2025 TAG Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: TAG's Market Position and Investment Value

Tagger (TAG), a decentralized AI data solutions platform establishing a cross-border data authentication protocol, has been creating a permissionless hub for data labeling, collection, management, and trading since its inception. As of December 2025, TAG's market capitalization has reached approximately USD 228.8 million, with a circulating supply of around 108.4 billion tokens, currently trading at USD 0.0005644 per token. This innovative asset, recognized for bridging AI and data infrastructure, is playing an increasingly critical role in enabling professional data labeling across domains such as medical diagnostics, agriculture, and autonomous vehicles.

This article will provide a comprehensive analysis of TAG's price trajectory from 2025 through 2030, integrating historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

TAG Price Analysis Report

I. TAG Price History Review and Current Market Status

TAG Historical Price Trajectory

Based on available data from the reference materials, TAG (Tagger) has demonstrated significant volatility since its launch:

- August 12, 2025: All-Time High (ATH) reached at $0.0012772, marking the peak valuation period for the token.

- October 10, 2025: All-Time Low (ATL) recorded at $0.0001298, representing a substantial correction from the previous peak.

- Year-to-Date Performance: TAG has exhibited exceptional growth with a 1-year return of 15,047.45%, reflecting strong upward momentum from its initial listing price to current levels.

TAG Current Market Status

As of December 18, 2025, TAG is trading at $0.0005644, reflecting a -1.86% decline over the past 24 hours and a -0.62% decline in the past hour. However, the token demonstrates positive momentum with a 20.8% weekly gain, suggesting short-term recovery dynamics.

Key Market Metrics:

- Market Capitalization: $61,183,540.77 (based on circulating supply)

- Fully Diluted Valuation (FDV): $228,796,923.52

- Circulating Supply: 108,404,572,594 TAG (26.74% of total supply)

- Total Supply: 405,380,800,000 TAG

- 24-Hour Trading Volume: $295,242.66

- Market Dominance: 0.0073%

- Token Holders: 24,906 addresses

- Exchange Listings: 12 trading venues

The token operates on the BEP-20 standard across the Binance Smart Chain (BSC) network. With a market cap representing 26.74% of its fully diluted valuation, TAG maintains significant upside potential if circulation increases toward total supply. The weekly performance of +20.8% contrasts with the monthly performance of +0.33%, indicating recent price consolidation with renewed buying interest.

Check current TAG market price on Gate.com

TAG Market Sentiment Index

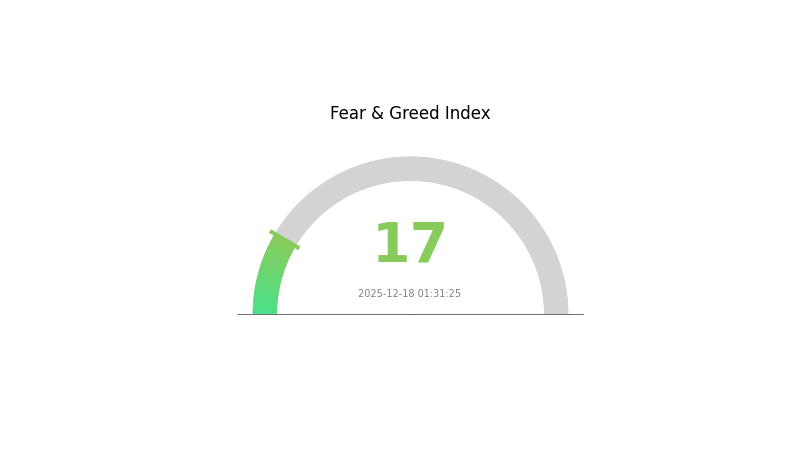

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 17. This historically low reading suggests that market participants are highly risk-averse and pessimistic about near-term price movements. Such extreme fear conditions often create contrarian opportunities for long-term investors, as panic selling may have reached exhaustion levels. However, traders should exercise caution and conduct thorough research before entering positions during such volatile periods. Consider dollar-cost averaging strategies to mitigate risk while building positions at potentially attractive prices on Gate.com.

TAG Holding Distribution

Visit TAG Holding Distribution for real-time data

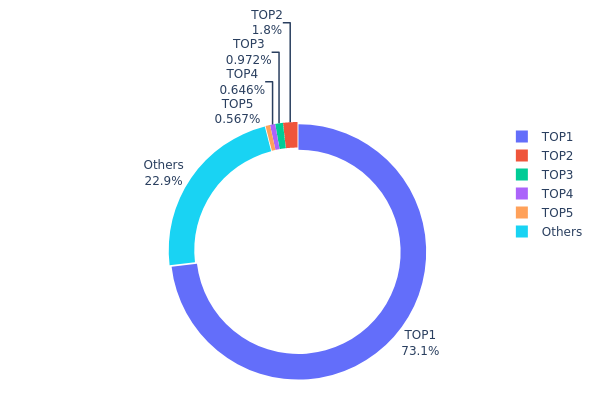

The address holding distribution represents the concentration of token ownership across blockchain addresses, serving as a critical metric for assessing the decentralization level and market structure of a cryptocurrency asset. This distribution reveals how token supply is dispersed among holders, with particular emphasis on identifying potential concentration risks among large holders, commonly referred to as "whales."

The current TAG distribution exhibits significant concentration characteristics. The top holder (0xb0bd...d35d62) commands 73.14% of total supply, representing an exceptionally high degree of centralization. This single address concentration far exceeds healthy decentralization thresholds typically observed in mature blockchain ecosystems. The subsequent top four addresses collectively hold only 4.0% of supply (1.79%, 0.97%, 0.64%, and 0.56% respectively), while the remaining distributed holders account for 22.9% of tokens. This stark disparity between the dominant holder and other participants indicates an extreme concentration pattern.

Such pronounced concentration poses considerable implications for market structure stability. The overwhelming dominance of a single address creates inherent asymmetries in decision-making power and introduces elevated susceptibility to potential price manipulation. Large-scale liquidation or movement of tokens from the primary holder could trigger substantial price volatility, while the concentration risk may constrain market efficiency and retail investor confidence. The current distribution reflects a relatively nascent market phase with limited decentralization, warranting close monitoring of token distribution evolution and potential holder behavior patterns.

</Holding Distribution Analysis>

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xb0bd...d35d62 | 296515994.89K | 73.14% |

| 2 | 0x73d8...4946db | 7296267.42K | 1.79% |

| 3 | 0xc882...84f071 | 3940900.50K | 0.97% |

| 4 | 0xffa8...44cd54 | 2619059.15K | 0.64% |

| 5 | 0xec87...8a0a2b | 2300207.97K | 0.56% |

| - | Others | 92708370.07K | 22.9% |

II. Core Factors Influencing TAG's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Major central bank policies and interest rate expectations continue to shape cryptocurrency market sentiment. Macroeconomic conditions and inflation rates remain primary drivers of market demand and investor allocation to digital assets.

-

Geopolitical Factors: International economic conditions and geopolitical developments influence broader market dynamics and can affect capital flows into cryptocurrency markets.

Note: The provided materials do not contain specific information about TAG's supply mechanisms, institutional holdings, corporate adoption, or technical development roadmap. To provide a comprehensive analysis of TAG's price drivers, detailed information about the token's tokenomics, development team roadmap, ecosystem partnerships, and market positioning would be required.

III. TAG Price Forecast 2025-2030

2025 Outlook

- Conservative Prediction: $0.00034 - $0.00059

- Neutral Prediction: $0.00057 (average trading range)

- Optimistic Prediction: $0.00059 (with sustained market interest and positive ecosystem developments)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with moderate growth trajectory, characterized by increasing institutional attention and protocol maturation.

- Price Range Forecast:

- 2026: $0.00031 - $0.00072

- 2027: $0.00061 - $0.00081

- 2028: $0.00070 - $0.00078

- Key Catalysts: Expansion of TAG utility within the ecosystem, strategic partnerships, improvements in market liquidity through platforms like Gate.com, and broader adoption of blockchain infrastructure.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00070 - $0.00091 (2029) progressing to $0.00048 - $0.00123 (2030), assuming stable market conditions and consistent ecosystem development.

- Optimistic Scenario: $0.00091 - $0.00123 (assuming accelerated mainstream adoption and increased institutional participation).

- Transformative Scenario: $0.00123+ (under conditions of significant technological breakthroughs, major enterprise adoption, and substantial increase in total addressable market).

Note: Price predictions are subject to significant volatility and market uncertainty. Historical cryptocurrency performance does not guarantee future results. Investors should conduct thorough due diligence and consider their risk tolerance before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00059 | 0.00057 | 0.00034 | 0 |

| 2026 | 0.00072 | 0.00058 | 0.00031 | 2 |

| 2027 | 0.00081 | 0.00065 | 0.00061 | 14 |

| 2028 | 0.00078 | 0.00073 | 0.0007 | 28 |

| 2029 | 0.00091 | 0.00076 | 0.0007 | 33 |

| 2030 | 0.00123 | 0.00084 | 0.00048 | 47 |

Tagger (TAG) Professional Investment Strategy and Risk Management Report

IV. TAG Professional Investment Strategy and Risk Management

TAG Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Believers in AI-driven data solutions, institutional investors seeking exposure to decentralized data infrastructure, and long-term portfolio diversifiers

- Operational Recommendations:

- Establish a core position during periods of market consolidation, accumulating at support levels around $0.0005-$0.0006

- Implement dollar-cost averaging (DCA) over 3-6 months to reduce timing risk and benefit from volatility

- Store TAG tokens in secure wallets with multi-signature protection for holdings exceeding significant portfolio allocations

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price Action Analysis: Monitor the 24-hour trading range ($0.0005597 to $0.000609) for breakout opportunities; watch for sustained closes above $0.0006 as potential bullish signals

- Volatility Metrics: Track 7-day gains of +20.8% and historical volatility patterns to identify optimal entry and exit windows

-

Swing Trading Key Points:

- Capitalize on the 7-day momentum (+20.8%) by identifying resistance levels and profit-taking zones

- Implement strict stop-loss orders at 10-15% below entry positions to manage downside risk

- Monitor trading volume ($295,242.66 USD in 24h) for confirmation of breakouts or breakdowns

TAG Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of portfolio allocation - Focus on minimal position sizes with strict risk controls

- Active Investors: 1-3% of portfolio allocation - Moderate positions with regular rebalancing and stop-loss discipline

- Professional/Institutional Investors: 2-5% of portfolio allocation - Larger positions with sophisticated hedging strategies and market-making participation

(2) Risk Hedging Strategies

- Correlation Hedging: Balance TAG holdings with uncorrelated assets (stablecoins, blue-chip cryptocurrencies) to reduce systemic risk exposure

- Position Sizing: Maintain strict position limits relative to total portfolio value; never allocate more than 5% of total investment capital to emerging-stage projects like TAG

(3) Secure Storage Solutions

- Hot wallet Strategy: For active traders, maintain only trading liquidity in exchange wallets on Gate.com, keeping maximum positions on-platform for execution

- Cold Storage Best Practice: Store majority holdings in hardware wallets with offline security protocols, reducing exposure to exchange hacks or smart contract vulnerabilities

- Security Considerations: Protect private keys with encrypted backups stored in geographically distributed locations; enable two-factor authentication on all exchange accounts; never share seed phrases or private keys

V. TAG Potential Risks and Challenges

TAG Market Risks

- Liquidity Risk: With 24-hour volume of approximately $295,242.66 USD and only 12 trading pairs, TAG exhibits relatively modest trading liquidity; large trades may experience significant slippage

- Price Volatility: Historical price swings from $0.0012772 (ATH on August 12, 2025) to $0.0001298 (ATL on October 10, 2025) represent 89% drawdown potential; future volatility may exceed investor risk tolerance

- Market Concentration Risk: With only 26.74% circulating supply utilized, 73.26% of tokens remain in reserve; future token unlocks could apply significant selling pressure and price depreciation

TAG Regulatory Risks

- Uncertain AI Data Regulation: Global regulatory frameworks for AI data labeling platforms remain undefined; evolving regulations regarding data privacy (GDPR, CCPA) could restrict Tagger's operational scope

- Cross-Border Compliance: As a "cross-border data authentication protocol," TAG faces potential restrictions in jurisdictions with strict data sovereignty requirements

- Institutional Adoption Barriers: Regulatory uncertainty may deter institutional partners from integrating Tagger's platform, limiting revenue growth and token utility expansion

TAG Technology Risks

- Smart Contract Vulnerability: As a BEP-20 token on the Binance Smart Chain, TAG faces inherent blockchain risks including potential contract bugs, exploits, or chain consensus failures

- Data Integrity Challenges: The core value proposition (decentralized AI data labeling) depends on maintaining data quality standards; poor labeling quality could undermine platform credibility

- Competitive Platform Threat: Emerging competitors in decentralized AI data infrastructure could offer superior efficiency, scalability, or cost advantages, eroding Tagger's market position

VI. Conclusion and Action Recommendations

TAG Investment Value Assessment

Tagger presents a compelling thesis in the emerging intersection of decentralized infrastructure and AI data solutions. With a market capitalization of $61.2 million and a fully diluted valuation of $228.8 million, TAG represents a speculative but potentially high-growth opportunity for investors believing in the long-term value of permissionless data labeling infrastructure. The project's year-to-date appreciation of 15,047% demonstrates exceptional growth, though this also creates elevated valuation risk and reversion potential. The current market share of 0.0073% indicates TAG remains a micro-cap asset with limited institutional adoption and considerable growth optionality—but also material execution risk.

TAG Investment Recommendations

✅ Beginners: Start with micro-allocations (0.25-0.5% of portfolio) through dollar-cost averaging on Gate.com; focus on understanding the platform's value proposition before scaling positions; use this as a learning vehicle for emerging AI infrastructure projects

✅ Experienced Investors: Establish 1-2% core positions with defined stop-losses; actively monitor technical trends and regulatory developments; consider the 7-day momentum (+20.8%) as potential rebalancing signal; utilize swing trading around identified support ($0.0005) and resistance ($0.0007) levels

✅ Institutional Investors: Evaluate TAG as a portfolio diversifier within AI/data infrastructure allocation buckets; consider building positions opportunistically during correction phases; engage with project fundamentals and roadmap progress before significant capital deployment

TAG Trading Participation Methods

- Exchange Trading on Gate.com: Execute spot trading through Gate.com's interface; leverage limit orders to optimize entry prices around identified support levels

- Dollar-Cost Averaging Program: Implement systematic purchasing on Gate.com through regular intervals (weekly or bi-weekly) to reduce timing risk

- Portfolio Rebalancing: Utilize TAG holdings as a portfolio tactical allocation, rotating exposure based on technical signals and fundamental developments

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and consult professional financial advisors. Never invest capital you cannot afford to lose completely. Past performance does not guarantee future results.

FAQ

What crypto will 1000x prediction?

Emerging altcoins with strong fundamentals and early-stage adoption potential show highest 1000x prospects. Projects focused on innovation, real-world utility, and significant transaction volume demonstrate stronger momentum for exponential growth in upcoming market cycles.

Does Rarible have a future?

Yes, Rarible has strong potential. As a leading NFT marketplace, it continues innovating with new features and expanding its ecosystem. Growing adoption and development roadmap suggest positive long-term prospects for the platform and RARI token.

Will TRX reach $1 in 2025?

TRX reaching $1 in 2025 is achievable with strong adoption and favorable market conditions. Technological advancements and growing institutional interest could drive this growth. While ambitious, current momentum makes this price target realistic.

Will Shiba hit $1 in 2040?

Hitting $1 by 2040 seems highly unlikely. Shiba would need massive token burns and extraordinary adoption growth to reach this price. Current projections and market dynamics make this scenario extremely unrealistic.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Top Solutions for Accepting Cryptocurrency Payments in Business

Introduction to Filecoin (FIL): Use Cases and Applications

Understanding NFT Rarity Scoring and Its Impact on Valuation

Ripple (XRP) Price Trends and Market Sentiment Analysis

Exploring T Coins: A Detailed Guide to Various T Cryptocurrencies