Glassnode

No content yet

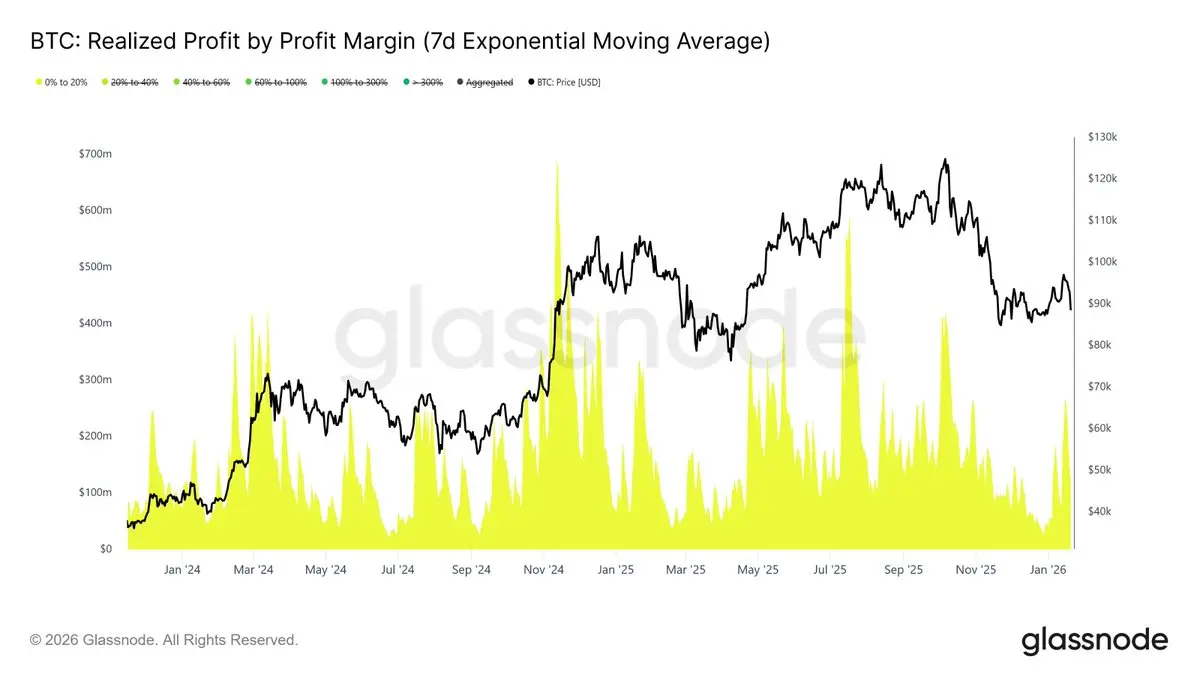

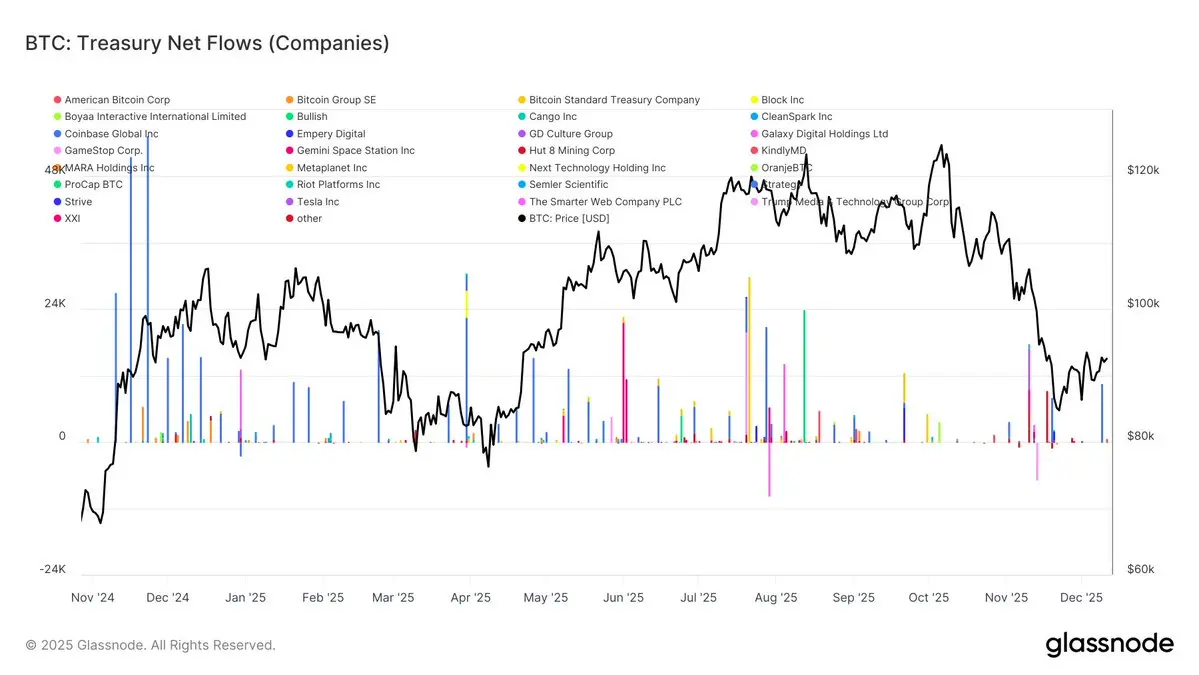

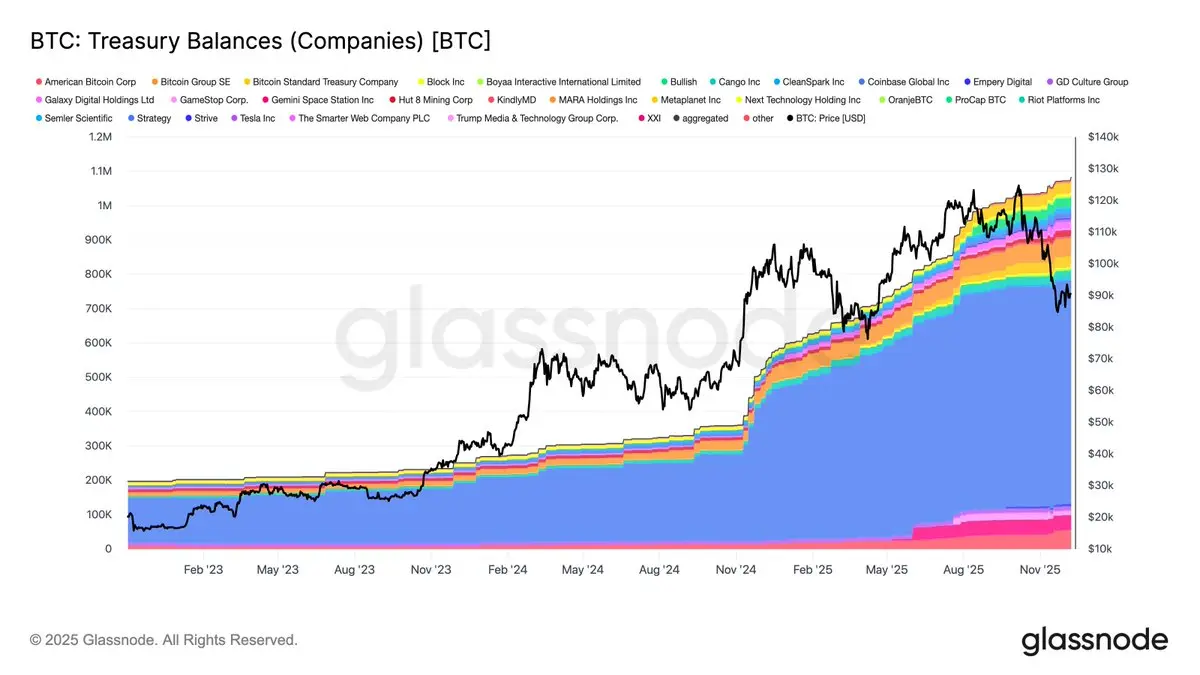

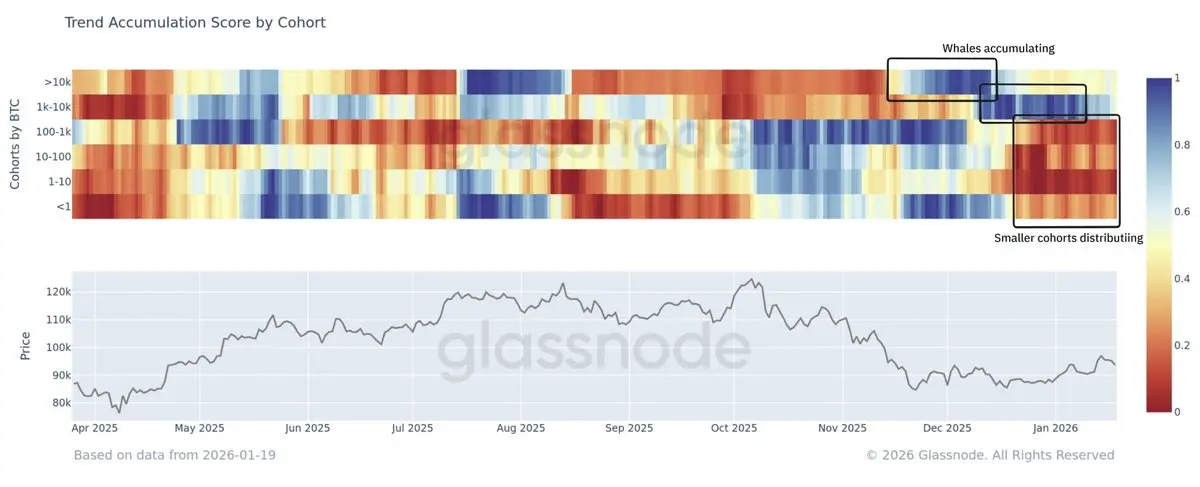

During the November–December bottoming phase, supply accumulation was primarily driven by larger entities, while smaller cohorts were distributing.

This divergence appears to be driven in part by exchange-related wallet reshuffling, and also by large holders buying the dip.

📉

This divergence appears to be driven in part by exchange-related wallet reshuffling, and also by large holders buying the dip.

📉

- Reward

- like

- Comment

- Repost

- Share

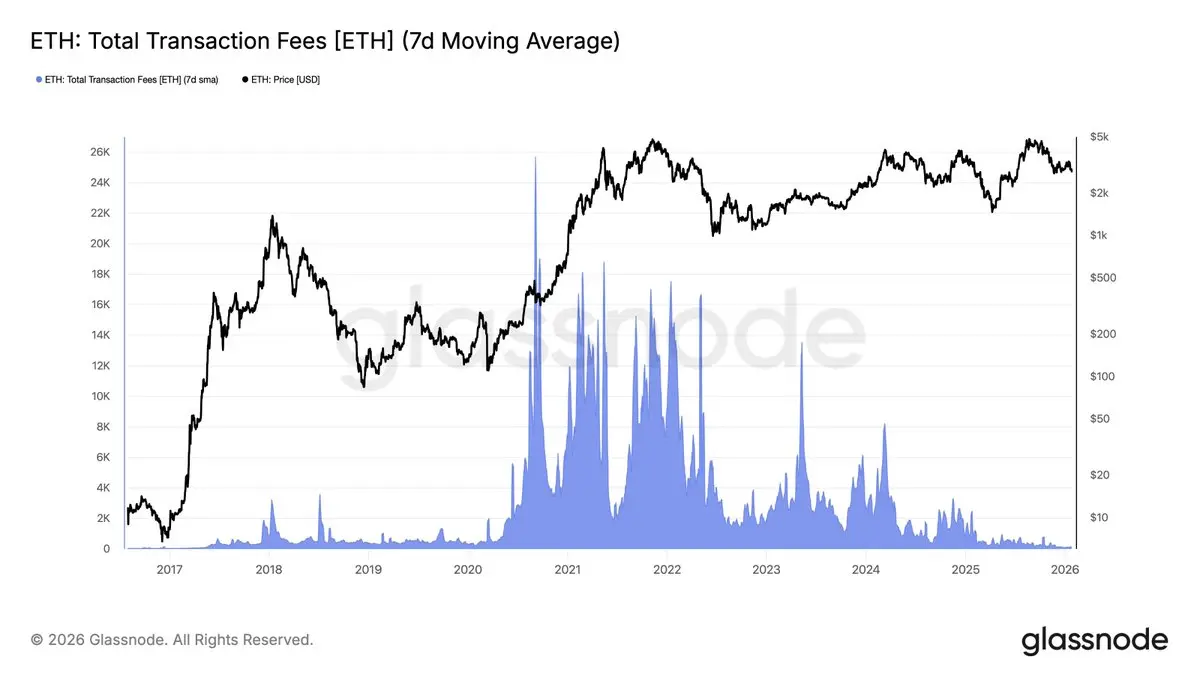

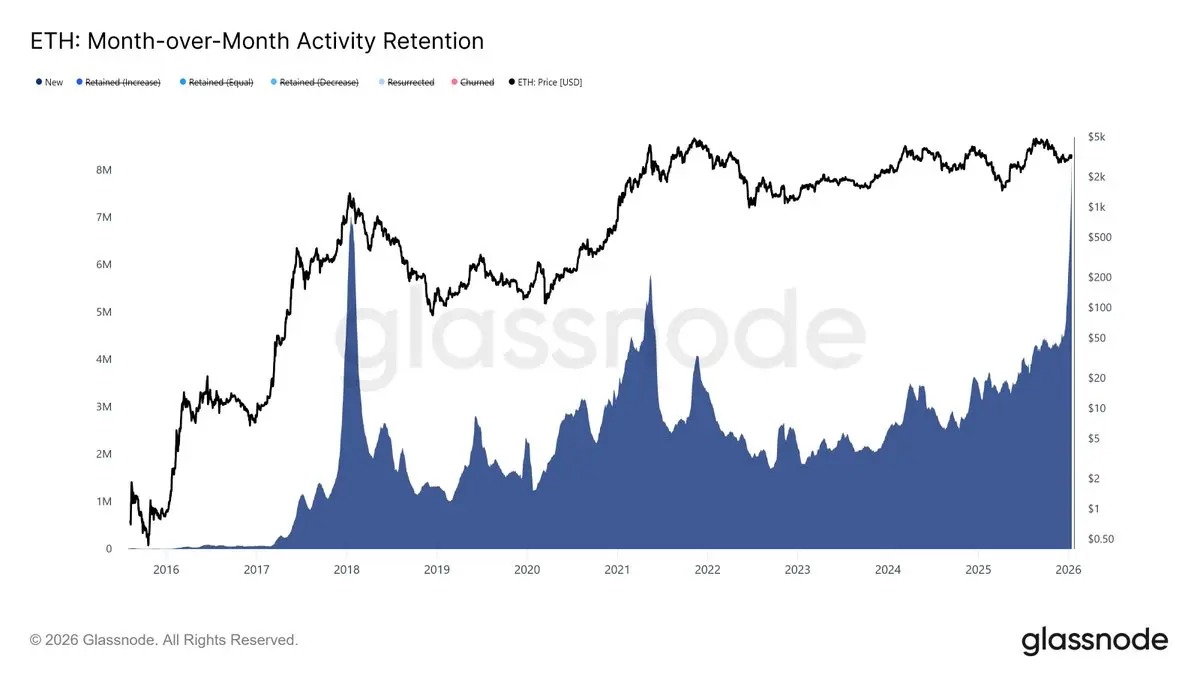

Ethereum’s Month-over-Month Activity Retention shows a sharp spike in the “New” cohort, indicating a surge in first-time interacting addresses over the past 30 days.

This reflects a notable influx of new wallets engaging with the Ethereum network, rather than activity being driven solely by existing participants.

📈

This reflects a notable influx of new wallets engaging with the Ethereum network, rather than activity being driven solely by existing participants.

📈

ETH-1,39%

- Reward

- like

- Comment

- Repost

- Share

Bouncing Into Supply

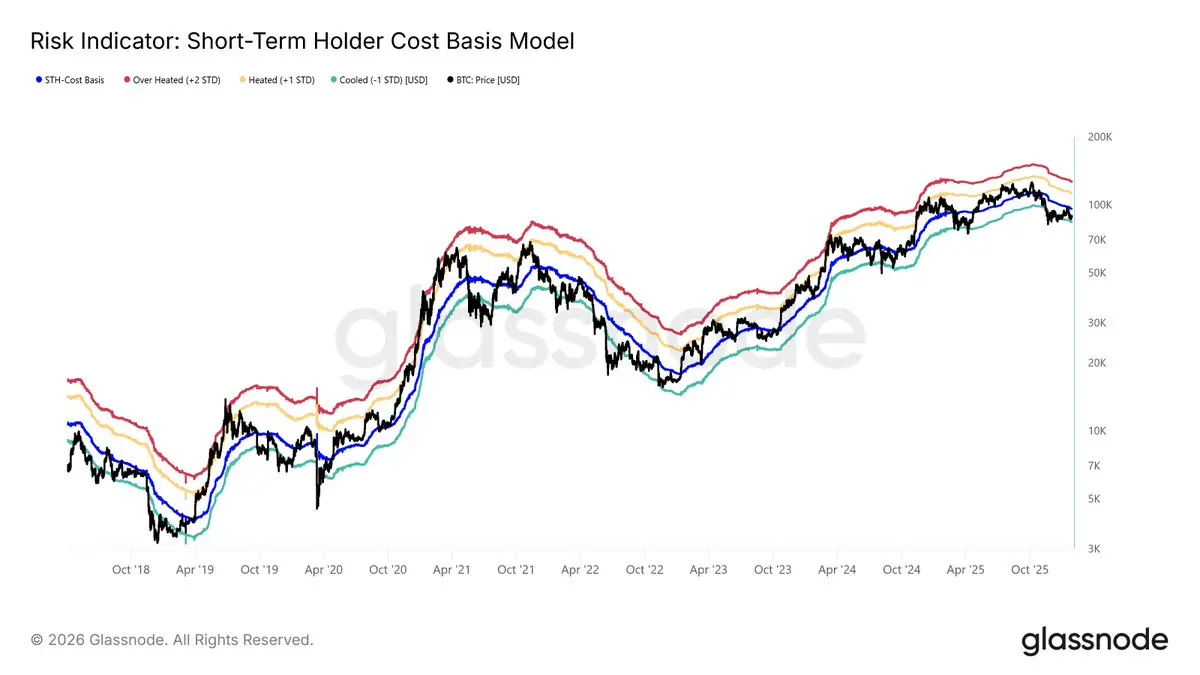

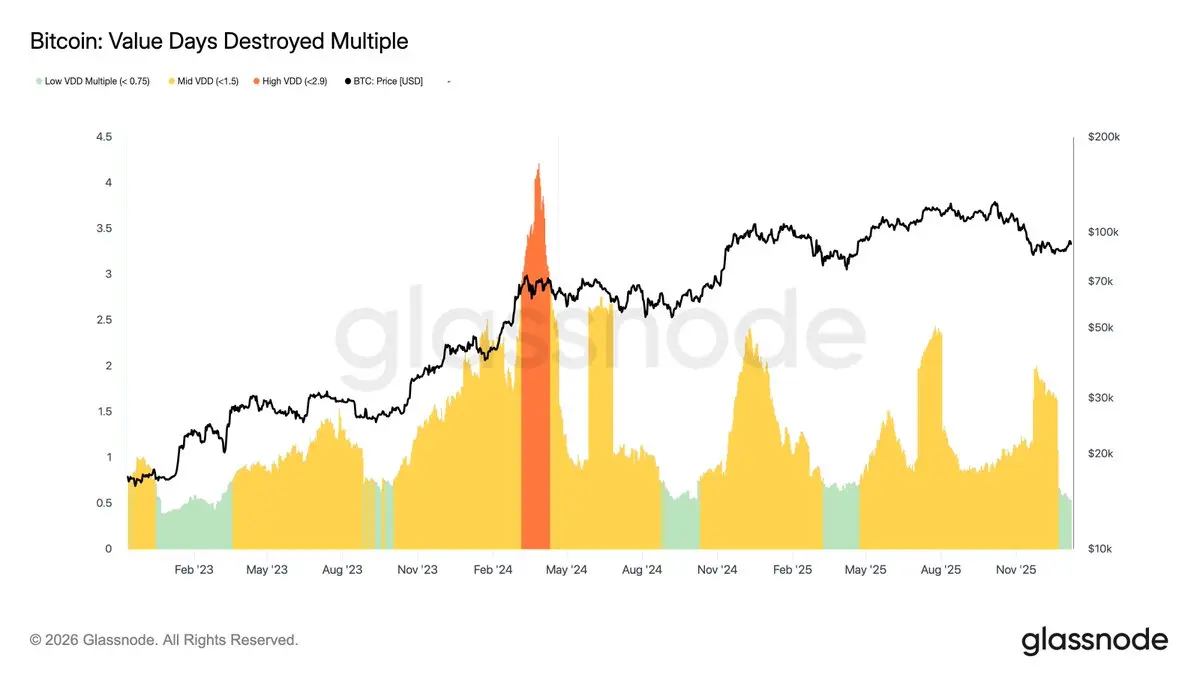

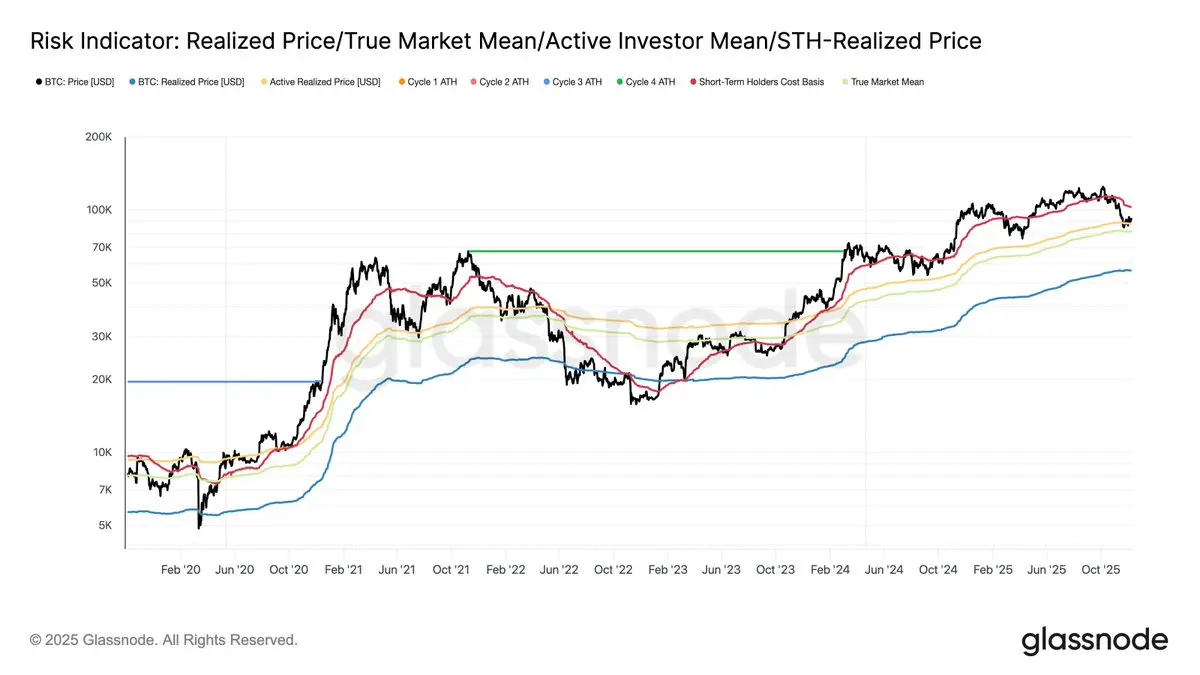

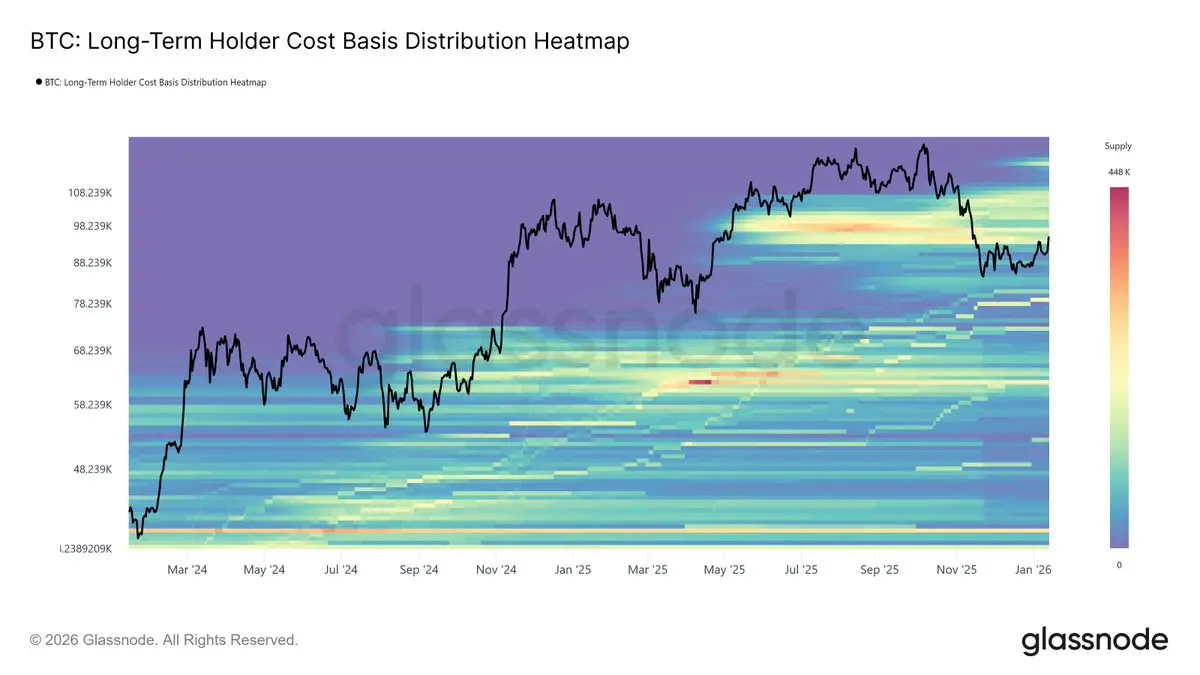

#Bitcoin has entered the new year with constructive momentum, printing two higher highs and extending price to $98k, but the advance now runs directly into a historically significant supply zone.

Read the full Week On-Chain👇

#Bitcoin has entered the new year with constructive momentum, printing two higher highs and extending price to $98k, but the advance now runs directly into a historically significant supply zone.

Read the full Week On-Chain👇

BTC-0,99%

- Reward

- 1

- 1

- Repost

- Share

PumpSpreeLive :

:

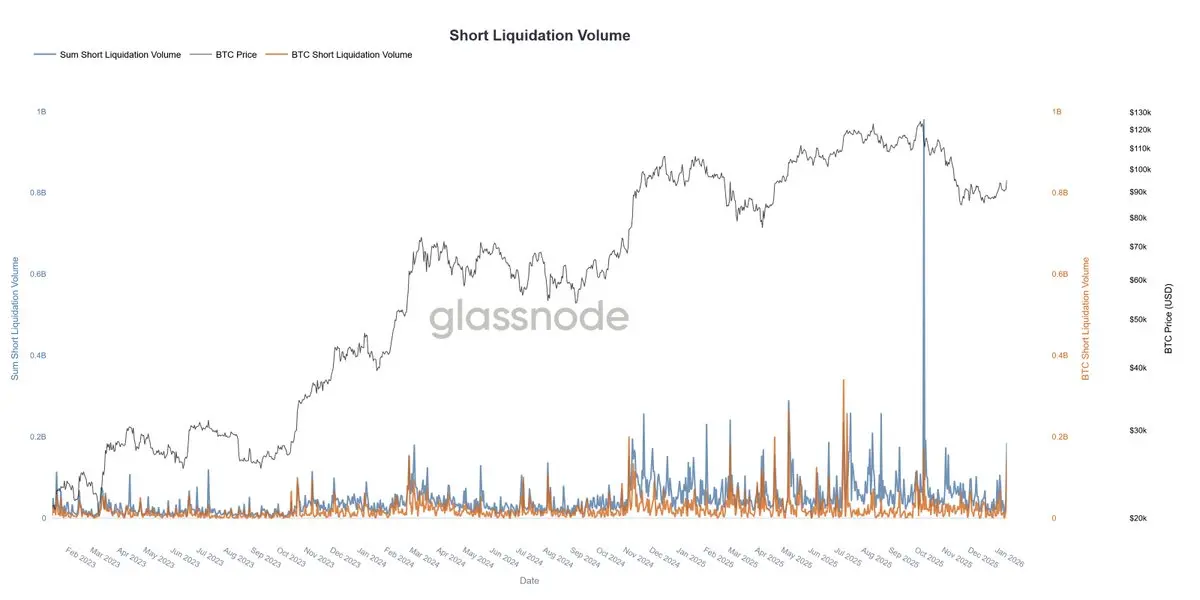

HODL Tight 💪Across the top 500 cryptocurrencies, the latest move triggered the largest short-liquidation event since 10/10.

📉

📉

- Reward

- like

- Comment

- Repost

- Share

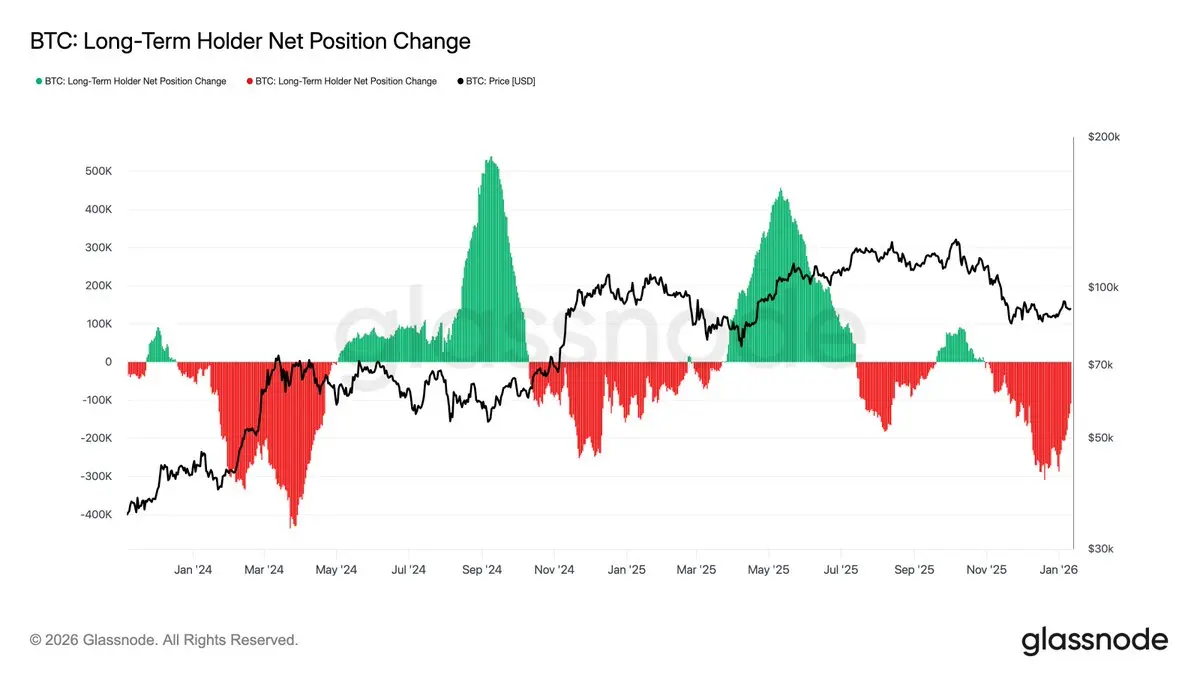

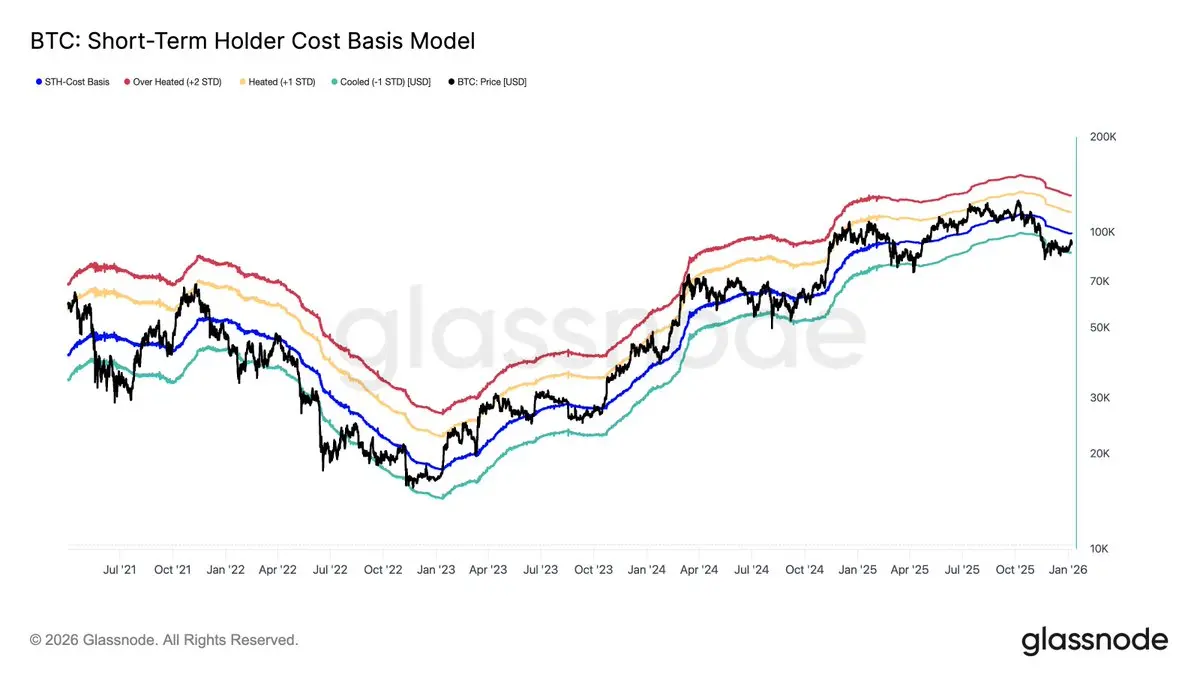

Using the newly launched Short-Term Holder Cost Basis Distribution (CBD) Heatmap, the recent $80K–$95K consolidation reflects a top-heavy cost-basis structure meeting renewed demand above $80K.

Overhead supply from recent buyers has absorbed bounce attempts, anchoring price despite sustained buying interest following the drawdown.

📉

Overhead supply from recent buyers has absorbed bounce attempts, anchoring price despite sustained buying interest following the drawdown.

📉

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

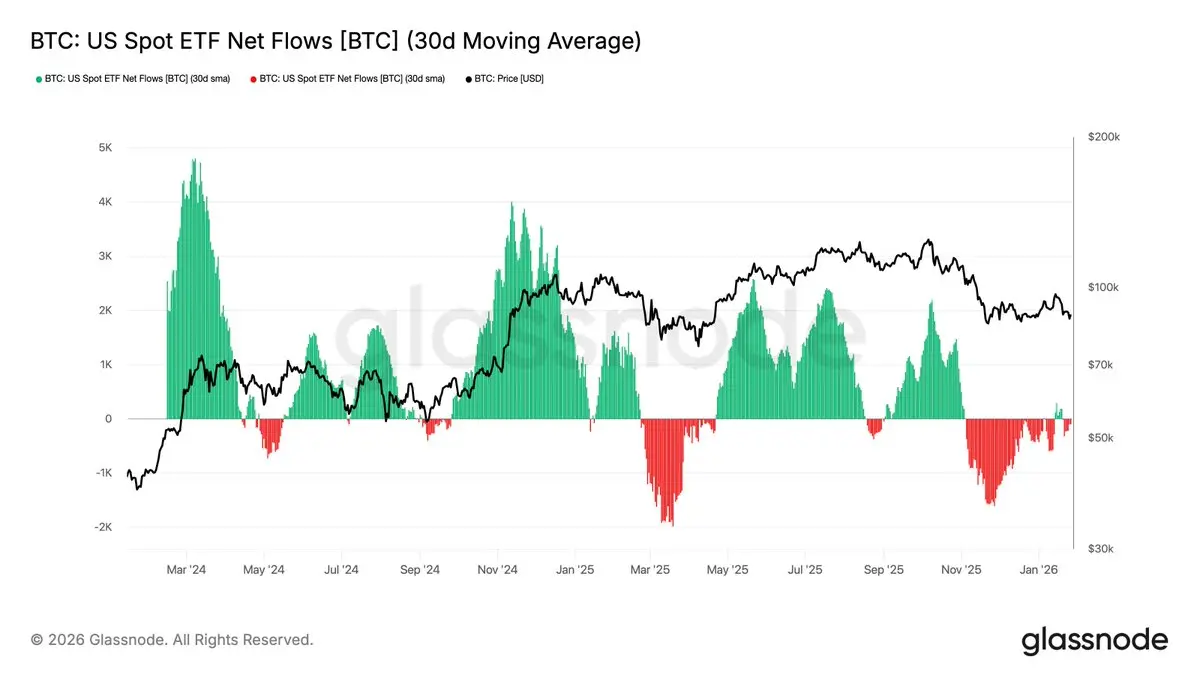

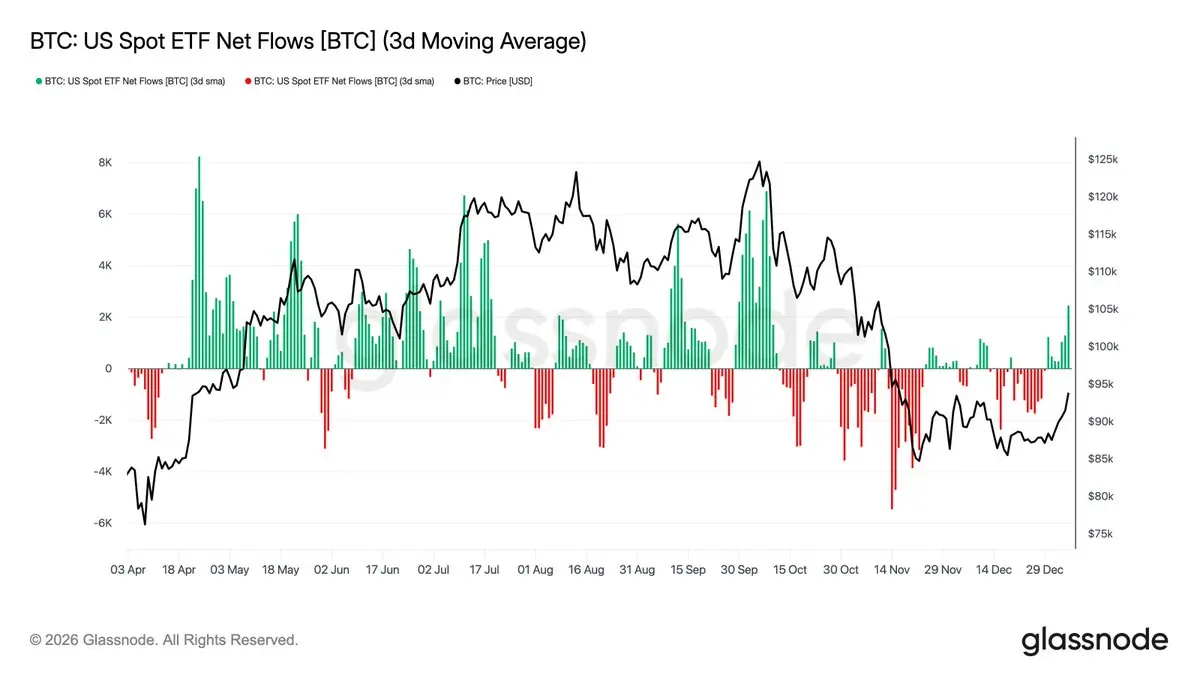

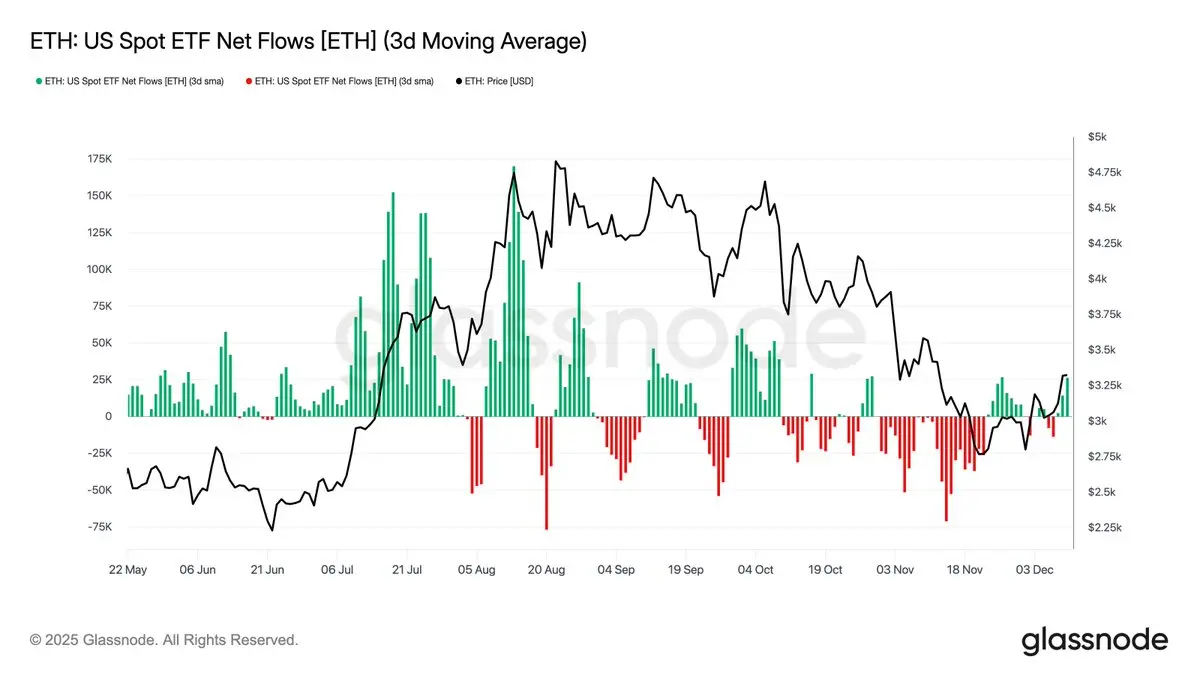

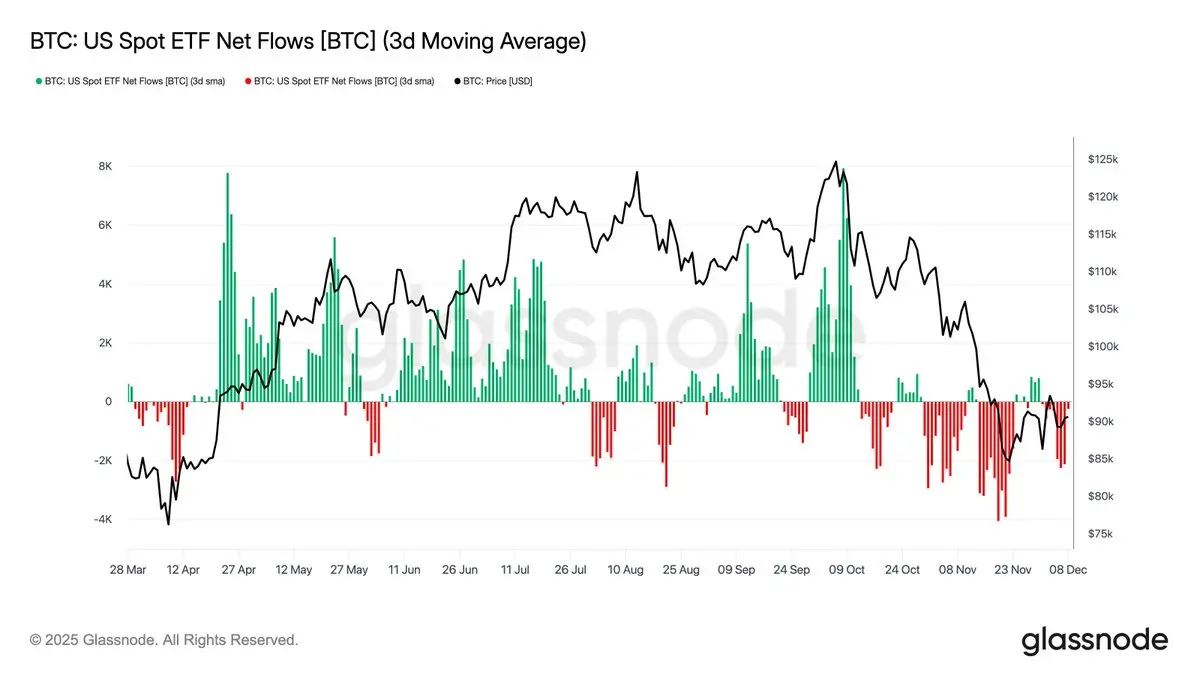

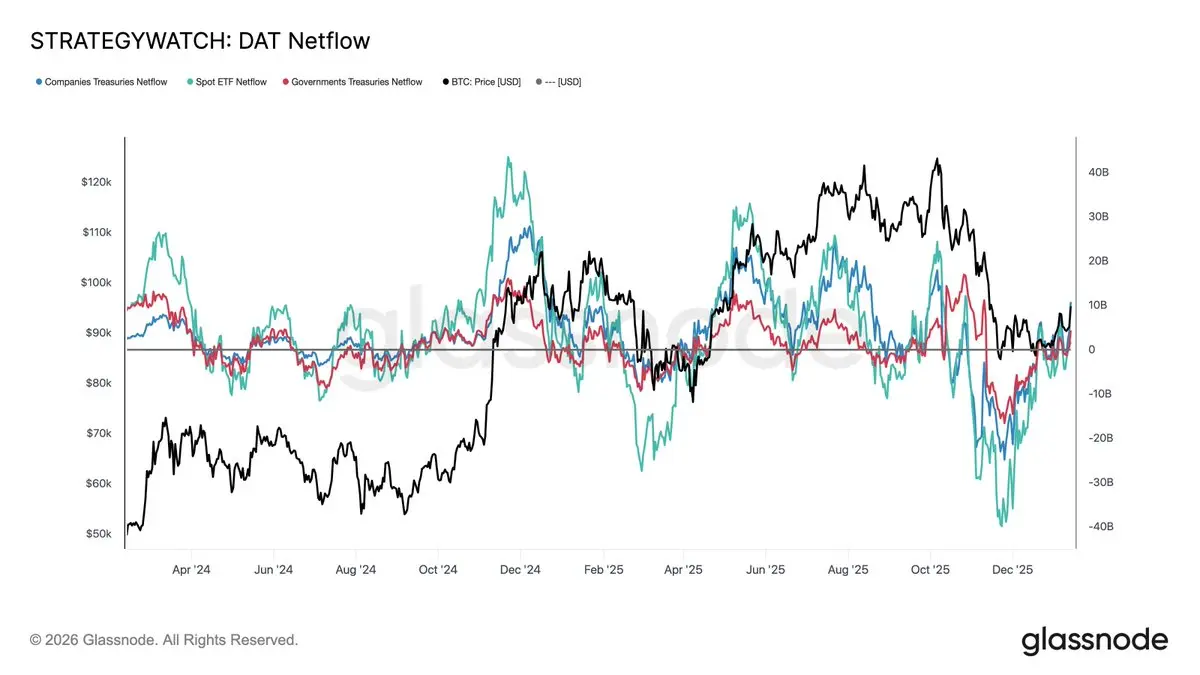

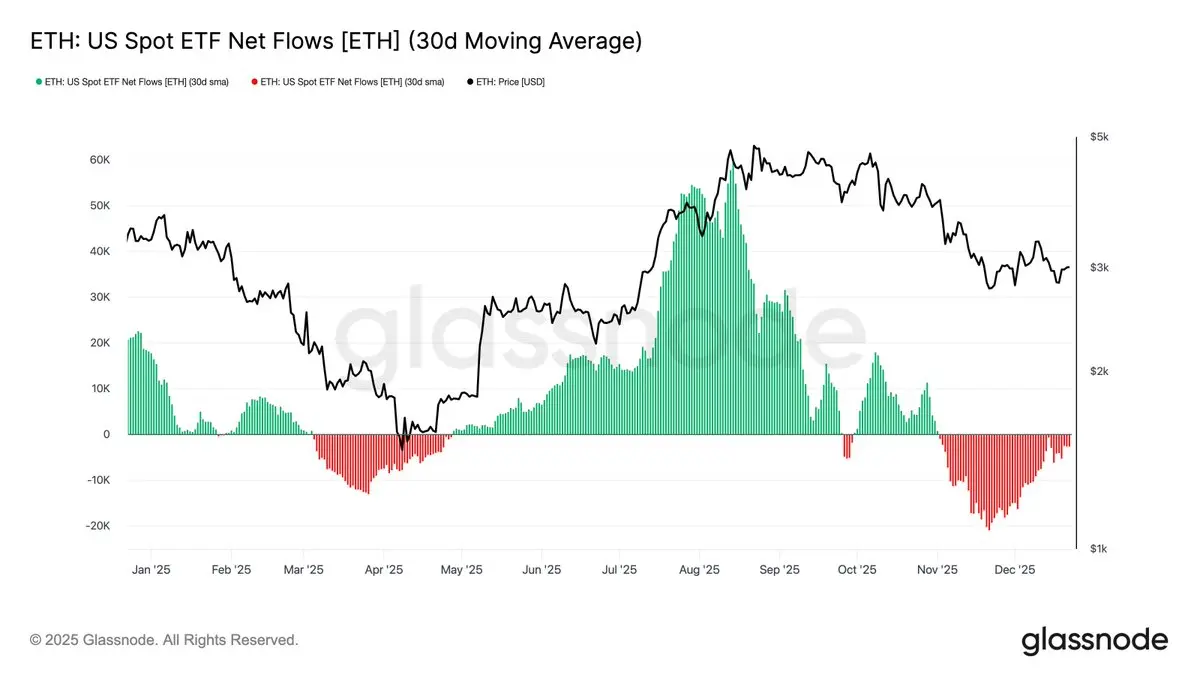

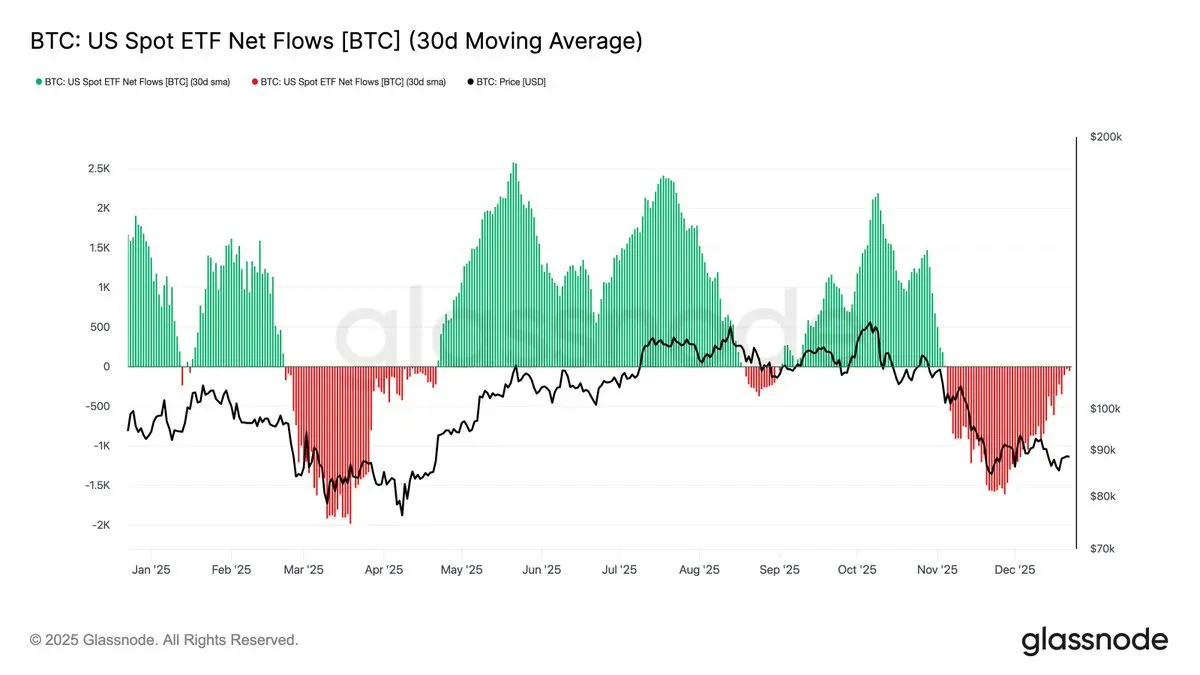

Since early November, the 30D-SMA of net flows into both Bitcoin and Ethereum ETFs has turned negative and remained so.

This persistence suggests a phase of muted participation and partial disengagement from institutional allocators, reinforcing the broader liquidity contraction across the crypto market.

📉

This persistence suggests a phase of muted participation and partial disengagement from institutional allocators, reinforcing the broader liquidity contraction across the crypto market.

📉

- Reward

- like

- Comment

- Repost

- Share

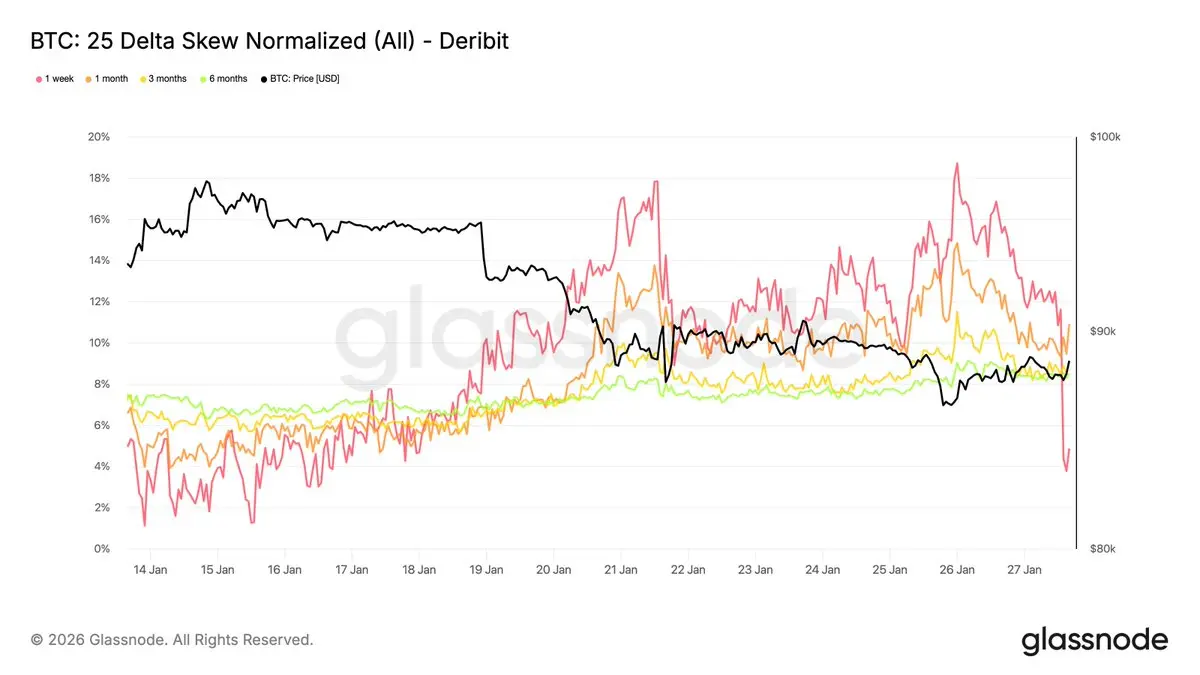

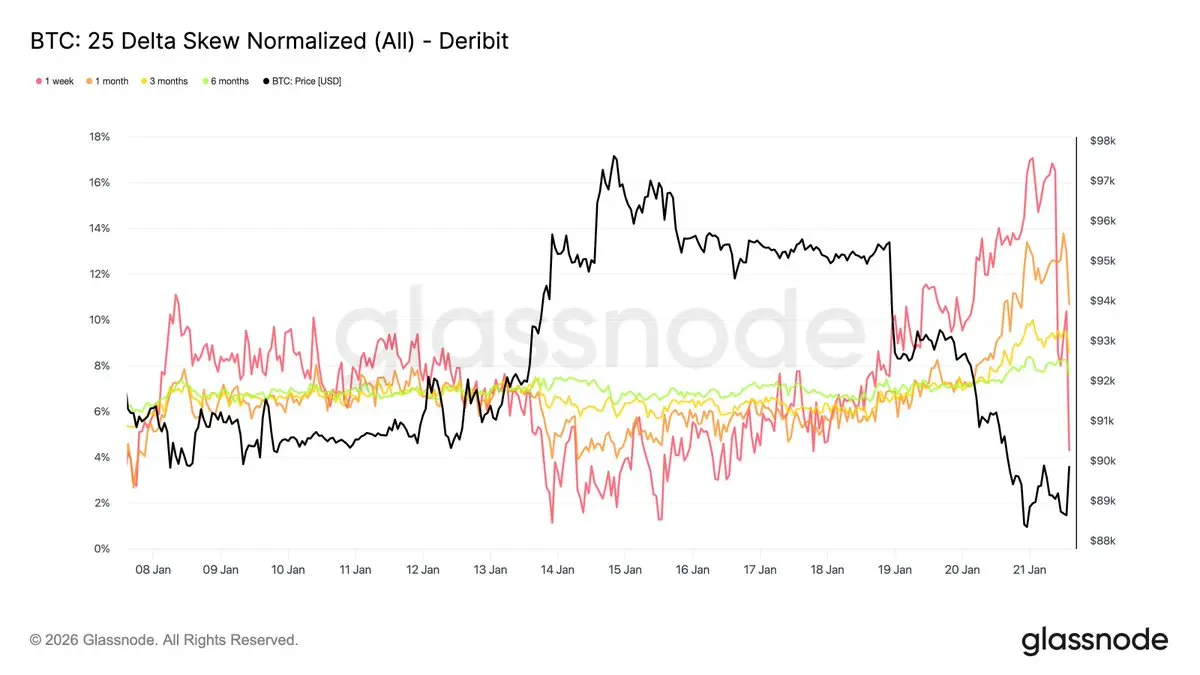

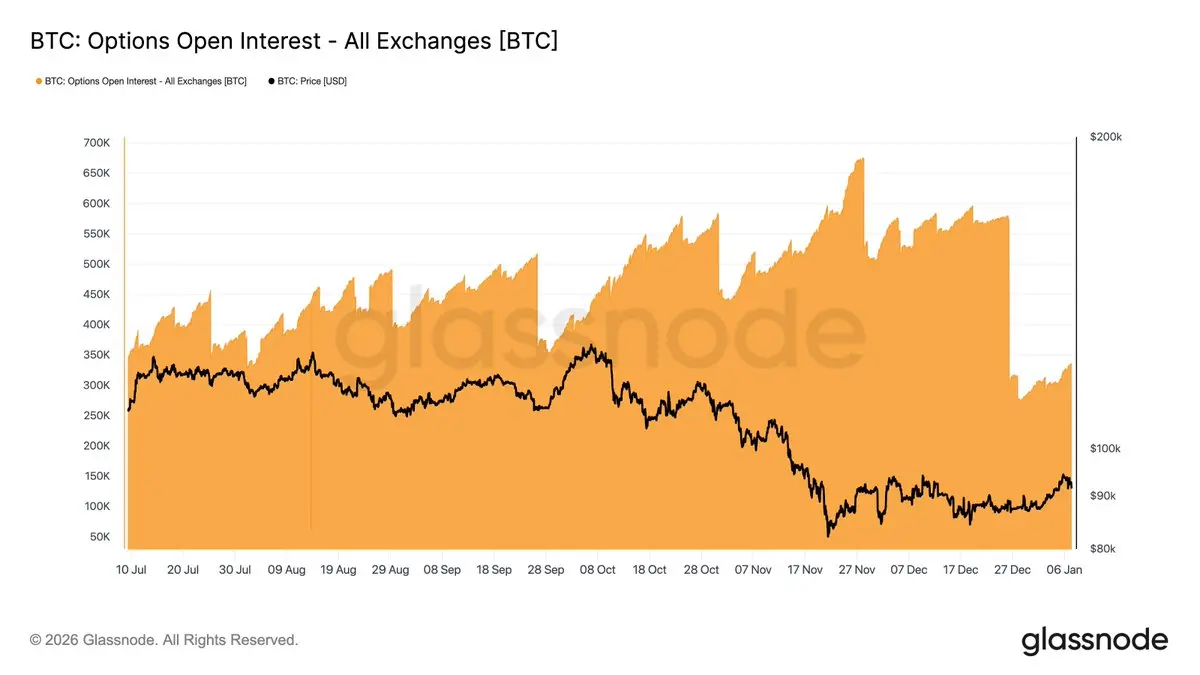

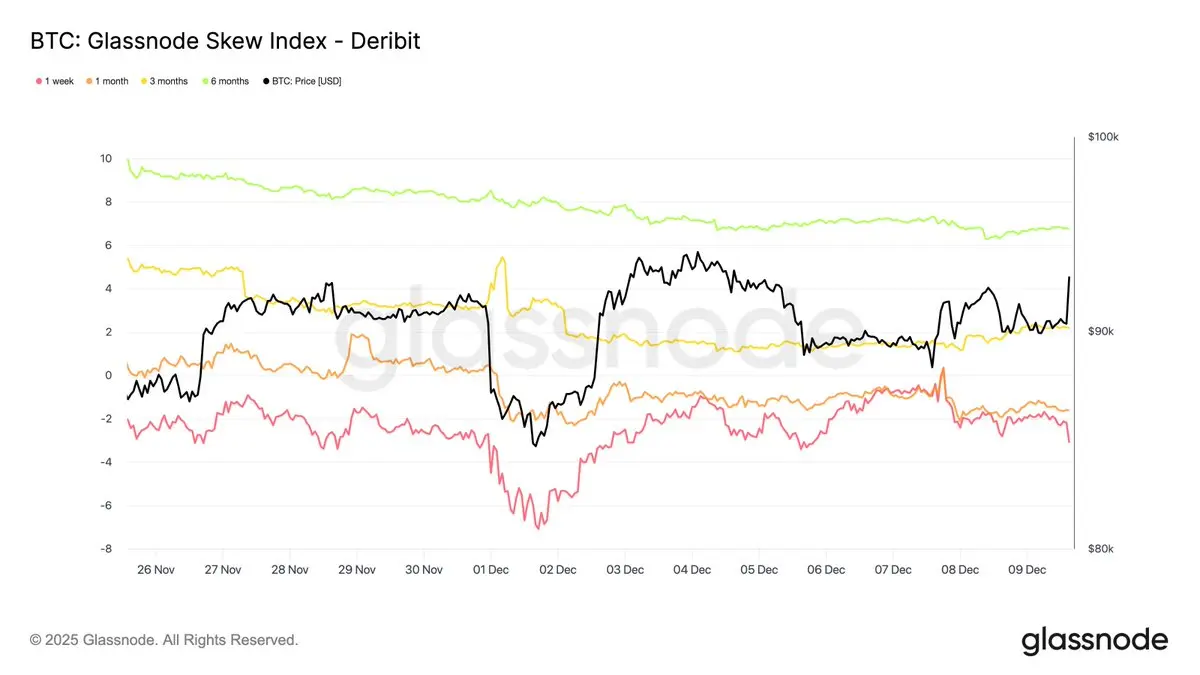

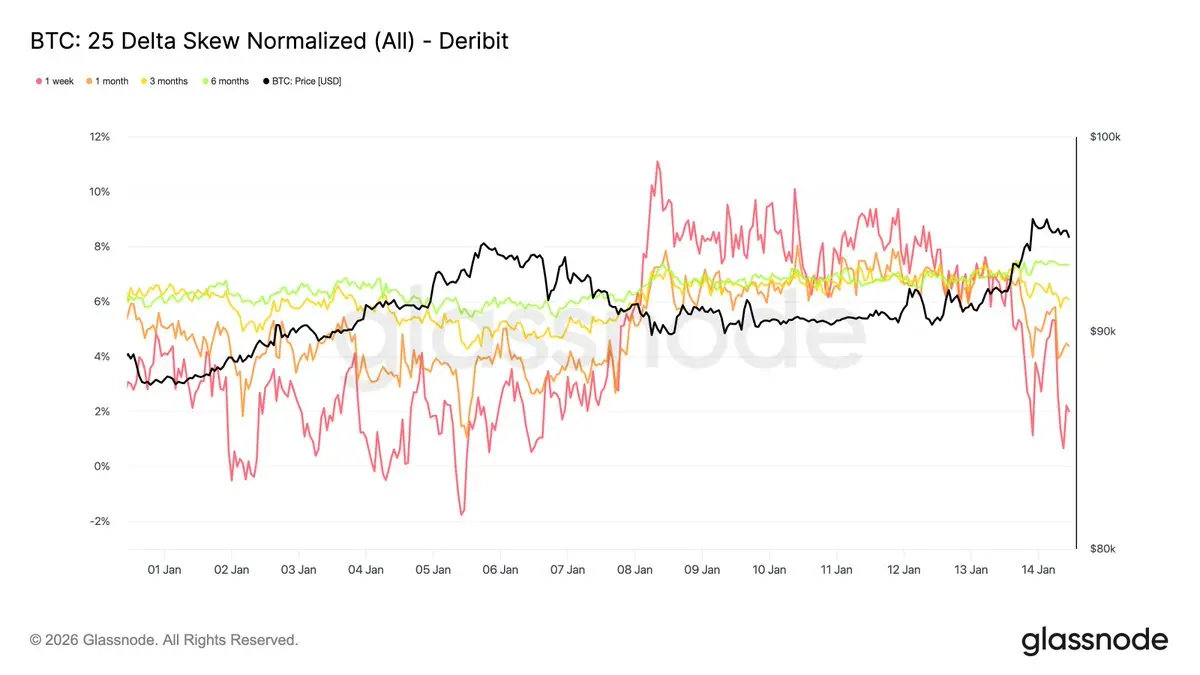

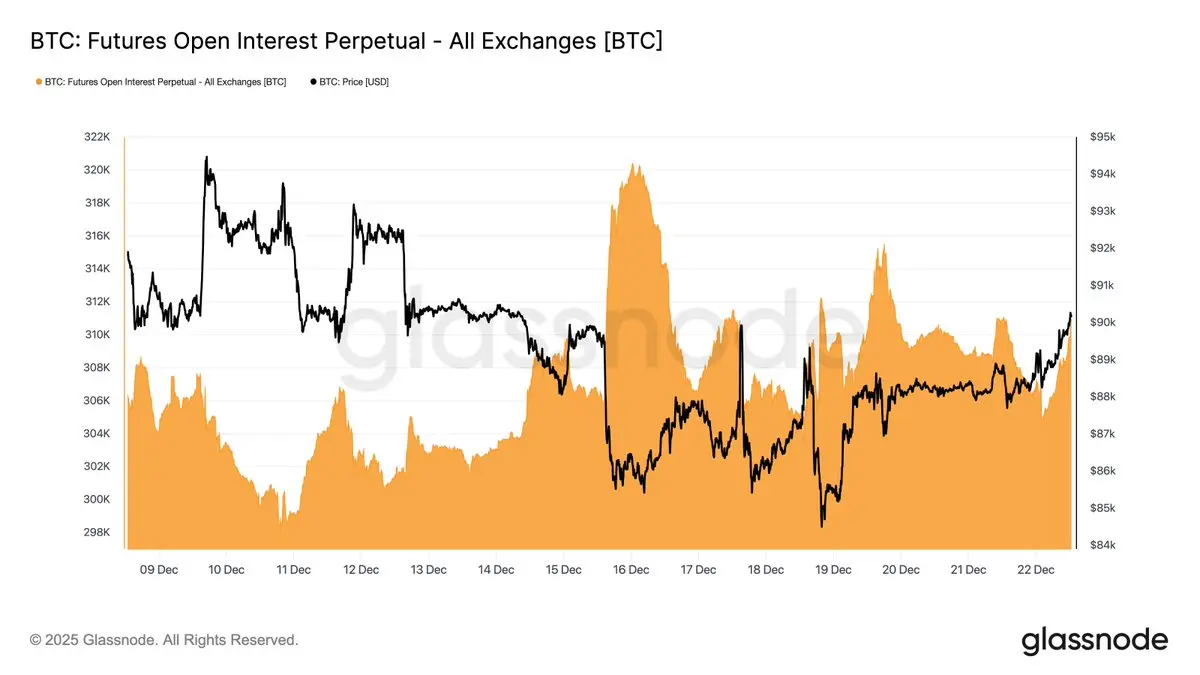

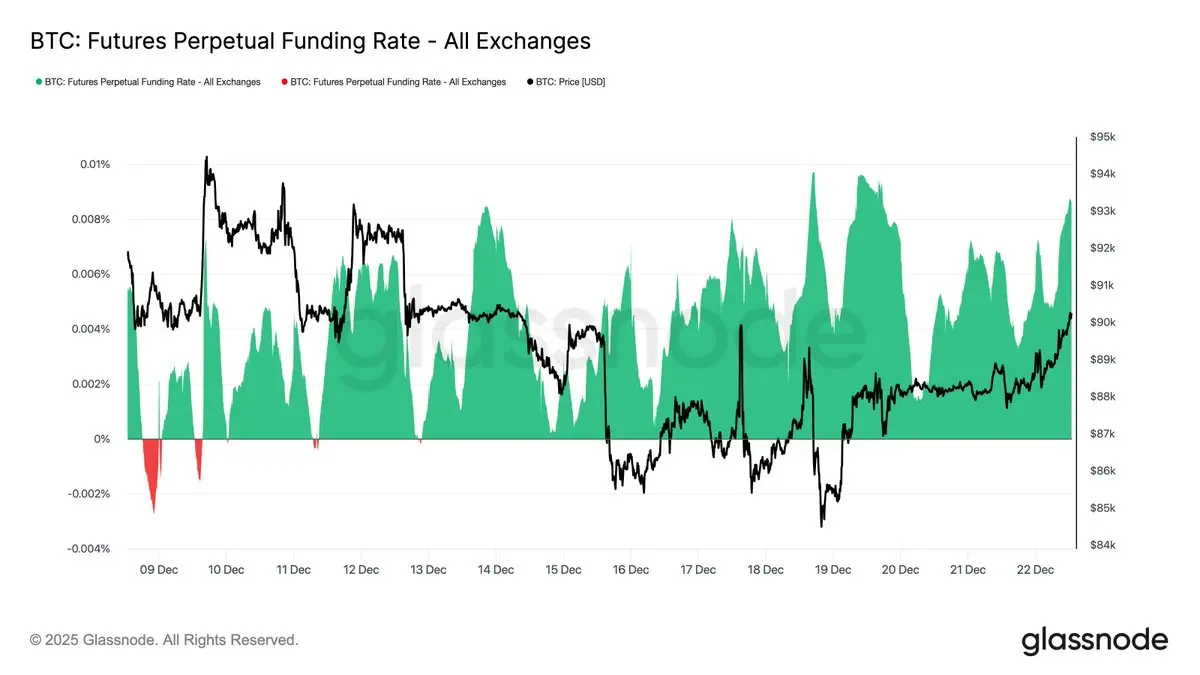

With price back above $90K, perpetual open interest has risen from 304K to 310K BTC (~2% increase), while the funding rate has heated up from 0.04% to 0.09%.

This combination signals a renewed buildup in leveraged long positioning, as perpetual traders position for a potential year-end move.

📊

This combination signals a renewed buildup in leveraged long positioning, as perpetual traders position for a potential year-end move.

📊

BTC-0,99%

- Reward

- like

- Comment

- Repost

- Share

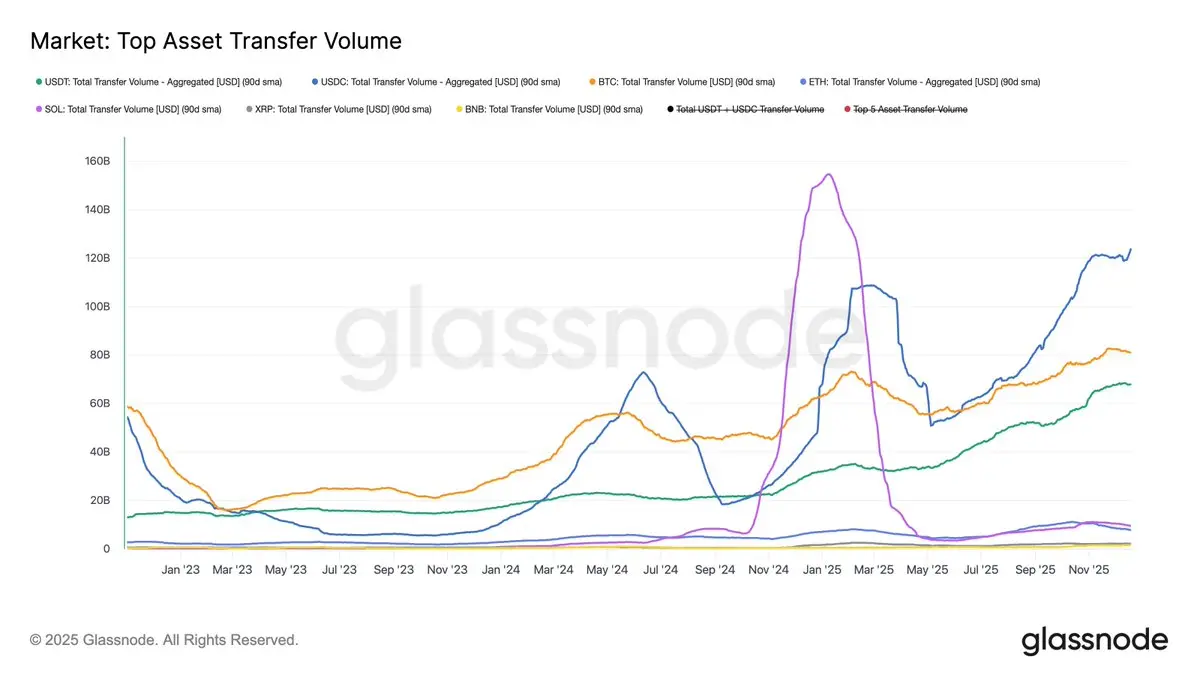

On a 90D-SMA, stablecoins now dominate on-chain value transfer:

• 🔵USDC: ~$124B

• 🟢USDT: ~$68B

Major assets:

• 🟠BTC: ~$81B

• 🟣ETH: ~$7.9B

• 🔵SOL: ~$9.6B

• ⚫️XRP: ~$2.2B

• 🟡BNB: ~$1.6B

Stablecoins have become the primary liquidity rails, while native asset transfers remain comparatively subdued.

📊

• 🔵USDC: ~$124B

• 🟢USDT: ~$68B

Major assets:

• 🟠BTC: ~$81B

• 🟣ETH: ~$7.9B

• 🔵SOL: ~$9.6B

• ⚫️XRP: ~$2.2B

• 🟡BNB: ~$1.6B

Stablecoins have become the primary liquidity rails, while native asset transfers remain comparatively subdued.

📊

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

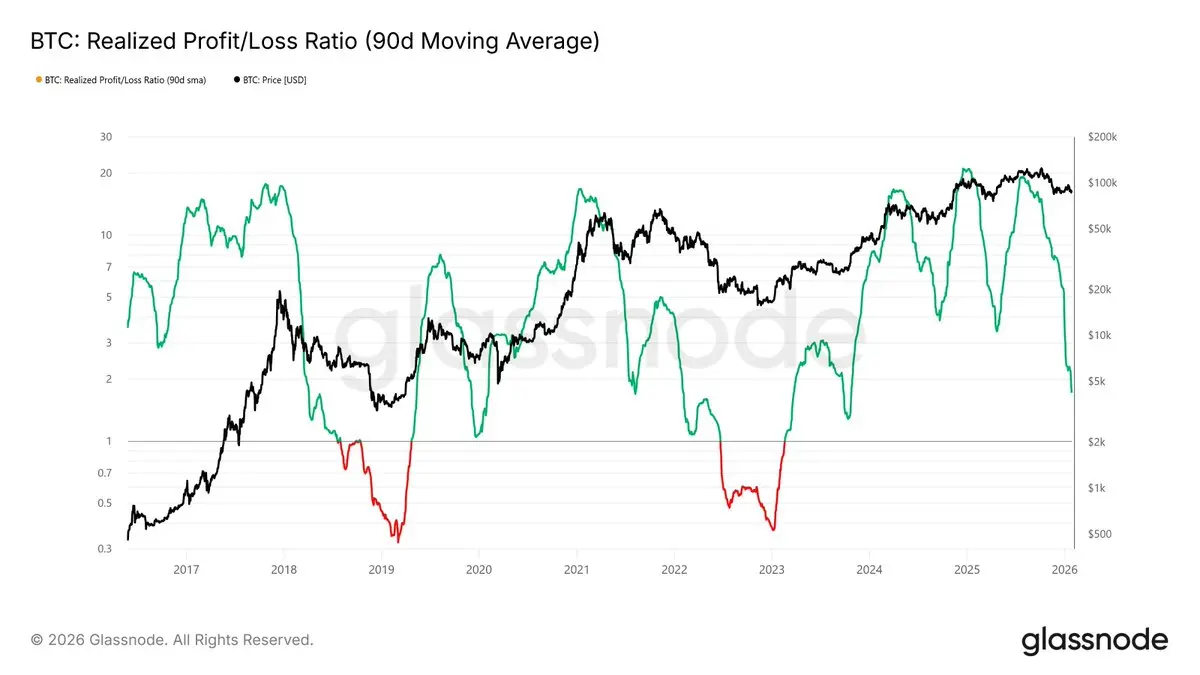

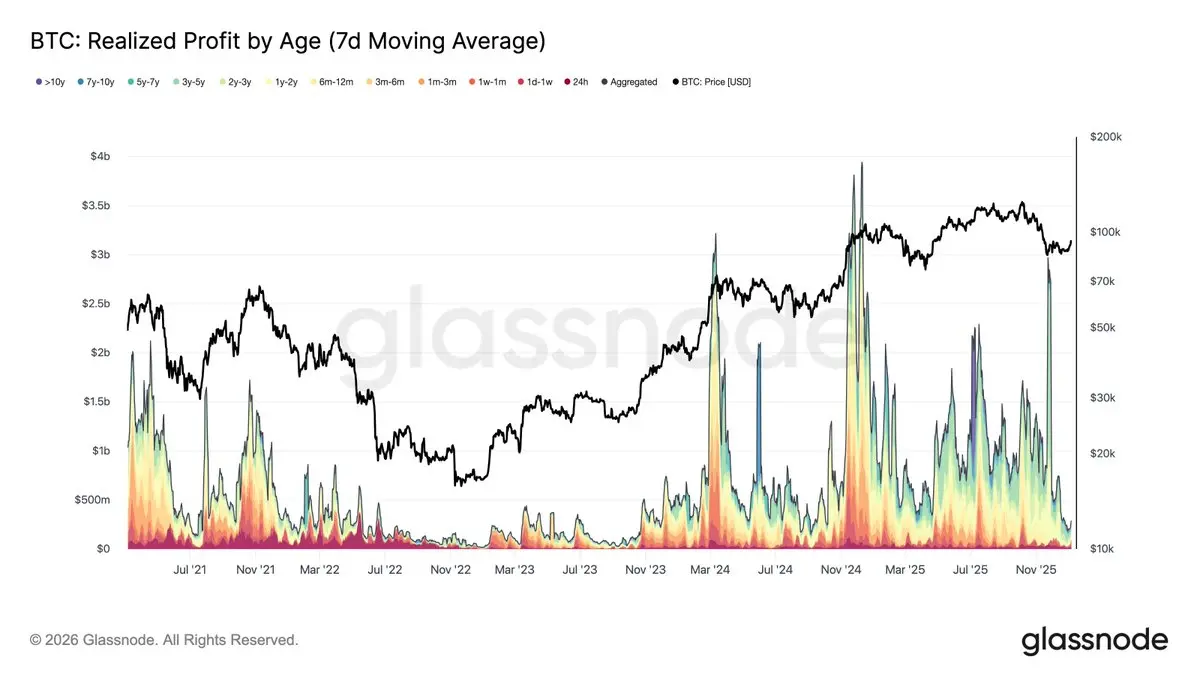

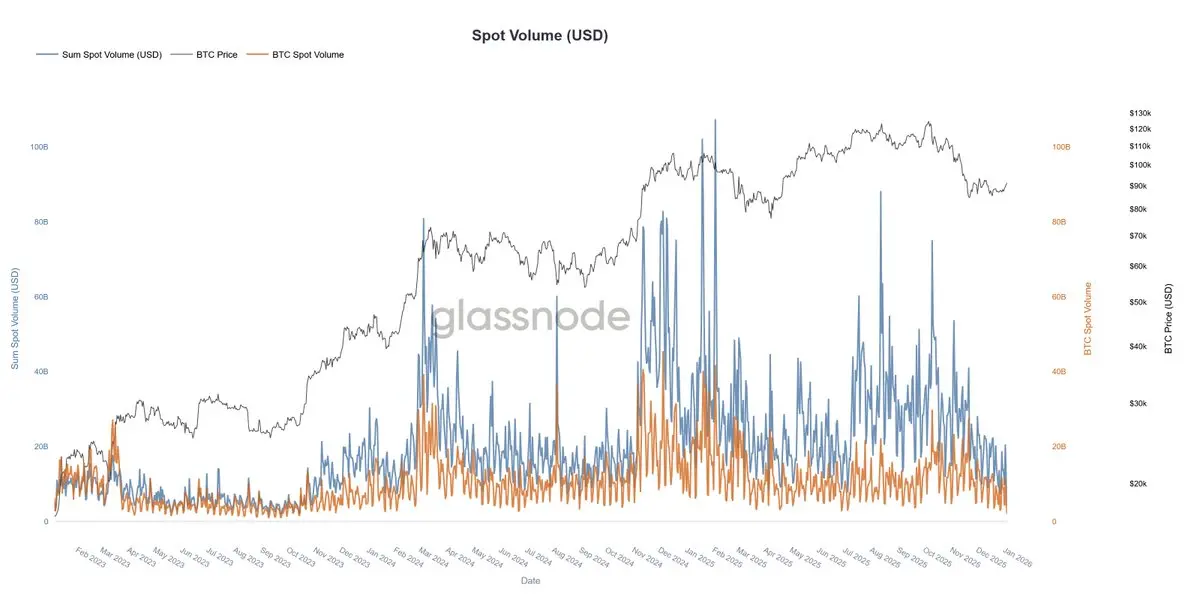

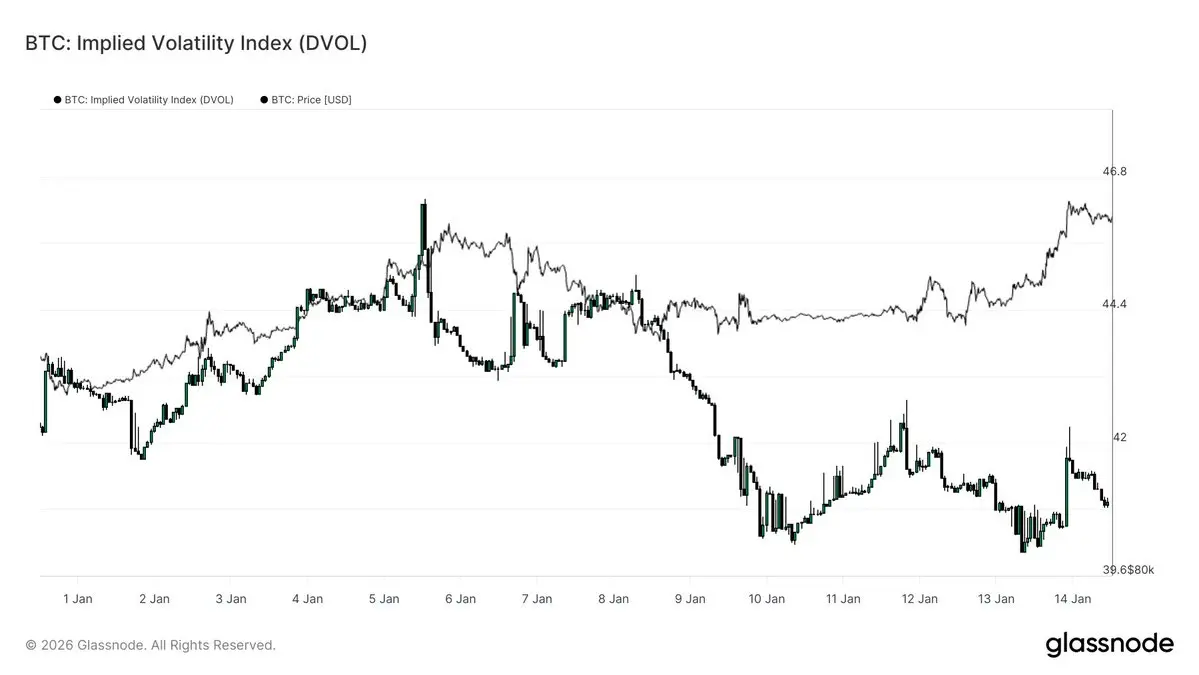

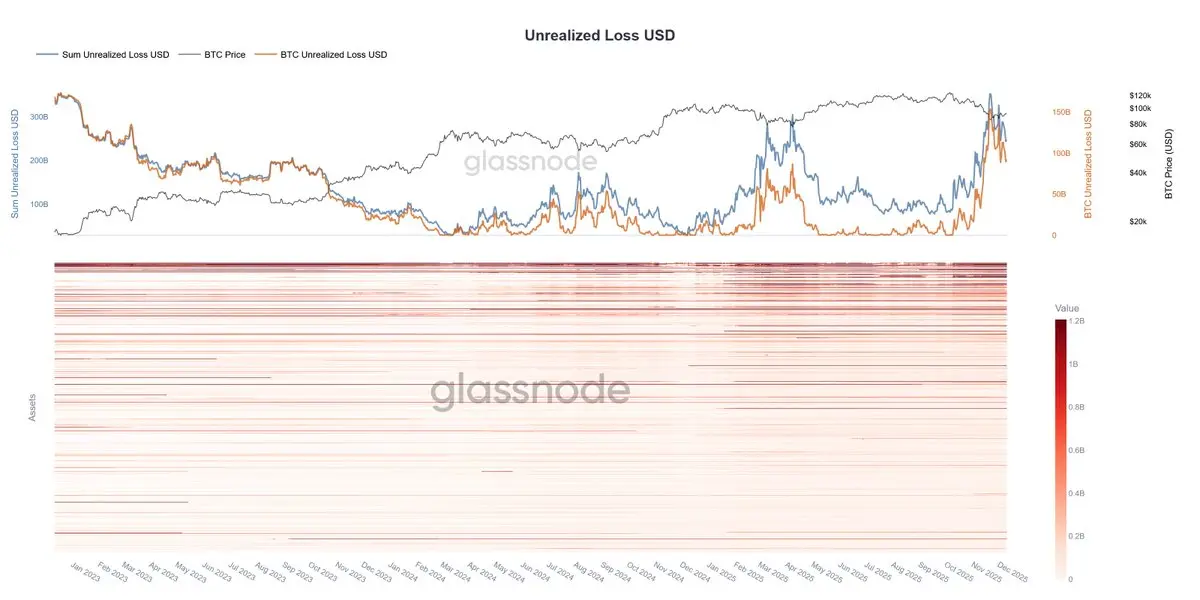

Unrealized losses across the crypto ecosystem have recently climbed to ~$350B, including ~$85B in BTC alone.

With multiple on-chain indicators signalling shrinking liquidity across the board, the market is likely entering a high-volatility regime in the weeks ahead.

📊

With multiple on-chain indicators signalling shrinking liquidity across the board, the market is likely entering a high-volatility regime in the weeks ahead.

📊

BTC-0,99%

- Reward

- like

- Comment

- Repost

- Share