TonyTheBull

No content yet

TonyTheBull

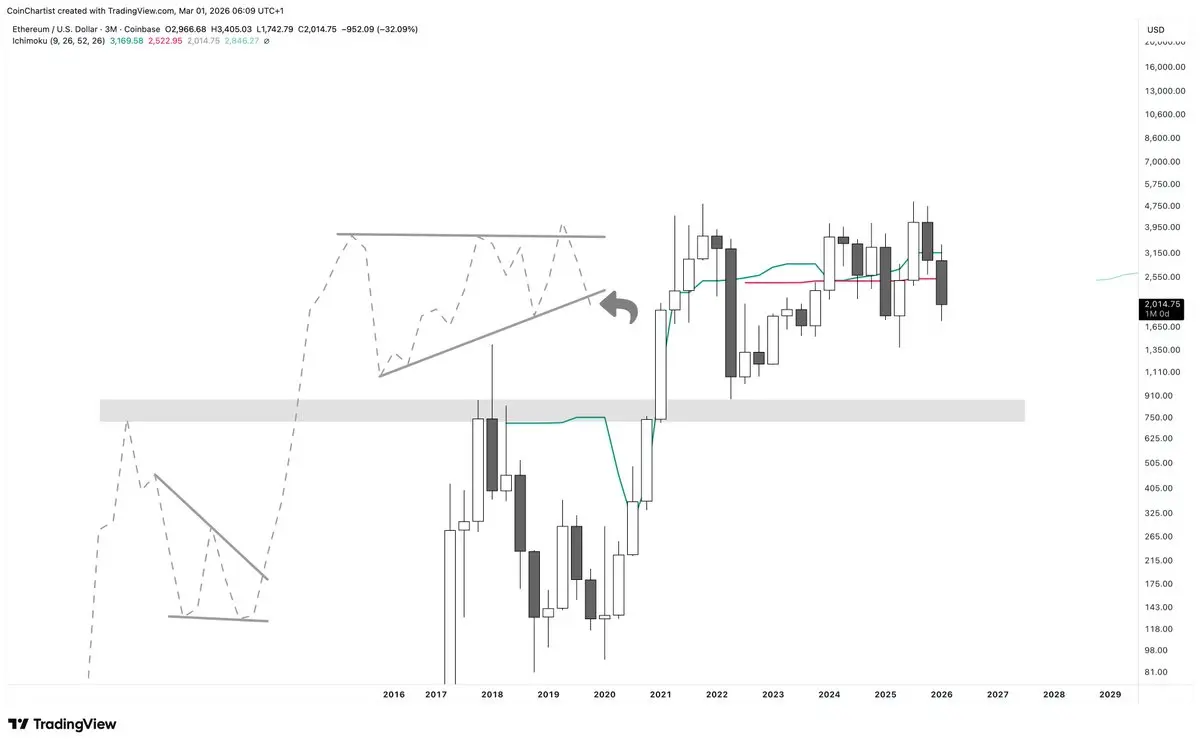

I just did a detailed study on the quarterly Ichimoku and found a signal that shows Bitcoin will likely fall another -38% to -66% from this level based on past evidence and data

There is only one place to see the signals, data, and final targets for the bear market bottom – bi0

There is only one place to see the signals, data, and final targets for the bear market bottom – bi0

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

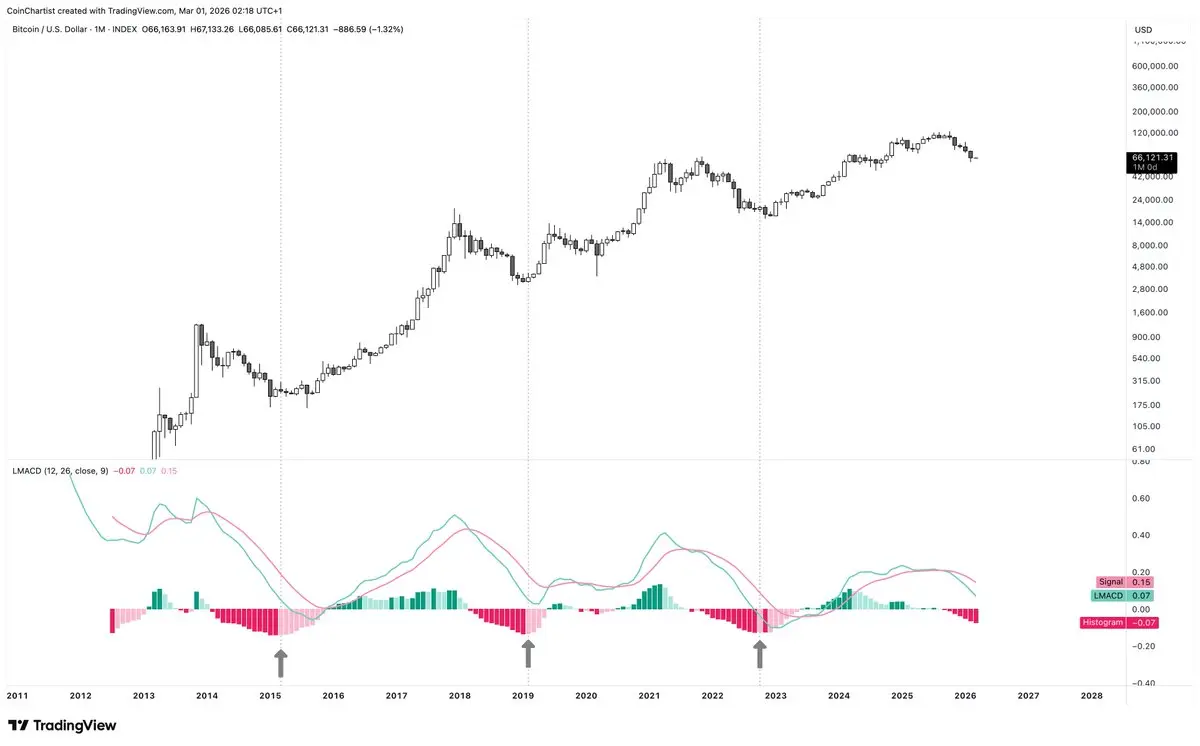

Think the bottom is in?

Pink first on the LMACD histogram, or else it is still a bear market

Think pink

Pink first on the LMACD histogram, or else it is still a bear market

Think pink

- Reward

- 2

- Comment

- Repost

- Share

Bitcoin BTCUSD 1M (Monthly) SuperTrend held support and kept its active buy signal

Interesting development

Note that almost all bear markets do hold at support for a month or three before the it eventually turns into a sell signal

That said, the bottom is usually close after

Interesting development

Note that almost all bear markets do hold at support for a month or three before the it eventually turns into a sell signal

That said, the bottom is usually close after

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

"The next big trade" after my Silver call was posted on Slice

It is yet another "show the me the chart and I'll tell you the news" example – where the chart was telling us this was all about to go down in the Middle East

Don't miss the TA

It is yet another "show the me the chart and I'll tell you the news" example – where the chart was telling us this was all about to go down in the Middle East

Don't miss the TA

- Reward

- 1

- Comment

- Repost

- Share

If Bitcoin opens on CME below $60,000 this weekend

It will gap below the monthly uptrend channel for the first time ever – not even COVID had an open or close below the line

This is a pivotal moment for BTC

But if it happens to bounce, the top of the channel is currently at $475,000 (I do not think this happens, but the data is what it is)

It will gap below the monthly uptrend channel for the first time ever – not even COVID had an open or close below the line

This is a pivotal moment for BTC

But if it happens to bounce, the top of the channel is currently at $475,000 (I do not think this happens, but the data is what it is)

BTC-0,64%

- Reward

- like

- Comment

- Repost

- Share

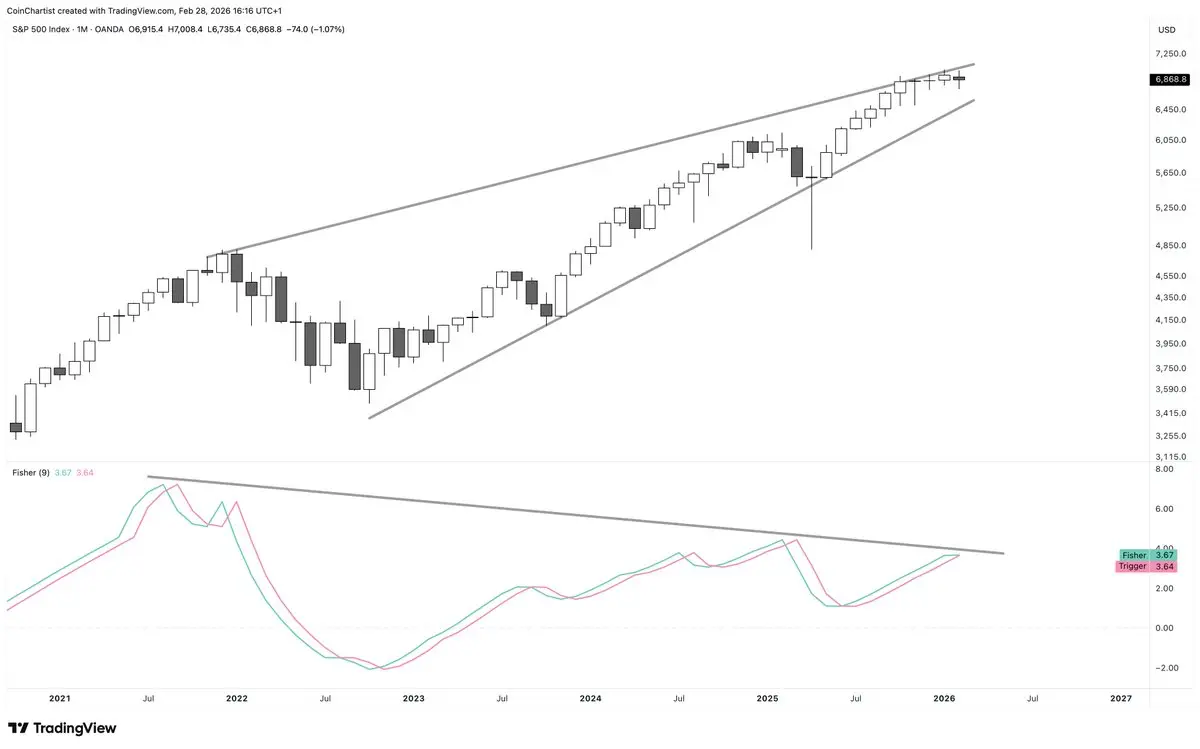

Has the S&P 500 topped? Slice subscribers just got the scoop

This chart is a freebie – find several more (better) charts with detailed technical breakdown and how I'm managing my positioning and portfolio exclusively on @SliceApp

Link in Bl0

This chart is a freebie – find several more (better) charts with detailed technical breakdown and how I'm managing my positioning and portfolio exclusively on @SliceApp

Link in Bl0

- Reward

- 1

- Comment

- Repost

- Share

Dropped a quick TA update for Slice users

More extensive analysis coming later today

X users will get some alpha too

Don't forget to hit the link in my bi0 – only a few days left to lock into my current subscription rate before I raise it significantly to keep up with demand

More extensive analysis coming later today

X users will get some alpha too

Don't forget to hit the link in my bi0 – only a few days left to lock into my current subscription rate before I raise it significantly to keep up with demand

- Reward

- 1

- Comment

- Repost

- Share

You buying that dip?

- Reward

- like

- Comment

- Repost

- Share

I just wrote a short article about a triangle...

Not the kind you're used to me talking about

It's about Maslow's Hierarchy of Needs and how working your way up the pyramid will make you a dramatically better trader and investor

Read "Why yourself is your most over-looked asset" for free on Slice:

Not the kind you're used to me talking about

It's about Maslow's Hierarchy of Needs and how working your way up the pyramid will make you a dramatically better trader and investor

Read "Why yourself is your most over-looked asset" for free on Slice:

- Reward

- 1

- Comment

- Repost

- Share

CAUTION: Slice subscribers just got a critical message about the market

GO read it ASAP - you need to adjust recent long/short positioning

This is the chart I have shared with subscribers to highlight the risk. But what I have to say and how I suggest you manage the situation is where the value is

To everyone else – I am stressing risk management at this moment. Something FEELS off

On the latest @WOLF_Bitcoin_ I talked about the chance of sudden negative news – make sure you hit my feed and watch the Market Talk to hear those thoughts

Working on a sound bite to share

GO read it ASAP - you need to adjust recent long/short positioning

This is the chart I have shared with subscribers to highlight the risk. But what I have to say and how I suggest you manage the situation is where the value is

To everyone else – I am stressing risk management at this moment. Something FEELS off

On the latest @WOLF_Bitcoin_ I talked about the chance of sudden negative news – make sure you hit my feed and watch the Market Talk to hear those thoughts

Working on a sound bite to share

BTC-0,64%

- Reward

- 1

- Comment

- Repost

- Share

No joke

This week alone, I was in a car accident with an unlicensed driver and had to call the cops to get info from them

My favorite aunt passed away

I slipped and fell on the ice (and have PTSD from tearing my entire rotator cuff and bicep off the bones a few years ago from falling on the ice)

And so much more

Yet – I did some of my best trading, doubled my subscriber count on Slice, and posted my best analysis

Making the right decisions under extreme emotional and mental distress is a skill that I've honed over the last few years

Staying grounded, calm, objective, and open to change is the

This week alone, I was in a car accident with an unlicensed driver and had to call the cops to get info from them

My favorite aunt passed away

I slipped and fell on the ice (and have PTSD from tearing my entire rotator cuff and bicep off the bones a few years ago from falling on the ice)

And so much more

Yet – I did some of my best trading, doubled my subscriber count on Slice, and posted my best analysis

Making the right decisions under extreme emotional and mental distress is a skill that I've honed over the last few years

Staying grounded, calm, objective, and open to change is the

- Reward

- like

- Comment

- Repost

- Share

Everything is cyclical

- Reward

- like

- Comment

- Repost

- Share

Is this sleeping giant about to awaken? That's quite the hammer candlestick on the Litecoin monthly with 3 days left to close

LTC-1,47%

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 3

- Comment

- Repost

- Share

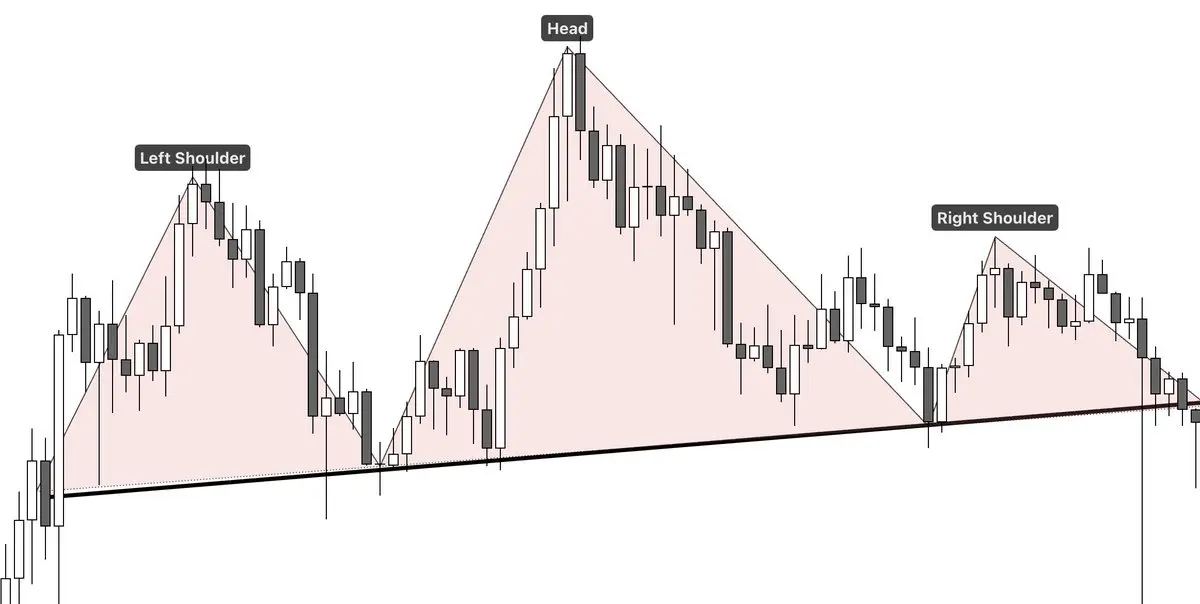

About to post an altcoin with a short-term setup that looks like it could do 100%

I want to double my money quickly

You want to sign up for my Slice even faster (link in bi0)

The coin perfectly hit my inverse head and shoulders target on the way down – can I do it again on the way up?

I want to double my money quickly

You want to sign up for my Slice even faster (link in bi0)

The coin perfectly hit my inverse head and shoulders target on the way down – can I do it again on the way up?

- Reward

- 2

- Comment

- Repost

- Share

I am going to stop sharing these soon because I really overall don’t like the look for my brand

However, I desire to show “proof of work” so to speak

Another high-confidence leveraged trade

I waited for 3 distinct signals to appear:

-Morning Star candlestick pattern

-RSI buy signal (higher high re: Wilder method)

-Bollinger Band squeeze setup with head fake to lower BB

All my trades require at least three signals to tell me the trade is in alignment

This was broken down for Slice subs yesterday before the big move. I also made sure everyone got out of their previous short trade in profit

3,

However, I desire to show “proof of work” so to speak

Another high-confidence leveraged trade

I waited for 3 distinct signals to appear:

-Morning Star candlestick pattern

-RSI buy signal (higher high re: Wilder method)

-Bollinger Band squeeze setup with head fake to lower BB

All my trades require at least three signals to tell me the trade is in alignment

This was broken down for Slice subs yesterday before the big move. I also made sure everyone got out of their previous short trade in profit

3,

- Reward

- like

- Comment

- Repost

- Share

GM

Incredibly grateful for my followers and subscribes on Slice

Even more grateful to be working in this industry, doing what I love, around some of the best minds in the entire world

Incredibly grateful for my followers and subscribes on Slice

Even more grateful to be working in this industry, doing what I love, around some of the best minds in the entire world

- Reward

- like

- Comment

- Repost

- Share