#BiggestCryptoOutflowsSince2022

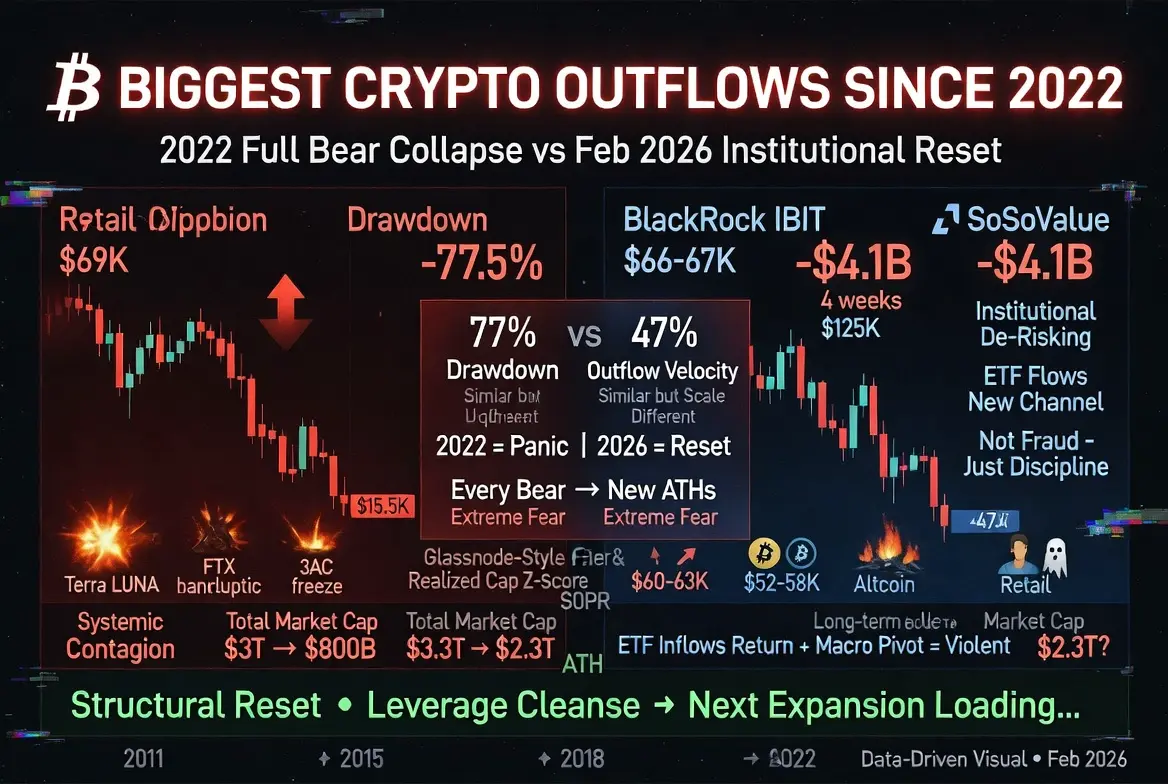

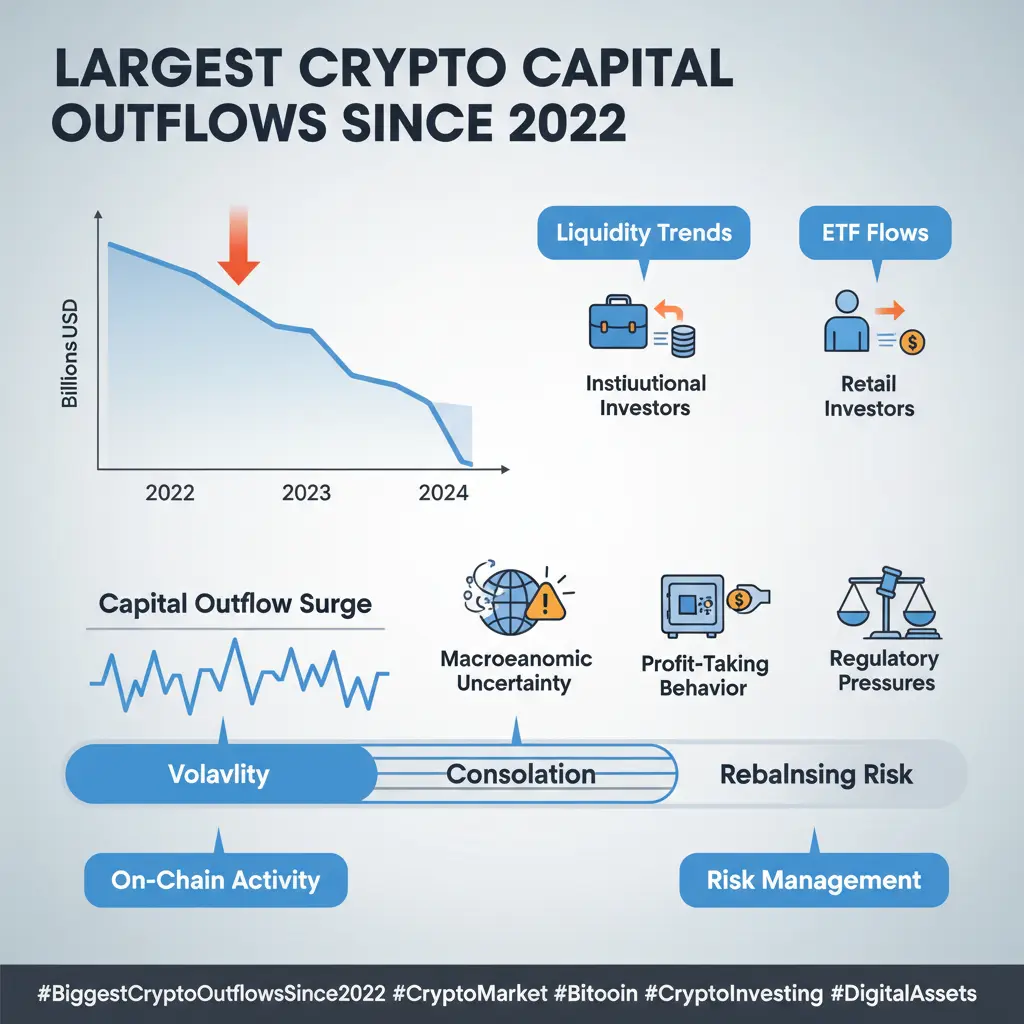

As of mid-February 2026, with Bitcoin hovering around $66,000–$67,000, the crypto market is experiencing the most aggressive capital outflow phase since the 2022 bear market collapse. According to on-chain data from Glassnode (highlighted by analyst Chris Beamish), the 30-day aggregate realized market value capital flow has turned sharply negative — the fastest outflow velocity recorded since the Terra/FTX/3AC contagion cycle.

But here’s the real question:

Is this a full 2022 repeat… or a structurally different correction in a more mature, institutional market?

Below is the most comprehensive breakdown — combining current February 2026 data with a direct side-by-side comparison to 2022.

1️⃣ Price Action & Drawdown Comparison – 2022 vs 2026

🔻 2022 Bear Market

Bitcoin peak: ~$69,000 (Nov 2021)

Bottom: ~$15,500 (Nov 2022)

Total drawdown: -77.5%

Ethereum: ~-79%

Total market cap: ~$3T → ~$800B

Multiple 30–40% monthly collapses

Driven by systemic failures: Terraform Labs (LUNA collapse), FTX bankruptcy, Celsius Network freeze, Three Arrows Capital liquidation

🔻 2026 Current Cycle (So Far)

Bitcoin peak: ~$124K–$126K (Oct 2025)

Current zone: ~$66K–$70K

Drawdown: ~45–47% in 4–5 months

Total market cap: ~$3.3T+ peak → ~$2.3–2.5T

Altcoins down 50–80% in many cases

📌 Verdict:

2026 is painful and fast — but only about 60% as deep as 2022 so far. Structurally more like a violent mid-cycle reset than full systemic collapse.

2️⃣ Capital Outflows – The Core Metric

🔎 2022 On-Chain Capitulation

30-day realized cap Z-score: -2.73 SD (record at the time)

Peak single-day realized loss: -$4.23B

Ethereum realized outflows: $27.6B in major waves

Long-term holders capitulated heavily

🔎 2026 Outflow Wave

30-day realized capital flow deeply negative — fastest since 2022

US Spot Bitcoin ETFs (data via SoSoValue/CoinShares):

~$3.7–$4.1B outflows over 4 weeks

Individual weeks exceeding -$1.2B

Multiple $100M+ redemptions from BlackRock’s IBIT

Broader digital asset funds: ~$3.74B 4-week outflows

Stablecoin supply contraction (~-$1.5B recent weekly burns)

Altcoin net sell pressure: ~$209B over 13 months (longest sustained distribution in 5+ years)

📌 Verdict:

Velocity resembles 2022 extremes. Absolute scale is smaller — but institutional ETF outflows introduce a new structural channel that didn’t exist in 2022.

3️⃣ What’s Driving 2026? (Different from 2022)

2022 = Panic + Contagion

Terra collapse

FTX fraud

Hedge fund insolvencies

Forced liquidations

Systemic confidence crisis

2026 = Institutional De-Risking

Post-euphoria fade after 2024–2025 rally

ETF investors sitting 20% below average entry ($80–85K)

Profit-taking + risk rotation

Macro risk-off environment

High BTC-Nasdaq correlation

Stablecoin growth stalled

Retail participation extremely low

📌 Key Difference:

2022 was chaos.

2026 is disciplined distribution.

4️⃣ Altcoin Carnage – Even Worse Structurally

2022 had heavy altcoin selling — but capital rotated eventually.

2026 shows:

$209B cumulative alt net sell volume (13 months)

Five straight red monthly candles on alt indices (historic first)

Millions of tokens fragmenting liquidity

BTC dominance rising as capital seeks relative safety

Some selective resilience has appeared in specific weeks — but broad alt structure remains fragile.

📌 Implication:

Alts are historically cheap relative to BTC — but demand must return before rotation can ignite.

5️⃣ Sentiment & Capitulation Signals

Both 2022 and 2026 show:

Extreme Fear readings

~46–50% BTC supply underwater

Long-Term Holder SOPR below 1

Large liquidation cascades ($2B+ events)

Negative funding persistent

However:

2022 had full despair (FTX week).

2026 has not yet reached that level of psychological collapse.

Glassnode’s Realized Price (~mid-$50Ks zone) now acts as deeper structural support.

6️⃣ Support, Risk & Forward Scenarios

Immediate Support:

$60K–$63K defensive range

Deeper Structural Zones:

$52K–$58K (200WMA region)

Psychological $50K

Extreme case: low $40Ks if ETF outflows persist aggressively

Overhead Resistance:

$72K–$79K

Heavy supply cluster $85K–$97K

Bull Triggers:

ETF flows turn positive

Stablecoin minting resumes

Macro pivot

Whale accumulation acceleration

Monthly green close signaling exhaustion

Recent on-chain data has already shown strong BTC accumulation spikes on certain days — similar to early 2023 bottoming behavior.

7️⃣ Institutional Evolution – The Biggest Structural Change

In 2022:

Retail dominated flows

Institutional footprint small

Total annual digital asset inflows were minimal

In 2026:

Spot Bitcoin ETFs (launched 2024) dominate liquidity flows

Billions move weekly

Corporate treasuries & endowments visible

Retail volume near multi-year lows

📌 This makes corrections slower, more orderly — but when flows reverse, the rebound could be violent.

Final Reality Check

Yes — this is the Biggest Crypto Outflow Phase Since 2022.

But it is NOT:

A fraud-driven collapse

A liquidity black hole like FTX week

A 77% macro wipeout (so far)

It IS:

A structural reset

A leverage cleanse

A valuation compression

A sentiment flush

A transition from euphoric 2025 highs to disciplined 2026 reality

Every major outflow wave in Bitcoin’s history (2011, 2015, 2018, 2022) eventually led to new all-time highs.

Markets don’t rise forever.

Markets don’t fall forever either.

🎯 Right-Now Playbook (No Hype, Just Structure)

• Risk management first

• Only deploy capital you can afford to lose

• Focus on BTC, ETH, and proven utility

• Avoid pure speculation

• Track ETF flows daily

• Watch stablecoin supply trend

• Monitor monthly candle closes

• Study whale accumulation patterns

This reset hurts. But historically, these phases build the foundation for the next expansion cycle.

Now the real question:

Are we witnessing a full 2022 replay…

Or a controlled institutional reset before the next structural leg higher?

As of mid-February 2026, with Bitcoin hovering around $66,000–$67,000, the crypto market is experiencing the most aggressive capital outflow phase since the 2022 bear market collapse. According to on-chain data from Glassnode (highlighted by analyst Chris Beamish), the 30-day aggregate realized market value capital flow has turned sharply negative — the fastest outflow velocity recorded since the Terra/FTX/3AC contagion cycle.

But here’s the real question:

Is this a full 2022 repeat… or a structurally different correction in a more mature, institutional market?

Below is the most comprehensive breakdown — combining current February 2026 data with a direct side-by-side comparison to 2022.

1️⃣ Price Action & Drawdown Comparison – 2022 vs 2026

🔻 2022 Bear Market

Bitcoin peak: ~$69,000 (Nov 2021)

Bottom: ~$15,500 (Nov 2022)

Total drawdown: -77.5%

Ethereum: ~-79%

Total market cap: ~$3T → ~$800B

Multiple 30–40% monthly collapses

Driven by systemic failures: Terraform Labs (LUNA collapse), FTX bankruptcy, Celsius Network freeze, Three Arrows Capital liquidation

🔻 2026 Current Cycle (So Far)

Bitcoin peak: ~$124K–$126K (Oct 2025)

Current zone: ~$66K–$70K

Drawdown: ~45–47% in 4–5 months

Total market cap: ~$3.3T+ peak → ~$2.3–2.5T

Altcoins down 50–80% in many cases

📌 Verdict:

2026 is painful and fast — but only about 60% as deep as 2022 so far. Structurally more like a violent mid-cycle reset than full systemic collapse.

2️⃣ Capital Outflows – The Core Metric

🔎 2022 On-Chain Capitulation

30-day realized cap Z-score: -2.73 SD (record at the time)

Peak single-day realized loss: -$4.23B

Ethereum realized outflows: $27.6B in major waves

Long-term holders capitulated heavily

🔎 2026 Outflow Wave

30-day realized capital flow deeply negative — fastest since 2022

US Spot Bitcoin ETFs (data via SoSoValue/CoinShares):

~$3.7–$4.1B outflows over 4 weeks

Individual weeks exceeding -$1.2B

Multiple $100M+ redemptions from BlackRock’s IBIT

Broader digital asset funds: ~$3.74B 4-week outflows

Stablecoin supply contraction (~-$1.5B recent weekly burns)

Altcoin net sell pressure: ~$209B over 13 months (longest sustained distribution in 5+ years)

📌 Verdict:

Velocity resembles 2022 extremes. Absolute scale is smaller — but institutional ETF outflows introduce a new structural channel that didn’t exist in 2022.

3️⃣ What’s Driving 2026? (Different from 2022)

2022 = Panic + Contagion

Terra collapse

FTX fraud

Hedge fund insolvencies

Forced liquidations

Systemic confidence crisis

2026 = Institutional De-Risking

Post-euphoria fade after 2024–2025 rally

ETF investors sitting 20% below average entry ($80–85K)

Profit-taking + risk rotation

Macro risk-off environment

High BTC-Nasdaq correlation

Stablecoin growth stalled

Retail participation extremely low

📌 Key Difference:

2022 was chaos.

2026 is disciplined distribution.

4️⃣ Altcoin Carnage – Even Worse Structurally

2022 had heavy altcoin selling — but capital rotated eventually.

2026 shows:

$209B cumulative alt net sell volume (13 months)

Five straight red monthly candles on alt indices (historic first)

Millions of tokens fragmenting liquidity

BTC dominance rising as capital seeks relative safety

Some selective resilience has appeared in specific weeks — but broad alt structure remains fragile.

📌 Implication:

Alts are historically cheap relative to BTC — but demand must return before rotation can ignite.

5️⃣ Sentiment & Capitulation Signals

Both 2022 and 2026 show:

Extreme Fear readings

~46–50% BTC supply underwater

Long-Term Holder SOPR below 1

Large liquidation cascades ($2B+ events)

Negative funding persistent

However:

2022 had full despair (FTX week).

2026 has not yet reached that level of psychological collapse.

Glassnode’s Realized Price (~mid-$50Ks zone) now acts as deeper structural support.

6️⃣ Support, Risk & Forward Scenarios

Immediate Support:

$60K–$63K defensive range

Deeper Structural Zones:

$52K–$58K (200WMA region)

Psychological $50K

Extreme case: low $40Ks if ETF outflows persist aggressively

Overhead Resistance:

$72K–$79K

Heavy supply cluster $85K–$97K

Bull Triggers:

ETF flows turn positive

Stablecoin minting resumes

Macro pivot

Whale accumulation acceleration

Monthly green close signaling exhaustion

Recent on-chain data has already shown strong BTC accumulation spikes on certain days — similar to early 2023 bottoming behavior.

7️⃣ Institutional Evolution – The Biggest Structural Change

In 2022:

Retail dominated flows

Institutional footprint small

Total annual digital asset inflows were minimal

In 2026:

Spot Bitcoin ETFs (launched 2024) dominate liquidity flows

Billions move weekly

Corporate treasuries & endowments visible

Retail volume near multi-year lows

📌 This makes corrections slower, more orderly — but when flows reverse, the rebound could be violent.

Final Reality Check

Yes — this is the Biggest Crypto Outflow Phase Since 2022.

But it is NOT:

A fraud-driven collapse

A liquidity black hole like FTX week

A 77% macro wipeout (so far)

It IS:

A structural reset

A leverage cleanse

A valuation compression

A sentiment flush

A transition from euphoric 2025 highs to disciplined 2026 reality

Every major outflow wave in Bitcoin’s history (2011, 2015, 2018, 2022) eventually led to new all-time highs.

Markets don’t rise forever.

Markets don’t fall forever either.

🎯 Right-Now Playbook (No Hype, Just Structure)

• Risk management first

• Only deploy capital you can afford to lose

• Focus on BTC, ETH, and proven utility

• Avoid pure speculation

• Track ETF flows daily

• Watch stablecoin supply trend

• Monitor monthly candle closes

• Study whale accumulation patterns

This reset hurts. But historically, these phases build the foundation for the next expansion cycle.

Now the real question:

Are we witnessing a full 2022 replay…

Or a controlled institutional reset before the next structural leg higher?