Crypto News Today: Bitcoin and XRP Stabilize While Ethereum Faces Resistance Ahead of Federal Reserve Monetary Policy Decision:

Caution Ahead of the Federal Reserve Monetary Policy Decision

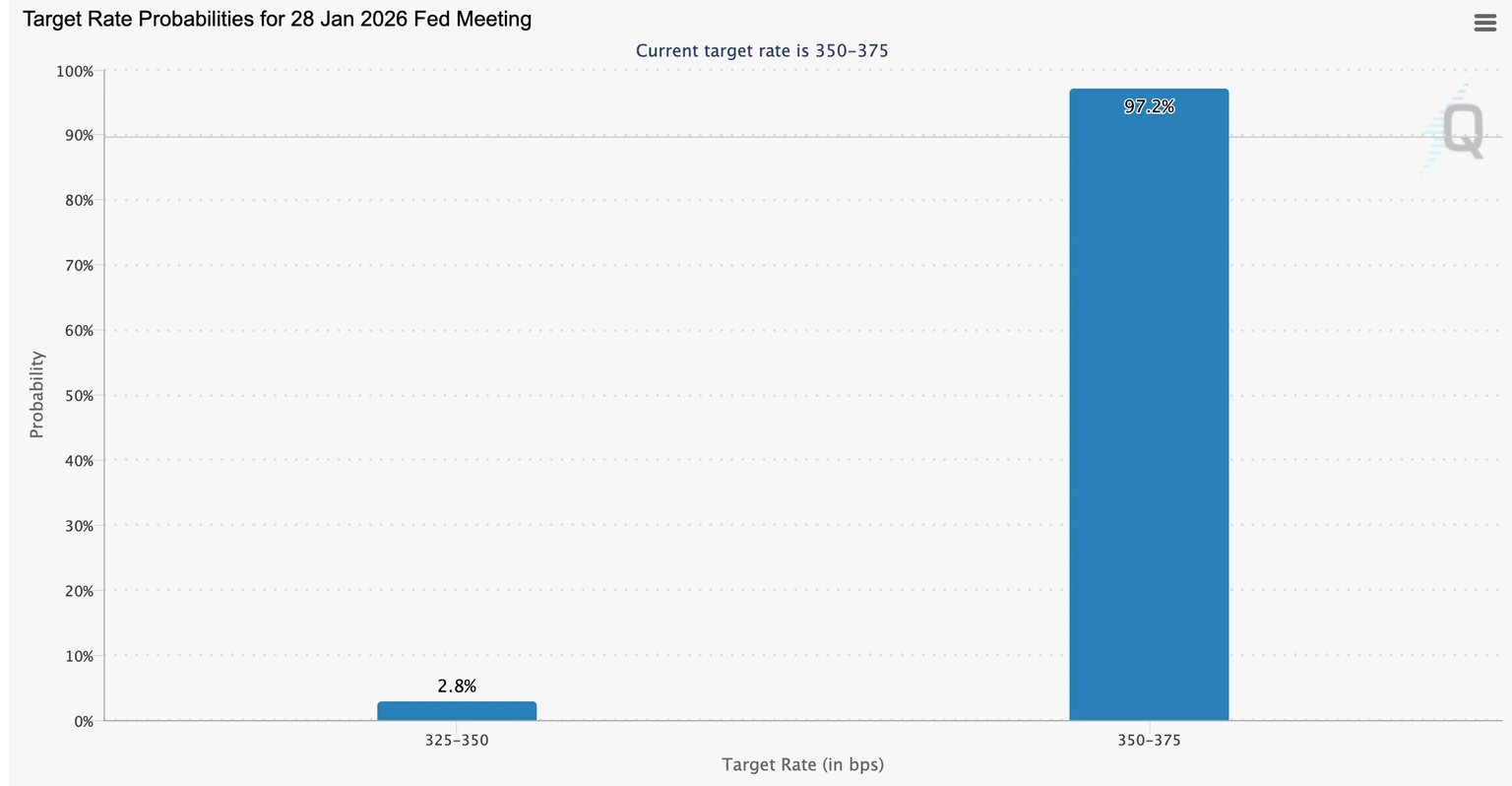

It is widely expected that the Federal Reserve will keep the federal funds rate at the target range of 3.50% - 3.75% during its meeting on Wednesday, halting the monetary easing cycle after three consecutive rate cuts in 2025 that lowered borrowing costs to their lowest level since early 2023.

The CME Group's FedWatch tool shows that investors still expect a 97.2% probability that the central bank will keep interest rates unchanged, with only 2.8% of market participants expecting a cut to the 3.25%–3.50% range.

Interest rate cuts act as a catalyst for rising high-risk assets like Bitcoin and altcoins, while maintaining low interest rates restricts liquidity.

FedWatch Tool | Source: CME Group

U.S. President Donald Trump urges Federal Reserve Chair Jerome Powell to significantly cut borrowing costs, but monetary policymakers insist on responding to market conditions and current data. The central bank often faces a dual task of reducing inflation to the 2% target and lowering unemployment.

U.S. job growth has slowed sharply in recent months, while the unemployment rate remains steady. However, with inflation surpassing the 2% target, policymakers may signal a temporary pause in the monetary easing cycle. Investors will closely watch the Federal Reserve's decision and Powell's press conference for any hints about the potential timing of the next rate cut.

Caution Ahead of the Federal Reserve Monetary Policy Decision

It is widely expected that the Federal Reserve will keep the federal funds rate at the target range of 3.50% - 3.75% during its meeting on Wednesday, halting the monetary easing cycle after three consecutive rate cuts in 2025 that lowered borrowing costs to their lowest level since early 2023.

The CME Group's FedWatch tool shows that investors still expect a 97.2% probability that the central bank will keep interest rates unchanged, with only 2.8% of market participants expecting a cut to the 3.25%–3.50% range.

Interest rate cuts act as a catalyst for rising high-risk assets like Bitcoin and altcoins, while maintaining low interest rates restricts liquidity.

FedWatch Tool | Source: CME Group

U.S. President Donald Trump urges Federal Reserve Chair Jerome Powell to significantly cut borrowing costs, but monetary policymakers insist on responding to market conditions and current data. The central bank often faces a dual task of reducing inflation to the 2% target and lowering unemployment.

U.S. job growth has slowed sharply in recent months, while the unemployment rate remains steady. However, with inflation surpassing the 2% target, policymakers may signal a temporary pause in the monetary easing cycle. Investors will closely watch the Federal Reserve's decision and Powell's press conference for any hints about the potential timing of the next rate cut.