Post content & earn content mining yield

placeholder

CigarDharma

#成长值抽奖赢iPhone17和周边

According to on-chain signals from CryptoQuant, we are indeed currently in the mid-stage between a deep correction and a structural pullback. This phase is not a result of “panic selling,” but rather:

On-chain profit-taking continues to be cleared out

Leverage is decreasing

Long-term holders (LTH) are slowing down their movements

The macro environment (interest rates + USD liquidity) remains tight

Until these conditions change, it will be difficult for the market to “bottom out quickly.”

But the good news is:

The current drawdown (-32%) is still within the “healthy correcti

According to on-chain signals from CryptoQuant, we are indeed currently in the mid-stage between a deep correction and a structural pullback. This phase is not a result of “panic selling,” but rather:

On-chain profit-taking continues to be cleared out

Leverage is decreasing

Long-term holders (LTH) are slowing down their movements

The macro environment (interest rates + USD liquidity) remains tight

Until these conditions change, it will be difficult for the market to “bottom out quickly.”

But the good news is:

The current drawdown (-32%) is still within the “healthy correcti

BTC0.96%

- Reward

- 1

- 1

- Repost

- Share

CigarDharma :

:

Sit tight and hold on, endure the loneliness, hold through the bottom, and make time your friend.- Reward

- like

- Comment

- Repost

- Share

Want to gain exposure to investment opportunities in decentralized AI networks? TAO is building something interesting here—using tokenomics to incentivize open-source AI development and leveraging distributed computing power.

What makes it unique? Instead of everything being controlled by centralized AI labs, the network directly rewards contributors. You can think of it as combining economic incentives with accessible AI infrastructure.

For qualified investors seeking institutional-level crypto exposure, Grayscale recently launched a private placement for the Bittensor Trust. This is one of t

What makes it unique? Instead of everything being controlled by centralized AI labs, the network directly rewards contributors. You can think of it as combining economic incentives with accessible AI infrastructure.

For qualified investors seeking institutional-level crypto exposure, Grayscale recently launched a private placement for the Bittensor Trust. This is one of t

TAO-1.62%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$SEI is gaining momentum again.

Now trading at $0.1309 (+3.56%), price has fully recovered from the $0.1244 dip and is pushing into a fresh 24h high.

The steady climb with rising buy pressure and consecutive higher lows signals strong bullish intent.

A hold above $0.1285 could fuel the next leg up.

#Gate

Now trading at $0.1309 (+3.56%), price has fully recovered from the $0.1244 dip and is pushing into a fresh 24h high.

The steady climb with rising buy pressure and consecutive higher lows signals strong bullish intent.

A hold above $0.1285 could fuel the next leg up.

#Gate

SEI-1.46%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

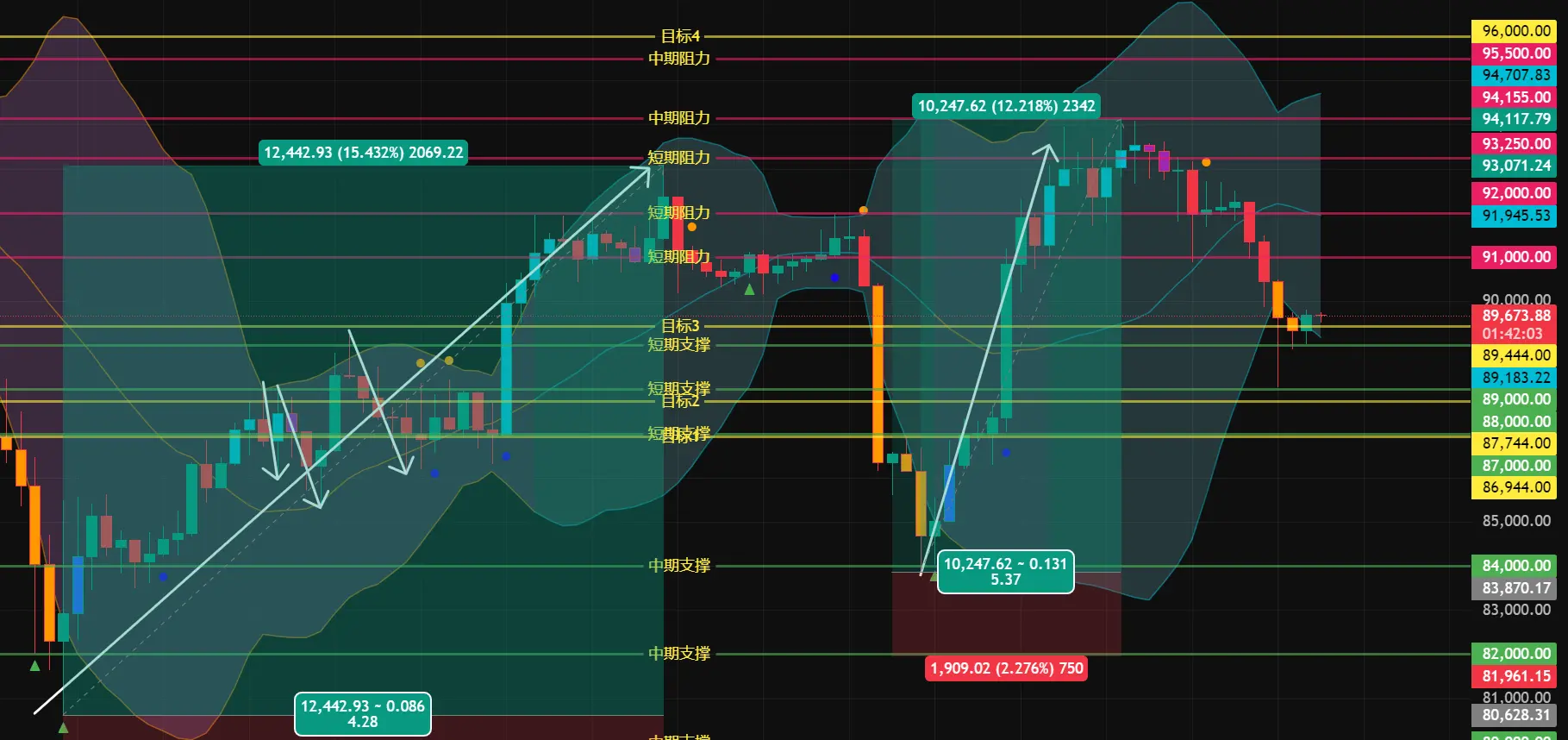

📊 Afternoon of December 6: Bitcoin #BTC Market Comprehensive Analysis and Latest Support & Resistance

Currently, bullish and bearish factors are intertwined, and the market is at a critical juncture for direction selection.

• Bearish signals: The moving average system is showing a bearish arrangement, with prices operating below key moving averages, indicating a weak short-term trend. The MACD indicator shows a weakening of short-term momentum, and there is certain selling pressure in the market. In addition, macro data shows that the US core PCE price index remains high year-on-year, inter

Currently, bullish and bearish factors are intertwined, and the market is at a critical juncture for direction selection.

• Bearish signals: The moving average system is showing a bearish arrangement, with prices operating below key moving averages, indicating a weak short-term trend. The MACD indicator shows a weakening of short-term momentum, and there is certain selling pressure in the market. In addition, macro data shows that the US core PCE price index remains high year-on-year, inter

BTC0.96%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

- Trending TopicsView More

283.46K Popularity

88.55K Popularity

15.71K Popularity

12.41K Popularity

16.35K Popularity

- Hot Gate FunView More

- MC:$3.54KHolders:10.00%

- MC:$3.92KHolders:41.87%

- MC:$3.59KHolders:30.49%

- MC:$3.58KHolders:30.00%

- MC:$10.55KHolders:1527.06%

- Pin