# IranTradeSanctions

8.71K

Trump says the U.S. will impose a 25% tariff on countries trading with Iran. Do you think this will be enforced or political pressure remians? Could it escalate geopolitics and impact financial and crypto markets?

HanssiMazak

#IranTradeSanctions Iran’s trade sanctions story in early 2026 has escalated from a long-running geopolitical tool into a wide-ranging force reshaping global economics and diplomacy. What began as targeted penalties tied to nuclear concerns and regional behavior has morphed into one of the most complex cross-border legislative and diplomatic challenges in recent decades. The multifaceted sanctions now not only restrict Tehran’s access to capital and technology, but also place pressure on Iran’s entire network of trading partners and global supply chains.

A dramatic recent development came when

A dramatic recent development came when

- Reward

- 5

- 5

- Repost

- Share

Peacefulheart :

:

HODL Tight 💪View More

#IranTradeSanctions

The "Domino Effect" in Global Trade: 2026 Iran Sanctions

As of the first weeks of 2026, the pressure on Iran has reached unprecedented levels. This time, the issue is not just about "what is being sold to Tehran," but rather "who is sitting at the table with Tehran."

1. Trump’s "25% Tariff": A Global Warning

In January 2026, U.S. President Donald Trump shook the foundations of the trade world with a radical social media announcement: "Any country doing business with Iran will face a 25% additional customs tariff on their exports to the United States."

The Impact: This move

The "Domino Effect" in Global Trade: 2026 Iran Sanctions

As of the first weeks of 2026, the pressure on Iran has reached unprecedented levels. This time, the issue is not just about "what is being sold to Tehran," but rather "who is sitting at the table with Tehran."

1. Trump’s "25% Tariff": A Global Warning

In January 2026, U.S. President Donald Trump shook the foundations of the trade world with a radical social media announcement: "Any country doing business with Iran will face a 25% additional customs tariff on their exports to the United States."

The Impact: This move

- Reward

- 65

- 64

- Repost

- Share

snowflakee :

:

Happy New Year! 🤑View More

#IranTradeSanctions In 2025–2026, trade sanctions on Iran have once again become a central focus of international politics and global markets, driven by long‑standing tensions between Tehran and the United States, European powers, and the United Nations. Sanctions are economic and financial penalties designed to pressure Iran over its nuclear program, human rights issues, and regional behavior. In recent weeks, these sanctions have taken on new dimensions with unexpected tariff threats from the United States and renewed global enforcement mechanisms that are reshaping Iran’s economic landscape

- Reward

- 7

- 15

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

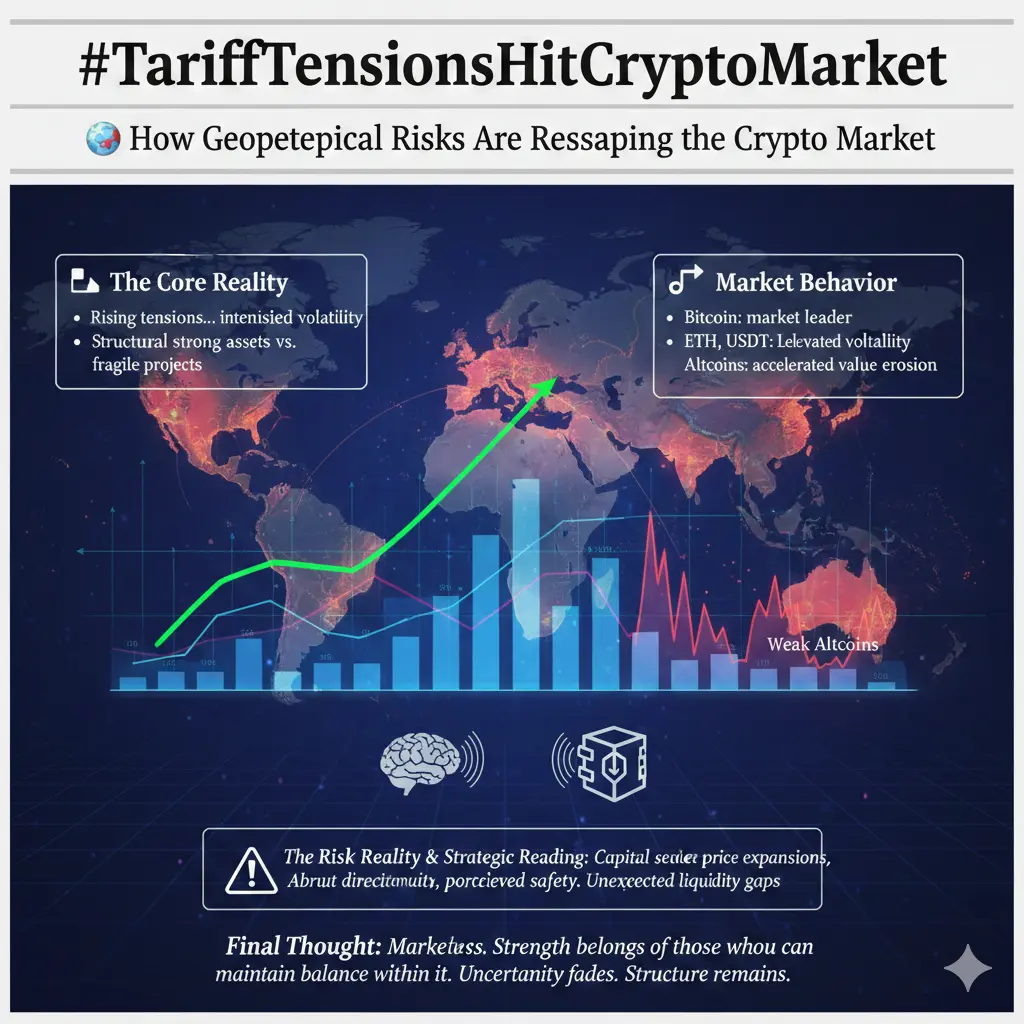

#IranTradeSanctions 💥 The United States’ threat to impose a 25% tariff on countries trading with Iran has sent ripples across global trade, geopolitics, and financial markets. While enforcement remains uncertain, the perception of risk alone is enough to drive volatility across equities, commodities, and digital assets. Market participants are reacting not just to policy announcements, but to the potential structural implications of disrupted trade flows.

Macro and Geopolitical Context

Iran is a major oil producer, and any restriction on its exports could immediately affect global energy mark

Macro and Geopolitical Context

Iran is a major oil producer, and any restriction on its exports could immediately affect global energy mark

- Reward

- 12

- 16

- Repost

- Share

QinShu :

:

Bull Run 🐂View More

#IranTradeSanctions

💥 IranTradeSanctions U.S. Threatens 25% Tariffs on Iran Trading Partners: Macro Shockwaves, Geopolitical Escalation, and Crypto Implications

The announcement that the United States may impose a 25% tariff on countries trading with Iran is far from a standard trade headline. This is a potential structural shock to global trade, geopolitics, and financial markets, one that requires serious attention from traders, allocators, and crypto participants alike. Even if full enforcement is uncertain, the market’s perception of risk alone can create volatility across equities, comm

💥 IranTradeSanctions U.S. Threatens 25% Tariffs on Iran Trading Partners: Macro Shockwaves, Geopolitical Escalation, and Crypto Implications

The announcement that the United States may impose a 25% tariff on countries trading with Iran is far from a standard trade headline. This is a potential structural shock to global trade, geopolitics, and financial markets, one that requires serious attention from traders, allocators, and crypto participants alike. Even if full enforcement is uncertain, the market’s perception of risk alone can create volatility across equities, comm

- Reward

- 11

- 13

- Repost

- Share

repanzal :

:

Watching Closely 🔍️View More

#IranTradeSanctions

U.S. Imposes 25% Tariffs on Countries Trading with Iran: Geopolitical Tensions and Market Implications

The Trump administration has announced plans to impose a 25% tariff on countries that maintain trade with Iran, signaling a potential escalation in global trade and geopolitical tensions. This move is intended to pressure countries into limiting economic engagement with Iran, particularly in sectors like energy, manufacturing, and technology.

While the announcement is bold, questions remain about enforcement, compliance, and real-world economic impact. Markets are already

U.S. Imposes 25% Tariffs on Countries Trading with Iran: Geopolitical Tensions and Market Implications

The Trump administration has announced plans to impose a 25% tariff on countries that maintain trade with Iran, signaling a potential escalation in global trade and geopolitical tensions. This move is intended to pressure countries into limiting economic engagement with Iran, particularly in sectors like energy, manufacturing, and technology.

While the announcement is bold, questions remain about enforcement, compliance, and real-world economic impact. Markets are already

BTC0,14%

- Reward

- 10

- 18

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

#IranTradeSanctions

1) What’s Happening Now

New US Tariff Threat Linked to Iran

The United States government has threatened a 25 % tariff on any country doing business with Iran, a broad measure aimed at isolating Tehran economically by forcing other nations to choose between trading with Iran or keeping full access to the US market. This threat has drawn strong criticism from China and Russia, which oppose interference and argue such measures harm global trade and stability.

European Union Moves Toward New Sanctions

The European Commission is planning additional sanctions on Iran’s exports

1) What’s Happening Now

New US Tariff Threat Linked to Iran

The United States government has threatened a 25 % tariff on any country doing business with Iran, a broad measure aimed at isolating Tehran economically by forcing other nations to choose between trading with Iran or keeping full access to the US market. This threat has drawn strong criticism from China and Russia, which oppose interference and argue such measures harm global trade and stability.

European Union Moves Toward New Sanctions

The European Commission is planning additional sanctions on Iran’s exports

- Reward

- 8

- 7

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#IranTradeSanctions

Global markets and geopolitical discussions are once again centered on Iran trade sanctions, as economic pressure remains one of the most powerful tools shaping international relations in the modern world. The hashtag #IranTradeSanctions reflects the ongoing restrictions placed on Iran’s trade, financial systems, and energy exports, which continue to influence not only the country’s domestic economy but also regional stability and global market dynamics. Sanctions are no longer viewed merely as political statements; they have evolved into strategic mechanisms that can resh

Global markets and geopolitical discussions are once again centered on Iran trade sanctions, as economic pressure remains one of the most powerful tools shaping international relations in the modern world. The hashtag #IranTradeSanctions reflects the ongoing restrictions placed on Iran’s trade, financial systems, and energy exports, which continue to influence not only the country’s domestic economy but also regional stability and global market dynamics. Sanctions are no longer viewed merely as political statements; they have evolved into strategic mechanisms that can resh

- Reward

- 2

- 7

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

#IranTradeSanctions In 2025–2026, trade sanctions on Iran have once again become a central focus of international politics and global markets, driven by long‑standing tensions between Tehran and the United States, European powers, and the United Nations. Sanctions are economic and financial penalties designed to pressure Iran over its nuclear program, human rights issues, and regional behavior. In recent weeks, these sanctions have taken on new dimensions with unexpected tariff threats from the United States and renewed global enforcement mechanisms that are reshaping Iran’s economic landscape

- Reward

- 5

- 6

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#IranTradeSanctions

The “Domino Effect” in Global Trade: 2026 Iran Sanctions

As of the first weeks of 2026, the pressure on Iran has reached unprecedented levels. This time, the issue is not just about “what is being sold to Tehran,” but rather “who is sitting at the table with Tehran.”

1. Trump’s “25% Tariff”: A Global Warning

In January 2026, U.S. President Donald Trump shook the foundations of the trade world with a radical social media announcement: “Any country doing business with Iran will face a 25% additional customs tariff on their exports to the United States.”

The Impact: This mov

The “Domino Effect” in Global Trade: 2026 Iran Sanctions

As of the first weeks of 2026, the pressure on Iran has reached unprecedented levels. This time, the issue is not just about “what is being sold to Tehran,” but rather “who is sitting at the table with Tehran.”

1. Trump’s “25% Tariff”: A Global Warning

In January 2026, U.S. President Donald Trump shook the foundations of the trade world with a radical social media announcement: “Any country doing business with Iran will face a 25% additional customs tariff on their exports to the United States.”

The Impact: This mov

- Reward

- 2

- 3

- Repost

- Share

Peacefulheart :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

37.64K Popularity

21.14K Popularity

15.39K Popularity

3.89K Popularity

11.39K Popularity

10.33K Popularity

8.71K Popularity

76.85K Popularity

37K Popularity

20.75K Popularity

7.72K Popularity

110.37K Popularity

252.7K Popularity

20.58K Popularity

180.09K Popularity

News

View MoreParadex caused liquidation due to database maintenance errors, refunding $650,000 to 200 users

31 m

Yesterday, the US spot Ethereum ETF experienced a net outflow of $41.7 million, marking the fourth consecutive day of net outflows.

51 m

Ethereum spot ETF saw a net outflow of $41,735,800 yesterday, continuing a 4-day net outflow.

54 m

Yesterday, the US spot Bitcoin ETF experienced a net outflow of $103.5 million, marking the fourth consecutive trading day of net outflows.

55 m

Bitcoin spot ETF experienced a net outflow of $104 million yesterday, marking the fifth consecutive day of net outflows.

55 m

Pin