2025 ANIME Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: Market Position and Investment Value of ANIME

Animecoin (ANIME) positions itself as the Culture Coin of the anime industry, dedicated to transforming the global anime sector into a community-owned creative network. As of December 2025, ANIME has achieved a market capitalization of approximately $54.14 million, with a circulating supply of approximately 5.54 billion tokens, maintaining a price around $0.005414. This innovative digital asset is empowering a digital economy where one billion global anime fans can shape and own the future of anime.

This article will provide a comprehensive analysis of ANIME's price trajectory from 2025 to 2030, combining historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors.

Animecoin (ANIME) Market Analysis Report

I. ANIME Price History Review and Current Market Status

ANIME Historical Price Trajectory

Animecoin (ANIME) was launched on January 23, 2025, at an initial price of $0.1. The token reached its all-time high of $0.12 on the same date (January 23, 2025), representing a 20% increase from its launch price during the initial market enthusiasm phase.

Since its peak, ANIME has experienced a significant decline. As of December 19, 2025, the token trades at $0.005414, representing a 95.41% decrease from its all-time high. This substantial pullback reflects the broader market dynamics and token performance over the year.

ANIME Current Market Status

Price Performance:

- Current Price: $0.005414

- 24-hour Change: +2.32% ($0.000123)

- 7-day Change: -19.43%

- 30-day Change: -17.29%

- 1-year Change: -96.10%

Market Capitalization Metrics:

- Market Cap: $29,986,005.61

- Fully Diluted Valuation: $54,140,000

- Market Cap to FDV Ratio: 55.39%

- Global Market Dominance: 0.0016%

Trading Activity:

- 24-hour Trading Volume: $301,025.99

- Volume to Market Cap Ratio: Indicates relatively moderate trading activity

- Exchange Listing Count: 35 exchanges

- Active Holders: 2,475

Supply Information:

- Circulating Supply: 5,538,604,656 ANIME (55.39% of total supply)

- Total Supply: 10,000,000,000 ANIME

- Maximum Supply: 10,000,000,000 ANIME

Network Information:

- Blockchain Platforms: Ethereum (ETH) and Arbitrum

- Contract Address (Arbitrum): 0x37a645648df29205c6261289983fb04ecd70b4b3

- Contract Address (Ethereum): 0x4dc26fc5854e7648a064a4abd590bbe71724c277

Market Sentiment:

- Current Market Fear Index: Extreme Fear (VIX: 16)

The token currently trades near its 24-hour low of $0.005049 and its 24-hour high of $0.005467, showing recent price consolidation around these levels.

Click to view current ANIME market price on Gate.com

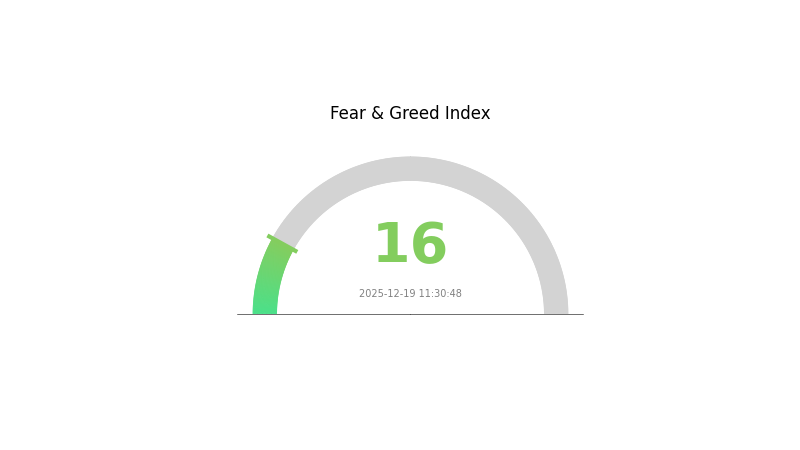

ANIME Market Sentiment Index

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The ANIME market is currently experiencing extreme fear, with the Fear and Greed Index at 16. This exceptionally low reading indicates severe market pessimism and capitulation among investors. Such extreme conditions historically present contrarian opportunities, as markets often experience significant reversals when sentiment reaches these levels. However, caution remains warranted as further downside pressure cannot be ruled out. Investors should remain vigilant, conduct thorough due diligence, and consider this volatility period strategically. Monitor Gate.com's real-time market data for emerging opportunities and risk management updates.

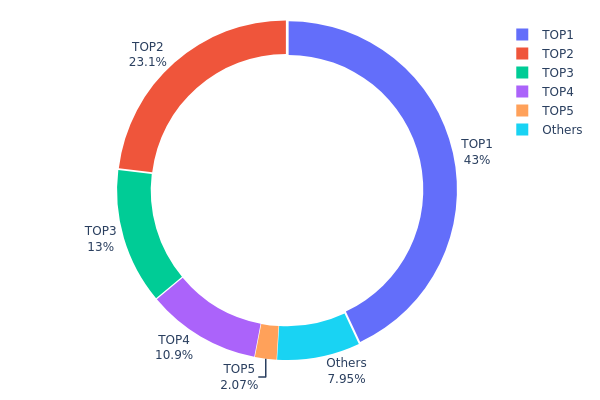

ANIME Holdings Distribution

Click to view current ANIME holdings distribution

The holdings distribution chart illustrates how ANIME tokens are concentrated across different blockchain addresses, providing critical insights into token ownership structure and potential market concentration risks. By analyzing the top holders and their respective percentages of total supply, we can assess the degree of decentralization and the market's vulnerability to large-scale liquidations or coordinated actions by major stakeholders.

ANIME exhibits significant concentration risk in its current holder distribution. The top four addresses collectively control 90.96% of the total token supply, with the largest holder commanding 43.01% of all tokens. This extreme concentration is further amplified when examining the top two addresses, which together account for 66.06% of circulating supply. Such a heavily skewed distribution indicates that a small number of entities possess disproportionate control over the token's liquidity and price dynamics. The remaining addresses, including the fragmented "Others" category representing 7.98%, hold minimal influence over market movements, suggesting a severely imbalanced ownership structure.

This pronounced centralization presents substantial risks to market stability and price integrity. With over 90% of tokens held by merely four addresses, ANIME is exposed to heightened volatility triggered by concentrated sell-offs or large transfers by dominant holders. The token's decentralized governance and long-term viability are compromised, as the potential for market manipulation and price suppression by major stakeholders remains elevated. The current distribution pattern reflects either early-stage tokenomics dominated by founders, venture investors, or strategic allocations, rather than a mature, widely distributed ecosystem typical of established cryptocurrencies with robust decentralization characteristics.

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xcee2...97180d | 4301389.62K | 43.01% |

| 2 | 0x1a14...540415 | 2305781.37K | 23.05% |

| 3 | 0x6ae7...a7040a | 1300000.00K | 13.00% |

| 4 | 0x2d87...ffe258 | 1090789.22K | 10.90% |

| 5 | 0xf977...41acec | 206648.91K | 2.06% |

| - | Others | 795390.87K | 7.98% |

II. Core Factors Influencing ANIME's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Central bank policy changes, such as interest rate adjustments and quantitative easing measures, will directly affect ANIME market capital flows and investor sentiment.

-

Inflation Hedge Properties: In periods of high inflation, ANIME may serve as a hedge against fiat currency depreciation, providing investors with alternative value storage mechanisms.

Technology Development and Ecosystem Building

-

Market Demand and Adoption: Future price trends are influenced by growing market demand and mainstream market acceptance of anime-themed digital assets.

-

AI and Innovation Impact: The rise of artificial intelligence and technological innovation in the anime and entertainment sectors creates cost pressures and efficiency improvements that can influence market dynamics.

-

Ecosystem Applications: Integration with anime, entertainment, and gaming platforms enhances utility and adoption potential, supporting long-term value proposition.

III. 2025-2030 ANIME Price Forecast

2025 Outlook

- Conservative Forecast: $0.00385 - $0.00543

- Base Case Forecast: $0.00543

- Optimistic Forecast: $0.00722 (requires sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectations: Consolidation phase with gradual recovery trend, characterized by volatility normalization and increasing institutional participation

- Price Range Predictions:

- 2026: $0.00556 - $0.00670

- 2027: $0.00560 - $0.00697

- 2028: $0.00654 - $0.00734

- Key Catalysts: Platform adoption growth, ecosystem expansion initiatives, market sentiment improvement, and potential regulatory clarity in major markets

2029-2030 Long-term Outlook

- Base Case: $0.00542 - $0.00838 (assuming moderate adoption acceleration and stable market conditions)

- Optimistic Scenario: $0.00838 - $0.00948 (driven by significant protocol upgrades and mainstream adoption)

- Transformation Scenario: $0.00948+ (contingent on breakthrough technological innovations, major institutional adoption, and favorable macroeconomic environment)

Price Trajectory Summary: The forecast indicates a cumulative appreciation of approximately 42% from 2025 to 2030, reflecting a measured long-term growth trajectory with year-over-year incremental gains, suggesting a fundamentally constructive but gradual value realization over the medium to long term.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00722 | 0.00543 | 0.00385 | 0 |

| 2026 | 0.0067 | 0.00632 | 0.00556 | 16 |

| 2027 | 0.00697 | 0.00651 | 0.0056 | 20 |

| 2028 | 0.00734 | 0.00674 | 0.00654 | 24 |

| 2029 | 0.00838 | 0.00704 | 0.00542 | 30 |

| 2030 | 0.00948 | 0.00771 | 0.00632 | 42 |

Animecoin (ANIME) Investment Strategy and Risk Management Report

IV. ANIME Professional Investment Strategy and Risk Management

ANIME Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Community-focused supporters of the anime ecosystem, long-term believers in decentralized creative networks, and retail investors with high risk tolerance

- Operational Recommendations:

- Accumulate during market downturns when ANIME trades below $0.01, capitalizing on the 55.39% market cap to fully diluted valuation ratio

- Dollar-cost averaging (DCA) approach: allocate small portions over multiple months to reduce average entry price volatility

- Store tokens securely in Gate Web3 wallet for convenient access while maintaining custody control

(2) Active Trading Strategy

- Technical Analysis Tools:

- 24-hour Price Action: ANIME showed +2.32% movement in the last 24 hours, indicating potential short-term volatility for swing traders

- 7-day and 30-day Trends: Review the -19.43% 7-day decline and -17.29% 30-day decline to identify support levels around $0.005049 (recent low)

- Wave Trading Key Points:

- Monitor resistance at $0.005467 (24-hour high) and support at $0.005049 (recent low)

- Trading volume of approximately $301,025.98 provides limited liquidity; execute large orders carefully to avoid slippage

ANIME Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Active Investors: 3-7% of portfolio allocation

- Professional Investors: Up to 10% for diversified exposure to cultural token narratives

(2) Risk Hedging Solutions

- Volatility Hedging: Maintain cash reserves or stablecoins equivalent to 50% of ANIME position size to capitalize on crash-buying opportunities

- Correlation Diversification: Balance ANIME holdings with other cryptocurrency sectors to reduce concentrated cultural/entertainment token exposure

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and frequent transactions with strong security features

- Cold Storage Approach: Transfer inactive holdings to hardware solutions for extended storage periods exceeding 6 months

- Security Precautions: Enable two-factor authentication on all exchange accounts, use strong unique passwords, never share private keys, and verify contract addresses (Arbitrum: 0x37a645648df29205c6261289983fb04ecd70b4b3; Ethereum: 0x4dc26fc5854e7648a064a4abd590bbe71724c277) before transactions

V. ANIME Potential Risks and Challenges

ANIME Market Risks

- Extreme Volatility: ANIME has declined 96.10% over the past year from historical highs of $0.12, with current price near multi-month lows of $0.005049, indicating severe valuation instability and potential for further downside

- Low Trading Liquidity: Daily volume of approximately $301,025.98 against a market cap of ~$29.99 million demonstrates limited liquidity; large transactions may experience significant slippage

- Market Capitalization Concentration: With only 2,475 holders distributed across 35 exchanges, the token faces concentration risk with potential for rapid price movements from major holder actions

ANIME Regulatory Risks

- Intellectual Property Concerns: The project aims to decentralize the anime industry; unclear how this model navigates existing intellectual property laws, licensing agreements, and content rights held by traditional anime studios and production companies

- Securities Classification Uncertainty: Regulatory agencies may reclassify entertainment-focused tokens, potentially restricting trading venues and investor eligibility in certain jurisdictions

- Geographic Compliance: Different regional regulations regarding cultural tokens and content monetization could limit market access and adoption in key markets

ANIME Technical Risks

- Smart Contract Vulnerabilities: The token operates on both Ethereum and Arbitrum networks; smart contract bugs or exploits in the protocol could lead to fund loss or token devaluation

- Network Scalability: Depending on network congestion during peak usage periods, transaction costs and confirmation times may increase significantly, affecting trading and transfer efficiency

- Cross-chain Bridge Risks: Multi-chain deployment (ETH/Arbitrum) introduces bridge protocol risks; vulnerabilities in bridge contracts could result in locked or lost tokens during cross-chain transfers

VI. Conclusion and Action Recommendations

ANIME Investment Value Assessment

Animecoin represents a speculative investment in the emerging cultural token space, targeting the intersection of anime fan communities and decentralized economics. While the project vision of democratizing anime industry ownership is innovative, the token has experienced severe underperformance with a 96.10% decline over one year, trading near recent lows. The limited liquidity (2,475 holders, $301K daily volume) and extreme concentration create significant execution challenges. Investors should view ANIME as a high-risk, early-stage community token with uncertain fundamental value and regulatory clarity. The 55.39% market cap to FDV ratio suggests limited token circulation, which could create additional volatility as supply dynamics shift.

ANIME Investment Recommendations

✅ Beginners: Start with micro-allocations (0.5-1% of portfolio) through Gate.com's trading interface; treat as speculative exposure to anime community narratives rather than core holdings; prioritize education on cultural token mechanics before increasing position size

✅ Experienced Investors: Consider tactical swing trades during identified support/resistance levels ($0.005049-$0.005467 range); accumulate selectively during panic selling phases; maintain strict stop-loss discipline at -20% to -25% given historical volatility patterns

✅ Institutional Investors: Conduct comprehensive due diligence on tokenomics, community governance structure, and anime industry partnership roadmap before considering allocation; structure positions to avoid illiquidity events; engage with project team on regulatory compliance and intellectual property frameworks

ANIME Trading Participation Methods

- Direct Exchange Trading: Purchase ANIME on Gate.com using spot trading with BTC, ETH, or stablecoins; verify contract addresses on Arbitrum and Ethereum before confirming transactions

- Decentralized Liquidity Pools: Provide liquidity on decentralized platforms supporting ANIME trading pairs; earn transaction fees but accept impermanent loss risks if token price diverges significantly

- Community Participation: Engage directly with the Animecoin community through official channels (Website: https://www.anime.xyz/, Twitter: https://x.com/animecoin) to track project developments and governance initiatives

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance and consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

Will ANIME coin prices rise?

Yes, ANIME prices are expected to rise significantly. Long-term predictions suggest potential gains of 104.63% by 2030, reaching approximately $0.01338. Market fundamentals and adoption trends support bullish momentum for ANIME in the coming years.

What is the price prediction for ANIME in 2030?

Based on current market analysis, ANIME price prediction for 2030 ranges from $0.00002978 to $0.00005122. This forecast reflects potential market growth and adoption trends in the cryptocurrency sector.

Is ANIME coin a meme coin?

No, ANIME is not a meme coin. It focuses on the anime community and ecosystem rather than viral trends. Unlike Dogecoin or Shiba Inu, ANIME has a dedicated niche purpose within the anime industry.

2025 LUNC Price Prediction: Analyzing Terra Luna Classic's Potential Recovery and Market Outlook in the Post-Crash Era

2025 HTX Price Prediction: Analyzing Market Trends and Growth Potential for the Digital Asset Exchange Token

2025 HBAR Price Prediction: Will Hedera Hashgraph Reach New Heights in the Crypto Market?

2025 CFX Price Prediction: Analysis of Market Trends and Potential Growth Factors for Conflux Network

2025 LTCPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Litecoin

2025 SMARTPrice Prediction: Advanced AI-Driven Market Analytics for Investment Portfolio Optimization

Exploring Ethereum's Innovative Leadership in Technology

Understanding Why Cryptographic Hashing is Preferred for Password Security Over Encryption

2025 SCARCITY Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 NOS Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

2025 SAUCE Price Prediction: Expert Analysis and Market Outlook for the Leading Cryptocurrency Token