2025 XYM Price Prediction: Expert Analysis and Market Forecast for Symbol Token

Introduction: Market Position and Investment Value of XYM

Symbol (XYM) is a next-generation open-source and decentralized platform designed to lead blockchain development. Since its launch in December 2020, Symbol has established itself as a reliable and secure value exchange network for business operations. As of December 2025, XYM maintains a market capitalization of approximately $47.48 million, with a circulating supply of around 6.23 billion tokens trading at $0.005276. This asset, recognized as a "value exchange network for business," is increasingly playing a key role in establishing connections between commerce and blockchain technology, enabling secure asset exchanges across various use cases.

This article will provide a comprehensive analysis of XYM's price trends through 2030, incorporating historical patterns, market supply dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

Symbol (XYM) Market Analysis Report

I. XYM Price History Review and Market Status

XYM Historical Price Evolution

- March 2021: XYM reached its all-time high of $0.726222, marking the peak of its market performance since launch.

- December 2020: XYM was released as the native currency of the Symbol public blockchain, with an initial listing price of $0.06.

- 2025: XYM has experienced significant long-term depreciation, declining approximately 74.26% over the past year.

- November 2025: XYM touched its all-time low of $0.00371324, representing the lowest point in the asset's trading history.

XYM Current Market Status

As of December 19, 2025, XYM is trading at $0.005276, reflecting a 24-hour price decline of 2.22%. The token demonstrates modest trading activity with a 24-hour volume of $44,753.39. The current market capitalization stands at approximately $32.88 million, with a fully diluted valuation of $47.48 million based on the total supply of 8.999 billion XYM tokens.

The circulating supply consists of 6.23 billion XYM tokens, representing 69.25% of the total supply. XYM maintains a market dominance of 0.0015%, ranking 649th among all cryptocurrencies. Short-term price movements show continued pressure, with a 1-hour decline of 0.085% and a 7-day decline of 0.32%. However, the 30-day performance indicates a gain of 32.30%, suggesting some recovery momentum from recent lows. The asset trades across 4 exchange platforms, with Gate.com providing trading access.

Market sentiment indicates extreme fear, with the current market environment characterized by significant apprehension among investors.

Click to view current XYM market price

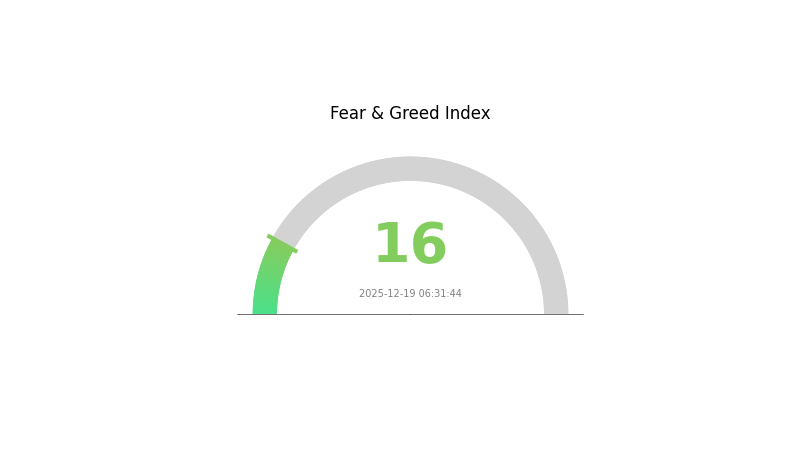

Market Sentiment Indicator

12-19-2025 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 16. This indicates widespread market pessimism and heightened uncertainty among investors. During such periods, risk appetite diminishes significantly, and traders often adopt defensive positions. However, extreme fear can present contrarian opportunities for long-term investors seeking discounted entry points. Market participants should exercise caution, conduct thorough research, and avoid emotional decision-making. Consider dollar-cost averaging strategies and maintain proper risk management protocols when navigating these volatile market conditions.

XYM Address Distribution

Click to view current XYM holdings distribution

Unfortunately, the address holding distribution data table provided is empty, containing no specific holder information or concentration metrics. Without the necessary on-chain data points, a comprehensive analysis of XYM's current distribution characteristics cannot be performed. To conduct a meaningful assessment of token concentration, market structure implications, and decentralization metrics, the following data elements are required: the addresses of major token holders, their respective holding quantities, and their percentage allocations relative to total circulating supply.

Once this data is populated, the analysis would typically examine whether token concentration exhibits concerning centralization patterns, evaluate the vulnerability of the network to potential price manipulation by large holders, and assess the overall stability of the on-chain structure. The address distribution serves as a critical indicator of decentralization health—highly concentrated holdings among a small number of addresses suggest elevated systemic risk, while more distributed holdings generally indicate a more resilient and genuinely decentralized network architecture.

Please provide the complete holder data table with specific addresses and their corresponding holdings to enable a thorough evaluation of XYM's current market structure and decentralization status.

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing XYM's Future Price

Market Supply and Demand Dynamics

-

Supply and Demand Balance: XYM's price fluctuates based on market supply and demand equilibrium, similar to other cryptocurrencies. The interplay between available token supply and investor demand directly impacts valuation.

-

Investor Sentiment: Market sentiment plays a significant role in price movements. Positive investor perception and increased demand can drive prices upward, while negative sentiment may result in price corrections.

Technology Development and Ecosystem Adoption

-

Underlying Utility: XYM's value is fundamentally dependent on its practical utility within the Symbol ecosystem. Enhanced use cases and integration across the network strengthen the token's intrinsic value proposition.

-

Ecosystem Expansion: The development and expansion of the XYM ecosystem directly influences its adoption rate and long-term price trajectory. Growth in decentralized applications and services utilizing XYM strengthens its market position.

Regulatory and Market Environment

-

Regulatory Changes: Shifts in cryptocurrency regulation at regional and global levels represent a significant price influence factor. Favorable regulatory developments can boost market confidence, while restrictive policies may create headwinds.

-

Broader Market Trends: XYM's price movements are influenced by overall cryptocurrency market conditions and trends. Bull or bear market phases in the broader digital asset space impact individual token valuations.

Three、2025-2030 XYM Price Forecast

2025 Outlook

- Conservative Forecast: $0.00345 - $0.00523

- Neutral Forecast: $0.00523 - $0.00612

- Optimistic Forecast: $0.00701 (requires sustained market momentum and increased adoption)

2026-2027 Medium-term Outlook

- Market Phase Expectation: Gradual recovery phase with consolidation patterns, supported by incremental ecosystem development and growing institutional interest.

- Price Range Forecast:

- 2026: $0.00551 - $0.00716

- 2027: $0.00399 - $0.00717

- Key Catalysts: Platform technological upgrades, expansion of DeFi integration, increased trading volume on platforms like Gate.com, and broader market sentiment improvement.

2028-2030 Long-term Outlook

- Base Case: $0.00491 - $0.00732 in 2028 and $0.00468 - $0.01106 by 2030 (assuming steady ecosystem growth and moderate market expansion)

- Optimistic Case: $0.01106+ by 2030 (assuming accelerated mainstream adoption and significant partnerships)

- Transformative Case: Extended upside potential beyond $0.01106 (contingent on breakthrough technological developments and substantial enterprise integration)

- 2030-12-31: XYM reaching 47% cumulative gains from 2025 baseline (demonstrating sustained bullish trajectory through decade)

Note: All forecasts are probabilistic in nature and subject to macroeconomic conditions, regulatory developments, and market sentiment shifts. Investors should conduct independent due diligence before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00701 | 0.00523 | 0.00345 | 0 |

| 2026 | 0.00716 | 0.00612 | 0.00551 | 16 |

| 2027 | 0.00717 | 0.00664 | 0.00399 | 25 |

| 2028 | 0.00732 | 0.00691 | 0.00491 | 30 |

| 2029 | 0.00847 | 0.00712 | 0.00363 | 34 |

| 2030 | 0.01106 | 0.00779 | 0.00468 | 47 |

Symbol (XYM) Professional Investment Strategy and Risk Management Report

IV. XYM Professional Investment Strategy and Risk Management

XYM Investment Methodology

(1) Long-term Holding Strategy

-

Suitable Investors: Investors with 2-5 year time horizons seeking exposure to enterprise blockchain infrastructure; those believing in Symbol's business-focused value exchange network proposition.

-

Operational Recommendations:

- Establish position gradually through dollar-cost averaging to mitigate price volatility and entry point risk

- Target accumulation during periods when XYM trades significantly below historical highs, particularly given the -74.26% year-over-year decline

- Hold through market cycles, as XYM has demonstrated recovery potential despite current downtrends

-

Storage Solutions:

- Utilize Gate.com's secure custody solutions for exchange-based holdings

- Consider Gate Web3 Wallet for self-custody with native Symbol blockchain support

- Implement multi-signature schemes for large holdings exceeding personal risk tolerance thresholds

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Volatility Assessment: Monitor 24-hour price ranges (currently trading between $0.005177-$0.005587) to identify short-term breakout opportunities

- Trend Analysis: Track 30-day performance (+32.30%) against longer-term deterioration (-74.26% annually) to assess momentum reversals and accumulation zones

-

Trading Execution Points:

- Enter positions during oversold conditions following the recent all-time low of $0.00371324 (established November 5, 2025)

- Take profit near historical resistance levels, with $0.03-$0.05 range representing significant recovery potential

- Monitor trading volume (currently $44,753.39 in 24-hour volume) for liquidity validation before executing large orders on Gate.com

XYM Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation maximum; limited to speculative positions only

- Active Investors: 3-7% portfolio allocation; can increase during accumulation phases at multi-year lows

- Professional Investors: 7-15% allocation permissible with sophisticated hedging and derivative strategies

(2) Risk Mitigation Strategies

- Dollar-Cost Averaging: Spread investments across 12+ months to reduce impact of price volatility; particularly relevant given XYM's -2.22% 24-hour fluctuation

- Position Sizing Discipline: Limit individual trade sizes to manageable risk; allocate based on personal loss tolerance thresholds rather than profit potential

(3) Secure Storage Framework

- Exchange Custody: Gate.com provides regulated custody with insurance protections for holdings up to specified thresholds

- Self-Custody Approach: Gate Web3 Wallet enables direct blockchain interaction while maintaining personal control; suitable for long-term conviction positions

- Security Best Practices:

- Never share private keys or recovery phrases with third parties

- Verify wallet addresses independently before transfers; Symbol blockchain addresses should be validated against official documentation

- Enable all available security features including two-factor authentication and withdrawal whitelisting

- Test wallet recovery procedures with small amounts before committing substantial holdings

V. XYM Potential Risks and Challenges

Market-Related Risks

- Extreme Volatility and Drawdown Exposure: XYM has declined 74.26% year-over-year from approximately $0.0770 to current levels of $0.005276, indicating sustained bearish pressure and limited institutional adoption; further downside remains possible

- Liquidity Constraints: With only $44,753.39 in 24-hour trading volume across limited exchange availability (4 exchanges), large position liquidation could encounter significant slippage

- Market Concentration Risk: Total market capitalization of $47.48 million represents minimal ecosystem liquidity; positions are vulnerable to coordinated sell-offs or whale activity

Competitive and Adoption Risks

- Enterprise Blockchain Competition: Symbol faces intense competition from established platforms offering similar business-focused value exchange capabilities; market adoption remains significantly below competing solutions

- User Adoption Plateau: Despite positioning for commercial use cases, Symbol has not achieved meaningful mainstream enterprise adoption; fundamentals remain speculative

Technical and Operational Risks

- Development Execution Risk: Continued platform development and feature deployment remain dependent on team execution; delays could impact competitive positioning

- Blockchain Network Security: While built on proven NEM foundation architecture, ongoing technical maintenance and security audits are critical to network integrity

- Regulatory Clarity Uncertainty: As a utility token primarily designed for transaction fees and network incentives, regulatory classification in major jurisdictions remains subject to evolving frameworks

VI. Conclusion and Action Recommendations

XYM Investment Value Assessment

Symbol (XYM) presents a speculative opportunity within the enterprise blockchain segment, positioning itself as a reliable and secure value exchange network for business applications. However, the token has experienced substantial depreciation (-74.26% year-over-year) and maintains minimal market capitalization ($47.48 million) with limited liquidity across only four exchanges. The platform's core value proposition—providing simplified blockchain infrastructure for commercial asset exchange—remains compelling long-term, but market adoption has not materialized at anticipated levels. Current pricing near multi-year lows may attract risk-tolerant investors seeking deep value opportunities, though significant risks remain regarding network adoption, competitive differentiation, and regulatory positioning.

XYM Investment Recommendations

✅ Beginner Investors:

Start with minimal positions (0.5-1% portfolio allocation) exclusively through Gate.com to evaluate project fundamentals; utilize dollar-cost averaging over 6-12 months rather than lump-sum purchases; maintain holdings in secure, insured exchange custody until conviction strengthens.

✅ Experienced Investors:

Establish larger accumulation positions (3-7% allocation) at current depressed valuations, particularly below $0.006 levels; implement technical trading strategies around identified support ($0.003-$0.005) and resistance ($0.015-$0.02) zones; consider self-custody via Gate Web3 Wallet for longer-term holdings exceeding 12 months.

✅ Institutional Investors:

Conduct comprehensive due diligence on Symbol's development roadmap, enterprise partnership pipeline, and competitive positioning before meaningful allocation; structure positions using derivative strategies for downside protection; establish relationships directly with Symbol development team to assess protocol evolution and commercialization timeline.

XYM Trading and Participation Methods

- Exchange Trading: Execute all XYM transactions through Gate.com, which provides competitive spreads, reliable liquidity pools, and regulatory compliance; utilize advanced order types (limit orders, stop-loss, take-profit) to manage risk exposure

- Long-term Portfolio Holding: Store XYM in Gate Web3 Wallet for self-custody of conviction positions; enables direct participation in network governance if applicable while maintaining security

- Staking and Network Participation: Monitor Symbol ecosystem opportunities for node operation or delegation rewards, if available; review official Symbol documentation at https://docs.symbol.dev/ for participation mechanisms

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and consult qualified financial advisors before committing capital. Never invest funds you cannot afford to lose completely. Past performance does not guarantee future results.

FAQ

Could XLM reach $1 dollar?

Yes, XLM could reach $1. Based on current market analysis, XLM is predicted to potentially reach $1.29 by end of 2025, with long-term predictions suggesting $1.76 to $3.36 by 2028.

What crypto will 1000x prediction?

DeepSnitch AI is predicted to achieve 1000x returns by 2026. It uses AI agents to identify crypto opportunities and risks. With a small presale valuation and real utility in the market, DSNT stands out as a potential high-growth candidate.

What is xym crypto?

XYM is the native cryptocurrency of the Symbol blockchain, designed for enterprise applications. It facilitates transactions and smart contracts on this decentralized platform.

Will XRP reach $10 in 2025?

XRP reaching $10 by end of 2025 is unlikely based on current market conditions. Most analyses suggest this milestone may occur in early 2026 or later, depending on broader crypto adoption and market momentum.

2025 XLM Price Prediction: Stellar Lumens' Potential Growth Trajectory in a Maturing Crypto Ecosystem

2025 DGB Price Prediction: Will DigiByte Reach New Heights in the Cryptocurrency Market?

2025 SOUL Price Prediction: Analyzing Market Trends and Future Prospects for the Digital Asset

2025 NANO Price Prediction: Analyzing Growth Potential and Market Trends for the Digital Currency

2025 QANX Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 DKA Price Prediction: Analyzing Market Trends and Potential Growth Factors

TRIBE vs ETC: A Comprehensive Comparison of Two Emerging Blockchain Ecosystems

Mastering Long and Short Strategies in Cryptocurrency Trading

Understanding Impermanent Loss in Liquidity Pools

Understanding Liquidity Mining: A Beginner's Guide

Top Solutions for Merchant Crypto Payment Gateways