# OvernightV-ShapedMoveinCrypto

26.22K

MingDragonX

#OvernightV-ShapedMoveinCrypto OvernightV-ShapedMoveinCrypto Understanding the Latest V-Shaped Recovery in Crypto

1️⃣ Market Overview

The crypto futures market has once again demonstrated its highly reactive nature through a sharp V-shaped recovery. After an aggressive overnight sell-off, prices rebounded just as quickly, catching both retail and leveraged traders off guard. These moves are not accidental—they reflect deep interactions between liquidity, derivatives positioning, funding rates, and macro sentiment. In today’s environment, futures markets often move faster than spot, making them

1️⃣ Market Overview

The crypto futures market has once again demonstrated its highly reactive nature through a sharp V-shaped recovery. After an aggressive overnight sell-off, prices rebounded just as quickly, catching both retail and leveraged traders off guard. These moves are not accidental—they reflect deep interactions between liquidity, derivatives positioning, funding rates, and macro sentiment. In today’s environment, futures markets often move faster than spot, making them

- Reward

- 1

- Comment

- Repost

- Share

#OvernightV-ShapedMoveinCrypto Understanding the Latest V-Shaped Recovery in Crypto

1️⃣ Market Overview

The crypto futures market has once again demonstrated its highly reactive nature through a sharp V-shaped recovery. After an aggressive overnight sell-off, prices rebounded just as quickly, catching both retail and leveraged traders off guard. These moves are not accidental—they reflect deep interactions between liquidity, derivatives positioning, funding rates, and macro sentiment. In today’s environment, futures markets often move faster than spot, making them the primary driver of short-t

1️⃣ Market Overview

The crypto futures market has once again demonstrated its highly reactive nature through a sharp V-shaped recovery. After an aggressive overnight sell-off, prices rebounded just as quickly, catching both retail and leveraged traders off guard. These moves are not accidental—they reflect deep interactions between liquidity, derivatives positioning, funding rates, and macro sentiment. In today’s environment, futures markets often move faster than spot, making them the primary driver of short-t

- Reward

- 11

- 8

- Repost

- Share

MrThanks77 :

:

Your analysis is excellent, deeply revealing the essence of the crypto market's "news-driven volatility," and clearly delineating the boundaries between emotional reactions and rational decision-making. The "experience gap" you mentioned is particularly crucial — it is exactly what distinguishes short-term speculators from long-term builders.View More

#OvernightV-ShapedMoveinCrypto

Crypto Market Shows Resilience with Sudden V-Shaped Recovery Amid Macro and Technical Pressures

The cryptocurrency market staged a dramatic and almost instantaneous reversal in early February 2026, demonstrating both the volatility and underlying resilience that characterize digital assets in periods of macro uncertainty. After a challenging start to the month, Bitcoin and Ethereum slid toward multi-month lows, triggering widespread panic among short-term traders and leveraged positions. Bitcoin briefly dipped below $73,000, retracing to levels last seen in Apri

Crypto Market Shows Resilience with Sudden V-Shaped Recovery Amid Macro and Technical Pressures

The cryptocurrency market staged a dramatic and almost instantaneous reversal in early February 2026, demonstrating both the volatility and underlying resilience that characterize digital assets in periods of macro uncertainty. After a challenging start to the month, Bitcoin and Ethereum slid toward multi-month lows, triggering widespread panic among short-term traders and leveraged positions. Bitcoin briefly dipped below $73,000, retracing to levels last seen in Apri

- Reward

- 5

- 14

- Repost

- Share

repanzal :

:

HODL Tight 💪View More

#OvernightV-ShapedMoveinCrypto

The crypto market just delivered a classic V-shaped recovery overnight: a sharp sell-off followed by an equally aggressive bounce. These moves aren’t random—they usually reflect a rapid shift in sentiment driven by liquidity, positioning, and macro triggers.

🔍 What Caused the Sudden Drop?

Liquidity Hunts: Late-session sell-offs often target overleveraged long positions. Once key support levels break, stop-losses cascade.

Macro Noise: Even minor headlines (rates, geopolitics, ETF flows) can spark fast risk-off reactions when markets are crowded.

Low Overnight Vo

The crypto market just delivered a classic V-shaped recovery overnight: a sharp sell-off followed by an equally aggressive bounce. These moves aren’t random—they usually reflect a rapid shift in sentiment driven by liquidity, positioning, and macro triggers.

🔍 What Caused the Sudden Drop?

Liquidity Hunts: Late-session sell-offs often target overleveraged long positions. Once key support levels break, stop-losses cascade.

Macro Noise: Even minor headlines (rates, geopolitics, ETF flows) can spark fast risk-off reactions when markets are crowded.

Low Overnight Vo

- Reward

- 7

- 5

- Repost

- Share

repanzal :

:

Happy New Year! 🤑View More

#OvernightV-ShapedMoveinCrypto .

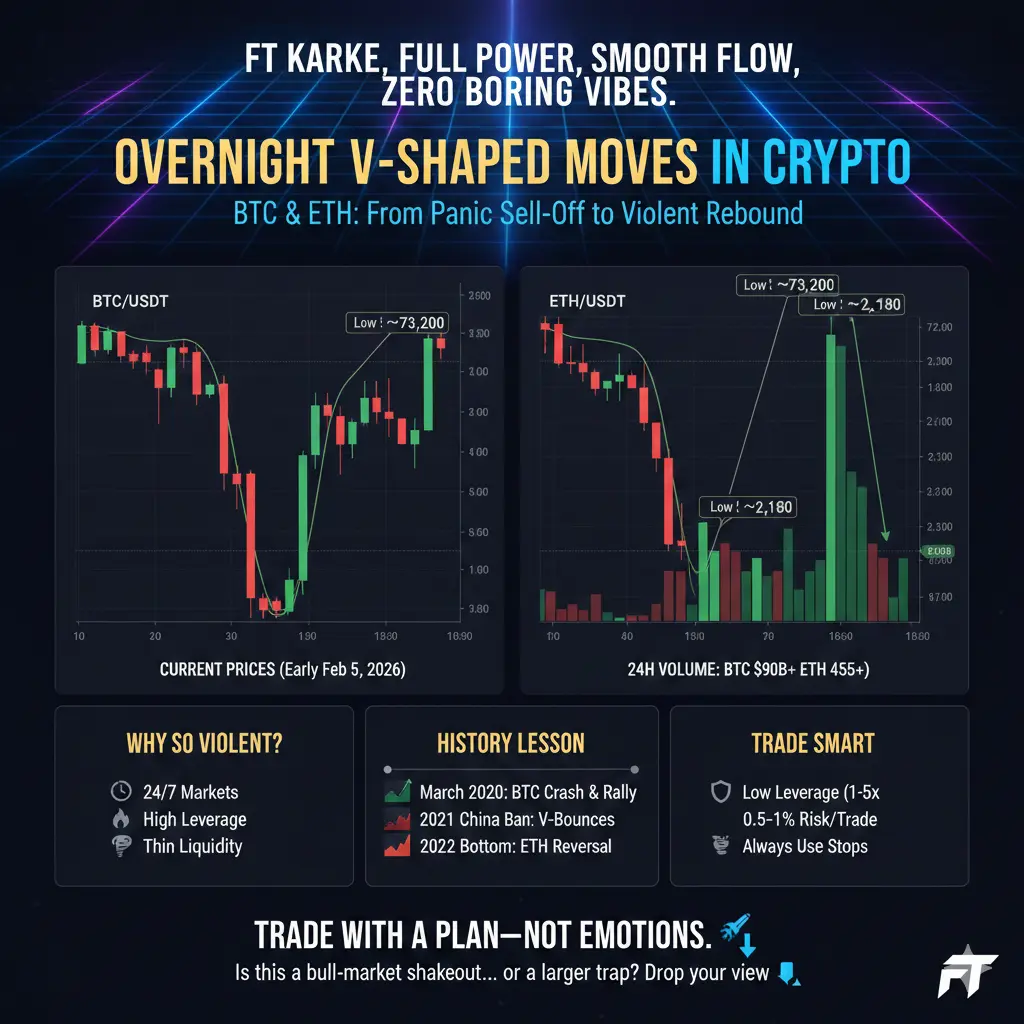

Overnight V-Shaped Moves in Crypto

BTC & ETH: From Panic Sell-Off to Violent Rebound — What Happened, Why It Matters, and How to Trade It

Crypto never sleeps—and early February 2026 just delivered a classic overnight V-shaped move that reminded everyone why this market is both feared and loved. Bitcoin (BTC) and Ethereum (ETH) saw a sharp overnight crash followed by an aggressive rebound, carving a clean “V” on lower-timeframe charts during thin liquidity hours.

These moves unfolded during Asian/overnight sessions, where low order-book depth, high leverage, and

Overnight V-Shaped Moves in Crypto

BTC & ETH: From Panic Sell-Off to Violent Rebound — What Happened, Why It Matters, and How to Trade It

Crypto never sleeps—and early February 2026 just delivered a classic overnight V-shaped move that reminded everyone why this market is both feared and loved. Bitcoin (BTC) and Ethereum (ETH) saw a sharp overnight crash followed by an aggressive rebound, carving a clean “V” on lower-timeframe charts during thin liquidity hours.

These moves unfolded during Asian/overnight sessions, where low order-book depth, high leverage, and

- Reward

- 20

- 13

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#OvernightV-ShapedMoveinCrypto

The crypto market once again surprised investors with a sharp overnight V-shaped move, highlighting both its volatility and resilience.

After a sudden sell-off that triggered panic across major assets, prices rebounded aggressively within hours, forming a classic V-shaped recovery. This type of movement is becoming increasingly common in the current market structure and offers important insights into sentiment, liquidity, and institutional behavior.

The initial drop was driven by a combination of factors. Short-term macro uncertainty, leveraged liquidations, and

The crypto market once again surprised investors with a sharp overnight V-shaped move, highlighting both its volatility and resilience.

After a sudden sell-off that triggered panic across major assets, prices rebounded aggressively within hours, forming a classic V-shaped recovery. This type of movement is becoming increasingly common in the current market structure and offers important insights into sentiment, liquidity, and institutional behavior.

The initial drop was driven by a combination of factors. Short-term macro uncertainty, leveraged liquidations, and

- Reward

- 2

- 1

- Repost

- Share

HighAmbition :

:

Watching Closely 🔍️#OvernightV-ShapedMoveinCrypto

The crypto market just delivered a classic V-shaped recovery overnight: a sharp sell-off followed by an equally aggressive bounce. These moves aren’t random—they usually reflect a rapid shift in sentiment driven by liquidity, positioning, and macro triggers.

🔍 What Caused the Sudden Drop?

Liquidity Hunts: Late-session sell-offs often target overleveraged long positions. Once key support levels break, stop-losses cascade.

Macro Noise: Even minor headlines (rates, geopolitics, ETF flows) can spark fast risk-off reactions when markets are crowded.

Low Overnight Vo

The crypto market just delivered a classic V-shaped recovery overnight: a sharp sell-off followed by an equally aggressive bounce. These moves aren’t random—they usually reflect a rapid shift in sentiment driven by liquidity, positioning, and macro triggers.

🔍 What Caused the Sudden Drop?

Liquidity Hunts: Late-session sell-offs often target overleveraged long positions. Once key support levels break, stop-losses cascade.

Macro Noise: Even minor headlines (rates, geopolitics, ETF flows) can spark fast risk-off reactions when markets are crowded.

Low Overnight Vo

- Reward

- 2

- 4

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

🚀 Dragon Fly Official Views — Overnight V‑Shaped Move in Crypto

Last night, Bitcoin (BTC) and Ethereum (ETH) experienced a sharp V‑shaped move — a rapid drop followed by an almost immediate rebound. These moves are important because they reflect high volatility, liquidity swings, and trader sentiment, not necessarily long-term trend changes.

📉 What Happened:

Bitcoin: Dropped from $76,800 to $71,900 overnight before recovering toward $72,350.

Ethereum: Fell from $2,289 to $2,078 before bouncing back to $2,148.

🔍 Why This V‑Shape Occurred:

1️⃣ Macro Pressure & Sentiment Shifts

Rumors about ha

Last night, Bitcoin (BTC) and Ethereum (ETH) experienced a sharp V‑shaped move — a rapid drop followed by an almost immediate rebound. These moves are important because they reflect high volatility, liquidity swings, and trader sentiment, not necessarily long-term trend changes.

📉 What Happened:

Bitcoin: Dropped from $76,800 to $71,900 overnight before recovering toward $72,350.

Ethereum: Fell from $2,289 to $2,078 before bouncing back to $2,148.

🔍 Why This V‑Shape Occurred:

1️⃣ Macro Pressure & Sentiment Shifts

Rumors about ha

- Reward

- 12

- 12

- Repost

- Share

GateUser-dccb3da2 :

:

I won't do the rest; you handle it yourself.View More

#Bitcoin price action and macro backdrop🎢

Bitcoin (CRYPTO: BTC) faced renewed selling pressure after briefly testing higher ground, with the asset sliding back toward the lower end of the recent trading band as the U.S. market reopened. The intraday trajectory pointed to a deeper tilt toward risk-off dynamics that have characterized much of the recent price action in crypto, equities, and precious metals. A key focus for traders has been whether BTC can sustain any bounce above the $76,000 level or if sellers reassert themselves and push the price toward the next major magnetic price point ar

Bitcoin (CRYPTO: BTC) faced renewed selling pressure after briefly testing higher ground, with the asset sliding back toward the lower end of the recent trading band as the U.S. market reopened. The intraday trajectory pointed to a deeper tilt toward risk-off dynamics that have characterized much of the recent price action in crypto, equities, and precious metals. A key focus for traders has been whether BTC can sustain any bounce above the $76,000 level or if sellers reassert themselves and push the price toward the next major magnetic price point ar

BTC-6,42%

- Reward

- 2

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

📉 BTC Under Pressure — Oversold, But Trend Still Weak

Bitcoin has experienced a sharp sell-off over the last 24 hours, with price action reflecting strong downside momentum and elevated fear across the market. While short-term indicators signal oversold conditions, the broader structure remains bearish for now.

📊 Market Snapshot

Current Price: ~73,600 USDT

24h Change: ~-3.0%

Intraday Range: 76,973 → 72,813 USDT

RSI (14): 34.2 | Hourly RSI: ~17 (Deep oversold)

Fear & Greed Index: 14 — Extreme Fear

Volatility: Rising

Bollinger Bands: Price trading below the lower band

📈 Volume & Momentum Insi

Bitcoin has experienced a sharp sell-off over the last 24 hours, with price action reflecting strong downside momentum and elevated fear across the market. While short-term indicators signal oversold conditions, the broader structure remains bearish for now.

📊 Market Snapshot

Current Price: ~73,600 USDT

24h Change: ~-3.0%

Intraday Range: 76,973 → 72,813 USDT

RSI (14): 34.2 | Hourly RSI: ~17 (Deep oversold)

Fear & Greed Index: 14 — Extreme Fear

Volatility: Rising

Bollinger Bands: Price trading below the lower band

📈 Volume & Momentum Insi

BTC-6,42%

- Reward

- 14

- 17

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

79.65K Popularity

6.56K Popularity

1.94K Popularity

2.95K Popularity

7.46K Popularity

5.84K Popularity

2.25K Popularity

3.78K Popularity

16.04K Popularity

4.21K Popularity

32.31K Popularity

14.49K Popularity

24.54K Popularity

11.56K Popularity

234.98K Popularity

News

View MoreOver $1.061 billion liquidated across the entire network in the past 24 hours, with $304 million liquidated in the last 4 hours.

1 m

Maji has been liquidated 6 times, and again deposits 250,000 USDC into Hyperliquid to go long on ETH and HYPE.

2 m

Data: Bitcoin price drops below $69,000, indicating a significant market decline. Investors are advised to exercise caution as the cryptocurrency experiences increased volatility and potential further downward movement.

4 m

Over the past 4 hours, the entire network has experienced liquidations of $263 million, with Bitcoin liquidations reaching $138 million.

5 m

Rainbow(RNBW) will fully launch contracts, leverage, wealth management, and other services on Gate on February 6.

5 m

Pin