Post content & earn content mining yield

placeholder

Crypto_Exper

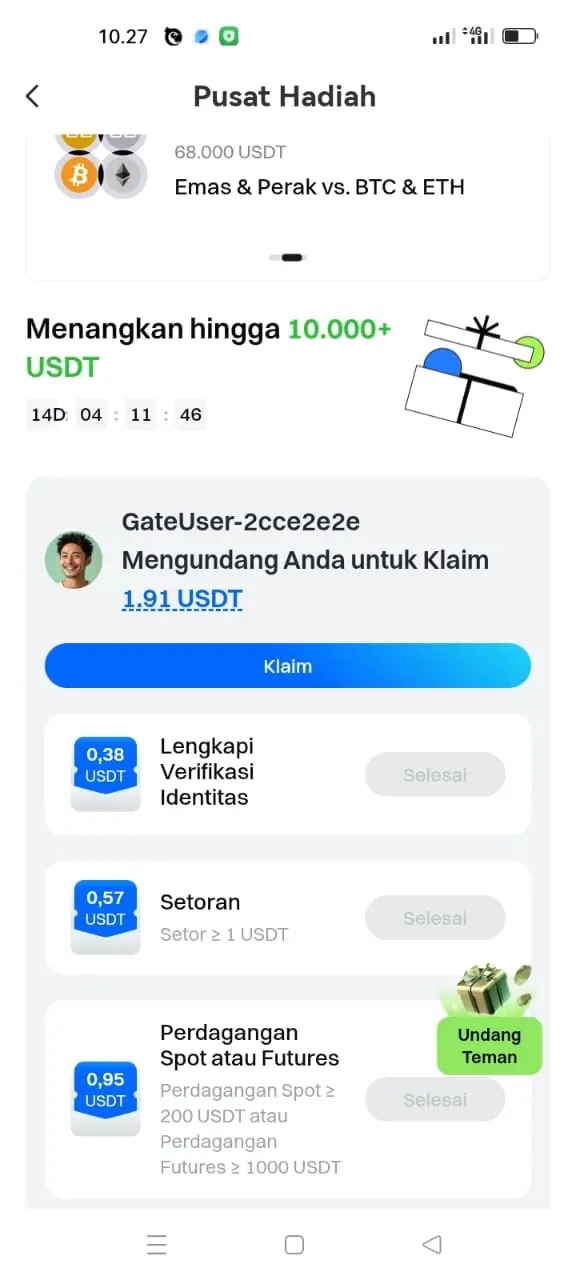

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4-gold-lucky-draw?ref_type=132

- Reward

- 2

- 1

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊Live Trading and Learning with Chillzzz

- Reward

- like

- 1

- Repost

- Share

YearOfTheHorseWealthExplosion :

:

New Year Wealth Explosion 🤑Ethereum Chart Analysis

On the 1-hour timeframe (1H), a clear bearish trend is visible. After a sharp decline from levels above 3400, the price of Ethereum entered a prolonged correction and consolidation phase. Currently, the asset is trading around $2945, trying to find solid ground beneath its feet.

Key support levels:

• $2892: An intermediate level where buyers previously showed activity.

• $2867: A local minimum. If the price breaks below this mark, the decline could accelerate to the $2700–$2800 zone.

Overall Context

Although the #GoldAndSilverHitRecordHighs, cryptomarket has not yet sho

On the 1-hour timeframe (1H), a clear bearish trend is visible. After a sharp decline from levels above 3400, the price of Ethereum entered a prolonged correction and consolidation phase. Currently, the asset is trading around $2945, trying to find solid ground beneath its feet.

Key support levels:

• $2892: An intermediate level where buyers previously showed activity.

• $2867: A local minimum. If the price breaks below this mark, the decline could accelerate to the $2700–$2800 zone.

Overall Context

Although the #GoldAndSilverHitRecordHighs, cryptomarket has not yet sho

ETH-0,54%

- Reward

- 1

- Comment

- Repost

- Share

兰亭序

兰亭序

Created By@V

Subscription Progress

0.00%

MC:

$0

Create My Token

Gate Alpha Launch Phase Charity Project Yanyan Angel Transaction tax will be donated to Yanyan Angel Children's Hospital. Welcome everyone to join in building the hottest Chinese MEME public welfare project on Sesame, and go public together to gain more exposure! Currently, a total of 1181 in transaction tax has been donated. Wishing all traders abundant virtue and blessings, spring fills the universe, and blessings fill the door #中文MEME

MEME-1,99%

[The user has shared his/her trading data. Go to the App to view more.]

MC:$18.76KHolders:3

49.76%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

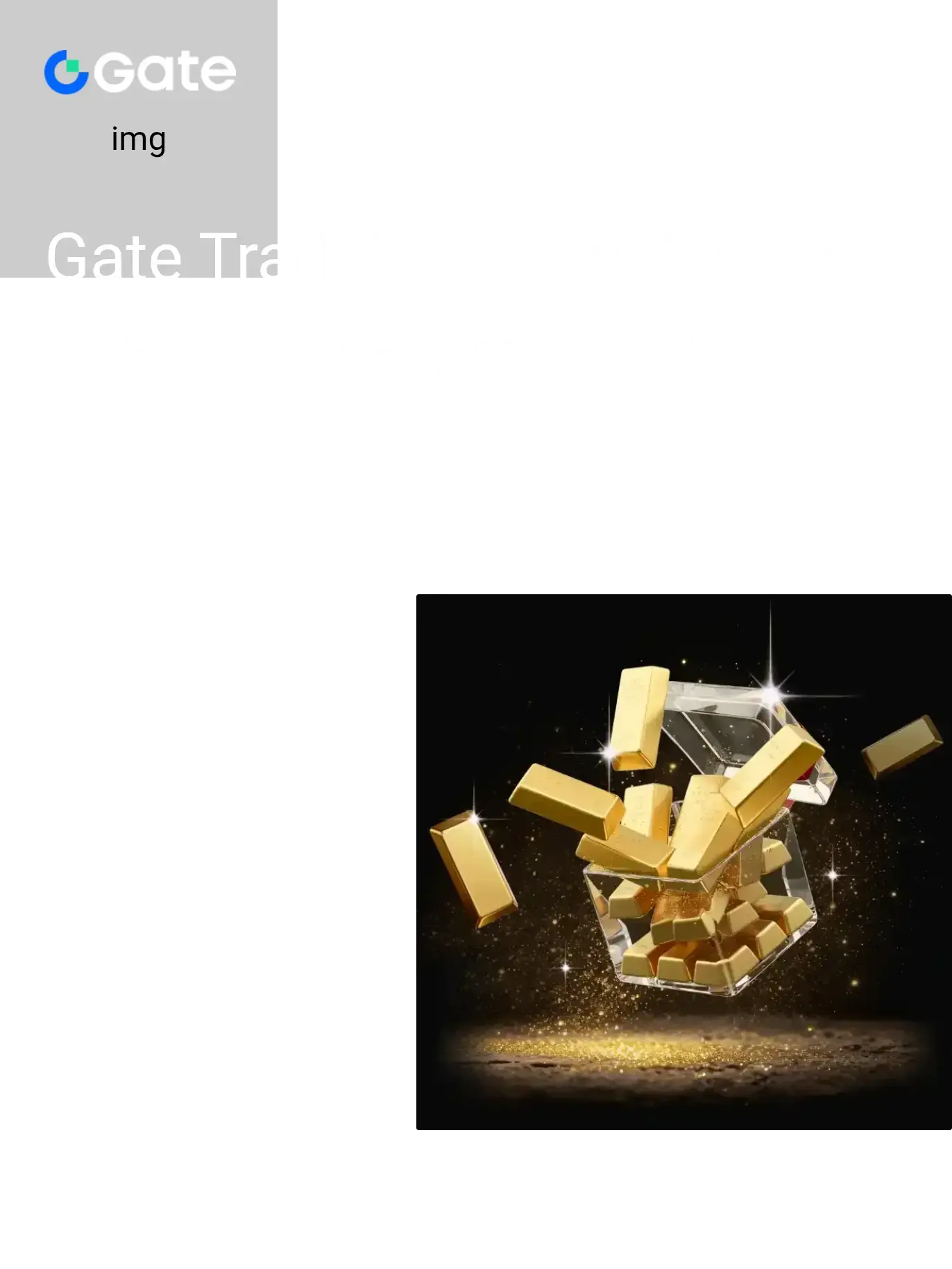

Hacks are still a huge problem.And most protocols never make it back.

- Reward

- like

- Comment

- Repost

- Share

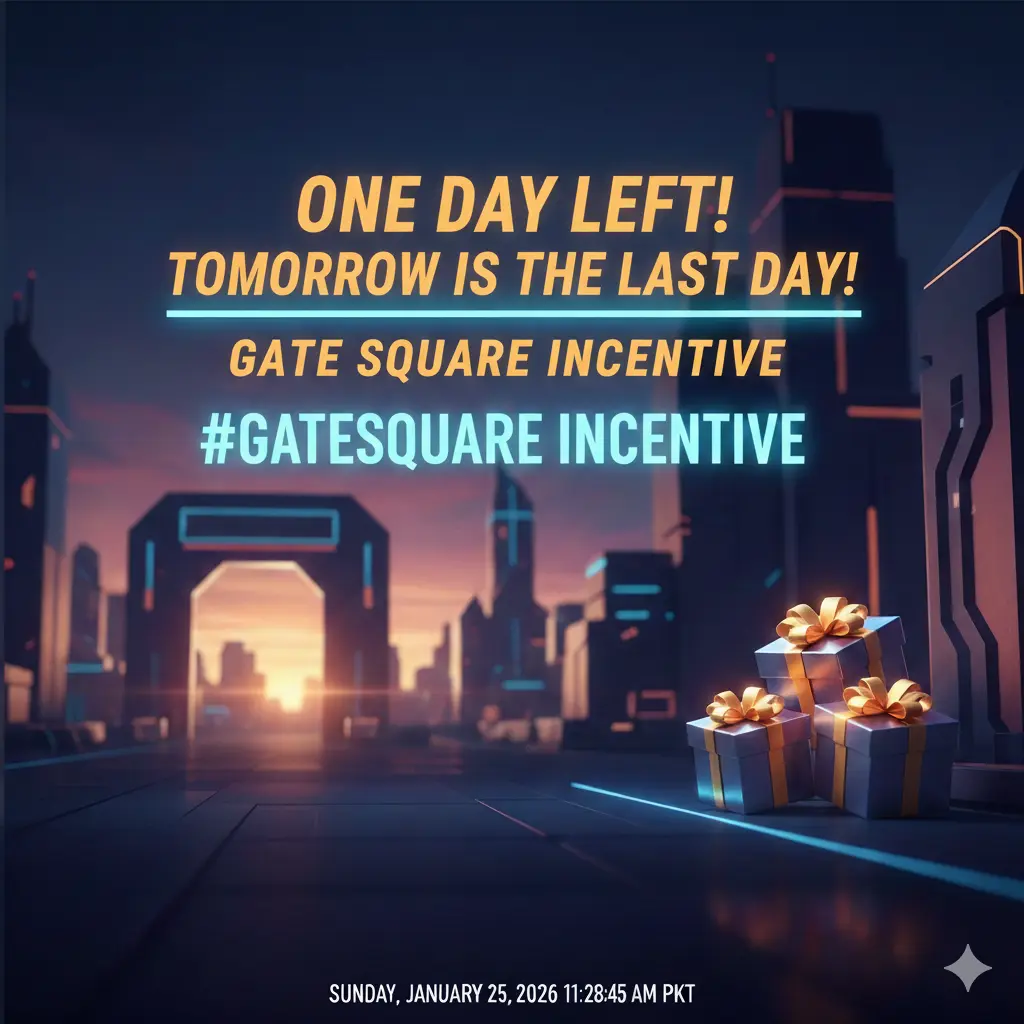

#GateSquareCreatorNewYearIncentives ⏳ Only 1️⃣ day left!

Last chance to grab your share of the $60,000 prize pool! 🎉

Creators who post with value now have the best shot at rewards.

🔥 Generous Rewards:

💰 Share $25,000 just by posting

🎁 10 lucky users win 1 GT + Gate cap

🎒 Top posters get Gate New Year merch & backpacks

🆕 New User Bonus:

✔ $50 for your first post

✔ + share of the $10,000 newcomer pool

📝 How to Join:

1️⃣ Sign up here: https://www.gate.com/questionnaire/7315

2️⃣ Post with text + your own creative edit (AI, infographic, caption, etc.)

📌 Event details: https://www.gate.com/a

Last chance to grab your share of the $60,000 prize pool! 🎉

Creators who post with value now have the best shot at rewards.

🔥 Generous Rewards:

💰 Share $25,000 just by posting

🎁 10 lucky users win 1 GT + Gate cap

🎒 Top posters get Gate New Year merch & backpacks

🆕 New User Bonus:

✔ $50 for your first post

✔ + share of the $10,000 newcomer pool

📝 How to Join:

1️⃣ Sign up here: https://www.gate.com/questionnaire/7315

2️⃣ Post with text + your own creative edit (AI, infographic, caption, etc.)

📌 Event details: https://www.gate.com/a

GT-0,6%

- Reward

- 1

- 3

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

#IranTradeSanctions

Global attention is once again turning toward Iran as trade sanctions tighten and enforcement becomes more aggressive. These measures are not just political signals — they have real economic consequences that ripple across energy markets, regional trade routes, and global supply chains.

Sanctions continue to restrict Iran’s access to international banking systems, limit oil exports, and discourage foreign investment. For everyday people, this often translates into higher inflation, currency pressure, and reduced access to imported goods. Businesses face shrinking trade chan

Global attention is once again turning toward Iran as trade sanctions tighten and enforcement becomes more aggressive. These measures are not just political signals — they have real economic consequences that ripple across energy markets, regional trade routes, and global supply chains.

Sanctions continue to restrict Iran’s access to international banking systems, limit oil exports, and discourage foreign investment. For everyday people, this often translates into higher inflation, currency pressure, and reduced access to imported goods. Businesses face shrinking trade chan

BTC-0,97%

- Reward

- 2

- 1

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎#GateTradFi1gGoldGiveaway, #GateTradFi1gGoldGiveaway, Of course. Here's an updated analysis of XAUt (Tether Gold), focusing on its current positioning, key metrics, and relevant market dynamics.

XAUt (Tether Gold) - Core Analysis Update

1. Fundamental Thesis: Digital Gold with Instant Settlement

XAUt is a digital asset where each token is backed 1:1 by one fine troy ounce of physical gold held in a Swiss vault. It combines the stability and intrinsic value of gold with the fungibility, programmability, and 24/7 transferability of a blockchain-based asset (Ethereum, Tron, EOS).

· Core Value Pro

XAUt (Tether Gold) - Core Analysis Update

1. Fundamental Thesis: Digital Gold with Instant Settlement

XAUt is a digital asset where each token is backed 1:1 by one fine troy ounce of physical gold held in a Swiss vault. It combines the stability and intrinsic value of gold with the fungibility, programmability, and 24/7 transferability of a blockchain-based asset (Ethereum, Tron, EOS).

· Core Value Pro

- Reward

- 3

- 3

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

GM Fam 👑 Are you still locked in ?

- Reward

- like

- Comment

- Repost

- Share

#IranTradeSanctions

#IranTradeSanctions adds a new layer of uncertainty to global markets.

A proposed 25% tariff on countries trading with Iran could be more than political signaling — it may affect trade routes, energy flows, and risk sentiment worldwide.

If enforced, this could push oil volatility higher, strengthen safe-haven demand, and pressure risk assets like equities and crypto in the short term.

If it remains political pressure, markets may quickly price it out.

I’m watching how commodities, the dollar, and BTC react to this headline.

Do you think this will be enforced or fade as ne

#IranTradeSanctions adds a new layer of uncertainty to global markets.

A proposed 25% tariff on countries trading with Iran could be more than political signaling — it may affect trade routes, energy flows, and risk sentiment worldwide.

If enforced, this could push oil volatility higher, strengthen safe-haven demand, and pressure risk assets like equities and crypto in the short term.

If it remains political pressure, markets may quickly price it out.

I’m watching how commodities, the dollar, and BTC react to this headline.

Do you think this will be enforced or fade as ne

BTC-0,97%

- Reward

- 1

- 1

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊#ElonMusk's depiction of the future of humanoid robots🤖 at the Davos Forum was truly shocking: robot production skyrocketing, economic output = robot productivity × quantity, ultimately saturating all human needs—you can't even imagine what they'll be used for! Based on the reality of an aging society: a global shortage of young people, high costs of elderly care, robots can provide 24/7 companionship and protect parents, solving the pain points of disappearing demographic dividends. At the same time, children and pets can also benefit—who wouldn't want a "never-tiring" guardian? But thinking

View Original- Reward

- like

- Comment

- Repost

- Share

oqoq

大鲨币

Created By@ixii

Listing Progress

0.00%

MC:

$3.39K

Create My Token

#RIVERUp50xinOneMonth

A One-Month Rally That Shocked the Crypto Market

The crypto market is no stranger to volatility, but every once in a while, a project delivers a move so strong that it captures the attention of the entire Web3 community. RIVER has done exactly that. In just one month, RIVER surged nearly 50x, transforming from a low-profile asset into one of the most talked-about tokens in the market.

This explosive growth was not driven by hype alone. Behind the #RIVERUp50xinOneMonth movement lies a powerful combination of strong fundamentals, increasing utility, and rapidly growing com

A One-Month Rally That Shocked the Crypto Market

The crypto market is no stranger to volatility, but every once in a while, a project delivers a move so strong that it captures the attention of the entire Web3 community. RIVER has done exactly that. In just one month, RIVER surged nearly 50x, transforming from a low-profile asset into one of the most talked-about tokens in the market.

This explosive growth was not driven by hype alone. Behind the #RIVERUp50xinOneMonth movement lies a powerful combination of strong fundamentals, increasing utility, and rapidly growing com

- Reward

- 1

- 2

- Repost

- Share

CryptoEye :

:

DYOR 🤓View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4-gold-lucky-draw?ref_type=132

- Reward

- 1

- Comment

- Repost

- Share

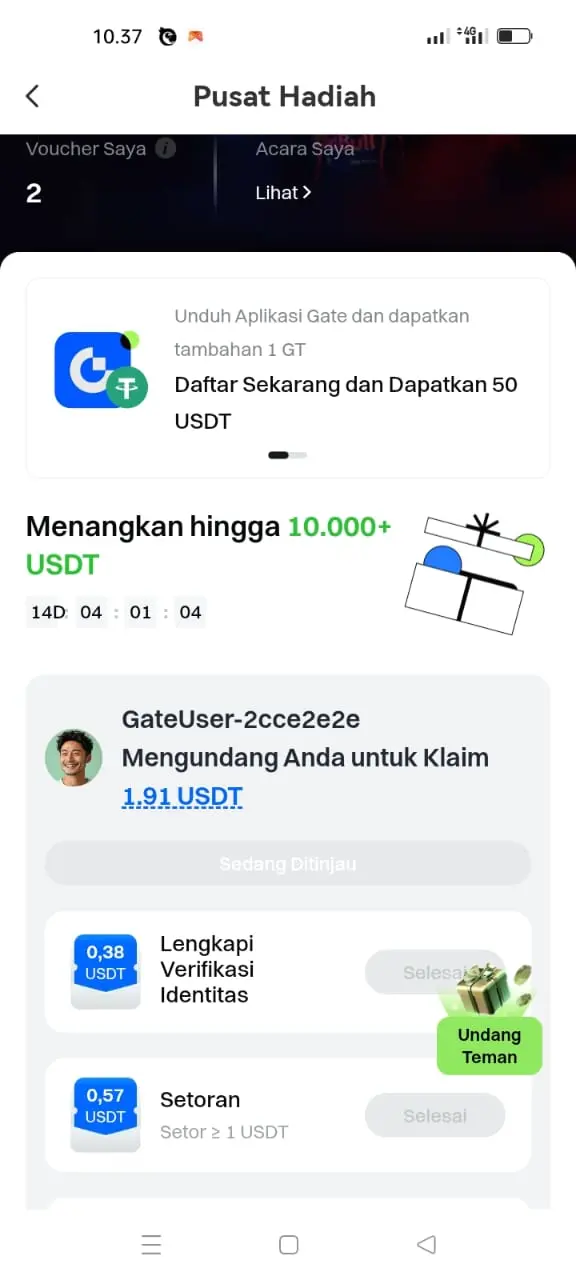

Hey, play with me on Gate.io. Masri, get interesting and many rewards, and you will receive special prizes.

View Original

- Reward

- like

- Comment

- Repost

- Share

Analysis of the Afternoon of the 25th

The current situation is clear: Bitcoin is in a volatile downward trend, with rebounds lacking trading volume support and clearly insufficient upward momentum. In this market environment, there’s no need for complex strategies over the weekend; the core approach is simple: follow the trend and focus on short positions.

Multiple short-term attempts to rebound have faced resistance, with the 89,500-90,000 range becoming a clear resistance zone. Due to continuous shrinking of trading volume, upward attempts are weak, and every rebound is an opportunity to pos

View OriginalThe current situation is clear: Bitcoin is in a volatile downward trend, with rebounds lacking trading volume support and clearly insufficient upward momentum. In this market environment, there’s no need for complex strategies over the weekend; the core approach is simple: follow the trend and focus on short positions.

Multiple short-term attempts to rebound have faced resistance, with the 89,500-90,000 range becoming a clear resistance zone. Due to continuous shrinking of trading volume, upward attempts are weak, and every rebound is an opportunity to pos

- Reward

- 1

- 2

- Repost

- Share

TheFateOfTheWoodenMan :

:

Hold on tight, we're about to take off 🛫View More

Southeast Asian Delicacy Nyonya Curry Coconut Rice 3u Everyone Who Has Tried Knows Its Value

View Original

- Reward

- like

- Comment

- Repost

- Share

Plz join my live stream friends 🤝

- Reward

- 3

- 4

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More62.77K Popularity

37.62K Popularity

31K Popularity

12.02K Popularity

25.07K Popularity

News

View MoreWarden completes $4 million strategic financing, with 0G, Messari, and Venice participating.

51 m

Aztec: AZTEC TGE proposal sequencer signal confirmation completed and community voting will commence

59 m

Data: A certain contract whale has been 20x long BTC in the past 1 day, with an overall position size exceeding 63 million USD.

1 h

Colombia's second-largest pension fund manager AFP Protección plans to launch a Bitcoin exposure fund

1 h

Seven Linked Wallets Purchase 4,300 XAUT for $21.71 Million

1 h

Pin