SHOLEH0X

No content yet

SHOLEH0X

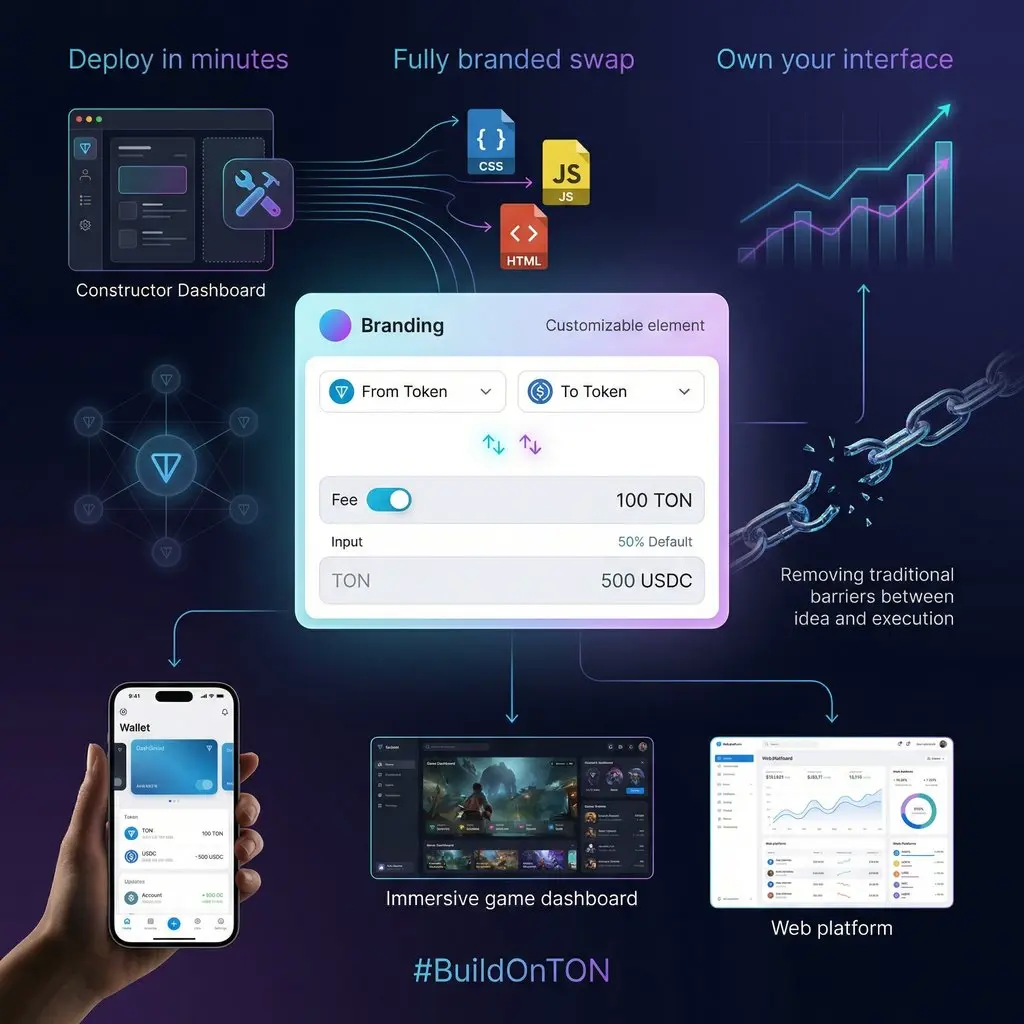

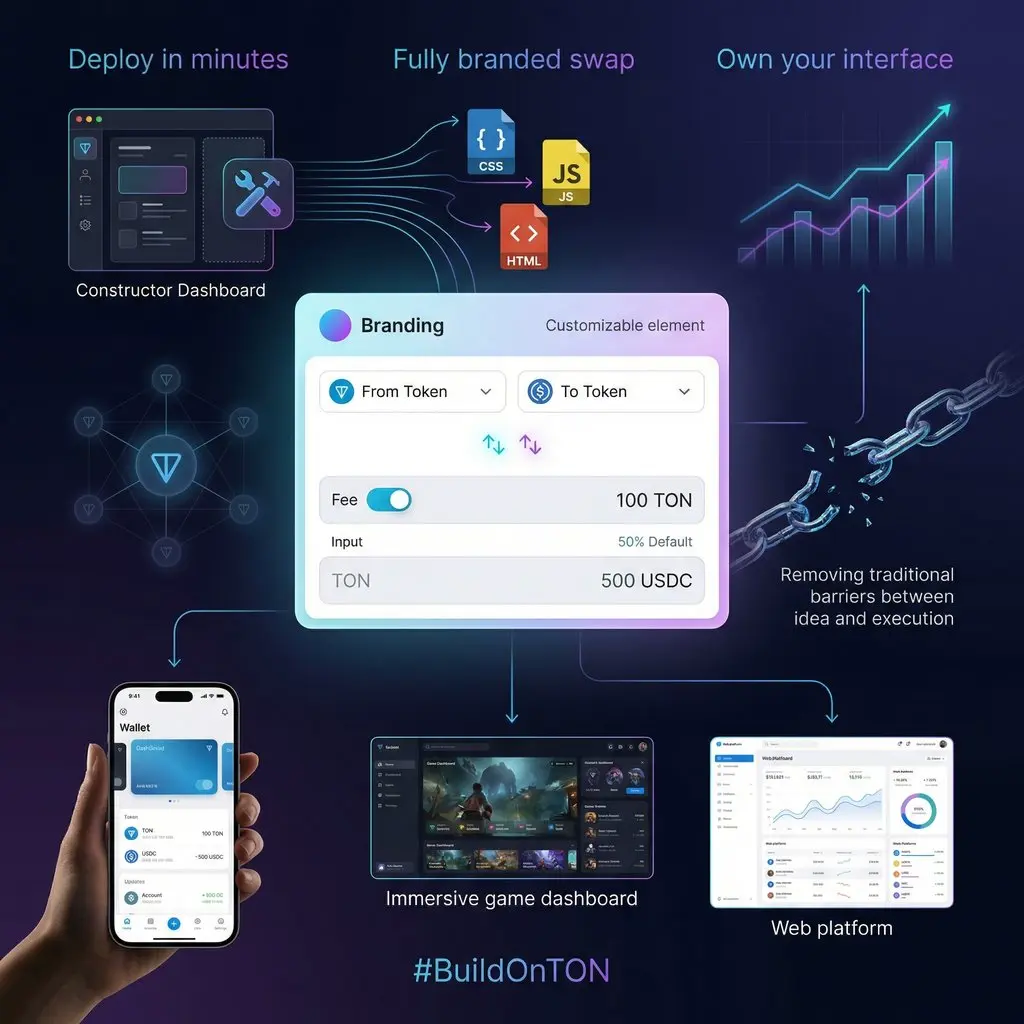

Built for Growth, Not Just Hype

In the early stages of any emerging technology, attention often focuses on excitement new features, rapid gains, and short term incentives. But long term success depends on something less visible: infrastructure that can support sustained growth. STONfi positions itself as part of TON’s foundational DeFi layer, aiming to serve not just today’s activity but tomorrow’s expansion.

Hype can bring users in. Infrastructure keeps them there.

🔹 What “Built for Growth” Really Means

Platforms designed for long term relevance focus on reliability, scalability, and practic

In the early stages of any emerging technology, attention often focuses on excitement new features, rapid gains, and short term incentives. But long term success depends on something less visible: infrastructure that can support sustained growth. STONfi positions itself as part of TON’s foundational DeFi layer, aiming to serve not just today’s activity but tomorrow’s expansion.

Hype can bring users in. Infrastructure keeps them there.

🔹 What “Built for Growth” Really Means

Platforms designed for long term relevance focus on reliability, scalability, and practic

- Reward

- 2

- Comment

- Repost

- Share

Speed Meets Transparency

One of the biggest advantages of decentralized finance is the ability to move assets quickly while maintaining full visibility into what is happening. In traditional financial systems, transactions often involve intermediaries, processing delays, limited operating hours, and opaque procedures. STONfi brings a different model to the TON ecosystem one where speed and transparency work together, not against each other.

You don’t have to choose between fast and trustworthy. You get both.

🔹 Faster Execution, Fewer Barriers

On STONfi, swaps are executed directly onchain thr

One of the biggest advantages of decentralized finance is the ability to move assets quickly while maintaining full visibility into what is happening. In traditional financial systems, transactions often involve intermediaries, processing delays, limited operating hours, and opaque procedures. STONfi brings a different model to the TON ecosystem one where speed and transparency work together, not against each other.

You don’t have to choose between fast and trustworthy. You get both.

🔹 Faster Execution, Fewer Barriers

On STONfi, swaps are executed directly onchain thr

- Reward

- 3

- Comment

- Repost

- Share

Liquidity Powers Everything

In decentralized finance, liquidity is the invisible engine that makes the entire system function. Every swap, trade, or asset conversion depends on available liquidity inside pools. Without it, transactions become slow, expensive, or even impossible. STONfi relies on liquidity infrastructure to ensure users can move between assets efficiently within the TON ecosystem.

Most users only notice liquidity when it’s missing but it affects every transaction.

🔹 What Liquidity Actually Does

Liquidity pools are collections of tokens supplied by participants that enable auto

In decentralized finance, liquidity is the invisible engine that makes the entire system function. Every swap, trade, or asset conversion depends on available liquidity inside pools. Without it, transactions become slow, expensive, or even impossible. STONfi relies on liquidity infrastructure to ensure users can move between assets efficiently within the TON ecosystem.

Most users only notice liquidity when it’s missing but it affects every transaction.

🔹 What Liquidity Actually Does

Liquidity pools are collections of tokens supplied by participants that enable auto

- Reward

- 2

- Comment

- Repost

- Share

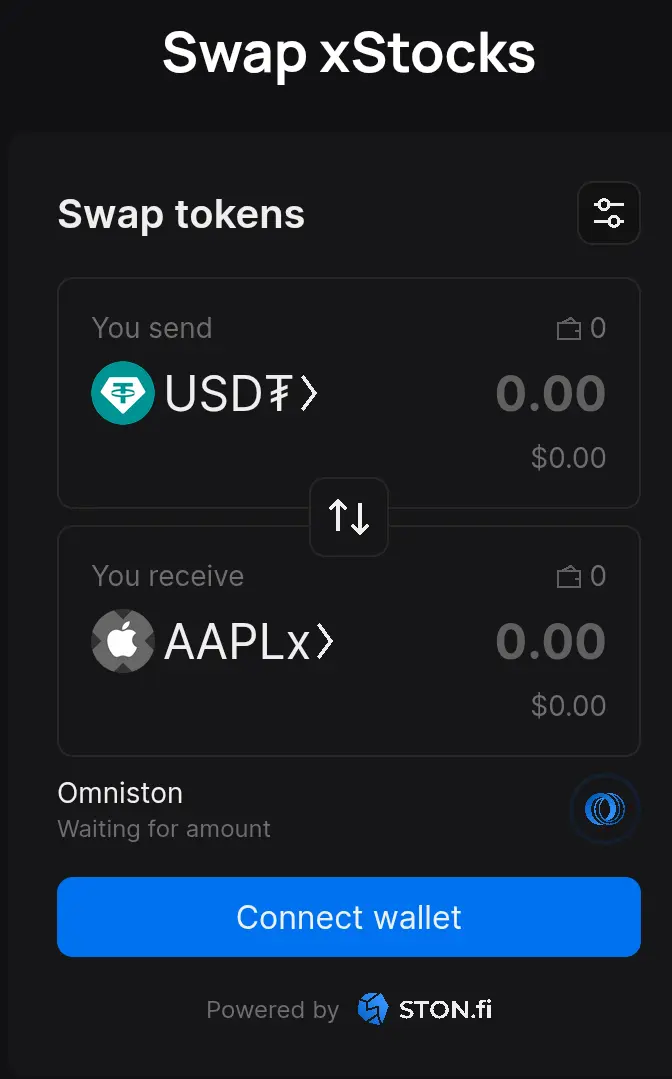

xStocks Open a New Door

For most of DeFi’s history, on-chain portfolios have been dominated by crypto native assets tokens whose value is driven largely by blockchain adoption, market sentiment, and network activity. While this creates exciting opportunities, it also concentrates exposure within a single financial domain. STONfi introduces xStocks to expand that horizon.

xStocks are tokenized representations of real world equities available inside the TON ecosystem. They allow users to gain stock linked exposure without leaving their onchain environment.

🔹 Bridging Two Financial Worlds

Tradit

For most of DeFi’s history, on-chain portfolios have been dominated by crypto native assets tokens whose value is driven largely by blockchain adoption, market sentiment, and network activity. While this creates exciting opportunities, it also concentrates exposure within a single financial domain. STONfi introduces xStocks to expand that horizon.

xStocks are tokenized representations of real world equities available inside the TON ecosystem. They allow users to gain stock linked exposure without leaving their onchain environment.

🔹 Bridging Two Financial Worlds

Tradit

TON-2,19%

- Reward

- 3

- Comment

- Repost

- Share

DeFi Made Practical

Decentralized finance is often described as revolutionary but for many users, it can also feel overwhelming. Complex terminology, unfamiliar interfaces, and unclear risks make it difficult to move from curiosity to confident action. STONfi addresses this gap by focusing on practicality, not just innovation.

Instead of presenting DeFi as a set of abstract concepts, STONfi delivers tools that users can immediately apply in real situations.

🔹 Turning Complexity Into Usability

On the platform, users can perform essential financial actions without navigating multiple protocols

Decentralized finance is often described as revolutionary but for many users, it can also feel overwhelming. Complex terminology, unfamiliar interfaces, and unclear risks make it difficult to move from curiosity to confident action. STONfi addresses this gap by focusing on practicality, not just innovation.

Instead of presenting DeFi as a set of abstract concepts, STONfi delivers tools that users can immediately apply in real situations.

🔹 Turning Complexity Into Usability

On the platform, users can perform essential financial actions without navigating multiple protocols

TON-2,19%

- Reward

- 1

- Comment

- Repost

- Share

The Future Is Hybrid Finance

The line between traditional finance and decentralized finance is starting to blur, and STONfi is at the forefront of that transition. By offering xStocks tokenized representations of real world equities on TON STONfi allows users to combine crypto native assets with exposure to traditional markets, all onchain.

This is more than convenience. It’s a structural shift in how people can manage their portfolios. Instead of choosing between the worlds of crypto and traditional finance, users can now access both through a single ecosystem.

🔹 Why Hybrid Finance Matters

H

The line between traditional finance and decentralized finance is starting to blur, and STONfi is at the forefront of that transition. By offering xStocks tokenized representations of real world equities on TON STONfi allows users to combine crypto native assets with exposure to traditional markets, all onchain.

This is more than convenience. It’s a structural shift in how people can manage their portfolios. Instead of choosing between the worlds of crypto and traditional finance, users can now access both through a single ecosystem.

🔹 Why Hybrid Finance Matters

H

- Reward

- 2

- Comment

- Repost

- Share

Built for TON’s Expansion

As blockchain ecosystems grow, infrastructure becomes more important than hype. Liquidity, usability, and reliability determine whether growth is sustainable or temporary. STONfi positions itself as part of TON’s core DeFi infrastructure not just another trading interface.

TON’s expansion is driven by accessibility and distribution, especially through Telegram. As more users enter the ecosystem, they need simple and reliable ways to:

• Swap assets

• Access liquidity

• Explore tokenized products like xStocks

• Manage portfolios on-chain

That’s where infrastructure plat

As blockchain ecosystems grow, infrastructure becomes more important than hype. Liquidity, usability, and reliability determine whether growth is sustainable or temporary. STONfi positions itself as part of TON’s core DeFi infrastructure not just another trading interface.

TON’s expansion is driven by accessibility and distribution, especially through Telegram. As more users enter the ecosystem, they need simple and reliable ways to:

• Swap assets

• Access liquidity

• Explore tokenized products like xStocks

• Manage portfolios on-chain

That’s where infrastructure plat

TON-2,19%

- Reward

- 4

- Comment

- 1

- Share

DeFi Without the Guesswork

One of the biggest challenges in decentralized finance is not access it’s understanding. Many users can connect a wallet and click “swap,” but far fewer truly understand what happens behind the scenes.

That’s where STONfi takes a different approach.

Beyond providing liquidity and tokenized assets like xStocks, the platform supports users with structured educational content. Instead of leaving participants to figure things out through trial and error, STONfi explains how its ecosystem works.

🔹 Why Education Changes Everything

When users understand core concepts like:

One of the biggest challenges in decentralized finance is not access it’s understanding. Many users can connect a wallet and click “swap,” but far fewer truly understand what happens behind the scenes.

That’s where STONfi takes a different approach.

Beyond providing liquidity and tokenized assets like xStocks, the platform supports users with structured educational content. Instead of leaving participants to figure things out through trial and error, STONfi explains how its ecosystem works.

🔹 Why Education Changes Everything

When users understand core concepts like:

TON-2,19%

- Reward

- 4

- 1

- Repost

- Share

ybaser :

:

To The Moon 🌕Why xStocks Matter

xStocks are more than just another asset category added to DeFi they represent a shift in what on-chain finance can offer. Through STONfi, users can access tokenized representations of real world equities directly within the TON ecosystem.

For years, DeFi portfolios have been largely crypto-native. While this creates strong upside during bullish cycles, it also means exposure is often concentrated within a single asset class. When crypto markets move sharply, most tokens tend to react in similar ways.

xStocks introduce a different layer.

🔹 Expanding Financial Access

By brin

xStocks are more than just another asset category added to DeFi they represent a shift in what on-chain finance can offer. Through STONfi, users can access tokenized representations of real world equities directly within the TON ecosystem.

For years, DeFi portfolios have been largely crypto-native. While this creates strong upside during bullish cycles, it also means exposure is often concentrated within a single asset class. When crypto markets move sharply, most tokens tend to react in similar ways.

xStocks introduce a different layer.

🔹 Expanding Financial Access

By brin

- Reward

- 3

- Comment

- Repost

- Share

Your Portfolio, Upgraded

Most crypto portfolios tend to follow a similar pattern a combination of native tokens, a few altcoins, and stablecoins for liquidity. While this structure can perform well in bullish cycles, it also creates concentration risk. When the crypto market moves sharply, many of these assets move in the same direction.

That’s where STONfi introduces something meaningful.

With xStocks, users can access tokenized representations of real world equities directly within the TON ecosystem. This allows you to expand beyond crypto-only exposure without leaving your wallet or relying

Most crypto portfolios tend to follow a similar pattern a combination of native tokens, a few altcoins, and stablecoins for liquidity. While this structure can perform well in bullish cycles, it also creates concentration risk. When the crypto market moves sharply, many of these assets move in the same direction.

That’s where STONfi introduces something meaningful.

With xStocks, users can access tokenized representations of real world equities directly within the TON ecosystem. This allows you to expand beyond crypto-only exposure without leaving your wallet or relying

- Reward

- 2

- Comment

- Repost

- Share

Real World Assets Meet Blockchain Speed

One of the most exciting developments in DeFi is the integration of real world assets into blockchain ecosystems. STONfi contributes to this evolution by enabling access to xStocks tokenized representations of traditional equities directly on TON.

This represents more than just adding new tokens. It’s about merging two financial worlds.

Traditionally, accessing stocks required: • A brokerage account

• Bank transfers

• Market hour restrictions

• Off-chain settlement systems

With tokenized exposure available on-chain, users can interact with stock linked a

One of the most exciting developments in DeFi is the integration of real world assets into blockchain ecosystems. STONfi contributes to this evolution by enabling access to xStocks tokenized representations of traditional equities directly on TON.

This represents more than just adding new tokens. It’s about merging two financial worlds.

Traditionally, accessing stocks required: • A brokerage account

• Bank transfers

• Market hour restrictions

• Off-chain settlement systems

With tokenized exposure available on-chain, users can interact with stock linked a

- Reward

- 3

- Comment

- Repost

- Share

DeFi is no longer just about chasing the latest token or making quick swaps. The space is maturing and Dex like STONfi are helping push that evolution forward.

With the introduction of xStocks, users can now access tokenized representations of real world equities directly inside the TON ecosystem. That means you’re no longer limited to crypto only exposure when operating onchain.

Instead of separating your financial world into “crypto” and “traditional markets,” you can now interact with both — within one ecosystem and one wallet.

That’s a major shift.

🚀 What This Actually Means

Through STONf

With the introduction of xStocks, users can now access tokenized representations of real world equities directly inside the TON ecosystem. That means you’re no longer limited to crypto only exposure when operating onchain.

Instead of separating your financial world into “crypto” and “traditional markets,” you can now interact with both — within one ecosystem and one wallet.

That’s a major shift.

🚀 What This Actually Means

Through STONf

TON-2,19%

- Reward

- 2

- Comment

- Repost

- Share

📈 Diversification Just Went OnChain

For a long time, most crypto portfolios have looked similar a mix of native tokens, a few altcoins, and stablecoins for liquidity. The challenge? Many of these assets move together. When the market rises, they rise together. When it falls, they often fall together.

That’s where STONfi introduces something different.

With xStocks, users can access tokenized representations of real world equities directly inside the TON ecosystem. This means you’re no longer limited to crypto only exposure when building your on-chain portfolio.

🔹 What Changes?

Instead of cho

For a long time, most crypto portfolios have looked similar a mix of native tokens, a few altcoins, and stablecoins for liquidity. The challenge? Many of these assets move together. When the market rises, they rise together. When it falls, they often fall together.

That’s where STONfi introduces something different.

With xStocks, users can access tokenized representations of real world equities directly inside the TON ecosystem. This means you’re no longer limited to crypto only exposure when building your on-chain portfolio.

🔹 What Changes?

Instead of cho

- Reward

- 1

- Comment

- Repost

- Share

One of the most interesting developments on STONfi is the launch of xStocks tokenized representations of real-world equities inside the TON ecosystem.

This matters because it expands what users can do onchain.

Instead of managing crypto in one place and traditional stocks in another, users can now gain stock linked exposure directly from their TON wallet. No separate brokerage interface. No leaving the ecosystem.

That’s a meaningful shift in accessibility.

🌍 What This Unlocks

• Unified portfolio management (crypto + tokenized equities)

• On-chain swaps powered by liquidity pools

• Broader di

This matters because it expands what users can do onchain.

Instead of managing crypto in one place and traditional stocks in another, users can now gain stock linked exposure directly from their TON wallet. No separate brokerage interface. No leaving the ecosystem.

That’s a meaningful shift in accessibility.

🌍 What This Unlocks

• Unified portfolio management (crypto + tokenized equities)

• On-chain swaps powered by liquidity pools

• Broader di

TON-2,19%

- Reward

- 1

- Comment

- Repost

- Share

DeFi is no longer just about swapping meme tokens or chasing short term yield. The space is evolving and STONfi is helping bring real world market exposure directly onto the blockchain.

With the introduction of xStocks, users can now access tokenized representations of traditional equities without leaving the TON ecosystem.

Let that sink in.

You can stay fully onchain inside your wallet and gain exposure to assets that were traditionally only available through brokerage accounts.

For years, DeFi and traditional finance operated in parallel worlds.

Now, they’re starting to merge.

STONfi is help

With the introduction of xStocks, users can now access tokenized representations of traditional equities without leaving the TON ecosystem.

Let that sink in.

You can stay fully onchain inside your wallet and gain exposure to assets that were traditionally only available through brokerage accounts.

For years, DeFi and traditional finance operated in parallel worlds.

Now, they’re starting to merge.

STONfi is help

TON-2,19%

- Reward

- 1

- Comment

- Repost

- Share

Ecosystem Update: BTC & ETH Liquidity Now Live on TON via STONfi

Bitcoin and Ethereum liquidity are now available directly on STONfi on the TON blockchain through cbBTC and WETH, both backed 1:1 by their native assets and integrated in a non-custodial manner.

This integration allows users to access BTC and ETH exposure on TON without relying on synthetic assets or IOU-based representations. Liquidity is routed via Omniston, enabling optimized swaps across available TON liquidity sources and improving execution quality for traders.

Key highlights:

Native BTC & ETH exposure on TON (cbBTC, WETH)

Bitcoin and Ethereum liquidity are now available directly on STONfi on the TON blockchain through cbBTC and WETH, both backed 1:1 by their native assets and integrated in a non-custodial manner.

This integration allows users to access BTC and ETH exposure on TON without relying on synthetic assets or IOU-based representations. Liquidity is routed via Omniston, enabling optimized swaps across available TON liquidity sources and improving execution quality for traders.

Key highlights:

Native BTC & ETH exposure on TON (cbBTC, WETH)

- Reward

- 4

- 2

- Repost

- Share

Vortex_King :

:

To The Moon 🌕View More

A Risk Aware Perspective: Innovation Requires Responsibility

While STONfi introduces useful tools and expands access to tokenized assets, it’s important to approach any DeFi platform with a clear understanding of risk.

DeFi innovation often moves faster than traditional finance. That speed creates opportunity but it also requires users to take personal responsibility.

🔹 Smart Contract Risk

All decentralized platforms rely on smart contracts. Even well-designed systems can face:

Bugs or vulnerabilities

Exploits

Unexpected technical failures

Audits and security measures reduce risk, but they do

While STONfi introduces useful tools and expands access to tokenized assets, it’s important to approach any DeFi platform with a clear understanding of risk.

DeFi innovation often moves faster than traditional finance. That speed creates opportunity but it also requires users to take personal responsibility.

🔹 Smart Contract Risk

All decentralized platforms rely on smart contracts. Even well-designed systems can face:

Bugs or vulnerabilities

Exploits

Unexpected technical failures

Audits and security measures reduce risk, but they do

TON-2,19%

- Reward

- 1

- Comment

- Repost

- Share

Beyond its trading interface and tokenized assets, STONfi invests in something that many DeFi platforms overlook: structured education.

In fast moving ecosystems, misinformation spreads quickly. Users often rely on short posts, speculation, or incomplete explanations when making financial decisions. This creates confusion and increases risk.

The STONfi Blog helps address that gap by providing clear, organized content that explains:

How to complete your first xStocks swap step-by-step

How tokenized real world assets are represented on TON

What ecosystem metrics like TVL mean in context

How DeFi

In fast moving ecosystems, misinformation spreads quickly. Users often rely on short posts, speculation, or incomplete explanations when making financial decisions. This creates confusion and increases risk.

The STONfi Blog helps address that gap by providing clear, organized content that explains:

How to complete your first xStocks swap step-by-step

How tokenized real world assets are represented on TON

What ecosystem metrics like TVL mean in context

How DeFi

- Reward

- 1

- Comment

- Repost

- Share

Beginner Friendly Design: Lowering the Barrier to TON DeFi

Entering DeFi for the first time can feel intimidating. New users are often confronted with unfamiliar terms, complex interfaces, and technical steps that aren’t clearly explained. Without proper guidance, even a simple token swap can seem risky or confusing.

STONfi addresses this challenge by focusing on beginner friendly design and clear user flows.

🔹 Simple and Intuitive Interface

The platform’s swap interface is designed to be straightforward:

Clear token selection

Transparent pricing

Easy-to-understand transaction details

Minimal

Entering DeFi for the first time can feel intimidating. New users are often confronted with unfamiliar terms, complex interfaces, and technical steps that aren’t clearly explained. Without proper guidance, even a simple token swap can seem risky or confusing.

STONfi addresses this challenge by focusing on beginner friendly design and clear user flows.

🔹 Simple and Intuitive Interface

The platform’s swap interface is designed to be straightforward:

Clear token selection

Transparent pricing

Easy-to-understand transaction details

Minimal

TON-2,19%

- Reward

- 1

- Comment

- Repost

- Share

Strong Position Within TON’s Growth Cycle

As the TON ecosystem continues to expand, infrastructure becomes increasingly important. Growth in users, liquidity, and activity requires reliable platforms that can handle volume while remaining accessible. STONfi has positioned itself as one of those foundational layers within TON DeFi.

Over time, TON has seen substantial increases in total value locked (TVL) and user participation. A major driver behind this growth is its integration with Telegram, which provides powerful distribution and onboarding potential. When access to DeFi tools is embedded

As the TON ecosystem continues to expand, infrastructure becomes increasingly important. Growth in users, liquidity, and activity requires reliable platforms that can handle volume while remaining accessible. STONfi has positioned itself as one of those foundational layers within TON DeFi.

Over time, TON has seen substantial increases in total value locked (TVL) and user participation. A major driver behind this growth is its integration with Telegram, which provides powerful distribution and onboarding potential. When access to DeFi tools is embedded

TON-2,19%

- Reward

- 1

- Comment

- Repost

- Share