IntoTheBlock

No content yet

IntoTheBlock

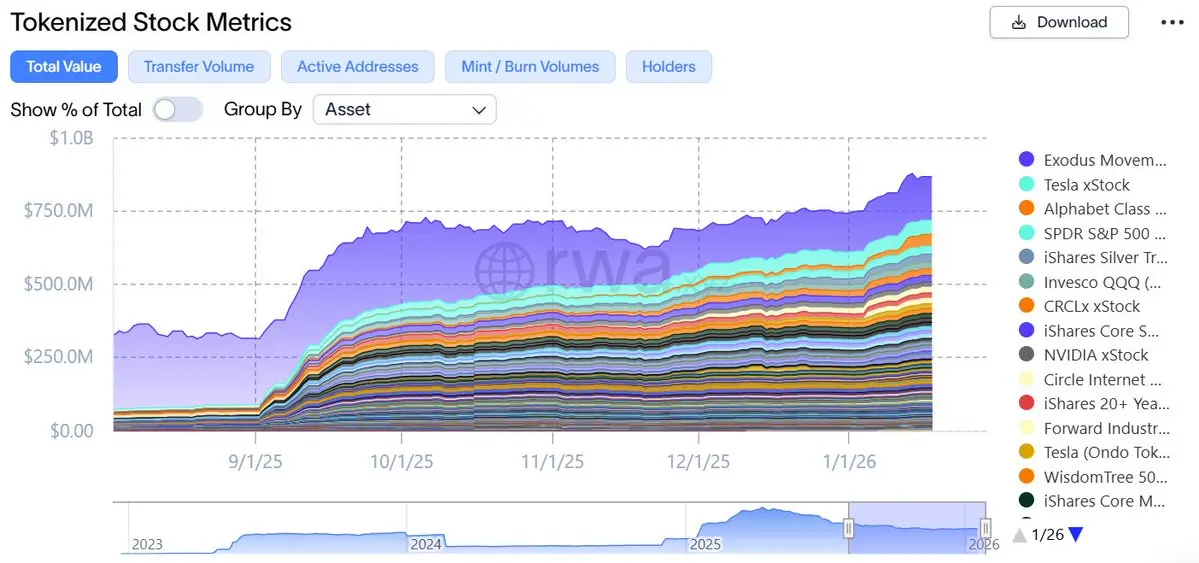

Trillions in equities are trapped in legacy rails. Tokenization unlocks them👇

- Reward

- like

- Comment

- Repost

- Share

While stablecoins grew rapidly in 2024–2025, that momentum has largely flattened since Q4 last year. On a monthly basis, the slowdown is driven primarily by USDT and USDC, whose market caps have contracted, while newer entrants such as PYUSD and RLUSD have continued to gain share.

PYUSD0,02%

- Reward

- like

- Comment

- Repost

- Share

Banks are feeling the pressure as tokenization accelerates.@admff492 breaks down why on @TradeTalks.

- Reward

- like

- Comment

- Repost

- Share

Curious what Sentora is building in tokenized equities?Sign up below to join our next webinar👇

- Reward

- like

- Comment

- Repost

- Share

In this week\'s newsletter, we break down Strategy\'s recent Bitcoin purchase and analyze risks involved with yield-bearing assets👇

BTC-2,26%

- Reward

- like

- Comment

- Repost

- Share

These are this week’s key DeFi metrics. The key shift is rising stablecoin borrowing costs, driven by shrinking liquidity across the market.

- Reward

- like

- Comment

- Repost

- Share

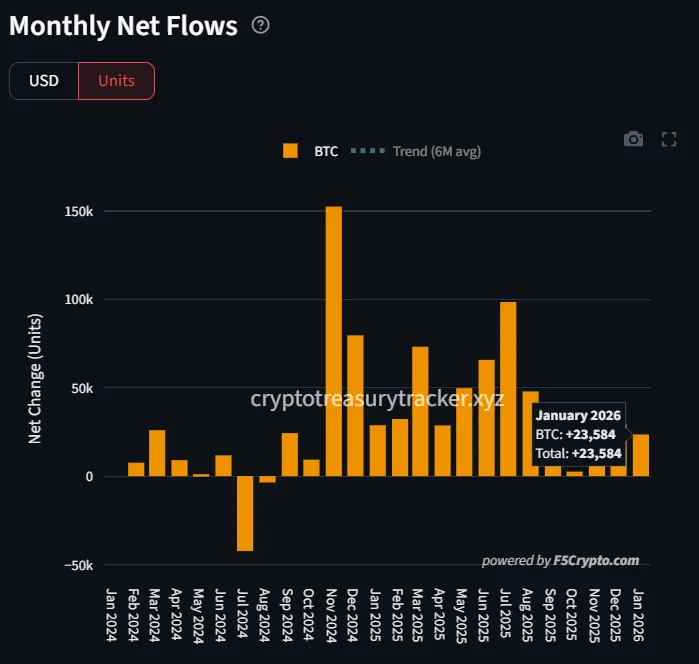

Strategy confirmed the acquisition of more than 22k BTC this week, pushing their total holdings past the 700,000 threshold

BTC-2,26%

- Reward

- like

- Comment

- Repost

- Share

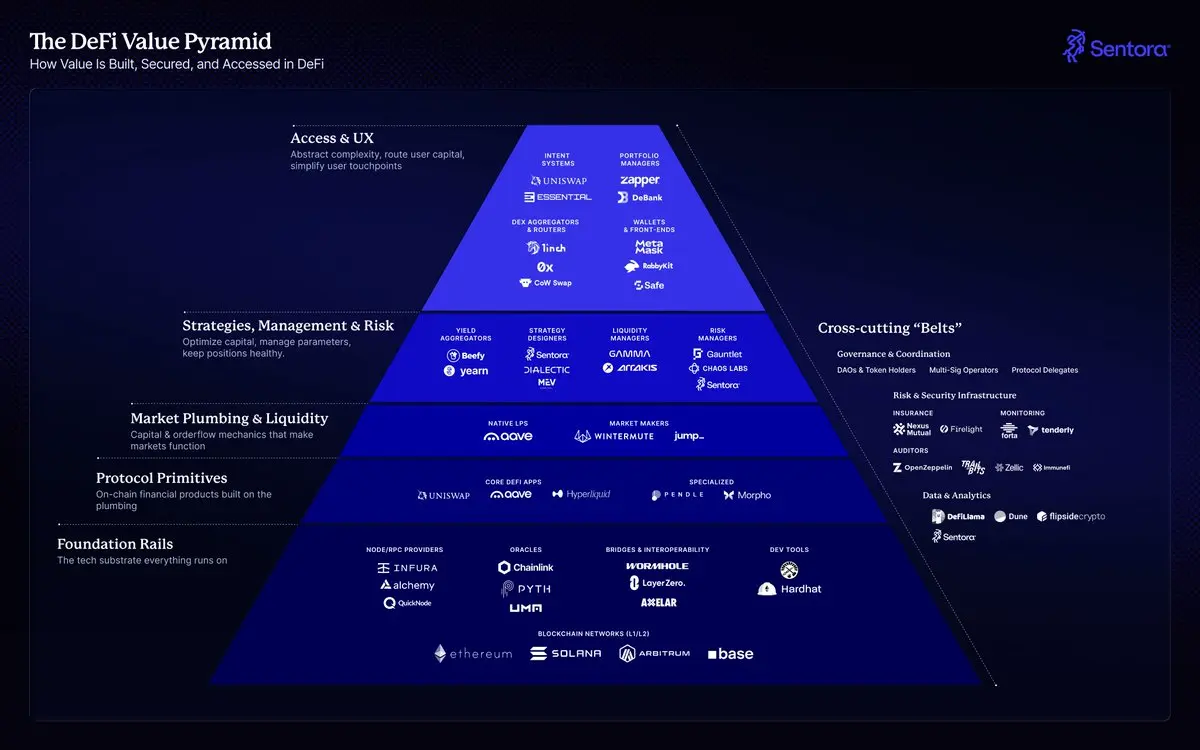

DeFi apps don’t become successful in isolation. \n\nYou can optimize one product, but lasting value shows up when the full stack aligns: rails, primitives, liquidity, risk, and the access layer that routes users. \n\nZoom in on the pyramid and share if you build in DeFi.

DEFI-1,14%

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Ready to learn about tokenized equities and their impact on DeFi?

Join our upcoming webinar live👇

Join our upcoming webinar live👇

DEFI-1,14%

- Reward

- like

- Comment

- Repost

- Share

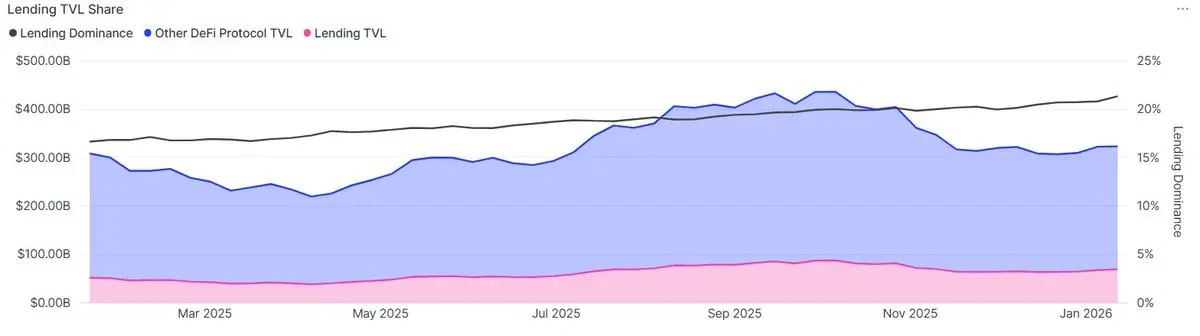

Lending protocols’ share of total DeFi TVL has trended upward over the last 12 months, increasing from 16.6% in January 2025 to more than 21.3% at present.

- Reward

- like

- Comment

- Repost

- Share

Treasuries keep stacking Bitcoin.

More than 23k BTC added so far in January, pushing total treasury holdings to 1,913,908 BTC.

That’s about 9.5% of all circulating Bitcoin.

More than 23k BTC added so far in January, pushing total treasury holdings to 1,913,908 BTC.

That’s about 9.5% of all circulating Bitcoin.

BTC-2,26%

- Reward

- like

- Comment

- Repost

- Share

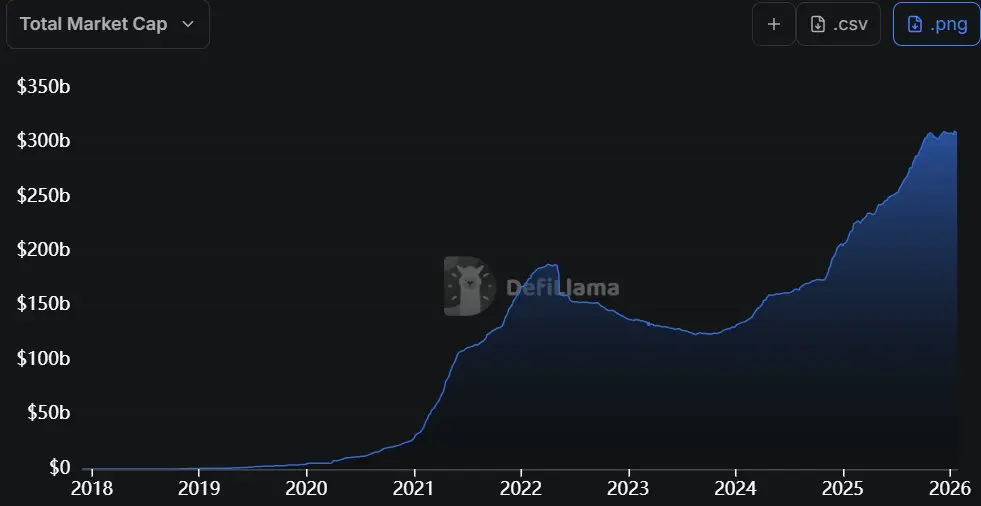

Tokenized stocks have been steadily growing, with market caps rising another 16% in the past 30 days after an already succesful Q4 of '25.

Continued integration by exchanges and fintech platforms could turn this into a multi-trillion-dollar market.

Continued integration by exchanges and fintech platforms could turn this into a multi-trillion-dollar market.

- Reward

- like

- Comment

- Repost

- Share