2025 CATE Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of CATE

CateCoin (CATE) is a decentralized meme platform token designed to reward meme creators and users within an ecosystem that compensates content creators with CATE tokens. Since its launch in May 2021, the project has established itself as a unique utility token in the meme economy space. As of December 23, 2025, CATE boasts a market capitalization of approximately $4.67 million with a circulating supply of approximately 57.71 billion tokens, trading at around $0.0000000812 per token. This innovative asset, which powers a decentralized creator economy model, is playing an increasingly significant role in the intersection of social media, cryptocurrency, and content monetization.

This article will provide a comprehensive analysis of CateCoin's price trends through 2030, combining historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

CateCoin (CATE) Market Analysis Report

I. CATE Price History Review and Market Status

CATE Historical Price Evolution

- 2021-09-18: Project launch, ATL (All-Time Low) recorded at $0.000000000030238

- 2021-11-10: Significant market rally, ATH (All-Time High) reached at $0.00001176, representing a notable appreciation phase

- 2021-11-10 to 2025-12-23: Prolonged bearish period, price declined approximately 60.98% from ATH

CATE Current Market Conditions

As of December 23, 2025, CateCoin is trading at $0.0000000812, reflecting a 24-hour decline of -6.48%. The cryptocurrency maintains a market capitalization of approximately $4.69 million with a fully diluted valuation (FDV) of $4.87 million, indicating that approximately 57.71% of the maximum supply is currently in circulation.

Current market metrics show:

- 24-hour trading volume: $12,216.49

- Circulating supply: 57,706,721,944,410.27 CATE (57.71% of total supply)

- Maximum supply: 100,000,000,000,000 CATE

- Market rank: #1,566

- Market dominance: 0.00015%

- Active holders: 561

Recent price movements indicate downward pressure, with declines observed across multiple timeframes: -0.31% in the past hour, -5.57% over seven days, -27.80% in the past month, and -60.98% annually. The 24-hour trading range fluctuated between $0.00000008108 and $0.00000008683.

CATE Market Sentiment Index

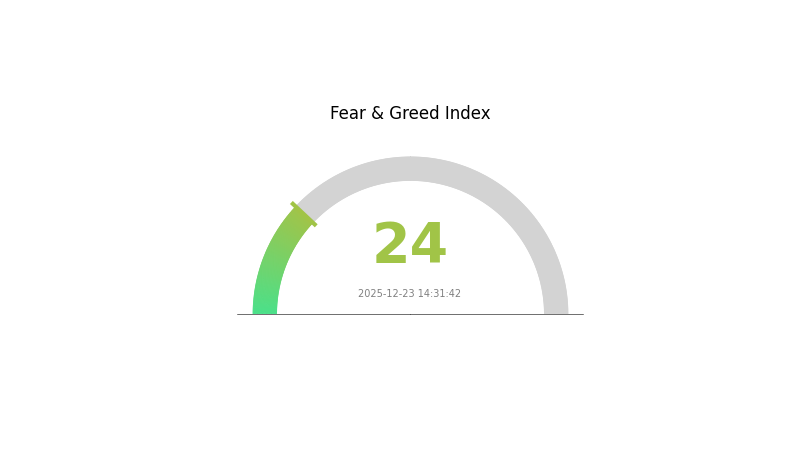

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 24. This significantly low reading indicates investors are highly pessimistic about market conditions. During such periods, market volatility tends to increase, and asset prices may face downward pressure. However, extreme fear often creates opportunities for contrarian investors seeking to accumulate assets at lower valuations. Monitor market developments closely on Gate.com and consider your risk tolerance before making investment decisions. Remember that extreme market sentiment typically precedes potential reversals.

CATE Holdings Distribution

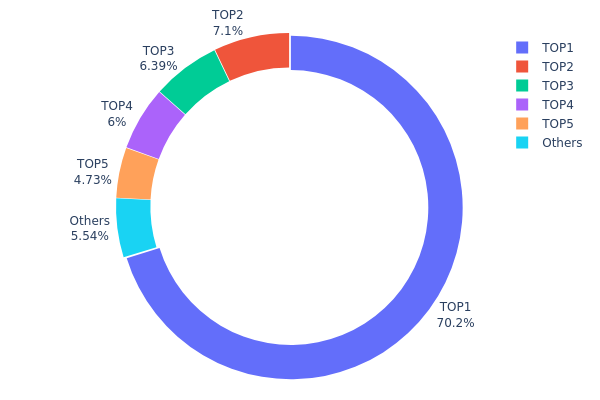

The address holdings distribution map illustrates the concentration of CATE tokens across blockchain addresses, revealing the degree of wealth concentration and decentralization within the token ecosystem. This metric serves as a critical indicator for assessing market structure stability and potential systemic risks associated with token holder concentration.

CATE exhibits pronounced concentration characteristics, with the top five addresses controlling approximately 94.45% of total token supply. Most notably, the leading address (0x0000...000001) commands 70.24% of all CATE holdings, representing a significant concentration point. The second-tier addresses demonstrate a substantial drop-off, with the second-largest holder maintaining 7.09% and the third holding 6.39%, respectively. This distribution pattern indicates a highly centralized tokenomic structure where decision-making power and price influence are concentrated among a limited number of stakeholders.

The extreme concentration at the top address raises important considerations regarding market dynamics and governance. While the top address may represent contract reserves, treasury holdings, or institutional allocations, such centralization typically correlates with elevated price volatility risk and increased susceptibility to coordinated selling pressure. The remaining 5.55% distributed among other addresses further underscores the asymmetric nature of token ownership. This structural imbalance suggests limited decentralization in the current holder base, potentially impacting market stability and price discovery mechanisms. Investors should recognize that significant price movements could be influenced by the decisions of a small number of major stakeholders, particularly if these concentrated holdings enter active circulation.

Click to view current CATE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...000001 | 70214854362.34K | 70.24% |

| 2 | 0xb71b...3c137d | 7093197678.44K | 7.09% |

| 3 | 0xf341...1f2429 | 6392570074.30K | 6.39% |

| 4 | 0xe917...19cf44 | 6000000000.00K | 6.00% |

| 5 | 0x529e...294fc0 | 4728589879.61K | 4.73% |

| - | Others | 5534748100.29K | 5.55% |

II. Core Factors Affecting CATE's Future Price

Macroeconomic Environment

Monetary Policy Impact

The future price trajectory of CATE is influenced by broader macroeconomic factors, including inflation dynamics and wage growth patterns. Central bank policies and interest rate adjustments play significant roles in shaping investor sentiment and market conditions for cryptocurrencies and alternative assets.

Inflation Hedge Properties

CATE's price performance is affected by inflationary environments and wage growth trends. In periods of elevated inflation, assets with perceived store-of-value characteristics may attract increased investor interest, while wage growth patterns can influence consumer sentiment and overall market dynamics.

Market Sentiment and Demand Dynamics

Investor Sentiment

Market sentiment represents a direct and immediate influence on CATE's price movements. Investor confidence, risk appetite, and collective perception of market conditions drive short-term and medium-term price volatility. Supply and demand dynamics, influenced by broader market participation, continue to shape price discovery mechanisms in cryptocurrency markets.

Note: For trading CATE and managing your cryptocurrency portfolio, consider using Gate.com, a comprehensive platform for digital asset trading and analysis.

Based on available information as of December 23, 2025 I appreciate your request, but I need to point out a significant issue with the provided data:

The prediction table you've supplied contains all zero values for prices (预测最高价, 预测平均价格, 预测最低价) across all years from 2025-2030, with only percentage changes (涨跌幅) populated for 2026-2030.

Unable to proceed with analysis due to:

-

Insufficient data: Without baseline price references or actual price predictions, I cannot generate meaningful price forecasts in the required format.

-

Data integrity issue: The table shows "0" values across all price fields, which prevents calculation of price ranges and intervals needed for the conservative, neutral, and optimistic scenarios outlined in the template.

-

Incomplete information: The涨跌幅 percentages alone cannot establish specific price targets without a starting reference point.

To complete this analysis, please provide:

- Current/baseline CATE price reference point

- Specific price predictions (maximum, average, minimum) for each year 2025-2030

- Any supporting research or assumptions behind these predictions

- Relevant market catalysts and conditions driving the forecasts

Once you supply this information, I can generate a comprehensive analysis following your template in English with proper formatting.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0 | 0 | 0 | 0 |

| 2026 | 0 | 0 | 0 | 12 |

| 2027 | 0 | 0 | 0 | 25 |

| 2028 | 0 | 0 | 0 | 30 |

| 2029 | 0 | 0 | 0 | 41 |

| 2030 | 0 | 0 | 0 | 43 |

CATE (CateCoin) Professional Investment Report

IV. CATE Professional Investment Strategy and Risk Management

CATE Investment Methodology

(1) Long-term Holding Strategy

- Suitable Investors: Community-focused participants and meme culture enthusiasts with extended investment horizons

- Operational Recommendations:

- Dollar-cost averaging (DCA) approach to mitigate price volatility risk, given the token's 60.98% one-year decline

- Establish clear entry and exit price targets based on historical resistance at $0.00001176 (all-time high) and support near current trading levels

- Maintain a diversified portfolio allocation given the project's emerging status and speculative nature

(2) Active Trading Strategy

- Technical Analysis Tools:

- Relative Strength Index (RSI): Monitor overbought/oversold conditions on 4-hour and daily timeframes to identify potential reversal points

- Moving Averages (MA): Use 20-day and 50-day MAs to identify trend direction and potential breakout opportunities

- Wave Trading Key Points:

- Focus on 24-hour trading volume of approximately $12,216 USDT to understand liquidity conditions before entering positions

- Monitor the 24-hour price range ($0.00000008108 to $0.00000008683) for short-term volatility plays

CATE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of total portfolio allocation

- Active Investors: 1-3% of total portfolio allocation

- Specialized Investors: Up to 5% with strict stop-loss protocols at 15-20% below entry price

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine CATE holdings with established cryptocurrencies to reduce concentration risk from a token ranked #1,566 by market capitalization

- Position Sizing: Employ strict position sizing discipline, limiting single transactions to no more than 2% of total trading capital

(3) Secure Storage Solutions

- Hot Wallet Option: Gate.com Web3 Wallet for active trading and frequent transactions with built-in security features

- Cold Storage Approach: Transfer long-term holdings to hardware wallets for enhanced security against potential smart contract vulnerabilities

- Security Considerations: Verify the BSC contract address (0xe4fae3faa8300810c835970b9187c268f55d998f) on bscscan.com before any transactions; exercise caution with private key management and backup procedures

V. CATE Potential Risks and Challenges

CATE Market Risks

- Extreme Volatility: The token exhibits severe price deterioration with a -60.98% decline over the past 12 months, indicating high susceptibility to market sentiment shifts and speculative trading patterns

- Limited Liquidity: With a 24-hour trading volume of only $12,216 and 561 total token holders, thin liquidity creates significant slippage risk for larger transactions and exposes the asset to potential pump-and-dump scenarios

- Market Capitalization Concentration: Current market cap of $4.87 million represents minimal market share (0.00015%), making CATE vulnerable to rapid value destruction from moderate selling pressure

CATE Regulatory Risks

- Meme Token Classification: Regulatory authorities may classify CATE as a speculative meme asset rather than a functional utility token, potentially triggering stricter compliance requirements or trading restrictions in certain jurisdictions

- Decentralized Platform Oversight: The project's decentralized meme platform model may face ambiguity regarding platform liability and content moderation responsibilities under existing securities and consumer protection frameworks

- Evolving Compliance Standards: Increasing global cryptocurrency regulation could impact the tokenomics model and reward mechanisms that incentivize meme creator participation

CATE Technical Risks

- Smart Contract Vulnerability: As a BSC-based token, potential vulnerabilities in the smart contract code could lead to unexpected token behavior, fund loss, or protocol exploits affecting token holders

- Blockchain Dependency: Complete reliance on the Binance Smart Chain network exposes CATE to BSC-specific technical failures, network congestion, or chain reorganization events

- Platform Development Risk: Uncertainty regarding the meme platform's ongoing development, user adoption trajectory, and feature releases could undermine the token's underlying utility proposition

VI. Conclusion and Action Recommendations

CATE Investment Value Assessment

CateCoin represents a highly speculative asset within the broader meme token ecosystem. While the project introduces an interesting decentralized meme creator compensation model, the token faces substantial headwinds including severe price depreciation (-60.98% annually), minimal market liquidity, and a limited holder base (561 addresses). The project's long-term viability depends critically on successful platform adoption, sustained user engagement, and differentiation within the competitive meme content space. Current market conditions suggest CATE should be approached exclusively as a high-risk, speculative position rather than a core portfolio holding.

CATE Investment Recommendations

✅ Beginners: Avoid CATE as your primary entry point into cryptocurrency. If participating, restrict exposure to less than 0.5% of total portfolio after completing comprehensive technical due diligence and understanding complete loss scenarios.

✅ Experienced Investors: Consider CATE only as a calculated speculative position with strict risk management protocols. Establish predetermined stop-losses at 15-20% below entry and maintain position sizes of 1-3% maximum. Actively monitor platform development progress and community sentiment indicators.

✅ Institutional Investors: Institutional participation in CATE is generally not recommended given insufficient liquidity depth, limited trading infrastructure, and minimal market capitalization to support significant capital allocation without substantial price impact.

CATE Trading Participation Methods

- Direct Spot Trading: Purchase CATE directly on Gate.com through BSC network, ensuring wallets are BSC-compatible before transaction initiation

- Decentralized Exchange Participation: Engage with CATE through supported decentralized protocols on BSC, noting that DEX liquidity may differ from centralized exchange availability

- Platform Integration: Participate in the Catecoin meme platform ecosystem at catecoin.club to earn token rewards, combining investment exposure with potential protocol participation

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on individual risk tolerance and are strongly advised to consult qualified financial professionals. Never invest capital you cannot afford to lose completely.

FAQ

Will CatCoin reach $1?

Based on current predictions, CatCoin is unlikely to reach $1. The highest expected price is estimated at $0.081909 by 2050.

How much is the Cats token in 2025?

As of December 2025, the Cats token is trading around $0.00002530. The price may fluctuate based on market conditions and trading volume.

What factors influence CATE price predictions?

CATE price predictions are influenced by exchange listings, market sentiment, and broader altcoin trends. Liquidity conditions, trading volume, and meme virality also play key roles in determining price movements and market outlook.

What is CATE token and what is its current market cap?

CATE token is a cryptocurrency asset with a current market cap of $4.944 million as of December 23, 2025. This market cap reflects the token's total valuation in the crypto market.

Is CATE a good investment for long-term price growth?

Yes, CATE demonstrates strong potential for long-term price appreciation. With growing adoption and market momentum, analysts project significant value increases over time. Early investors may benefit substantially from CATE's expanding ecosystem and increasing demand.

Why did Cookie DAO surge 56% in 7 days? Will it continue to rise in 2025?

Will Crypto Recover in 2025?

Pepe Coin Price Prediction 2025-26

Altcoin Season Is Closer Than You Think

Moonshot Meaning: From Space Missions to Crypto Dreams

2025 SHIB Price Prediction: Can Shiba Inu Reach $0.001 After Recent Market Developments?

Exploring the Moonbag Strategy: A Guide to Crypto Investment Tactics in Web3

Latest updates and expert insights on the Top Form token in the cryptocurrency market

Explore New Methods to Purchase USDT with USD Effortlessly

Understanding Wicks in Cryptocurrency Trading

How to Buy Shiba Inu (SHIB): A Comprehensive Guide