# JapanBondMarketSellOff

2.61K

HighAmbition

#JapanBondMarketSell-Off

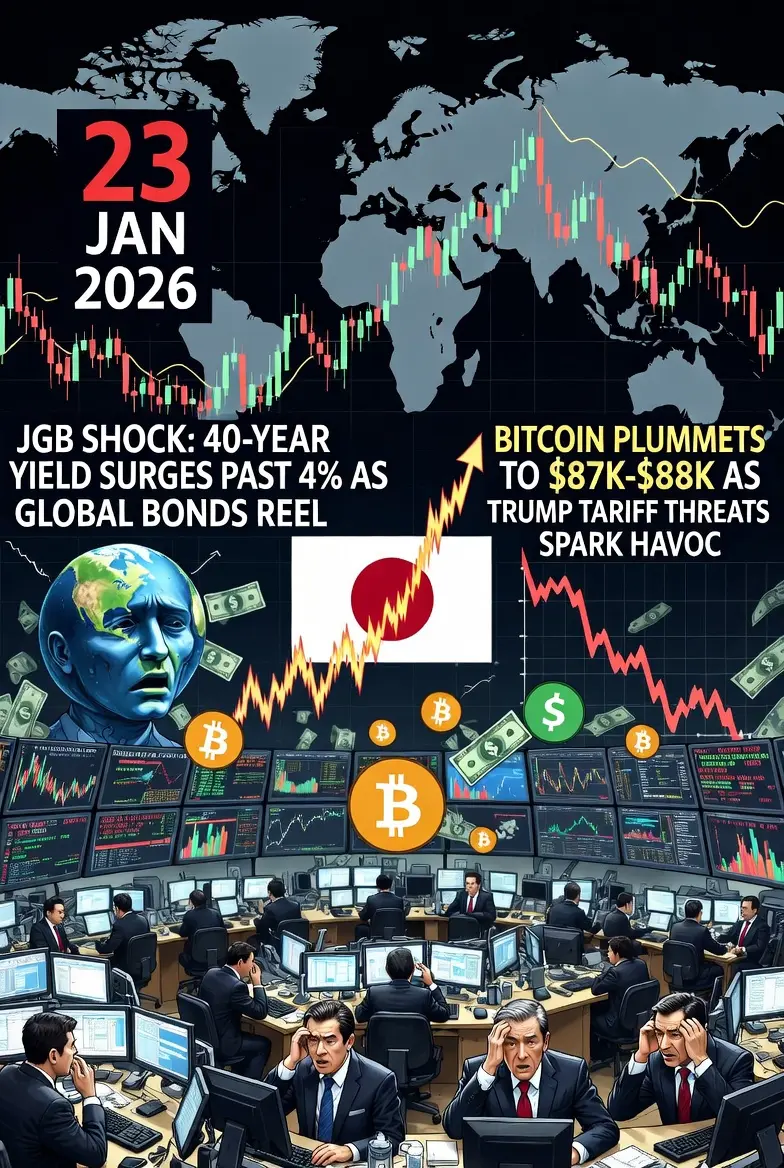

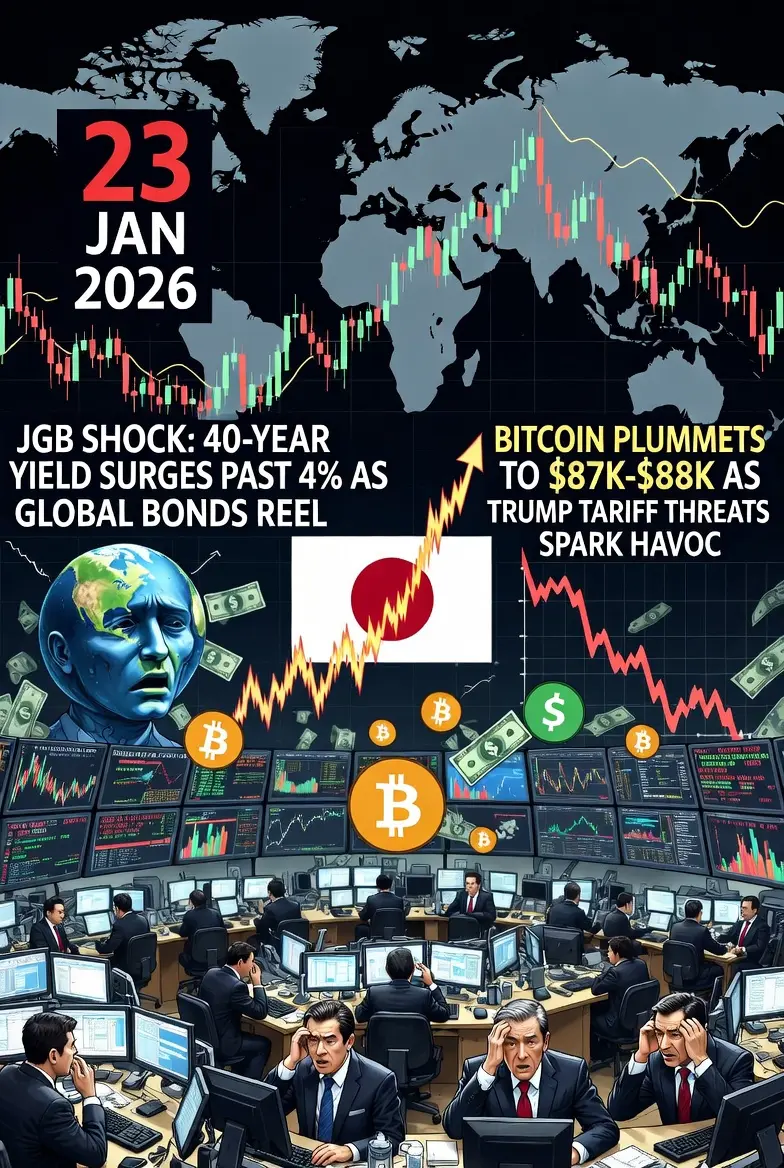

As of January 23, 2026, global financial markets are still digesting a historic Japanese government bond (JGB) shock that reverberated across equities, currencies, safe havens, and cryptocurrencies. What started as a domestic political move in Tokyo quickly became a macro contagion event, testing risk assets worldwide. For Bitcoin (BTC) and other crypto, this episode compounded existing volatility from Trump’s Greenland tariff drama (#TariffTensionsHitCryptoMarket), creating a “double macro whiplash” for risk-on markets.

This is a full deep dive, timeline, impact anal

As of January 23, 2026, global financial markets are still digesting a historic Japanese government bond (JGB) shock that reverberated across equities, currencies, safe havens, and cryptocurrencies. What started as a domestic political move in Tokyo quickly became a macro contagion event, testing risk assets worldwide. For Bitcoin (BTC) and other crypto, this episode compounded existing volatility from Trump’s Greenland tariff drama (#TariffTensionsHitCryptoMarket), creating a “double macro whiplash” for risk-on markets.

This is a full deep dive, timeline, impact anal

- Reward

- 22

- 28

- Repost

- Share

GateUser-fb813ea7 :

:

Good morning, remember to have a good breakfast and start a energetic day!View More

#TariffTensionsHitCryptoMarket

#JapanBondMarketSellOff — A Turning Point for Global Markets

The Japan bond market sell-off has emerged as one of the most important macroeconomic developments shaking global financial markets. For decades, Japan’s bond market was seen as a symbol of stability, supported by ultra-low interest rates and aggressive intervention by the Bank of Japan (BoJ). Today, that long-standing balance is being tested as yields rise and investors reassess risk.

At the heart of the sell-off lies a shift in expectations around Japan’s monetary policy. Inflation in Japan, once con

#JapanBondMarketSellOff — A Turning Point for Global Markets

The Japan bond market sell-off has emerged as one of the most important macroeconomic developments shaking global financial markets. For decades, Japan’s bond market was seen as a symbol of stability, supported by ultra-low interest rates and aggressive intervention by the Bank of Japan (BoJ). Today, that long-standing balance is being tested as yields rise and investors reassess risk.

At the heart of the sell-off lies a shift in expectations around Japan’s monetary policy. Inflation in Japan, once con

- Reward

- 13

- 18

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

🇯🇵 Japan Bond Market Shock: A Liquidity Event With Global Consequences

Japan’s government bond market just saw a historic liquidity breakdown. The 30-year JGB yield surged 30+ bps to ~3.9%, marking a 27-year high — a six-standard-deviation move not seen since 2003. This was not a routine sell-off, but a true liquidity crisis.

📉 What Happened

Disruption began Jan 20–21

Buyers stepped aside → bond prices collapsed

Liquidity dried up — JGB Liquidity Index hit record lows

Stress spilled into global rates and risk markets

🧠 Why It Matters

Japan has long been a global liquidity provider:

Ultra-l

Japan’s government bond market just saw a historic liquidity breakdown. The 30-year JGB yield surged 30+ bps to ~3.9%, marking a 27-year high — a six-standard-deviation move not seen since 2003. This was not a routine sell-off, but a true liquidity crisis.

📉 What Happened

Disruption began Jan 20–21

Buyers stepped aside → bond prices collapsed

Liquidity dried up — JGB Liquidity Index hit record lows

Stress spilled into global rates and risk markets

🧠 Why It Matters

Japan has long been a global liquidity provider:

Ultra-l

- Reward

- 2

- 2

- Repost

- Share

repanzal :

:

Buy To Earn 💎View More

#JapanBondMarketSellOff 🌏

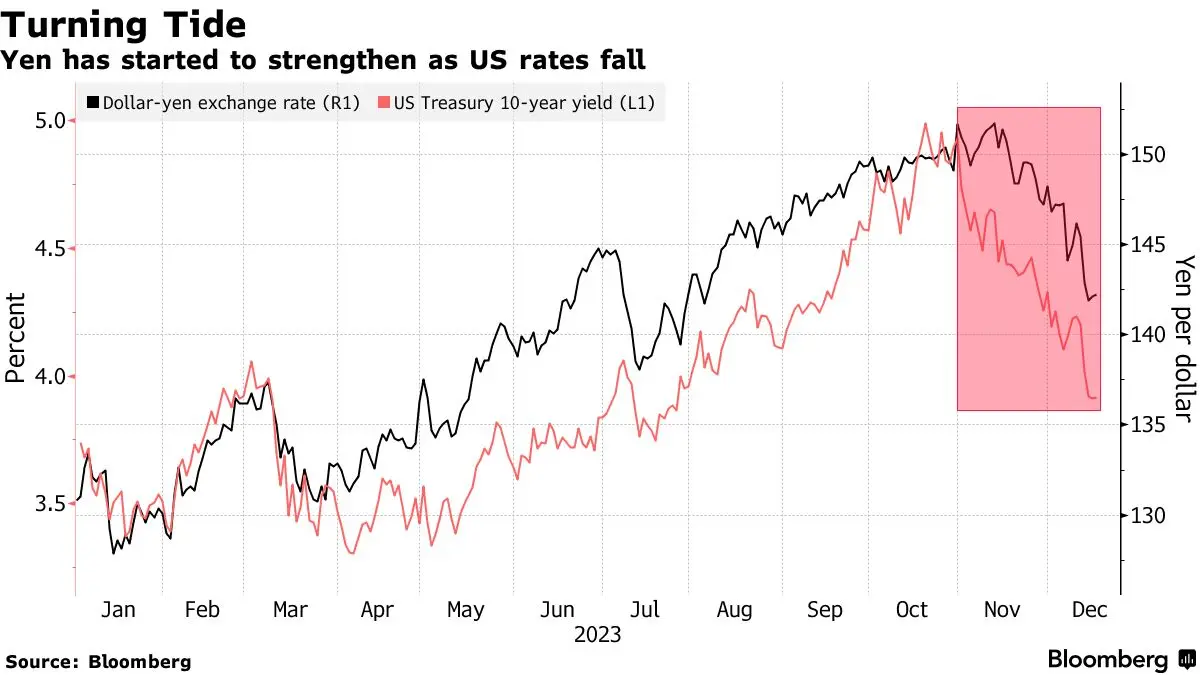

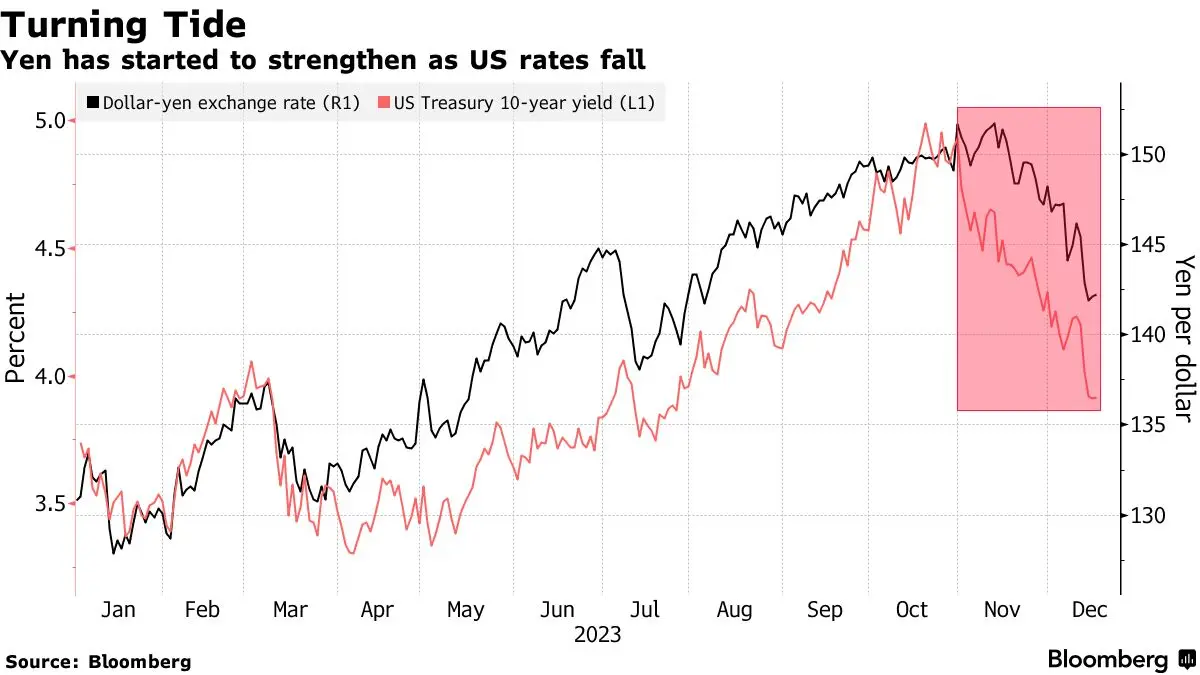

The Yen Carry Trade Unwind Is Quietly Redrawing the Global Map in 2026

A major shift is taking place inside Japan’s financial system — and its ripple effects are starting to reach far beyond bonds, including crypto markets.

🏦 Policy Transition in Japan

After years of ultra-loose monetary policy, the Bank of Japan is moving toward normalization. Rising yields on Japanese Government Bonds are changing behavior across domestic institutions that once sent capital abroad, particularly into U.S. Treasuries.

💧 Capital Is Reallocating

As yields at home become attractive ag

The Yen Carry Trade Unwind Is Quietly Redrawing the Global Map in 2026

A major shift is taking place inside Japan’s financial system — and its ripple effects are starting to reach far beyond bonds, including crypto markets.

🏦 Policy Transition in Japan

After years of ultra-loose monetary policy, the Bank of Japan is moving toward normalization. Rising yields on Japanese Government Bonds are changing behavior across domestic institutions that once sent capital abroad, particularly into U.S. Treasuries.

💧 Capital Is Reallocating

As yields at home become attractive ag

BTC0,51%

- Reward

- 10

- 10

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

#JapanBondMarketSellOff | A Warning Signal for Global Financial Markets

The recent Japan bond market sell-off has sent shockwaves across global financial markets, raising serious concerns among investors, economists, and policymakers. For decades, Japan’s bond market was considered one of the most stable in the world, supported by ultra-loose monetary policies, near-zero interest rates, and strong central bank intervention. However, the current sell-off marks a powerful shift in sentiment and signals a new era of financial uncertainty.

At the center of this turbulence is the Bank of Japan’s ev

The recent Japan bond market sell-off has sent shockwaves across global financial markets, raising serious concerns among investors, economists, and policymakers. For decades, Japan’s bond market was considered one of the most stable in the world, supported by ultra-loose monetary policies, near-zero interest rates, and strong central bank intervention. However, the current sell-off marks a powerful shift in sentiment and signals a new era of financial uncertainty.

At the center of this turbulence is the Bank of Japan’s ev

- Reward

- 3

- 3

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

#JapanBondMarketSellOff | Why Japan’s Bond Market Is Under Pressure and Why It Matters Globally

Japan’s bond market is experiencing a notable sell-off, drawing the attention of global investors and financial analysts. For decades, Japanese government bonds (JGBs) were considered one of the safest assets in the world, supported by ultra-low interest rates and strong central bank backing. However, recent developments suggest that this long-standing stability is being challenged.

One of the key drivers behind the Japan bond market sell-off is the growing expectation that the Bank of Japan (BOJ) m

Japan’s bond market is experiencing a notable sell-off, drawing the attention of global investors and financial analysts. For decades, Japanese government bonds (JGBs) were considered one of the safest assets in the world, supported by ultra-low interest rates and strong central bank backing. However, recent developments suggest that this long-standing stability is being challenged.

One of the key drivers behind the Japan bond market sell-off is the growing expectation that the Bank of Japan (BOJ) m

- Reward

- 1

- 2

- Repost

- Share

Vortex_King :

:

Buy To Earn 💎View More

#TariffTensionsHitCryptoMarket

#JapanBondMarketSellOff — A Turning Point for Global Markets

The sell-off in Japan’s bond market has become one of the most consequential macro developments shaking global financial markets in 2026. For decades, Japan’s bonds symbolized stability—anchored by ultra-low interest rates and firm intervention from the Bank of Japan (BoJ). That foundation is now being tested as yields rise and investors reassess long-standing assumptions.

🔎 What’s Driving the Shift?

At the core of the sell-off is a fundamental change in expectations around Japanese monetary policy. In

#JapanBondMarketSellOff — A Turning Point for Global Markets

The sell-off in Japan’s bond market has become one of the most consequential macro developments shaking global financial markets in 2026. For decades, Japan’s bonds symbolized stability—anchored by ultra-low interest rates and firm intervention from the Bank of Japan (BoJ). That foundation is now being tested as yields rise and investors reassess long-standing assumptions.

🔎 What’s Driving the Shift?

At the core of the sell-off is a fundamental change in expectations around Japanese monetary policy. In

- Reward

- like

- 1

- Repost

- Share

Alvizehen :

:

very nice article good trade history#JapanBondMarketSellOff | #SpotGoldHitsaNewHigh

🌟 Gold shines as global uncertainty rises

Spot gold has surged to a new all-time high, reinforcing its role as the ultimate safe-haven asset. With rising geopolitical tensions, inflation concerns, volatile equities, and instability across risk assets, capital is flowing back into time-tested value.

📈 What’s driving gold higher?

Global market uncertainty & risk-off sentiment

Expectations of interest-rate shifts

Central bank accumulation and institutional demand

Technical breakout above key resistance levels

🏦 Central banks continue to diversify

🌟 Gold shines as global uncertainty rises

Spot gold has surged to a new all-time high, reinforcing its role as the ultimate safe-haven asset. With rising geopolitical tensions, inflation concerns, volatile equities, and instability across risk assets, capital is flowing back into time-tested value.

📈 What’s driving gold higher?

Global market uncertainty & risk-off sentiment

Expectations of interest-rate shifts

Central bank accumulation and institutional demand

Technical breakout above key resistance levels

🏦 Central banks continue to diversify

- Reward

- 1

- 1

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🌱 “Growth mindset activated! Learning so much from these posts.”#JapanBondMarketSellOff | #SpotGoldHitsaNewHigh

🌟 Gold shines as global uncertainty rises

Spot gold has surged to a new all-time high, reinforcing its role as the ultimate safe-haven asset. With rising geopolitical tensions, inflation concerns, volatile equities, and instability across risk assets, capital is flowing back into time-tested value.

📈 What’s driving gold higher?

Global market uncertainty & risk-off sentiment

Expectations of interest-rate shifts

Central bank accumulation and institutional demand

Technical breakout above key resistance levels

🏦 Central banks continue to diversify

🌟 Gold shines as global uncertainty rises

Spot gold has surged to a new all-time high, reinforcing its role as the ultimate safe-haven asset. With rising geopolitical tensions, inflation concerns, volatile equities, and instability across risk assets, capital is flowing back into time-tested value.

📈 What’s driving gold higher?

Global market uncertainty & risk-off sentiment

Expectations of interest-rate shifts

Central bank accumulation and institutional demand

Technical breakout above key resistance levels

🏦 Central banks continue to diversify

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊#JapanBondMarketSell-Off

As of January 23, 2026, global financial markets are still digesting a historic Japanese government bond (JGB) shock that reverberated across equities, currencies, safe havens, and cryptocurrencies. What started as a domestic political move in Tokyo quickly became a macro contagion event, testing risk assets worldwide. For Bitcoin (BTC) and other crypto, this episode compounded existing volatility from Trump’s Greenland tariff drama (#TariffTensionsHitCryptoMarket), creating a “double macro whiplash” for risk-on markets.

This is a full deep dive, timeline, impact anal

As of January 23, 2026, global financial markets are still digesting a historic Japanese government bond (JGB) shock that reverberated across equities, currencies, safe havens, and cryptocurrencies. What started as a domestic political move in Tokyo quickly became a macro contagion event, testing risk assets worldwide. For Bitcoin (BTC) and other crypto, this episode compounded existing volatility from Trump’s Greenland tariff drama (#TariffTensionsHitCryptoMarket), creating a “double macro whiplash” for risk-on markets.

This is a full deep dive, timeline, impact anal

- Reward

- 1

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

47.62K Popularity

28.98K Popularity

22.36K Popularity

5.9K Popularity

14.42K Popularity

13.52K Popularity

11.15K Popularity

78.98K Popularity

38.4K Popularity

22.23K Popularity

11.1K Popularity

159 Popularity

257.57K Popularity

21.25K Popularity

181.63K Popularity

News

View MoreIn the past 24 hours, the entire network's contract liquidations reached $240 million, mainly from short positions.

3 m

If Ethereum breaks through $3100, the total liquidation strength of mainstream CEXs' short positions will reach 728 million.

11 m

Data: 502.78 BTC transferred from an anonymous address, worth approximately $44.91 million

23 m

European investors' appetite for US stocks diminishes; long-term decoupling may be underway

54 m

Casterman Founder: 2026 will be a critical turning point for the crypto market, and the industry will shift towards building new financial infrastructure

59 m

Pin