#加密市场回调 Market Cap Shrinks by Hundreds of Billions! What’s Next for the Crypto World?

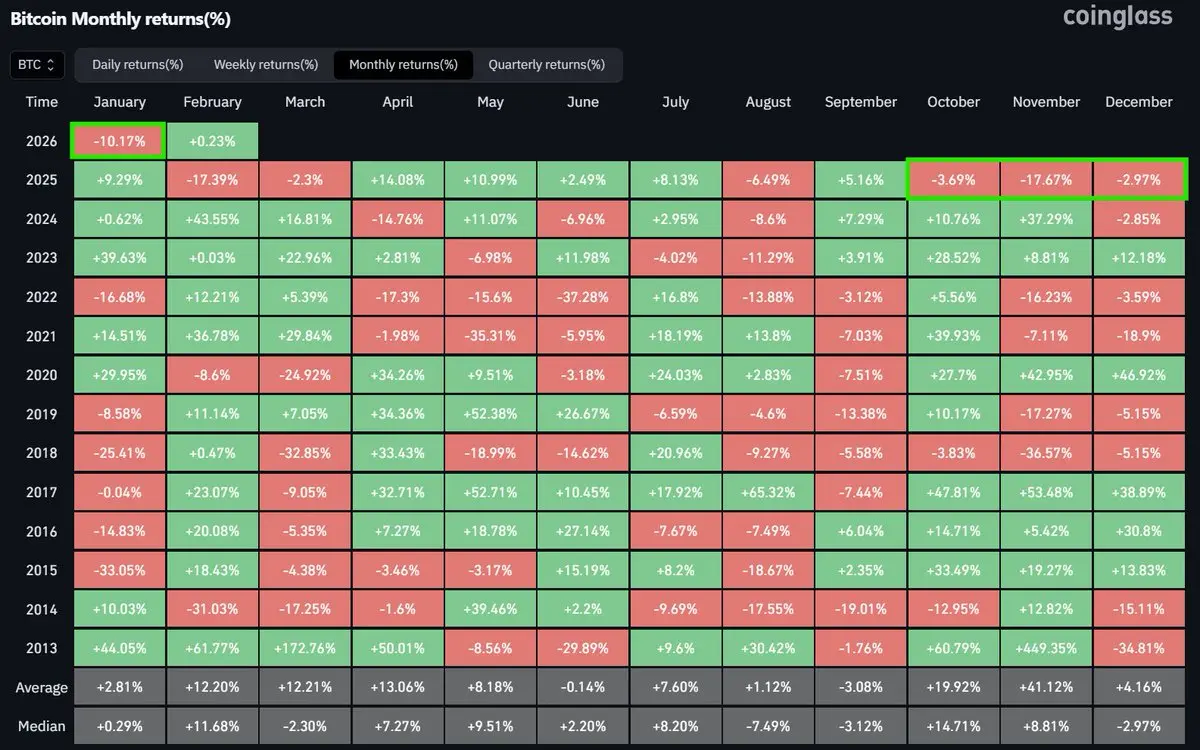

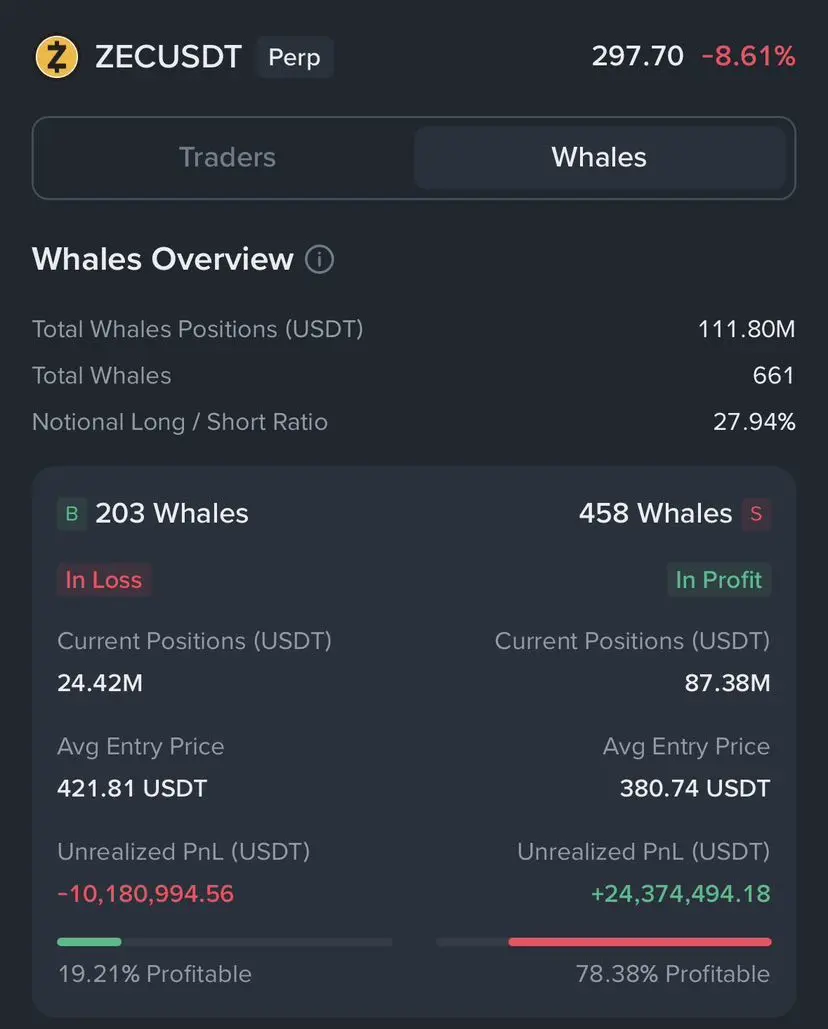

This sharp decline was caused by multiple negative factors stacking up: macroeconomic pressures from the Federal Reserve’s tightening policies and regulatory uncertainties; rising geopolitical risks triggering market risk aversion; at the same time, Bitcoin’s narrative as “digital gold” short-term failed, combined with high leverage in the market, leading to this intense correction and chain liquidations.

Market Analysis

Bitcoin price is in the $78,000-$79,000 range, breaking below the key psychological level of $80,000, hitting a new low since April 2025.

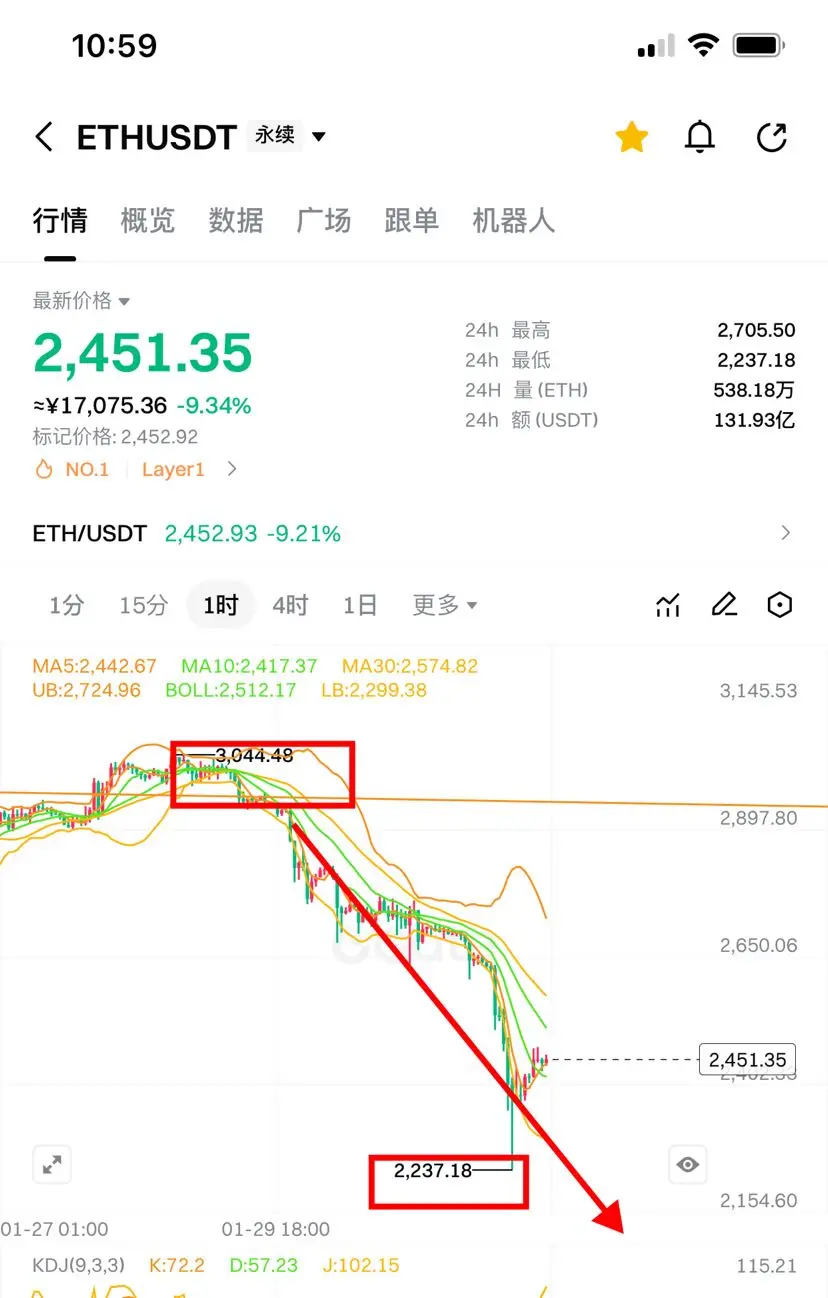

Ethereum price is around $2,436, down over 10% in 24 hours, briefly touching a low of $2,240.

Bitcoin

Key Resistance Levels: $80,000 (psychological level and previous support), $82,000-$85,200.

Key Support Levels: $76,000-$78,000 (recent low area). If broken, the next important support zone is at $72,300-$75,300.

Technical Pattern: Overall technical indicators are bearish, with the price below all major moving averages.

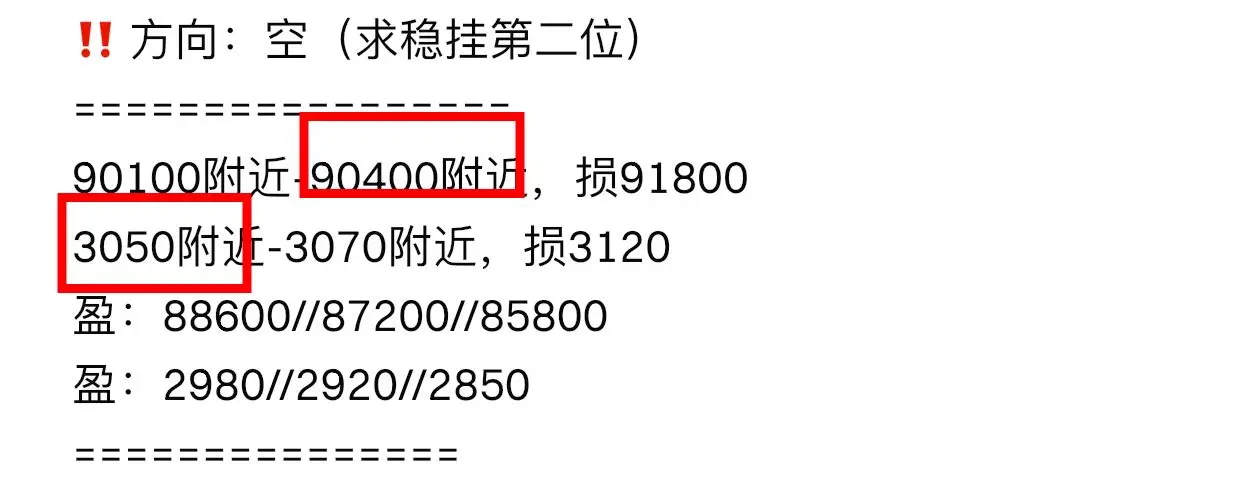

Ethereum

Key Support Level: Close attention needed around the 200-day moving average. If broken, further decline could test support zones at $1,900 and even $1,713.

Technical Pattern: The full-cycle technical indicators show an extremely bearish pattern, with a significantly larger decline than Bitcoin, indicating a deeper correction.

Strategy Analysis

Current market opinions are highly divided, with different strategies suited for different types of investors:

For Short-term Traders

Market sentiment is extremely pessimistic right now, with clear downward trends in technicals. The primary task is risk prevention.

Key Observation: Watch closely whether Bitcoin can regain and hold above $80,000. Before a confirmed breakout and stabilization above key resistance zones (such as $82,000-$85,200), any rebound may only be a technical pullback, and chasing high is not advisable.

Risk Warning: Market volatility is intense, and high leverage can easily lead to liquidations during price swings in either direction.

For Medium- to Long-term Investors

The market is currently in a deep adjustment and stress-testing phase. Some analyses believe this could be a process of clearing excessive leverage, laying the foundation for healthy future growth.

· Institutional Outlook: Different institutions have vastly different long-term forecasts. For example, JPMorgan, Bernstein, and others have predicted long-term highs exceeding $150,000, while Fidelity and others have indicated potential support zones at $65,000-$75,000.

· Operational Advice: Focus on market reactions around strong support zones such as $75,000 (Bitcoin) and $1,900 (Ethereum). Adopt a phased, cautious approach and manage positions carefully.

This sharp decline was caused by multiple negative factors stacking up: macroeconomic pressures from the Federal Reserve’s tightening policies and regulatory uncertainties; rising geopolitical risks triggering market risk aversion; at the same time, Bitcoin’s narrative as “digital gold” short-term failed, combined with high leverage in the market, leading to this intense correction and chain liquidations.

Market Analysis

Bitcoin price is in the $78,000-$79,000 range, breaking below the key psychological level of $80,000, hitting a new low since April 2025.

Ethereum price is around $2,436, down over 10% in 24 hours, briefly touching a low of $2,240.

Bitcoin

Key Resistance Levels: $80,000 (psychological level and previous support), $82,000-$85,200.

Key Support Levels: $76,000-$78,000 (recent low area). If broken, the next important support zone is at $72,300-$75,300.

Technical Pattern: Overall technical indicators are bearish, with the price below all major moving averages.

Ethereum

Key Support Level: Close attention needed around the 200-day moving average. If broken, further decline could test support zones at $1,900 and even $1,713.

Technical Pattern: The full-cycle technical indicators show an extremely bearish pattern, with a significantly larger decline than Bitcoin, indicating a deeper correction.

Strategy Analysis

Current market opinions are highly divided, with different strategies suited for different types of investors:

For Short-term Traders

Market sentiment is extremely pessimistic right now, with clear downward trends in technicals. The primary task is risk prevention.

Key Observation: Watch closely whether Bitcoin can regain and hold above $80,000. Before a confirmed breakout and stabilization above key resistance zones (such as $82,000-$85,200), any rebound may only be a technical pullback, and chasing high is not advisable.

Risk Warning: Market volatility is intense, and high leverage can easily lead to liquidations during price swings in either direction.

For Medium- to Long-term Investors

The market is currently in a deep adjustment and stress-testing phase. Some analyses believe this could be a process of clearing excessive leverage, laying the foundation for healthy future growth.

· Institutional Outlook: Different institutions have vastly different long-term forecasts. For example, JPMorgan, Bernstein, and others have predicted long-term highs exceeding $150,000, while Fidelity and others have indicated potential support zones at $65,000-$75,000.

· Operational Advice: Focus on market reactions around strong support zones such as $75,000 (Bitcoin) and $1,900 (Ethereum). Adopt a phased, cautious approach and manage positions carefully.