Highlights

①. Gate's "Basic Futures Contracts" course introduces various methods of technical analysis that are commonly employed in futures trading. The aim of these courses is to help traders establish a comprehensive framework for technical analysis. Covered topics include the basics of Candlestick charts, technical patterns, moving averages, trend lines, and the application of technical indicators.

②. This article, as Course VIII of the series "Master Technical Analysis", will introduce one key candlestick pattern-rounding top, and will cover the concept of the pattern, its characteristics, technical meaning, as well as its application in trading.

1. What is the rounding top?

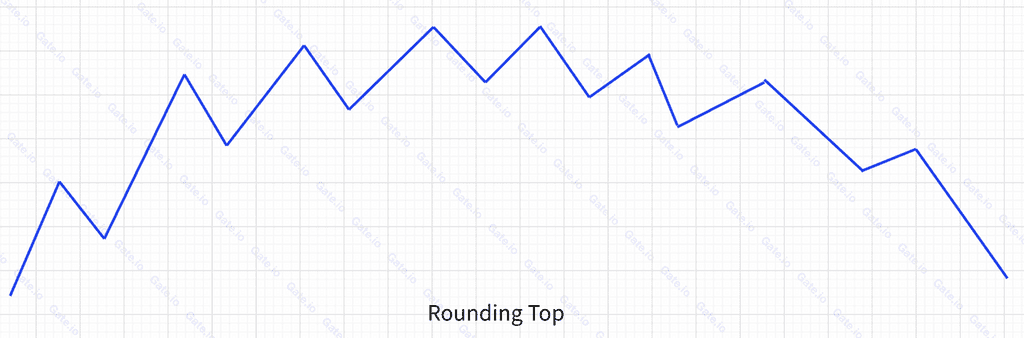

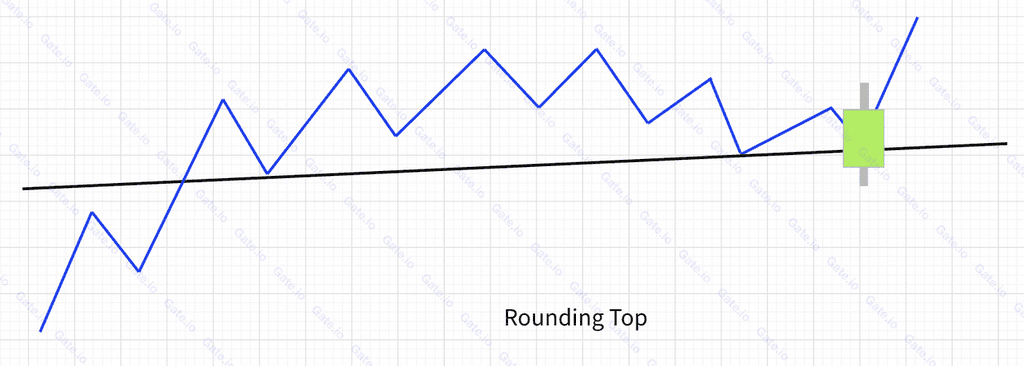

A rounding top illustrates a pattern of price movement, initially rising but at an increasingly decelerated pace while trading volume diminishes. Following this, it undergoes a period of consolidation at the peak, before commencing a decline. The fall begins gently, then gradually intensifies into a sharper descent. This entire progression creates an upward and downward trajectory, mirroring the shape of a rounding top and thus, giving the technical pattern its name. Below is an example of a rounding top:

2. Technical features of the rounding top

①. The pattern can emerge at the culmination of a bullish run or amidst a bearish trend.

②. Initially, the price fluctuates rapidly. As more traders exit, the price experiences diminishing momentum, achieving a series of highs, each marginally higher than the preceding one.

③. As the upward market-driving force weakens, the price begins to descend, marking highs that are each lower than the last. Linking all highs forms a dome-like trajectory. Ultimately, traders rush to exit, resulting in a sharp market decline.

④. In contrast to the rounding bottom, the trading volume during the formation of the rounding top does not evolve consistently. In some instances, the volume histogram may also arrange itself into a rounding top-shaped pattern.

3. The technical meaning of rounding top

The rounding top is often considered a more reliable reversal signal compared to the rounding bottom, largely because its emergence typically coincides with investor exits, a primary condition for forming a bearish market. Conversely, sculpting a bullish market tends to be more challenging as it hinges on fund injections to propel price increases.

Following the formation of the rounding bottom, two potential scenarios may unfold. In the first, the market might collapse dramatically. Alternatively, rather than declining, the market might enter a contemplative period, with a range of sideways movement forming the so-called 'bowl handle.'

In both scenarios, traders should be poised to sell assets and exit since a market downturn will invariably ensue once a rounding top has formed. Even if a bowl handle follows, consolidations are typically quite brief and will swiftly morph into a pronounced downturn.

4. Application

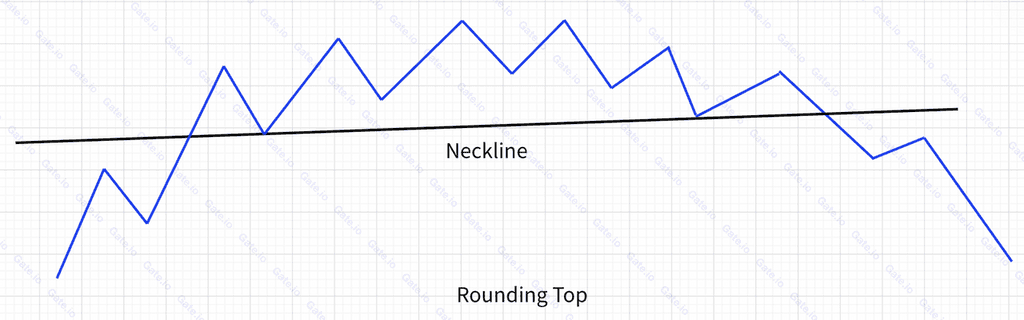

①.The breakdown of the neckline of the rounding top is a signal to exit. The neckline is a straight line that passes through most troughs of the price movement, as shown below:

②.The following is a use case of employing a rounding top to analyze market trends in trading.

The illustration above presents the BTC candlestick from October 1, 2021, to December 5, 2021. Initially, the price soared rapidly before slowing to display a diminished range of growth, attributed to a weakening of selling power. As buying power intensified, an equilibrium between the two forces was reached, steering the market into a sideways movement. After a final surge failed to achieve the previous high, the market gracefully pivoted downward, culminating in the formation of a rounding top. This was followed by a stark decline, during which the price shattered the neckline, inaugurating a year-long bear market that ultimately sliced the price by an accumulated 70%.

③.Trading opportunities prompted by rounding top:

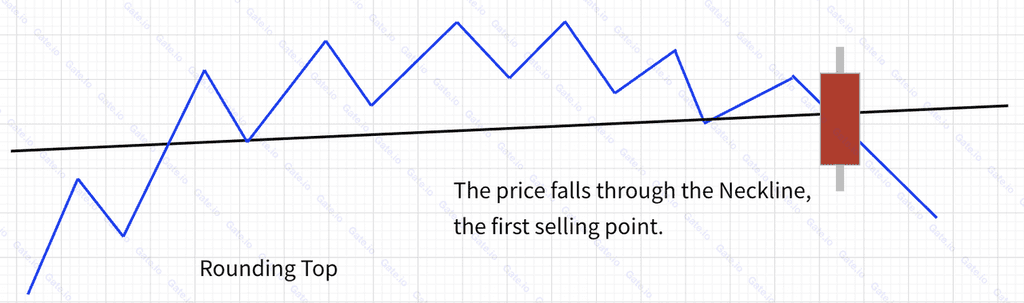

A.The first exit point is when the currency price falls below the neckline. However, this signal is less reliable as most traders are driven by an impulse to exit.

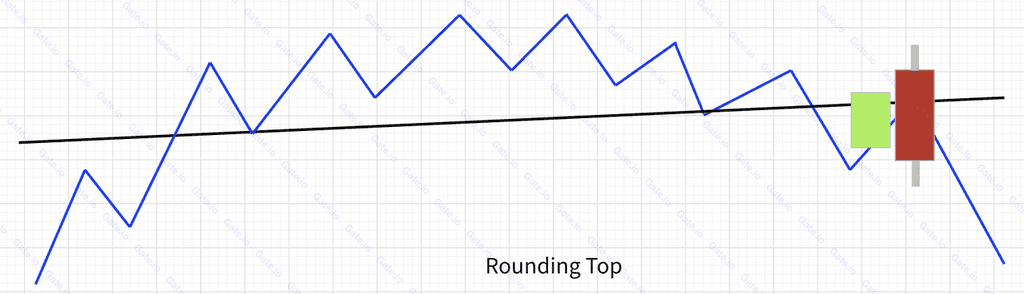

B.Once the price drops below the neckline, a second exit signal is triggered when the price rebounds to meet the neckline but, instead of surpassing it, pivots to decline once again. At this juncture, utilizing additional technical patterns is recommended to affirm the trend. The second exit signal is often deemed more reliable, and traders should decisively close positions to exit upon its appearance.

C.The longer the rounding top takes to build, the longer the subsequent decline will last, and the greater the range of the decline will be.

D.Just as not all rounding bottoms are valid ones, some rounding tops are fake:

④. A 'fake' rounding top refers to a scenario where the price, after breaking down below the neckline, rises above it again and fails to proceed through on a subsequent attempt. In such instances, traders should utilize additional technical tools to confirm the trend and determine whether to exit.

Summary

Rounding top is a common-use technical pattern in trading. However, traders should note the following when using this signal:

①. Employing the 'rounding top' encounters a similar challenge as the 'rounding bottom.' Specifically, in certain cases, the position of the neckline cannot be clearly defined. In such instances, traders should consult additional technical indicators to validate the market conditions.

②. There is no requisite trading volume to validate the pattern when the price breaks down below the neckline. In other words, any breakthrough is considered valid.

Start trading futures by registering on Gate Futures.

Disclaimer

This article is for informational purposes only and does not constitute investment advice. Gate is not responsible for any investment decisions you make. Content related to technical analysis, market assessments, trading skills, and traders' insights should not be considered a basis for investment. Investing carries potential risks and uncertainties. This article offers no guarantees or assurances of returns on any type of investment.