#AltcoinDivergence

🔍 What is Altcoin Divergence?

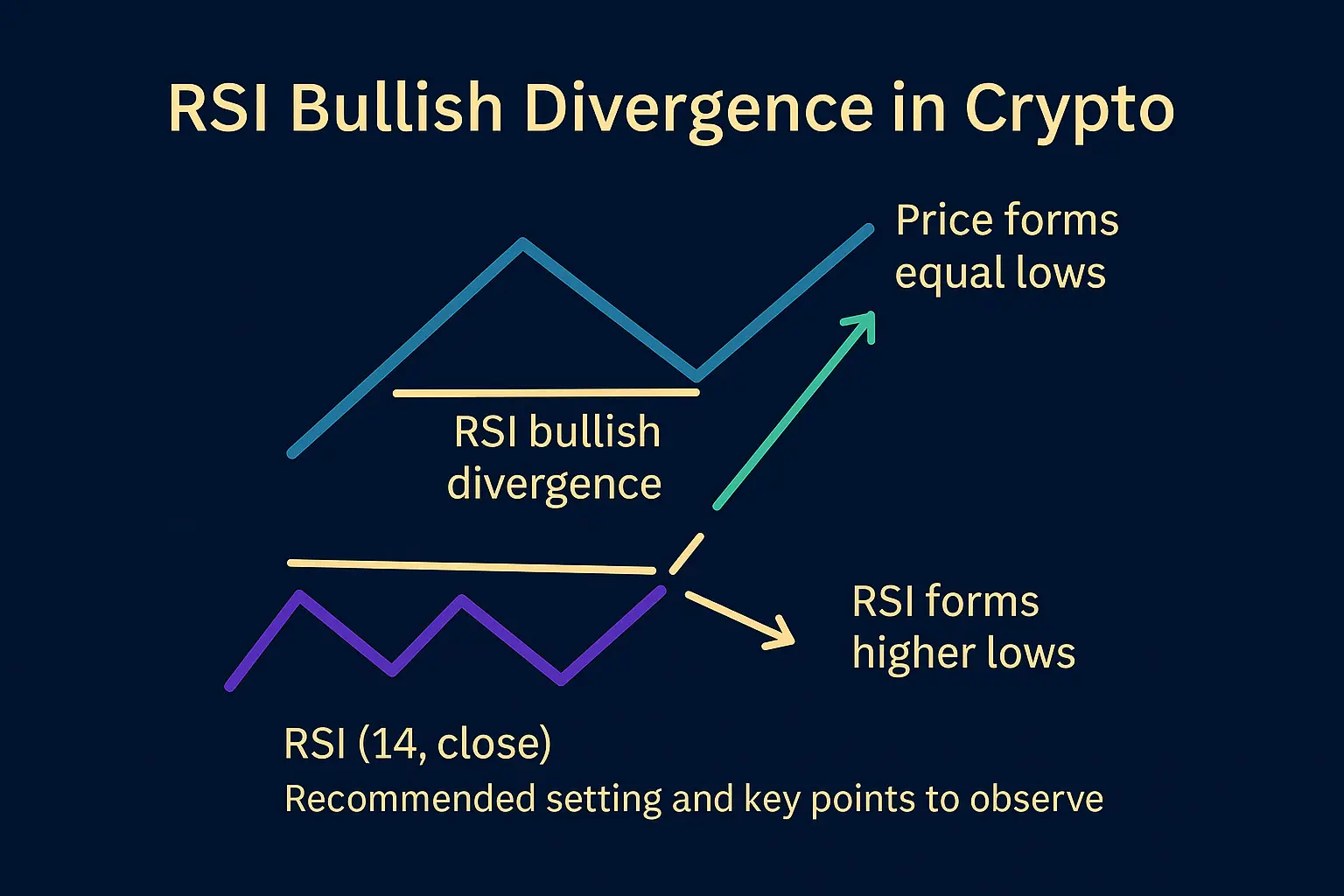

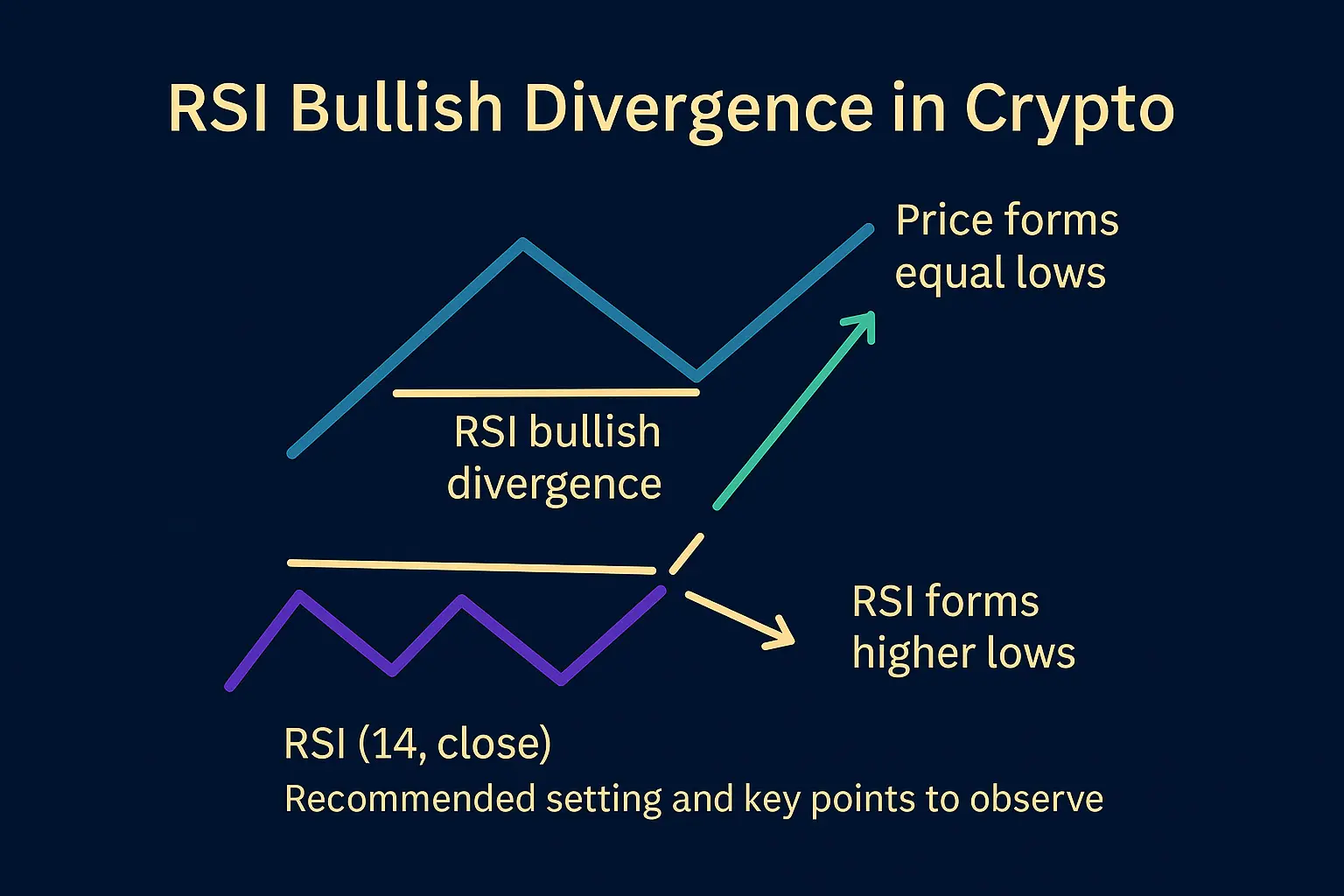

Divergence occurs when price action moves in the opposite direction of momentum indicators like RSI, MACD, or On-Balance Volume (OBV). In simpler terms:

Price is falling but momentum shows strength → possible bottom forming.

Price is rising but momentum weakens → potential bull trap.

Altcoin divergence helps traders identify early trend reversals, traps, and accumulation zones before they appear on the price chart.

📈 Key Divergence Setups to Watch

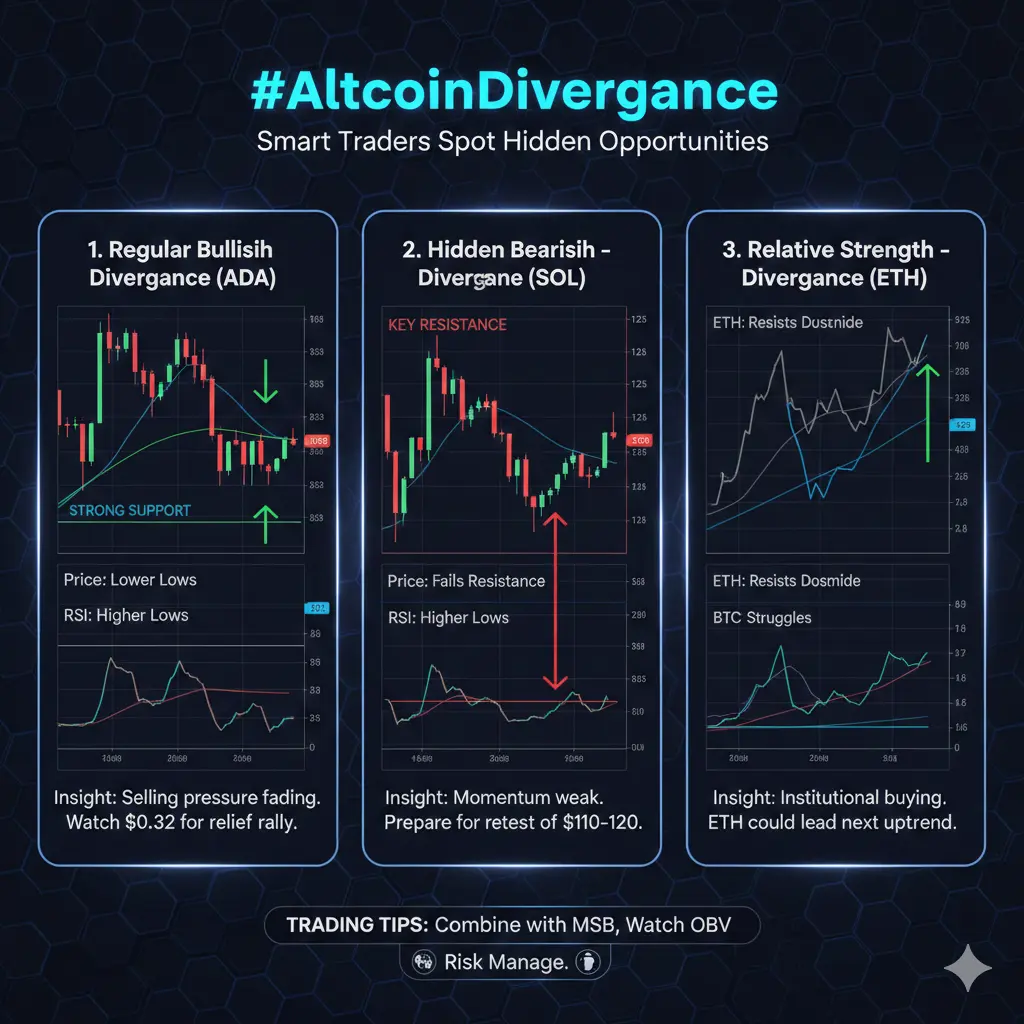

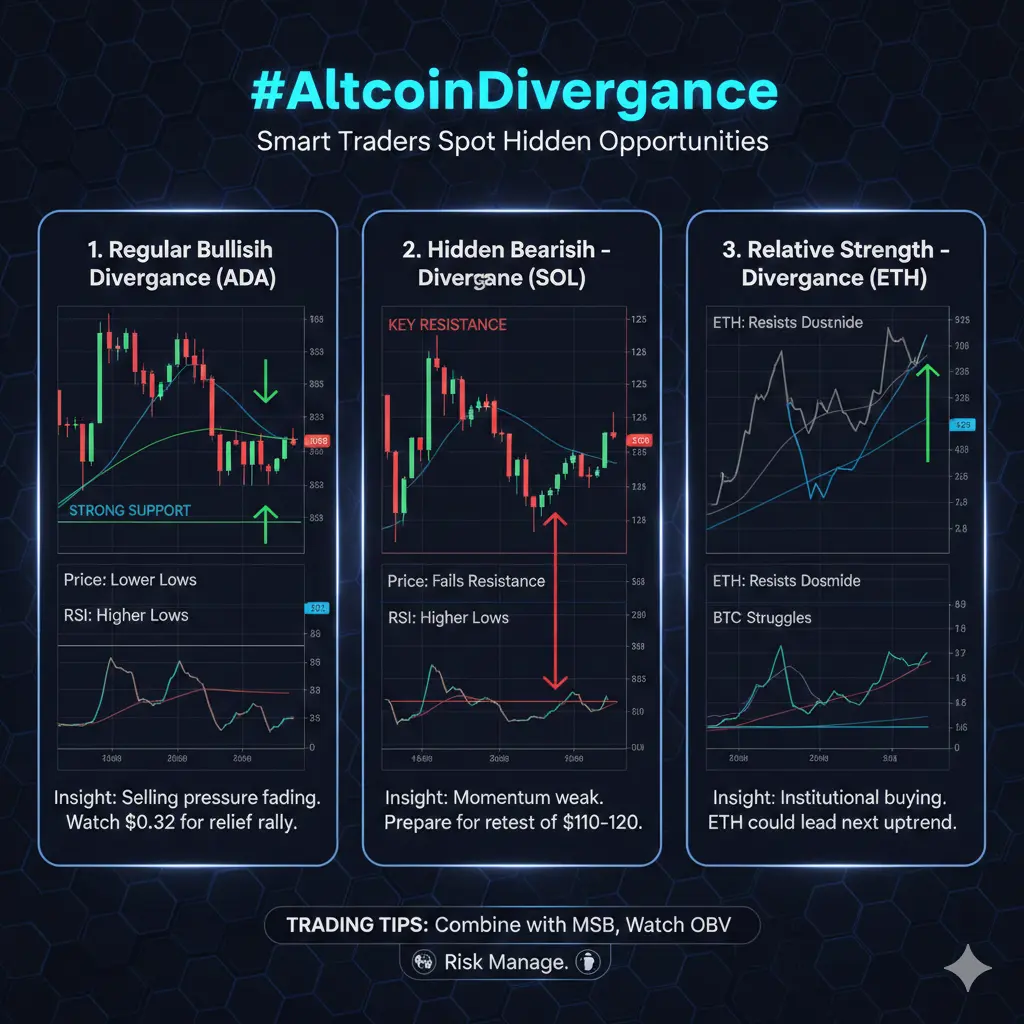

1. Regular Bullish Divergence – Cardano (ADA)

Observation: ADA hits new local lows, but RSI makes higher lows.

Interpretation: Selling pressure is fading; smart money is quietly absorbing supply.

Actionable Insight: Watch $0.32 as a strong support. A relief rally could be imminent if this level holds.

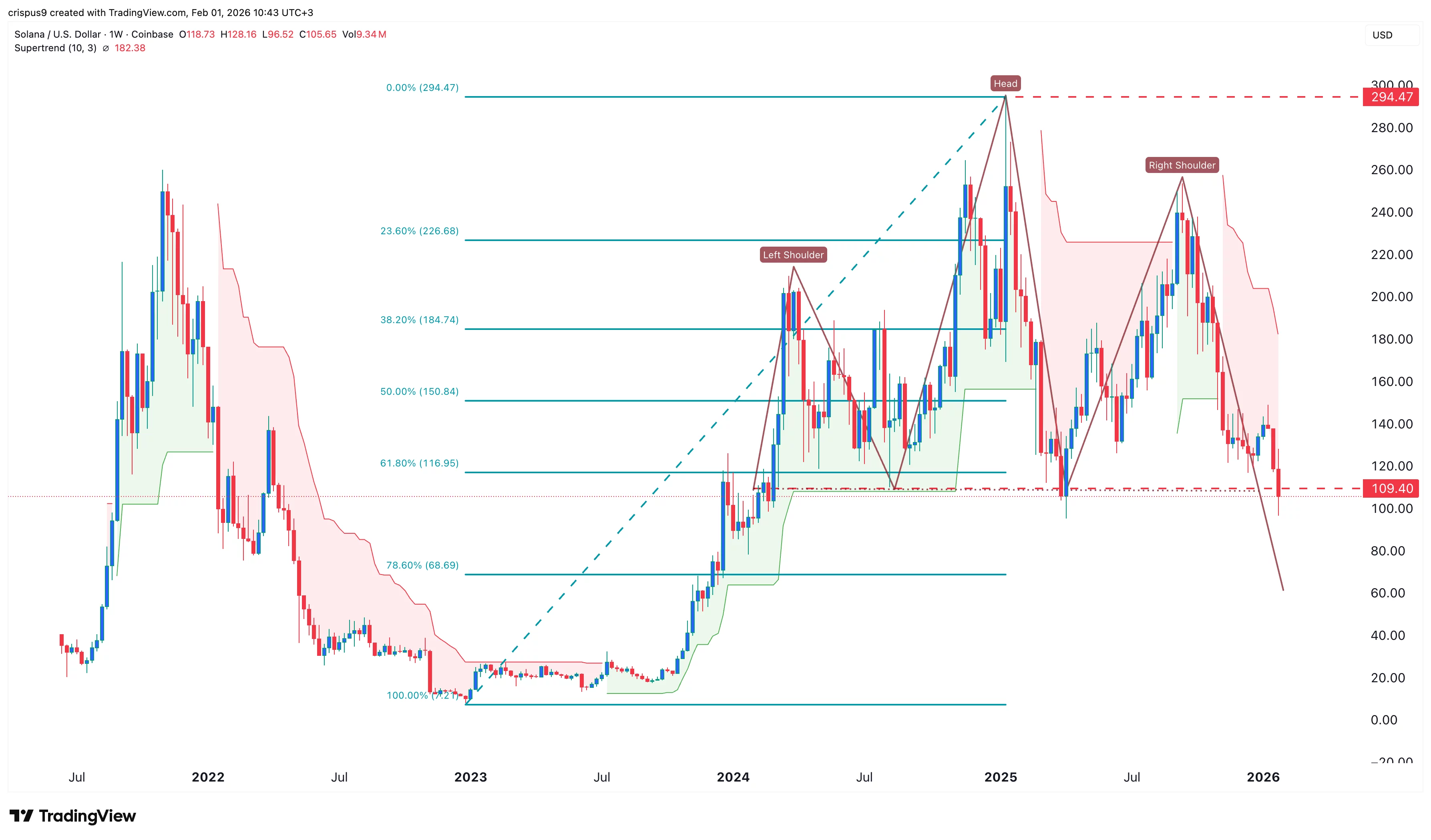

2. Hidden Bearish Divergence – Solana (SOL)

Observation: SOL’s RSI rises while price fails to break key resistance.

Interpretation: Momentum is weak; the current pump is likely unsustainable.

Actionable Insight: Prepare for a potential retest of $110–$120. Avoid chasing this rally.

3. Relative Strength Divergence – Ethereum (ETH)

Observation: ETH resists downside pressure even as BTC struggles.

Interpretation: Institutional buying is creating a floor for ETH, likely linked to major tech rollouts (e.g., ERC-8004).

Actionable Insight: ETH could lead the next altcoin uptrend once BTC stabilizes.

🛠 Trading Tips for February 2026

Confluence is Key: Never rely on divergence alone. Combine it with market structure breaks (MSB) and support/resistance levels.

Watch OBV: If price falls but OBV stays flat or rises, it indicates accumulation by stronger hands.

Risk Management: Daily swings of 12–13% are common. Keep small positions, wide stops, and avoid panic trading.

🏁 Summary

Altcoin divergence signals hidden opportunities in a fear-driven market.

Extreme fear can create strong bottoms and early reversal setups.

Key levels like ADA $0.32, SOL $110–$120, and ETH $2,165 are crucial for spotting potential trend changes.

Bottom line: While most traders panic during heavy liquidations, divergences reveal where smart money is quietly building positions. Mastering this skill can give you an edge in the market before the next major altcoin leg up.

🔍 What is Altcoin Divergence?

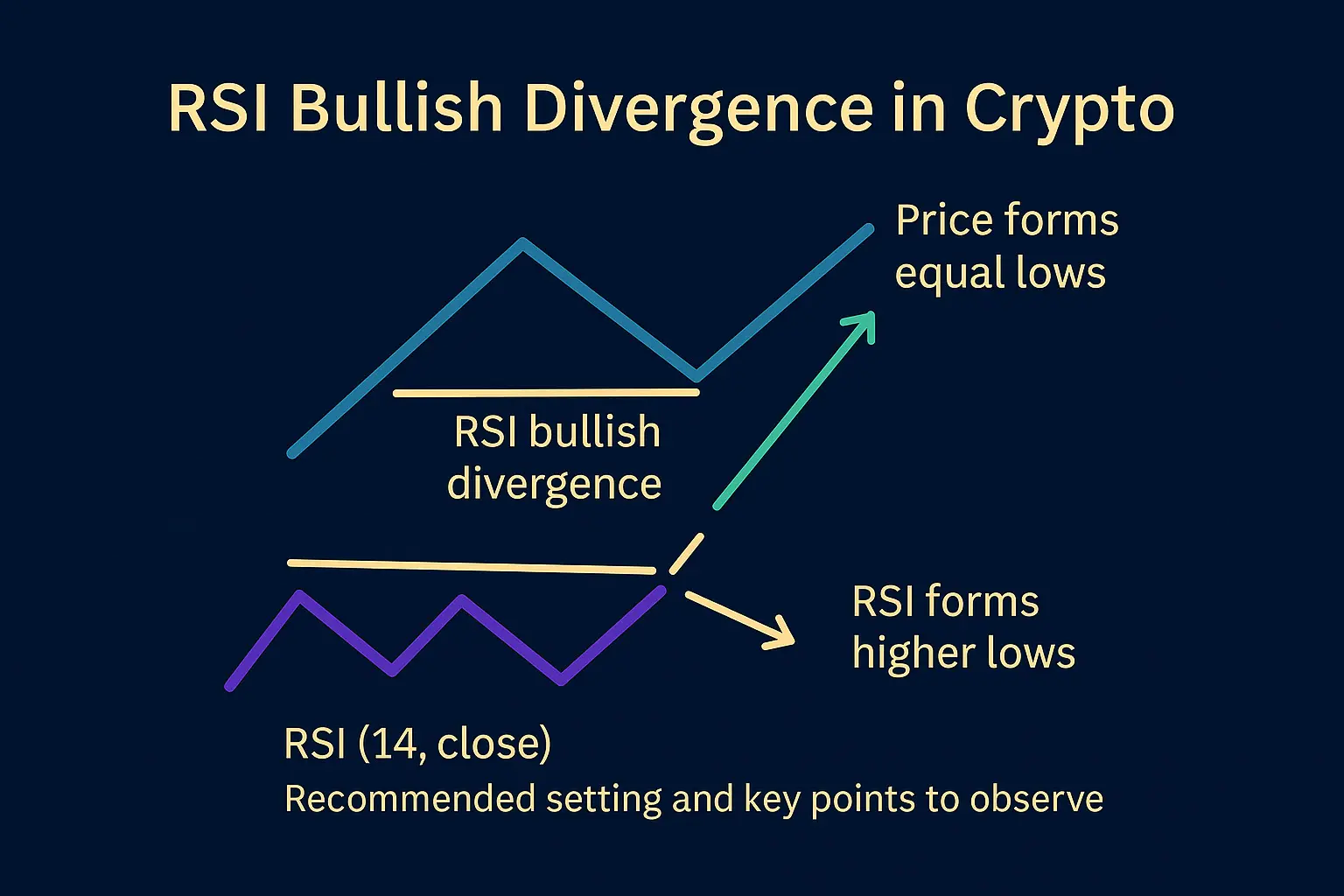

Divergence occurs when price action moves in the opposite direction of momentum indicators like RSI, MACD, or On-Balance Volume (OBV). In simpler terms:

Price is falling but momentum shows strength → possible bottom forming.

Price is rising but momentum weakens → potential bull trap.

Altcoin divergence helps traders identify early trend reversals, traps, and accumulation zones before they appear on the price chart.

📈 Key Divergence Setups to Watch

1. Regular Bullish Divergence – Cardano (ADA)

Observation: ADA hits new local lows, but RSI makes higher lows.

Interpretation: Selling pressure is fading; smart money is quietly absorbing supply.

Actionable Insight: Watch $0.32 as a strong support. A relief rally could be imminent if this level holds.

2. Hidden Bearish Divergence – Solana (SOL)

Observation: SOL’s RSI rises while price fails to break key resistance.

Interpretation: Momentum is weak; the current pump is likely unsustainable.

Actionable Insight: Prepare for a potential retest of $110–$120. Avoid chasing this rally.

3. Relative Strength Divergence – Ethereum (ETH)

Observation: ETH resists downside pressure even as BTC struggles.

Interpretation: Institutional buying is creating a floor for ETH, likely linked to major tech rollouts (e.g., ERC-8004).

Actionable Insight: ETH could lead the next altcoin uptrend once BTC stabilizes.

🛠 Trading Tips for February 2026

Confluence is Key: Never rely on divergence alone. Combine it with market structure breaks (MSB) and support/resistance levels.

Watch OBV: If price falls but OBV stays flat or rises, it indicates accumulation by stronger hands.

Risk Management: Daily swings of 12–13% are common. Keep small positions, wide stops, and avoid panic trading.

🏁 Summary

Altcoin divergence signals hidden opportunities in a fear-driven market.

Extreme fear can create strong bottoms and early reversal setups.

Key levels like ADA $0.32, SOL $110–$120, and ETH $2,165 are crucial for spotting potential trend changes.

Bottom line: While most traders panic during heavy liquidations, divergences reveal where smart money is quietly building positions. Mastering this skill can give you an edge in the market before the next major altcoin leg up.