InvestingWithBrandon

🔴If you held a gun to my head and said "Brandon, beat the market in the next 10 years or you are dead"

I would say, no prob.

There is a 99.9% chance I will.

This is exactly how.

First off, "the market" is the SP500.

We will say I have a $1m account to start.

The first thing I would do to beat the market is to simply buy the market.

So I would buy $1m of $VOO (sp500 ETF)

Second, just buying the market via $VOO will actually underperform a tad because of the expense ratio... no prob

So here is the spot that matters to beat it.

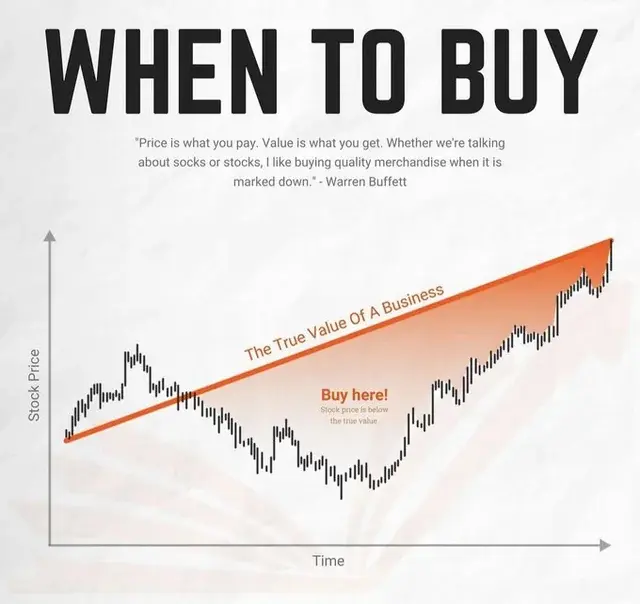

In that 10 year period, I would be patient, sitting, & waiting for a

I would say, no prob.

There is a 99.9% chance I will.

This is exactly how.

First off, "the market" is the SP500.

We will say I have a $1m account to start.

The first thing I would do to beat the market is to simply buy the market.

So I would buy $1m of $VOO (sp500 ETF)

Second, just buying the market via $VOO will actually underperform a tad because of the expense ratio... no prob

So here is the spot that matters to beat it.

In that 10 year period, I would be patient, sitting, & waiting for a