# crypto.

16.39M

AhmadOnAlpha

When the market dips, the most important thing is not speed, but clarity.

Most people panic because they confuse price movement with value change.

A dip doesn’t automatically mean something is broken. Sometimes it simply means liquidity is shifting, weak hands are exiting, or the market is taking a breath after excess optimism.

This is where discipline separates participants from spectators.

Chasing green candles feels good emotionally, but it rarely builds long-term conviction. Dips, on the other hand, force you to answer hard questions:

Do you actually understand what you’re holding?

Do you

Most people panic because they confuse price movement with value change.

A dip doesn’t automatically mean something is broken. Sometimes it simply means liquidity is shifting, weak hands are exiting, or the market is taking a breath after excess optimism.

This is where discipline separates participants from spectators.

Chasing green candles feels good emotionally, but it rarely builds long-term conviction. Dips, on the other hand, force you to answer hard questions:

Do you actually understand what you’re holding?

Do you

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

ProsperityComesFromAll :

:

Hold on tight, we're about to take off 🛫- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

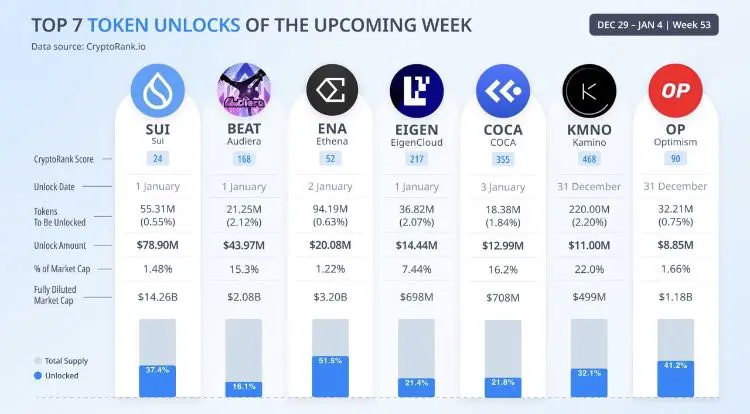

Top ( Token Unlocks ) for the upcoming week:

🔓 Top 7 cryptocurrency unlocks:

• Sui: worth $78.90M

• Audiera: worth $43.97M

• Ethena: worth $20.08M

• EigenCloud: worth $14.44M

• COCA: worth $12.99M

• Kamino: worth $11.00M

• Optimism: worth $8.85M

Keep a close eye on the market movements with these massive unlocks.

Personally, I have my eyes on Sui. I expect strong volatility this week. What do you think?

#elaouzi #crypto. #Gate2025AnnualReportComing

View Original🔓 Top 7 cryptocurrency unlocks:

• Sui: worth $78.90M

• Audiera: worth $43.97M

• Ethena: worth $20.08M

• EigenCloud: worth $14.44M

• COCA: worth $12.99M

• Kamino: worth $11.00M

• Optimism: worth $8.85M

Keep a close eye on the market movements with these massive unlocks.

Personally, I have my eyes on Sui. I expect strong volatility this week. What do you think?

#elaouzi #crypto. #Gate2025AnnualReportComing

MC:$5.94KHolders:3

0.00%

- Reward

- 1

- 1

- Repost

- Share

kkwknh :

:

Merry Christmas ⛄Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

72.04K Popularity

1.46K Popularity

1.26K Popularity

1.66K Popularity

4.73K Popularity

4K Popularity

961 Popularity

1.72K Popularity

14.76K Popularity

2.6K Popularity

29.35K Popularity

11.84K Popularity

23.81K Popularity

10.67K Popularity

215.02K Popularity

News

View MoreCongress Questions "Who Will Save Bitcoin"? Treasury Secretary Bessent Clearly States No Authority to Intervene, Causing Market Fluctuations

2 m

Ethereum Price Prediction: ETH dips to around $2100, can it rebound to $3000 in February?

5 m

Pi Network community strongly promotes GCV 314159 vision, with 50 million users supporting the long-term value narrative

6 m

Shanghai Stock Exchange Silver Inventory Drops by 26 Tons, Tightening China's Silver Supply and Potentially Boosting Price Expectations

8 m

ZK tokens surge nearly 10 times, prompting regulatory action! South Korea's FSS conducts emergency monitoring, market manipulation suspicion arises again

9 m

Pin