2025 IOTX Price Prediction: Expert Analysis and Market Forecast for IoTeX Token

Introduction: Market Position and Investment Value of IOTX

IoTeX (IOTX) is an automatically extensible and privacy-centric blockchain infrastructure designed for the Internet of Things (IoT). Since its inception in 2018, IoTeX has established itself as a dedicated platform for IoT applications. As of 2025, IOTX has achieved a market capitalization of approximately $68.2 million USD, with a circulating supply of 9.44 billion tokens trading at around $0.007224. This innovative asset, positioned as a "privacy-first IoT blockchain," is playing an increasingly vital role in enabling lightweight, scalable, and secure distributed applications within the IoT ecosystem.

This article will provide a comprehensive analysis of IOTX's price trajectory through 2030, incorporating historical price patterns, market supply and demand dynamics, ecosystem development milestones, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors seeking exposure to this IoT-focused digital asset.

IOTX Price Analysis Report

I. IOTX Price History Review and Market Status

IOTX Historical Price Evolution

IOTX reached its all-time high (ATH) of $0.255593 on November 14, 2021, representing the peak of market enthusiasm during that period. The token subsequently experienced a significant downtrend, declining substantially over the following years. As of the current reporting period, IOTX has fallen to $0.007224, representing an 84.44% decrease over the past year from its historical highs, with the all-time low (ATL) recorded at $0.00121576 on March 13, 2020.

IOTX Current Market Position

As of December 18, 2025, IOTX is trading at $0.007224, reflecting a 24-hour decline of 3.89%. The token's market capitalization stands at $68.20 million with a circulating supply of 9.44 billion IOTX tokens out of a total supply of 9.44 billion tokens and a maximum supply cap of 10 billion.

The 24-hour trading volume reached $23,464.27, indicating moderate trading activity. IOTX ranks 420th by market capitalization with a market dominance of 0.0022%. The token maintains a circulating supply ratio of 94.41% relative to maximum supply, reflecting a high degree of token distribution in the ecosystem.

Over various timeframes, IOTX has demonstrated consistent downward momentum: declining 0.89% in the past hour, 3.89% over 24 hours, 14.11% over 7 days, 26.44% over 30 days, and 84.44% over the past year. The 24-hour trading range shows a high of $0.007679 and a low of $0.007158. Market sentiment indicators reflect extreme fear conditions in the broader market environment.

Check current IOTX market price

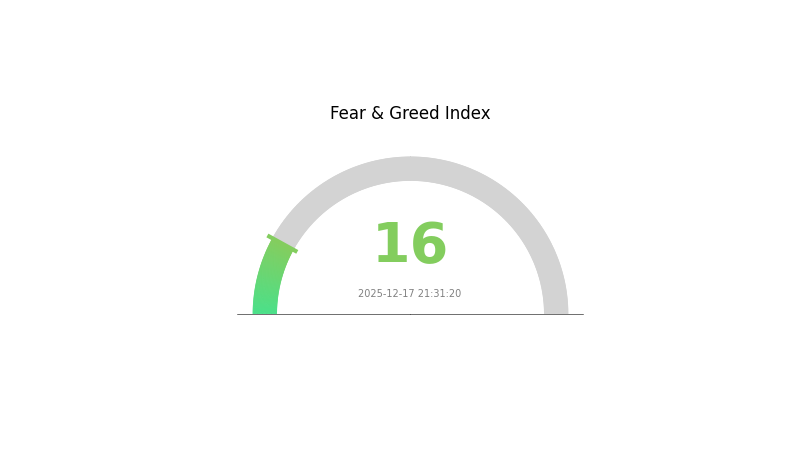

IOTX Market Sentiment Indicator

2025-12-17 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 16. This indicates heightened market anxiety and significant selling pressure across digital assets. When the index reaches such extreme lows, it often signals potential oversold conditions, presenting contrarian investment opportunities for risk-tolerant traders. However, investors should exercise caution and conduct thorough research before making trading decisions. Market conditions at this level typically warrant increased portfolio monitoring and adherence to strict risk management strategies.

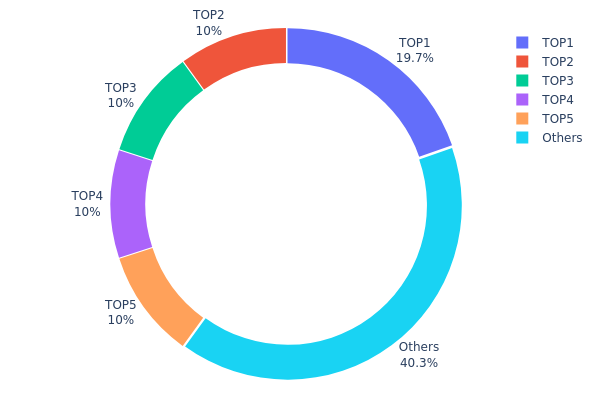

IOTX Holdings Distribution

The address holdings distribution map illustrates the concentration of IOTX tokens across the blockchain network, revealing the ownership structure and decentralization characteristics of the token. By analyzing the top holders and their respective shareholding percentages, this metric provides critical insights into potential market concentration risks and the overall health of the token's distribution landscape.

IOTX currently exhibits moderate concentration characteristics with notable structural insights. The top holder accounts for 19.66% of total supply, while four addresses identified with null designations (0x0000...000001 through 0x0000...000006) collectively represent 40% of circulating tokens. These addresses, typically associated with protocol reserves, liquidity pools, or ecosystem allocations, indicate that a significant portion of IOTX is allocated to strategic purposes rather than speculative trading. The remaining 40.34% distributed across other addresses suggests reasonable decentralization among retail and institutional participants, mitigating extreme concentration risks that could trigger sharp price volatility or market manipulation concerns.

The current distribution pattern reflects a mixed market structure characterized by both institutional control and community participation. While the top five addresses commanding approximately 59.66% of supply could theoretically influence price action, the nature of these holdings—particularly the substantial portions held in protocol-designated addresses—suggests these are largely illiquid or protocol-managed reserves. This structure maintains relative stability while preserving opportunities for organic price discovery driven by active trading participants in the remaining 40% of freely distributed tokens.

Click to view current IOTX Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x87c9...729193 | 1966208.64K | 19.66% |

| 2 | 0x0000...000002 | 1000000.00K | 10.00% |

| 3 | 0x0000...000006 | 1000000.00K | 10.00% |

| 4 | 0x0000...000004 | 1000000.00K | 10.00% |

| 5 | 0x0000...000001 | 1000000.00K | 10.00% |

| - | Others | 4033791.36K | 40.34% |

II. Core Factors Affecting IOTX Future Price

Supply Mechanism

- Limited Supply with Increasing Demand: IoTeX has a limited token supply while demand tends to increase, which often drives prices upward. Conversely, large supply increases or reduced demand can lower prices.

Technical Development and Ecosystem Construction

-

IoTeX 2.0 Launch: The platform announced IoTeX 2.0, which generated price volatility following the announcement. The token increased 2.17% in the past 24 hours and 24.19% over the past week following this development.

-

MachineFi Ecosystem: MachineFi functions similarly to decentralized finance but is specifically tailored for machines. This innovation represents a key product development that impacts IOTX's future performance.

-

Platform Development: Technical progress and community activities on the IoTeX platform directly influence IOTX's value proposition.

Market Sentiment and Strategic Factors

-

Market Sentiment: Overall cryptocurrency market sentiment, particularly regarding IoT and blockchain technology adoption, significantly impacts IOTX price movements. Current market sentiment is reported as neutral, with trader target prices at $0.0322.

-

Strategic Partnerships: New partnerships and collaborations are crucial factors determining IOTX's future performance.

-

Community Governance: IOTX token holders can actively participate in network governance by voting for representatives, thereby influencing the network's future development trajectory.

III. 2025-2030 IOTX Price Forecast

2025 Outlook

- Conservative Forecast: $0.00455 - $0.00722

- Base Case Forecast: $0.00722

- Optimistic Forecast: $0.00888 (requires sustained ecosystem development and increased institutional adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Gradual recovery phase with consolidation and infrastructure maturation, characterized by moderate volatility and incremental utility expansion across IoT applications

- Price Range Predictions:

- 2026: $0.00435 - $0.01006 (11% upside potential)

- 2027: $0.00471 - $0.00996 (25% cumulative gain)

- 2028: $0.00856 - $0.01284 (31% cumulative gain)

- Key Catalysts: Enhanced blockchain scalability solutions, expanded IoT device integration, strategic partnerships with major technology providers, regulatory clarity in IoT and blockchain sectors, and growing enterprise adoption of decentralized identity solutions

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01073 - $0.01397 (54% cumulative appreciation by 2029, reflecting steady ecosystem growth and mainstream IoT adoption)

- Optimistic Scenario: $0.01219 - $0.01496 (74% cumulative appreciation by 2030, supported by breakthrough IoT infrastructure developments and significant enterprise deployment)

- Transformational Scenario: Higher valuation multiples achievable through sector-wide IoT standardization adoption, mass-market smart device proliferation powered by blockchain technology, and IOTX establishing itself as the primary protocol layer for decentralized IoT infrastructure globally

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00888 | 0.00722 | 0.00455 | 0 |

| 2026 | 0.01006 | 0.00805 | 0.00435 | 11 |

| 2027 | 0.00996 | 0.00906 | 0.00471 | 25 |

| 2028 | 0.01284 | 0.00951 | 0.00856 | 31 |

| 2029 | 0.01397 | 0.01118 | 0.01073 | 54 |

| 2030 | 0.01496 | 0.01257 | 0.01219 | 74 |

IoTeX (IOTX) Professional Investment Strategy and Risk Management Report

IV. IOTX Professional Investment Strategy and Risk Management

IOTX Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Investors with long-term vision focused on IoT ecosystem development, patient capital holders willing to endure market volatility, and those believing in privacy-centric blockchain infrastructure adoption.

-

Operational Recommendations:

- Establish a dollar-cost averaging (DCA) entry strategy over 6-12 months to reduce timing risk and average out market volatility

- Set price targets based on fundamental IoT adoption milestones rather than short-term market fluctuations

- Participate in network staking or governance activities if available to generate additional yield while maintaining exposure

-

Storage Solutions:

- Utilize hardware wallets for amounts exceeding $10,000 to ensure maximum security

- Employ Gate Web3 Wallet for smaller holdings requiring frequent access and active participation in the IoTeX ecosystem

- Maintain cold storage backup with encrypted private key management

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Averages (MA 20/50/200): Use for trend identification and support/resistance level determination

- Relative Strength Index (RSI): Apply 30-70 threshold levels to identify oversold and overbought conditions

- Volume Analysis: Confirm price movements with trading volume to validate trend strength

-

Swing Trading Key Points:

- Capitalize on the observed 24-hour volatility range ($0.007158-$0.007679) through disciplined entry and exit points

- Implement stop-loss orders at 5-8% below entry positions to manage downside risk

- Take profits at predetermined resistance levels to lock in gains during upward movements

IOTX Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation

- Active Investors: 3-5% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation

(2) Risk Hedging Strategies

- Portfolio Diversification: Combine IOTX holdings with stablecoins and other established blockchain assets to reduce concentration risk and provide liquidity for rebalancing opportunities

- Position Sizing: Never allocate more than 5% of total investment capital to any single position, especially for volatile assets like IOTX trading at significantly lower price levels than historical highs

(3) Secure Storage Solutions

- Hot Wallet Strategy: Gate Web3 Wallet offers convenient access for active traders while maintaining security through Gate.com's institutional-grade infrastructure

- Cold Storage Approach: Hardware wallets recommended for long-term holders prioritizing maximum security over accessibility

- Security Considerations: Enable two-factor authentication (2FA) on all accounts, use unique passwords, maintain offline backup of recovery phrases, and never share private keys with third parties

V. IOTX Potential Risks and Challenges

IOTX Market Risk

- Price Volatility Exposure: IOTX demonstrates extreme volatility with a 1-year decline of -84.44% from previous levels, indicating significant downside risk potential and the speculative nature of the asset

- Liquidity Constraints: With a 24-hour trading volume of $23,464 on a market cap of $68.2 million, large position exits may face slippage and difficulty finding sufficient buyers

- Market Cap Concentration: At rank 420 with only 0.0022% market dominance, IOTX faces competition from thousands of alternative blockchain projects with potentially superior technology or adoption

IOTX Regulatory Risk

- IoT Privacy Regulations: As jurisdictions worldwide implement stricter data privacy frameworks (GDPR, CCPA extensions), IoTeX's privacy-centric positioning may face regulatory scrutiny regarding compliance with emerging standards

- Cryptocurrency Classification Uncertainty: Ongoing regulatory debates about token classification and staking mechanisms could impact IOTX utility and trading availability across different markets

- Jurisdictional Enforcement: Potential restrictions on privacy-focused blockchain technologies in certain regions may limit IOTX adoption and reduce market opportunities

IOTX Technical Risk

- Adoption Execution Risk: The success of IoTeX depends on achieving meaningful adoption within the IoT device ecosystem, which remains nascent and faces competition from established centralized solutions

- Protocol Security: As an infrastructure-level blockchain, any critical vulnerabilities or network compromises could severely damage investor confidence and token value

- Competition from Established Platforms: Larger blockchain networks with greater developer resources and market share may capture the IoT market before IoTeX achieves critical mass

VI. Conclusion and Action Recommendations

IOTX Investment Value Assessment

IoTeX presents a specialized investment thesis centered on privacy-centric IoT infrastructure, representing a significant market opportunity if adoption accelerates. However, the current market positioning reflects substantial skepticism, evidenced by the -84.44% annual decline and relatively low market capitalization. The project's success hinges on demonstrating tangible IoT ecosystem growth and achieving meaningful device integration. While the technology addresses a legitimate market need, investors must acknowledge the extremely speculative nature of this asset class, particularly given the early-stage maturity of the IoT blockchain space and intense competition from alternatives.

IOTX Investment Recommendations

✅ Beginners: Start with micro-allocations (0.5-1% of portfolio) using dollar-cost averaging over extended periods. Focus on understanding IoTeX fundamentals before committing capital. Utilize Gate.com's educational resources to build knowledge before making investment decisions.

✅ Experienced Investors: Employ tactical position sizing (2-4% allocation) combining long-term core holdings with active trading strategies around identified support/resistance levels. Maintain strict discipline around stop-loss implementation and portfolio rebalancing.

✅ Institutional Investors: Consider IOTX within specialized thematic portfolios focused on IoT infrastructure plays, but limit exposure to 3-5% given the early-stage risk profile. Conduct thorough due diligence on the project's technical roadmap and partnership developments before capital deployment.

IOTX Trading Participation Methods

- Exchange Trading: Access IOTX directly through Gate.com's professional trading platform with margin and derivatives options for experienced traders

- Spot Purchases: Execute standard spot market transactions for straightforward IOTX acquisition with secure settlement

- Staking Participation: If available, participate in network staking mechanisms to generate yield on holdings while contributing to protocol security

Cryptocurrency investments carry extreme risk and are subject to significant volatility. This report does not constitute investment advice. Investors must evaluate their individual risk tolerance and financial situations independently. Consult with qualified financial advisors before making investment decisions. Never invest amounts exceeding your capacity to endure total loss. Past performance does not guarantee future results.

FAQ

Does IOTX have a future?

Yes, IOTX has a promising future. As the Internet of Things continues expanding globally, IOTX's blockchain infrastructure for IoT devices positions it well for growth. Increasing adoption and technological development support long-term potential.

What are the risks of investing in IOTX coin?

IOTX carries risks including market volatility, regulatory uncertainty, and technology adoption challenges. As an emerging IoT blockchain project, price fluctuations are significant. Conduct thorough research and only invest what you can afford to lose.

What is the price prediction for IOTX coin?

IOTX is predicted to reach $0.007245 by end of 2025 and $0.007124 by January 2026. Long-term forecasts suggest it could reach $0.005854 by 2030, based on current market trends and technical analysis.

What is the all time high of IoTeX?

IoTeX's all-time high was $0.266, reached on November 13, 2021. The token has experienced significant price decline since then.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

What is CSPR: A Comprehensive Guide to Casper Network's Native Cryptocurrency

What is SOSO: A Comprehensive Guide to Understanding the Emerging Social Platform and Its Impact on Digital Communication

What is SKL: A Comprehensive Guide to Understanding the Scikit-Learn Machine Learning Library

What is ANKR: A Comprehensive Guide to Ankr Protocol and Its Role in Web3 Infrastructure

What is RECALL: Understanding the Essential Metric for Evaluating Machine Learning Model Performance