#PartialGovernmentShutdownEnds Market Impact & Analysis

The conclusion of a partial U.S. government shutdown removes a significant layer of uncertainty from financial markets, but it is not a standalone bullish catalyst. Think of it as risk normalization rather than an immediate market trigger. Here’s a detailed breakdown of its implications:

🔹 1) Macro Sentiment Reset

The shutdown had forced institutions into defensive positioning and created hesitation around liquidity deployment. With federal operations, data releases, and payments now restored, market participants can operate with more confidence.

📌 Key Insight: Relief is reflected in reduced uncertainty, but future direction still depends on upcoming macroeconomic data and policy decisions.

🔹 2) Traditional Markets Response

Equities: Short-term stabilization is expected, particularly in government-linked sectors and contractors.

Bonds: Volatility typically declines as fiscal uncertainty eases.

USD: Often sees modest strength as confidence in governance returns.

Overall, this is normalization rather than a sudden shift — markets adjust smoothly without dramatic spikes.

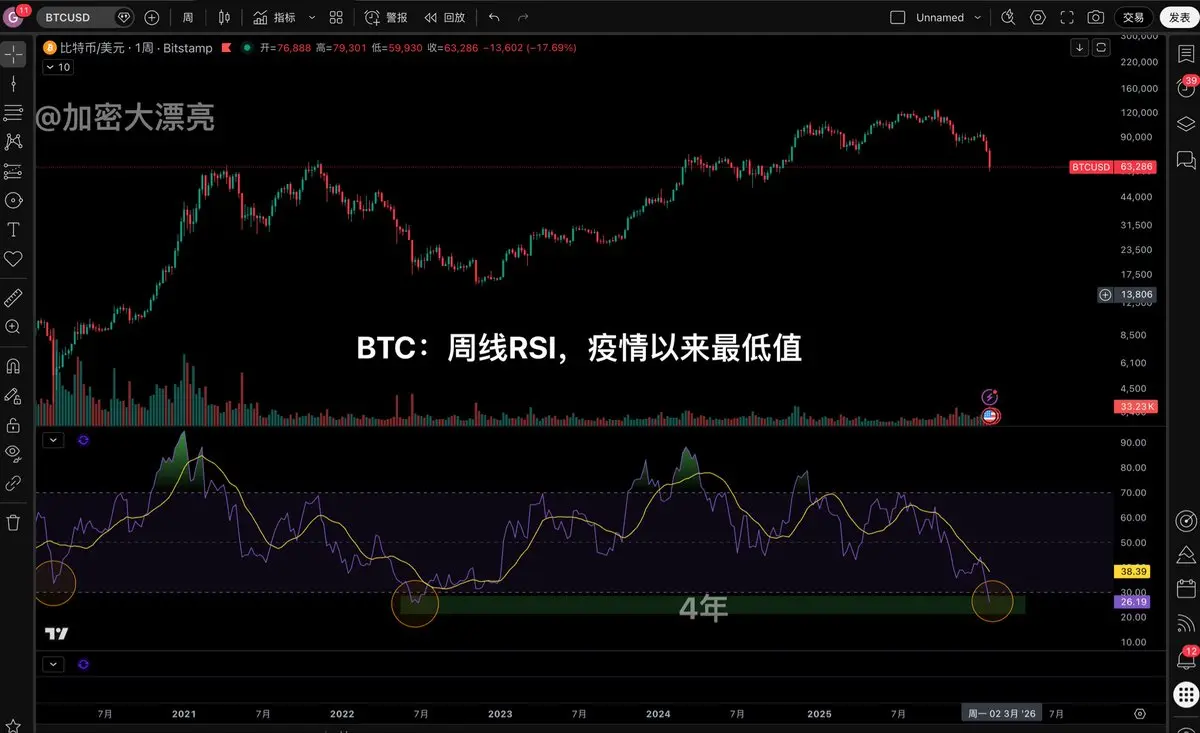

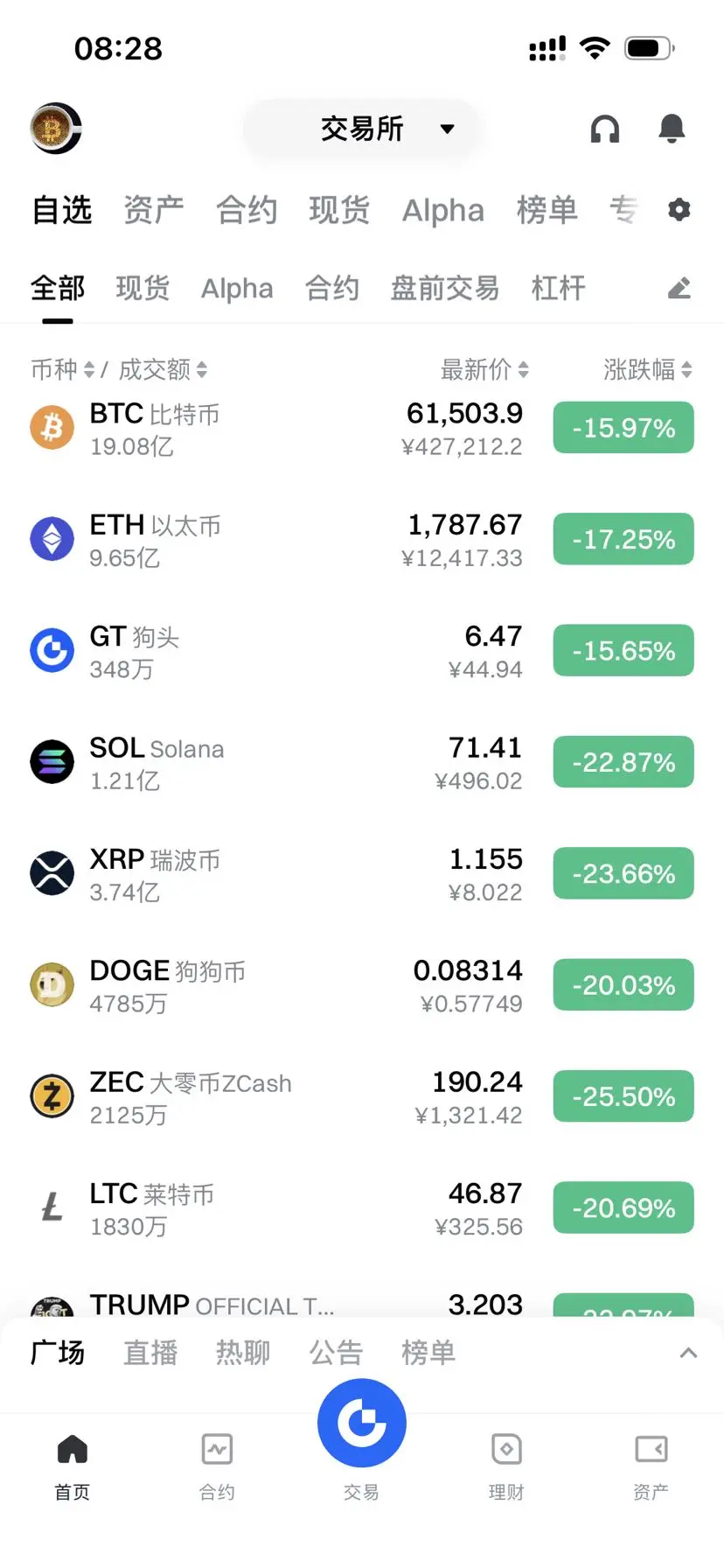

🔹 3) Crypto Market Implications

Cryptocurrency markets had partially priced in the shutdown as:

• Hesitation in deploying capital

• Risk-off positioning by traders

With the shutdown over:

• Downside tail risk is reduced

• There is no immediate bullish trigger

📉 Crypto gains structural support from reduced uncertainty, but this alone is unlikely to drive aggressive upside.

🔹 4) Smart Money Focus

With political uncertainty resolved, attention turns to fundamental drivers:

• Upcoming inflation and labor market data

• Federal Reserve rate expectations

• Treasury issuance schedules and liquidity conditions

These factors will dictate both short-term volatility and medium-term trends in traditional and crypto markets.

🔹 5) Key Takeaway

Ending a government shutdown is about removing risk, not confirming risk-on conditions. Markets may grind higher gradually rather than surge abruptly. True momentum will depend on economic data, liquidity flows, and monetary policy signals — not politics alone.

The conclusion of a partial U.S. government shutdown removes a significant layer of uncertainty from financial markets, but it is not a standalone bullish catalyst. Think of it as risk normalization rather than an immediate market trigger. Here’s a detailed breakdown of its implications:

🔹 1) Macro Sentiment Reset

The shutdown had forced institutions into defensive positioning and created hesitation around liquidity deployment. With federal operations, data releases, and payments now restored, market participants can operate with more confidence.

📌 Key Insight: Relief is reflected in reduced uncertainty, but future direction still depends on upcoming macroeconomic data and policy decisions.

🔹 2) Traditional Markets Response

Equities: Short-term stabilization is expected, particularly in government-linked sectors and contractors.

Bonds: Volatility typically declines as fiscal uncertainty eases.

USD: Often sees modest strength as confidence in governance returns.

Overall, this is normalization rather than a sudden shift — markets adjust smoothly without dramatic spikes.

🔹 3) Crypto Market Implications

Cryptocurrency markets had partially priced in the shutdown as:

• Hesitation in deploying capital

• Risk-off positioning by traders

With the shutdown over:

• Downside tail risk is reduced

• There is no immediate bullish trigger

📉 Crypto gains structural support from reduced uncertainty, but this alone is unlikely to drive aggressive upside.

🔹 4) Smart Money Focus

With political uncertainty resolved, attention turns to fundamental drivers:

• Upcoming inflation and labor market data

• Federal Reserve rate expectations

• Treasury issuance schedules and liquidity conditions

These factors will dictate both short-term volatility and medium-term trends in traditional and crypto markets.

🔹 5) Key Takeaway

Ending a government shutdown is about removing risk, not confirming risk-on conditions. Markets may grind higher gradually rather than surge abruptly. True momentum will depend on economic data, liquidity flows, and monetary policy signals — not politics alone.