2025 MYTH Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: MYTH's Market Position and Investment Value

Mythos (MYTH) is a decentralized gaming infrastructure token designed to democratize the gaming world by enabling players and creators to participate in the value chain. Since its launch in 2022, MYTH has established itself as a foundational utility token within a multi-chain ecosystem that supports unified markets, decentralized finance, governance mechanisms, and multi-token gaming economies. As of December 2025, MYTH boasts a fully diluted market cap of $18.92 million with approximately 796.42 million tokens in circulation, currently trading around $0.01892. This asset, which serves as an interoperable native utility token for gaming developers, publishers, and content creators, is playing an increasingly vital role in the decentralized gaming sector.

This article will provide a comprehensive analysis of MYTH's price trajectory through 2030, incorporating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors seeking exposure to the gaming tokenomics space.

MYTH Price Review and Market Analysis

I. MYTH Price History Review and Market Status

MYTH Historical Price Trajectory

-

2023: MYTH reached its all-time high (ATH) of $1.10 on December 7, 2023, marking a peak valuation period for the token following its launch in November 2022.

-

2024-2025: MYTH experienced significant depreciation throughout this period, declining substantially from its peak as market conditions shifted and the project navigated various market cycles.

-

December 2025: MYTH hit its all-time low (ATL) of $0.01696 on December 19, 2025, representing an approximately 90.64% decline over the past year.

MYTH Current Market Condition

As of December 21, 2025, MYTH is trading at $0.01892, reflecting recent volatility in the market. The token demonstrated a 6.44% gain over the last 24 hours, recovering slightly from recent lows. However, the broader trend remains challenging, with MYTH down 9.32% over the past 7 days and 58.19% over the past 30 days.

The 24-hour trading range spans from a low of $0.01785 to a high of $0.0204, indicating moderate price fluctuation. With a circulating supply of approximately 796.42 million MYTH tokens out of a total supply of 1 billion, the current market capitalization stands at around $15.07 million, while the fully diluted valuation (FDV) is valued at $18.92 million.

The current market shows a circulating supply ratio of 79.64%, indicating that a significant portion of the total token supply is already in circulation. Market participation remains relatively active with 4,985 token holders, and MYTH is currently listed on 3 exchanges. The market sentiment reflects extreme fear conditions (VIX: 20), suggesting heightened market anxiety and pessimistic outlooks.

Click to view current MYTH market price

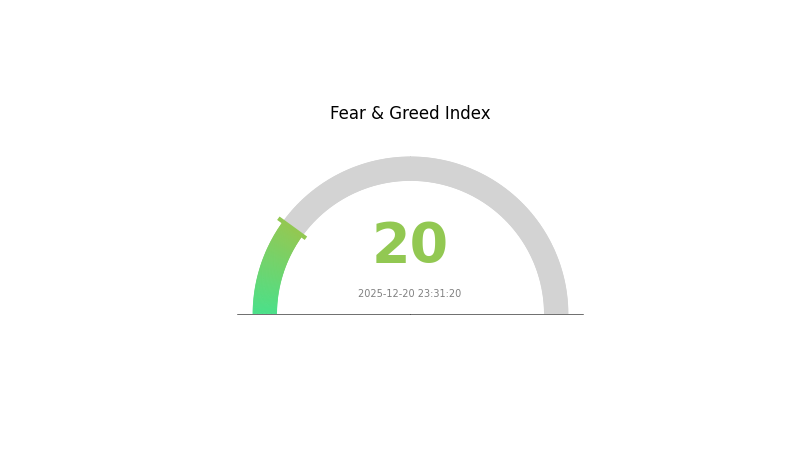

MYTH Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates significant market pessimism and investor anxiety. During such periods, price volatility tends to increase, presenting both risks and potential opportunities for strategic traders. Investors should exercise caution and avoid emotional decision-making. Consider dollar-cost averaging or establishing positions gradually rather than entering the market all at once. Monitor market fundamentals closely and maintain proper risk management strategies. Extreme fear often marks potential reversal points, though patience and discipline remain essential for successful navigation through volatile market conditions.

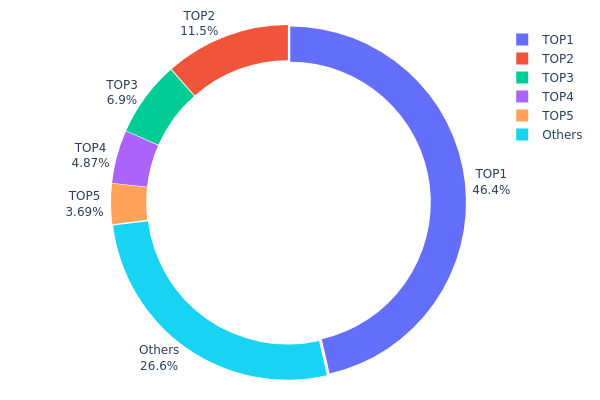

MYTH Holdings Distribution

Address holdings distribution represents the concentration of token ownership across blockchain addresses, serving as a critical metric for assessing decentralization levels and potential market concentration risks. By analyzing the distribution patterns of top holders, market participants can evaluate the structural stability of a project and identify potential vulnerabilities to market manipulation or price volatility.

MYTH's current holdings distribution exhibits significant concentration characteristics. The top address controls 46.39% of all circulating tokens, while the combined holdings of the top five addresses account for 73.34% of the total supply. This concentration level indicates a pronounced centralization tendency within the token distribution structure. The second-largest holder maintains an 11.50% stake, followed by progressively smaller positions, with the remaining 26.66% dispersed among other addresses. Such a distribution pattern suggests limited decentralization at present, with governance and price direction heavily influenced by a small number of major stakeholders.

This concentrated ownership structure presents tangible implications for market dynamics and stability. The dominance of the largest holder, controlling nearly half of all MYTH tokens, creates considerable potential for significant price movements should this entity decide to transact substantial quantities. The steep drop-off from the largest to secondary holders further amplifies concentration risk, as coordinated actions among the top five holders could effectively shape market direction. However, the approximately 26.66% held by dispersed smaller addresses provides some degree of distributed support, potentially offering a counterbalance to extreme volatility scenarios. Overall, MYTH's current holdings distribution reflects an early-stage or concentrated project structure, suggesting that stakeholder composition and decentralization progression merit continued monitoring.

For real-time tracking of MYTH holdings distribution, visit MYTH Holdings Distribution on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd803...b846a8 | 463993.70K | 46.39% |

| 2 | 0xbee7...c52668 | 115067.87K | 11.50% |

| 3 | 0xabed...eea440 | 68967.94K | 6.89% |

| 4 | 0x06fd...950e3f | 48701.04K | 4.87% |

| 5 | 0xa3af...1a6bc8 | 36931.55K | 3.69% |

| - | Others | 266337.89K | 26.66% |

II. Core Factors Influencing MYTH's Future Price

Supply Mechanism

- Market Dynamics: Supply and demand relationships directly determine market trends; supply fluctuations will continue to impact price volatility.

- Current Impact: Supply changes are expected to maintain sustained influence on price movements going forward.

Macroeconomic Environment

- Monetary Policy Impact: Major central bank policy expectations will significantly influence MYTH's price direction.

- Inflation Hedge Properties: MYTH's performance in inflationary environments represents a critical variable for price assessment.

- Geopolitical Factors: International developments and shifts in geopolitical dynamics will impact MYTH's valuation.

III. 2025-2030 MYTH Price Forecast

2025 Outlook

- Conservative Forecast: $0.01781 - $0.01915

- Neutral Forecast: $0.01915 - $0.02000

- Optimistic Forecast: $0.02100 - $0.02298 (requires sustained positive market sentiment and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Gradual accumulation phase with incremental growth trajectory, supported by ecosystem development and increasing institutional interest

- Price Range Predictions:

- 2026: $0.01917 - $0.03054

- 2027: $0.0209 - $0.0369

- 2028: $0.02853 - $0.04452

- Key Catalysts: Enhanced tokenomics implementation, strategic partnerships, expansion of use cases, growing market capitalization, and positive regulatory developments

2029-2030 Long-term Outlook

- Base Case: $0.03149 - $0.05349 (assumes steady ecosystem expansion and moderate market growth)

- Optimistic Scenario: $0.03794 - $0.05349 (assumes accelerated adoption, stronger institutional participation, and favorable market conditions)

- Transformative Scenario: $0.04571 - $0.05349 with 141% cumulative growth by 2030 (requires breakthrough technological innovations, mainstream adoption milestones, and significant market capitalization expansion)

Note: All price predictions are subject to market volatility and macroeconomic conditions. Trading on Gate.com and other platforms should be conducted with appropriate risk management strategies.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02298 | 0.01915 | 0.01781 | 1 |

| 2026 | 0.03054 | 0.02107 | 0.01917 | 11 |

| 2027 | 0.0369 | 0.0258 | 0.0209 | 36 |

| 2028 | 0.04452 | 0.03135 | 0.02853 | 65 |

| 2029 | 0.05349 | 0.03794 | 0.03149 | 100 |

| 2030 | 0.05349 | 0.04571 | 0.02469 | 141 |

MYTH Investment Strategy and Risk Management Report

IV. MYTH Professional Investment Strategy and Risk Management

MYTH Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Gaming ecosystem enthusiasts, decentralized governance advocates, and long-term cryptocurrency believers

- Operational Recommendations:

- Accumulate MYTH tokens during market downturns when prices fall below $0.02, as the project focuses on democratizing the gaming world with multi-chain ecosystem support

- Dollar-cost averaging (DCA) approach: invest fixed amounts monthly to reduce timing risk

- Participate in governance activities and ecosystem development to maximize utility value of held tokens

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price volatility analysis: Monitor 24-hour trading volume ($18,883.52) and price range ($0.01785 to $0.0204) to identify entry and exit points

- Historical performance tracking: Reference the all-time high of $1.1 (December 7, 2023) and recent low of $0.01696 (December 19, 2025) to understand support and resistance levels

-

Wave Trading Key Points:

- Current market position: MYTH trades near its recent lows, presenting potential accumulation opportunities for contrarian traders

- Volume monitoring: Track daily volume movements relative to the 24-hour average of approximately $18,883.52 to confirm trend strength

MYTH Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of total cryptocurrency portfolio

- Aggressive Investors: 5-7% of total cryptocurrency portfolio

- Professional Investors: 3-5% of total cryptocurrency portfolio with hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine MYTH holdings with established gaming and decentralized finance tokens to reduce single-project concentration risk

- Position Sizing: Limit individual MYTH position to prevent catastrophic losses given the -90.64% one-year decline

(3) Secure Storage Solutions

- Hot Wallet Solution: Gate.com Web3 Wallet for active trading and frequent transactions

- Security Considerations: Enable two-factor authentication, use strong passwords, and never share private keys; regularly backup wallet information; verify contract addresses before transactions

V. MYTH Potential Risks and Challenges

MYTH Market Risk

- Extreme Price Volatility: MYTH has declined 90.64% over one year and 58.19% over thirty days, indicating high volatility unsuitable for risk-averse investors

- Low Trading Liquidity: 24-hour volume of $18,883.52 is relatively low, potentially causing slippage on large orders

- Market Cap Concentration: Total market capitalization of $18.92 million represents a micro-cap asset with limited institutional adoption

MYTH Regulatory Risk

- Evolving Gaming and DeFi Regulations: Increased regulatory scrutiny on gaming tokens and decentralized governance mechanisms could impact project viability

- Geographic Compliance Challenges: Multi-chain and global gaming focus may face conflicting regulatory requirements across jurisdictions

- Token Classification Uncertainty: Regulatory bodies may reclassify MYTH as a security rather than utility token, affecting trading and usage

MYTH Technology Risk

- Multi-Chain Ecosystem Execution: Successfully implementing unified markets and interoperable systems across multiple blockchains presents significant technical challenges

- Smart Contract Vulnerabilities: Any bugs in decentralized governance or financial system contracts could lead to fund loss

- Market Adoption Risk: The gaming ecosystem must achieve critical mass for the multi-token economy to function effectively

VI. Conclusion and Action Recommendations

MYTH Investment Value Assessment

MYTH aims to democratize the gaming world through a multi-chain ecosystem with decentralized governance and unified markets. However, the token faces significant headwinds: a 90.64% one-year decline, low trading liquidity, and modest market capitalization of $18.92 million. While the long-term vision of gaming democratization holds merit, investors should recognize this as a speculative, high-risk venture in an early development stage. The project's success depends on ecosystem adoption by game developers, publishers, and content creators—an outcome that remains uncertain.

MYTH Investment Recommendations

✅ Beginners: Limit exposure to 1-2% of your cryptocurrency portfolio; treat as speculative venture capital rather than core holdings; only invest capital you can afford to lose completely

✅ Experienced Investors: Consider using technical analysis to identify entry points near support levels; participate in ecosystem governance if actively managing your position; maintain strict position sizing discipline

✅ Institutional Investors: Conduct thorough due diligence on the team's execution capabilities and gaming partnerships; consider this allocation only as a thematic gaming bet within diversified Web3 portfolios; establish clear exit criteria based on ecosystem milestones

MYTH Trading Participation Methods

- Direct Purchase: Trade MYTH on Gate.com, which lists the token with 24/7 liquidity and competitive trading pairs

- Ecosystem Participation: Engage in governance activities and platform features to accrue utility value beyond pure speculation

- Threshold Monitoring: Set buy alerts for support levels around $0.018 and sell targets based on 25-50% recovery scenarios rather than waiting for all-time high recoveries

Cryptocurrency investment carries extreme risk. This report is for informational purposes only and does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. Always consult with professional financial advisors before investing. Never invest funds you cannot afford to lose completely.

FAQ

What is the most accurate predictor for crypto?

Historical price data and market trends are the most reliable predictors for crypto. Advanced algorithms using regression analysis on historical exchange rates provide accurate forecasts. More historical data available means higher prediction accuracy for cryptocurrency price movements.

What is MYTH token and what is its use case?

MYTH token is the governance token for Mythos DAO, enabling community members to vote on proposals and shape the platform's direction. It underpins all Mythical products and provides holders with governance rights and participation in ecosystem decisions.

What factors influence MYTH price prediction?

MYTH price prediction is influenced by supply and demand dynamics, block reward halvings, protocol updates, market sentiment, trading volume, and real-world adoption events. Technical analysis and ecosystem developments also impact price movements.

What was MYTH's historical price performance and trend analysis?

MYTH rose 1.43% in the last 24 hours, but declined 5.85% over the past week and 4.68% over the past month. The recent uptick aligns with bullish momentum in the gaming sector, showing mixed performance across different timeframes.

What is TRG: Understanding the Tactical Response Group in Law Enforcement

Is Karrat (KARRAT) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

How Does a Token Economic Model Balance Distribution, Inflation, and Governance?

Is My DeFi Pet (DPET) a good investment?: Analyzing the Potential and Risks of this Blockchain-based Game Token

What are the key security risks and vulnerabilities in ARTY smart contracts with 88.47% network security score?

What Are the Key Elements of a Token Economic Model in Crypto?

Crypto Trading Profitability: What You Need to Know

Play-to-Earn Games: How to Earn Bitcoin and Ethereum Rewards

Maximize Your Portfolio: Strategic Investment in Optimism Protocol ($OP)

Ultimate Guide to Trading Pi Network Coins: Top Platforms of 2024

PeiPei Web3 Token: An In-Depth Exploration