# BitcoinFallsBehindGold

13.79K

MrFlower_XingChen

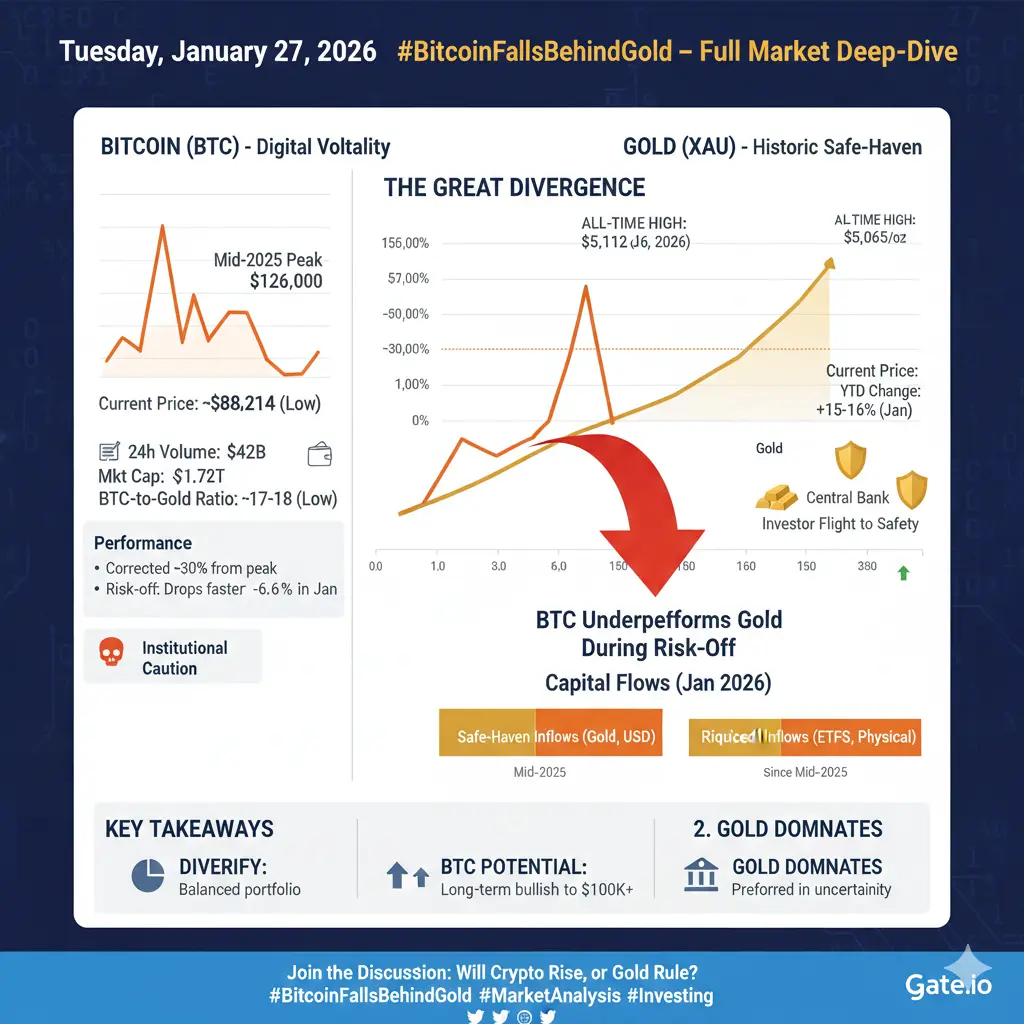

#BitcoinFallsBehindGold Global financial markets are quietly signaling a shift: the hierarchy of safe-haven assets is evolving. Recent price behavior highlights a growing divergence between Bitcoin and Gold — one that reflects a decisive change in investor priorities. As geopolitical tensions, monetary uncertainty, and macro instability intensify, capital is no longer chasing innovation. It is seeking protection.

Gold’s advance is deliberate, not accidental. Its move toward the $4,900–$5,000 per ounce range reflects calculated allocation decisions by institutions, central banks, and sovereign

Gold’s advance is deliberate, not accidental. Its move toward the $4,900–$5,000 per ounce range reflects calculated allocation decisions by institutions, central banks, and sovereign

BTC1.46%

- Reward

- 11

- 15

- Repost

- Share

LilBulla :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold

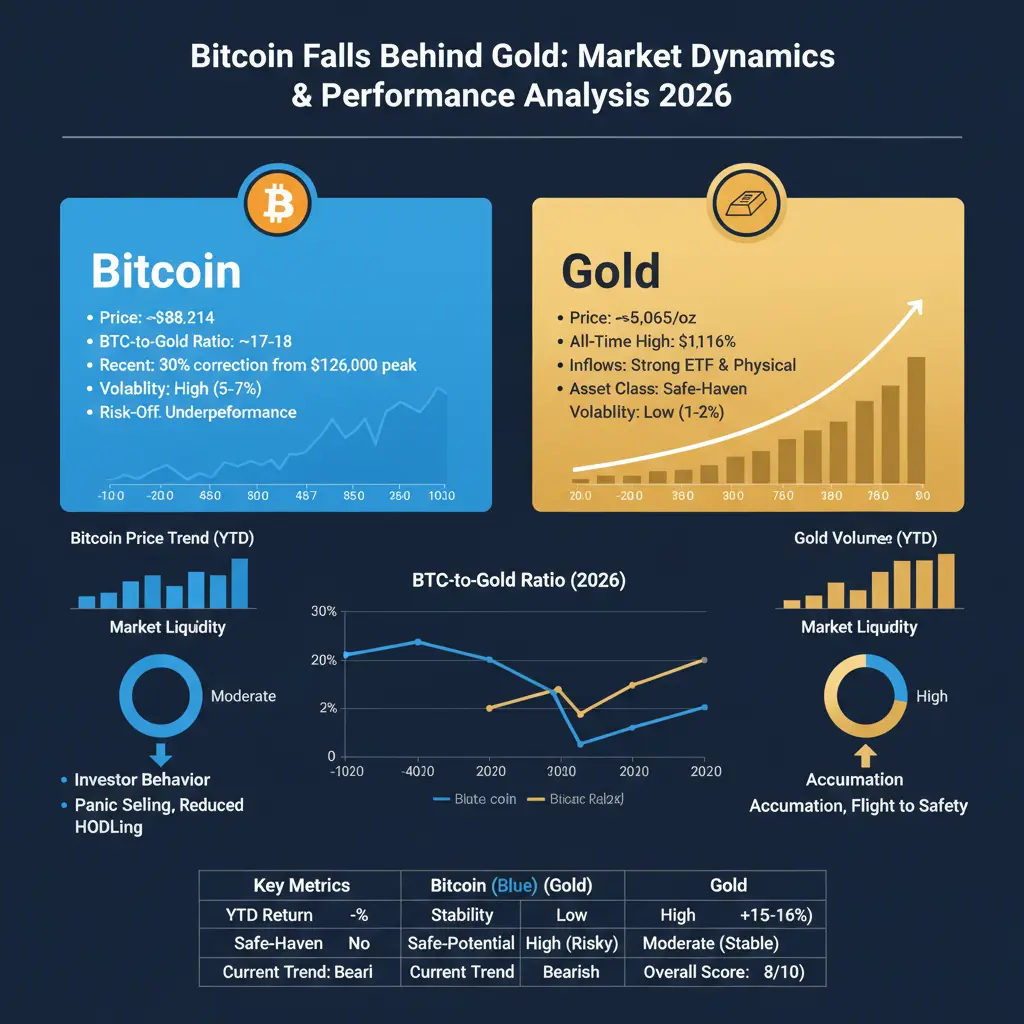

As 2026 progresses, Bitcoin’s claim as “digital gold” faces its toughest challenge yet. Gold continues its historic surge, hitting new all-time highs, while Bitcoin underperforms significantly, especially during risk-off phases. The divergence between these two supposed stores of value reveals deeper market dynamics, including liquidity flows, investor psychology, and macroeconomic pressures. This deep dive analyzes everything: price movements, percentage changes, volume trends, market liquidity, BTC-to-gold ratio, macro drivers, and forward outlooks.

Bitcoin – Detaile

As 2026 progresses, Bitcoin’s claim as “digital gold” faces its toughest challenge yet. Gold continues its historic surge, hitting new all-time highs, while Bitcoin underperforms significantly, especially during risk-off phases. The divergence between these two supposed stores of value reveals deeper market dynamics, including liquidity flows, investor psychology, and macroeconomic pressures. This deep dive analyzes everything: price movements, percentage changes, volume trends, market liquidity, BTC-to-gold ratio, macro drivers, and forward outlooks.

Bitcoin – Detaile

BTC1.46%

- Reward

- 3

- 2

- Repost

- Share

sellak :

:

Bullish market at its peak 🐂View More

#BitcoinFallsBehindGold The financial markets are witnessing a powerful shift in sentiment 📉📊 as Bitcoin, once hailed as “digital gold,” begins to fall behind the performance of its traditional counterpart. #BitcoinFallsBehindGold has emerged as a defining narrative in the current market cycle, highlighting how investors are reassessing risk, stability, and trust amid rising global uncertainty. While Bitcoin continues to command attention as a revolutionary asset and store of value, its recent performance compared to gold reveals an important reality: during periods of intense geopolitical t

BTC1.46%

- Reward

- 10

- 18

- Repost

- Share

GateUser-d198bac8 :

:

btcView More

#BitcoinFallsBehindGold

1. Current Bitcoin Price

Bitcoin (BTC) is currently trading around $87,900 USD, showing continued volatility and a cautious market stance. This price remains below prior all-time highs, reflecting ongoing rotation of capital into safer assets.

2. Gold’s Record Surge

Gold has recently surged to over $5,000 per ounce, reaching new highs as investors seek traditional safe-haven assets amid economic uncertainty and geopolitical tensions.

3. Divergence in Performance

While Bitcoin struggles to regain momentum, gold continues to attract investor flows. This divergence highli

1. Current Bitcoin Price

Bitcoin (BTC) is currently trading around $87,900 USD, showing continued volatility and a cautious market stance. This price remains below prior all-time highs, reflecting ongoing rotation of capital into safer assets.

2. Gold’s Record Surge

Gold has recently surged to over $5,000 per ounce, reaching new highs as investors seek traditional safe-haven assets amid economic uncertainty and geopolitical tensions.

3. Divergence in Performance

While Bitcoin struggles to regain momentum, gold continues to attract investor flows. This divergence highli

BTC1.46%

- Reward

- 10

- 24

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

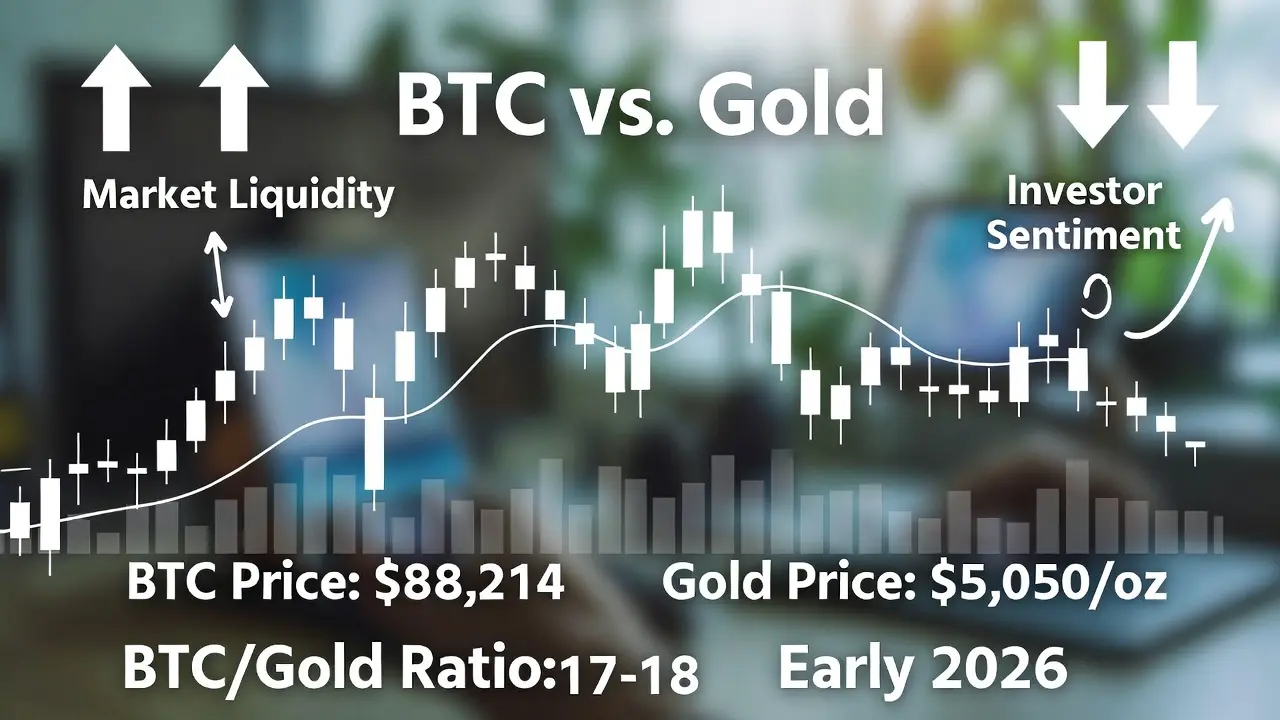

📉 Bitcoin Gold Ratio Hits Key Levels — Dip-Buy Opportunity?

The Bitcoin-to-Gold ratio has fallen roughly 55% from its peak and recently dipped below the 200-week moving average, signaling extended underperformance relative to gold. Historically, moves below this MA have often coincided with accumulation opportunities for long-term BTC holders.

Current Market Context

Bitcoin (BTC): $96,400 (approx.) | 200-week MA breached

Gold (XAU/USD): $5,020/oz | safe-haven demand remains elevated

Sentiment: Caution in equities and crypto; risk-off flows continue to support gold

Strategic Insights

Historica

The Bitcoin-to-Gold ratio has fallen roughly 55% from its peak and recently dipped below the 200-week moving average, signaling extended underperformance relative to gold. Historically, moves below this MA have often coincided with accumulation opportunities for long-term BTC holders.

Current Market Context

Bitcoin (BTC): $96,400 (approx.) | 200-week MA breached

Gold (XAU/USD): $5,020/oz | safe-haven demand remains elevated

Sentiment: Caution in equities and crypto; risk-off flows continue to support gold

Strategic Insights

Historica

BTC1.46%

- Reward

- 17

- 12

- Repost

- Share

QueenOfTheDay :

:

Buy To Earn 💎View More

#BitcoinFallsBehindGold

Bitcoin Falls Behind Gold: Deep-Dive Analysis of the 55% Ratio Decline, Technical Weakness, and Strategic Accumulation Opportunities

Bitcoin has recently fallen behind gold in performance, with the Bitcoin-to-gold ratio down about 55% from its peak, marking a significant divergence between traditional and digital stores of value. Simultaneously, BTC has slipped below its 200-week moving average, a critical long-term technical support level that historically signals market bottoms or prolonged corrections. This combination of relative underperformance and technical weak

Bitcoin Falls Behind Gold: Deep-Dive Analysis of the 55% Ratio Decline, Technical Weakness, and Strategic Accumulation Opportunities

Bitcoin has recently fallen behind gold in performance, with the Bitcoin-to-gold ratio down about 55% from its peak, marking a significant divergence between traditional and digital stores of value. Simultaneously, BTC has slipped below its 200-week moving average, a critical long-term technical support level that historically signals market bottoms or prolonged corrections. This combination of relative underperformance and technical weak

BTC1.46%

- Reward

- 4

- 3

- Repost

- Share

GateUser-68291371 :

:

Hold tight 💪View More

#BitcoinFallsBehindGold

🟠 Bitcoin vs Gold: 55% Drawdown — Opportunity or Structural Shift?

Bitcoin’s BTC/Gold ratio has declined ~55% from its peak and is now trading below the 200-week moving average — a level widely viewed as a long-term regime indicator.

The core question investors must answer: Is this a high-probability accumulation zone, or a warning of a deeper macro shift?

Let’s break it down objectively.

1️⃣ What the Bitcoin/Gold Ratio Really Signals

The BTC/Gold ratio measures Bitcoin’s performance against hard money, not fiat.

📈 Rising ratio → Bitcoin outperforming gold

(risk-on, l

🟠 Bitcoin vs Gold: 55% Drawdown — Opportunity or Structural Shift?

Bitcoin’s BTC/Gold ratio has declined ~55% from its peak and is now trading below the 200-week moving average — a level widely viewed as a long-term regime indicator.

The core question investors must answer: Is this a high-probability accumulation zone, or a warning of a deeper macro shift?

Let’s break it down objectively.

1️⃣ What the Bitcoin/Gold Ratio Really Signals

The BTC/Gold ratio measures Bitcoin’s performance against hard money, not fiat.

📈 Rising ratio → Bitcoin outperforming gold

(risk-on, l

BTC1.46%

- Reward

- 7

- 9

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold

As 2026 progresses, Bitcoin’s claim as “digital gold” faces its toughest challenge yet. Gold continues its historic surge, hitting new all-time highs, while Bitcoin underperforms significantly, especially during risk-off phases. The divergence between these two supposed stores of value reveals deeper market dynamics, including liquidity flows, investor psychology, and macroeconomic pressures. This deep dive analyzes everything: price movements, percentage changes, volume trends, market liquidity, BTC-to-gold ratio, macro drivers, and forward outlooks.

Bitcoin – Detaile

As 2026 progresses, Bitcoin’s claim as “digital gold” faces its toughest challenge yet. Gold continues its historic surge, hitting new all-time highs, while Bitcoin underperforms significantly, especially during risk-off phases. The divergence between these two supposed stores of value reveals deeper market dynamics, including liquidity flows, investor psychology, and macroeconomic pressures. This deep dive analyzes everything: price movements, percentage changes, volume trends, market liquidity, BTC-to-gold ratio, macro drivers, and forward outlooks.

Bitcoin – Detaile

BTC1.46%

- Reward

- 23

- 20

- Repost

- Share

repanzal :

:

Buy To Earn 💎View More

#BitcoinFallsBehindGold | Digital Gold vs Real Safe Haven

As 2026 unfolds, Bitcoin’s long-standing narrative as “digital gold” is facing its toughest stress test yet.

While gold continues its historic rally—breaking above $5,100 per ounce and attracting massive institutional and central-bank inflows—Bitcoin has significantly underperformed during recent risk-off phases. This divergence highlights a deeper shift in liquidity, investor psychology, and macroeconomic positioning.

Bitcoin: Volatility Meets Caution

BTC trades near $88,200, down ~30% from its 2025 peak of $126,000

High volatility per

As 2026 unfolds, Bitcoin’s long-standing narrative as “digital gold” is facing its toughest stress test yet.

While gold continues its historic rally—breaking above $5,100 per ounce and attracting massive institutional and central-bank inflows—Bitcoin has significantly underperformed during recent risk-off phases. This divergence highlights a deeper shift in liquidity, investor psychology, and macroeconomic positioning.

Bitcoin: Volatility Meets Caution

BTC trades near $88,200, down ~30% from its 2025 peak of $126,000

High volatility per

BTC1.46%

- Reward

- 7

- 14

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

#BitcoinFallsBehindGold

The Traditional Victor of the Digital Age

As of January 2026, the gap between "digital gold" and "physical gold" in global financial markets has widened more than ever before. While Bitcoin struggles to break through the psychological barrier of $100,000, traditional gold continues to shatter records, proving itself as the true sovereign of the stage.

The year 2026 began as a "reality check" for the financial world. While there has been talk for years about Bitcoin claiming its crown as digital gold, data from January presents a starkly different picture. Gold (XAU)

The Traditional Victor of the Digital Age

As of January 2026, the gap between "digital gold" and "physical gold" in global financial markets has widened more than ever before. While Bitcoin struggles to break through the psychological barrier of $100,000, traditional gold continues to shatter records, proving itself as the true sovereign of the stage.

The year 2026 began as a "reality check" for the financial world. While there has been talk for years about Bitcoin claiming its crown as digital gold, data from January presents a starkly different picture. Gold (XAU)

BTC1.46%

- Reward

- 43

- 38

- Repost

- Share

sun_zero :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

5.89K Popularity

67.69K Popularity

22.76K Popularity

8.99K Popularity

8.73K Popularity

8.01K Popularity

7.33K Popularity

6.69K Popularity

73.5K Popularity

20.08K Popularity

81.61K Popularity

23.18K Popularity

49.27K Popularity

43.23K Popularity

178.35K Popularity

News

View MoreRipple launches Ripple Treasury, RLUSD and XRP Ledger accelerate towards enterprise-level financial scenarios

1 m

Retail investor sentiment surges towards silver; does the popularity of safe-haven assets indicate a potential top?

3 m

January CEX spot trading volume plummets, putting pressure on the crypto market structure; total market capitalization may further shrink.

4 m

If Bitcoin breaks through $90,000, the total liquidation strength of mainstream CEXs' short positions will reach 435 million.

4 m

Villeroy: Weakening US dollar could impact ECB interest rate decisions

5 m

Pin

WHAT'S THE WAY FORWARD FOR BITCOIN?

PUMPING OR DUMPING SOON ? FIND OUT HERE:

As of January 27, 2026, Bitcoin ($BTC ) is trading around $87,700 - $88,600 (With a live price of $88,300 at the time of writing) showing signs of consolidation after recent volatility. The cryptocurrency has been under pressure from macroeconomic factors, geopolitical tensions (such as U.S.-Iran issues), and market rotations away from risk assets. This has led to a choppy trading environment, with BTC struggling to reclaim higher levels like $90,000 while defending key supports. Short-Term Price Movement (1-30 DGate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889