# BitcoinDropsBelow$65K

5.99K

Asiftahsin

BTC Technical Outlook: Macro Breakdown, Entering Deep Corrective Phase

Bitcoin has been rejected from the $112K–$126K macro supply zone (0.786–1 Fib) and remains in a broader corrective structure following the cycle distribution top. Price continues to respect a descending corrective channel, producing lower highs and weak recovery attempts.

Recent price action shows BTC losing the $81K–$85K support cluster (0.382 Fib) and flushing aggressively into the $60K–$66K macro demand base, where buyers are now attempting to slow downside momentum. However, overall structure remains bearish.

EMA Struct

Bitcoin has been rejected from the $112K–$126K macro supply zone (0.786–1 Fib) and remains in a broader corrective structure following the cycle distribution top. Price continues to respect a descending corrective channel, producing lower highs and weak recovery attempts.

Recent price action shows BTC losing the $81K–$85K support cluster (0.382 Fib) and flushing aggressively into the $60K–$66K macro demand base, where buyers are now attempting to slow downside momentum. However, overall structure remains bearish.

EMA Struct

BTC-4,03%

- Reward

- 1

- 2

- Repost

- Share

Ryakpanda :

:

Just go for it💪View More

#BitcoinDropsBelow$65K

The recent move where Bitcoin drops below $65K is more than just a psychological level breach it signals a potential shift in market structure. Historically, $65K has acted as a major support zone, attracting buyers during corrections. Breaking below it suggests that sellers are currently in control, and market participants may need to reassess risk management strategies. Technical indicators, including moving averages and RSI, now show increased bearish momentum, hinting at further consolidation or downward pressure in the short term.

2. Market Sentiment and Fear Index

The recent move where Bitcoin drops below $65K is more than just a psychological level breach it signals a potential shift in market structure. Historically, $65K has acted as a major support zone, attracting buyers during corrections. Breaking below it suggests that sellers are currently in control, and market participants may need to reassess risk management strategies. Technical indicators, including moving averages and RSI, now show increased bearish momentum, hinting at further consolidation or downward pressure in the short term.

2. Market Sentiment and Fear Index

BTC-4,03%

- Reward

- 2

- 8

- Repost

- Share

Falcon_Official :

:

Buy To Earn 💎View More

#BitcoinDropsBelow$65K

#BitcoinDropsBelow$65K

Bitcoin slipping below $65K feels dramatic mainly because of how crowded expectations had become above it.

Psychological levels matter — but not because they change fundamentals. They matter because they reveal positioning. And this move tells me more about sentiment than it does about Bitcoin itself.

What I see isn’t a breakdown of structure. It’s a reset of confidence.

Momentum cooled, leverage got uncomfortable, and price moved to where certainty thins out. That process is rarely clean. It’s usually volatile, frustrating, and emotionally loud.

#BitcoinDropsBelow$65K

Bitcoin slipping below $65K feels dramatic mainly because of how crowded expectations had become above it.

Psychological levels matter — but not because they change fundamentals. They matter because they reveal positioning. And this move tells me more about sentiment than it does about Bitcoin itself.

What I see isn’t a breakdown of structure. It’s a reset of confidence.

Momentum cooled, leverage got uncomfortable, and price moved to where certainty thins out. That process is rarely clean. It’s usually volatile, frustrating, and emotionally loud.

BTC-4,03%

- Reward

- like

- Comment

- Repost

- Share

🚨 It’s official.

Bitcoin just recorded its first ever daily drop of OVER -$10,000.

Even the -$19.5B liquidation event on October 10 didn’t match today’s impact.

Something BIG just happened.

Was this:

• A whale liquidation?

• Over-leveraged longs getting wiped?

• A cascading futures domino effect?

• Smart money exiting before news?

When price drops this violently, it’s rarely retail.

This smells like forced liquidation.

What do you think caused it?

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵

👇 Drop your theory.

#BuyTheDipOrWaitNow? #GateJanTransparencyReport

Bitcoin just recorded its first ever daily drop of OVER -$10,000.

Even the -$19.5B liquidation event on October 10 didn’t match today’s impact.

Something BIG just happened.

Was this:

• A whale liquidation?

• Over-leveraged longs getting wiped?

• A cascading futures domino effect?

• Smart money exiting before news?

When price drops this violently, it’s rarely retail.

This smells like forced liquidation.

What do you think caused it?

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵

👇 Drop your theory.

#BuyTheDipOrWaitNow? #GateJanTransparencyReport

- Reward

- 2

- 4

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

#BitcoinDropsBelow$65K #BitcoinDropsBelow$65K – MARKET UPDATE 🚨

Bitcoin has plunged below the $65,000 level, marking one of the most significant downturns in its price in over a year. The drop is not just a minor pullback — it reflects deepening selling pressure, broader risk‑off market sentiment, and a shift in investor confidence across crypto markets.

Here’s what’s happening:

📉 Sharp Price Decline

• Bitcoin has slid below $65 K, with intraday trading dropping toward around $62,500–$64,000, the lowest levels since late 2024.

• This drop has erased nearly half of its value from the recent

Bitcoin has plunged below the $65,000 level, marking one of the most significant downturns in its price in over a year. The drop is not just a minor pullback — it reflects deepening selling pressure, broader risk‑off market sentiment, and a shift in investor confidence across crypto markets.

Here’s what’s happening:

📉 Sharp Price Decline

• Bitcoin has slid below $65 K, with intraday trading dropping toward around $62,500–$64,000, the lowest levels since late 2024.

• This drop has erased nearly half of its value from the recent

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 3

- 2

- Repost

- Share

ybaser :

:

HOLD HOLDView More

#BitcoinDropsBelow$65K 🚨

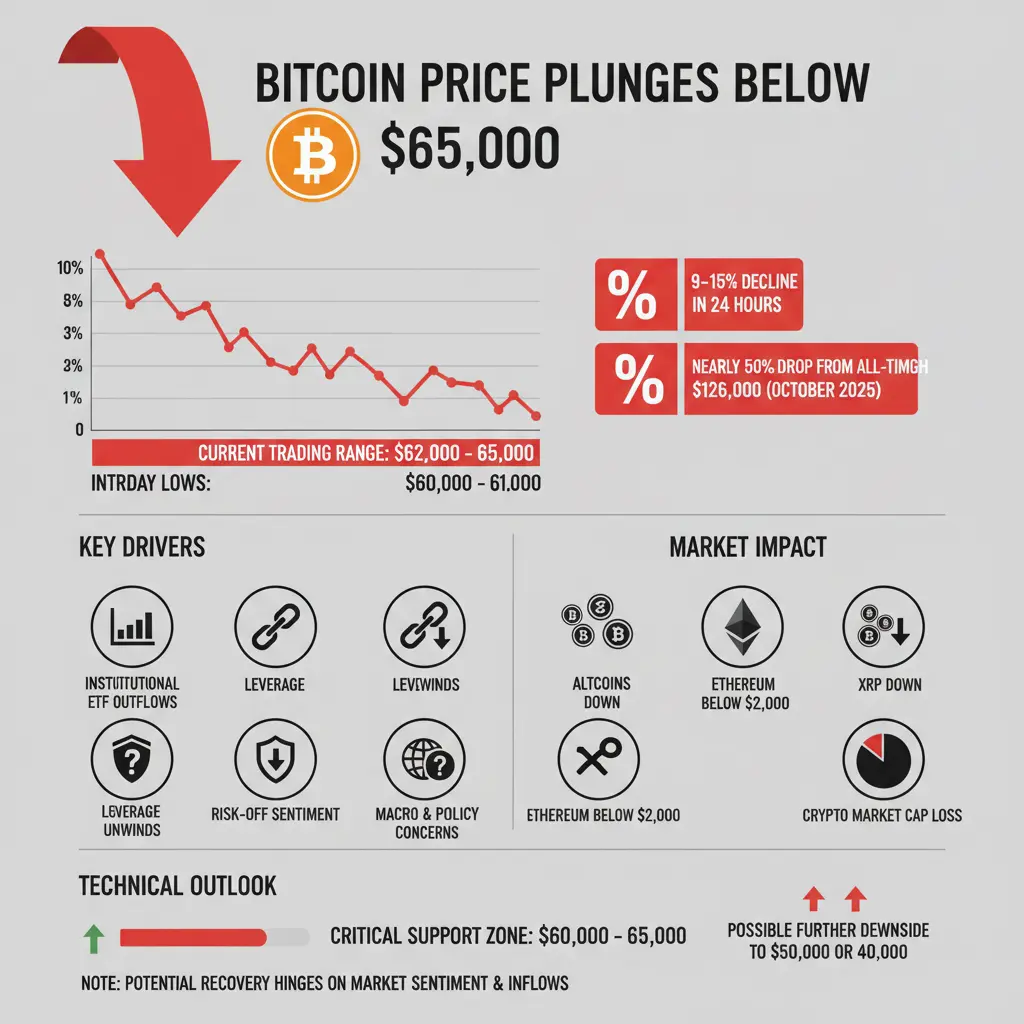

Bitcoin has recently slipped below the $65,000 mark, trading in the $62,000–$65,000 range, with intraday lows touching $60,000–$61,000. This represents a sharp decline of 9–15% in just 24 hours and marks Bitcoin's lowest level since October 2024. From its all-time high of $126,000 in October 2025, BTC has now lost nearly 50% of its value in only a few months.

Key Drivers of the Drop:

Institutional ETF Outflows: Spot Bitcoin ETFs have seen massive redemptions, removing a critical source of buying pressure.

Leverage Unwinds: Margin calls and forced liquidations are casc

Bitcoin has recently slipped below the $65,000 mark, trading in the $62,000–$65,000 range, with intraday lows touching $60,000–$61,000. This represents a sharp decline of 9–15% in just 24 hours and marks Bitcoin's lowest level since October 2024. From its all-time high of $126,000 in October 2025, BTC has now lost nearly 50% of its value in only a few months.

Key Drivers of the Drop:

Institutional ETF Outflows: Spot Bitcoin ETFs have seen massive redemptions, removing a critical source of buying pressure.

Leverage Unwinds: Margin calls and forced liquidations are casc

- Reward

- 8

- 14

- Repost

- Share

CryptoEye :

:

DYOR 🤓View More

#BitcoinDropsBelow$65K

What It Means for the Market

Bitcoin has recently slipped below the $65,000 mark, reigniting discussions across the crypto community about its short-term trajectory and the broader implications for digital assets. This correction comes after a period of sustained bullish momentum, during which BTC had reclaimed much of its previous highs. While dips are a natural part of any market cycle, the speed and timing of this decline have caught the attention of traders, investors, and analysts alike.

The drop below $65K can be attributed to a combination of factors. Firstly, pr

What It Means for the Market

Bitcoin has recently slipped below the $65,000 mark, reigniting discussions across the crypto community about its short-term trajectory and the broader implications for digital assets. This correction comes after a period of sustained bullish momentum, during which BTC had reclaimed much of its previous highs. While dips are a natural part of any market cycle, the speed and timing of this decline have caught the attention of traders, investors, and analysts alike.

The drop below $65K can be attributed to a combination of factors. Firstly, pr

BTC-4,03%

- Reward

- 3

- 6

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

#BitcoinDropsBelow$65K

Bitcoin slipping below the $65K level has instantly reignited debate across the crypto market. For some, this move feels like a warning sign; for others, it looks like a textbook shakeout. Psychological price levels like $65K matter not just because of charts, but because of market behavior. When such levels break, emotions often react faster than logic.

From a technical lens, Bitcoin’s drop below $65K appears to be a short-term loss of momentum rather than a structural breakdown. Price had been consolidating near resistance for weeks, and this pullback is easing overhe

Bitcoin slipping below the $65K level has instantly reignited debate across the crypto market. For some, this move feels like a warning sign; for others, it looks like a textbook shakeout. Psychological price levels like $65K matter not just because of charts, but because of market behavior. When such levels break, emotions often react faster than logic.

From a technical lens, Bitcoin’s drop below $65K appears to be a short-term loss of momentum rather than a structural breakdown. Price had been consolidating near resistance for weeks, and this pullback is easing overhe

BTC-4,03%

- Reward

- 5

- 6

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#BitcoinDropsBelow$65K In early February 2026, Bitcoin has fallen below the critical $65,000 level, signaling renewed volatility and raising questions about market direction, investor confidence, and overall structural stability in the crypto ecosystem. This decline marks a decisive transition from the bullish expansion seen during late 2025, when BTC reached all-time highs above $120,000, into a corrective consolidation phase that has erased nearly half of the cycle gains. Over recent trading sessions, Bitcoin has hovered in the $63,000–$64,000 range, a level not seen since late 2024, reflect

BTC-4,03%

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊Michael Saylor is currently facing an unrealized loss of $4.4 billion as Bitcoin slips below $70,000.

📉 With MicroStrategy’s average purchase price around $76,000, the company’s massive holdings are now deep in the red.

MicroStrategy controls roughly 713,000 BTC, and the decline is weighing heavily on its balance sheet.

😐 The irony? Saylor has spent years promoting the mantra “never sell.”

But the market may now force a difficult choice:

realize a portion of the losses,

or borrow more to average down and reassure investors.

🧠 While retail traders stress over a $100 dip, whales quietly abs

📉 With MicroStrategy’s average purchase price around $76,000, the company’s massive holdings are now deep in the red.

MicroStrategy controls roughly 713,000 BTC, and the decline is weighing heavily on its balance sheet.

😐 The irony? Saylor has spent years promoting the mantra “never sell.”

But the market may now force a difficult choice:

realize a portion of the losses,

or borrow more to average down and reassure investors.

🧠 While retail traders stress over a $100 dip, whales quietly abs

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

105.65K Popularity

18.43K Popularity

387.55K Popularity

5.99K Popularity

3.57K Popularity

3.37K Popularity

2.17K Popularity

3.36K Popularity

1.94K Popularity

3.34K Popularity

12.05K Popularity

8.03K Popularity

20K Popularity

28.41K Popularity

23.23K Popularity

News

View MoreGalaxy Board Approves $200 Million Stock Buyback Program

1 m

The Hyperliquid team wallet allocated 140,400 HYPE tokens, which were unlocked in February, to three different addresses.

1 m

Bostick: The duration of prolonged high inflation has now stabilized.

2 m

Bostick, the Federal Reserve cannot ignore concerns about inflation.

5 m

The European Central Bank calls on the EU to take urgent collective action in five key areas, including the digital euro

6 m

Pin