OurCryptoTalk

No content yet

OurCryptoTalk

When you compare today’s privacy-focused blockchains side by side, $XNT (Neptune Privacy) clearly stands apart.

Neptune Privacy is built on zk-STARKs and Mutator Sets, delivering strong on-chain privacy without trusted setups and with post-quantum cryptography at its core. While many privacy projects rely on older cryptographic assumptions or trusted hardware, Neptune is designed for the long term.

→ Quantum resistance matters.

As quantum computing progresses, legacy privacy models like ring signatures and traditional zk-SNARKs face real security risks. $XNT is already post-quantum safe, avoid

Neptune Privacy is built on zk-STARKs and Mutator Sets, delivering strong on-chain privacy without trusted setups and with post-quantum cryptography at its core. While many privacy projects rely on older cryptographic assumptions or trusted hardware, Neptune is designed for the long term.

→ Quantum resistance matters.

As quantum computing progresses, legacy privacy models like ring signatures and traditional zk-SNARKs face real security risks. $XNT is already post-quantum safe, avoid

- Reward

- like

- Comment

- Repost

- Share

🇳🇱 Netherlands : 36% (unrealized gains tax)

Countries with 0% Crypto Taxes:

🇦🇪 UAE : 0% tax

🇨🇾 Cyprus : 0% tax

🇵🇹 Portugal : 0% tax

🇵🇦 Panama : 0% tax

🇸🇬 Singapore : 0% tax

🇲🇹 Malta : 0% tax

🇧🇧 Barbados : 0% tax

🇧🇲 Bermuda : 0% tax

🇰🇾 Cayman Islands : 0% tax

🇭🇰 Hong Kong : 0% tax

🇲🇺 Mauritius : 0% tax

🇻🇺 Vanuatu : 0% tax

🇬🇮 Gibraltar : 0% tax

🇱🇮 Liechtenstein : 0% tax

🇸🇰 Slovenia : 0% tax

🇨🇭 Switzerland : 0% tax

🇺🇾 Uruguay : 0% tax

🇸🇻 El Salvador : 0% tax

🇵🇷 Puerto Rico : 0% tax

How hard is your country hitting your bags?

Drop your flag below 👇

Countries with 0% Crypto Taxes:

🇦🇪 UAE : 0% tax

🇨🇾 Cyprus : 0% tax

🇵🇹 Portugal : 0% tax

🇵🇦 Panama : 0% tax

🇸🇬 Singapore : 0% tax

🇲🇹 Malta : 0% tax

🇧🇧 Barbados : 0% tax

🇧🇲 Bermuda : 0% tax

🇰🇾 Cayman Islands : 0% tax

🇭🇰 Hong Kong : 0% tax

🇲🇺 Mauritius : 0% tax

🇻🇺 Vanuatu : 0% tax

🇬🇮 Gibraltar : 0% tax

🇱🇮 Liechtenstein : 0% tax

🇸🇰 Slovenia : 0% tax

🇨🇭 Switzerland : 0% tax

🇺🇾 Uruguay : 0% tax

🇸🇻 El Salvador : 0% tax

🇵🇷 Puerto Rico : 0% tax

How hard is your country hitting your bags?

Drop your flag below 👇

- Reward

- like

- Comment

- Repost

- Share

ALTSEASON COMES IN WAVES

For the last 2 years, we have ignore this 120 day cycle that comes when everyone is giga bullish.

Not “a bad week.”

Not “a red month.”

A full 4-month downtrend.

If you’re sitting in drawdowns right now, this is the first real reason to feel a bit hopeful again.

👉 THE PATTERN NOBODY IS TALKING ABOUT

Look at Total3 (altcoin market cap ex BTC/ETH) since Jan 2024.

We get a push.

Then we get a long grind down.

Q1 2024: altcoins rip.

Then they enter a 120-day downtrend where everything feels dead and bounces get sold.

Later in the cycle, we get another big leg up (the chart

For the last 2 years, we have ignore this 120 day cycle that comes when everyone is giga bullish.

Not “a bad week.”

Not “a red month.”

A full 4-month downtrend.

If you’re sitting in drawdowns right now, this is the first real reason to feel a bit hopeful again.

👉 THE PATTERN NOBODY IS TALKING ABOUT

Look at Total3 (altcoin market cap ex BTC/ETH) since Jan 2024.

We get a push.

Then we get a long grind down.

Q1 2024: altcoins rip.

Then they enter a 120-day downtrend where everything feels dead and bounces get sold.

Later in the cycle, we get another big leg up (the chart

- Reward

- like

- Comment

- Repost

- Share

JEROME POWELL : YOUR FINAL CHANCE

US CPI just dropped to 2.4% vs 2.5% expected.

Core CPI came in at 2.5%, matching expectations.

On the surface? Normal.

Under the surface?

This is the lowest CPI since April 2025.

Core inflation is now at its lowest level in almost 5 years.

That takes us back to lockdown-era levels.

While the Fed keeps warning about inflation heating up…

The data is quietly moving the other way.

And something else is breaking.

👉 INFLATION IS MOVING DOWN, NOT UP

The Fed has stayed hawkish longer than most expected.

Rates high.

Cuts delayed.

Messaging firm.

But CPI is trending l

US CPI just dropped to 2.4% vs 2.5% expected.

Core CPI came in at 2.5%, matching expectations.

On the surface? Normal.

Under the surface?

This is the lowest CPI since April 2025.

Core inflation is now at its lowest level in almost 5 years.

That takes us back to lockdown-era levels.

While the Fed keeps warning about inflation heating up…

The data is quietly moving the other way.

And something else is breaking.

👉 INFLATION IS MOVING DOWN, NOT UP

The Fed has stayed hawkish longer than most expected.

Rates high.

Cuts delayed.

Messaging firm.

But CPI is trending l

- Reward

- like

- Comment

- Repost

- Share

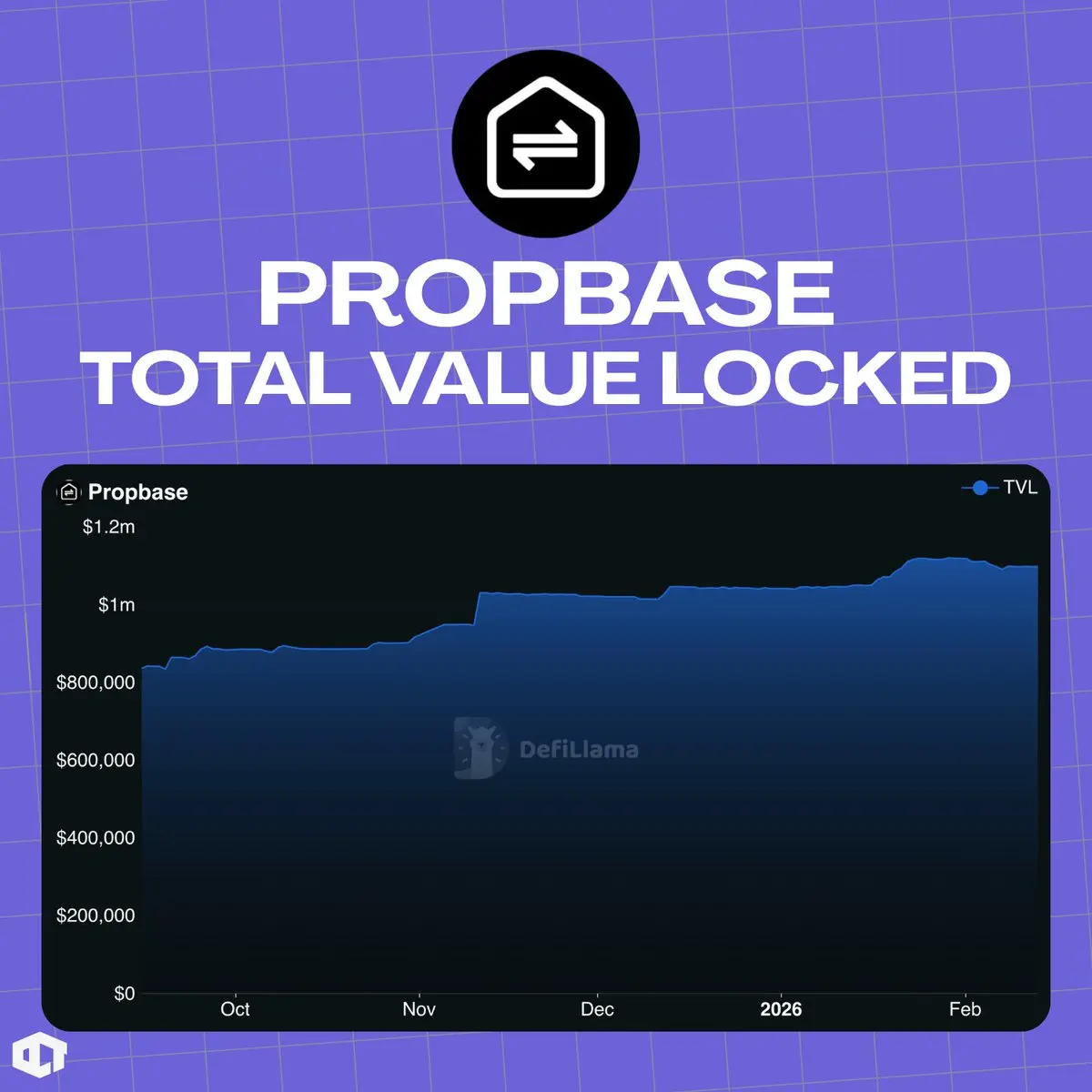

Despite the bad market conditions and a dip in RWA hype for the past 5-6 months, the TVL on $PROPS | @PropbaseApp has still been constantly growing.

The TVL currently sits at $1.1 Million and has increased by nearly $300,000 since the markets started following back in October.

Higher TVL just goes to show the utility and trust behind the project as $PROPS ecosystem continues to grow despite market conditions.

The TVL currently sits at $1.1 Million and has increased by nearly $300,000 since the markets started following back in October.

Higher TVL just goes to show the utility and trust behind the project as $PROPS ecosystem continues to grow despite market conditions.

PROPS-0,64%

- Reward

- 1

- Comment

- Repost

- Share

90% of the CT is calling this an end.

But this chart indicates a new start of an "uptrend"

Bitcoin weekly RSI has reach the same level it did after in 2022 Bear Market.

The last time weekly RSI dropped into the mid-20s, Bitcoin was deep in capitulation.

Sellers were already exhausted.

👉 RSI LEVELS THAT PRECEDED MAJOR REVERSALS

Momentum couldn’t push lower because most weak hands had already exited.

That phase didn’t lead to further collapse.

It led to base formation → trend reversal → new cycle.

Historically, weekly RSI under 30 has coincided with major macro lows across cycles.

These zones a

But this chart indicates a new start of an "uptrend"

Bitcoin weekly RSI has reach the same level it did after in 2022 Bear Market.

The last time weekly RSI dropped into the mid-20s, Bitcoin was deep in capitulation.

Sellers were already exhausted.

👉 RSI LEVELS THAT PRECEDED MAJOR REVERSALS

Momentum couldn’t push lower because most weak hands had already exited.

That phase didn’t lead to further collapse.

It led to base formation → trend reversal → new cycle.

Historically, weekly RSI under 30 has coincided with major macro lows across cycles.

These zones a

BTC-2,27%

- Reward

- like

- Comment

- Repost

- Share

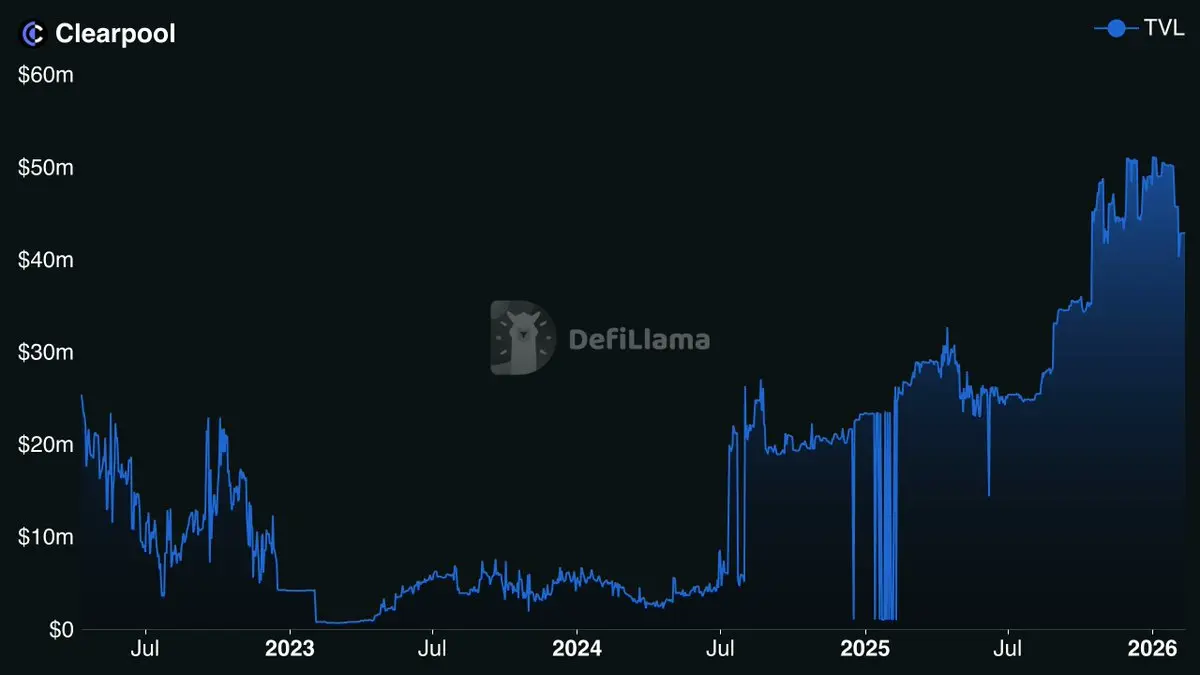

Despite difficult market conditions, the TVL on $CPOOL | @ClearpoolFin has constantly seen growth over the last two years.

The TVL was around $6M the same time in 2024 and now it's $43M, a 7x growth.

Before the latest crash, at the end of 2025, TVL reached $50.2 million, marking a period of expansion tied to products like the USDX T-Pool (a tokenized treasury pool) and increased loan originations

Not just that, Clearpool has facilitated over $924.4 million in loans to date, with $300 million specifically on its Clearpool Prime platform (a KYC-compliant marketplace for institutional credit).

Bo

The TVL was around $6M the same time in 2024 and now it's $43M, a 7x growth.

Before the latest crash, at the end of 2025, TVL reached $50.2 million, marking a period of expansion tied to products like the USDX T-Pool (a tokenized treasury pool) and increased loan originations

Not just that, Clearpool has facilitated over $924.4 million in loans to date, with $300 million specifically on its Clearpool Prime platform (a KYC-compliant marketplace for institutional credit).

Bo

CPOOL-0,37%

- Reward

- 1

- Comment

- Repost

- Share

SBF claims from prison that FTX was "Never Bankrupt"

So was FTX ever truly bankrupt?

So was FTX ever truly bankrupt?

- Reward

- like

- Comment

- Repost

- Share

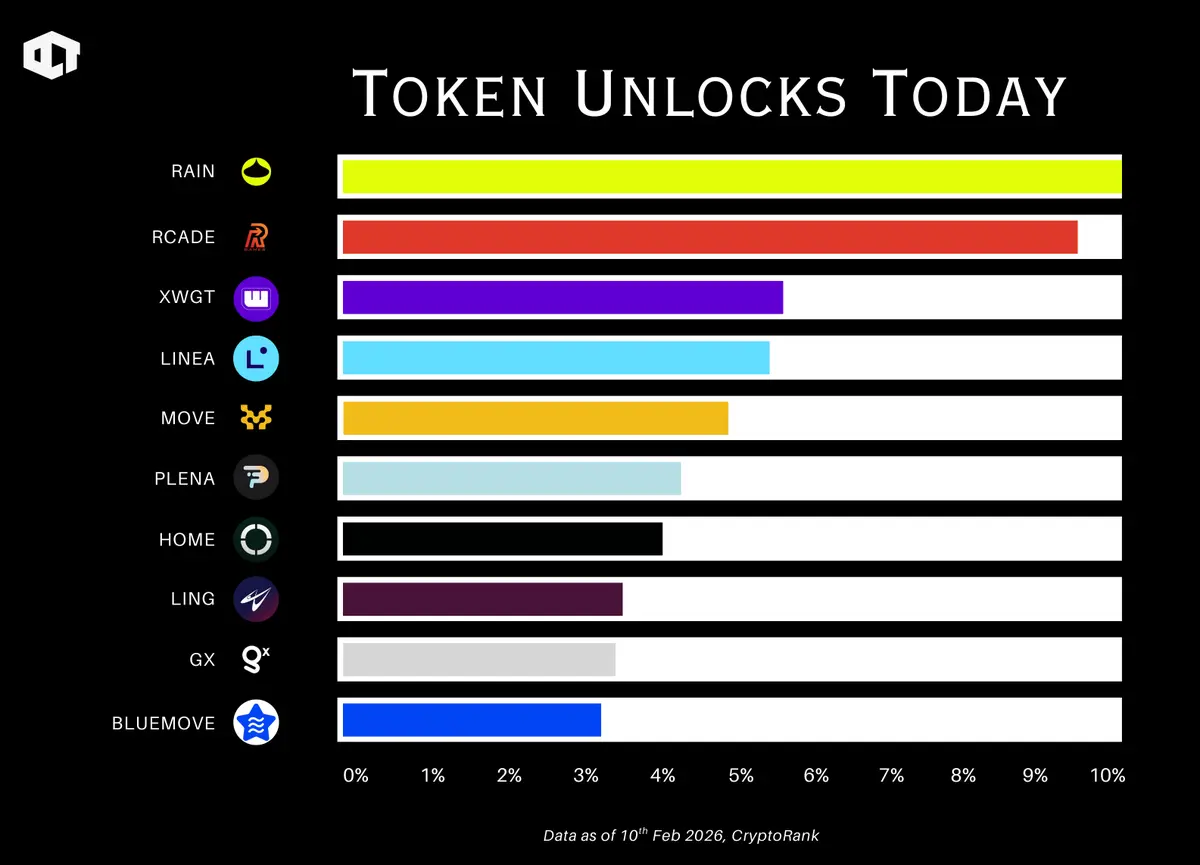

🚨 Top 10 Token Unlocks

(Feb 10, 2026)

• $RAIN : 11.0% of MCap

≈ $3930.18M

• $RCADE : 9.48% of MCap

≈ $49.41K

• $XWGT : 5.65% of MCap

≈ $2.64K

• $LINEA : 5.30% of MCap

≈ $3.23M

• $MOVE (Movement) : 4.84% of MCap

≈ $3.60M

• $PLENA : 4.17% of MCap

≈ $200.9

• $HOME (DeFi app) : 4.00% of MCap

≈ $3.83M

• $SLING : 3.41% of MCap

≈ $446.4

• $GX (Grindery) : 3.37% of MCap

≈ $17.6

• $BLUEMOVE : 3.16% of MCap

≈ $1.26K

Today is a huge unlock day.

👉 ~$440M worth of tokens are hitting the market in a single session.

👉 High % of MCap unlocks = short-term sell pressure risk.

👉 Prices can stay flat only if

(Feb 10, 2026)

• $RAIN : 11.0% of MCap

≈ $3930.18M

• $RCADE : 9.48% of MCap

≈ $49.41K

• $XWGT : 5.65% of MCap

≈ $2.64K

• $LINEA : 5.30% of MCap

≈ $3.23M

• $MOVE (Movement) : 4.84% of MCap

≈ $3.60M

• $PLENA : 4.17% of MCap

≈ $200.9

• $HOME (DeFi app) : 4.00% of MCap

≈ $3.83M

• $SLING : 3.41% of MCap

≈ $446.4

• $GX (Grindery) : 3.37% of MCap

≈ $17.6

• $BLUEMOVE : 3.16% of MCap

≈ $1.26K

Today is a huge unlock day.

👉 ~$440M worth of tokens are hitting the market in a single session.

👉 High % of MCap unlocks = short-term sell pressure risk.

👉 Prices can stay flat only if

- Reward

- like

- Comment

- Repost

- Share

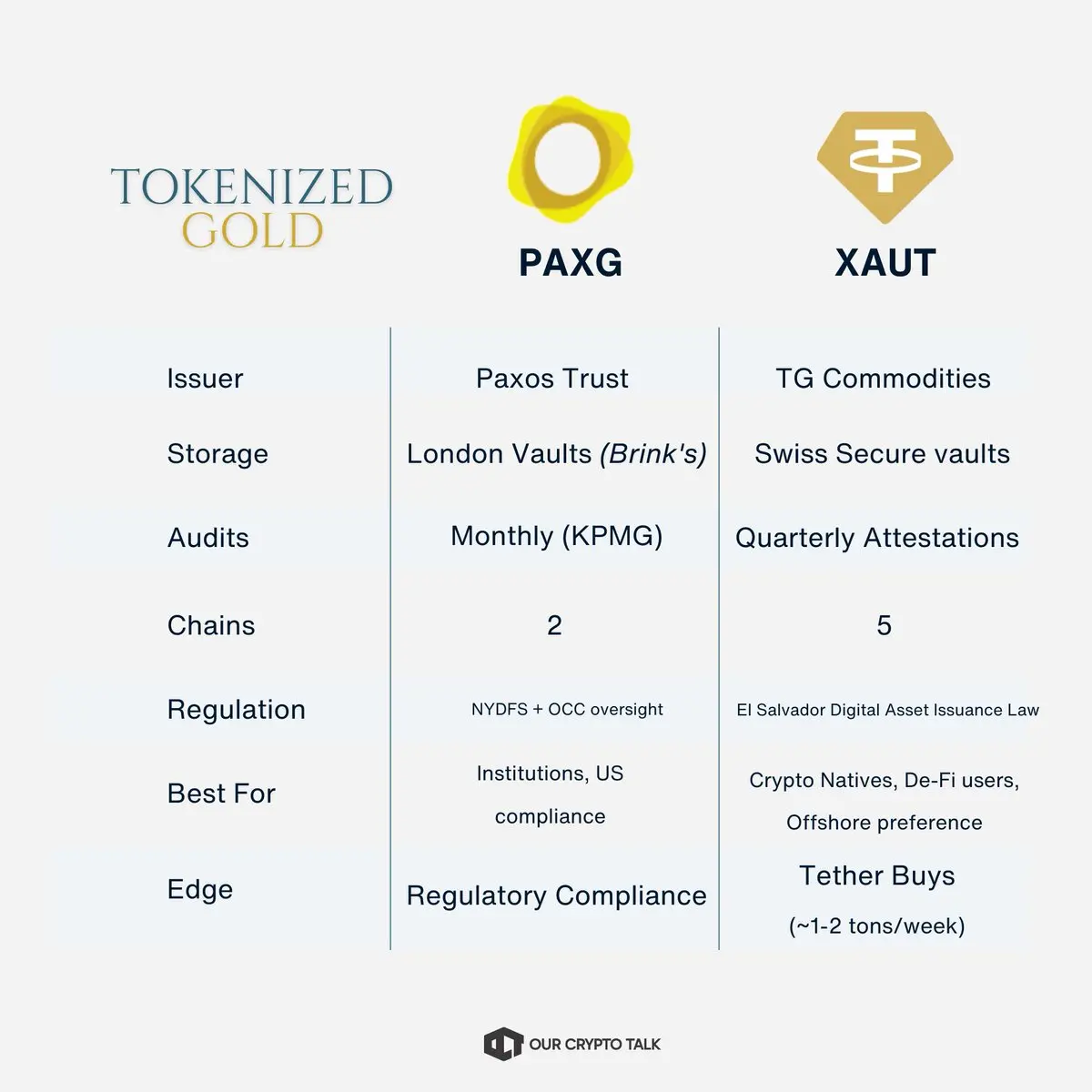

Tokenized Gold ft. PAXG vs XAUT 🪙

Gold hit $5,000 (again)

Two tokens dominate tokenized gold:

• $PAXG: $2.3B MC

• $XAUT: $2.6B MC

Both = 1 troy ounce of physical gold.

Both = 24/7 trading.

Both = 95% gains in one year.

The difference?

Where you draw your line.

🟡 PAXG : THE WALL STREET PLAY

• Issuer: Paxos Trust

• Regulation: NYDFS + OCC oversight

• Gold Location: London vaults (Brink's)

• Audits: Monthly KPMG reports

• Transparency: Serial numbers on-chain

• Storage Fees: Zero

• Redemption: 430+ tokens → bars, gold, or USD

Best For:

→ Institutions

→ Compliance-focused funds

→ Anyone who need

Gold hit $5,000 (again)

Two tokens dominate tokenized gold:

• $PAXG: $2.3B MC

• $XAUT: $2.6B MC

Both = 1 troy ounce of physical gold.

Both = 24/7 trading.

Both = 95% gains in one year.

The difference?

Where you draw your line.

🟡 PAXG : THE WALL STREET PLAY

• Issuer: Paxos Trust

• Regulation: NYDFS + OCC oversight

• Gold Location: London vaults (Brink's)

• Audits: Monthly KPMG reports

• Transparency: Serial numbers on-chain

• Storage Fees: Zero

• Redemption: 430+ tokens → bars, gold, or USD

Best For:

→ Institutions

→ Compliance-focused funds

→ Anyone who need

- Reward

- 1

- 1

- Repost

- Share

Lock_433 :

:

Buy To Earn 💎Four Unique Selling Points For $WELF Project:

1️⃣ Seamless Bridge Between Traditional and Digital Finance: Welf integrates conventional banking with Web3 technologies, enabling tokenization of RWAs for enhanced liquidity, transparency, and efficiency in wealth management.

2️⃣ Holistic and Personalized Wealth Approach: It offers a comprehensive, tailored strategy that goes beyond financial growth to include estate protection, lifestyle enhancement, and long-term fulfillment, treating wealth as a unified journey with a focus on legacy building.

3️⃣ AI-Driven Innovation and Precision Tools: Lever

1️⃣ Seamless Bridge Between Traditional and Digital Finance: Welf integrates conventional banking with Web3 technologies, enabling tokenization of RWAs for enhanced liquidity, transparency, and efficiency in wealth management.

2️⃣ Holistic and Personalized Wealth Approach: It offers a comprehensive, tailored strategy that goes beyond financial growth to include estate protection, lifestyle enhancement, and long-term fulfillment, treating wealth as a unified journey with a focus on legacy building.

3️⃣ AI-Driven Innovation and Precision Tools: Lever

- Reward

- like

- Comment

- Repost

- Share

🥇 Join our YouTube family – be among the first lucky 3000! 🎉

- Reward

- like

- Comment

- Repost

- Share