2025 ARRR Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: ARRR's Market Position and Investment Value

Pirate Chain (ARRR) is a truly private, decentralized privacy coin that prioritizes financial privacy and has established itself as a significant asset within the Zcash ecosystem and Komodo blockchain ecosystem. Since its launch in 2019, ARRR has developed into a 100% private cryptocurrency with innovative privacy protocols that cannot be compromised by the activities of other users on the network. As of December 18, 2025, ARRR's market capitalization has reached approximately $56.68 million with a circulating supply of around 196.21 million tokens, trading at $0.2834 per token. Known as a "true privacy coin," ARRR is increasingly playing a critical role in protecting users' financial privacy across decentralized transactions.

This article will provide a comprehensive analysis of ARRR's price movements and market trends for 2025, combining historical price patterns, market supply and demand dynamics, ecosystem development, and broader economic factors to deliver professional price forecasts and practical investment strategies for investors.

Pirate Chain (ARRR) Market Analysis Report

I. ARRR Price History Review and Current Market Status

ARRR Historical Price Evolution Trajectory

- 2021: ARRR reached its all-time high of $16.76 on April 24, 2021, marking a significant peak in the project's price history.

- 2020: ARRR hit its all-time low of $0.00797788 on November 26, 2020, representing the lowest valuation point since the project's inception.

- 2025: ARRR experienced substantial volatility, with a notable 30-day decline of -50.94%, demonstrating significant downward pressure over the medium term.

ARRR Current Market Status

As of December 18, 2025, Pirate Chain (ARRR) is trading at $0.2834, reflecting a 24-hour price decline of -6.53%. The cryptocurrency shows mixed performance across different timeframes: the 1-hour change stands at -1.6%, while the 7-day performance is positive at +9.56%, indicating intra-week recovery attempts. However, the 30-day performance remains significantly negative at -50.94%, highlighting recent bearish sentiment. Over the 1-year period, ARRR has appreciated by 18.62%, suggesting long-term investors have experienced modest gains.

The total market capitalization stands at $56.68 million, with a circulating supply of approximately 196.21 million tokens out of a total supply of 200 million tokens, representing a circulation ratio of 98.11%. The 24-hour trading volume is $16,973.14, with the price range for the day between $0.2778 and $0.3196. ARRR currently ranks 470th by market capitalization with a market dominance of 0.0018%.

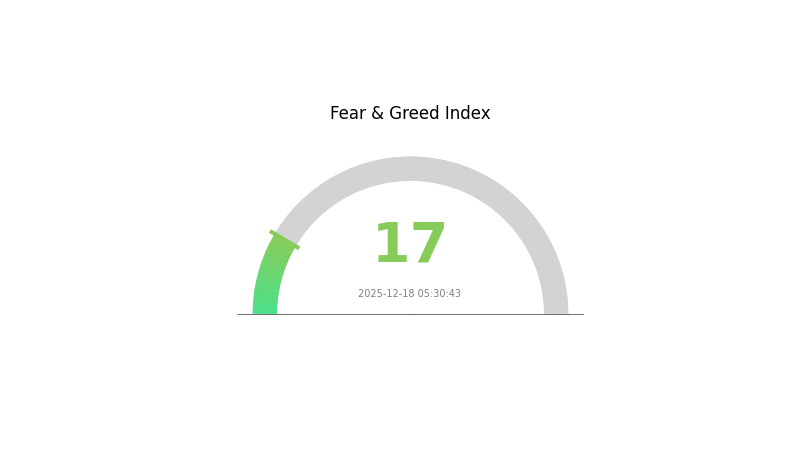

Current market sentiment is characterized by "Extreme Fear" with a volatility index of 17, indicating heightened market anxiety and risk aversion across the broader cryptocurrency ecosystem.

Click to view current ARRR market price

ARRR Market Sentiment Indicator

2025-12-18 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The market is currently experiencing extreme fear, with the Fear and Greed Index at 17. This historically low reading signals significant market pessimism and potential capitulation among investors. Such extreme fear conditions often precede market rebounds, as panic selling reaches exhaustion levels. Cautious investors may view this as a potential accumulation opportunity, while risk-averse traders should maintain defensive positions. Monitor key support levels closely, as volatility may continue in the near term. Consider diversifying your portfolio and adhering to your investment strategy during these turbulent market conditions.

ARRR Address Distribution

Unable to provide analysis at this time. The address holding distribution data table you provided is empty, containing no specific holding information, addresses, quantities, or percentage allocations for ARRR tokens.

To generate a comprehensive analysis of ARRR's concentration characteristics, market structure implications, and decentralization assessment, please provide the complete dataset including:

- Top holder addresses

- Individual holding quantities

- Percentage distribution among major holders

- Total circulating supply reference

Once you supply the populated data table, I will deliver a detailed analytical assessment covering holder concentration metrics, potential market manipulation risks, on-chain structure stability, and the overall decentralization profile of the ARRR token ecosystem.

For current ARRR holding distribution data, visit ARRR Holdings on Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing ARRR's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Central bank policies, interest rate adjustments, and fiscal stimulus measures directly influence market liquidity, which in turn affects ARRR price movements. Changes in monetary policy can create ripple effects across cryptocurrency markets.

-

Geopolitical Factors: International tensions and geopolitical conflicts, such as regional tensions, can impact global markets and commodity prices, which subsequently influence cryptocurrency valuations including ARRR.

Market Dynamics and Liquidity

-

Market Liquidity: The overall flow of capital in cryptocurrency markets plays a crucial role in determining ARRR's price trajectory. Enhanced market liquidity can facilitate price discovery and reduce volatility, while constrained liquidity may amplify price swings.

-

Trading Volume Trends: As of October 2025, ARRR was trading at USD 0.4101 with a market capitalization of USD 80 million. Monitoring trading volume and market capitalization trends provides insight into market sentiment and potential price movements.

III. 2025-2030 ARRR Price Forecast

2025 Outlook

- Conservative Forecast: $0.15277 - $0.2829

- Base Case Forecast: $0.2829

- Optimistic Forecast: $0.38474 (requires sustained market recovery and increased adoption)

2026-2028 Medium-Term Perspective

- Market Stage Expectation: Gradual accumulation and early growth phase with expanding institutional interest

- Price Range Predictions:

- 2026: $0.26372 - $0.46735 (17% upside potential)

- 2027: $0.26038 - $0.55682 (41% cumulative increase)

- 2028: $0.4069 - $0.55529 (68% cumulative increase)

- Key Catalysts: Enhanced protocol developments, growing ecosystem partnerships, improving market sentiment, and increased trading volume on platforms like Gate.com

2029-2030 Long-Term Outlook

- Base Case: $0.33605 - $0.5687 (82% cumulative increase by 2029, assuming steady adoption)

- Optimistic Scenario: $0.47228 - $0.75456 (91% cumulative increase by 2030, assuming accelerated mainstream adoption and positive macro conditions)

- Transformative Scenario: $0.75456+ (requires breakthrough technological innovations, significant enterprise adoption, and favorable regulatory environment)

Key Observations: The forecast trajectory demonstrates consistent appreciation potential across the five-year period, with average prices stabilizing around $0.40-$0.54 range during 2027-2030, suggesting a maturation phase with sustained upward momentum.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.38474 | 0.2829 | 0.15277 | 0 |

| 2026 | 0.46735 | 0.33382 | 0.26372 | 17 |

| 2027 | 0.55682 | 0.40059 | 0.26038 | 41 |

| 2028 | 0.55529 | 0.4787 | 0.4069 | 68 |

| 2029 | 0.5687 | 0.517 | 0.33605 | 82 |

| 2030 | 0.75456 | 0.54285 | 0.47228 | 91 |

Pirate Chain (ARRR) Professional Investment Strategy and Risk Management Report

IV. ARRR Professional Investment Strategy and Risk Management

ARRR Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Privacy-focused investors, long-term cryptocurrency holders, and those seeking decentralized financial privacy solutions.

-

Operational Recommendations:

- Accumulate ARRR during market downturns when sentiment is bearish, leveraging the current 30-day decline of -50.94% as a potential entry point for dollar-cost averaging.

- Establish a multi-year holding position with a minimum horizon of 3-5 years to benefit from the development of Pirate Chain's privacy protocol within the Komodo ecosystem.

- Utilize Gate.com's spot trading pairs to acquire ARRR and maintain positions with secure storage practices.

-

Storage Solutions:

- For extended holding periods, transfer ARRR to secure offline storage solutions that support privacy-focused assets.

- Maintain operational ARRR on reputable exchanges such as Gate.com for convenient access during market opportunities.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Monitor the 24-hour trading range of $0.2778 (low) to $0.3196 (high) for intraday volatility signals and potential breakout opportunities.

- Moving Averages: Apply 7-day and 30-day moving average analysis to identify trend reversals, given the asset's -50.94% monthly decline indicating potential bottoming patterns.

-

Swing Trading Key Points:

- Capitalize on the 9.56% weekly recovery as an indicator of bouncing from oversold conditions; accumulate at support levels and liquidate at resistance.

- Monitor the volume metrics ($16,973.14 in 24h volume) to confirm trading signals; higher volume validates price movements and trend sustainability.

ARRR Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of total cryptocurrency portfolio allocation, maintaining minimal exposure to privacy coins due to regulatory uncertainties.

- Active Investors: 2-5% of total portfolio, allowing participation in ARRR's potential upside while limiting downside exposure from regulatory headwinds.

- Professional Investors: 5-10% of portfolio, employing hedging strategies and tactical rebalancing based on regulatory developments and technical signals.

(2) Risk Hedging Solutions

- Diversification Strategy: Distribute ARRR holdings across multiple time periods and entry points to reduce impact of adverse price movements and increase average entry prices.

- Position Sizing: Implement strict position limits based on individual risk tolerance; never allocate more than you can afford to lose without affecting financial stability.

(3) Secure Storage Solutions

- Hot Wallet Management: Maintain only operational amounts needed for frequent trading on Gate.com, keeping the majority of holdings in cold storage to mitigate exchange counterparty risk.

- Cold Storage Approach: Transfer larger ARRR holdings to self-custodial solutions that support privacy coins, ensuring complete control over private keys and elimination of third-party custody risks.

- Security Considerations: Implement multi-signature authentication, regular backup of recovery phrases, and separation of operational and reserve holdings to prevent catastrophic loss scenarios.

V. ARRR Potential Risks and Challenges

ARRR Market Risk

- Extreme Volatility: ARRR exhibits significant price fluctuation, declining 50.94% in the past 30 days while maintaining a current market capitalization of only $56.68 million, indicating susceptibility to rapid liquidation events and low liquidity conditions during market stress.

- Limited Trading Volume: With only $16,973.14 in 24-hour trading volume across 4 exchange pairs, ARRR faces substantial slippage risks for large position entries or exits, potentially resulting in unfavorable execution prices.

- Market Sentiment Fragility: The asset's 1-hour decline of -1.6% combined with 24-hour losses of -6.53% demonstrates vulnerability to negative news cycles and rapid sentiment reversals among the small investor base.

ARRR Regulatory Risk

- Privacy Coin Restrictions: As a fully private cryptocurrency focused on anonymous transactions, ARRR faces increasing regulatory scrutiny from global financial authorities seeking to combat money laundering and illicit financing, potentially resulting in exchange delistings or transaction restrictions.

- Compliance Uncertainty: The lack of clear regulatory frameworks for privacy-preserving technologies creates ambiguity regarding ARRR's long-term legal status across major jurisdictions, exposing investors to sudden regulatory action.

- Exchange Delisting Threat: Given the privacy-focused nature and limited exchange presence (only 4 trading pairs), ARRR remains vulnerable to regulatory-driven delisting from existing venues, severely limiting liquidity and market access.

ARRR Technical Risk

- Protocol Dependency: ARRR's privacy protocol effectiveness relies on continuous maintenance and security updates within the Komodo ecosystem; any vulnerabilities or compromises in the underlying privacy mechanism could severely damage investor confidence and asset value.

- Network Adoption Uncertainty: The relatively small market capitalization and user base compared to established privacy coins create risks of network effects stalling and insufficient developer resources for ongoing protocol improvements.

- Integration Challenges: As an asset linked to the Komodo ecosystem, ARRR's development depends on the broader ecosystem's technical progress; delays or setbacks in Komodo infrastructure could negatively impact ARRR's functionality and value proposition.

VI. Conclusion and Action Recommendations

ARRR Investment Value Assessment

Pirate Chain (ARRR) presents a specialized investment opportunity for those prioritizing financial privacy and decentralization, backed by its 100% private cryptocurrency status and integration within the Komodo ecosystem. The asset's current market position reflects extreme risk characteristics, with a -50.94% monthly decline indicating either significant selling pressure or potential accumulation opportunity depending on technical and fundamental perspectives. However, the combination of regulatory uncertainty for privacy coins, limited trading liquidity ($16,973 daily volume), and small market capitalization ($56.68 million) creates substantial risks for mainstream investors. Long-term value depends on increasing adoption of privacy-preserving technologies, regulatory acceptance, and sustained ecosystem development within Komodo.

ARRR Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of cryptocurrency holdings) through Gate.com spot trading to learn about privacy coins; prioritize capital preservation over aggressive accumulation and maintain conservative position sizing.

✅ Experienced Investors: Implement tactical allocation strategies (2-5% of portfolio) with disciplined entry points during oversold conditions (such as current levels); utilize technical analysis tools to identify swing trading opportunities while maintaining strict risk management protocols.

✅ Institutional Investors: Develop comprehensive due diligence on regulatory compliance frameworks before participation; consider structured allocation approaches with hedging strategies and diversified entry timing to manage the asset's extreme volatility and liquidity constraints.

ARRR Trading Participation Methods

- Spot Trading via Gate.com: Execute direct ARRR purchases on Gate.com's spot trading platform, allowing full custody control and flexibility in position management across multiple trading pairs.

- Dollar-Cost Averaging: Deploy capital gradually over multiple weeks or months to reduce impact of price volatility and achieve improved average entry prices during extended downtrends.

- Limit Order Strategies: Set predetermined buy orders at key technical support levels and sell targets to enforce disciplined trading without emotional decision-making during volatile price swings.

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on individual risk tolerance and are strongly advised to consult professional financial advisors. Never invest more than you can afford to lose completely. Privacy coins face heightened regulatory risks; investors should monitor regulatory developments actively.

FAQ

What crypto will 1000x prediction?

Emerging altcoins with strong fundamentals and early-stage pricing show highest 1000x potential. Projects like Bitcoin Hyper demonstrate innovative use cases and massive investor support, positioning them as top candidates for explosive growth in current market cycle.

Can XRP reach $100 by 2025?

XRP reaching $100 by 2025 is possible but uncertain. Expert predictions vary widely, with some analysts suggesting potential for significant growth. However, market volatility and regulatory factors remain unpredictable variables affecting price movements.

How much is Pirate Chain Arrr worth today?

Pirate Chain (ARRR) is currently worth $0.2891 as of December 18, 2025. The price has declined by 0.17% in the last 24 hours, with a trading volume of $445,498.

Will the pirate chain go up?

Yes, Pirate Chain shows strong growth potential. Based on current market trends and technical analysis, the price is expected to continue rising in the medium to long term.

Where to Find Alpha in the 2025 Crypto Spot Market

why is crypto crashing and will it recover ?

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

Pi to GBP: Price and Prediction

2025 CHZ Price Prediction: Will Chiliz Soar to New Heights in the Crypto Sports Market?

2025 BRETTPrice Prediction: Analyzing Future Market Trends, Challenges, and Growth Potential

Exploring Cosmos Network: Is It Truly a Layer 1 Blockchain?

Ultimate Guide to Setting Up Your Own GPU Mining Rig

2025 QANX Price Prediction: Expert Analysis, Market Trends, and Investment Outlook for the Upcoming Year

2025 TNSR Price Prediction: Expert Analysis and Market Forecast for Tensor's Future Value

2025 SYND Price Prediction: Expert Analysis and Market Forecast for Syndicate Token