Besides 114514, what other Meme coins can you buy? These 3 strategies will ensure you don't miss out

114514 Two days of surge, 250 times increase, breaking through a $40 million market cap, Meme coin total market cap rebounded from 35 billion to 50 billion, Pepe weekly up 70%. Investors should focus on three major directions: attention rotation new hotspots, classical Meme coins, and income-generating projects with token rights.

Why 114514 Can Replicate the White Whale Myth

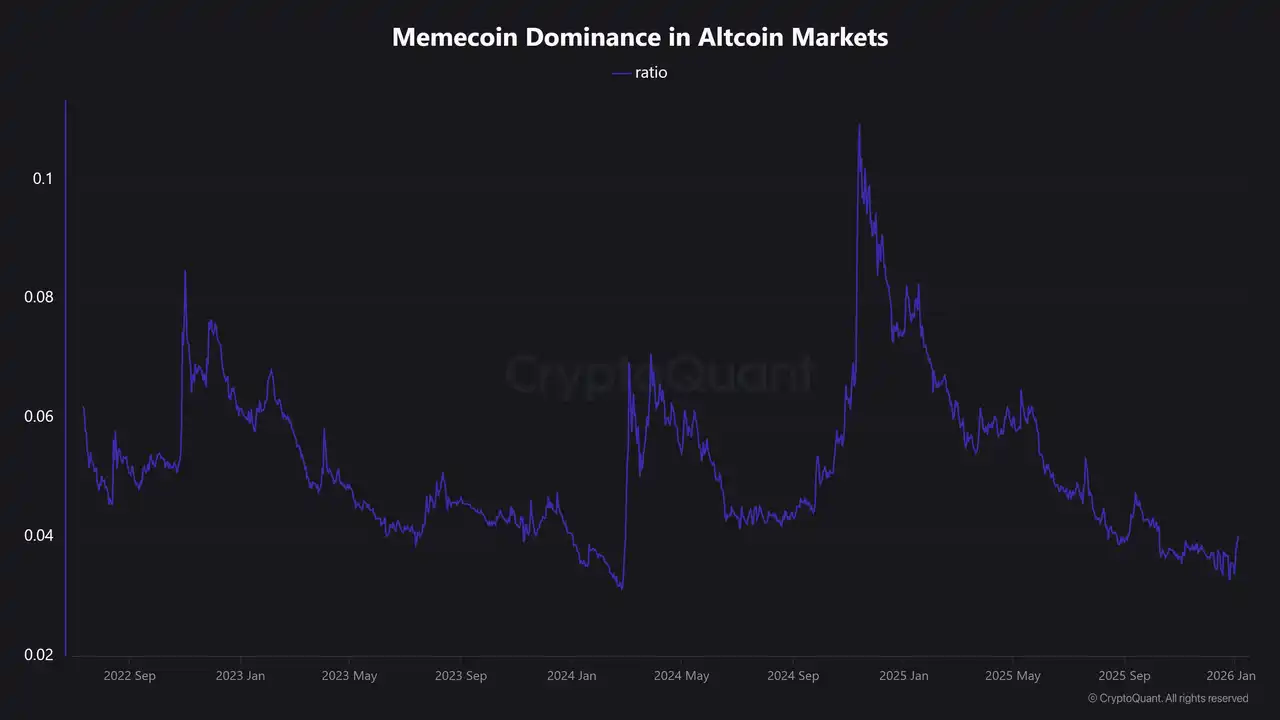

(Source: CryptoQuant)

The sharp rise of 114514 is not accidental but signals a new cycle in the Meme coin market. Since mid-September 2025, the total market cap of Meme coins has gradually declined from about $80 billion to a low of only $35 billion, with little significant rebound along the way. But entering 2026, in the first week of the new year, the total market cap of Meme coins finally rebounded, approaching $50 billion.

A more critical indicator is the proportion of Meme coins within the overall altcoin market. This ratio has nearly reached the lowest point since July 2022, remaining at about 3%. By 2026, this indicator has rebounded to around 4%. This shift from extreme depression to recovery often marks the beginning of a new wave of wealth creation opportunities.

The meme reference “114514” originates from a Japanese adult film in 2001, where an actor’s line “Alright! Come on! (いいよ!こいよ)” is phonetically represented as “114514” in Japanese numbers. Although this is an old meme that started circulating in 2011, its explosion in the crypto space demonstrates the lasting vitality of cultural memes in the crypto market. The success of White Whale just over a week ago also shows that attention shifts are becoming rapid again.

Three Major Investment Directions to Capture New Meme Coin Opportunities

The recent Meme coin rebound gives a nostalgic vibe. The market cycle has shifted from “newbie sh*tcoins” back to “classic old coins.” Large-cap, long-lifecycle Meme coins like Doge, Shiba, Pepe, BONK, Pengu, SPX, and Fartcoin have all surged over the past week, with no decline below 20%. If this trend continues, based on past experience, we may see a repeat of the previous bull markets where large-cap Meme coins led the charge and new stars emerged.

Direction One: New Golden Dogs in Attention Rotation

In the game of attention tokens, it’s not about asking why but about judging how other players will think. The emotional spillover of 114514 can be understood from the Japanese Meme culture perspective or as a pure number meme like “42069.” Similar logic includes:

Cultural Meme Coins: Internet memes with cross-cultural dissemination potential, such as anime, gaming, movies

Pure Number Memes: Easily memorable and shareable number combinations like 420, 69, 1337

Current Hot Topics: Meme coins that respond quickly to current social events

The key is to judge what reasons will be accepted by most as buying signals, along with luck.

Direction Two: Classical Meme Coins Proven by Time

In this rebound, the return of “classical Meme coins” like Pepe, BONK, Pengu is surprising. These large-cap, long-standing Meme coins that have been tested over time have not been in the spotlight for a long time. Murad’s “Super Cycle of Meme Coins” theory includes criteria such as maintaining a large market cap (over $5 million), having endured at least 6 months of testing, possessing clear goals and concepts, and resonating emotionally with holders to facilitate holding.

According to these standards, besides the market-accepted “too big to fail” coins like Doge, Shiba, Pepe, BONK, Pengu, there are many potential candidates:

Large-cap stable type: SPX, Fartcoin, Mog, BITCOIN (HarryPotterObamaSonic10Inu)

Mid-cap growth type: neet, Chillhouse, Joe, etc.

Evaluation criteria: social media activity, community cohesion, ongoing operational capacity

These coins aim not just for internal stability but to attract external incremental via multiple channels, even influencing the real world from a Meme culture perspective.

Direction Three: Revenue-Driven Projects with Token Rights

For a long time, projects in the crypto space with impressive revenue reports have been hard to analyze using stock market P/E ratios because token holders do not enjoy rights like dividends. But since last year, progress has been seen: Uniswap fee switch successfully turned on, and Aave Labs promised to share protocol-generated revenue with token holders.

Looking further, Uniswap and Aave remain top market caps, while Hyperliquid’s rapid growth has significantly boosted the Perp DEX sector’s ceiling. If the market continues to trend upward, projects that excel in revenue and profit sharing are likely to gain more recognition.

Three Key Principles to Seize Opportunities

The Meme coin rebound is seen by optimistic crypto players as the start of a new full-market cycle. Historically, Meme coins have often been early indicators of market risk appetite shifts, such as Doge in 2021, Bome and pump.fun in 2024. Since Meme coins rely on emotional support and are easily discussed on social media, increased positive discussion during rallies can quickly create a full-blown bull market atmosphere among retail investors.

For ordinary investors, a diversified strategy is recommended: 30% in classic Meme coins for steady holding, 30% in attention rotation for quick entry and exit, 30% in income projects for long-term holding, and 10% in cash to respond to opportunities. Only invest funds you can afford to lose, set strict stop-losses, and avoid FOMO-driven irrational decisions.

Related Articles

Dogecoin Leads a Risk-On Frenzy as Memecoins Outrun Bitcoin

ZEC Price Prediction: Can Zcash Sustain Rally Toward $293?

Altcoins Heat This Valentine’s Week: 5 Coins Flashing 80% Upside as MACD Signals a Major Breakout

“Not Panic Selling”: Pierre Rochard on Bitcoin’s 21M Edge

Here’s Where Hedera (HBAR) Price Could Go This Week