#WhenWillBTCRebound?

📊 BTC Market Deep Dive: Extreme Fear, Liquidity Stress, and Rebound Potential

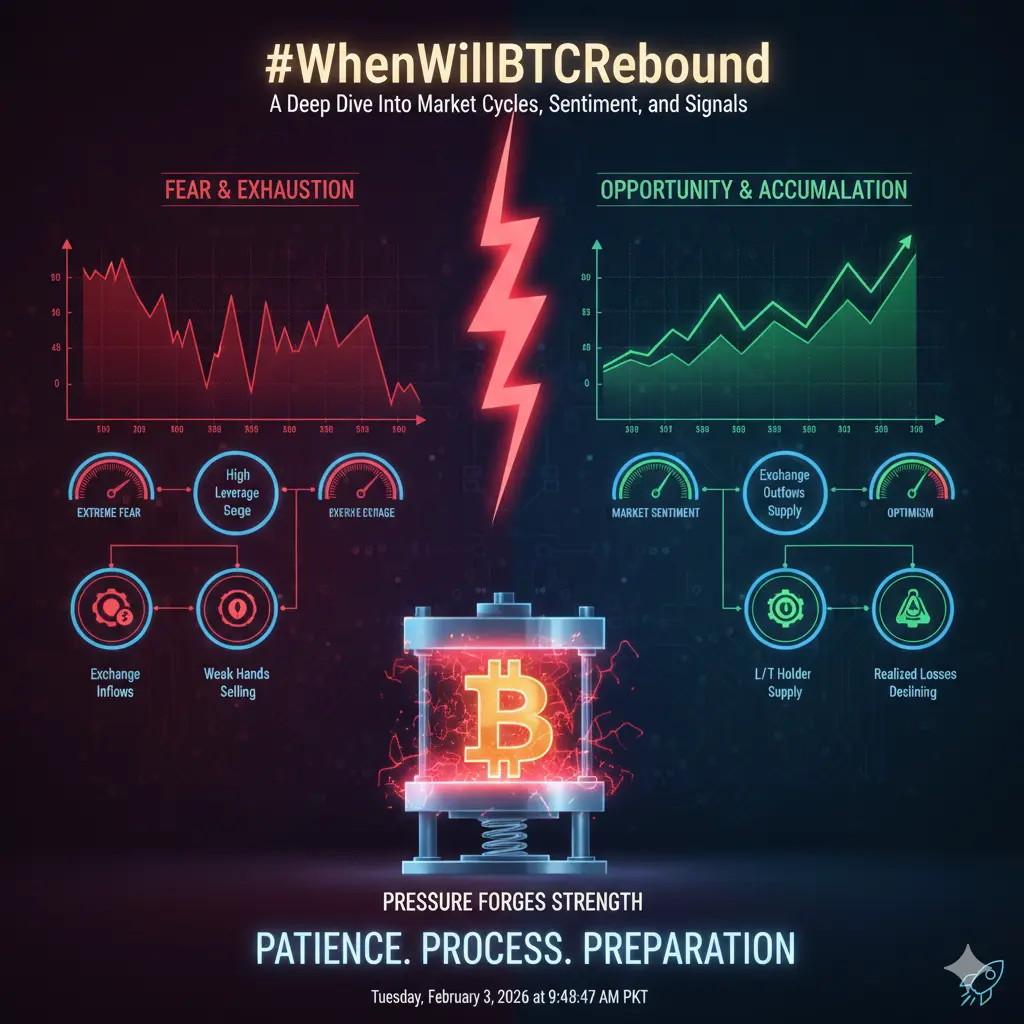

Bitcoin (BTC) is currently navigating a phase of extreme fear, trading near critical support levels after a period of sharp declines. Understanding whether BTC will rebound—or if downside persists—requires looking at technicals, liquidity, volume, macro factors, on-chain data, and trader psychology.

📈 Current BTC Snapshot

Metric

Value

Price (BTC/USDT)

$78,543

24h Change

+1.89%

24h Range

$74,601 – $79,349

Fear & Greed Index

17 (Extreme Fear)

Short-Term Support

$78,513

Daily Support

$74,601

Resistance

$79,104 – $79,169

24h Volume (Spot)

$24.5B USDT (Gate.io)

Liquidity Observation

Low order book depth near support, high bid-ask spread

Notable Fund Buying

SAFU bought 1,315 BTC ($100M+) recently

💡 Technical Analysis: Rebound Probability

Short-Term Charts (15m – 1h)

BTC tested $78,500 and showed a minor bounce, but volume remains low, signaling weak conviction.

MACD: Bearish crossover, but histogram shows decreasing momentum loss, hinting at potential relief bounce.

RSI: 45–55 (neutral to slightly oversold). This suggests short-term consolidation rather than immediate explosive reversal.

Daily Chart

RSI: Extremely oversold near 0 on some exchanges, indicating potential for short-term technical rebound.

Bollinger Bands: Price is hugging the lower band. Historically, BTC often bounces 2–5% from this extreme.

Moving Averages: BTC is below both 50-day and 200-day MA, suggesting longer-term bearish pressure remains.

🔍 Liquidity & Volume Dynamics

Liquidity vacuum: Recent sharp sell-offs created a thin order book, amplifying volatility. Small buy orders fail to hold prices, while large sell orders trigger cascading liquidations.

Volume patterns: On dips below $78,500, spot trading volume spiked but not enough to absorb selling pressure, highlighting institutional accumulation lagging retail panic.

Implication: A rebound is possible if liquidity improves, but without sizable bid walls, BTC may retest $74,600 before a sustained recovery.

📊 On-Chain & Sentiment Signals

Fear & Greed Index at 17 signals extreme fear, historically a setup for short-term rebounds of 2–7% within days.

Whale accumulation: Funds like SAFU are buying heavily (~1,315 BTC). Large wallet inflows suggest buy-the-dip mentality among institutions.

KOL sentiment: Bullish voices slightly outnumber bearish (190 vs. 155), but overall social chatter shows caution and hedging.

📰 Macro & News Catalysts

Fed Chair Speculation: Kevin Warsh nomination created fear of tighter US monetary policy, pressuring BTC.

Regulatory Timeline: US crypto tax and policy updates expected in Q1–Q2 2026; these can trigger sudden swings.

Global Liquidity Conditions: Rising US interest rates may divert capital away from risk assets, including BTC.

Implication: Rebound potential is highly conditional. Any relief rally may reverse if Fed or regulatory news is negative.

🎯 Rebound Scenarios & Probable Targets

Scenario

Likelihood

Short-Term Target

Commentary

Technical Relief Bounce

Medium-High

$79,500 – $80,000

Oversold RSI + lower Bollinger support; likely 2–5% upside.

Macro-Driven Rebound

Medium

$81,000 – $82,500

Triggered by positive Fed/regulatory signals or institutional buying.

Continued Downtrend

Medium

$74,500 – $73,000

Break of daily support, liquidity vacuum persists, retail panic selling.

Price % Potential:

Immediate bounce: ~2–5% (short-term scalp)

Extended rebound if macro improves: ~4–7%

Breakdown scenario: ~5–7% downside to new daily lows

🧠 Trader Psychology & Market Mindset

Traders are cautious: fear dominates over greed, many are waiting for confirmation above $79,200–$79,500 with strong volume.

Short-term scalpers may buy near $78,500 with tight stop-losses (~$78,000).

Swing traders may wait for daily close above $79,500 before entering larger positions.

Institutional accumulation suggests a longer-term base may be forming, but confirmation requires macro clarity.

⚙️ Trading Strategy: What to Do Next

For short-term traders

Buy small on dips ($78,500–$78,000)

Watch for MACD bullish crossover or RSI moving out of oversold

Take partial profits near $79,500–$80,000

For medium-term traders / swing

Wait for daily close above $79,200–$79,500

Scale in gradually, avoid buying all at once

Monitor Fed/regulatory updates for trend validation

For risk-averse / long-term investors

Consider accumulating near strong support ($74,600) if BTC shows base formation signs

Use position sizing and stop-loss to mitigate volatility

⚠️ Key Risks

Breaking below $74,600 daily support may trigger extended sell-off to $72,500–$73,000.

Liquidity remains thin, amplifying price swings on both sides.

Fed decisions or unexpected regulatory news may override technicals.

💡 My Views & Thoughts

BTC is extremely oversold technically, creating high-probability short-term rebound opportunities, but macro uncertainty keeps risk elevated. Traders should focus on confirmation signals rather than chasing dips, and keep an eye on volume, liquidity, and Fed/regulatory updates.

Personally, I see a 3–5% short-term rebound likely, but caution that sustained recovery above $82,000 requires macro clarity. Strategically, scaling in and out, rather than all-in, is the safest approach for both traders and investors.

BTC is testing the patience of the market, and how it behaves around $78,500–$79,200 will define the next meaningful move.

📊 BTC Market Deep Dive: Extreme Fear, Liquidity Stress, and Rebound Potential

Bitcoin (BTC) is currently navigating a phase of extreme fear, trading near critical support levels after a period of sharp declines. Understanding whether BTC will rebound—or if downside persists—requires looking at technicals, liquidity, volume, macro factors, on-chain data, and trader psychology.

📈 Current BTC Snapshot

Metric

Value

Price (BTC/USDT)

$78,543

24h Change

+1.89%

24h Range

$74,601 – $79,349

Fear & Greed Index

17 (Extreme Fear)

Short-Term Support

$78,513

Daily Support

$74,601

Resistance

$79,104 – $79,169

24h Volume (Spot)

$24.5B USDT (Gate.io)

Liquidity Observation

Low order book depth near support, high bid-ask spread

Notable Fund Buying

SAFU bought 1,315 BTC ($100M+) recently

💡 Technical Analysis: Rebound Probability

Short-Term Charts (15m – 1h)

BTC tested $78,500 and showed a minor bounce, but volume remains low, signaling weak conviction.

MACD: Bearish crossover, but histogram shows decreasing momentum loss, hinting at potential relief bounce.

RSI: 45–55 (neutral to slightly oversold). This suggests short-term consolidation rather than immediate explosive reversal.

Daily Chart

RSI: Extremely oversold near 0 on some exchanges, indicating potential for short-term technical rebound.

Bollinger Bands: Price is hugging the lower band. Historically, BTC often bounces 2–5% from this extreme.

Moving Averages: BTC is below both 50-day and 200-day MA, suggesting longer-term bearish pressure remains.

🔍 Liquidity & Volume Dynamics

Liquidity vacuum: Recent sharp sell-offs created a thin order book, amplifying volatility. Small buy orders fail to hold prices, while large sell orders trigger cascading liquidations.

Volume patterns: On dips below $78,500, spot trading volume spiked but not enough to absorb selling pressure, highlighting institutional accumulation lagging retail panic.

Implication: A rebound is possible if liquidity improves, but without sizable bid walls, BTC may retest $74,600 before a sustained recovery.

📊 On-Chain & Sentiment Signals

Fear & Greed Index at 17 signals extreme fear, historically a setup for short-term rebounds of 2–7% within days.

Whale accumulation: Funds like SAFU are buying heavily (~1,315 BTC). Large wallet inflows suggest buy-the-dip mentality among institutions.

KOL sentiment: Bullish voices slightly outnumber bearish (190 vs. 155), but overall social chatter shows caution and hedging.

📰 Macro & News Catalysts

Fed Chair Speculation: Kevin Warsh nomination created fear of tighter US monetary policy, pressuring BTC.

Regulatory Timeline: US crypto tax and policy updates expected in Q1–Q2 2026; these can trigger sudden swings.

Global Liquidity Conditions: Rising US interest rates may divert capital away from risk assets, including BTC.

Implication: Rebound potential is highly conditional. Any relief rally may reverse if Fed or regulatory news is negative.

🎯 Rebound Scenarios & Probable Targets

Scenario

Likelihood

Short-Term Target

Commentary

Technical Relief Bounce

Medium-High

$79,500 – $80,000

Oversold RSI + lower Bollinger support; likely 2–5% upside.

Macro-Driven Rebound

Medium

$81,000 – $82,500

Triggered by positive Fed/regulatory signals or institutional buying.

Continued Downtrend

Medium

$74,500 – $73,000

Break of daily support, liquidity vacuum persists, retail panic selling.

Price % Potential:

Immediate bounce: ~2–5% (short-term scalp)

Extended rebound if macro improves: ~4–7%

Breakdown scenario: ~5–7% downside to new daily lows

🧠 Trader Psychology & Market Mindset

Traders are cautious: fear dominates over greed, many are waiting for confirmation above $79,200–$79,500 with strong volume.

Short-term scalpers may buy near $78,500 with tight stop-losses (~$78,000).

Swing traders may wait for daily close above $79,500 before entering larger positions.

Institutional accumulation suggests a longer-term base may be forming, but confirmation requires macro clarity.

⚙️ Trading Strategy: What to Do Next

For short-term traders

Buy small on dips ($78,500–$78,000)

Watch for MACD bullish crossover or RSI moving out of oversold

Take partial profits near $79,500–$80,000

For medium-term traders / swing

Wait for daily close above $79,200–$79,500

Scale in gradually, avoid buying all at once

Monitor Fed/regulatory updates for trend validation

For risk-averse / long-term investors

Consider accumulating near strong support ($74,600) if BTC shows base formation signs

Use position sizing and stop-loss to mitigate volatility

⚠️ Key Risks

Breaking below $74,600 daily support may trigger extended sell-off to $72,500–$73,000.

Liquidity remains thin, amplifying price swings on both sides.

Fed decisions or unexpected regulatory news may override technicals.

💡 My Views & Thoughts

BTC is extremely oversold technically, creating high-probability short-term rebound opportunities, but macro uncertainty keeps risk elevated. Traders should focus on confirmation signals rather than chasing dips, and keep an eye on volume, liquidity, and Fed/regulatory updates.

Personally, I see a 3–5% short-term rebound likely, but caution that sustained recovery above $82,000 requires macro clarity. Strategically, scaling in and out, rather than all-in, is the safest approach for both traders and investors.

BTC is testing the patience of the market, and how it behaves around $78,500–$79,200 will define the next meaningful move.