#PostToWinLaunchpadKDK,

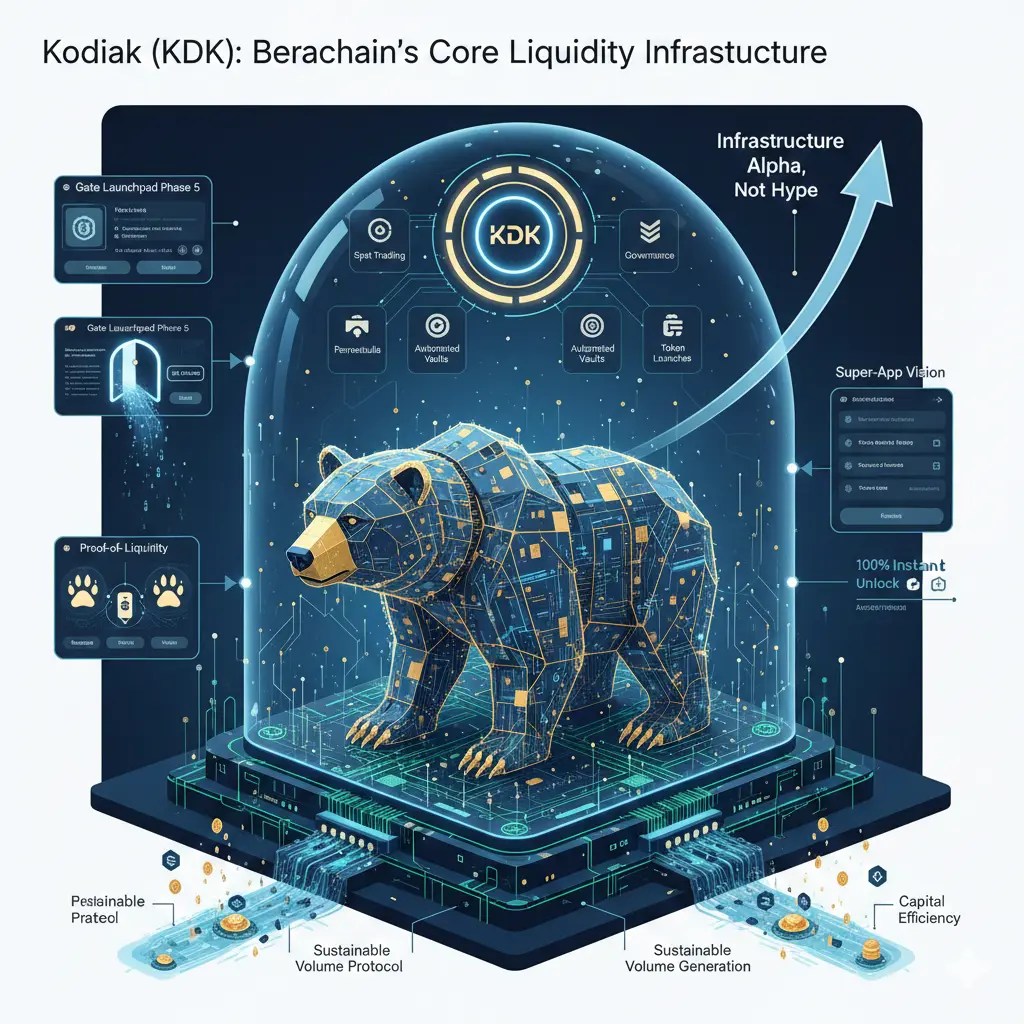

Kodiak (KDK): Building Berachain’s Core Liquidity Infrastructure, Not Just Another Token

Kodiak is designed as foundational infrastructure for Berachain rather than a short-term speculative asset. By embedding liquidity directly into its protocol architecture, KDK focuses on long-term capital efficiency, sustainable volume generation, and ecosystem coordination. This approach prioritizes durability and relevance over hype-driven growth cycles.

---

2. Why Kodiak’s Gate Launchpad Phase 5 Marks a Structural Shift in DeFi Liquidity

Gate Launchpad Phase 5 introduces KDK as an infrastructure-first asset, signaling a shift from experimental DeFi toward system-level maturity. Kodiak’s launch emphasizes structured liquidity, governance alignment, and fair distribution, positioning it as a long-term liquidity layer rather than a temporary yield opportunity.

---

3. From Experiment to Infrastructure: KDK’s Role in Berachain’s DeFi Maturity

As Berachain evolves, Kodiak represents the transition from early experimentation to reliable infrastructure. KDK enables efficient liquidity routing, deeper markets, and sustainable incentives, helping Berachain scale responsibly while supporting traders, builders, and governance participants within a unified framework.

---

4. Kodiak Finance: Solving Liquidity Fragmentation at the Protocol Level

Liquidity fragmentation weakens market efficiency and capital productivity. Kodiak addresses this challenge by consolidating liquidity across spot, perpetuals, and automated vaults. This protocol-level solution improves execution quality, reduces slippage, and creates a more resilient trading environment for Berachain users.

---

5. Gate Launchpad Phase 5: KDK Enters DeFi With Long-Term Structural Conviction

KDK’s launch through Gate Launchpad Phase 5 reflects confidence in its long-term vision. Rather than prioritizing rapid price expansion, the launch focuses on fair access, transparent allocation, and ecosystem integration, allowing participants to align with Kodiak’s structural growth trajectory.

---

6. KDK Isn’t Chasing Hype — It’s Designing Berachain’s Liquidity Backbone

Kodiak deliberately avoids hype-driven narratives. Instead, it builds the liquidity backbone that supports trading, governance, and protocol expansion. This infrastructure-first mindset ensures KDK remains relevant as Berachain grows, benefiting from increased usage rather than speculative momentum alone.

---

7. Infrastructure Over Speculation: The Strategic Case for Kodiak (KDK)

The strategic value of KDK lies in its utility, not short-term price action. By focusing on liquidity coordination, governance participation, and revenue-aligned incentives, Kodiak positions itself as an indispensable component of Berachain’s DeFi stack, attracting long-horizon participants.

---

8. How Kodiak Aligns Liquidity, Governance, and Capital Efficiency in One System

Kodiak integrates liquidity provision, governance decision-making, and capital efficiency into a single ecosystem. Through KDK and xKDK, users are incentivized to participate actively, ensuring that capital deployment, voting power, and protocol growth remain aligned over time.

---

9. KDK on Gate Launchpad: Where Liquidity Efficiency Meets Governance Power

Gate Launchpad provides early access to KDK while reinforcing its governance-driven design. Participants gain immediate liquidity through full unlock while retaining the option to stake for xKDK, balancing flexibility with long-term influence over Kodiak’s protocol decisions.

---

10. Why Kodiak’s 100% Instant Unlock Still Supports Long-Term Value Creation

While instant unlock often raises sell-pressure concerns, Kodiak offsets this through governance incentives and utility-driven demand. The xKDK model encourages holding and participation, allowing value to accrue through protocol usage rather than enforced lockups.

---

11. KDK’s Dual-Currency Launchpad Model Redefines Capital Productivity

Allowing subscriptions via USDT and yield-bearing GUSD improves capital efficiency. Participants can engage in the launchpad while maintaining productivity on their assets, introducing a more advanced participation model that reflects DeFi’s shift toward optimized capital deployment.

---

12. Kodiak’s Proof-of-Liquidity Integration Sets a New DeFi Standard

By leveraging Berachain’s Proof-of-Liquidity framework, Kodiak aligns rewards with meaningful liquidity contribution. This ensures incentives are sustainable, reduces mercenary behavior, and strengthens the protocol’s long-term stability and economic security.

---

13. Beyond Token Sales: KDK as a Long-Horizon Liquidity Coordination Layer

KDK extends beyond launchpad participation by acting as a coordination layer for liquidity providers, traders, and protocols. Its role grows alongside ecosystem usage, reinforcing network effects that compound value over time rather than peaking at launch.

---

14. Kodiak Finance: Turning Trading Volume Dominance Into Sustainable Token Value

With over 90% dominance in Berachain’s trading volume, Kodiak converts activity into real protocol revenue. This revenue supports token utility and governance relevance, ensuring that KDK’s value proposition remains tied to measurable on-chain performance.

---

15. xKDK Governance: Shifting DeFi From Speculation to Participation

Staking KDK into xKDK transforms passive holders into active contributors. Governance rights, reward distribution, and protocol influence encourage long-term alignment, reducing speculative churn and fostering a committed community focused on sustainable growth.

---

16. Why Serious DeFi Capital Is Watching Kodiak on Berachain

Institutional and strategic investors recognize Kodiak’s infrastructure role. Backing from reputable funds reflects confidence in its execution, revenue potential, and governance model, positioning KDK as a protocol designed for scale rather than short-term market cycles.

---

17. Gate Square + KDK: Social Consensus Meets Infrastructure-First DeFi

Gate Square enables collaborative evaluation of Kodiak, turning research and discussion into collective intelligence. This model enhances transparency and informed participation, aligning community sentiment with infrastructure-focused decision-making.

---

18. Kodiak’s Super-App Vision: One Hub for Liquidity, Trading, and Launches

Kodiak’s Super-App integrates spot trading, perpetuals, vaults, and token launches into a unified interface. This consolidation reduces fragmentation, improves user experience, and strengthens Kodiak’s role as a central hub within Berachain’s ecosystem.

---

19. Berachain-Native, Capital-Efficient, Governance-Driven: The KDK Thesis

Built natively for Berachain, KDK benefits from deep protocol integration. Its capital-efficient design and governance-first incentives ensure adaptability as the network evolves, reducing obsolescence risk and reinforcing long-term relevance.

---

20. KDK Represents Infrastructure Alpha in a Maturing DeFi Market

As DeFi matures, value increasingly concentrates in foundational protocols. KDK represents this infrastructure alpha by prioritizing liquidity efficiency, governance alignment, and ecosystem scalability, offering participants exposure to durable, compounding relevance rather than transient narratives.

Kodiak (KDK): Building Berachain’s Core Liquidity Infrastructure, Not Just Another Token

Kodiak is designed as foundational infrastructure for Berachain rather than a short-term speculative asset. By embedding liquidity directly into its protocol architecture, KDK focuses on long-term capital efficiency, sustainable volume generation, and ecosystem coordination. This approach prioritizes durability and relevance over hype-driven growth cycles.

---

2. Why Kodiak’s Gate Launchpad Phase 5 Marks a Structural Shift in DeFi Liquidity

Gate Launchpad Phase 5 introduces KDK as an infrastructure-first asset, signaling a shift from experimental DeFi toward system-level maturity. Kodiak’s launch emphasizes structured liquidity, governance alignment, and fair distribution, positioning it as a long-term liquidity layer rather than a temporary yield opportunity.

---

3. From Experiment to Infrastructure: KDK’s Role in Berachain’s DeFi Maturity

As Berachain evolves, Kodiak represents the transition from early experimentation to reliable infrastructure. KDK enables efficient liquidity routing, deeper markets, and sustainable incentives, helping Berachain scale responsibly while supporting traders, builders, and governance participants within a unified framework.

---

4. Kodiak Finance: Solving Liquidity Fragmentation at the Protocol Level

Liquidity fragmentation weakens market efficiency and capital productivity. Kodiak addresses this challenge by consolidating liquidity across spot, perpetuals, and automated vaults. This protocol-level solution improves execution quality, reduces slippage, and creates a more resilient trading environment for Berachain users.

---

5. Gate Launchpad Phase 5: KDK Enters DeFi With Long-Term Structural Conviction

KDK’s launch through Gate Launchpad Phase 5 reflects confidence in its long-term vision. Rather than prioritizing rapid price expansion, the launch focuses on fair access, transparent allocation, and ecosystem integration, allowing participants to align with Kodiak’s structural growth trajectory.

---

6. KDK Isn’t Chasing Hype — It’s Designing Berachain’s Liquidity Backbone

Kodiak deliberately avoids hype-driven narratives. Instead, it builds the liquidity backbone that supports trading, governance, and protocol expansion. This infrastructure-first mindset ensures KDK remains relevant as Berachain grows, benefiting from increased usage rather than speculative momentum alone.

---

7. Infrastructure Over Speculation: The Strategic Case for Kodiak (KDK)

The strategic value of KDK lies in its utility, not short-term price action. By focusing on liquidity coordination, governance participation, and revenue-aligned incentives, Kodiak positions itself as an indispensable component of Berachain’s DeFi stack, attracting long-horizon participants.

---

8. How Kodiak Aligns Liquidity, Governance, and Capital Efficiency in One System

Kodiak integrates liquidity provision, governance decision-making, and capital efficiency into a single ecosystem. Through KDK and xKDK, users are incentivized to participate actively, ensuring that capital deployment, voting power, and protocol growth remain aligned over time.

---

9. KDK on Gate Launchpad: Where Liquidity Efficiency Meets Governance Power

Gate Launchpad provides early access to KDK while reinforcing its governance-driven design. Participants gain immediate liquidity through full unlock while retaining the option to stake for xKDK, balancing flexibility with long-term influence over Kodiak’s protocol decisions.

---

10. Why Kodiak’s 100% Instant Unlock Still Supports Long-Term Value Creation

While instant unlock often raises sell-pressure concerns, Kodiak offsets this through governance incentives and utility-driven demand. The xKDK model encourages holding and participation, allowing value to accrue through protocol usage rather than enforced lockups.

---

11. KDK’s Dual-Currency Launchpad Model Redefines Capital Productivity

Allowing subscriptions via USDT and yield-bearing GUSD improves capital efficiency. Participants can engage in the launchpad while maintaining productivity on their assets, introducing a more advanced participation model that reflects DeFi’s shift toward optimized capital deployment.

---

12. Kodiak’s Proof-of-Liquidity Integration Sets a New DeFi Standard

By leveraging Berachain’s Proof-of-Liquidity framework, Kodiak aligns rewards with meaningful liquidity contribution. This ensures incentives are sustainable, reduces mercenary behavior, and strengthens the protocol’s long-term stability and economic security.

---

13. Beyond Token Sales: KDK as a Long-Horizon Liquidity Coordination Layer

KDK extends beyond launchpad participation by acting as a coordination layer for liquidity providers, traders, and protocols. Its role grows alongside ecosystem usage, reinforcing network effects that compound value over time rather than peaking at launch.

---

14. Kodiak Finance: Turning Trading Volume Dominance Into Sustainable Token Value

With over 90% dominance in Berachain’s trading volume, Kodiak converts activity into real protocol revenue. This revenue supports token utility and governance relevance, ensuring that KDK’s value proposition remains tied to measurable on-chain performance.

---

15. xKDK Governance: Shifting DeFi From Speculation to Participation

Staking KDK into xKDK transforms passive holders into active contributors. Governance rights, reward distribution, and protocol influence encourage long-term alignment, reducing speculative churn and fostering a committed community focused on sustainable growth.

---

16. Why Serious DeFi Capital Is Watching Kodiak on Berachain

Institutional and strategic investors recognize Kodiak’s infrastructure role. Backing from reputable funds reflects confidence in its execution, revenue potential, and governance model, positioning KDK as a protocol designed for scale rather than short-term market cycles.

---

17. Gate Square + KDK: Social Consensus Meets Infrastructure-First DeFi

Gate Square enables collaborative evaluation of Kodiak, turning research and discussion into collective intelligence. This model enhances transparency and informed participation, aligning community sentiment with infrastructure-focused decision-making.

---

18. Kodiak’s Super-App Vision: One Hub for Liquidity, Trading, and Launches

Kodiak’s Super-App integrates spot trading, perpetuals, vaults, and token launches into a unified interface. This consolidation reduces fragmentation, improves user experience, and strengthens Kodiak’s role as a central hub within Berachain’s ecosystem.

---

19. Berachain-Native, Capital-Efficient, Governance-Driven: The KDK Thesis

Built natively for Berachain, KDK benefits from deep protocol integration. Its capital-efficient design and governance-first incentives ensure adaptability as the network evolves, reducing obsolescence risk and reinforcing long-term relevance.

---

20. KDK Represents Infrastructure Alpha in a Maturing DeFi Market

As DeFi matures, value increasingly concentrates in foundational protocols. KDK represents this infrastructure alpha by prioritizing liquidity efficiency, governance alignment, and ecosystem scalability, offering participants exposure to durable, compounding relevance rather than transient narratives.