K366366k

No content yet

K366366k

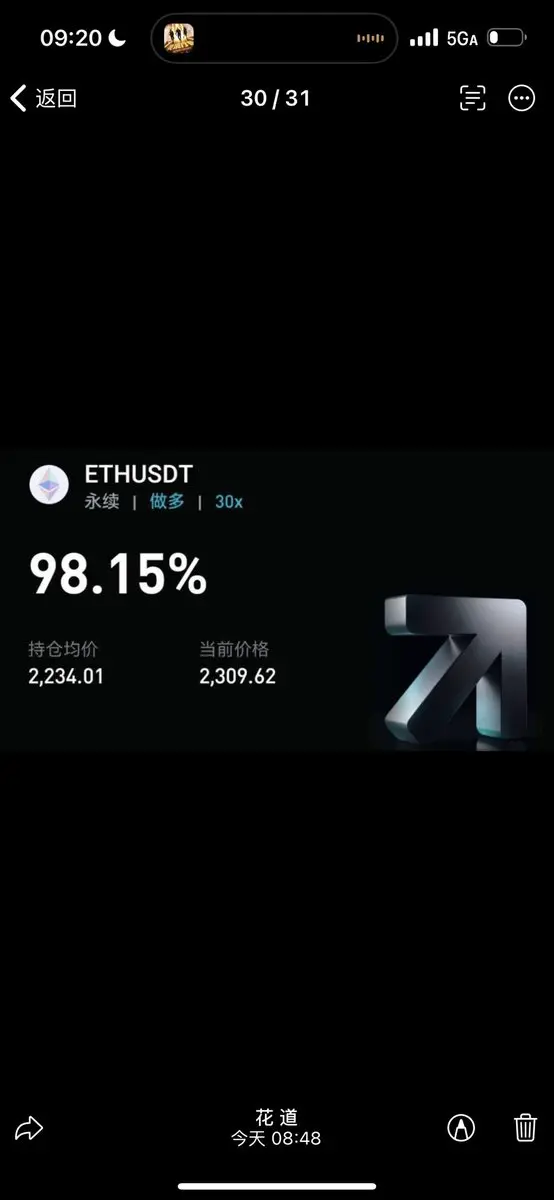

The first order has already taken profit. This is the second order, get ready.

View Original

- Reward

- like

- Comment

- Repost

- Share

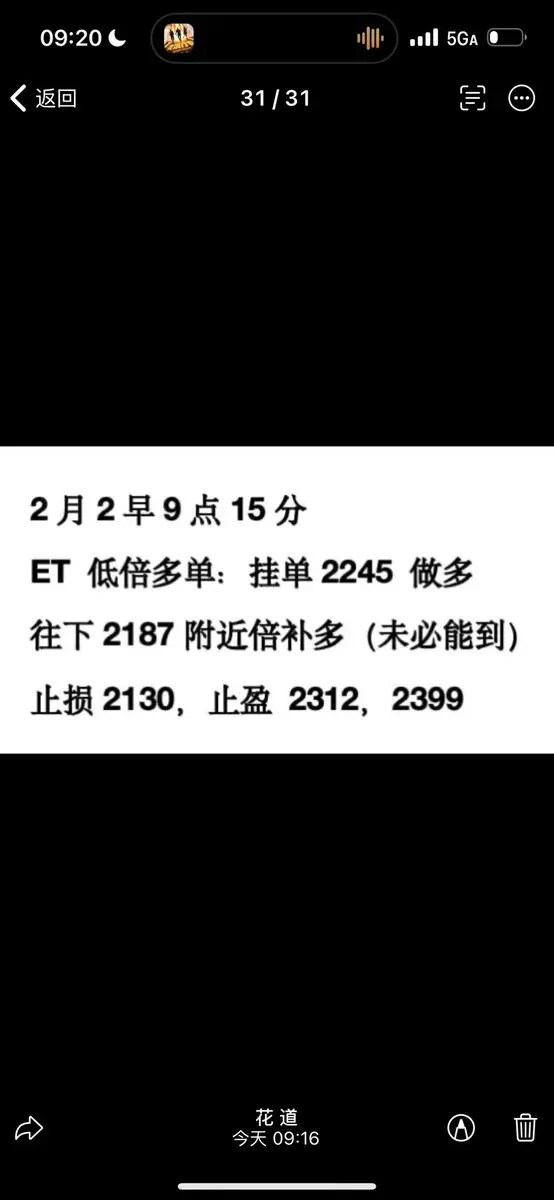

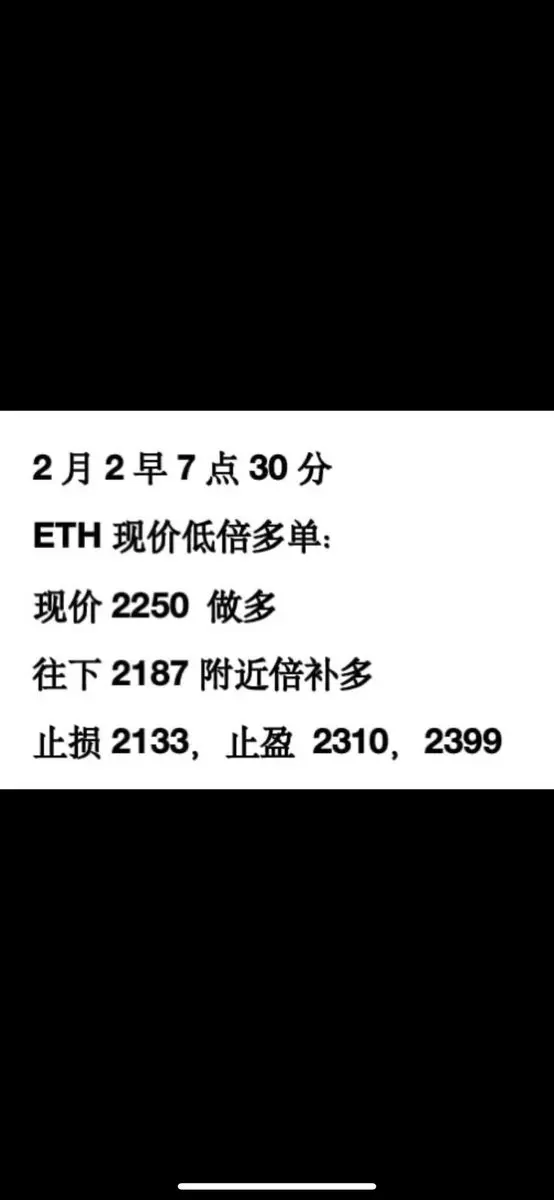

Start a deal—are early risers available?

View Original

- Reward

- like

- Comment

- Repost

- Share

Today is January 26th. BTC price is 878,401. On a macro level, the U.S. aircraft carrier strike group is approaching Iran, and China has replaced the conservative military commission vice chairman, strengthening the position of the young and main combat factions. A brother from my unit told me that a bunch of lieutenant colonels and colonels are anxiously eager for military achievements to get promoted. Therefore, gold and silver have hit new highs, clearly indicating that preparations for war have begun. 2. BTC will continue to fluctuate, but a major drop at this level is unlikely; the bearis

BTC-1,55%

- Reward

- like

- Comment

- Repost

- Share

Friendly reminder, notes on orders labeled as aggressive orders or high-leverage orders generally indicate that profits are imminent. A 30x multiplier means at least half of the profit should be taken at the take-profit point, with the rest set to break even!! If you understand, type 11

View Original

- Reward

- like

- Comment

- Repost

- Share

January 26th at 3:00 AM, send a small aggressive order: ETH high leverage short position in the 2909~ 2922 range, stop loss at 2946, take profit at 2881, 2853. Valid until 8:00 PM, orders will be canceled if overdue, and new levels need to be arranged if overdue.

ETH-6,49%

- Reward

- like

- Comment

- Repost

- Share

WLFI Foundation is very likely to buy EGL1 again. The trading competition in the USD1 system with EGL1 has always been a star project. EGL1 should have been repurchased by the whales to regain chips, aiming for a chance to go long on the contract. Set the stop loss at 0.028 to participate.

View Original- Reward

- like

- Comment

- Repost

- Share

Today is January 14th. BTC price is 94,888 (just a shout-out).

1. When emotions influence your judgment, you should check out my analysis because I am rational, and my win rate is 90%. I keep records every day, which cannot be lied about. You deserve to have this.

2. Previously, after a stretch to 94,000 and a pullback, I kept emphasizing that the larger structure was not complete. The long positions I provided are all good entry points.

3. Many brothers said to join the group. Tonight, I will set up a "Buy 8" registration.

1. When emotions influence your judgment, you should check out my analysis because I am rational, and my win rate is 90%. I keep records every day, which cannot be lied about. You deserve to have this.

2. Previously, after a stretch to 94,000 and a pullback, I kept emphasizing that the larger structure was not complete. The long positions I provided are all good entry points.

3. Many brothers said to join the group. Tonight, I will set up a "Buy 8" registration.

BTC-1,55%

- Reward

- like

- Comment

- Repost

- Share