2025 PLUME Price Prediction: Expert Analysis and Future Market Outlook for Plume Network Token

Introduction: PLUME's Market Position and Investment Value

Plume (PLUME) stands as the first RWAfi L1 network focused on crypto natives, building infrastructure to seamlessly connect the real world with crypto markets. Since its launch in December 2024, Plume has established itself as an innovative force in the RWA sector by redefining traditional asset tokenization—moving beyond conventional on-chain TradFi to create crypto-first RWA use cases including RWA derivatives, lending protocols, yield farming, and speculative instruments. As of December 19, 2025, Plume's market capitalization has reached $31.06 million with a fully diluted valuation of $155.3 million, commanding a circulating supply of 2 billion tokens at a current price of approximately $0.01553. This groundbreaking asset is playing an increasingly vital role in bridging real-world assets with decentralized finance infrastructure.

This article will provide a comprehensive analysis of Plume's price trajectory from 2025 through 2030, integrating historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for informed market participants.

PLUME Price History Review and Current Market Status

I. PLUME Price History Review and Current Market Status

PLUME Historical Price Evolution

- December 2025: PLUME experienced significant market volatility since its launch, with the token reaching its all-time high of $0.24903 on March 19, 2025, before entering a prolonged correction phase. The price subsequently declined to its all-time low of $0.01007 on October 10, 2025, representing a substantial drawdown from peak levels.

PLUME Current Market Position

As of December 19, 2025, PLUME is trading at $0.01553, reflecting a 24-hour price increase of 4.22% with a trading volume of $759,381.37 over the past 24 hours. The token exhibits a market capitalization of $31,060,000 and a fully diluted valuation of $155,300,000, with a circulating supply of 2,000,000,000 tokens out of a maximum supply of 10,000,000,000 tokens (20% circulating ratio).

Over the extended timeframes, PLUME demonstrates considerable bearish pressure: the 7-day performance shows a decline of 22.5%, while the 30-day and 1-year performances have deteriorated by 46.05% and 90.52% respectively, indicating sustained downward momentum throughout the year. The hourly movement shows a marginal decline of 0.19%. The token maintains a market ranking of 681 with a market dominance of 0.0048%. PLUME is currently listed on 35 exchanges with 22,039 token holders, and maintains an active development ecosystem with an explorer available at https://explorer.plume.org.

Click to view current PLUME market price

PLUME Market Sentiment Indicator

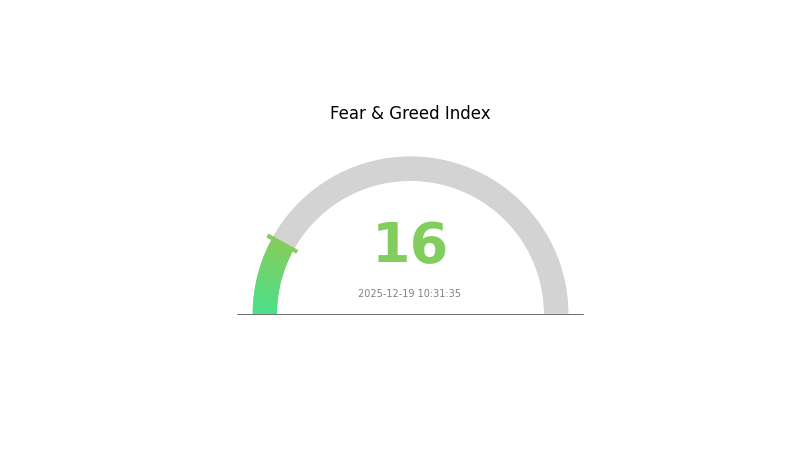

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index dropping to 16. This unusually low reading suggests significant market pessimism and potential capitulation among investors. When fear reaches such extreme levels, it often creates compelling buying opportunities for contrarian traders and long-term holders. Market volatility typically accompanies such sentiment shifts, making it crucial to maintain disciplined risk management. On Gate.com, you can monitor real-time market data and adjust your portfolio strategy accordingly. Consider this period as a potential accumulation phase before the next market cycle.

PLUME Holdings Distribution

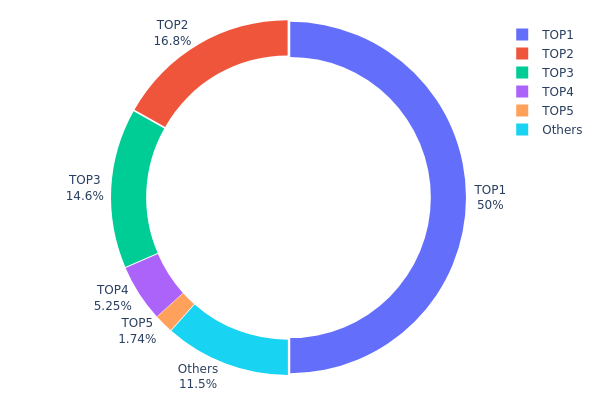

The address holdings distribution map illustrates the concentration of PLUME tokens across blockchain addresses, providing critical insights into token ownership structure and potential market dynamics. This metric aggregates the top token holders and quantifies their proportional stakes, serving as a key indicator of decentralization and market concentration risk.

PLUME's current holdings distribution exhibits pronounced concentration characteristics. The top address controls 50.00% of all tokens, representing a significant centralization point. When combined, the top three addresses account for approximately 81.45% of total token supply, indicating substantial concentration in a relatively small number of holders. The fourth and fifth largest addresses contribute 5.25% and 1.74% respectively, while the remaining fragmented holders collectively represent 11.56% of the circulating supply. This skewed distribution pattern suggests that the token's ownership landscape is dominated by a small cohort of major stakeholders, which raises material considerations regarding governance influence and token liquidity.

The extreme concentration observed in PLUME's holder distribution carries meaningful implications for market structure and price dynamics. The prevalence of whale positions—particularly the 50% concentration in the largest address—creates elevated vulnerability to significant price movements triggered by concentrated selling pressure or large-scale transfers. While such concentration may reflect legitimate project allocation, team holdings, or early investor positions, it inherently constrains the token's resilience to market shocks and increases susceptibility to potential supply-side volatility. The 11.56% distribution among dispersed addresses suggests limited retail participation, which further undermines natural price discovery mechanisms and liquidity depth. This structural imbalance indicates that PLUME's current market architecture demonstrates relatively low decentralization, with governance and price action remaining heavily influenced by a concentrated stakeholder base rather than a broad, distributed community.

View current PLUME holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7fd9...f3baf6 | 5000000.02K | 50.00% |

| 2 | 0x3538...adef83 | 1683834.57K | 16.83% |

| 3 | 0xe13b...fd0e97 | 1462946.43K | 14.62% |

| 4 | 0x711f...f47949 | 525469.66K | 5.25% |

| 5 | 0x9999...15d321 | 174124.32K | 1.74% |

| - | Others | 1153625.00K | 11.56% |

II. Core Factors Influencing PLUME's Future Price

Technology Development and Ecosystem Construction

-

RWA Infrastructure Development: Plume Network is currently in private testnet phase and has established over 80 RWA and DeFi projects on its network. These projects span collectibles, alternative assets, synthetic materials, luxury goods, real estate, lending/borrowing protocols, and perpetual futures. The expansion of real-world asset tokenization infrastructure directly supports network adoption and token utility growth.

-

Ecosystem Application Expansion: Plume's ecosystem focuses on bridging traditional finance and decentralized finance by enabling real-world assets to be integrated into blockchain. The platform's architecture—where smart contracts automatically execute rules, on-chain data remains transparent and verifiable, and liquidity is formed naturally through decentralized markets—differentiates it from traditional asset certification methods and attracts institutional participation in RWAfi space.

Macroeconomic Environment

-

Regulatory Compliance Impact: Global cryptocurrency compliance trends significantly influence Plume Network's future prospects. As regulatory frameworks evolve worldwide, platforms demonstrating robust compliance measures and authentic asset verification mechanisms gain competitive advantages. Plume's focus on ensuring on-chain asset authenticity and fraud prevention becomes increasingly valuable in regulatory environments prioritizing institutional-grade infrastructure.

-

Geopolitical Factors: Market sentiment regarding cryptocurrency pricing is substantially affected by macroeconomic events and policy announcements. Tariff policies and international economic developments create volatility in cryptocurrency markets, which indirectly impacts PLUME's price volatility and investor positioning.

III. 2025-2030 PLUME Price Forecast

2025 Outlook

- Conservative Forecast: $0.01472 - $0.01549

- Base Case Forecast: $0.01549

- Optimistic Forecast: $0.01998 (requires sustained market sentiment and increased adoption)

2026-2028 Mid-term Outlook

- Market Phase Expectations: Gradual recovery and accumulation phase with incremental growth trajectory

- Price Range Predictions:

- 2026: $0.01206 - $0.02093 (14% upside potential)

- 2027: $0.01199 - $0.02243 (24% upside potential)

- 2028: $0.01357 - $0.02443 (34% upside potential)

- Key Catalysts: Network expansion, ecosystem development, institutional interest, and macro market conditions recovery

2029-2030 Long-term Outlook

- Base Case Scenario: $0.02039 - $0.02333 (45% cumulative gain by 2029, reflecting steady ecosystem maturation)

- Optimistic Scenario: $0.02299 - $0.03426 (48% cumulative gain by 2030, assuming accelerated adoption and positive market cycles)

- Transformative Scenario: Above $0.03426 (contingent on breakthrough technological advancements, major partnership announcements, or significant expansion in DeFi ecosystem integration)

- December 19, 2025: PLUME trading near mid-range levels (market consolidation phase ongoing)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01998 | 0.01549 | 0.01472 | 0 |

| 2026 | 0.02093 | 0.01774 | 0.01206 | 14 |

| 2027 | 0.02243 | 0.01933 | 0.01199 | 24 |

| 2028 | 0.02443 | 0.02088 | 0.01357 | 34 |

| 2029 | 0.02333 | 0.02265 | 0.02039 | 45 |

| 2030 | 0.03426 | 0.02299 | 0.01196 | 48 |

PLUME Professional Investment Strategy and Risk Management Report

IV. PLUME Professional Investment Strategy and Risk Management

PLUME Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Crypto-native investors with conviction in RWA infrastructure development, institutional allocators seeking exposure to emerging L1 ecosystems, and those comfortable with 18-24 month+ investment horizons.

- Operation Recommendations:

- Accumulate during market downturns when PLUME trades below $0.015, dollar-cost averaging to reduce timing risk given the -22.5% 7-day performance and -46.05% 30-day decline.

- Monitor ecosystem development milestones including RWA derivatives launch, lending protocol expansion, and yield farming feature rollout as indicators of fundamental progress.

- Store holdings securely using Gate Web3 Wallet for active management with hardware backup for long-term positions exceeding $10,000 USD equivalent.

(2) Active Trading Strategy

- Technical Analysis Tools:

- Relative Strength Index (RSI): Monitor oversold conditions below 30 for potential reversal entries, particularly relevant given PLUME's -90.52% 1-year decline suggesting accumulated weakness.

- Moving Average Crossovers: Use 20-day and 50-day moving averages to identify trend confirmation; current -22.5% weekly decline indicates downtrend dominance requiring caution.

- Wave Trading Key Points:

- Identify resistance at historical high of $0.24903 (last reached March 19, 2025) and support near all-time low of $0.01007 (October 10, 2025) for defined risk/reward ratios.

- Execute position sizing limiting single trades to 2-3% of portfolio given PLUME's $759,381 24-hour volume representing relatively tight liquidity for large positions.

PLUME Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum, treating PLUME as speculative allocation to emerging RWA infrastructure with asymmetric upside but significant downside risk.

- Aggressive Investors: 3-5% portfolio allocation, appropriate for those with 3+ year investment horizons and conviction in crypto-native RWA market development.

- Professional Investors: 5-8% allocation within dedicated emerging blockchain infrastructure sleeve, implementing systematic rebalancing quarterly or upon 25% price movements.

(2) Risk Hedging Solutions

- Dollar-Cost Averaging (DCA): Execute purchases over 12-24 week periods rather than lump-sum investment, mitigating timing risk during price volatility and allowing accumulation at averaging entry prices below current $0.01553.

- Portfolio Diversification: Limit PLUME exposure within broader Web3 infrastructure allocation alongside established L1s, ensuring no single project represents >10% of blockchain-focused holdings.

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active traders managing frequent transactions, providing institutional-grade security with multi-signature support and real-time portfolio tracking integrated with Gate.com exchange connectivity.

- Cold Storage Protocol: For holdings exceeding 6-month horizon, transfer PLUME tokens (ERC-20 standard on Ethereum mainnet) to hardware-secured wallets with offline key management, utilizing address: 0x4c1746a800d224393fe2470c70a35717ed4ea5f1 for verification.

- Security Considerations: Enable two-factor authentication on all exchange accounts, never share private keys, verify contract addresses directly via Etherscan (https://etherscan.io/token/0x4c1746a800d224393fe2470c70a35717ed4ea5f1) before transfers, and maintain backup seed phrases in secure physical locations.

V. PLUME Potential Risks and Challenges

PLUME Market Risk

- Severe Price Volatility: PLUME has declined 90.52% over 12 months from initial levels, demonstrating extreme downside risk and suggesting significant investor liquidation or loss of confidence in project execution versus original thesis.

- Liquidity Constraints: Daily trading volume of $759,381 across 35 trading venues remains relatively thin for a $155.3 million fully diluted valuation, creating slippage risk for position exits and potential price manipulation vulnerability.

- Market Share Concentration: Ranking 681 by market cap with only 0.0048% dominance indicates marginal market presence, limiting institutional adoption and increasing susceptibility to sentiment shifts away from RWA narratives.

PLUME Regulatory Risk

- RWA Regulatory Uncertainty: Real-world asset tokenization remains under evolving regulatory frameworks globally, with potential restrictions on derivatives, lending, and yield farming mechanisms that form PLUME's core value proposition.

- Token Classification Risk: Regulatory bodies may reclassify RWA-linked tokens as securities, requiring compliance modifications that could restrict trading pairs, reduce exchange listings, or necessitate protocol redesign.

- Jurisdictional Compliance: International regulatory divergence on crypto-native RWA issuance may limit geographic expansion of PLUME ecosystem adoption and create geographic arbitrage or compliance arbitrage pressure.

PLUME Technical Risk

- Infrastructure Execution Risk: As an emerging L1 network, PLUME faces risks from protocol bugs, smart contract vulnerabilities, or consensus mechanism failures that could jeopardize user assets or network integrity.

- Ecosystem Developer Adoption: Limited developer ecosystem and third-party application rollout compared to established L1s creates network effect weakness and potential stagnation in RWA use case expansion.

- Scalability Uncertainty: Performance metrics, transaction throughput, and finality guarantees relative to competing RWA infrastructure remain unproven at scale, with unknown performance degradation under high-volume trading conditions.

VI. Conclusion and Action Recommendations

PLUME Investment Value Assessment

PLUME presents a high-conviction thesis for believers in crypto-native real-world asset infrastructure development, offering exposure to paradigm-shifting RWA use cases including derivatives, lending, and yield farming mechanisms. However, current valuation depression (-90.52% annually) reflects substantial execution risk, developer adoption challenges, and regulatory uncertainty around RWA tokenization frameworks. The token's $155.3 million fully diluted valuation and 20% circulating supply ratio position PLUME as early-stage with significant dilution potential, requiring patient capital with 3+ year horizons and acceptance of total loss scenarios. Near-term catalysts including RWA derivatives launch and institutional lending partnerships could provide 2-5x upside, while regulatory setbacks or ecosystem stagnation pose 50-75% downside from current levels.

PLUME Investment Recommendations

✅ Newcomers: Allocate 0.5-1% of investment portfolio as speculative exposure, acquiring via dollar-cost averaging over 12 weeks at Gate.com to build positions below $0.015, and storing via Gate Web3 Wallet with stop-loss discipline at 30% below entry prices.

✅ Experienced Investors: Establish 2-3% tactical positions targeting support levels near $0.012-$0.013, actively trade 5-10% position sizing around technical resistance ($0.018-$0.020), and rotate profits into established infrastructure positions upon 50%+ gains.

✅ Institutional Investors: Conduct deep technical due diligence on RWA derivatives and lending protocol performance, negotiate direct token allocations with project stakeholders at discounted pricing, and implement staged deployment over 6-12 months to avoid market impact.

PLUME Trading Participation Methods

- Exchange Trading: Access PLUME via Gate.com and 34 additional venues, leveraging spot trading for direct ownership, margin trading for leverage exposure (manage 3-5x maximum leverage), and exchange integration with automated rebalancing tools.

- Direct Acquisition: Participate in ecosystem governance events, RWA protocol participation rewards, or foundation grants offering discounted token allocations for long-term ecosystem contributors.

- Yield Generation: Monitor ecosystem yield farming opportunities on PLUME-based RWA lending protocols once protocols mature, potentially targeting 15-25% annual yield on capital deployed to early-stage infrastructure.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and should consult professional financial advisors. Never invest funds you cannot afford to lose completely.

FAQ

What are the risks of investing in Plume coin?

Plume coin investments carry risks including market volatility, regulatory uncertainty, and technology vulnerabilities. Cryptocurrency markets are highly speculative and unpredictable. Conduct thorough research before investing.

What is plume token all time high?

Plume token reached an all-time high of $0.2475 on March 19, 2025. This represents the peak price ever achieved since the token's launch.

Is plume coin legit?

Yes, Plume coin is legitimate. It focuses on real-world assets(RWAs)integration with strong backing. The project demonstrates genuine technical development and growing ecosystem adoption in the Web3 space.

What factors influence PLUME price movements and predictions?

PLUME price movements are driven by trading volume, technical trends, and market sentiment. Predictions consider these key factors plus RWA infrastructure developments. Short-term volatility exists, but long-term prospects appear positive.

What is the current price of PLUME and what are expert price predictions for 2024-2025?

The current price of PLUME is $0.155. Experts predict PLUME could range from $0.146 to $0.155 throughout 2025, with potential for steady growth in the coming months.

RWA on Avalanche (AVAX): How Real-World Assets Come On-Chain

Is Ondo Finance (ONDO) a good investment?: Analyzing the potential and risks of this innovative DeFi protocol

2025 QNT Price Prediction: Analyzing Potential Growth and Market Trends for Quant Network's Token

Is ELYSIA (EL) a Good Investment?: Analyzing the Potential and Risks of This Emerging Cryptocurrency in 2024

Is XDC Network (XDC) a good investment?: Analyzing the potential of this enterprise-focused blockchain platform

OCT vs AVAX: Comparing Two Promising Blockchain Platforms for Smart Contract Development

How can on-chain data analysis reveal Bitcoin market trends through active addresses, transaction volume, and whale movements in 2025?

What is Cryptocurrency Mining? | Understanding The Process and Mechanisms

How Does Resolv (RESOLV) Maintain 50,000+ Active Users With 35% Network Growth and 56% Monthly Engagement Rate?

Understanding Polygon Addresses: Key Features and Functions in Crypto

Is Cryptocurrency Mining Allowed in India? | Comprehensive Guide