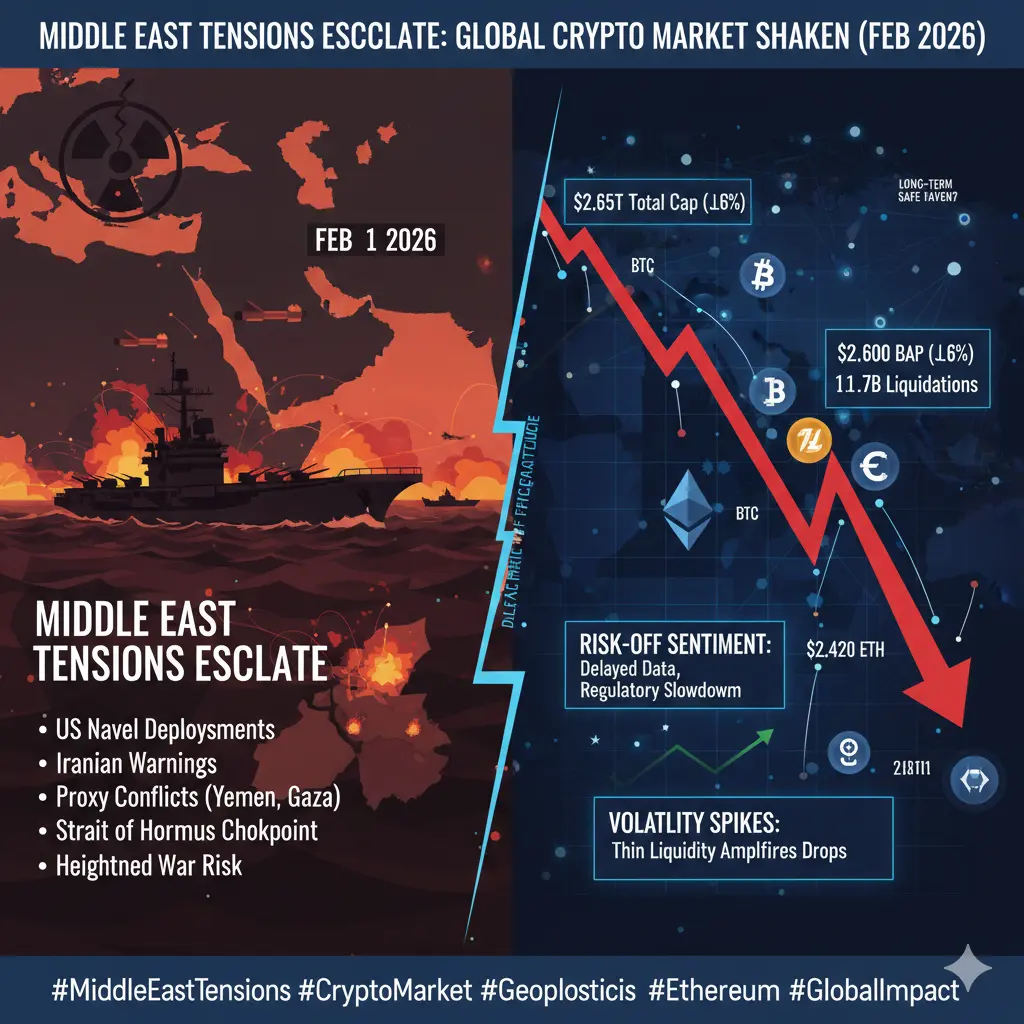

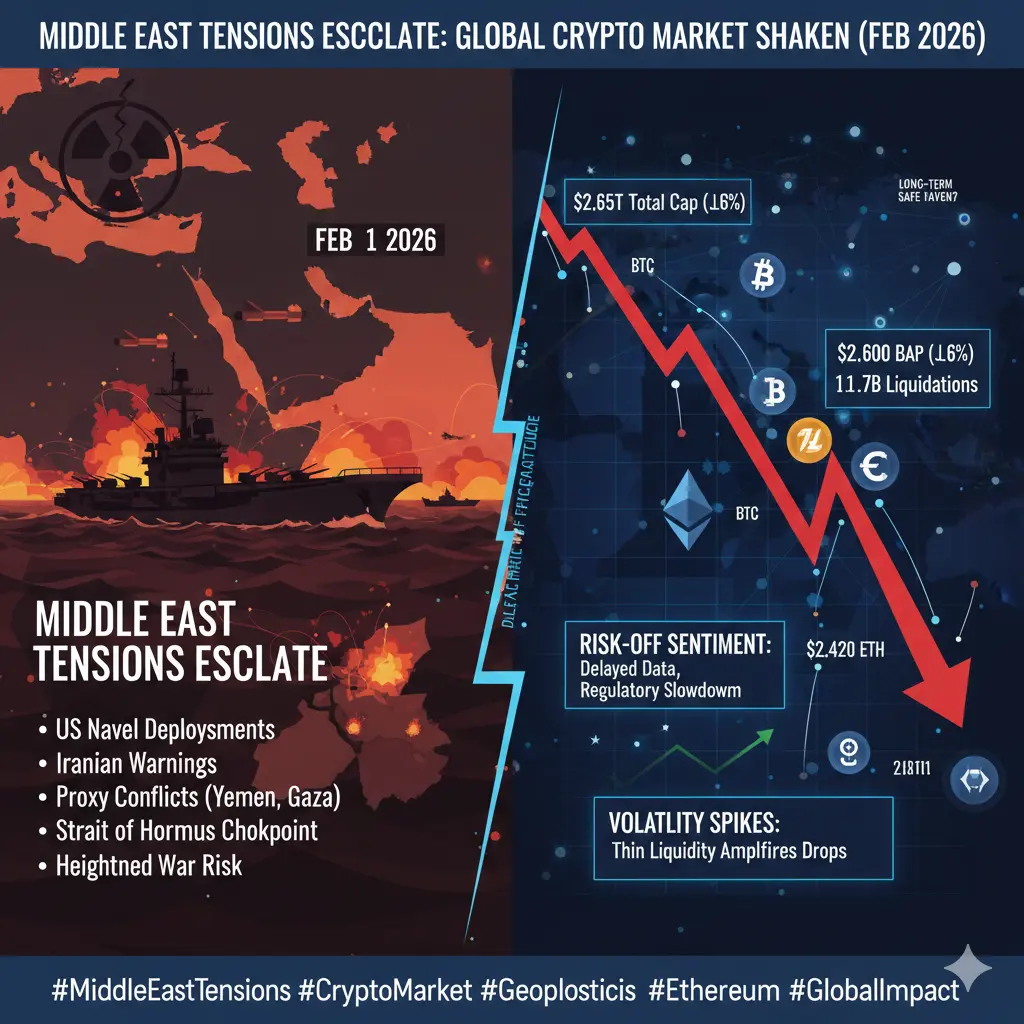

#MiddleEastTensionsEscalate The rapid escalation of geopolitical tensions in the Middle East has materially intensified stress across the cryptocurrency market, transforming what initially looked like a controlled pullback into a full-scale risk-off event. As tensions involving the U.S. and Iran escalated, crypto markets reacted immediately with accelerated price declines, thinning liquidity, and liquidation-driven volume spikes—highlighting just how sensitive digital assets remain to global instability.

Price Impact: Escalation Multiplies the Downside

Before the geopolitical flare-up intensified, Bitcoin was trading within a relatively stable consolidation range. Once escalation headlines hit, downside pressure expanded sharply. Bitcoin (BTC) extended losses to roughly 8–10%, decisively breaking below the $80,000 threshold. Ethereum (ETH) underperformed further, sliding 10–14%, while large-cap altcoins fell 12–18%. Mid- and small-cap tokens experienced severe drawdowns of 20–35%. The widening gap between majors and higher-beta assets confirms that each escalation phase compounds downside risk.

Liquidity Impact: Market Depth Erodes Rapidly

Escalation has triggered a pronounced liquidity drain across major exchanges. Estimated order-book depth declined by 25–40%, while bid–ask spreads widened by 30% or more. Slippage on larger trades increased sharply, particularly during off-peak trading hours. As geopolitical risk rises, market makers reduce exposure, causing liquidity to thin further. In this environment, even modest sell orders can push prices aggressively lower.

Volume Surge: Distress, Not Demand

Despite falling liquidity, trading volumes surged. BTC daily volume jumped 35–50%, while ETH and altcoin volumes spiked 40–70% during peak sell-offs. Importantly, this volume expansion was driven primarily by forced liquidations, margin calls, and stop-loss cascades, not organic buying. Such activity signals stress and deleveraging rather than accumulation or bullish conviction.

Liquidations: Escalation Is Non-Linear

As tensions intensified, total market liquidations climbed into the multi-billion-dollar range. Long positions accounted for approximately 70–80% of forced closures, with ETH and altcoins taking a disproportionate hit due to higher leverage profiles. Each new geopolitical headline triggered fresh liquidation waves, demonstrating that escalation compounds downside pressure instead of allowing markets to stabilize.

Sentiment Shift: From Caution to Capital Preservation

Market psychology has shifted decisively. Fear indicators pushed deeper into extreme risk-aversion territory, funding rates flipped negative across multiple venues, and institutional flows slowed markedly. Capital rotated toward cash and defensive assets, while large holders prioritized capital preservation over yield or growth, further suppressing liquidity and upside momentum.

Why Escalation Matters More Than the Initial Drop

The critical insight is that escalation amplifies impact through a feedback loop. Initial headlines trigger pullbacks; continued escalation causes liquidity withdrawal; reduced liquidity leads to outsized price moves; outsized moves trigger liquidations; liquidations fuel panic-driven volume. This loop explains why crypto reacts faster and more violently than traditional markets during geopolitical stress.

Bottom Line

Escalating Middle East tensions are doing more than pressuring prices—they are structurally weakening market conditions. Liquidity is down 30–40%, volatility is up 20–30%, trading volumes are surging due to forced selling, and most crypto assets are experiencing double-digit percentage declines.

Until geopolitical risks de-escalate, crypto markets are likely to remain fragile, headline-driven, and highly volatile. In this environment, risk management beats aggression, and survival takes priority over speculation.

Price Impact: Escalation Multiplies the Downside

Before the geopolitical flare-up intensified, Bitcoin was trading within a relatively stable consolidation range. Once escalation headlines hit, downside pressure expanded sharply. Bitcoin (BTC) extended losses to roughly 8–10%, decisively breaking below the $80,000 threshold. Ethereum (ETH) underperformed further, sliding 10–14%, while large-cap altcoins fell 12–18%. Mid- and small-cap tokens experienced severe drawdowns of 20–35%. The widening gap between majors and higher-beta assets confirms that each escalation phase compounds downside risk.

Liquidity Impact: Market Depth Erodes Rapidly

Escalation has triggered a pronounced liquidity drain across major exchanges. Estimated order-book depth declined by 25–40%, while bid–ask spreads widened by 30% or more. Slippage on larger trades increased sharply, particularly during off-peak trading hours. As geopolitical risk rises, market makers reduce exposure, causing liquidity to thin further. In this environment, even modest sell orders can push prices aggressively lower.

Volume Surge: Distress, Not Demand

Despite falling liquidity, trading volumes surged. BTC daily volume jumped 35–50%, while ETH and altcoin volumes spiked 40–70% during peak sell-offs. Importantly, this volume expansion was driven primarily by forced liquidations, margin calls, and stop-loss cascades, not organic buying. Such activity signals stress and deleveraging rather than accumulation or bullish conviction.

Liquidations: Escalation Is Non-Linear

As tensions intensified, total market liquidations climbed into the multi-billion-dollar range. Long positions accounted for approximately 70–80% of forced closures, with ETH and altcoins taking a disproportionate hit due to higher leverage profiles. Each new geopolitical headline triggered fresh liquidation waves, demonstrating that escalation compounds downside pressure instead of allowing markets to stabilize.

Sentiment Shift: From Caution to Capital Preservation

Market psychology has shifted decisively. Fear indicators pushed deeper into extreme risk-aversion territory, funding rates flipped negative across multiple venues, and institutional flows slowed markedly. Capital rotated toward cash and defensive assets, while large holders prioritized capital preservation over yield or growth, further suppressing liquidity and upside momentum.

Why Escalation Matters More Than the Initial Drop

The critical insight is that escalation amplifies impact through a feedback loop. Initial headlines trigger pullbacks; continued escalation causes liquidity withdrawal; reduced liquidity leads to outsized price moves; outsized moves trigger liquidations; liquidations fuel panic-driven volume. This loop explains why crypto reacts faster and more violently than traditional markets during geopolitical stress.

Bottom Line

Escalating Middle East tensions are doing more than pressuring prices—they are structurally weakening market conditions. Liquidity is down 30–40%, volatility is up 20–30%, trading volumes are surging due to forced selling, and most crypto assets are experiencing double-digit percentage declines.

Until geopolitical risks de-escalate, crypto markets are likely to remain fragile, headline-driven, and highly volatile. In this environment, risk management beats aggression, and survival takes priority over speculation.