Post content & earn content mining yield

placeholder

‼️ JUST IN: 🇫🇷French police raid Elon Musk’s X office in Paris. Prosecutor says the probe is part of a long-running investigation into "algorithms and harmful content."#crypto

- Reward

- like

- Comment

- Repost

- Share

📊 Institutional Bitcoin Strategy — Long‑Term Conviction or Tactical Adjustment?

In the latest market environment, data shows two very different behaviors between institutional investors and retail participants in Bitcoin (BTC):

1. Institutions Are Still Accumulating — Not Selling

Multiple on‑chain metrics and industry reports show that institutions continue to build Bitcoin exposure even as prices pull back:

Large holders and “whales” have been accumulating significant BTC amounts, reaching multi‑month highs in holdings.

Surveys indicate that about 80 % of institutions plan to buy more Bitco

In the latest market environment, data shows two very different behaviors between institutional investors and retail participants in Bitcoin (BTC):

1. Institutions Are Still Accumulating — Not Selling

Multiple on‑chain metrics and industry reports show that institutions continue to build Bitcoin exposure even as prices pull back:

Large holders and “whales” have been accumulating significant BTC amounts, reaching multi‑month highs in holdings.

Surveys indicate that about 80 % of institutions plan to buy more Bitco

BTC0,12%

- Reward

- 1

- Comment

- Repost

- Share

MYJB

蚂蚁金币

Created By@MunanYiBufan

Listing Progress

100.00%

MC:

$7.24K

Create My Token

Referral Trading Challenge: Earn 50 GT Together, Top the Leaderboard to Win a Case of Moutai Feitian https://www.gate.com/id/campaigns/3999?ref_type=132

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- 2

- Repost

- Share

GateUser-7cd24e22 :

:

Experienced driver, guide me 📈View More

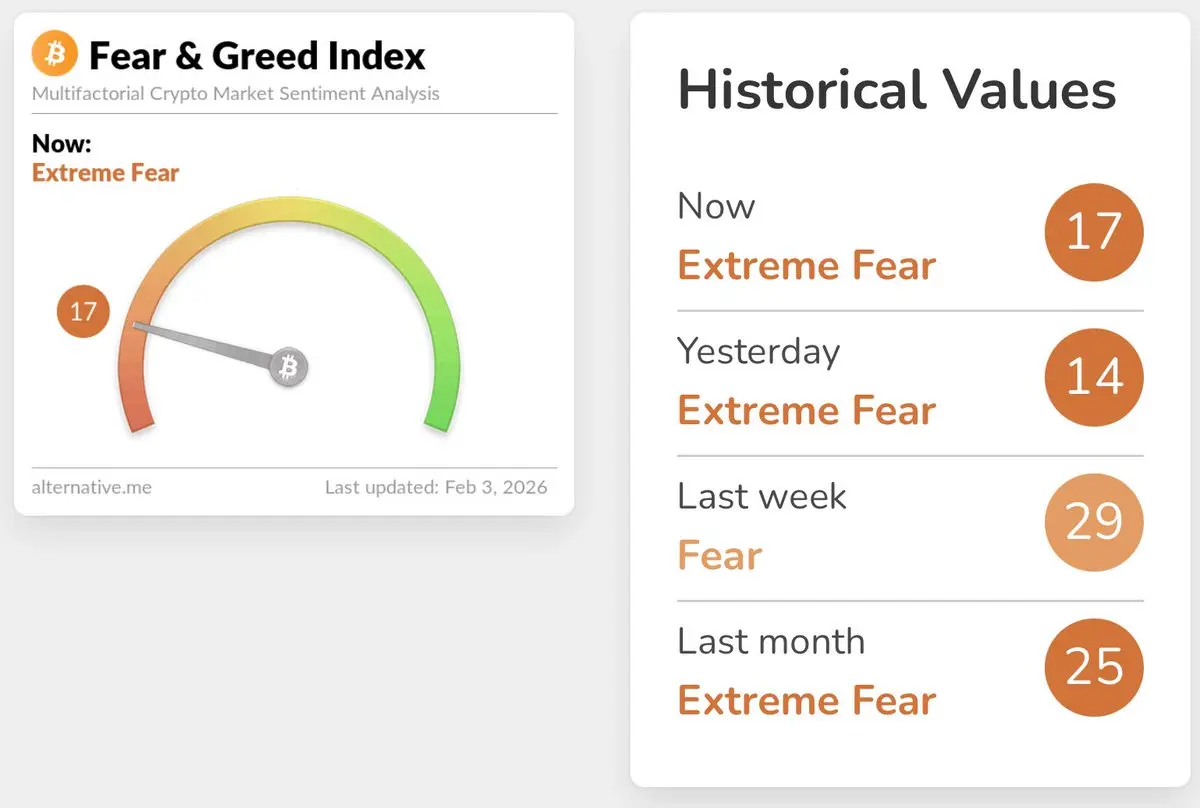

DEVELOPING: Bitcoin has now spent more consecutive days in Extreme Fear than any point in its history.

BTC0,12%

- Reward

- like

- Comment

- Repost

- Share

SOL Technical Review: Arc Top Concerns vs Key Support Defense Battle1️⃣ Pattern Warning: The weekly K-line level arc top prototype has emerged. The neckline area is the "life and death line"; once broken, the support vacuum zone below may trigger a sharp pullback2️⃣ Bullish Defense Line: Currently, the daily chart shows a valid rebound at the $100 level3️⃣ Resistance Observation: Short-term resistance focuses on $105 / $113 / around $120💡 Core Logic: SOL's trend needs to be anchored to BTC movements; as long as the neckline is not broken, the outlook remains cautiously optimistic

View Original

- Reward

- like

- Comment

- Repost

- Share

#InstitutionalHoldingsDebate

The Rise of Institutional Giants: A New Power Balance in Digital Assets

The digital asset ecosystem is evolving from a "playground" for individual investors into a strategic headquarters for global financial titans. Today, the core debate is no longer about the value of these assets, but rather in whose hands they are concentrated and how this power shifts market dynamics. #InstitutionalHoldingsDebate highlights precisely this fine line between the philosophy of decentralization and institutional discipline.

The Current Portrait of Institutional Dominance

A

The Rise of Institutional Giants: A New Power Balance in Digital Assets

The digital asset ecosystem is evolving from a "playground" for individual investors into a strategic headquarters for global financial titans. Today, the core debate is no longer about the value of these assets, but rather in whose hands they are concentrated and how this power shifts market dynamics. #InstitutionalHoldingsDebate highlights precisely this fine line between the philosophy of decentralization and institutional discipline.

The Current Portrait of Institutional Dominance

A

- Reward

- 8

- 10

- Repost

- Share

MoonGirl :

:

2026 GOGOGO 👊View More

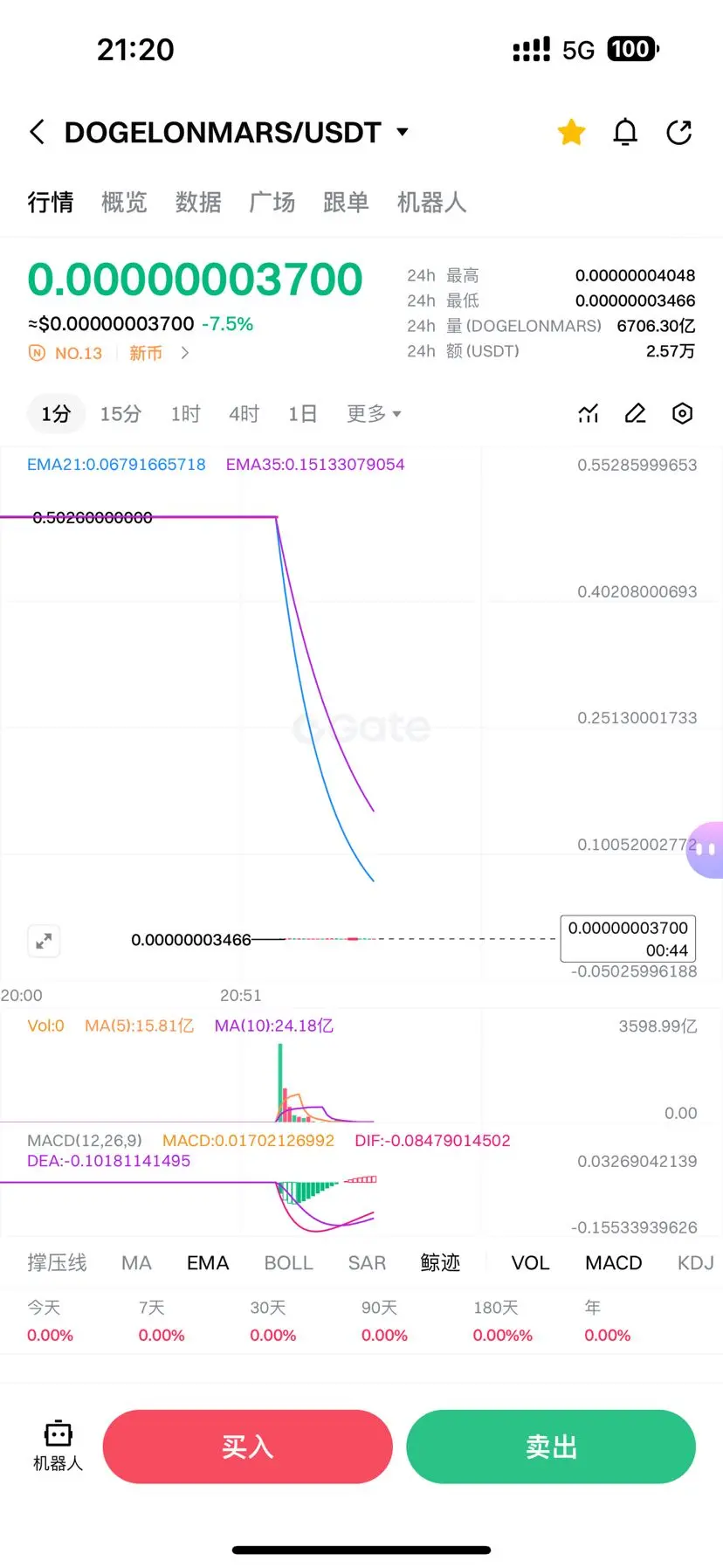

Nobody's playing anymore, and it's still steadily declining. No one is interested, and the enthusiasm has completely faded away.

View Original

- Reward

- like

- 2

- Repost

- Share

monowar2782 :

:

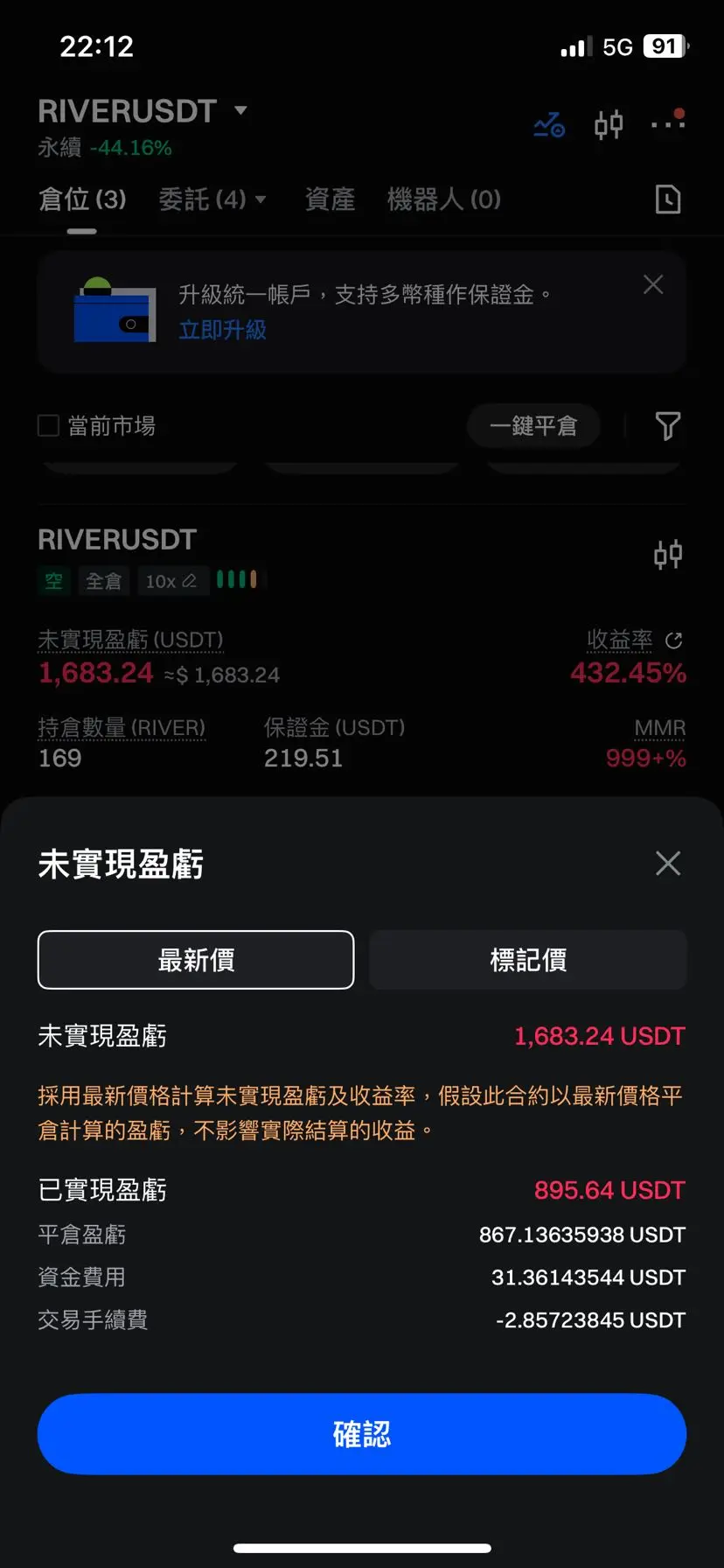

bro, close it if your loss is covered or you will regret laterView More

- Reward

- 6

- 1

- Repost

- Share

小木论 :

:

Hold on tight, we're about to take off 🛫- Reward

- 1

- 1

- Repost

- Share

Join111 :

:

Bitcoin's attempt to stabilize as demand for put options used to hedge downside risk has eased somewhat, but the concentration of open interest at specific strike prices indicates that market tension has not fully dissipated. According to Deribit data, the highest concentration of put options shows that buyers are providing support around $75,000, making it a key support level. The token briefly dropped to $74,541 on Monday before rebounding. The next key support level is at $70,000.屁

屁

Created By@GateUser-faac49f1

Subscription Progress

0.00%

MC:

$0

Create My Token

Indicators are in hand, no panic, no bottom-fishing.

View Original

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 1

- 2

- Repost

- Share

IndicatorWithSourceCode001 :

:

New Year Wealth Explosion 🤑View More

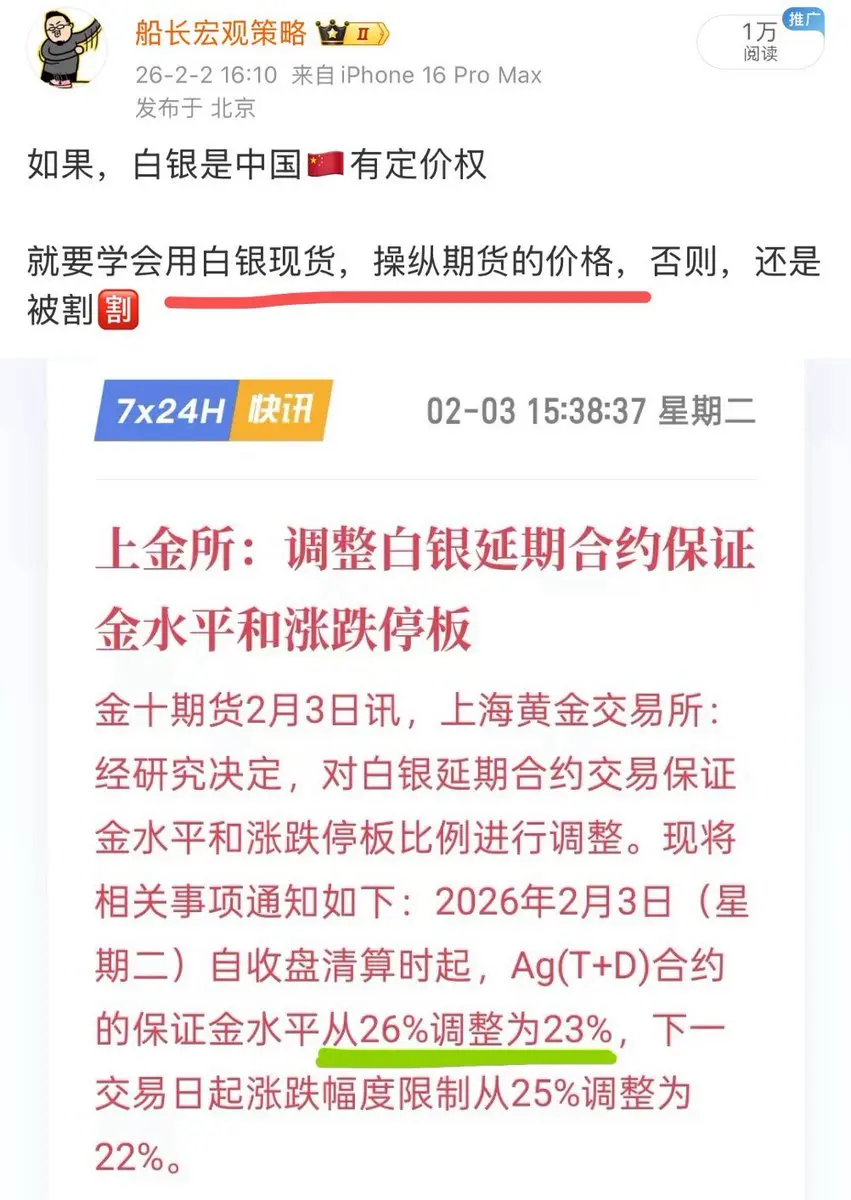

Yesterday, there was speculation that China would gain more pricing power in silver. Today, the China Financial Futures Exchange (CFFEX) lowered the silver margin requirement, while CME increased the margin requirement, which is exactly the opposite. ❤️ Gold and silver are stored by the empire, keep up with 😃

View Original

- Reward

- like

- Comment

- Repost

- Share

The BIRB Futures Trading Challenge is now live on Gate. Check in daily and share 200,000 USDT in total rewards. Simple trading, exciting airdrops – don't miss out. https://www.gate.com/id/campaigns/3971?ref=VQUQVAXXVA&ref_type=132

- Reward

- 1

- Comment

- Repost

- Share

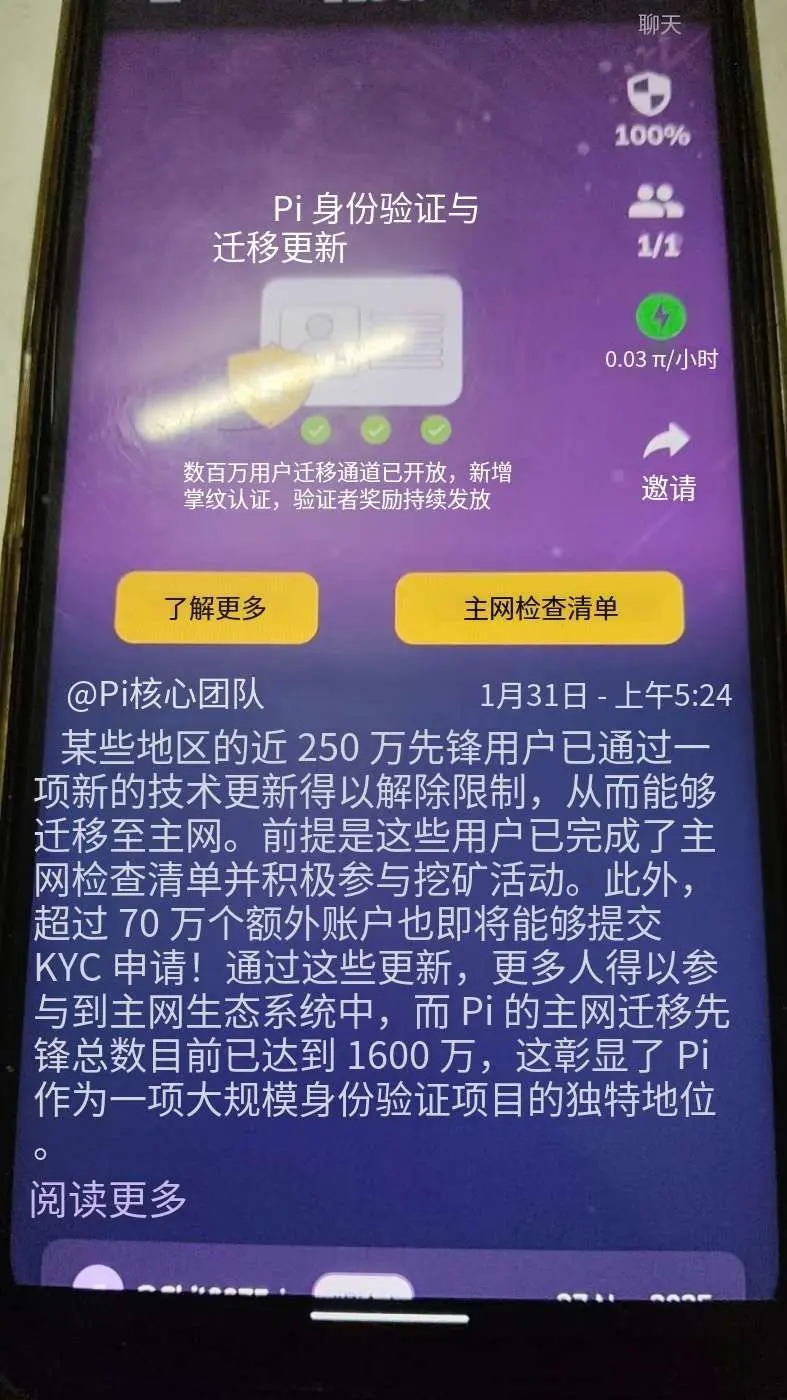

Pi is just a hype class, it’s about to take off soon. Pi is about to take off soon.

PI0,83%

- Reward

- 4

- Comment

- Repost

- Share

$CHESS is waking up!

Up over +40% today and currently consolidating around 0.028.

After hitting a high of 0.032, it’s holding support above the short-term Moving Averages. Is this accumulation for the next leg up, or are we cooling off?

Let me know your targets below!

#WhenWillBTCRebound? #StrategyBitcoinPositionTurnsRed #WhiteHouseCryptoSummit #AIExclusiveSocialNetworkMoltbook #HongKongIssueStablecoinLicenses

Up over +40% today and currently consolidating around 0.028.

After hitting a high of 0.032, it’s holding support above the short-term Moving Averages. Is this accumulation for the next leg up, or are we cooling off?

Let me know your targets below!

#WhenWillBTCRebound? #StrategyBitcoinPositionTurnsRed #WhiteHouseCryptoSummit #AIExclusiveSocialNetworkMoltbook #HongKongIssueStablecoinLicenses

CHESS45,27%

- Reward

- like

- Comment

- Repost

- Share

🔹 Bitcoin slips below $80,000 again. Where does market confidence go from here? Institutions see a potential bottom near $60,000, with a recovery window later this year

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊$Laozi, I swear I’m screwed for buying these knockoff spot assets, they’re all scam coins... Never made a dime from spot trading!

老子-7,15%

- Reward

- 2

- 4

- Repost

- Share

HumanWeaknessesInGrow :

:

No bottomView More

No one wants this deal 👀

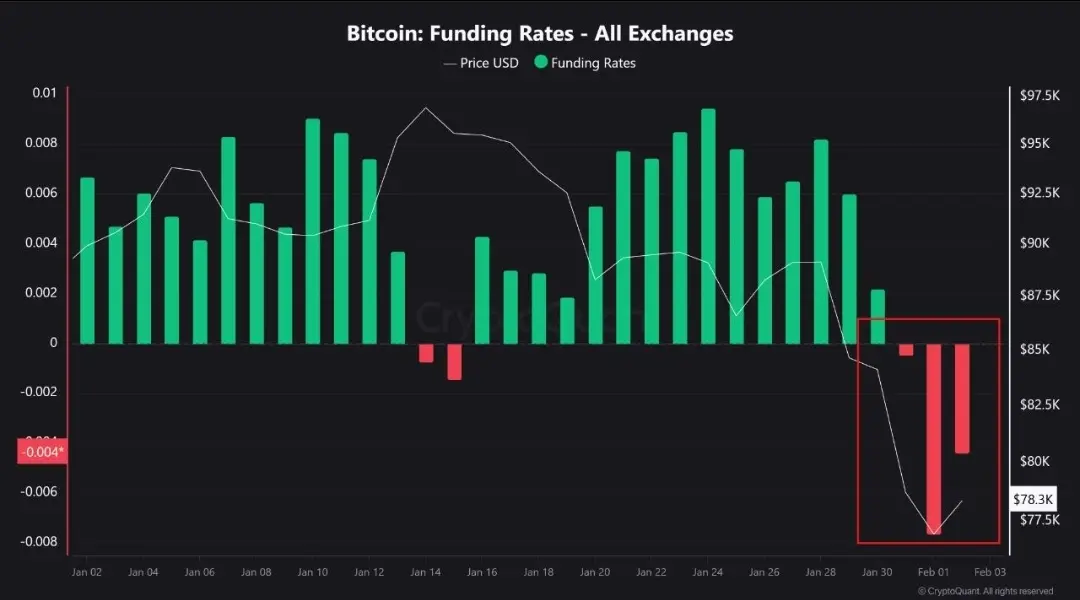

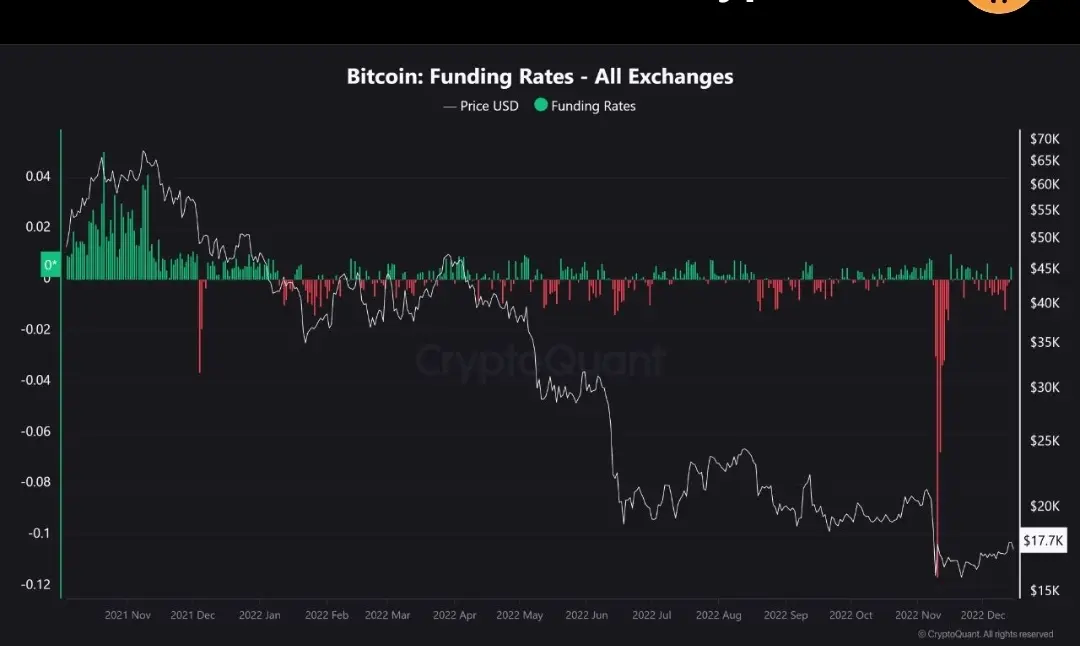

Funding rates have been negative for three consecutive days — short sellers are paying long traders.

This is what happens after leverage decreases, not when the market is euphoric.

Momentum remains weak, and the Chicago Mercantile Exchange gap near $84,000 has not yet been filled — but positions are becoming clearer, sentiment is cautious, and bullish traders are no longer crowded.

When no one wants this deal, the risk-to-reward ratio usually improves. Now, it’s about waiting for confirmation. ⌛️ 🚀

*Market chart illust

View OriginalFunding rates have been negative for three consecutive days — short sellers are paying long traders.

This is what happens after leverage decreases, not when the market is euphoric.

Momentum remains weak, and the Chicago Mercantile Exchange gap near $84,000 has not yet been filled — but positions are becoming clearer, sentiment is cautious, and bullish traders are no longer crowded.

When no one wants this deal, the risk-to-reward ratio usually improves. Now, it’s about waiting for confirmation. ⌛️ 🚀

*Market chart illust

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

When no one is interested in this deal, the risk-to-reward ratio usually improves. Now, it's a matter of waiting for confirmation. ⌛️ 🚀Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More12.22K Popularity

8.4K Popularity

5K Popularity

565 Popularity

2.98K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$2.79KHolders:10.00%

- MC:$2.79KHolders:10.00%

- MC:$2.8KHolders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreBitwise launches digital asset model portfolio solution

1 m

Chiliz will launch a US fan token, and 10% of its revenue will be used to buy back and burn CHZ tokens.

2 m

Safe: Revenue will exceed $10 million in 2025, but profitability has not yet been achieved.

6 m

Gate Launchpool Episode 359 launches Echelon(ELON), stake BTC or USD1 or ELON to share airdrop of 350,000 ELON

13 m

The Spanish Red Cross has launched RedChain, a blockchain-based aid system designed to improve the transparency and efficiency of humanitarian assistance efforts.

13 m

Pin