SkYler

No content yet

SkYler

- Reward

- 1

- Comment

- Repost

- Share

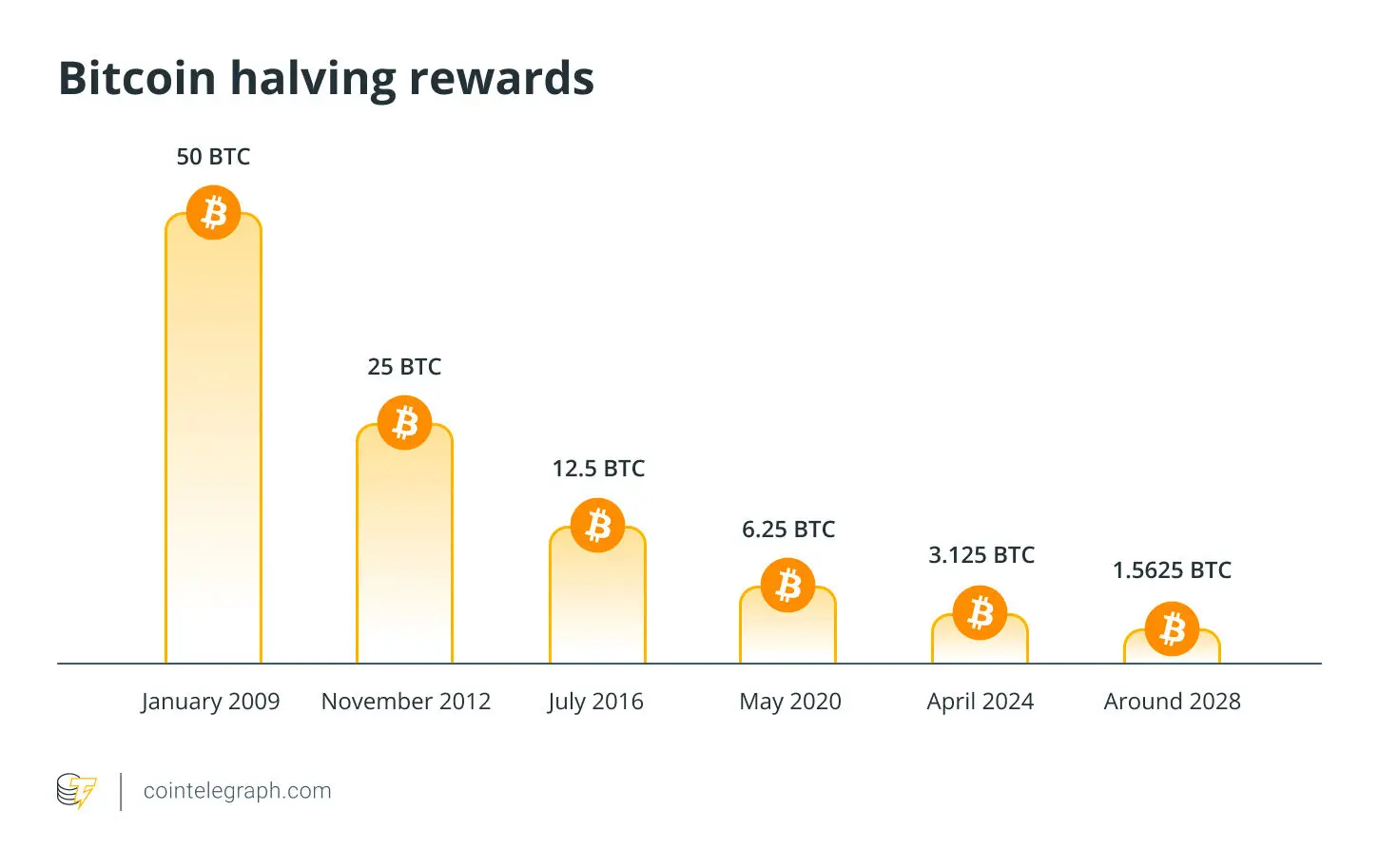

Grayscale suggests Bitcoin may be drifting away from its classic 4-year halving cycle and institutions could be the reason.

With ETFs, sovereign adoption, and major funds absorbing supply, retail might no longer define macro trends.

The question now: is Bitcoin entering a new, institution-led market regime?

$BTC

With ETFs, sovereign adoption, and major funds absorbing supply, retail might no longer define macro trends.

The question now: is Bitcoin entering a new, institution-led market regime?

$BTC

BTC-1.36%

- Reward

- 1

- Comment

- Repost

- Share

Grayscale suggests $BTC may be breaking away from its traditional four-year halving cycle, noting that institutional capital flows, evolving macro conditions, and shifting supply dynamics now exert a stronger influence on BTC’s price behavior.

The firm argues that these factors could redefine how future market cycles unfold.

The firm argues that these factors could redefine how future market cycles unfold.

BTC-1.36%

- Reward

- 1

- Comment

- Repost

- Share

Global Bitcoin treasuries have now surpassed 4M $BTC , spread across ETFs, public companies, governments, DeFi protocols, private firms, and custodians.

The milestone highlights accelerating institutional accumulation, yet analysts note Bitcoin still behaves like a risk asset, not fully transitioning into “digital gold” status.

The growing concentration of BTC in long-term treasuries, however, suggests shifting market structure that could strengthen its macro positioning over time.

The milestone highlights accelerating institutional accumulation, yet analysts note Bitcoin still behaves like a risk asset, not fully transitioning into “digital gold” status.

The growing concentration of BTC in long-term treasuries, however, suggests shifting market structure that could strengthen its macro positioning over time.

BTC-1.36%

- Reward

- 1

- Comment

- Repost

- Share

$WIF climbs to $0.392 after bouncing from the $0.361 low, building steady momentum on the 15m chart.

Bulls briefly pushed to $0.397, signaling growing strength as buyers defend higher lows.

Holding above $0.388 keeps the short-term trend bullish, with a potential retest of $0.397–$0.398 on the table.

#Trading #Gate

Bulls briefly pushed to $0.397, signaling growing strength as buyers defend higher lows.

Holding above $0.388 keeps the short-term trend bullish, with a potential retest of $0.397–$0.398 on the table.

#Trading #Gate

WIF-0.15%

- Reward

- like

- Comment

- Repost

- Share

$PEPE surges to 0.00000480 after a clean rebound from the 0.00000430 zone, ripping higher with strong hourly momentum.

Bulls pushed price just shy of the 0.00000487 high, signaling sustained demand.

As long as PEPE holds above 0.00000470, upside pressure remains in play for another potential breakout.

Bulls pushed price just shy of the 0.00000487 high, signaling sustained demand.

As long as PEPE holds above 0.00000470, upside pressure remains in play for another potential breakout.

PEPE-1.69%

- Reward

- like

- Comment

- Repost

- Share

$SOL climbs to $137 after a sharp rebound from $127, extending its hourly uptrend with strong momentum.

Bulls pushed price to $139 before a minor pullback, but buyers remain in control.

Holding above $135 keeps the structure bullish, and a retest of $139–$140 could set up the next breakout move.

#Trading #Write2Earn

Bulls pushed price to $139 before a minor pullback, but buyers remain in control.

Holding above $135 keeps the structure bullish, and a retest of $139–$140 could set up the next breakout move.

#Trading #Write2Earn

SOL-2.97%

- Reward

- like

- Comment

- Repost

- Share

$ZEC rockets to $398 after a powerful breakout from the $330 zone, posting double-digit gains on strong hourly momentum.

Bulls pushed price as high as $404, signaling aggressive demand.

Holding above $390 keeps the upside intact, with eyes on a potential continuation toward new local highs.

#Trading #Write2Earn

Bulls pushed price as high as $404, signaling aggressive demand.

Holding above $390 keeps the upside intact, with eyes on a potential continuation toward new local highs.

#Trading #Write2Earn

ZEC10.04%

- Reward

- 1

- Comment

- Repost

- Share

$ETH is back above $3,150 after rebounding strongly from the $2,930 zone, showing renewed bullish momentum on the 4h chart.

Buyers are reclaiming key levels with confidence, and a break above $3,180 could signal a push toward the next major resistance as upside pressure builds.

#Trading #Write2Earn

Buyers are reclaiming key levels with confidence, and a break above $3,180 could signal a push toward the next major resistance as upside pressure builds.

#Trading #Write2Earn

ETH-0.09%

- Reward

- 1

- Comment

- Repost

- Share

ETF FLOWS: Last week saw a rotation in crypto ETF demand.

Spot Bitcoin ETFs recorded $87.77M in net outflows, while Ethereum faced $65.59M in outflows.

In contrast, sentiment flipped positive for altcoins as $SOL ETFs brought in $20.3M and $XRP ETFs surged with $230.74M in net inflows, signaling shifting investor appetite.

Spot Bitcoin ETFs recorded $87.77M in net outflows, while Ethereum faced $65.59M in outflows.

In contrast, sentiment flipped positive for altcoins as $SOL ETFs brought in $20.3M and $XRP ETFs surged with $230.74M in net inflows, signaling shifting investor appetite.

- Reward

- 2

- Comment

- Repost

- Share

$DOT slipped to $2.04 after rejecting the $2.165 high, showing clear selling pressure on the 1H chart.

A quick bounce pushed price back above $2.10, but momentum remains fragile.

Bulls must reclaim $2.12–$2.15 to regain control, while bears eye another dip toward $2.00.

Volatility rising, watch closely!

A quick bounce pushed price back above $2.10, but momentum remains fragile.

Bulls must reclaim $2.12–$2.15 to regain control, while bears eye another dip toward $2.00.

Volatility rising, watch closely!

DOT-0.09%

- Reward

- 2

- Comment

- Repost

- Share

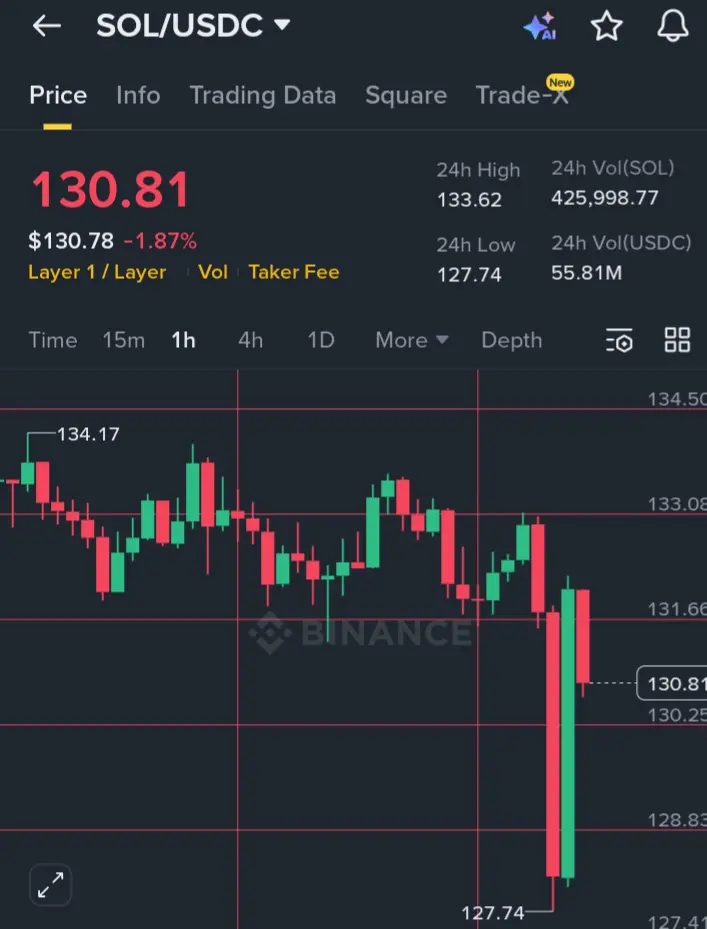

$BTC wicked down to $127.74 before a sharp rebound, but the recovery stalled around $131 as sellers quickly stepped back in.

With volatility spiking and the 1H structure still weak, bulls must reclaim $133+ to shift momentum.

For now, SOL sits at $130.8 caught between pressure and a potential bounce.

#Trading #Write2Earn

With volatility spiking and the 1H structure still weak, bulls must reclaim $133+ to shift momentum.

For now, SOL sits at $130.8 caught between pressure and a potential bounce.

#Trading #Write2Earn

BTC-1.36%

- Reward

- 1

- Comment

- Repost

- Share

$ATOM just dipped to $2.13 after failing to hold the $2.28 local top.

Volatility is heating up as sellers dominate the 1H chart, but buyers are attempting a small rebound.

Key levels to watch: $2.20 reclaim or a deeper retest toward $2.10. Stay alert.

#Trading #Write2Earn

#G

Volatility is heating up as sellers dominate the 1H chart, but buyers are attempting a small rebound.

Key levels to watch: $2.20 reclaim or a deeper retest toward $2.10. Stay alert.

#Trading #Write2Earn

#G

ATOM0.85%

- Reward

- like

- Comment

- Repost

- Share

$SEI is gaining momentum again.

Now trading at $0.1309 (+3.56%), price has fully recovered from the $0.1244 dip and is pushing into a fresh 24h high.

The steady climb with rising buy pressure and consecutive higher lows signals strong bullish intent.

A hold above $0.1285 could fuel the next leg up.

#Gate

Now trading at $0.1309 (+3.56%), price has fully recovered from the $0.1244 dip and is pushing into a fresh 24h high.

The steady climb with rising buy pressure and consecutive higher lows signals strong bullish intent.

A hold above $0.1285 could fuel the next leg up.

#Gate

SEI-0.45%

- Reward

- 1

- Comment

- Repost

- Share

$AR is climbing with steady momentum!.

Now at $0.2102 (+3.34%), bulls pushed price to a 24h high of $0.2107, reclaiming the mid-range after bouncing off $0.205 support.

Rising volume and clean higher lows show strong buyer intent.

A firm hold above $0.209 could open the door for a stronger push.

#Trading #Write2Earn #G

Now at $0.2102 (+3.34%), bulls pushed price to a 24h high of $0.2107, reclaiming the mid-range after bouncing off $0.205 support.

Rising volume and clean higher lows show strong buyer intent.

A firm hold above $0.209 could open the door for a stronger push.

#Trading #Write2Earn #G

AR-0.14%

- Reward

- 1

- Comment

- Repost

- Share

$ORDI is heating up.

Now trading at $4.16 (+6%), pushing off the $3.80 support and tapping a 24h high of $4.25.

Strong momentum, rising volume, and clean higher lows signal renewed strength.

If bulls hold above $4.08, another breakout attempt looks likely.

#Trading #Write2Earn #G

Now trading at $4.16 (+6%), pushing off the $3.80 support and tapping a 24h high of $4.25.

Strong momentum, rising volume, and clean higher lows signal renewed strength.

If bulls hold above $4.08, another breakout attempt looks likely.

#Trading #Write2Earn #G

ORDI2.35%

- Reward

- 1

- Comment

- Repost

- Share

$DOGS heating up again.

$DOGS bounced from 0.00000439 and spiked to a 24h high of 0.00000512 on 3.28B volume before cooling slightly to 0.00000473.

Buyers are defending 0.00000462 as short-term support.

A strong hold here could fuel another push toward the 0.00000498–0.00000517 zone.

#Trading #Write2Earn #Gate

$DOGS bounced from 0.00000439 and spiked to a 24h high of 0.00000512 on 3.28B volume before cooling slightly to 0.00000473.

Buyers are defending 0.00000462 as short-term support.

A strong hold here could fuel another push toward the 0.00000498–0.00000517 zone.

#Trading #Write2Earn #Gate

DOGS-3.12%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share