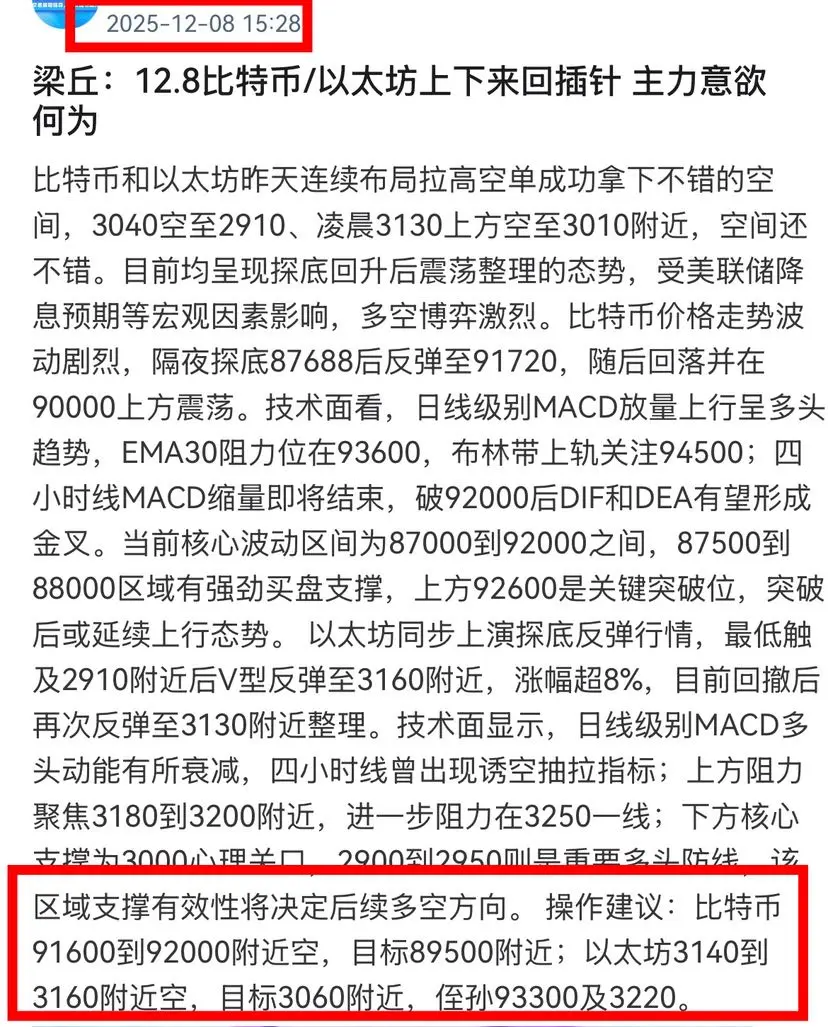

Liangqiu: 12.8 Bitcoin/Ethereum Whipsaw Movements—What Is the Main Force Trying to Achieve?

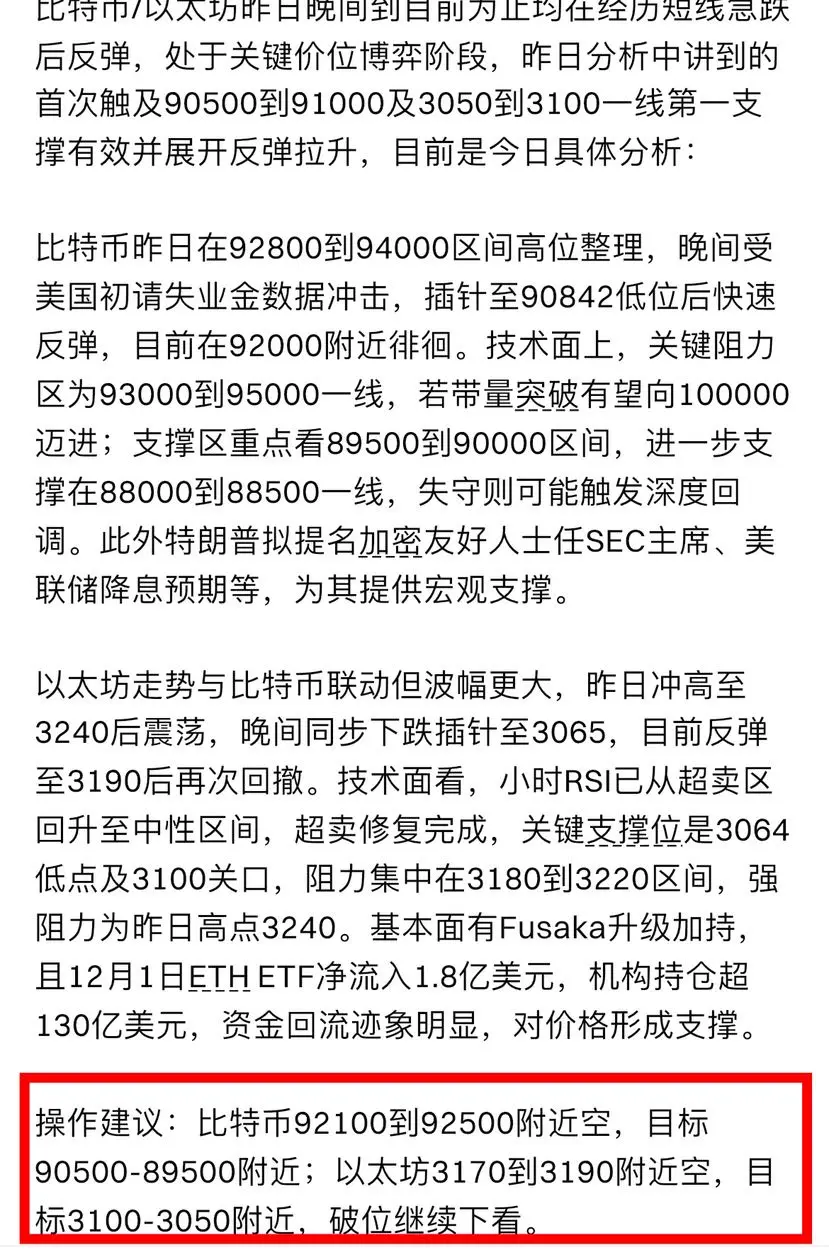

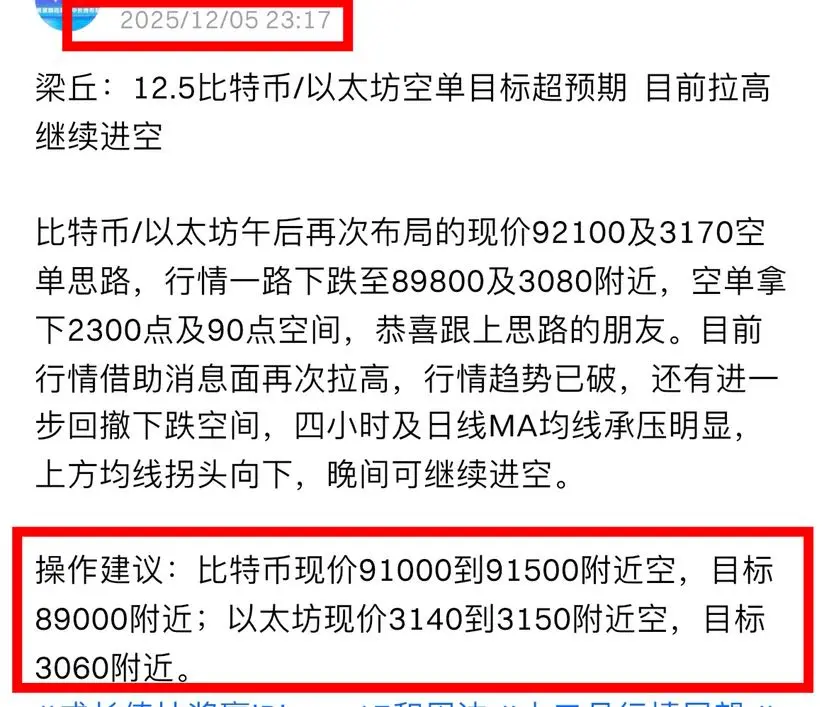

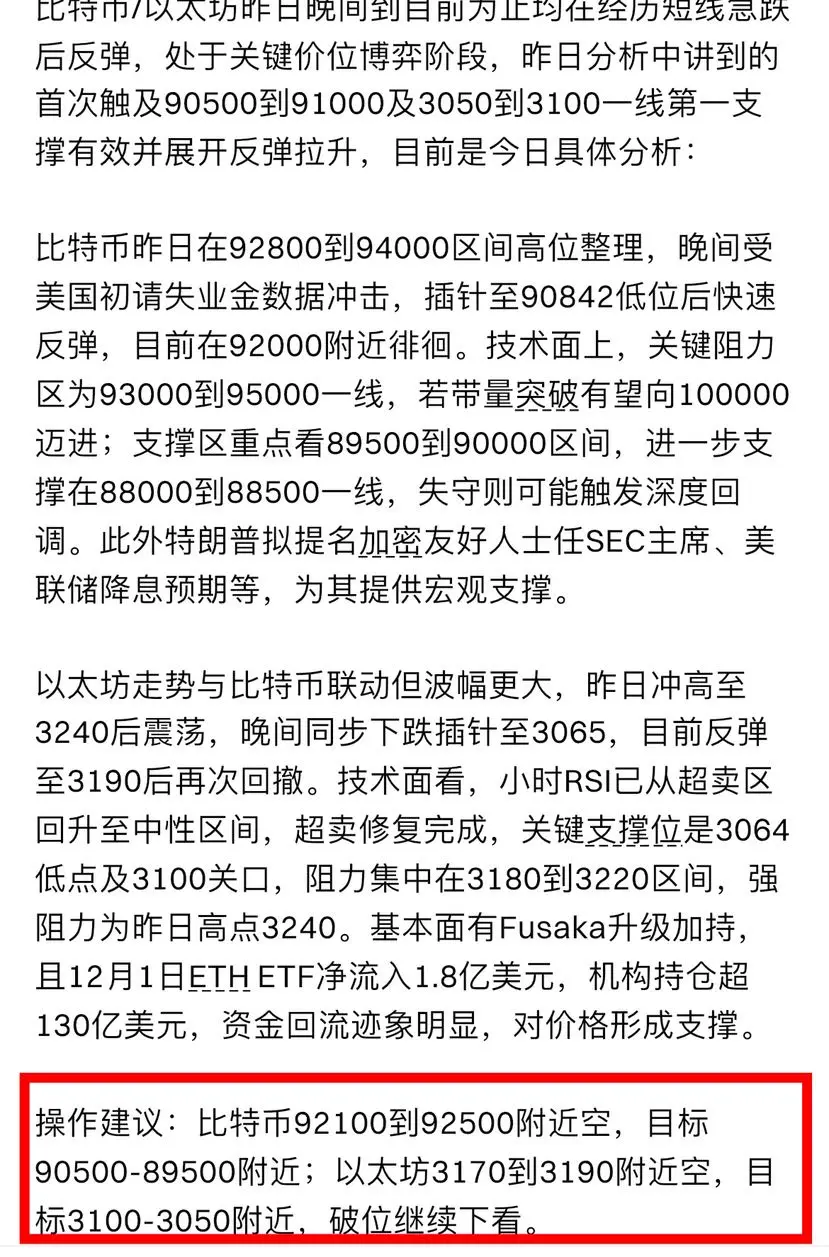

Bitcoin and Ethereum both saw successful short setups yesterday, capturing significant moves: short from 30,400 to 29,100 and, in the early morning, short from above 31,300 to around 30,100—both decent ranges. Currently, both are consolidating after rebounding from lows, exhibiting a volatile sideways trend influenced by macro factors like Fed rate cut expectations and fierce long-short battles. Bitcoin’s price action has been highly volatile, rebounding from 87,688 overnight to 91,720, then pulling back and consolidating above 90,000. Technically, MACD on the daily chart is expanding upward, showing a bullish trend. EMA30 resistance is at 93,600, and the upper Bollinger Band is at 94,500; on the 4-hour chart, MACD is nearly done contracting and after breaking 92,000, DIF and DEA may form a golden cross. The core volatility range is between 87,000 and 92,000, with strong buy support at the 87,500–88,000 area. The key breakout level is 92,600; a break above could see the uptrend continue.

Ethereum has also staged a V-shaped rebound, hitting a low near 2,910 before bouncing to around 3,160, an increase of over 8%. After a pullback, it’s now consolidating again near 3,130. Technically, daily MACD bullish momentum has weakened, and there were signs of a fake-out on the 4-hour chart. Resistance is concentrated near 3,180–3,200, with further resistance at the 3,250 level. Key psychological support is at 3,000, and the 2,900–2,950 area is a critical bull defense line; the effectiveness of support here will determine the future direction of the market.

Trading suggestions: For Bitcoin, short near 91,600–92,000, target around 89,500; for Ethereum, short near 3,140–3,160, target around 3,060; nephew-grandson 93,300 and 3,220.

Daily analysis and strategies have a high win rate and can be referenced, but analysis and strategies are for reference only—trade at your own risk. Articles are not published in real time, so refer to real-time data! #美联储降息预测 #SUIETF正式上线 #广场发帖领$50

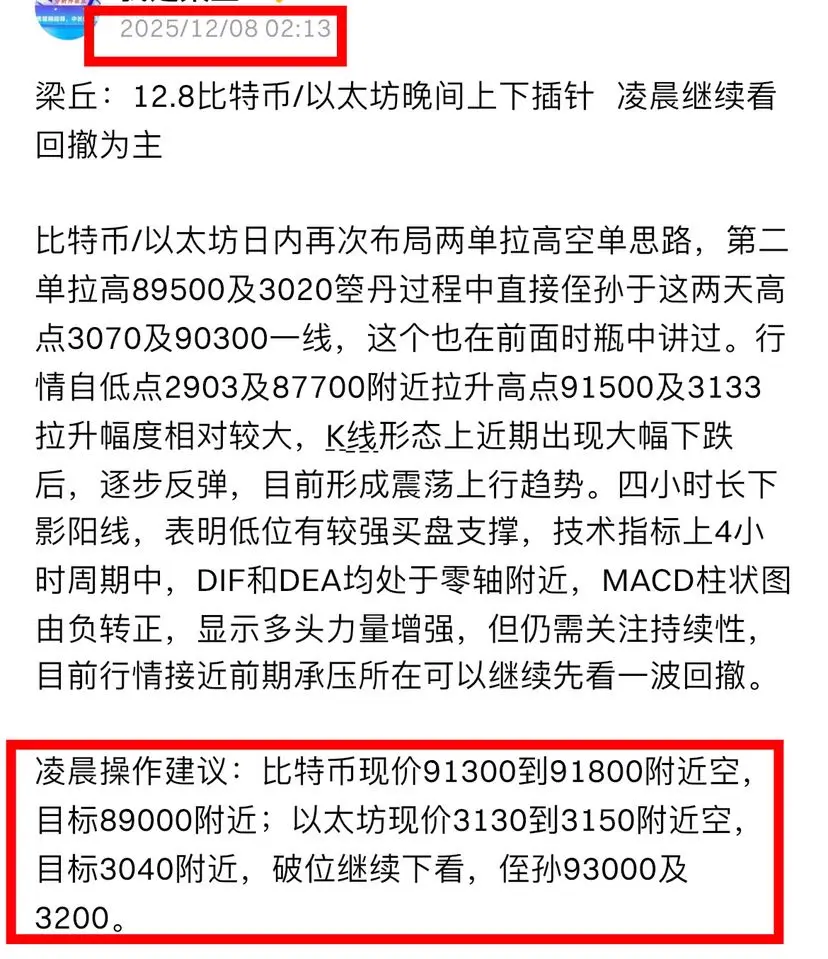

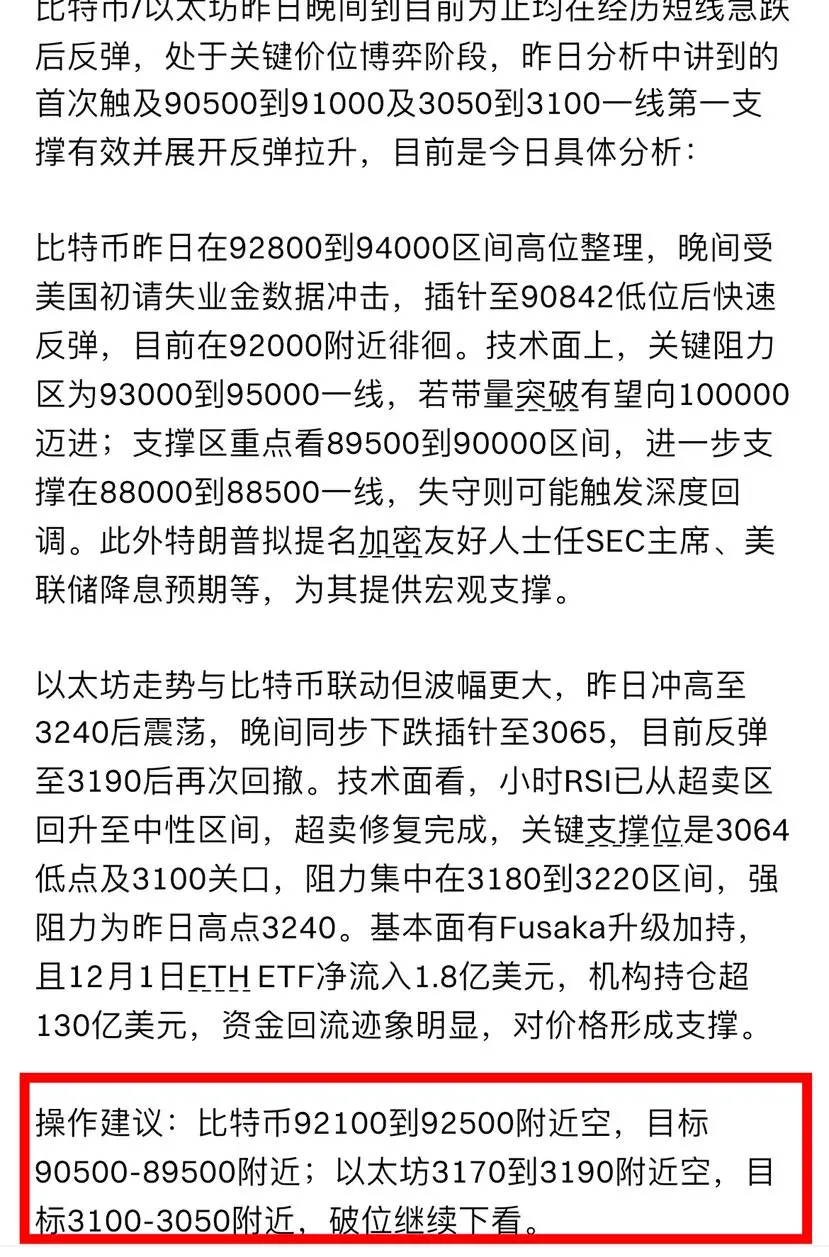

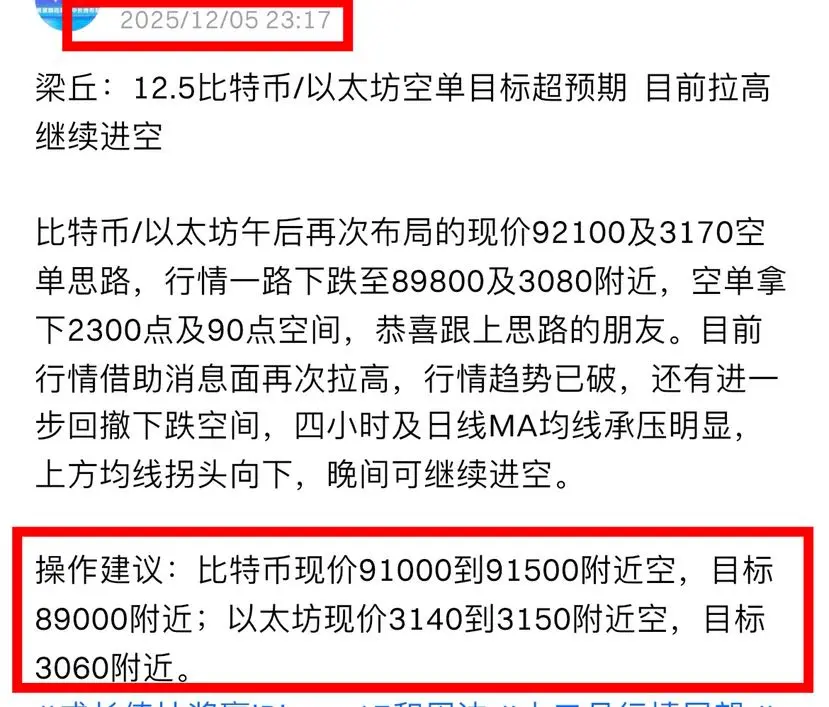

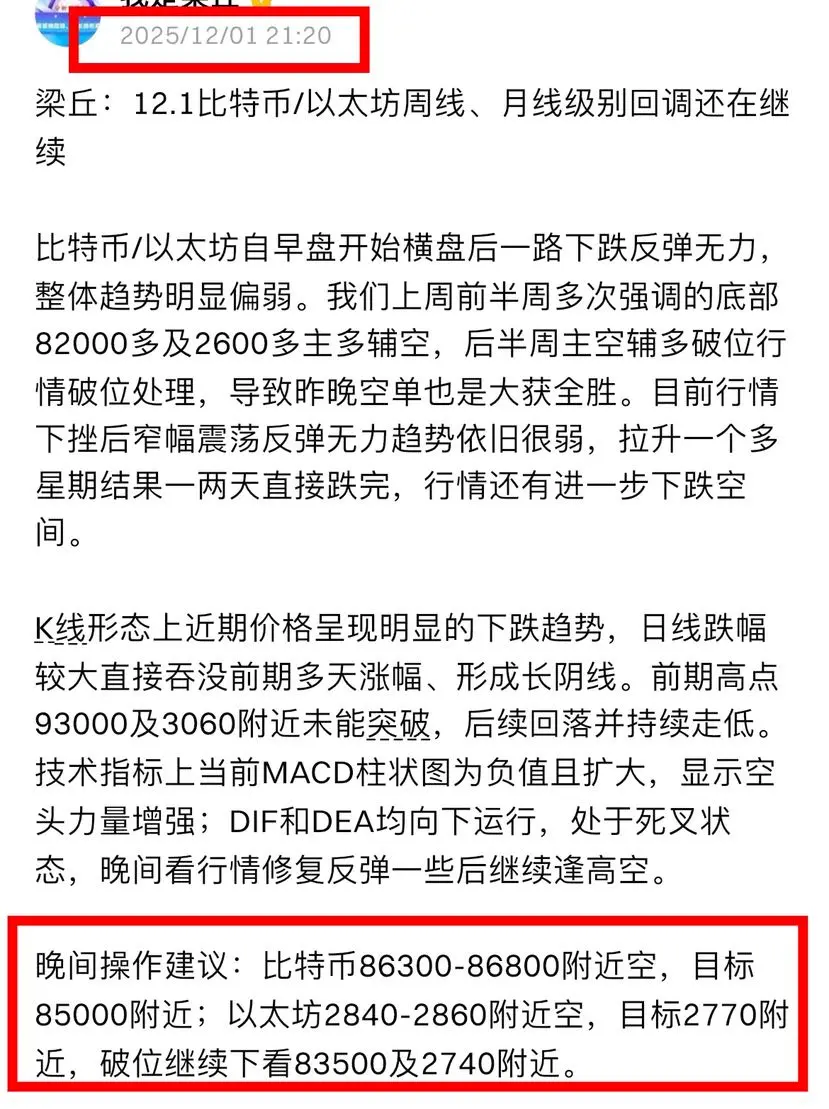

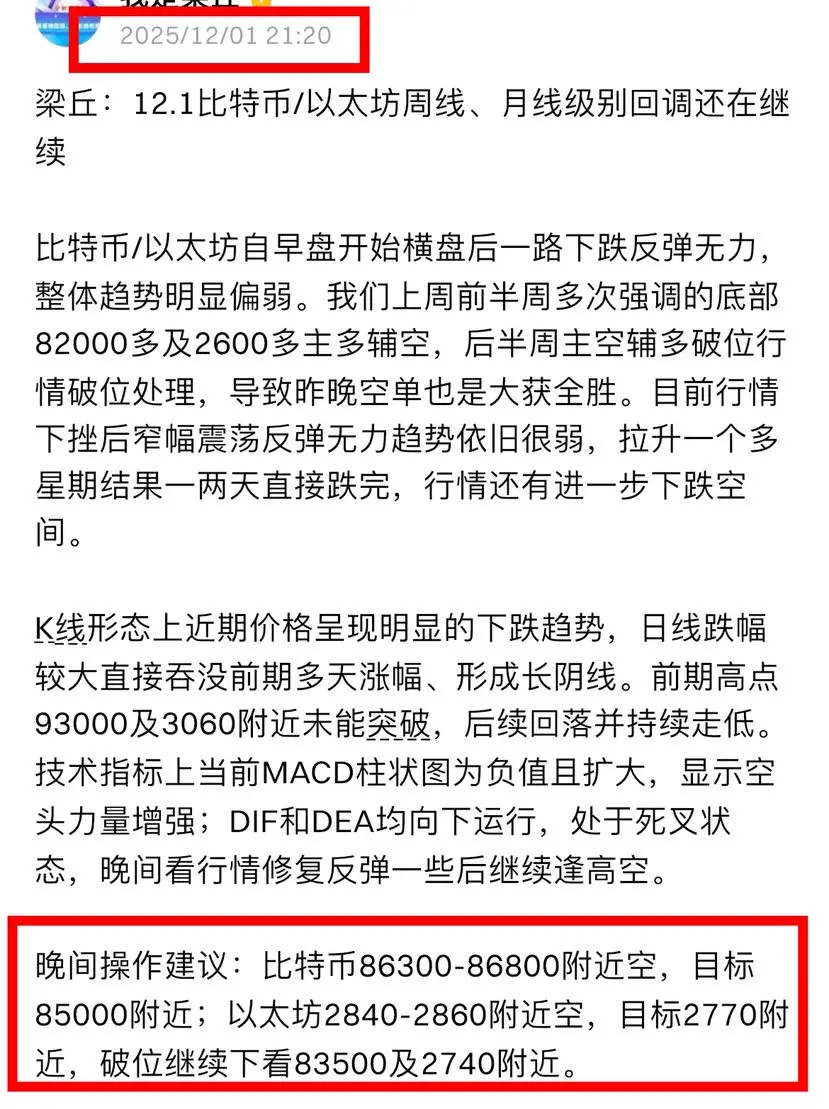

Bitcoin and Ethereum both saw successful short setups yesterday, capturing significant moves: short from 30,400 to 29,100 and, in the early morning, short from above 31,300 to around 30,100—both decent ranges. Currently, both are consolidating after rebounding from lows, exhibiting a volatile sideways trend influenced by macro factors like Fed rate cut expectations and fierce long-short battles. Bitcoin’s price action has been highly volatile, rebounding from 87,688 overnight to 91,720, then pulling back and consolidating above 90,000. Technically, MACD on the daily chart is expanding upward, showing a bullish trend. EMA30 resistance is at 93,600, and the upper Bollinger Band is at 94,500; on the 4-hour chart, MACD is nearly done contracting and after breaking 92,000, DIF and DEA may form a golden cross. The core volatility range is between 87,000 and 92,000, with strong buy support at the 87,500–88,000 area. The key breakout level is 92,600; a break above could see the uptrend continue.

Ethereum has also staged a V-shaped rebound, hitting a low near 2,910 before bouncing to around 3,160, an increase of over 8%. After a pullback, it’s now consolidating again near 3,130. Technically, daily MACD bullish momentum has weakened, and there were signs of a fake-out on the 4-hour chart. Resistance is concentrated near 3,180–3,200, with further resistance at the 3,250 level. Key psychological support is at 3,000, and the 2,900–2,950 area is a critical bull defense line; the effectiveness of support here will determine the future direction of the market.

Trading suggestions: For Bitcoin, short near 91,600–92,000, target around 89,500; for Ethereum, short near 3,140–3,160, target around 3,060; nephew-grandson 93,300 and 3,220.

Daily analysis and strategies have a high win rate and can be referenced, but analysis and strategies are for reference only—trade at your own risk. Articles are not published in real time, so refer to real-time data! #美联储降息预测 #SUIETF正式上线 #广场发帖领$50