2025 ENSO Price Prediction: Forecasting Global Commodity Markets and Agricultural Trends in the Coming Year

Introduction: ENSO's Market Position and Investment Value

Enso (ENSO) is a unified network that connects all blockchains, empowering developers to build composable applications for millions of users across Web2 and Web3. As of December 21, 2025, ENSO has achieved a market capitalization of $66.76 million, with approximately 20.59 million tokens in circulation and a current price hovering around $0.6676. This innovative asset is playing an increasingly vital role in enabling cross-chain interoperability and building composable applications across the blockchain ecosystem.

This article will provide a comprehensive analysis of ENSO's price trends and market performance, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

I. ENSO Price History Review and Current Market Status

ENSO Historical Price Evolution

- October 2025: ENSO reached its all-time high (ATH) of $4.903 on October 14, 2025, marking a significant peak in the token's valuation.

- December 2025: ENSO experienced a substantial decline, reaching its all-time low (ATL) of $0.5955 on December 18, 2025, representing a dramatic correction from the ATH level.

ENSO Current Market Dynamics

As of December 21, 2025, ENSO is trading at $0.6676, demonstrating a modest recovery of 0.57% over the past 24 hours. The token's hourly performance shows a 0.44% increase, while the 7-day period reflects minimal movement at 0.29% growth. However, the broader 30-day perspective reveals concerning bearish pressure, with ENSO declining 14.75% over this timeframe.

The 24-hour trading range spans from $0.6599 (low) to $0.7211 (high), indicating moderate volatility within the short-term window. Current trading volume reaches $1,191,794.84 in 24-hour activity, supporting the price discovery process.

Regarding market capitalization metrics, ENSO maintains a market cap of approximately $13.75 million based on its circulating supply of 20,590,000 tokens. The fully diluted valuation stands at $66.76 million against a maximum supply of 100,000,000 tokens, with circulating supply representing 20.59% of total supply. The token commands a market dominance of 0.0020%, reflecting its positioning at rank 1,027 within the broader cryptocurrency ecosystem.

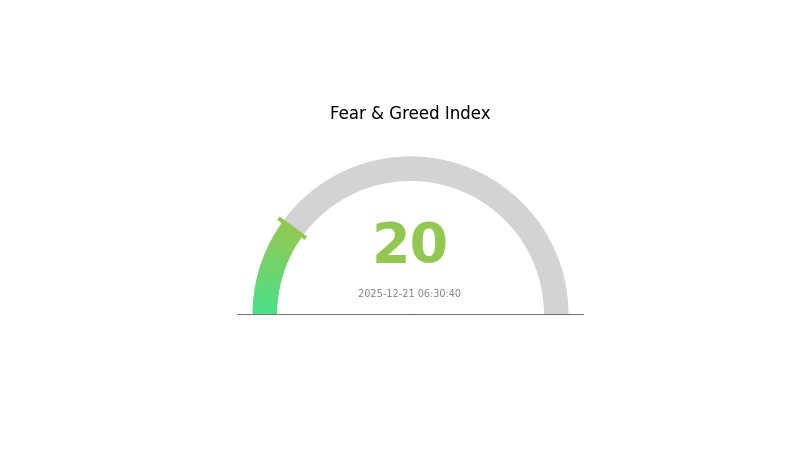

The token holder base comprises 4,895 addresses, with ENSO operating as an ERC-20 standard token on the Ethereum blockchain. Current market sentiment indicators suggest "Extreme Fear" conditions with a VIX reading of 20, reflecting heightened market apprehension and risk aversion.

Click to view current ENSO market price

ENSO Market Sentiment Index

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates heightened market anxiety and pessimism among investors. During such periods, rational investors often view sharp declines as potential buying opportunities, as extreme fear typically precedes market recoveries. However, caution remains essential—continued careful analysis and risk management are crucial before entering positions. Monitor key support levels and consider dollar-cost averaging strategies to navigate this volatile environment effectively.

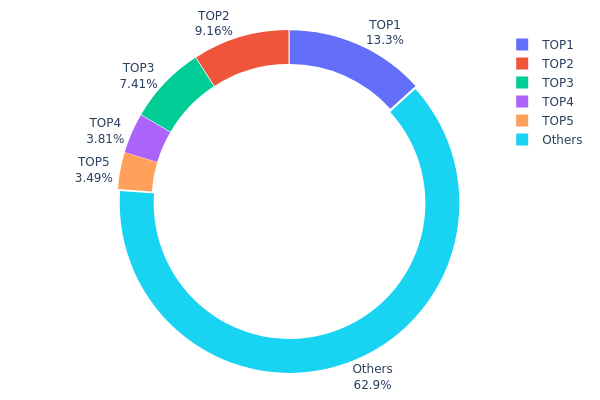

ENSO Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across the blockchain network by identifying the top holders and their respective proportions of total circulating supply. This metric serves as a critical indicator for assessing market structure, decentralization levels, and potential systemic risks associated with large-scale token concentration.

Current ENSO holdings data reveals a moderately distributed ownership structure. The top five addresses collectively control approximately 37.12% of the token supply, with the largest holder accounting for 13.28%. While this concentration level warrants attention, it does not necessarily indicate excessive centralization when viewed against industry benchmarks. The top address holding at 0x4110...c9679b contains 13.45 million tokens, followed by 0x6801...454ced with 9.27 million tokens. Notably, the "Others" category represents 62.88% of total holdings, distributed across numerous addresses, which suggests a relatively healthy degree of decentralization and community participation in the token economy.

From a market dynamics perspective, this distribution pattern presents moderate implications for price stability and governance. While the concentration of approximately 37% among top-five holders could theoretically facilitate coordinated market movements, the substantial portion held by dispersed participants mitigates extreme manipulation risks. The current structure indicates neither excessive whale dominance nor fragmentation, positioning ENSO within a balanced range that supports both institutional confidence and grassroots network participation. This distribution framework reflects a maturing token ecosystem with reasonable safeguards against monopolistic control.

Click to view current ENSO holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x4110...c9679b | 13445.86K | 13.28% |

| 2 | 0x6801...454ced | 9271.19K | 9.15% |

| 3 | 0xdabc...46b164 | 7500.00K | 7.40% |

| 4 | 0x3dea...dec17a | 3860.44K | 3.81% |

| 5 | 0x28c6...f21d60 | 3528.93K | 3.48% |

| - | Others | 63629.94K | 62.88% |

II. Core Factors Influencing ENSO's Future Price

Supply Mechanism

- Total Token Supply: ENSO has a total supply of 100,000,000 tokens with a no-inflation token model, which supports long-term value stability.

- Current Market Impact: As a newly listed token that launched on major exchanges in October 2025, ENSO is in an early price discovery phase with rapid volatility as the market determines fair value based on the project's technical promise, team execution, and competitive positioning in the DeFi infrastructure sector.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policy changes significantly influence overall cryptocurrency market liquidity and risk appetite. Interest rate movements directly affect investor risk preferences and cryptocurrency adoption trends.

- Regulatory Developments: Key market regulatory stance shifts toward cryptocurrencies and DeFi protocols can substantially impact ENSO's adoption trajectory. Regulatory uncertainty is a primary trigger for significant downtrends in the cryptocurrency sector.

- Geopolitical Factors: Broader market sentiment shifts and systemic risks in the cryptocurrency ecosystem can create contagion effects that impact emerging infrastructure tokens like ENSO.

Technology Development and Ecosystem Building

- Cross-Chain Integration: Successful integrations with major blockchain networks represent critical catalysts for bullish price action. ENSO's ability to connect all blockchains as a unified network positions it to benefit from increased cross-chain application adoption.

- Developer Activity and Adoption: Growth in developer activity building on the ENSO platform and adoption by notable DeFi protocols utilizing the unified network infrastructure directly support price appreciation. Key indicators include expansion of the developer ecosystem and successful DeFi protocol implementations.

- Strategic Partnerships: Announcements of strategic partnerships with established Web2 or Web3 companies can drive significant price movements. ENSO's recent provision of a DeFi toolkit to Monad on its first day exemplifies ecosystem development that attracts market attention.

- Scalability Solutions: ENSO implements novel sharding mechanisms achieving transaction speeds up to 100,000 transactions per second, effectively addressing long-standing network congestion issues and enhancing the platform's utility.

- Ecosystem Applications: EnsoFi platform metrics demonstrate growing ecosystem health, with active users increasing 285%, total value locked reaching $3.2 million, and processing over 120,000 cross-chain transactions, indicating genuine adoption beyond speculative interest.

III. 2025-2030 ENSO Price Forecast

2025 Outlook

- Conservative Forecast: $0.47-$0.67

- Neutral Forecast: $0.67-$0.79

- Bullish Forecast: $0.92 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Forecast:

- 2026: $0.48-$0.96 (18% upside potential)

- 2027: $0.62-$1.05 (31% upside potential)

- 2028: $0.53-$1.11 (44% upside potential)

- Key Catalysts: Enhanced protocol adoption, ecosystem expansion, institutional interest, and technological upgrades

2029-2030 Long-term Outlook

- Base Case: $0.82-$1.39 (55% appreciation by 2029, driven by mainstream adoption and improved market sentiment)

- Optimistic Scenario: $1.01-$1.27 (81% cumulative gains by 2030, assuming accelerated adoption and favorable macroeconomic conditions)

- Transformative Scenario: $1.38-$1.40+ (extreme bull case contingent upon breakthrough partnerships, significant protocol innovations, and broader crypto market capitulation recovery)

Market Trajectory Note: ENSO demonstrates consistent upward bias across the forecast period, with average prices rising from $0.67 in 2025 to $1.21 by 2030, reflecting anticipated network maturation and increased market participation through platforms like Gate.com.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.9206 | 0.6671 | 0.47364 | 0 |

| 2026 | 0.96056 | 0.79385 | 0.48425 | 18 |

| 2027 | 1.05264 | 0.8772 | 0.62281 | 31 |

| 2028 | 1.10966 | 0.96492 | 0.53071 | 44 |

| 2029 | 1.38997 | 1.03729 | 0.81946 | 55 |

| 2030 | 1.27431 | 1.21363 | 1.00731 | 81 |

ENSO Professional Investment Strategy and Risk Management Report

IV. ENSO Professional Investment Strategy and Risk Management

ENSO Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Retail investors and institutional players seeking exposure to cross-chain infrastructure with medium to long-term horizons

- Operational Recommendations:

- Dollar-cost averaging (DCA) into ENSO positions over 3-6 month periods to mitigate volatility risk

- Establish a core position during market downturns and hold through at least one complete market cycle

- Maintain position sizing at 2-5% of total portfolio allocation for retail investors given the project's stage and market cap positioning (ranked #1027)

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Averages (20/50/200-day): Identify trend direction and support/resistance levels

- Relative Strength Index (RSI): Monitor overbought (>70) and oversold (<30) conditions for entry/exit signals

-

Wave Trading Key Points:

- Current 24-hour range: $0.6599 - $0.7211, suggesting moderate volatility for day traders

- 30-day performance showing -14.75% decline indicates potential consolidation phase

- Monitor volume patterns around historical resistance at $0.7211 and support at $0.6599

ENSO Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum

- Active Investors: 3-5% portfolio allocation

- Professional Investors: 5-10% portfolio allocation with hedging strategies

(2) Risk Hedging Solutions

- Position Sizing Hedging: Implement stop-loss orders at 15-20% below entry price to limit downside exposure

- Portfolio Diversification: Balance ENSO holdings with established Layer 1/Layer 2 solutions to reduce concentration risk

(3) Secure Storage Solutions

- Cold Storage Recommendations: For long-term holdings exceeding $50,000 USD equivalent, utilize hardware wallet solutions with multi-signature capabilities

- Hot Wallet Strategy: For active traders, maintain smaller positions in Gate.com's Web3 wallet for seamless trading execution while securing majority of holdings offline

- Security Considerations: ENSO operates on ERC-20 standard (Ethereum network) - ensure wallet infrastructure supports smart contract interaction; enable two-factor authentication on all trading accounts; never share private keys or seed phrases; verify contract addresses before any token transfers (Official: 0x699f088b5dddcafb7c4824db5b10b57b37cb0c66)

V. ENSO Potential Risks and Challenges

ENSO Market Risks

- Liquidity Risk: Current 24-hour trading volume of approximately $1.19 million against a market cap of $13.75 million indicates potential slippage on large trades; liquidity concentration on limited exchanges increases execution risk

- Price Volatility: 30-day decline of -14.75% demonstrates significant downside pressure; the token has experienced -85.4% depreciation from its all-time high of $4.903 (reached October 14, 2025), reflecting substantial correction cycles

- Market Sentiment Risk: With only 4,895 active token holders and circulating supply representing only 20.59% of total supply, future dilution events or large holder liquidations could trigger significant price pressure

ENSO Regulatory Risks

- Jurisdictional Uncertainty: Cross-chain protocols face evolving regulatory frameworks across multiple blockchain ecosystems; unclear classification as utility tokens versus securities in various jurisdictions

- Compliance Risk: As the project expands governance and token utility, regulatory authorities may impose restrictions on token trading or functionality

- Policy Changes: Potential future regulations on interoperability protocols or blockchain infrastructure could impact ENSO's operational model

ENSO Technical Risks

- Smart Contract Vulnerability: ERC-20 implementation on Ethereum network carries inherent smart contract risks; potential exploits could compromise token functionality

- Network Risk: Dependency on Ethereum's security and efficiency; network congestion could impact ENSO's ability to facilitate cross-chain operations

- Adoption Risk: Success depends on developer adoption for building composable applications; slow developer uptake or competing solutions could limit ecosystem growth

VI. Conclusion and Action Recommendations

ENSO Investment Value Assessment

ENSO presents a speculative opportunity in the cross-chain infrastructure space at a critical development stage. The project's unified network approach connecting multiple blockchains addresses a significant market need for composable applications. However, the 85.4% depreciation from all-time high, negative 30-day returns, and limited trading liquidity suggest the market is currently repricing the token. The circulating supply representing only 20.59% of total supply introduces significant future dilution risk. At current valuation ($13.75 million market cap), ENSO remains a high-risk, high-reward opportunity suitable only for risk-tolerant investors with conviction in cross-chain infrastructure adoption.

ENSO Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of portfolio) on Gate.com using dollar-cost averaging; focus on understanding the project's technical fundamentals through whitepaper review before scaling exposure; consider ENSO as a long-term speculative holding rather than active trading vehicle

✅ Experienced Investors: Build tactical positions during support levels around $0.65-0.66; employ technical analysis for entry/exit signals; maintain strict 15-20% stop-losses; consider 3-5% portfolio allocation with clear thesis validation checkpoints every quarter

✅ Institutional Investors: Conduct thorough due diligence on development team and technical roadmap; negotiate potential strategic allocations with project team; implement sophisticated hedging strategies; maintain separate governance and operational risk assessments

ENSO Trading Participation Methods

- Exchange Trading: Access ENSO trading on Gate.com with competitive fees; utilize limit orders to minimize slippage given current liquidity conditions

- DCA Programs: Establish automated weekly or monthly purchases through Gate.com's Dollar-Cost Averaging features to smooth entry prices

- Portfolio Tracking: Monitor holdings through Gate.com's portfolio management tools; set price alerts at key resistance ($0.75) and support ($0.63) levels

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. All investors must conduct independent research and consult qualified financial professionals before making investment decisions. Never invest funds you cannot afford to lose completely. Past performance does not guarantee future results. Market conditions and project fundamentals can change rapidly, necessitating continuous reassessment of investment theses.

FAQ

How high will ens go?

ENS is projected to reach approximately $393.91 by 2030 based on long-term market analysis. Growth potential depends on ecosystem adoption and broader crypto market conditions.

Can enso be predicted?

Yes, ENSO can be predicted using advanced models. Current prediction tools capture enough variability to provide useful forecasts, though predictions improve continuously with better modeling techniques and data integration.

Is ens a good crypto?

ENS is a decentralized domain name service on Ethereum that simplifies blockchain addresses. It's considered innovative with strong utility, browser integration through Opera, and serves as a foundation for clearer, decentralized identification in the blockchain space.

Avalanche (AVAX) 2025 Price Analysis and Market Trends

FTT Explained

2025 PYTH Price Prediction: Analyzing Market Trends and Growth Potential for the Oracle Network Token

2025 VELO Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Next Bull Run

2025 WPrice Prediction: Analyzing Market Trends and Future Valuation of Global W Index

2025 YFI Price Prediction: Potential Growth Factors and Market Analysis for Yearn Finance Token

Khám phá Movement token: Tính năng và hoạt động

AI-Driven Blockchain Scalability: Exploring NEx and Its 400,000 TPS Vision

Guide to Participating and Claiming Rewards in the Latest Airdrop

Advanced EVM blockchain for tokenizing real-world assets and enabling DeFi lending

Hướng dẫn từng bước bán Pi coin năm 2025