The recent market movements are like riding a roller coaster, with sharp rises and falls. Basically, it's a typical shakeout pattern.

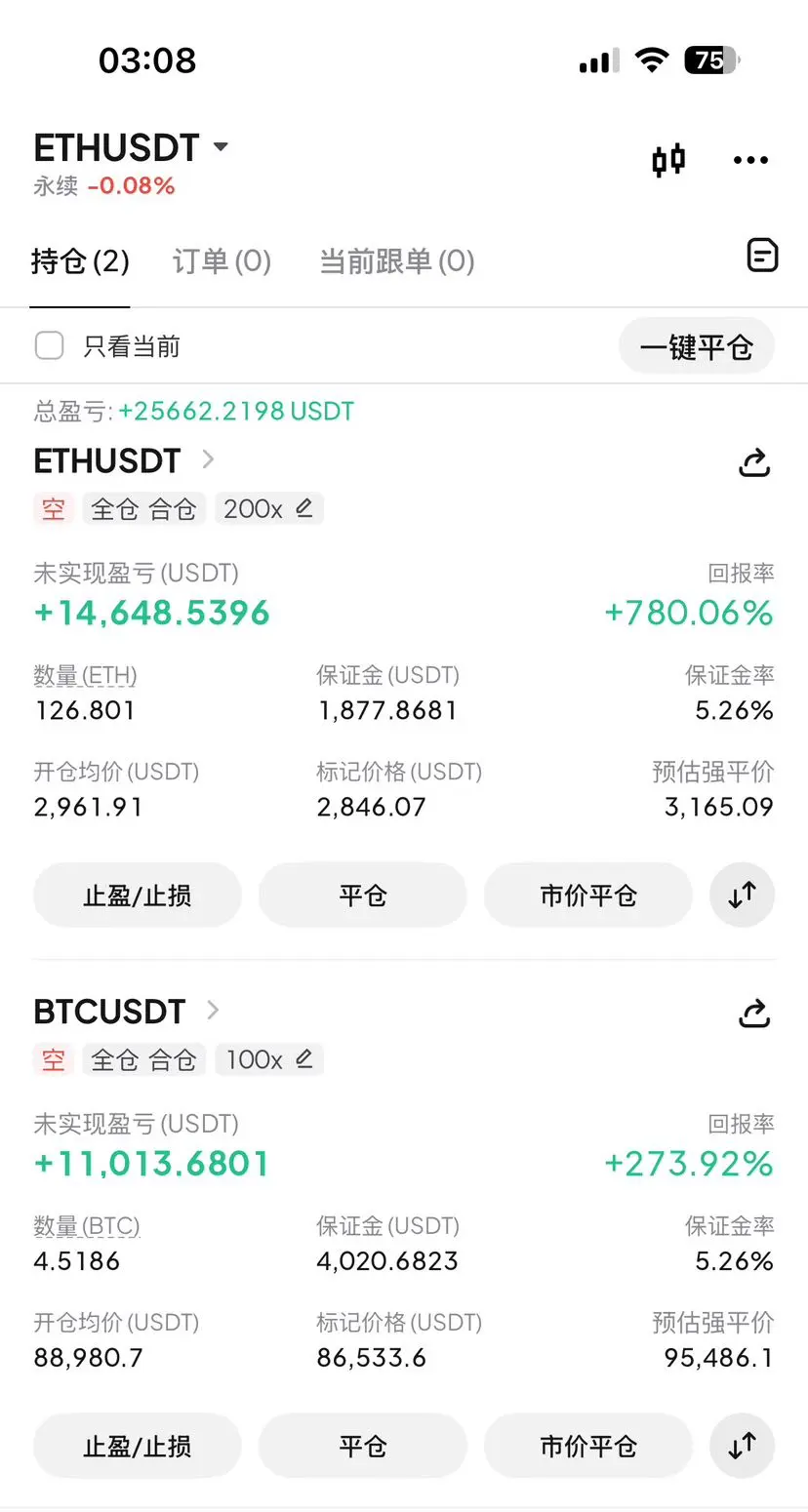

Yesterday was the same, with rapid and intense fluctuations. For those following the strategy, after the market surged, shorting down probably yielded profits. The publicly shared strategies have generally helped everyone catch the rhythm, and quite a few followers have even achieved account recovery.

This kind of market is highly speculative, so risk control must come first. Operations should not be rushed; acting impulsively often leads to repeated losses and can cause emotional breakdowns. Interestingly, those who don't set stop-losses and stubbornly hold sometimes manage to recover—sounds contradictory, but it actually shows that timing the entry is key.

As long as you stay calm, avoid chasing highs and selling lows, enter gradually, and set proper stop-losses, you can still play well in this kind of market.

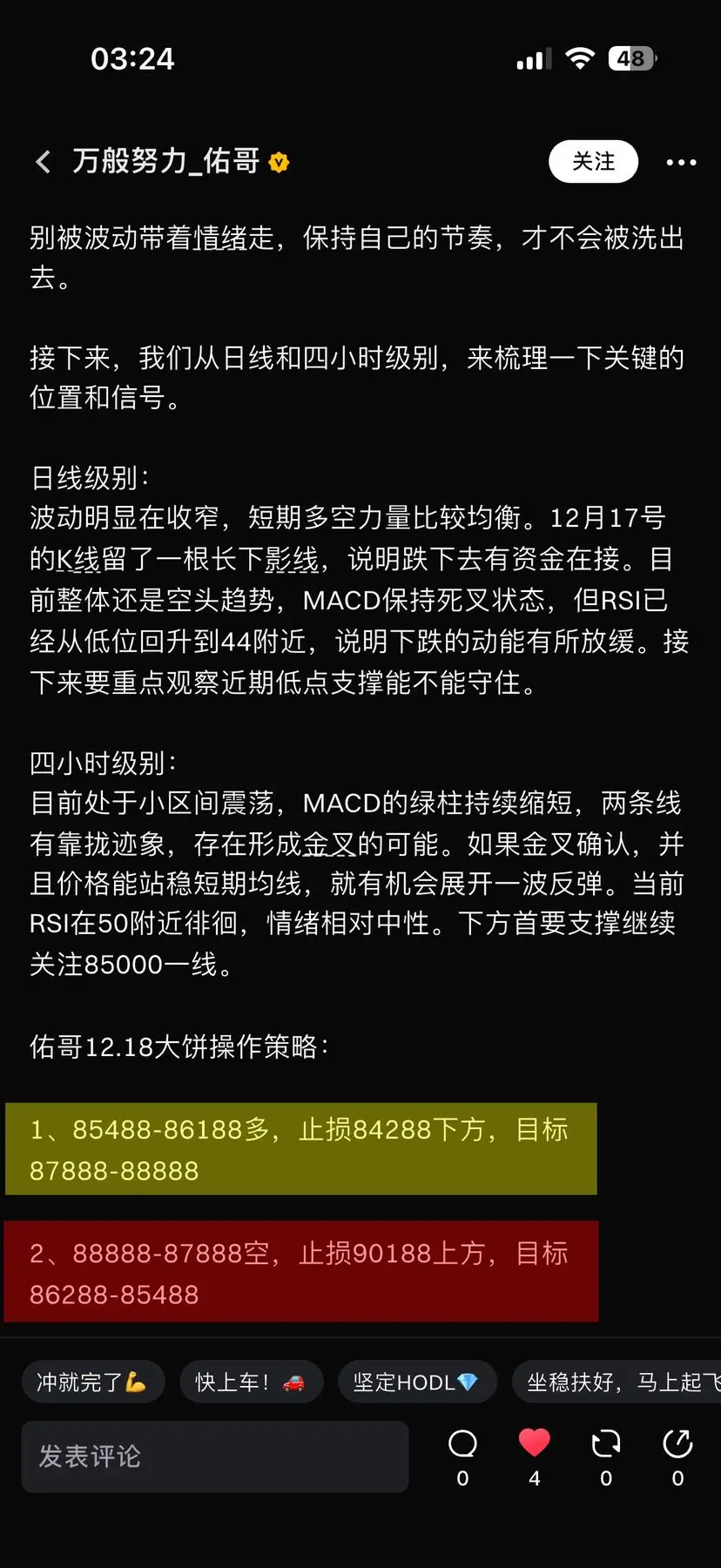

Don't let volatility sway your emotions; maintain your own rhythm to avoid being washed out.

Next, let's analyze key levels and signals from the daily and four-hour charts.

Daily Chart:

Volatility is clearly narrowing, with short-term bullish and bearish forces relatively balanced. The candle on December 17th left a long lower shadow, indicating that there is buying support at the lows. Overall, the trend remains bearish; MACD remains in a death cross, but RSI has rebounded from lows to around 44, suggesting that downward momentum is slowing. The next focus is whether the recent low support can hold.

Four-Hour Chart:

Currently in a small-range consolidation, with the green MACD bars gradually shortening and the two lines showing signs of converging, possibly forming a golden cross. If the golden cross confirms and the price stabilizes above the short-term moving averages, a rebound could be underway. RSI is hovering around 50, indicating a relatively neutral sentiment. The primary support below is around 85,000.

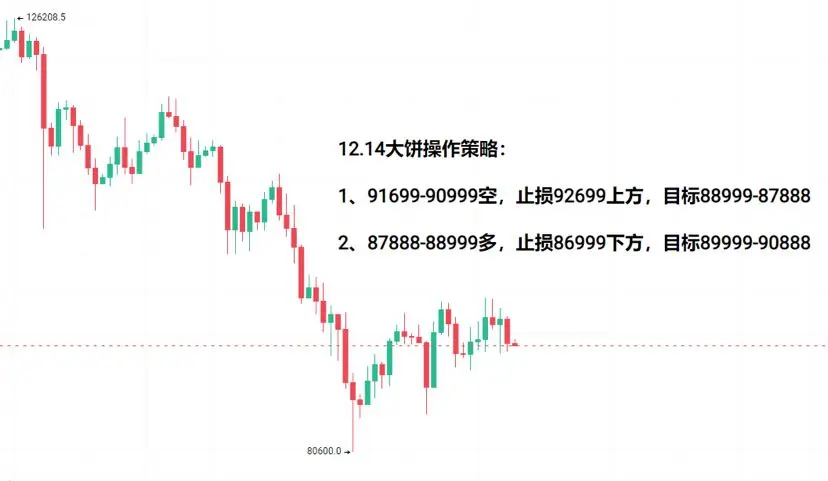

Yego's Bitcoin (BTC) trading strategy for 12.18:

1. Buy at 85,488-86,188, stop-loss below 84,288, target 87,888-88,888

2. Short at 88,888-87,888, stop-loss above 90,188, target 86,288-85,488

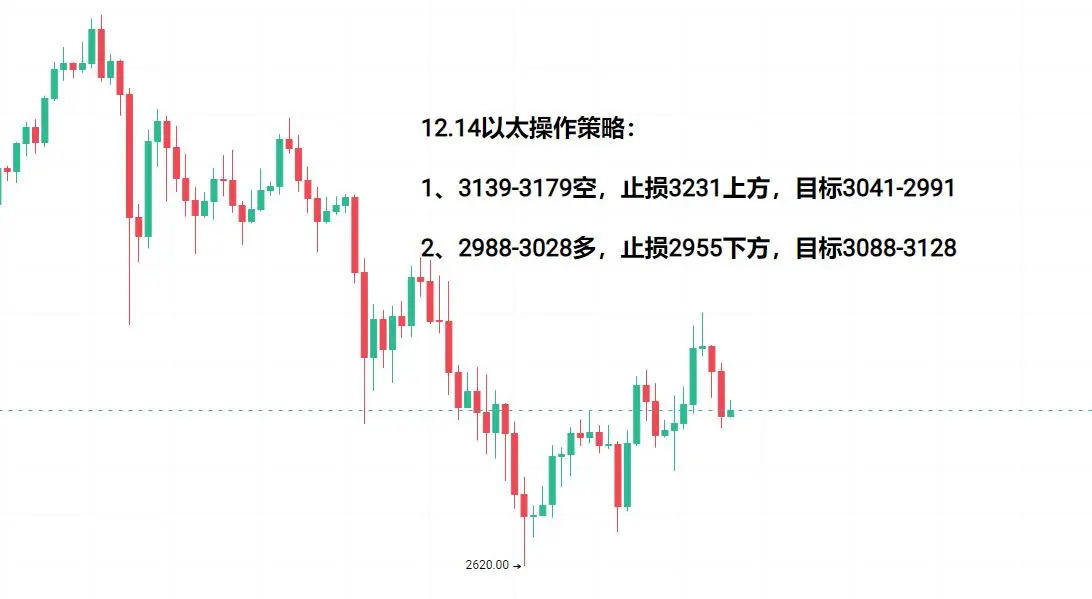

Yego's Ethereum (ETH) trading strategy for 12.18:

1. Buy at 2,733-2,768, stop-loss below 2,677, target 2,838-2,878

2. Short at 2,878-2,838, stop-loss above 2,948, target 2,771-2,731

The above analysis and strategies are for reference only. Currently, BTC, ETH, BTAT, ZEC, LUNA, FIL, SOL, XRP, BCH, BNB, and FHE also have analysis guidance available. Feel free to communicate anytime.

Yesterday was the same, with rapid and intense fluctuations. For those following the strategy, after the market surged, shorting down probably yielded profits. The publicly shared strategies have generally helped everyone catch the rhythm, and quite a few followers have even achieved account recovery.

This kind of market is highly speculative, so risk control must come first. Operations should not be rushed; acting impulsively often leads to repeated losses and can cause emotional breakdowns. Interestingly, those who don't set stop-losses and stubbornly hold sometimes manage to recover—sounds contradictory, but it actually shows that timing the entry is key.

As long as you stay calm, avoid chasing highs and selling lows, enter gradually, and set proper stop-losses, you can still play well in this kind of market.

Don't let volatility sway your emotions; maintain your own rhythm to avoid being washed out.

Next, let's analyze key levels and signals from the daily and four-hour charts.

Daily Chart:

Volatility is clearly narrowing, with short-term bullish and bearish forces relatively balanced. The candle on December 17th left a long lower shadow, indicating that there is buying support at the lows. Overall, the trend remains bearish; MACD remains in a death cross, but RSI has rebounded from lows to around 44, suggesting that downward momentum is slowing. The next focus is whether the recent low support can hold.

Four-Hour Chart:

Currently in a small-range consolidation, with the green MACD bars gradually shortening and the two lines showing signs of converging, possibly forming a golden cross. If the golden cross confirms and the price stabilizes above the short-term moving averages, a rebound could be underway. RSI is hovering around 50, indicating a relatively neutral sentiment. The primary support below is around 85,000.

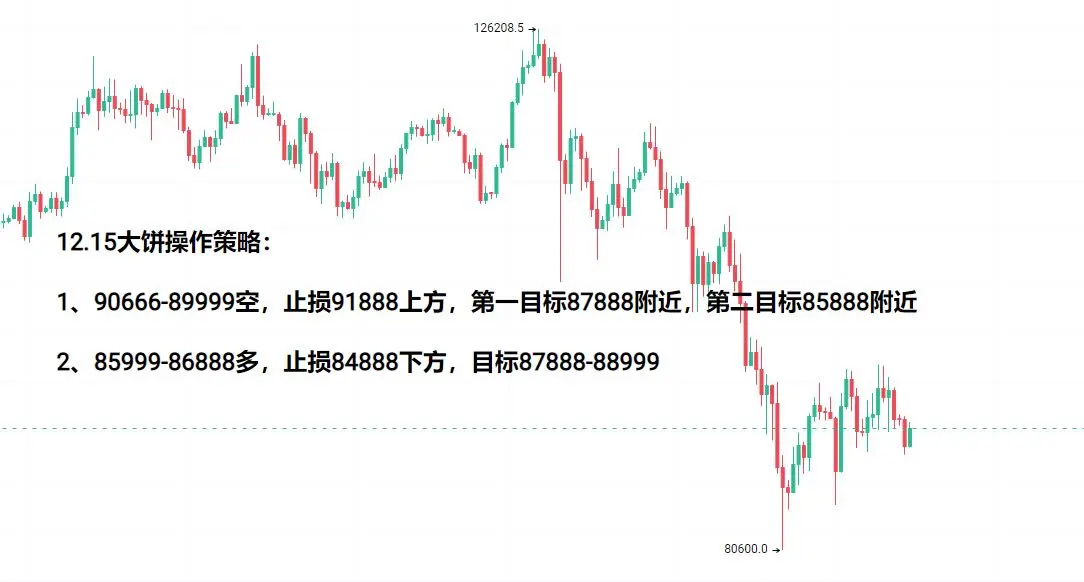

Yego's Bitcoin (BTC) trading strategy for 12.18:

1. Buy at 85,488-86,188, stop-loss below 84,288, target 87,888-88,888

2. Short at 88,888-87,888, stop-loss above 90,188, target 86,288-85,488

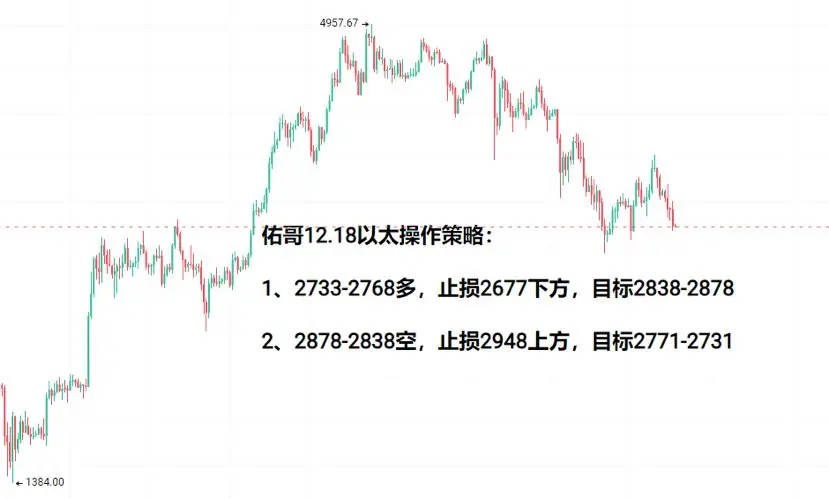

Yego's Ethereum (ETH) trading strategy for 12.18:

1. Buy at 2,733-2,768, stop-loss below 2,677, target 2,838-2,878

2. Short at 2,878-2,838, stop-loss above 2,948, target 2,771-2,731

The above analysis and strategies are for reference only. Currently, BTC, ETH, BTAT, ZEC, LUNA, FIL, SOL, XRP, BCH, BNB, and FHE also have analysis guidance available. Feel free to communicate anytime.