Post content & earn content mining yield

placeholder

Watcher.Guru

JUST IN: $4,850 Gold

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

又没赚上

又没赚上

Created By@MakeMoneyToGetGender

Listing Progress

0.00%

MC:

$3.37K

Create My Token

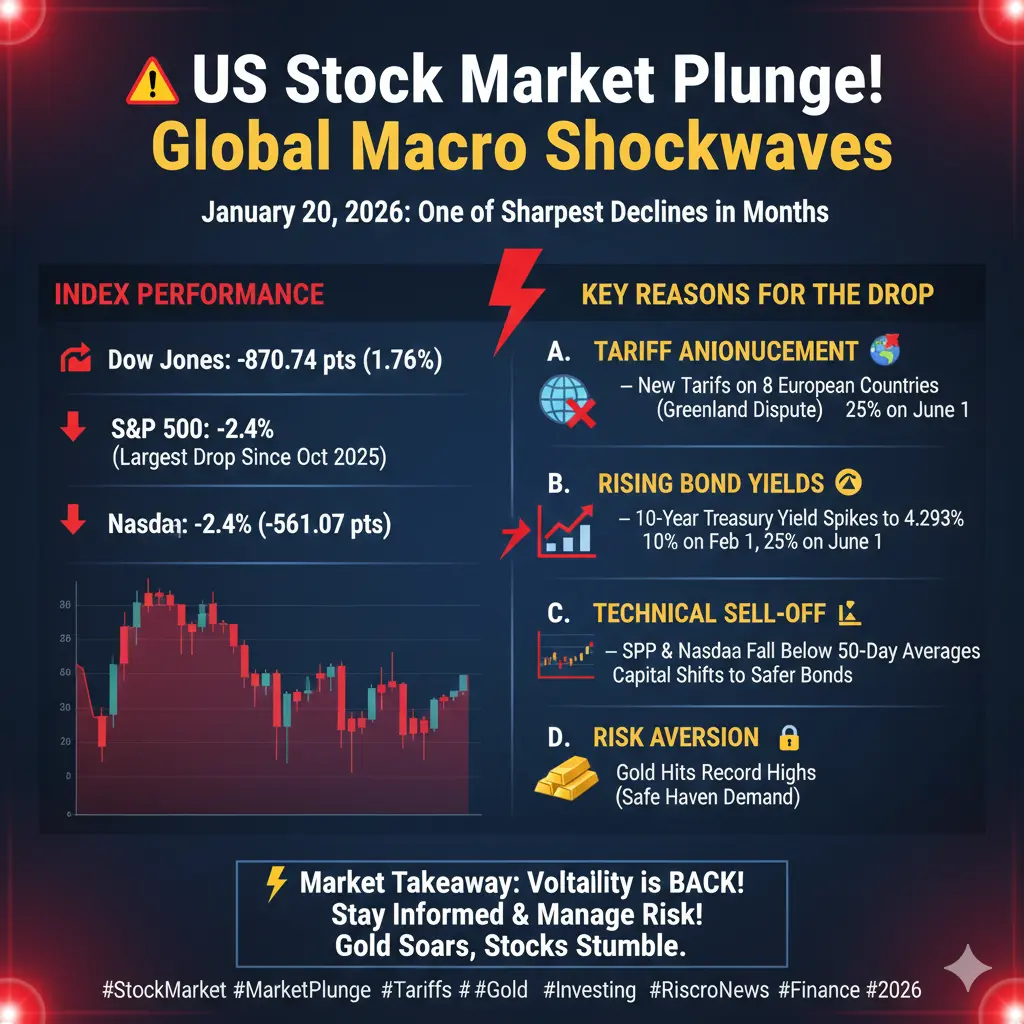

#MajorStockIndexesPlunge

US Stock Market Plunge: What Investors Need to Know

On January 20, 2026, the U.S. stock market experienced one of its sharpest one-day declines in months. All three major indexes — Dow Jones, S&P 500, and Nasdaq — fell dramatically, signaling heightened market uncertainty.

1. Index Performance

Dow Jones Industrial Average: Fell 870.74 points (–1.76%), closing at 48,488.59

S&P 500: Dropped 2.4%, its largest decline since October 2025

Nasdaq Composite: Declined 561.07 points (–2.4%), closing at 22,954.32

This widespread decline highlights that investors are reacting to

US Stock Market Plunge: What Investors Need to Know

On January 20, 2026, the U.S. stock market experienced one of its sharpest one-day declines in months. All three major indexes — Dow Jones, S&P 500, and Nasdaq — fell dramatically, signaling heightened market uncertainty.

1. Index Performance

Dow Jones Industrial Average: Fell 870.74 points (–1.76%), closing at 48,488.59

S&P 500: Dropped 2.4%, its largest decline since October 2025

Nasdaq Composite: Declined 561.07 points (–2.4%), closing at 22,954.32

This widespread decline highlights that investors are reacting to

- Reward

- 5

- 7

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

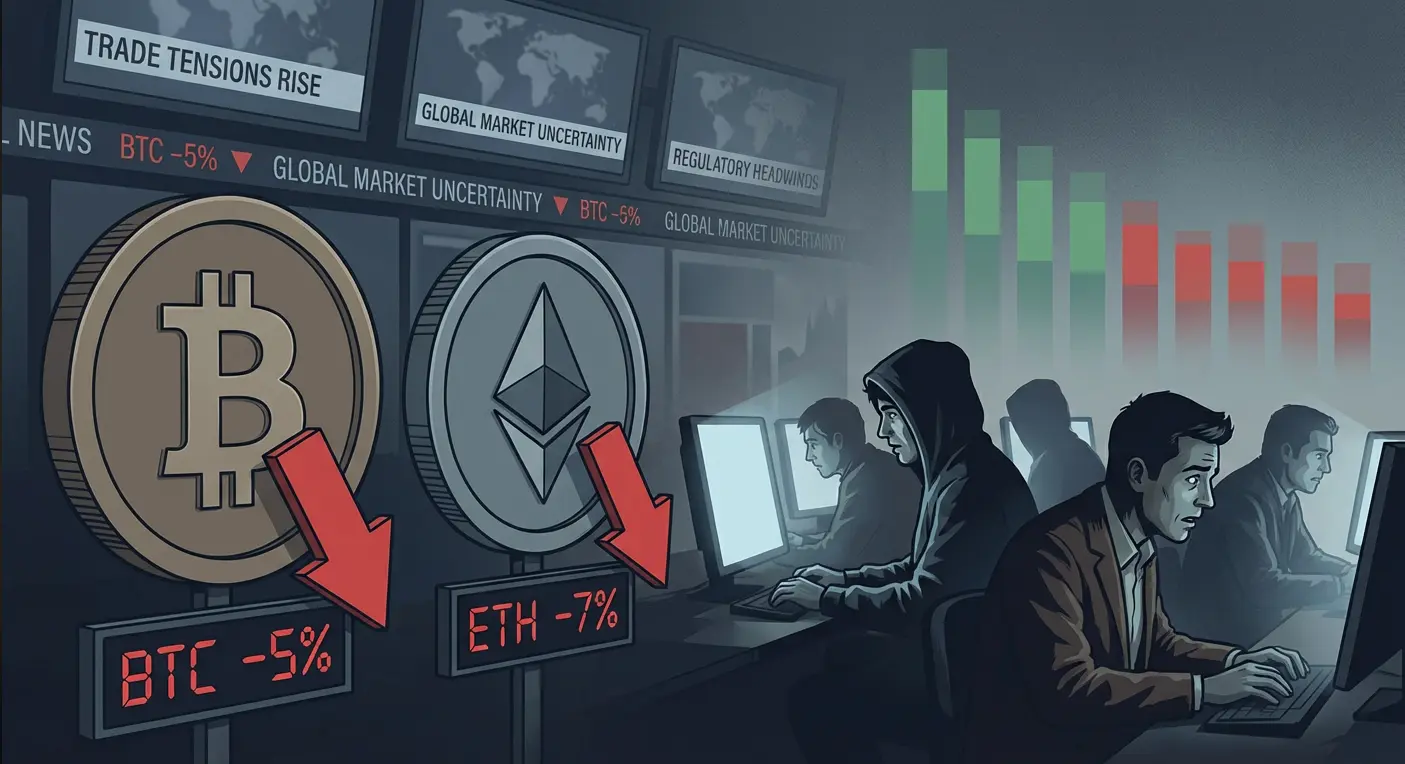

#TariffTensionsHitCryptoMarket

Tariff Tensions Hit Crypto Market Evaluating Risk-Off Sentiment, BTC Pullback, and Strategic Outlook Amid Trade Uncertainty

The crypto market has recently felt the effects of renewed tariff threats, triggering a notable risk-off sentiment that has weighed heavily on Bitcoin (BTC) and major altcoins. After a brief surge earlier, BTC saw a sharp pullback as investors recalibrated positions in response to the heightened uncertainty surrounding trade policies. This raises an important question for market participants: is the current reaction a rational pricing-in of

Tariff Tensions Hit Crypto Market Evaluating Risk-Off Sentiment, BTC Pullback, and Strategic Outlook Amid Trade Uncertainty

The crypto market has recently felt the effects of renewed tariff threats, triggering a notable risk-off sentiment that has weighed heavily on Bitcoin (BTC) and major altcoins. After a brief surge earlier, BTC saw a sharp pullback as investors recalibrated positions in response to the heightened uncertainty surrounding trade policies. This raises an important question for market participants: is the current reaction a rational pricing-in of

BTC-2.17%

- Reward

- 1

- 1

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊Today's strategy has been shared

Place order at 11:30, currently tracking a profit of 35%

Pay attention to controlling position size

View OriginalPlace order at 11:30, currently tracking a profit of 35%

Pay attention to controlling position size

- Reward

- like

- Comment

- Repost

- Share

Strategy continues its Bitcoin purchases despite a decline in its stock - #cryptocurrency #bitcoin #altcoins

BTC-2.17%

- Reward

- like

- Comment

- Repost

- Share

The new Chairman of the U.S. Commodity Futures Trading Commission (CFTC), Mike Selig, publicly stated that he will promote a rules-based approach to cryptocurrency regulation, reducing the past reliance on enforcement actions and instead managing the crypto market through clear regulations.

This statement indicates that the U.S. regulatory direction is shifting from uncertain enforcement to a more predictable institutional framework.

The White House has reaffirmed that the U.S. government is advancing its policy goal of making the United States a global crypto capital hub. Although specific de

View OriginalThis statement indicates that the U.S. regulatory direction is shifting from uncertain enforcement to a more predictable institutional framework.

The White House has reaffirmed that the U.S. government is advancing its policy goal of making the United States a global crypto capital hub. Although specific de

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 2

- Repost

- Share

BrotherCheng :

:

Still able to go upView More

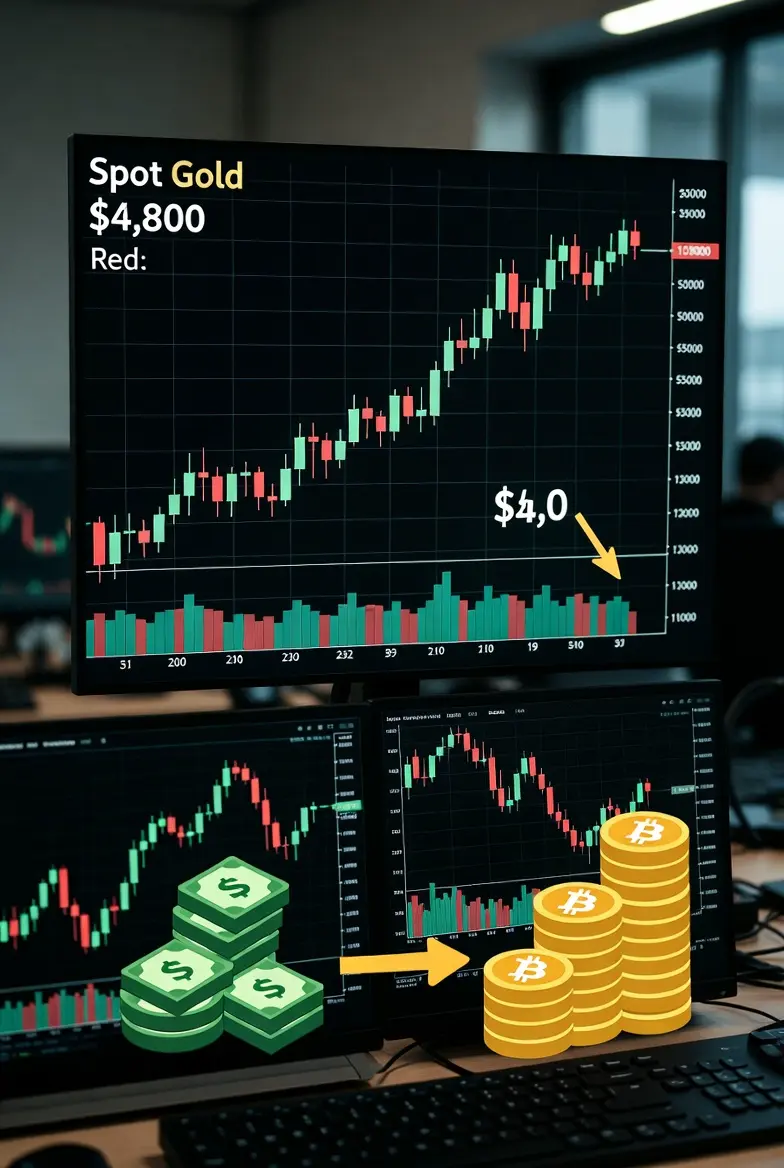

#SpotGoldHitsaNewHigh

📌 1. Current Spot Gold Price

🔹 Spot gold is currently trading near record highs above $4,800 per ounce, showing strong bullish momentum and safe‑haven demand in global markets.

This level is significant because it reflects real‑time investor behavior, where capital rotates into gold as uncertainty rises.

📌 2. Why Gold Is Rising

Gold is climbing because:

✅ Safe‑Haven Demand

Investors move into gold when fear increases, protecting capital from downturns.

✅ Weakening Risk Appetite

As confidence in risky assets declines, money flows into gold.

✅ Central Bank Buying

Many c

📌 1. Current Spot Gold Price

🔹 Spot gold is currently trading near record highs above $4,800 per ounce, showing strong bullish momentum and safe‑haven demand in global markets.

This level is significant because it reflects real‑time investor behavior, where capital rotates into gold as uncertainty rises.

📌 2. Why Gold Is Rising

Gold is climbing because:

✅ Safe‑Haven Demand

Investors move into gold when fear increases, protecting capital from downturns.

✅ Weakening Risk Appetite

As confidence in risky assets declines, money flows into gold.

✅ Central Bank Buying

Many c

XAUT3.92%

- Reward

- 6

- 8

- Repost

- Share

Yusfirah :

:

Happy New Year! 🤑View More

The trend after the 2021 bull market high perfectly coincides with the trend after the current new high!

(Technical analysis) Please make sure to read this before leaving 🙏

Everyone can look at the chart below ⬇️

I used Fibonacci retracement to calculate the results at the daily level for Bitcoin: from the highest point of the bull market down to the lowest point of the first decline, the conclusion is that "the first wave of rebound at the bull market high all reached the 0.382 golden ratio, and a new round of decline has begun."

Moreover, after the first decline in 2021, the rebound back to

(Technical analysis) Please make sure to read this before leaving 🙏

Everyone can look at the chart below ⬇️

I used Fibonacci retracement to calculate the results at the daily level for Bitcoin: from the highest point of the bull market down to the lowest point of the first decline, the conclusion is that "the first wave of rebound at the bull market high all reached the 0.382 golden ratio, and a new round of decline has begun."

Moreover, after the first decline in 2021, the rebound back to

BTC-2.17%

- Reward

- like

- Comment

- Repost

- Share

特斯马

TSM

Created By@NorthWarm

Listing Progress

100.00%

MC:

$26.2K

Create My Token

#MajorStockIndexesPlunge Global equity markets are facing a sharp wave of selling as major stock indexes across the world plunge simultaneously, signaling a sudden shift in investor sentiment. What began as localized weakness has rapidly transformed into a broad risk-off movement, pulling down U.S., European, and Asian markets together. The scale and speed of the decline suggest deeper concerns than short-term profit-taking.

U.S. markets have led the downturn, with the Dow Jones, S&P 500, and Nasdaq all experiencing heavy losses in a single session. Technology and growth stocks — which had pre

U.S. markets have led the downturn, with the Dow Jones, S&P 500, and Nasdaq all experiencing heavy losses in a single session. Technology and growth stocks — which had pre

- Reward

- 2

- Comment

- Repost

- Share

#GateTradFiExperience

Exploring Gate.io’s TradFi: Trade Gold & Forex Directly from Your Crypto Wallet!

Market swings can be intense — while Bitcoin and altcoins look for direction, capital is quietly moving into safe-haven assets like Gold ($XAU) and Silver. Gate.io’s new TradFi feature couldn’t have come at a better time for me. Now I can trade traditional markets directly from my crypto balance, all in one account.

Here’s what I’ve noticed so far:

1️⃣ One Account, Multiple Markets

No more juggling separate bank accounts or brokerage platforms. My Gate.io account now gives me instant access t

Exploring Gate.io’s TradFi: Trade Gold & Forex Directly from Your Crypto Wallet!

Market swings can be intense — while Bitcoin and altcoins look for direction, capital is quietly moving into safe-haven assets like Gold ($XAU) and Silver. Gate.io’s new TradFi feature couldn’t have come at a better time for me. Now I can trade traditional markets directly from my crypto balance, all in one account.

Here’s what I’ve noticed so far:

1️⃣ One Account, Multiple Markets

No more juggling separate bank accounts or brokerage platforms. My Gate.io account now gives me instant access t

BTC-2.17%

- Reward

- 1

- 1

- Repost

- Share

MrFlower_XingChen :

:

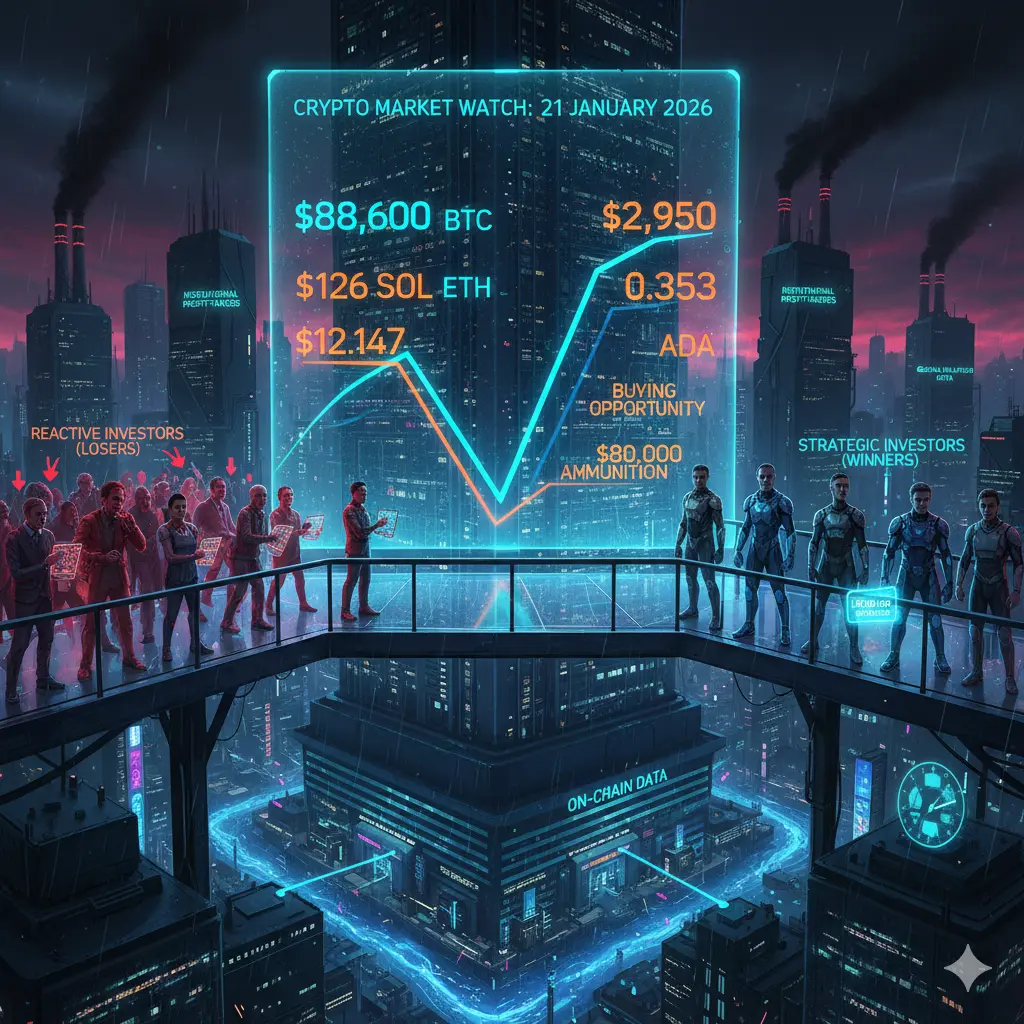

2026 GOGOGO 👊#CryptoMarketWatch

The cryptocurrency market is facing one of its first major tests of 2026 today. Bitcoin's drop below the $90,000 mark and the pullbacks in altcoins have led investors to wonder if the rally is over, but in reality, this is a cooling-off phase for an overheated market.

Today's market structure is a struggle between institutional profit-taking and global inflation data. While Bitcoin's fall to the $88,600 level has tightened overall market liquidity, this is not a collapse, but a healthy correction to the aggressive rise expected at the end of 2025. The main reason for t

The cryptocurrency market is facing one of its first major tests of 2026 today. Bitcoin's drop below the $90,000 mark and the pullbacks in altcoins have led investors to wonder if the rally is over, but in reality, this is a cooling-off phase for an overheated market.

Today's market structure is a struggle between institutional profit-taking and global inflation data. While Bitcoin's fall to the $88,600 level has tightened overall market liquidity, this is not a collapse, but a healthy correction to the aggressive rise expected at the end of 2025. The main reason for t

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

#CryptoMarketPullback

BTC & Altcoins Slide Amid Trade Concerns: Defensive Phase or Pre-Rebound Setup?

The crypto market is showing signs of short-term weakness as Bitcoin and major altcoins pull back amid renewed trade tension headlines. Traders and investors are questioning whether this is merely a defensive pause or the start of a rebound setup.

Market Overview

Bitcoin (BTC) tested support near $28,000–$28,500, while Ethereum (ETH) dipped below $1,900.

Altcoins broadly followed BTC’s lead, showing increased sensitivity to macro news.

Trading volume has declined, suggesting short-term risk a

BTC & Altcoins Slide Amid Trade Concerns: Defensive Phase or Pre-Rebound Setup?

The crypto market is showing signs of short-term weakness as Bitcoin and major altcoins pull back amid renewed trade tension headlines. Traders and investors are questioning whether this is merely a defensive pause or the start of a rebound setup.

Market Overview

Bitcoin (BTC) tested support near $28,000–$28,500, while Ethereum (ETH) dipped below $1,900.

Altcoins broadly followed BTC’s lead, showing increased sensitivity to macro news.

Trading volume has declined, suggesting short-term risk a

- Reward

- 1

- Comment

- Repost

- Share

$BCH /USDT ⚡ 15M Chart Surge

🔥 Price: $589.63

📈 24H Change: +1.37%

⬆️ High: $591.83 | ⬇️ Low: $564.48

💰 24H Volume: 8.94K BCH

🔁 Turnover: $5.16M

📊 Action: Violent spike from $564.48 → $591.83 — bulls took control fast.

📈 MAs:

MA5: 589.93

MA10: 588.67

MA30: 578.97

⚔️ Price holding above all key MAs — bullish structure intact.

🚀 Break & hold $592 = continuation toward $600+.

🛑 Lose $586–588 = pullback risk to $578–580 zone.

BCH just ignited — momentum is alive and watching higher.

#TariffTensionsHitCryptoMarket

🔥 Price: $589.63

📈 24H Change: +1.37%

⬆️ High: $591.83 | ⬇️ Low: $564.48

💰 24H Volume: 8.94K BCH

🔁 Turnover: $5.16M

📊 Action: Violent spike from $564.48 → $591.83 — bulls took control fast.

📈 MAs:

MA5: 589.93

MA10: 588.67

MA30: 578.97

⚔️ Price holding above all key MAs — bullish structure intact.

🚀 Break & hold $592 = continuation toward $600+.

🛑 Lose $586–588 = pullback risk to $578–580 zone.

BCH just ignited — momentum is alive and watching higher.

#TariffTensionsHitCryptoMarket

BCH1.92%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More20.56K Popularity

3.49K Popularity

56.18K Popularity

48.16K Popularity

339.95K Popularity

News

View MoreArthur Hayes: Rising Japanese government bond yields may weaken Japan's support for U.S. Treasuries

2 m

Bitcoin repeatedly hits new highs in 2025, but social media and search popularity continue to decline

2 m

Mad Lads announced that they have taken a snapshot, possibly hinting at the launch of a token.

2 m

Arthur Hayes: The surge in Japanese government bond yields may cause investors to lose interest in U.S. Treasuries

5 m

Data: 234.99 BTC transferred from an anonymous address, then routed through a relay and sent to another anonymous address

8 m

Pin

Strike Gold by Sharing Your TradFi Orders and Pictures!

Post on Gate Square and split $10,000 in rewards!

The TradFi Gold Lucky Bag is now live—1g of real gold every 10 minutes. Trade nonstop, win nonstop!

👉 https://www.gate.com/announcements/article/49357

🎁 50 lucky winners × $200 Position Vouchers ($10 × 20 leverage)

How to Join:

1️⃣ Post your order on Square with #GateTradFi1gGoldGiveaway, including:

A trade or draw screenshot

A brief experience sharing

2️⃣ Or create a related image (AI creation allowed) with a short promo line, such as:

Get gold on Gate App — 1g every 10 minutes!

⏰ Jan 2Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889