# GOLD

234.37K

GateUser-f97b82d4

🟦 BTC/GOLD approaching macro floor.

BTC priced in gold has been in a relative bear market since Dec 2024.

Every prior BTC/GOLD bear regime:

• Lasted ~395–400 days

• Saw −85% to −75% relative drawdowns (2017,2021)

• Resolved with a structural expansion phase

This cycle, simple regression + volatility decay imply a terminal zone around −60% to −65%.

We’re now fully inside that historical compression zone.

Not hopium - just facts.

This is where relative bottoms have formed and where the next regime begins.

Ignore my analysis at your own risk. #bitcoin #gold

BTC priced in gold has been in a relative bear market since Dec 2024.

Every prior BTC/GOLD bear regime:

• Lasted ~395–400 days

• Saw −85% to −75% relative drawdowns (2017,2021)

• Resolved with a structural expansion phase

This cycle, simple regression + volatility decay imply a terminal zone around −60% to −65%.

We’re now fully inside that historical compression zone.

Not hopium - just facts.

This is where relative bottoms have formed and where the next regime begins.

Ignore my analysis at your own risk. #bitcoin #gold

BTC-6,19%

- Reward

- like

- Comment

- Repost

- Share

🚨 #GoldBreaksAbove $5,200 | Market Update

Gold has officially broken above the $5,200 level, signaling renewed strength in the precious metals market.

This breakout reflects: • Strong safe-haven demand

• Ongoing macro uncertainty

• Sustained bullish momentum on higher timeframes

📈 Technical View:

Gold held key support zones and pushed through resistance with conviction. If price sustains above $5,200, the next phase could bring continued upside with healthy pullbacks offering structure-based opportunities.

🧠 Market Insight:

When gold breaks major psychological levels, it often attracts both

Gold has officially broken above the $5,200 level, signaling renewed strength in the precious metals market.

This breakout reflects: • Strong safe-haven demand

• Ongoing macro uncertainty

• Sustained bullish momentum on higher timeframes

📈 Technical View:

Gold held key support zones and pushed through resistance with conviction. If price sustains above $5,200, the next phase could bring continued upside with healthy pullbacks offering structure-based opportunities.

🧠 Market Insight:

When gold breaks major psychological levels, it often attracts both

- Reward

- 11

- 24

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#TrumpWithdrawsEUTariffThreats Bitcoin Slides, Gold Soars Amid Macro Tensions

Global markets have reacted sharply to renewed tariff threats and geopolitical tensions emanating from the U.S., sending shockwaves through both traditional and digital assets. Bitcoin (BTC) dropped from above $95,000 to lows near $86,000–$90,000, while gold surged past $5,000, hitting record highs. This divergence highlights a classic risk-off rotation: investors are moving capital from high-beta assets into defensive stores of value. The move underscores how macro policy headlines can temporarily overshadow fundame

Global markets have reacted sharply to renewed tariff threats and geopolitical tensions emanating from the U.S., sending shockwaves through both traditional and digital assets. Bitcoin (BTC) dropped from above $95,000 to lows near $86,000–$90,000, while gold surged past $5,000, hitting record highs. This divergence highlights a classic risk-off rotation: investors are moving capital from high-beta assets into defensive stores of value. The move underscores how macro policy headlines can temporarily overshadow fundame

BTC-6,19%

- Reward

- 12

- 10

- Repost

- Share

Yunna :

:

2026 gogogView More

#TrumpWithdrawsEUTariffThreats Global markets reacted sharply to renewed tariff threats and rising geopolitical tension from the United States, triggering volatility across both traditional and digital assets. Bitcoin fell from above 95,000 toward the 86,000–90,000 range, while gold surged beyond 5,000 to new record highs. This divergence reflects a classic risk-off rotation, with capital moving away from high-beta assets and into defensive stores of value. Macro policy headlines once again proved capable of overpowering short-term fundamentals in crypto markets.

Bitcoin’s decline aligned clos

Bitcoin’s decline aligned clos

BTC-6,19%

- Reward

- 2

- 1

- Repost

- Share

Yajing :

:

2026 GOGOGO 👊#BitcoinFallsBehindGold 🪙➡️🥇

Bitcoin’s performance vs. gold is signaling caution. The BTC/Gold ratio is down ~55% from its peak and has slipped below the 200-week moving average, a historically important level marking major regime shifts—not just short-term noise.

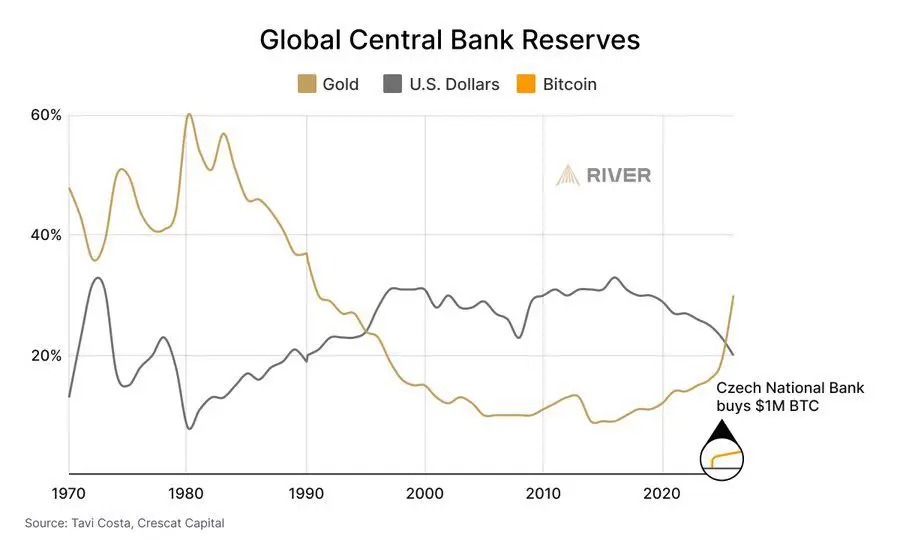

Gold is soaking up geopolitical risk and central bank flows, while Bitcoin is acting like a liquidity-sensitive macro asset, reacting to tighter financial conditions.

📌 Key takeaway:

BTC underperformance vs. gold often happens in late-stage risk-off periods.

These phases flush leverage, reset expectations, and quietly create long-

Bitcoin’s performance vs. gold is signaling caution. The BTC/Gold ratio is down ~55% from its peak and has slipped below the 200-week moving average, a historically important level marking major regime shifts—not just short-term noise.

Gold is soaking up geopolitical risk and central bank flows, while Bitcoin is acting like a liquidity-sensitive macro asset, reacting to tighter financial conditions.

📌 Key takeaway:

BTC underperformance vs. gold often happens in late-stage risk-off periods.

These phases flush leverage, reset expectations, and quietly create long-

BTC-6,19%

- Reward

- 3

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊#BitcoinFallsBehindGold 🪙➡️🥇

Bitcoin’s performance vs. gold is signaling caution. The BTC/Gold ratio is down ~55% from its peak and has slipped below the 200-week moving average, a historically important level marking major regime shifts—not just short-term noise.

Gold is soaking up geopolitical risk and central bank flows, while Bitcoin is acting like a liquidity-sensitive macro asset, reacting to tighter financial conditions.

📌 Key takeaway:

BTC underperformance vs. gold often happens in late-stage risk-off periods.

These phases flush leverage, reset expectations, and quietly create long-

Bitcoin’s performance vs. gold is signaling caution. The BTC/Gold ratio is down ~55% from its peak and has slipped below the 200-week moving average, a historically important level marking major regime shifts—not just short-term noise.

Gold is soaking up geopolitical risk and central bank flows, while Bitcoin is acting like a liquidity-sensitive macro asset, reacting to tighter financial conditions.

📌 Key takeaway:

BTC underperformance vs. gold often happens in late-stage risk-off periods.

These phases flush leverage, reset expectations, and quietly create long-

BTC-6,19%

- Reward

- 2

- 1

- Repost

- Share

CyberpunkDanny :

:

I Ike yours point of view#GoldBreaksAbove$5,200 #GoldBreaksAbove$5,200 🟡🚀

Gold has pushed above the $5,200 level, signaling strong safe-haven demand as global uncertainty and macro pressure continue to build.

When gold rallies this aggressively, it often reflects:

• Risk-off sentiment

• Inflation or rate uncertainty

• Capital rotating out of high-volatility assets

For crypto traders, this matters.

A strong gold breakout can temporarily pressure risk assets like BTC — but it can also signal deeper macro instability that later benefits decentralized assets.

Key things to watch:

• DXY movement

• Bond yields

• BTC corre

Gold has pushed above the $5,200 level, signaling strong safe-haven demand as global uncertainty and macro pressure continue to build.

When gold rallies this aggressively, it often reflects:

• Risk-off sentiment

• Inflation or rate uncertainty

• Capital rotating out of high-volatility assets

For crypto traders, this matters.

A strong gold breakout can temporarily pressure risk assets like BTC — but it can also signal deeper macro instability that later benefits decentralized assets.

Key things to watch:

• DXY movement

• Bond yields

• BTC corre

BTC-6,19%

- Reward

- 9

- 15

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#GoldBreaks$5,500 #GoldBreaks$5,500 🟡🚀

Gold has surged past the $5,500 level, sending a strong signal across global markets. This kind of breakout doesn’t happen without serious capital movement behind it.

When gold rallies aggressively, it usually reflects rising uncertainty, inflation concerns, or macro instability. Investors rotate into safety — and liquidity shifts fast.

For crypto traders, this matters.

A strong gold move can temporarily pressure BTC and high-risk assets, but it can also highlight weakening confidence in traditional systems — which historically benefits decentralized as

Gold has surged past the $5,500 level, sending a strong signal across global markets. This kind of breakout doesn’t happen without serious capital movement behind it.

When gold rallies aggressively, it usually reflects rising uncertainty, inflation concerns, or macro instability. Investors rotate into safety — and liquidity shifts fast.

For crypto traders, this matters.

A strong gold move can temporarily pressure BTC and high-risk assets, but it can also highlight weakening confidence in traditional systems — which historically benefits decentralized as

BTC-6,19%

- Reward

- 6

- 4

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#Gold did exactly what the chart said it would do.

Structure → pullback → continuation.

+$200 day, clean and controlled.

Trading is boring when you do it right.

#GoldBreaksAbove$5,200 #GateLiveMiningProgramPublicBeta #FedRateDecisionApproaches #BitcoinFallsBehindGold $XAUT $BTC

Structure → pullback → continuation.

+$200 day, clean and controlled.

Trading is boring when you do it right.

#GoldBreaksAbove$5,200 #GateLiveMiningProgramPublicBeta #FedRateDecisionApproaches #BitcoinFallsBehindGold $XAUT $BTC

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

7K Popularity

23.42K Popularity

351.52K Popularity

31.7K Popularity

50.73K Popularity

89 Popularity

18.86K Popularity

7.55K Popularity

82.27K Popularity

29.51K Popularity

12.29K Popularity

24.25K Popularity

7.35K Popularity

15.74K Popularity

187.64K Popularity

News

View MoreBit Digital completely bids farewell to Bitcoin mining and shifts to Ethereum staking and AI computing power

3 m

Cryptocurrency Market Crash: $1.7 Billion Liquidated in 24 Hours, Bitcoin Hits 9-Month Low

6 m

Data: 3,500 ETH transferred to Wintermute, worth approximately $9.53 million

7 m

Alpha Token Launch: MOLT is now live

12 m

Jiuzi Holdings receives $90 million investment to advance blockchain and Web3 ecosystem expansion

13 m

Pin