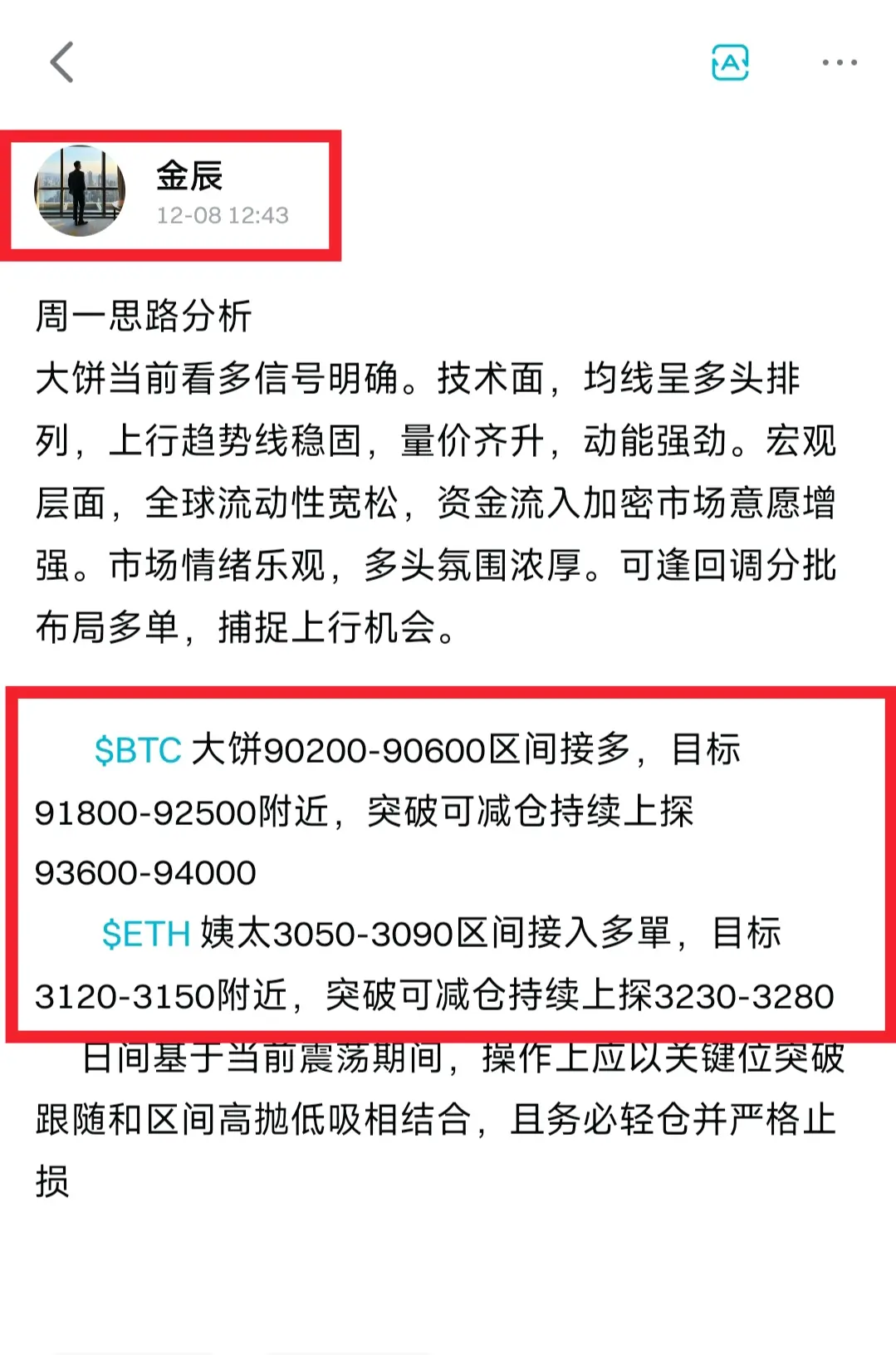

Monday Strategy Analysis

BTC currently shows clear bullish signals. Technically, moving averages are in a bullish alignment, the uptrend line is solid, and both volume and price are rising with strong momentum. On the macro level, global liquidity is loose, and the willingness of funds to flow into the crypto market is increasing. Market sentiment is optimistic, and the bullish atmosphere is strong. Consider accumulating long positions in batches during pullbacks to capture upside opportunities.

$BTC BTC go long in the 90200-90600 range, target around 91800-92500. If a breakout occurs

View OriginalBTC currently shows clear bullish signals. Technically, moving averages are in a bullish alignment, the uptrend line is solid, and both volume and price are rising with strong momentum. On the macro level, global liquidity is loose, and the willingness of funds to flow into the crypto market is increasing. Market sentiment is optimistic, and the bullish atmosphere is strong. Consider accumulating long positions in batches during pullbacks to capture upside opportunities.

$BTC BTC go long in the 90200-90600 range, target around 91800-92500. If a breakout occurs