GateUser-b7a65f00

GateUser-b7a65f00

No content yet

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$TOTAL - [W]

- Reward

- like

- Comment

- Repost

- Share

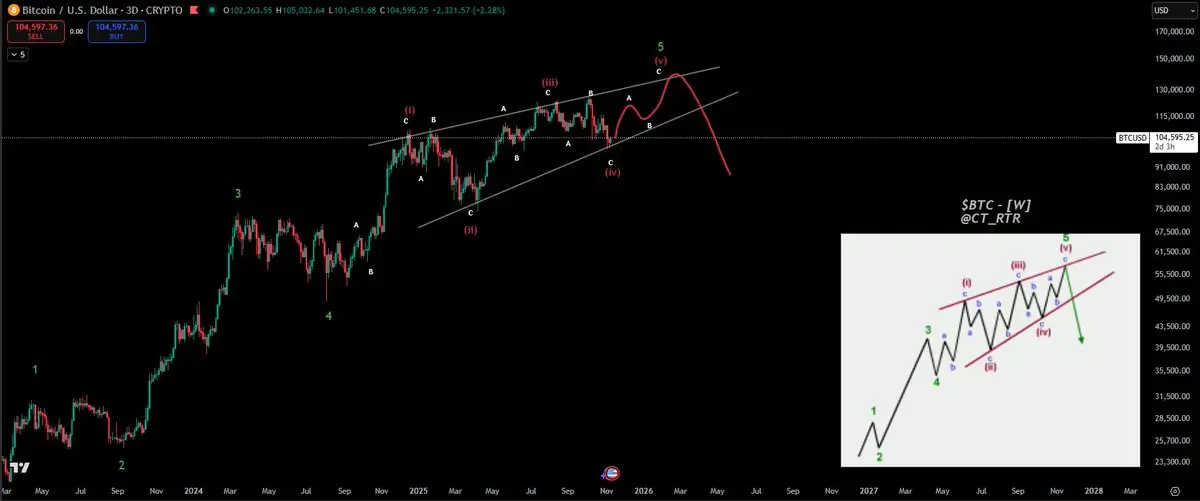

$BTC - [D]

Very easy chart to read.

I strongly believe the bottom formation won't be mirrored (three drives pattern excluded).

However, failing to push above the Yearly Open and mid-range levels soon enough suggests with a high probability the lows will be swept before any meaningful rally.

Rarely we have seen V-shape recoveries during the bull-run and I don't think it's the case here - hence I am trusting the white pattern to likely happen.

Very easy chart to read.

I strongly believe the bottom formation won't be mirrored (three drives pattern excluded).

However, failing to push above the Yearly Open and mid-range levels soon enough suggests with a high probability the lows will be swept before any meaningful rally.

Rarely we have seen V-shape recoveries during the bull-run and I don't think it's the case here - hence I am trusting the white pattern to likely happen.

BTC-2.89%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Real resistance is at 100-105k$

- Reward

- like

- Comment

- Repost

- Share

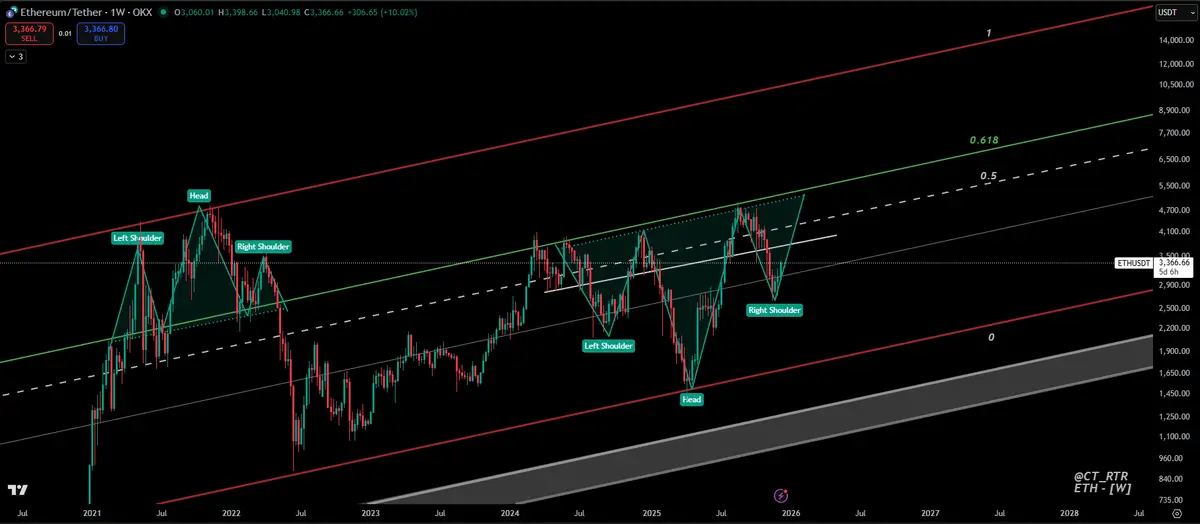

$ETH - [3D]

Timeline extra super bearish within support area.

Break of Structure to the upside (HH) and currently working on HL - bull trend intact.

Be bearish as much as you want, yes the market is brutal, but structure is intact and working on a bottom possibly.

Lose the bands and yes, you will be able to question the market, likely bear market confirmation.

Timeline extra super bearish within support area.

Break of Structure to the upside (HH) and currently working on HL - bull trend intact.

Be bearish as much as you want, yes the market is brutal, but structure is intact and working on a bottom possibly.

Lose the bands and yes, you will be able to question the market, likely bear market confirmation.

ETH-4.96%

- Reward

- like

- Comment

- Repost

- Share

Back from London, let's see some charts

- Reward

- like

- Comment

- Repost

- Share

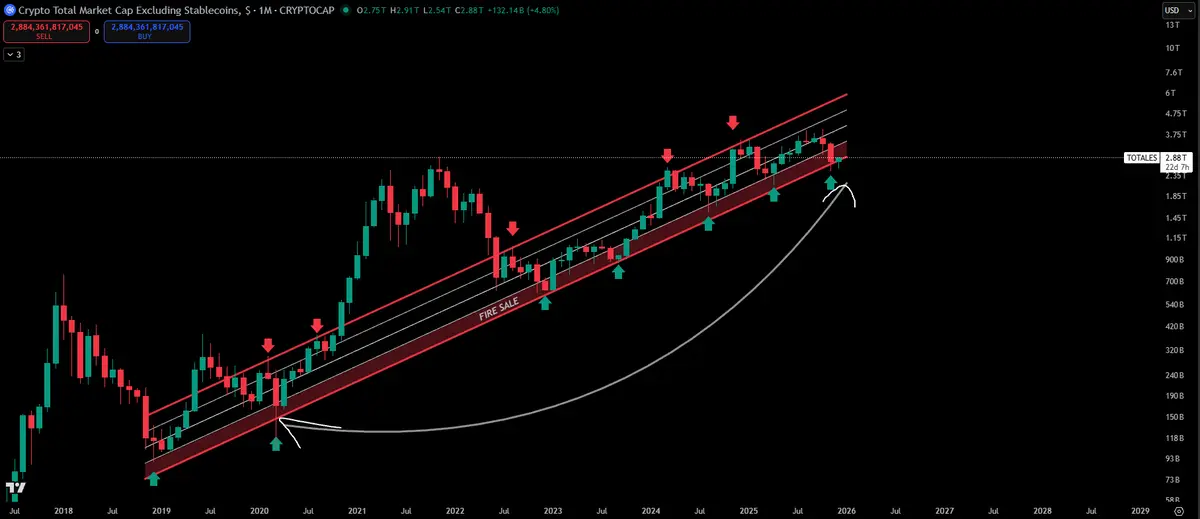

$TOTALES - [W]

Chart speaks for itself.

Chart speaks for itself.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#TOTAL3/GOLD

Chart illustrates altcoins performance in relation to gold.

Now hovering between Value Area Low and Point of Control. Before the recent expansions, this area was used as accumulation zone.

Also near the 36RSI level, this is bear-trap RSI, my favorite bull-ignition level.

Would like to see some bullish divergences formed near here to build more confidence.

Notes:

1) Should the ratio break above the VAH - raging bull.

2) Ratio breaks below VAL - 25% correction.

Chart illustrates altcoins performance in relation to gold.

Now hovering between Value Area Low and Point of Control. Before the recent expansions, this area was used as accumulation zone.

Also near the 36RSI level, this is bear-trap RSI, my favorite bull-ignition level.

Would like to see some bullish divergences formed near here to build more confidence.

Notes:

1) Should the ratio break above the VAH - raging bull.

2) Ratio breaks below VAL - 25% correction.

- Reward

- like

- Comment

- Repost

- Share

$RSC - [M]

Very good looking monthly chart.

Double bottom with hammer monthly candle at Range Lows?

Even if asset gets sort of pullback, still translates into a dragonfly doji.

Next monthly candle high possibility to be big green, followed by expansion over Fibs box.

Brian's Armstrong (Coinbase CEO) is the co-founder of this coin - doubt this don't get the chance to run before bear market.

Very good looking monthly chart.

Double bottom with hammer monthly candle at Range Lows?

Even if asset gets sort of pullback, still translates into a dragonfly doji.

Next monthly candle high possibility to be big green, followed by expansion over Fibs box.

Brian's Armstrong (Coinbase CEO) is the co-founder of this coin - doubt this don't get the chance to run before bear market.

RSC-3.6%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$BTC - [D]

This is some warning post you need to be aware of.

The situation is not clear yet, that's why I labelled it as informative.

The weekly candle has not closed yet, hence the reasonings above.

But if it closes like this, ain't a really good sign after 3 months spent bouncing from the support - price finds acceptance back below the weekly S/R, case it happens. (i.e. lower prices expected)

We'll update with a 100% clear answer upon weekly close.

This is some warning post you need to be aware of.

The situation is not clear yet, that's why I labelled it as informative.

The weekly candle has not closed yet, hence the reasonings above.

But if it closes like this, ain't a really good sign after 3 months spent bouncing from the support - price finds acceptance back below the weekly S/R, case it happens. (i.e. lower prices expected)

We'll update with a 100% clear answer upon weekly close.

BTC-2.89%

- Reward

- like

- Comment

- Repost

- Share

$MSTR - [3D]

Easy 30% gain here into Point - of - Control, where supply aligns, similarly with the previous range.

Should that point be reached, there comes the question whether that area gets flipped into support or is rejected.

Case it gets flipped, we can talk higher numbers, possible new highs, equivalent with Bitcoin pushing much, much higher.

Other than that, treat the range until proven otherwise.

Easy 30% gain here into Point - of - Control, where supply aligns, similarly with the previous range.

Should that point be reached, there comes the question whether that area gets flipped into support or is rejected.

Case it gets flipped, we can talk higher numbers, possible new highs, equivalent with Bitcoin pushing much, much higher.

Other than that, treat the range until proven otherwise.

BTC-2.89%

- Reward

- like

- Comment

- Repost

- Share

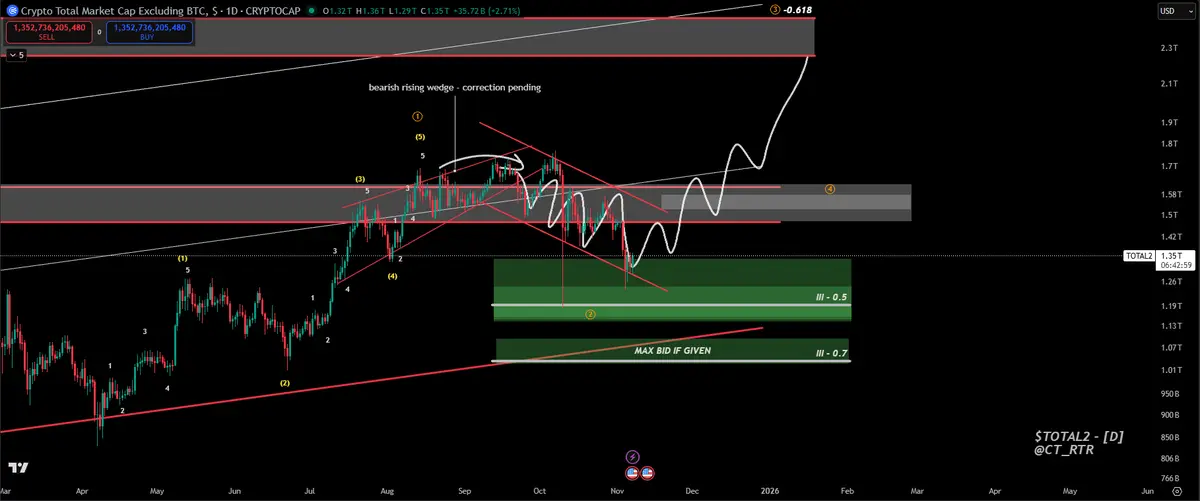

#TOTAL2 - [D]

Elliot-wave analysis for studying purposes.

Clear 5-wave impulsive move from the channel lower boundary.

At the moment, within second wave correction.

What is the next? - the third and the most impulsive leg of the whole count.

Elliot-wave analysis for studying purposes.

Clear 5-wave impulsive move from the channel lower boundary.

At the moment, within second wave correction.

What is the next? - the third and the most impulsive leg of the whole count.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share