Kamran Asghar

#加密货币交易者 | 仅分享交易、新闻与观点 | DYOR

Kamran Asghar

劳动力市场冲击🚨:美国经济在2月失去92万个工作岗位,失业率升至4.4%。

查看原文

- 赞赏

- 2

- 评论

- 转发

- 分享

🚨 海湾国家在伊朗紧张局势下发出潜在3.6万亿美元投资撤退的信号。

据报道,沙特阿拉伯、阿联酋和科威特正考虑从全球市场大规模撤退——可能影响超过$2T 美元的美国资产。

查看原文据报道,沙特阿拉伯、阿联酋和科威特正考虑从全球市场大规模撤退——可能影响超过$2T 美元的美国资产。

- 赞赏

- 点赞

- 评论

- 转发

- 分享

- 赞赏

- 1

- 评论

- 转发

- 分享

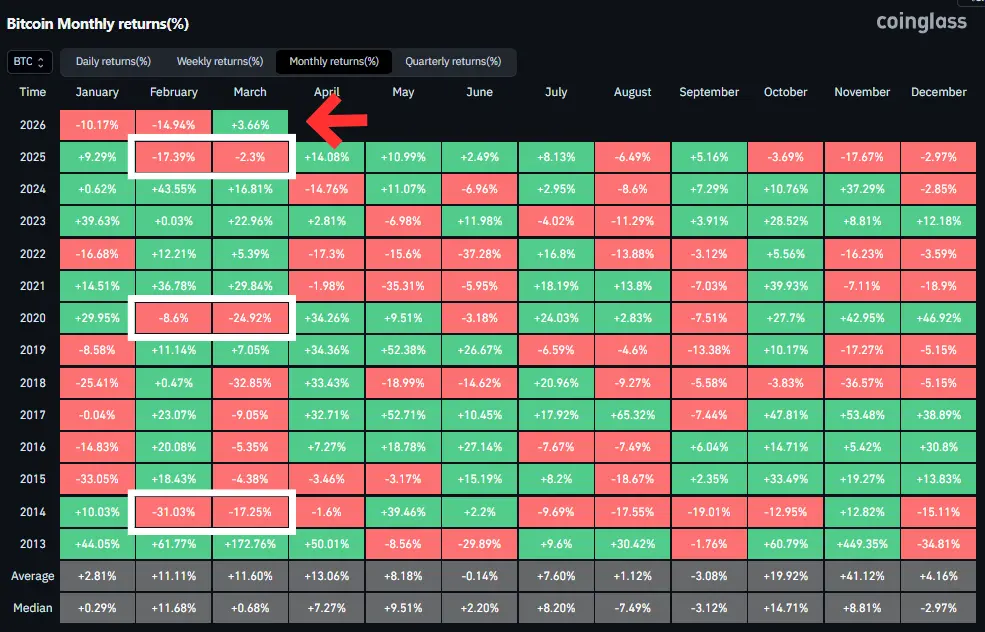

📉 历史趋势:

历史显示,当二月收跌时,三月往往也会跟随。

如果2026年2月下跌,2026年3月也可能收跌。

查看原文历史显示,当二月收跌时,三月往往也会跟随。

如果2026年2月下跌,2026年3月也可能收跌。

- 赞赏

- 点赞

- 评论

- 转发

- 分享

置顶

【千问公告】进场前请读完:我的交易室规则,不合规者请勿跟随 ⚡️

我是千问,Gate 年度收益榜 No.2(+2300%)。

为了维持长期稳定的复利曲线,从即日起,所有跟单者必须严格遵守以下三条硬性铁律:

1️⃣ 资金红线:严禁满仓跟单

禁止将全部身家押注在单一带单员身上。跟单资金请严格控制在个人总仓位的 30% 以内。 只有你能承受波动的压力,我才能带你抓到大级别的利润。

2️⃣ 止损铁律:单笔回撤 <5%

职业交易员不扛单。从即刻起,我将严格执行每单最大回撤不超过 5% 的风控方案。

我会用最小的代价去博取非对称收益。如果你追求的是永不损单的“幻象”,请绕道;如果你追求的是极致的风险收益比,请跟紧。

3️⃣ 信任周期:严禁频繁撤资

交易是概率的集合,不是每一分钟都在盈利。

案例背书: 1月至今,某跟单者从 100U 起步,期间历经多次震荡洗盘,因保持高度信任与耐心,截至今日(3月6日)已斩获 700U,实现 8倍 净利润。

如果你稍微看见一点浮亏就撤单,那你注定会错过随后的暴力翻倍。 ---

⚠️ 郑重警告:

我的交易室只欢迎理性、果断、有大格局的追随者。

如果你心态不稳、频繁上下车、无法忍受正常的战术回撤,请立即取消跟单,把名额留给真正懂交易的朋友。

看准趋势,尊重概率,共拿结果。

👇 执行入口:

#Gateio #千问 #职业风控 $ETH {currencycard:sGate 广场|3/5 今日话题: #比特币创下近一月新高

🎁 解读行情走势,抽 5 位锦鲤送出 $2,500 仓位体验券!

随着白宫表示已向参议院提交凯文·沃什担任美联储主席的提名,美国参议院未通过叫停特朗普打击伊朗的投票,比特币于今日凌晨创下 2 月 5 日以来新高,最高触及 74,050 美元,加密货币总市值回升突破 2.538 万亿美元。

💬 本期热议:

1️⃣ 凯文·沃什的提名是否意味着降息预期升温?

2️⃣ 当前关口,你是持币待涨、顺势追多,还是反手布局回调?

分享观点,瓜分好礼 👉️ https://www.gate.com/post

📅 3/6 15:00 - 3/8 12:00 (UTC+8)Gate 广场内容挖矿奖励继续升级!无论您是创作者还是用户,挖矿新人还是头部作者都能赢取好礼获得大奖。现在就进入广场探索吧!

创作者享受最高60%创作返佣

创作者奖励加码1500USDT:更多新人作者能瓜分奖池!

观众点击交易组件交易赢大礼!最高50GT等新春壕礼等你拿!

详情:https://www.gate.com/announcements/article/49802