#BitMineAcquires20,000ETH Institutional Strategy and Ethereum’s Long-Term Outlook

Institutional Confidence Strengthens Ethereum’s Narrative

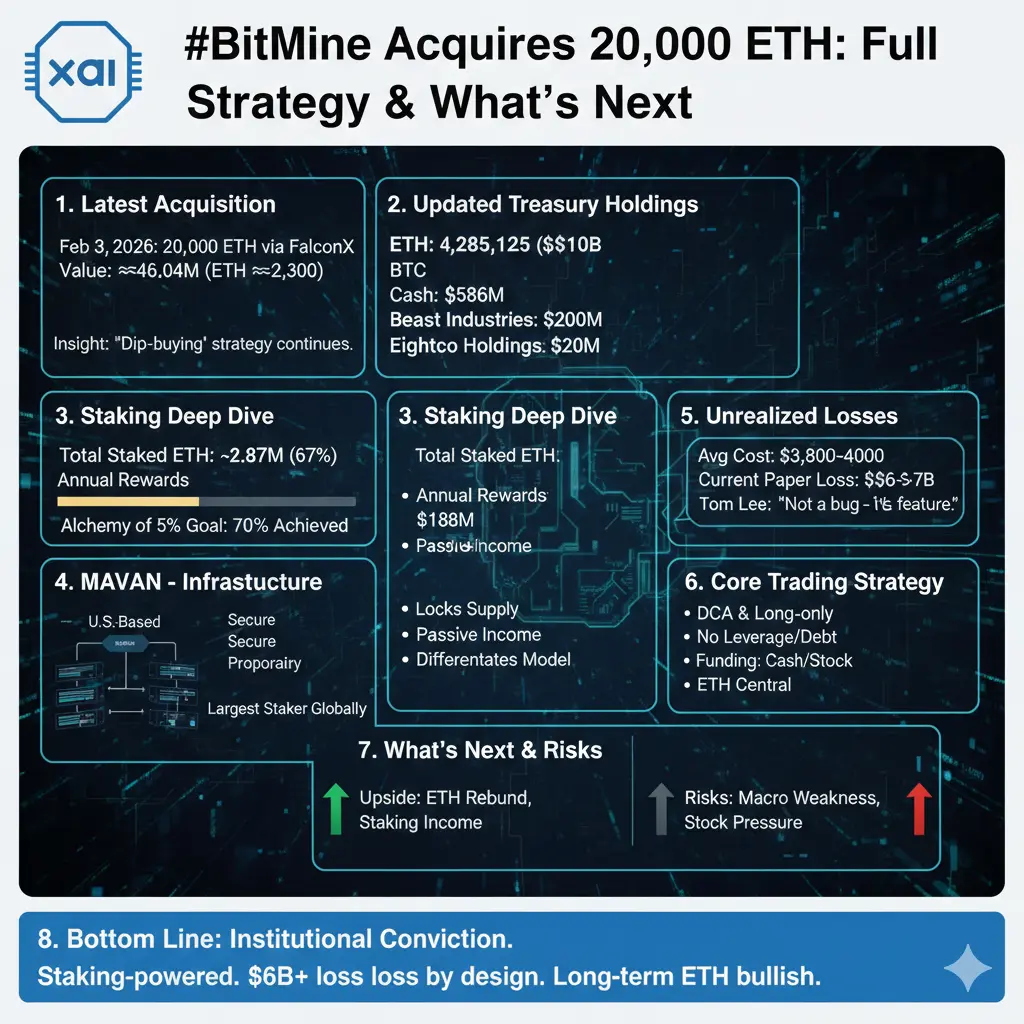

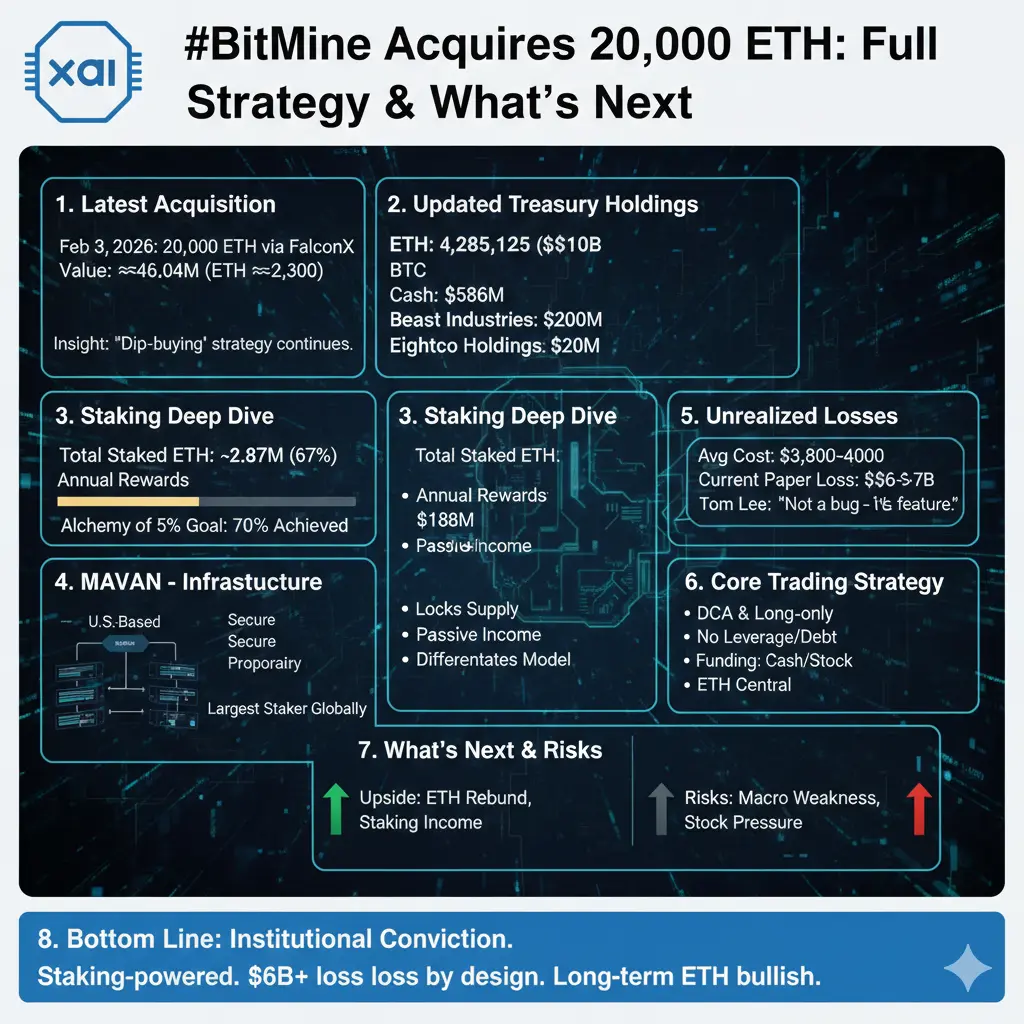

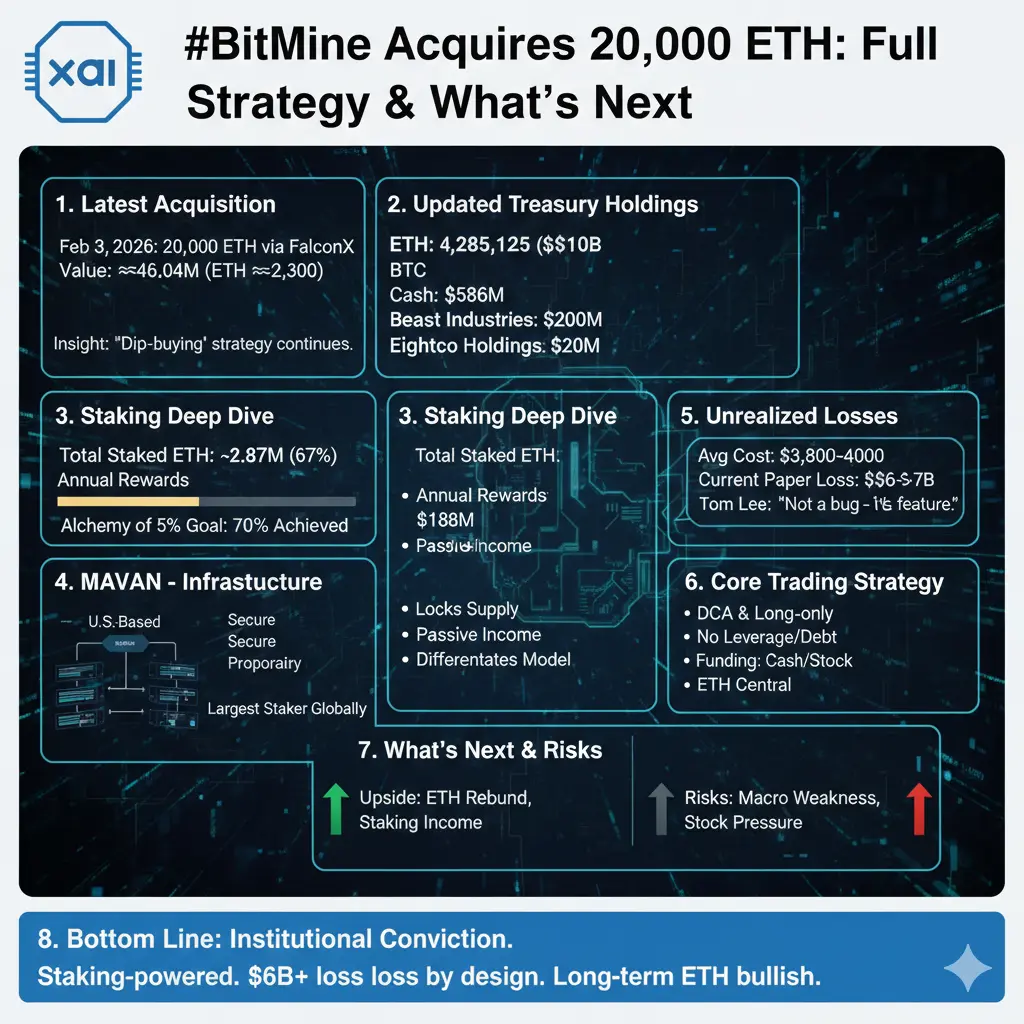

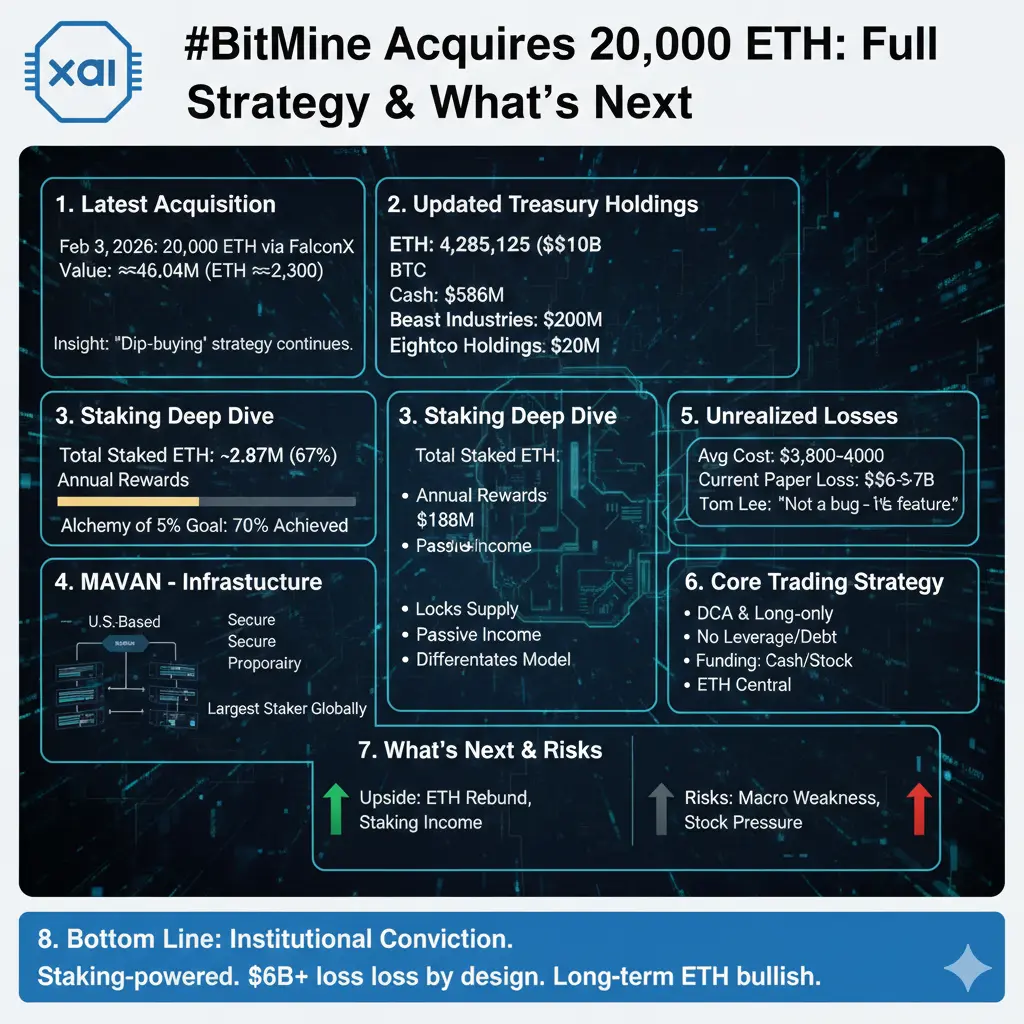

BitMine’s acquisition of 20,000 ETH represents far more than a large on-chain transaction. It reflects growing institutional confidence in Ethereum’s long-term value proposition. Such allocations are typically backed by extensive research, risk modeling, and macro analysis, signaling belief in ETH as core digital infrastructure for future financial systems.

Strategic Accumulation During Market Consolidation

This purchase occurred during a period of market consolidation, when price momentum was relatively muted. Institutions historically prefer to accumulate in these phases rather than chase breakouts. This timing suggests BitMine is positioning for multi-cycle growth rather than short-term speculation.

A Structured Treasury Expansion Plan

The acquisition aligns with BitMine’s broader treasury management strategy. Over recent periods, the firm has steadily increased its Ethereum exposure, indicating disciplined capital deployment. Such consistency reflects strong conviction and long-term portfolio planning rather than opportunistic trading.

Yield Generation Through Active Staking

BitMine is not merely holding ETH—it is deploying a significant portion into staking. This enables passive yield generation while contributing to network security. This shift from idle holdings to productive assets highlights Ethereum’s evolution into a yield-bearing institutional-grade platform.

Ethereum’s Expanding Institutional Use Case

Ethereum is increasingly viewed as more than a smart contract network. With Layer-2 scaling, real-world asset tokenization, DeFi integration, and regulated custody solutions, ETH is becoming a foundational component of digital financial infrastructure. These developments enhance its appeal to large capital allocators.

Effects on Supply and Market Liquidity

Large-scale accumulation and staking reduce the circulating supply available on exchanges. Over time, this tightening of liquid supply can influence price dynamics, particularly during periods of rising demand. While the impact is gradual, it contributes to stronger long-term structural support.

Long-Term Vision Over Short-Term Hype

Institutional purchases of this scale are rarely driven by short-term profit motives. Instead, they reflect confidence in multi-year adoption trends. Such moves often precede shifts in market structure rather than immediate price rallies.

Alignment With Broader On-Chain Accumulation Trends

BitMine’s activity mirrors a wider trend of increasing institutional and whale participation in Ethereum. More ETH is being locked in staking contracts and cold storage, signaling rising trust in network stability and governance. This trend supports long-term ecosystem resilience.

Strategic Lessons for Market Participants

Institutional investors focus on fundamentals—network activity, developer engagement, economic incentives, and real-world adoption. They accumulate patiently and quietly, avoiding emotional reactions to headlines. BitMine’s approach reflects this disciplined, data-driven mindset.

Strengthening Ethereum’s Long-Term Market Position

Overall, BitMine’s 20,000 ETH acquisition reinforces Ethereum’s image as a productive, scalable, and institution-friendly digital asset. While short-term volatility remains inevitable, such strategic positioning suggests major players are preparing for sustained growth as global liquidity cycles evolve.

Institutional Confidence Strengthens Ethereum’s Narrative

BitMine’s acquisition of 20,000 ETH represents far more than a large on-chain transaction. It reflects growing institutional confidence in Ethereum’s long-term value proposition. Such allocations are typically backed by extensive research, risk modeling, and macro analysis, signaling belief in ETH as core digital infrastructure for future financial systems.

Strategic Accumulation During Market Consolidation

This purchase occurred during a period of market consolidation, when price momentum was relatively muted. Institutions historically prefer to accumulate in these phases rather than chase breakouts. This timing suggests BitMine is positioning for multi-cycle growth rather than short-term speculation.

A Structured Treasury Expansion Plan

The acquisition aligns with BitMine’s broader treasury management strategy. Over recent periods, the firm has steadily increased its Ethereum exposure, indicating disciplined capital deployment. Such consistency reflects strong conviction and long-term portfolio planning rather than opportunistic trading.

Yield Generation Through Active Staking

BitMine is not merely holding ETH—it is deploying a significant portion into staking. This enables passive yield generation while contributing to network security. This shift from idle holdings to productive assets highlights Ethereum’s evolution into a yield-bearing institutional-grade platform.

Ethereum’s Expanding Institutional Use Case

Ethereum is increasingly viewed as more than a smart contract network. With Layer-2 scaling, real-world asset tokenization, DeFi integration, and regulated custody solutions, ETH is becoming a foundational component of digital financial infrastructure. These developments enhance its appeal to large capital allocators.

Effects on Supply and Market Liquidity

Large-scale accumulation and staking reduce the circulating supply available on exchanges. Over time, this tightening of liquid supply can influence price dynamics, particularly during periods of rising demand. While the impact is gradual, it contributes to stronger long-term structural support.

Long-Term Vision Over Short-Term Hype

Institutional purchases of this scale are rarely driven by short-term profit motives. Instead, they reflect confidence in multi-year adoption trends. Such moves often precede shifts in market structure rather than immediate price rallies.

Alignment With Broader On-Chain Accumulation Trends

BitMine’s activity mirrors a wider trend of increasing institutional and whale participation in Ethereum. More ETH is being locked in staking contracts and cold storage, signaling rising trust in network stability and governance. This trend supports long-term ecosystem resilience.

Strategic Lessons for Market Participants

Institutional investors focus on fundamentals—network activity, developer engagement, economic incentives, and real-world adoption. They accumulate patiently and quietly, avoiding emotional reactions to headlines. BitMine’s approach reflects this disciplined, data-driven mindset.

Strengthening Ethereum’s Long-Term Market Position

Overall, BitMine’s 20,000 ETH acquisition reinforces Ethereum’s image as a productive, scalable, and institution-friendly digital asset. While short-term volatility remains inevitable, such strategic positioning suggests major players are preparing for sustained growth as global liquidity cycles evolve.