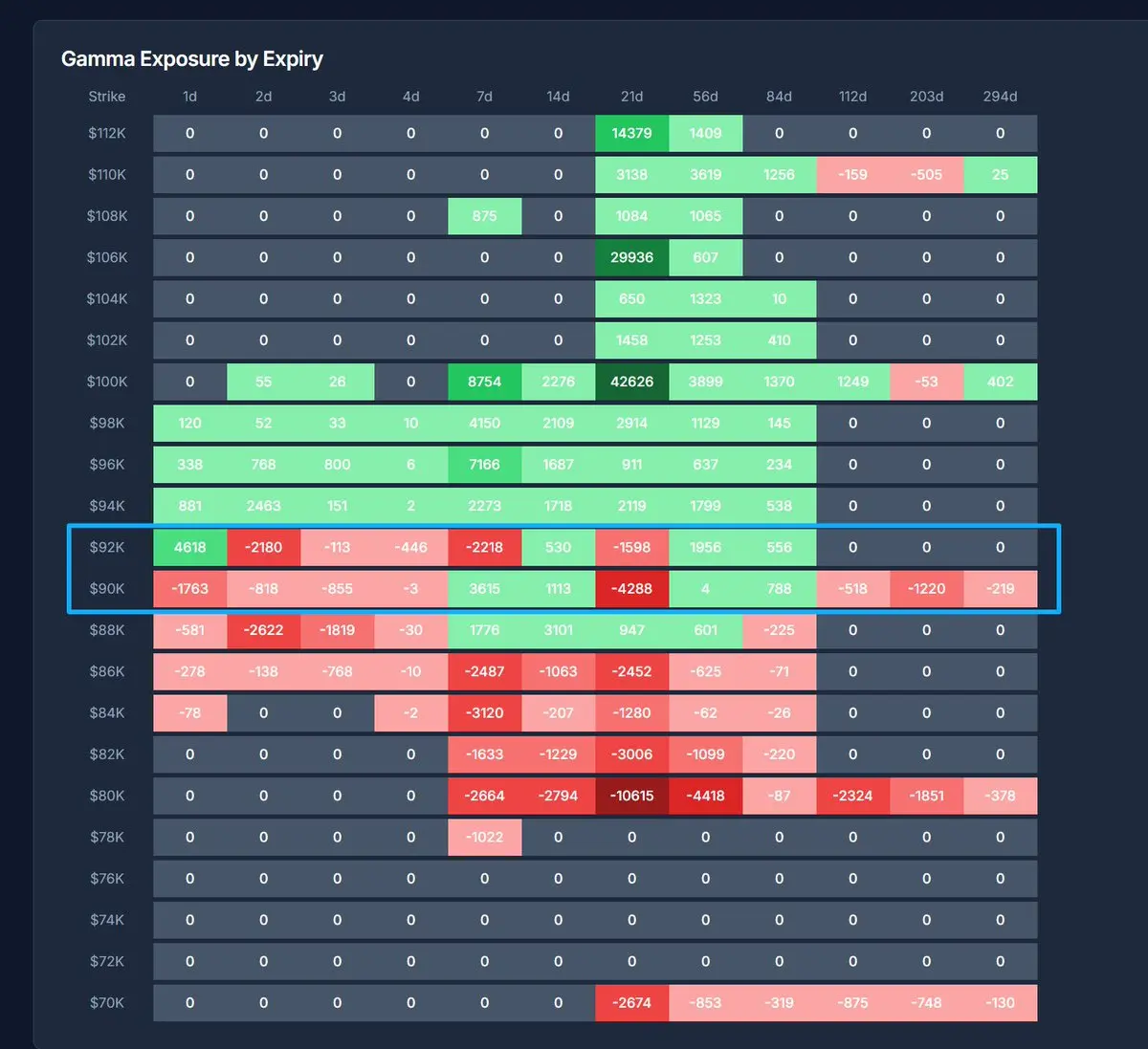

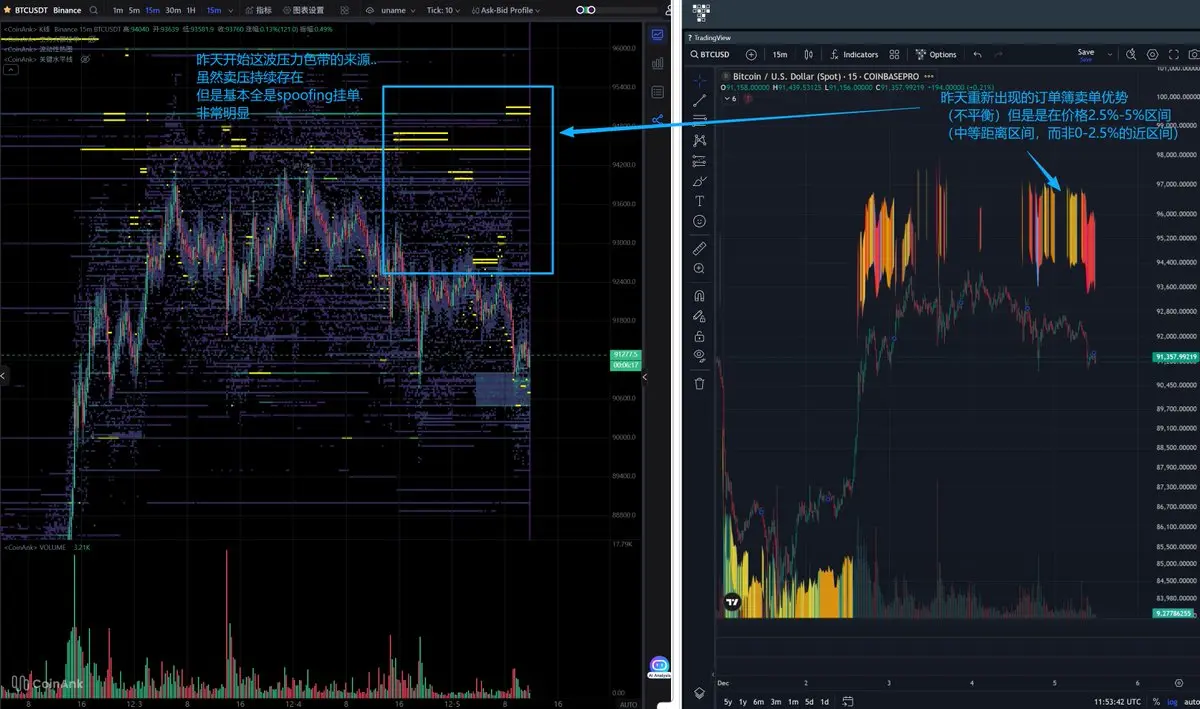

Ahead of the Fed meeting, options capital is betting on this scenario: no major blowups, no surges—ideally a slow rise...

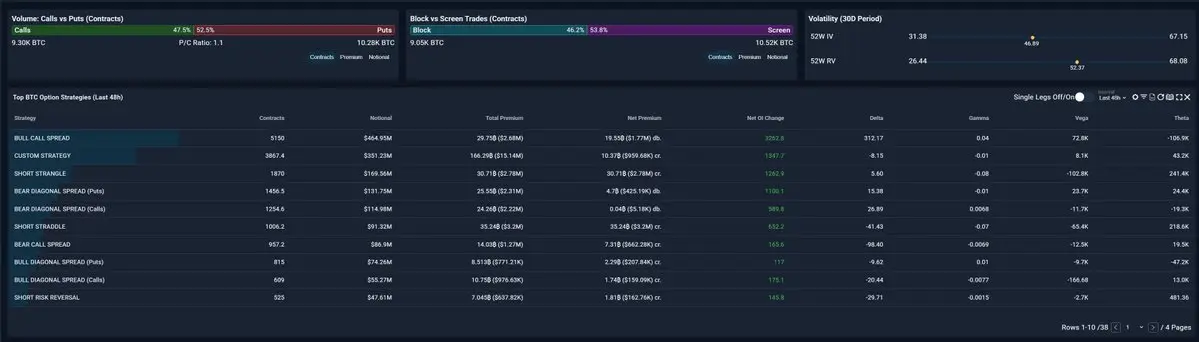

Continuing to study options, I just focused on the main strategies adopted by options capital over the past 48 hours. This gives insight into how they’re positioning for the market:

Top Strategy: Bull Call Spread (BULL CALL SPREAD) — “I want upside, but not too much”

The overall stance is bullish, making this the dominant voice in the options market over the past 48 hours.

However, by using a spread, they’re signaling there’s a ceiling to the upside (e.g., 95k or 100k). The

View Original