CryptoFrog

No content yet

CryptoFrog

Canton Network (@CantonNetwork) is redefining what it means to be permissionless. It’s not just another blockchain, it works sort of like the Internet.

Here’s the difference:

Canton Network moves similar to the Internet, a network where data routes point to point, and apps enforce compliance on the rails while ensuring flexibility.

Canton’s infrastructure is open source, meaning anyone can build and spin up a node, making it highly decentralized.

But when it comes to the apps, access is controlled by the smart contract, not the network operator, ensuring both privacy and security.

Canton Netw

Here’s the difference:

Canton Network moves similar to the Internet, a network where data routes point to point, and apps enforce compliance on the rails while ensuring flexibility.

Canton’s infrastructure is open source, meaning anyone can build and spin up a node, making it highly decentralized.

But when it comes to the apps, access is controlled by the smart contract, not the network operator, ensuring both privacy and security.

Canton Netw

CC2,53%

- Reward

- like

- Comment

- Repost

- Share

$KTA is rapidly expanding its global reach, with more fiat anchors now connected. 🌍

The current public roadmap shows ACH/Wire and SEPA anchors are already live, and more countries and fiat payment options will be added soon.

Next up, SPEI and MXN in Mexico, PIX and BRL in Brazil, as well as SWIFT connections in additional regions.

Keeta Network is working to build the future of seamless global payments, bridging traditional finance with the blockchain.

As the network grows, $KTA holders can look forward to even more developments ahead...stay tuned for what's to come!

The current public roadmap shows ACH/Wire and SEPA anchors are already live, and more countries and fiat payment options will be added soon.

Next up, SPEI and MXN in Mexico, PIX and BRL in Brazil, as well as SWIFT connections in additional regions.

Keeta Network is working to build the future of seamless global payments, bridging traditional finance with the blockchain.

As the network grows, $KTA holders can look forward to even more developments ahead...stay tuned for what's to come!

- Reward

- like

- Comment

- Repost

- Share

Canton Network (@CantonNetwork) is taking digital asset security to the next level with the launch of Send Safe.

This new, non custodial, multi sig solution is built directly into the @Send app, giving you stronger control over assets without the need for third party custody or moving anything off-chain.

Here’s What Send Safe Offers:

• Create a Safe for your assets directly inside the Send app

• Add trusted members (team members, colleagues, or trusted contacts)

• Set approval thresholds (ex. 4 members, 3 approvals required)

• Propose transactions that only go through once the required approv

This new, non custodial, multi sig solution is built directly into the @Send app, giving you stronger control over assets without the need for third party custody or moving anything off-chain.

Here’s What Send Safe Offers:

• Create a Safe for your assets directly inside the Send app

• Add trusted members (team members, colleagues, or trusted contacts)

• Set approval thresholds (ex. 4 members, 3 approvals required)

• Propose transactions that only go through once the required approv

- Reward

- like

- Comment

- Repost

- Share

Bitcoin is slowly making its way back to our 4H trendline… 👀

After seeing a rejection just a few days ago from the 4H trendline we’ve been watching closely, price has once again started pushing higher, showing strong short term bullish momentum.

The nice part about seeing trendline rejections repeatedly, is that the more price retests them, the higher the rejection level tends to move. A few days ago, Bitcoin was rejected around $94.5k from the trendline, but that potential new rejection zone has now shifted higher to roughly $97k–$98k.

Looking at the even shorter term price action, you could

After seeing a rejection just a few days ago from the 4H trendline we’ve been watching closely, price has once again started pushing higher, showing strong short term bullish momentum.

The nice part about seeing trendline rejections repeatedly, is that the more price retests them, the higher the rejection level tends to move. A few days ago, Bitcoin was rejected around $94.5k from the trendline, but that potential new rejection zone has now shifted higher to roughly $97k–$98k.

Looking at the even shorter term price action, you could

BTC-2,53%

- Reward

- like

- Comment

- Repost

- Share

Bitcoin’s weekly chart is starting to look concerning… 😳

Taking a look at the moving averages, we can see that the VERY important 50 EMA and 20 EMA are on the verge of a death cross.

This would be the first time this cycle that the smaller 20 EMA crosses below the 50 EMA, while Bitcoin’s price is being held up by only the 100 EMA.

All of this is extremely concerning. Bitcoin has now closed 9 consecutive weekly candles below the 50 EMA, which is what’s causing this potential death cross. Historically, this has been an early warning signal before entering a true bear market.

I wouldn’t be surpr

Taking a look at the moving averages, we can see that the VERY important 50 EMA and 20 EMA are on the verge of a death cross.

This would be the first time this cycle that the smaller 20 EMA crosses below the 50 EMA, while Bitcoin’s price is being held up by only the 100 EMA.

All of this is extremely concerning. Bitcoin has now closed 9 consecutive weekly candles below the 50 EMA, which is what’s causing this potential death cross. Historically, this has been an early warning signal before entering a true bear market.

I wouldn’t be surpr

BTC-2,53%

- Reward

- like

- Comment

- Repost

- Share

Strong networks aren’t built on code alone.

Canton Network (@CantonNetwork) is scaling across 4 key pillars:

Applications, Assets, Users, and Infrastructure.

With these foundational elements in place, the ecosystem is live and evolving.

As the network continues to grow, it creates a powerful environment that fuels the future of DeFi and blockchain technology.

This is only the beginning, Canton is setting the stage for a new era of scalability and innovation 👀

Canton Network (@CantonNetwork) is scaling across 4 key pillars:

Applications, Assets, Users, and Infrastructure.

With these foundational elements in place, the ecosystem is live and evolving.

As the network continues to grow, it creates a powerful environment that fuels the future of DeFi and blockchain technology.

This is only the beginning, Canton is setting the stage for a new era of scalability and innovation 👀

- Reward

- like

- Comment

- Repost

- Share

$BTC has once again failed to recover its 4H trendline from late December…

As we discussed a few weeks ago, Bitcoin’s 4-hour trendline broke down at the beginning of the year, and that same trendline has since been acting as major resistance for price action.

As we can see, the strong rally from a few days ago received a HARD rejection from this EXACT trendline around $95k, which caused Bitcoin to fall right back into the $90k range.

It’s very important for price to break back above this trendline on the 4H chart if we want to see new highs in the near future.

I don’t see many people on CT tal

As we discussed a few weeks ago, Bitcoin’s 4-hour trendline broke down at the beginning of the year, and that same trendline has since been acting as major resistance for price action.

As we can see, the strong rally from a few days ago received a HARD rejection from this EXACT trendline around $95k, which caused Bitcoin to fall right back into the $90k range.

It’s very important for price to break back above this trendline on the 4H chart if we want to see new highs in the near future.

I don’t see many people on CT tal

BTC-2,53%

- Reward

- like

- Comment

- Repost

- Share

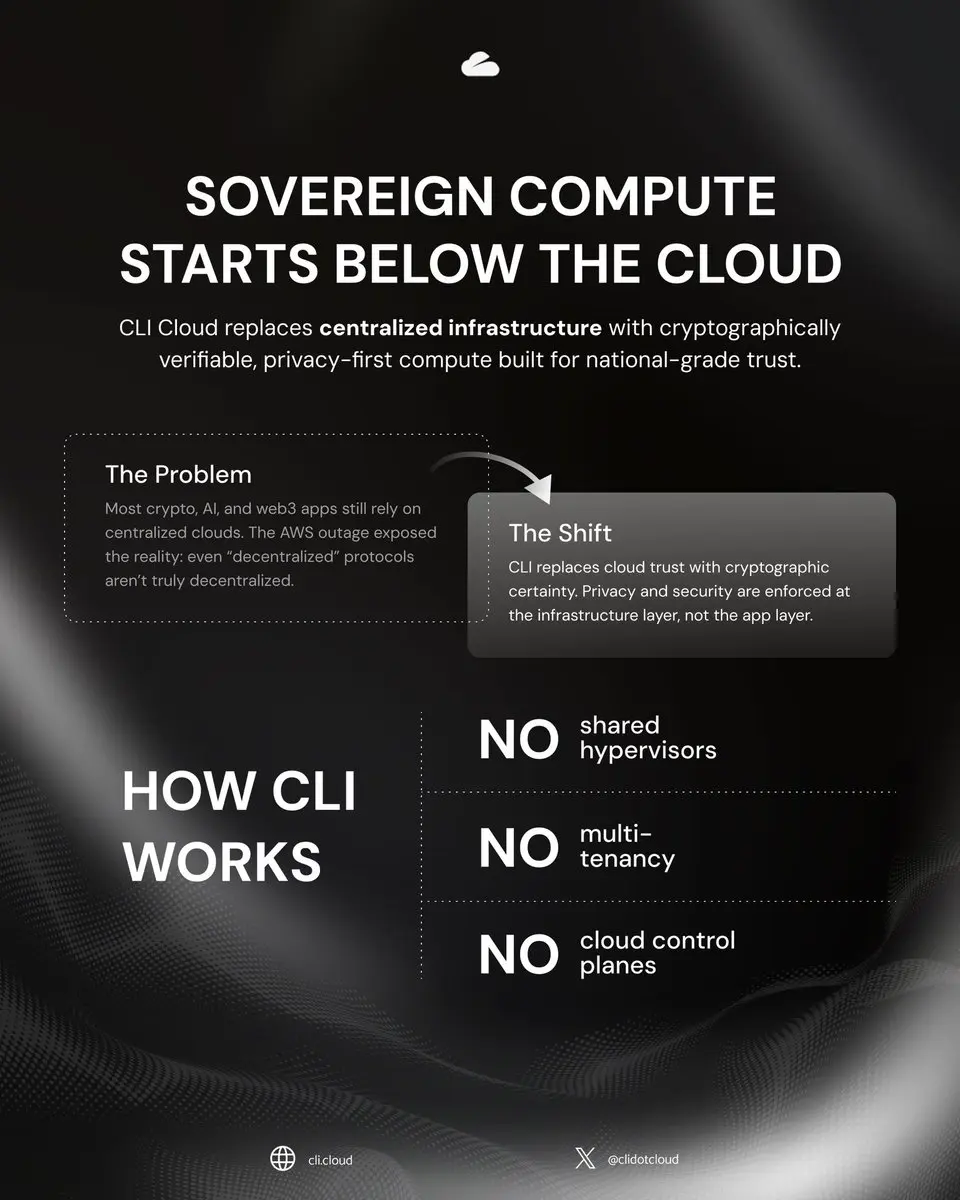

The biggest liability in the crypto space has always been dApps and protocols that trust and run on centralized cloud infrastructure…

That’s why CLI is here to completely change that, replacing easy to hack centralized clouds with REAL cryptographic certainty.

People are starting to take privacy and security more seriously for a reason… HIGHLY recommend checking out @clidotcloud for yourself 🤝

That’s why CLI is here to completely change that, replacing easy to hack centralized clouds with REAL cryptographic certainty.

People are starting to take privacy and security more seriously for a reason… HIGHLY recommend checking out @clidotcloud for yourself 🤝

- Reward

- like

- Comment

- Repost

- Share

$KTA is making some BIG moves so far in 2026.

The roadmap is progressing steadily with a bunch of important updates that show the project is heading in the right direction.

Keeta Pay and the DEX are actively in development, bringing more services to the ecosystem.

Keeta Card is coming soon, letting users make purchases with KUSD, which will add a lot of value to the token.

There’s also progress on Public Repositories and Community Grants, which show the team’s focus on transparency and supporting the dev community.

The Identity Anchor is live and complete, making it easier for users to secure

The roadmap is progressing steadily with a bunch of important updates that show the project is heading in the right direction.

Keeta Pay and the DEX are actively in development, bringing more services to the ecosystem.

Keeta Card is coming soon, letting users make purchases with KUSD, which will add a lot of value to the token.

There’s also progress on Public Repositories and Community Grants, which show the team’s focus on transparency and supporting the dev community.

The Identity Anchor is live and complete, making it easier for users to secure

- Reward

- like

- Comment

- Repost

- Share

With $ZERO, you can browse anonymously, earn tokens, and move assets across networks effortlessly.

Built in 2025 by ex-Zcash core deve, $ZERO was intended to redefine browsing as a privacy fortress. Their goal is to build a self-sufficient ecosystem where privacy leads to monetary growth.

Lots has been happening in the background as of late, with macOS release pending, CoinGecko application submitted, and an X space happening by 7 PM UTC today.

The've also established partnerships with Quickswap, Silentswap, and Houdini Swap in the works.

Dozens of short-form content creators are ready to star

Built in 2025 by ex-Zcash core deve, $ZERO was intended to redefine browsing as a privacy fortress. Their goal is to build a self-sufficient ecosystem where privacy leads to monetary growth.

Lots has been happening in the background as of late, with macOS release pending, CoinGecko application submitted, and an X space happening by 7 PM UTC today.

The've also established partnerships with Quickswap, Silentswap, and Houdini Swap in the works.

Dozens of short-form content creators are ready to star

ZERO-7,05%

- Reward

- like

- Comment

- Repost

- Share

$BTC is FINALLY starting to gain some strong bullish momentum to start the week… 👀

As we’ve mentioned several times over the past month, Bitcoin has been sitting at crucial support on the weekly chart, that support being the 100MA and the 2W 50MA.

We’ve been talking about how price MUST bounce from this level if we want the market to continue higher, and that’s exactly what we’ve seen today…

Bitcoin has rallied all the way back above $94k for the first time in WEEKS, but it’s important not to get too excited yet. This move could very well lead to a dead cat bounce once price reaches the $100k

As we’ve mentioned several times over the past month, Bitcoin has been sitting at crucial support on the weekly chart, that support being the 100MA and the 2W 50MA.

We’ve been talking about how price MUST bounce from this level if we want the market to continue higher, and that’s exactly what we’ve seen today…

Bitcoin has rallied all the way back above $94k for the first time in WEEKS, but it’s important not to get too excited yet. This move could very well lead to a dead cat bounce once price reaches the $100k

BTC-2,53%

- Reward

- like

- Comment

- Repost

- Share

$KTA is setting the stage for real world adoption.

With a direct pilot connection to Visa and the only blockchain ever listed on their Global Registry of Service Providers, it’s clear that $KTA is building something that banks and payment systems actually need.

From real transactions and real volume to fees related to usage, they’re creating a foundation that works, not just looks good.

They have connects to Bank of America, Stripe, Royal Bank of Canada, and National Australia Bank.

The future is already underway, with $KTA running ledgers and record keeping for over 50 regions.

When you combi

With a direct pilot connection to Visa and the only blockchain ever listed on their Global Registry of Service Providers, it’s clear that $KTA is building something that banks and payment systems actually need.

From real transactions and real volume to fees related to usage, they’re creating a foundation that works, not just looks good.

They have connects to Bank of America, Stripe, Royal Bank of Canada, and National Australia Bank.

The future is already underway, with $KTA running ledgers and record keeping for over 50 regions.

When you combi

- Reward

- like

- Comment

- Repost

- Share

Bitcoin is FINALLY starting to bounce off the 100MA 👀

We’ve been keeping an eye on this chart and the 2W 50MA for a while now, and Bitcoin is FINALLY starting to do something…

We have started to see a VERY nice bounce back above $91k for the first time in weeks, with some pretty decent bullish momentum.

I’ve got a feeling there’s a very good chance we keep going higher here, but I’m not convinced we will see new ATHs this year. A dead cat bounce to the $110k range would make a lot of sense to me, as we saw Bitcoin reject hard from that level around this time last year.

Even if we don’t get ne

We’ve been keeping an eye on this chart and the 2W 50MA for a while now, and Bitcoin is FINALLY starting to do something…

We have started to see a VERY nice bounce back above $91k for the first time in weeks, with some pretty decent bullish momentum.

I’ve got a feeling there’s a very good chance we keep going higher here, but I’m not convinced we will see new ATHs this year. A dead cat bounce to the $110k range would make a lot of sense to me, as we saw Bitcoin reject hard from that level around this time last year.

Even if we don’t get ne

BTC-2,53%

- Reward

- 2

- 2

- Repost

- Share

GateUser-7cf8e7b6 :

:

Nice working yar good thanks for your workView More