Post content & earn content mining yield

placeholder

LumeoLab

🇻🇳 Vietnam gold prices rise as SJC bars surge $80–$87 per ounce to $6,530–$6,610, far above global spot price 🚨

- Reward

- like

- Comment

- Repost

- Share

if any one now enter in the market and just invest one Dollar I hope he will get soon 10 dollar rewards and if he invest much more he will become a billionaire don't waste chance

- Reward

- like

- Comment

- Repost

- Share

What causes this? alcohol or just sugar?

- Reward

- like

- Comment

- Repost

- Share

WJ

过年

Created By@所愿即所得

Listing Progress

0.00%

MC:

$3.33K

Create My Token

Crypto Market Trends

- Reward

- like

- Comment

- Repost

- Share

Jackie Chan just released, bottom chips, seize the opportunity, go all in with Uncle Long. Back then, we watched Jackie Chan fight on TV, and now the global consensus is beating on the chain. What we miss is collective passion, what we seize is the rhythm of wealth. The crypto world isn't short of miracles, what it lacks is trust like Jackie Chan's—trust in yourself this time.

$BNB

$BNB

BNB-1,16%

MC:$9.87KHolders:2

26.66%

- Reward

- 1

- Comment

- Repost

- Share

Gold prices are soaring, and the crypto world is bleeding! When the cannon fires, gold is worth ten thousand ounces!

As Middle Eastern conflict pushes gold to a peak of $5,000, BTC drops below $90,000, and $583 million long positions vanish in an instant. This extreme "ice and fire" situation proves: gold is the true safe haven, while crypto assets are experiencing brutal liquidations due to tightening liquidity.

The market is shifting from bullish fantasies to extreme panic. Funds are flooding into military industry and gold, with safe-haven pricing entering "war mode"; driven by soaring oil

As Middle Eastern conflict pushes gold to a peak of $5,000, BTC drops below $90,000, and $583 million long positions vanish in an instant. This extreme "ice and fire" situation proves: gold is the true safe haven, while crypto assets are experiencing brutal liquidations due to tightening liquidity.

The market is shifting from bullish fantasies to extreme panic. Funds are flooding into military industry and gold, with safe-haven pricing entering "war mode"; driven by soaring oil

BTC-1,29%

- Reward

- like

- Comment

- Repost

- Share

#GateWeb3UpgradestoGateDEX

Gate Web3 ka Gate DEX mein upgrade Web3 ecosystem ke liye ek major milestone hai. Is upgrade ka core focus true decentralization, enhanced security, aur complete user control ko next level par le jana hai.

Gate DEX ke through users ko:

Non-custodial trading ka full control milta hai

Assets hamesha users ke apne wallets mein rehte hain

Multi-chain access ke zariye different blockchains par seamless swaps possible hain

Ab traders kisi central middleman ke baghair directly blockchain par trading aur swapping kar sakte hain, jo transparency aur trust dono ko strong banat

Gate Web3 ka Gate DEX mein upgrade Web3 ecosystem ke liye ek major milestone hai. Is upgrade ka core focus true decentralization, enhanced security, aur complete user control ko next level par le jana hai.

Gate DEX ke through users ko:

Non-custodial trading ka full control milta hai

Assets hamesha users ke apne wallets mein rehte hain

Multi-chain access ke zariye different blockchains par seamless swaps possible hain

Ab traders kisi central middleman ke baghair directly blockchain par trading aur swapping kar sakte hain, jo transparency aur trust dono ko strong banat

DEFI-9,02%

- Reward

- 2

- 3

- Repost

- Share

AylaShinex :

:

Buy To Earn 💎View More

#加密市场回调 The cryptocurrency market is showing renewed correction pressure today, with Bitcoin slipping below key support levels and broader risk-off sentiment emerging. As of the latest trading sessions, Bitcoin is trading around the mid‑$80,000s to low‑$90,000s, struggling to hold above psychological thresholds as traders reassess risk in the face of macro uncertainty and profit‑taking pressure.

At the same time, Ethereum is also under pressure, trading near the $2,900–$3,000 range, reflecting weakening momentum in the second‑largest digital asset. This dynamic has reverberated across altcoins

At the same time, Ethereum is also under pressure, trading near the $2,900–$3,000 range, reflecting weakening momentum in the second‑largest digital asset. This dynamic has reverberated across altcoins

- Reward

- 3

- 3

- Repost

- Share

ameely :

:

thanks for informing us thanks for informing us thanks for informing usView More

#BitcoinFallsBehindGold

Bitcoin’s Gold Ratio Down 55% Is This a Dip-Buying Opportunity or a Warning Signal?

Bitcoin has recently fallen behind gold in terms of relative strength, with the BTC-to-gold ratio down approximately 55% from its peak. Additionally, BTC has slipped below its 200-week moving average, a long-term technical benchmark that has historically acted as a strong support level during major corrections. These movements have left investors and traders asking: Is this the ideal moment to accumulate, or is the downside risk still too high?

Bitcoin’s recent underperformance relativ

Bitcoin’s Gold Ratio Down 55% Is This a Dip-Buying Opportunity or a Warning Signal?

Bitcoin has recently fallen behind gold in terms of relative strength, with the BTC-to-gold ratio down approximately 55% from its peak. Additionally, BTC has slipped below its 200-week moving average, a long-term technical benchmark that has historically acted as a strong support level during major corrections. These movements have left investors and traders asking: Is this the ideal moment to accumulate, or is the downside risk still too high?

Bitcoin’s recent underperformance relativ

- Reward

- 5

- 5

- Repost

- Share

BeautifulDay :

:

DYOR 🤓View More

Time will give the answer. With strength online, you can handle any market situation with ease, and comfortably provide a 5-point space. The New Year is coming, it's time to get motivated.

LTC-0,68%

- Reward

- like

- Comment

- Repost

- Share

#RIVERUp50xinOneMonth —

The RIVER token has been one of the most explosive performers in the crypto market recently, with price action showing an extraordinary rally — up by multiples in just one month. This kind of move captures attention not only from retail traders but also institutional observers, but it also carries important technical and fundamental nuances worth understanding before positioning into or out of the token.

1. Why RIVER Surged (Key Catalysts)

Major Exchange Listings

A pivotal catalyst behind RIVER’s rally was its listing on South Korea’s Coinone exchange. The debut trading

The RIVER token has been one of the most explosive performers in the crypto market recently, with price action showing an extraordinary rally — up by multiples in just one month. This kind of move captures attention not only from retail traders but also institutional observers, but it also carries important technical and fundamental nuances worth understanding before positioning into or out of the token.

1. Why RIVER Surged (Key Catalysts)

Major Exchange Listings

A pivotal catalyst behind RIVER’s rally was its listing on South Korea’s Coinone exchange. The debut trading

- Reward

- 7

- 8

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs XAG SILVER GOES PARABOLIC — GOLD FOLLOWS WITH A HISTORIC BREAKOUT 🚨

The hard-asset trade just went nuclear. Silver has officially printed a new all-time high at $108, exploding 53% in just the first 26 days of 2026. That’s not a grind — that’s a vertical move driven by aggressive capital inflows and tightening supply.

Gold isn’t far behind. The world’s oldest store of value smashed through $5,073 for the first time ever, already up 16.88% YTD. This isn’t retail speculation — it’s institutional money racing for protection as macro pressure builds.

When metals start mo

The hard-asset trade just went nuclear. Silver has officially printed a new all-time high at $108, exploding 53% in just the first 26 days of 2026. That’s not a grind — that’s a vertical move driven by aggressive capital inflows and tightening supply.

Gold isn’t far behind. The world’s oldest store of value smashed through $5,073 for the first time ever, already up 16.88% YTD. This isn’t retail speculation — it’s institutional money racing for protection as macro pressure builds.

When metals start mo

- Reward

- like

- Comment

- Repost

- Share

特斯马

TSM

Created By@NorthWarm

Listing Progress

100.00%

MC:

$30.27K

Create My Token

#GateTradFi1gGoldGiveaway

💰 Trade & Win Gold Every 10 Minutes! 💰

Here’s the deal — every time you trade on TradFi:

✨ Make a single trade over 100 USDT and unlock 5 chances for consecutive gold draws.

⏱️ Draws happen every 10 minutes, giving you multiple chances to win.

🏆 Keep trading daily, and you could win up to 1,152g of gold!

💡 Multiple entries allowed, and yes — you can win more than once!

This isn’t just hype — it’s real rewards for real traders. Make your trades count and watch the gold roll in.

#TradeAndWin #GoldRewards

💰 Trade & Win Gold Every 10 Minutes! 💰

Here’s the deal — every time you trade on TradFi:

✨ Make a single trade over 100 USDT and unlock 5 chances for consecutive gold draws.

⏱️ Draws happen every 10 minutes, giving you multiple chances to win.

🏆 Keep trading daily, and you could win up to 1,152g of gold!

💡 Multiple entries allowed, and yes — you can win more than once!

This isn’t just hype — it’s real rewards for real traders. Make your trades count and watch the gold roll in.

#TradeAndWin #GoldRewards

- Reward

- like

- Comment

- Repost

- Share

WTI crude oil surges early in the morning! Standing firm at the 61 level and pushing to new highs

Market fluctuations are always the result of a battle between bulls and bears. Only by confidently following the trend can profits be secured. WTI crude oil continues its relatively strong pattern in the morning, with the rhythm of oscillation being key. Grasping support levels to position is to seize opportunities.

Cheng Jingsheng provides an analysis of the short-term trend. From the news perspective, the temporary shutdown of oil fields in Kazakhstan has caused supply disruptions. Extreme cold

View OriginalMarket fluctuations are always the result of a battle between bulls and bears. Only by confidently following the trend can profits be secured. WTI crude oil continues its relatively strong pattern in the morning, with the rhythm of oscillation being key. Grasping support levels to position is to seize opportunities.

Cheng Jingsheng provides an analysis of the short-term trend. From the news perspective, the temporary shutdown of oil fields in Kazakhstan has caused supply disruptions. Extreme cold

MC:$3.61KHolders:2

0.00%

- Reward

- like

- Comment

- Repost

- Share

Hello everyone, I am a GM Diamond Hand💎, with a total of one billion chips and a market cap of 10 million. Before going live, I only buy and never sell boom, GM to the Moon!!!

GM is part of the Sesame platform's value system ecosystem... Let's all look forward to the moment of going live...#GateWeb3正式升级为GateDEX to build an even more powerful ecosystem for GM

GM is part of the Sesame platform's value system ecosystem... Let's all look forward to the moment of going live...#GateWeb3正式升级为GateDEX to build an even more powerful ecosystem for GM

GMWAGMI1,55%

MC:$129.79KHolders:77616

100.00%

- Reward

- 3

- Comment

- Repost

- Share

#ETHTrendWatch

Ethereum has been one of the most watched digital assets in 2026, showing notable price swings that reflect both market sentiment and real adoption metrics. After a period of consolidation, ETH has been trading roughly between $4,200 and $4,700, with sudden spikes driven by Layer 2 growth, DeFi activity, NFT market dynamics, and institutional inflows. These movements illustrate that Ethereum’s price is increasingly influenced by structural developments in the ecosystem rather than pure speculation, making it both an exciting and challenging asset for traders and investors alike

Ethereum has been one of the most watched digital assets in 2026, showing notable price swings that reflect both market sentiment and real adoption metrics. After a period of consolidation, ETH has been trading roughly between $4,200 and $4,700, with sudden spikes driven by Layer 2 growth, DeFi activity, NFT market dynamics, and institutional inflows. These movements illustrate that Ethereum’s price is increasingly influenced by structural developments in the ecosystem rather than pure speculation, making it both an exciting and challenging asset for traders and investors alike

ETH-2,53%

- Reward

- 4

- 6

- Repost

- Share

BeautifulDay :

:

Watching Closely 🔍️View More

#AIBT Don't hesitate or waver when you believe in AIBT. Hesitation and wavering won't make you wealthy. Just go for it.

View Original

- Reward

- like

- Comment

- Repost

- Share

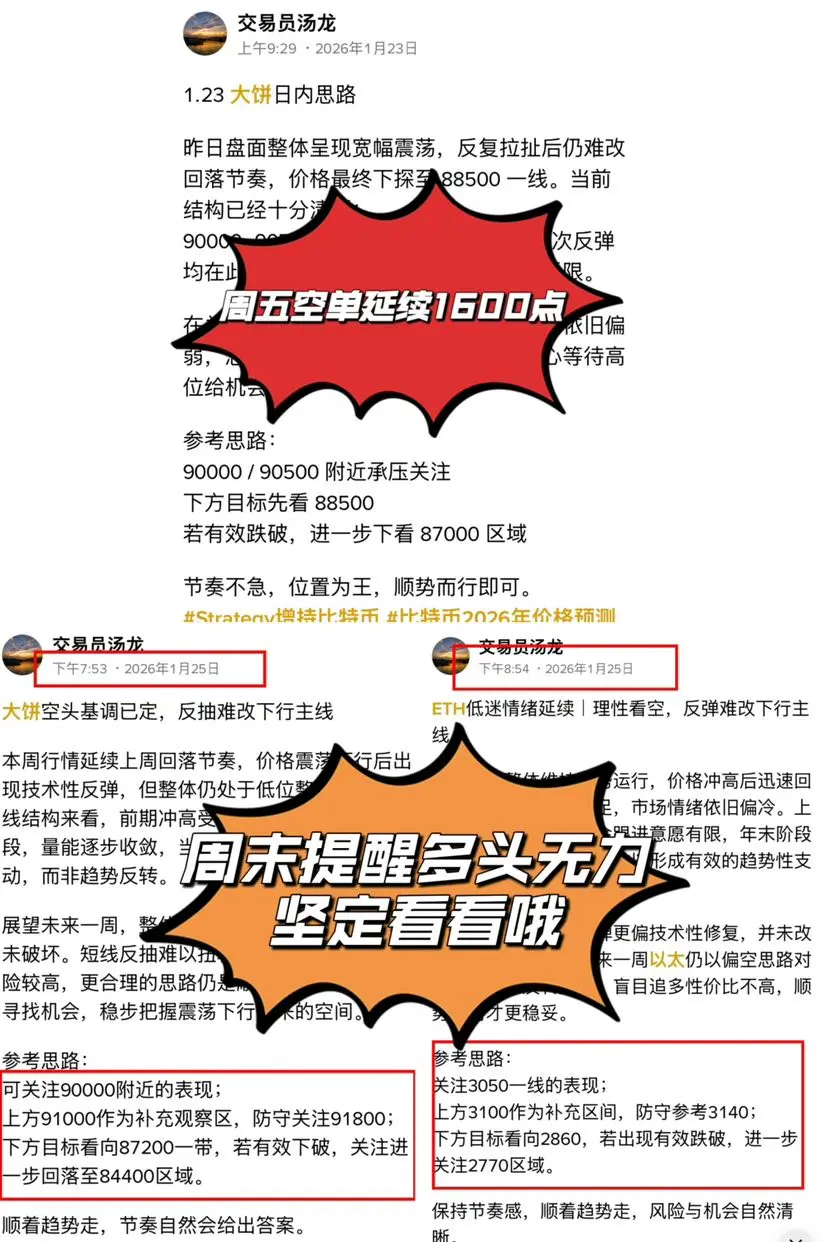

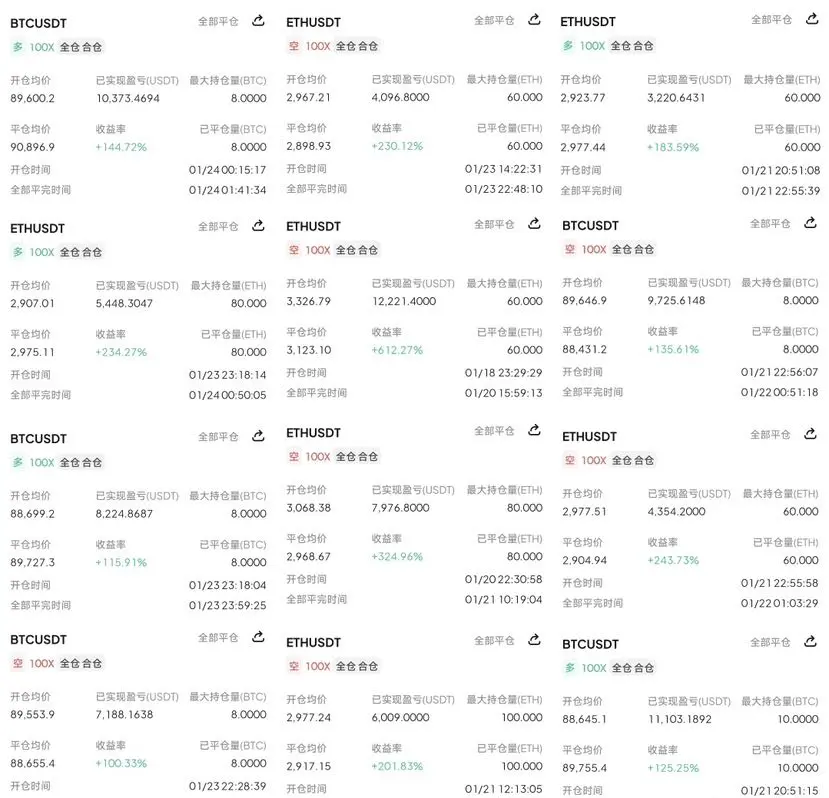

【Last Week's Closing Report】

Bitcoin decisively shorted around 93,200, and the trend played out perfectly, with the lowest dip near 86,000, and the target directly hitting 85,000—successfully achieved; Ethereum also gained momentum, capturing a weekly space of 800 points, with clear results and high profitability!

The week started with a "king bomb" level market, with the plunge rhythm locked in early. We steadily positioned ourselves, riding the trend with our brothers, eating up profits along the way, and directly pocketing the gains.

Subsequently, the market entered a wide-range oscillation

View OriginalBitcoin decisively shorted around 93,200, and the trend played out perfectly, with the lowest dip near 86,000, and the target directly hitting 85,000—successfully achieved; Ethereum also gained momentum, capturing a weekly space of 800 points, with clear results and high profitability!

The week started with a "king bomb" level market, with the plunge rhythm locked in early. We steadily positioned ourselves, riding the trend with our brothers, eating up profits along the way, and directly pocketing the gains.

Subsequently, the market entered a wide-range oscillation

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More80.44K Popularity

53.02K Popularity

43K Popularity

17.46K Popularity

32.13K Popularity

Hot Gate Fun

View More- MC:$3.32KHolders:10.00%

- MC:$3.46KHolders:20.56%

- MC:$3.32KHolders:10.00%

- MC:$3.32KHolders:10.00%

- MC:$3.38KHolders:20.06%

News

View MoreMatrixport: Bitcoin's key support level breached, the market remains in a correction phase overall

2 m

"Special Empty New Coin" traders add to their MEGA short positions, with a slight increase in unrealized profit.

18 m

The risk of a US government shutdown rises to 75%, Bitcoin drops to $87,000, and ETF funds see significant outflows.

19 m

"20 million Wave Hunter" buys HYPE spot and shorts for hedging, with an unrealized profit of $14.72 million.

27 m

Data: 4585.91 ETH transferred out from Everstake, worth approximately $13.04 million

33 m

Pin