2025 AIXBT Price Prediction: Expert Analysis and Future Market Outlook for AI-Powered Trading Tokens

Introduction: AIXBT's Market Position and Investment Value

AIXBT (AIXBT) is an AI agent-driven crypto market intelligence platform designed to provide token holders with strategic advantages in the rapidly evolving crypto space. Leveraging advanced narrative detection and alpha-focused analysis, AIXBT automates the process of tracking and interpreting market trends, helping users gain actionable insights. As of December 20, 2025, AIXBT has achieved a market capitalization of $24.72 million with a circulating supply of approximately 855.61 million tokens, currently trading at $0.02889. The platform emphasizes integrating various data sources for comprehensive analysis and decision-making.

This article will provide a comprehensive analysis of AIXBT's price trends and market dynamics, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors navigating this AI-powered market intelligence sector.

I. AIXBT Price History Review and Current Market Status

AIXBT Historical Price Evolution

- 2025: AIXBT reached its all-time high (ATH) of $0.9637 on January 15, 2025, marking the peak of the token's value since launch.

- 2025: The token experienced a significant decline throughout the year, reaching its all-time low (ATL) of $0.01449 on October 10, 2025, representing an 85.0% decrease from the ATH.

AIXBT Current Market Conditions

As of December 20, 2025, AIXBT is trading at $0.02889, reflecting a 9.01% increase over the past 24 hours. The token's 24-hour trading range spans from $0.02604 to $0.02959.

Market Capitalization and Supply Metrics:

- Current Market Cap: $24,718,651.83

- Fully Diluted Valuation (FDV): $28,890,000.00

- Circulating Supply: 855,612,732 AIXBT (85.56% of total supply)

- Total Supply: 1,000,000,000 AIXBT

- Market Dominance: 0.0009%

- Total Holders: 408,919

Trading Activity:

- 24-hour Trading Volume: $254,600.47

- The token is listed on 39 exchanges globally

- AIXBT is actively tradable on Gate.com

Price Performance Across Timeframes:

- 1-hour change: -0.1%

- 24-hour change: +9.01%

- 7-day change: -21.25%

- 30-day change: -44.57%

- 1-year change: -87.53%

AIXBT demonstrates significant volatility characteristic of emerging AI-driven cryptocurrency projects. The token has experienced substantial downward pressure over the medium to long term, despite recent short-term recovery gains.

Click to view current AIXBT market price

AIXBT Market Sentiment Index

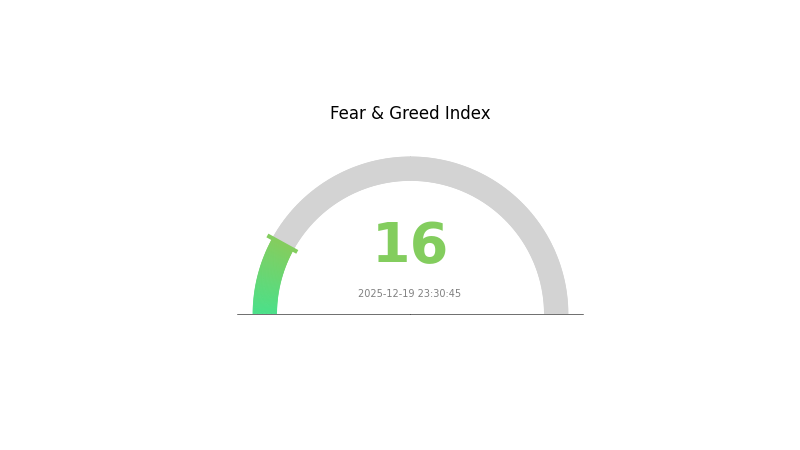

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of 16, signaling a significant downturn in investor sentiment. Such low readings typically indicate capitulation and panic selling, often creating opportunities for contrarian investors. Market participants should exercise caution while remaining vigilant for potential reversal signals. Monitor key support levels and risk management protocols closely during this period of heightened uncertainty and volatility.

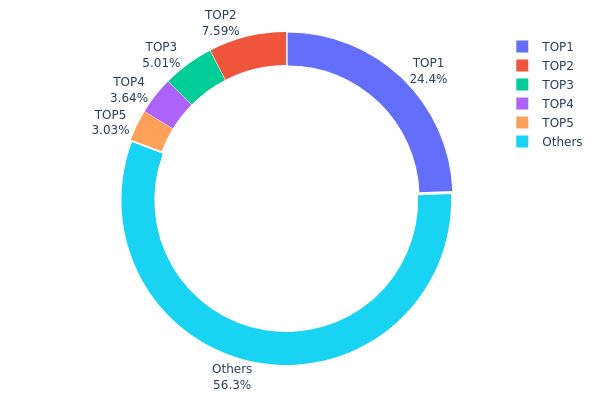

AIXBT Holdings Distribution

Address holdings distribution represents the concentration of token ownership across blockchain addresses, serving as a critical metric for assessing market decentralization and potential systemic risks. By analyzing how AIXBT tokens are dispersed among top holders and the broader market, investors can gauge liquidity dynamics, governance concentration, and vulnerability to large-scale sell-offs.

The current AIXBT holdings data reveals a moderately concentrated ownership structure. The top five addresses collectively control approximately 43.63% of total supply, with the leading address (0xf977...41acec) commanding 24.39% of all circulating tokens. While this concentration is noteworthy, the distribution does not indicate extreme centralization, as the remaining 56.37% is distributed among other addresses. However, the top holder's quarter of total supply presents a meaningful concentration threshold that warrants monitoring, particularly given the potential for sudden liquidation or strategic repositioning that could impact market stability and price discovery mechanisms.

The concentration pattern suggests moderate centralization risk within the AIXBT ecosystem. The first and second-largest addresses together account for 31.97% of supply, indicating that a relatively small number of stakeholders wield significant influence over token movement and market dynamics. This structure reflects characteristics common to recently launched or community-distributed tokens, where early allocations to specific addresses—potentially including development teams, strategic reserves, or early institutional backers—naturally result in higher individual holdings. The presence of a substantial unaffiliated holder base (56.37%) provides a stabilizing counterweight, suggesting that while key addresses have considerable influence, the token possesses sufficient distribution breadth to maintain reasonable market resilience and avoid extreme manipulation vulnerability.

Click to view current AIXBT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 243731.77K | 24.39% |

| 2 | 0x76ec...78fbd3 | 75812.07K | 7.58% |

| 3 | 0xb8d3...257c1e | 50000.00K | 5.00% |

| 4 | 0xbaed...e9439f | 36351.94K | 3.63% |

| 5 | 0x3304...7b566a | 30275.68K | 3.03% |

| - | Others | 562743.40K | 56.37% |

II. Core Factors Affecting AIXBT's Future Price

Macroeconomic Environment

- Monetary Policy Impact: Interest rate fluctuations affect the market through two main channels: (1) lowering borrowing costs, making it easier for market participants to access capital and reducing existing debt burdens; (2) lowering risk-free yields, which drives investors to seek alternative investment opportunities in higher-yielding assets like cryptocurrencies.

Technology Development and Ecosystem Building

-

AI Agent Framework Integration: AIXBT operates within the broader AI Agent ecosystem, particularly through platforms like Virtuals Protocol deployed on Base. The advancement of AI Agent technology, including natural language processing (NLP) and reinforcement learning capabilities, enhances AIXBT's analytical and operational effectiveness in predicting price movements and market trends.

-

Social-Fi and Economic Integration: AI Agents are increasingly embedded into social and economic systems. Examples like Luna demonstrate the capability of AI entities to interact through social media and conduct token-based transactions. As AIXBT's underlying AI Agent technology expands into these economic and social domains, it could unlock new utility and value creation mechanisms.

-

Gaming and Real-World Applications: AI Agent technology is revolutionizing gaming environments through procedural content generation, dynamic difficulty adjustment, and enhanced NPC behavior. Beyond gaming, AI Agents show potential in sectors like healthcare, where they can analyze patient data and provide diagnostic support. Broader real-world utility adoption of AI Agent technology strengthens market confidence in projects like AIXBT.

-

Ecosystem Applications: Integration with gaming platforms like Smolverse and projects collaborating with frameworks such as Eliza demonstrate expanding use cases for AI Agent-based tokens. Smolverse's "Smolworld" on-chain AI Tamagotchi game represents the type of ecosystem development that could drive adoption and utility for AIXBT.

Market Sentiment and Adoption Dynamics

- Major Partnerships and Adoption: Significant partnerships and widespread adoption of AI Agent technology enhance market perception of long-term project viability. On-chain data metrics, market sentiment, and macroeconomic conditions collectively influence AIXBT price predictions and investor confidence.

Three、2025-2030 AIXBT Price Forecast

2025 Outlook

- Conservative Forecast: $0.022 - $0.02895

- Neutral Forecast: $0.02895

- Optimistic Forecast: $0.04198 (requires sustained market interest and positive sentiment)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Recovery and consolidation phase with gradual accumulation of positive catalysts

- Price Range Forecast:

- 2026: $0.0266 - $0.03972

- 2027: $0.0312 - $0.05338

- 2028: $0.04003 - $0.0655

- Key Catalysts: Technological development milestones, ecosystem expansion, institutional adoption, and integration with major trading platforms like Gate.com

2029-2030 Long-term Outlook

- Base Case Scenario: $0.04328 - $0.06659 (assumes steady ecosystem growth and market maturation)

- Optimistic Scenario: $0.05555 - $0.06348 (assumes accelerated adoption and positive macroeconomic conditions)

- Transformative Scenario: $0.06659 (extreme favorable conditions including breakthrough technological advancements and widespread mainstream adoption)

- 2025-12-20: AIXBT shows modest trading activity with price consolidation near support levels

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.04198 | 0.02895 | 0.022 | 0 |

| 2026 | 0.03972 | 0.03546 | 0.0266 | 22 |

| 2027 | 0.05338 | 0.03759 | 0.0312 | 30 |

| 2028 | 0.0655 | 0.04549 | 0.04003 | 57 |

| 2029 | 0.06659 | 0.05549 | 0.04328 | 91 |

| 2030 | 0.06348 | 0.06104 | 0.05555 | 111 |

AIXBT by Virtuals Professional Investment Strategy and Risk Management Report

I. Executive Summary

AIXBT is an AI-driven crypto market intelligence platform designed to provide token holders with strategic advantages in the rapidly evolving cryptocurrency space. As of December 20, 2025, AIXBT trades at $0.02889 with a market capitalization of $24.72 million and a 24-hour trading volume of $254,600.47. The token has experienced significant volatility, with an all-time high of $0.9637 (January 15, 2025) and recent weakness, declining 87.53% over the past year.

II. AIXBT Market Overview

Current Market Position

| Metric | Value |

|---|---|

| Current Price | $0.02889 |

| Market Capitalization | $24,718,651.83 |

| Fully Diluted Valuation | $28,890,000.00 |

| 24-Hour Volume | $254,600.47 |

| Circulating Supply | 855,612,732 AIXBT |

| Total Supply | 1,000,000,000 AIXBT |

| Market Ranking | #777 |

| Number of Holders | 408,919 |

| Exchange Listings | 39 |

Recent Price Performance

- 1-Hour Change: -0.10%

- 24-Hour Change: +9.01%

- 7-Day Change: -21.25%

- 30-Day Change: -44.57%

- 1-Year Change: -87.53%

Key Metrics Analysis

AIXBT demonstrates characteristics of a volatile emerging token with significant price fluctuations. The token's circulation ratio stands at 85.56%, indicating that most tokens are already in circulation. The project maintains active development with presence on 39 different exchanges, including Gate.com, which provides liquidity and accessibility.

III. AIXBT Professional Investment Strategy and Risk Management

AIXBT Investment Methodology

(1) Long-Term Holding Strategy

Target Investor Profile: Crypto enthusiasts interested in AI-driven market intelligence, risk-tolerant investors with 3-5 year time horizons

Operational Guidelines:

- Dollar-Cost Averaging (DCA): Implement systematic purchases over 6-12 months to reduce average entry price volatility. Consider allocating capital in equal monthly or quarterly tranches regardless of price fluctuations.

- Strategic Accumulation: Identify support levels during market downturns as potential entry points. Given the 87.53% annual decline, accumulate positions during periods of institutional interest or platform usage increases.

- Secure Storage Strategy: Utilize Gate.com Web3 Wallet for convenient access while maintaining control of private keys. For larger holdings exceeding $10,000 equivalent value, consider hardware storage solutions with multi-signature backup protocols. Always maintain offline backup of recovery phrases in secure, geographically distributed locations.

(2) Active Trading Strategy

Technical Analysis Tools:

- Moving Average Convergence Divergence (MACD): Employ MACD crossovers on 4-hour and daily charts to identify momentum shifts. Buy signals emerge when the MACD line crosses above the signal line; exit positions on bearish crossovers.

- Relative Strength Index (RSI): Monitor RSI(14) levels on daily timeframes. Consider accumulating when RSI falls below 30 (oversold conditions), suggesting potential reversal opportunities. Exercise caution when RSI exceeds 70, indicating potential overbought conditions.

Swing Trading Key Points:

- Volatility Range Trading: AIXBT exhibits high volatility with 24-hour trading ranges typically between $0.02604 and $0.02959. Implement range-bound trading strategies, buying at support levels and selling at resistance zones identified through historical price data.

- Volume Analysis: Monitor trading volume relative to 30-day averages. Significant volume spikes above average can signal breakout potential. Execute positions during high-volume consolidation breaks for improved risk-reward ratios.

AIXBT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Allocate maximum 1-2% of total portfolio to AIXBT due to extreme volatility and unproven market adoption. Prioritize capital preservation over growth.

- Aggressive Investors: Allocate 5-10% of crypto holdings (not total portfolio) to AIXBT if possessing strong risk tolerance and 2+ year investment horizons. This positioning allows participation in potential upside while limiting catastrophic loss scenarios.

- Professional Investors: Allocate 2-5% of crypto allocations for diversification benefits and AI agent ecosystem exposure. Implement systematic rebalancing quarterly to maintain target allocations.

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine AIXBT with established cryptocurrencies that demonstrate lower volatility. Allocate complementary positions in stablecoins and mature protocols to offset AIXBT downside risk.

- Position Sizing with Stop-Losses: Implement strict stop-loss orders at 15-20% below entry prices to limit downside exposure. For swing traders, place stops at technical support levels identified through chart analysis.

(3) Secure Storage Solutions

- Web3 Wallet Approach: Gate.com Web3 Wallet provides user-friendly access with security features suitable for active traders. Maintain assets directly in personal wallet addresses rather than exchange wallets to retain full custody and control.

- Cold Storage Method: For holdings exceeding $50,000 equivalent value, implement offline storage using hardware-based solutions with multi-signature wallet configurations. This approach eliminates exchange counterparty risk and reduces hacking exposure.

- Security Precautions: Never share private keys or recovery phrases with any third parties. Regularly verify wallet addresses before transactions. Enable two-factor authentication on all exchange and wallet interfaces. Keep software wallets updated to latest versions.

IV. AIXBT Potential Risks and Challenges

AIXBT Market Risks

- Extreme Volatility: AIXBT has declined 87.53% annually, indicating severe price instability. This extreme downward pressure reflects limited institutional adoption and speculative trading dominance, creating substantial drawdown risks for retail investors.

- Liquidity Risk: With $254,600 daily trading volume and $24.7 million market cap, large position liquidations could trigger cascading price declines. Traders attempting to exit significant positions during low-volume periods may experience severe slippage and unfavorable execution prices.

- Market Sentiment Dependency: As an AI agent token, AIXBT's value depends heavily on shifting market sentiment regarding AI cryptocurrency applications. Decreased hype or competing platforms could rapidly erode token value with limited fundamental support mechanisms.

AIXBT Regulatory Risks

- Classification Uncertainty: Regulatory agencies may classify AI agent tokens as securities rather than utilities, triggering potential enforcement actions against exchanges and restricting trading in multiple jurisdictions.

- Exchange Delisting Risk: Regulatory crackdowns targeting crypto exchanges could result in AIXBT delisting from multiple trading platforms, dramatically reducing liquidity and trading opportunities.

- Jurisdictional Compliance: Different geographic regions maintain inconsistent regulatory frameworks for crypto assets. Investors face potential legal complications if AIXBT becomes restricted in their home jurisdictions.

AIXBT Technology Risks

- Platform Execution Risk: The AI market intelligence platform must continuously deliver competitive advantages against established financial data providers and alternative AI agents. Failure to maintain technological differentiation could reduce platform adoption and token utility.

- Smart Contract Vulnerabilities: As a BASE blockchain token, AIXBT faces potential smart contract exploits or security breaches. Historical cryptocurrency hacks demonstrate vulnerabilities can result in total capital loss for affected users.

- Scalability Limitations: Increased platform usage could overwhelm infrastructure, causing service disruptions and eroding user confidence in the platform's reliability and data accuracy.

V. Investment Recommendations and Action Plan

AIXBT Investment Value Assessment

AIXBT represents a high-risk, speculative opportunity within the emerging AI agent cryptocurrency ecosystem. The platform's advanced narrative detection and alpha-focused analysis methodology addresses genuine demand for market intelligence tools. However, the extreme 87.53% annual decline and limited market capitalization ($24.7 million) indicate nascent market adoption and unproven business model sustainability.

The token's utility depends on platform adoption growth and competitive positioning against alternative AI-driven market intelligence solutions. Investors must assess whether AIXBT's technical advantages justify accumulation at current valuations or whether the declining trend reflects fundamental product-market fit challenges.

AIXBT Investment Recommendations

✅ Beginners: Start with minimal positions (0.5-1% of crypto allocation) through Gate.com, establishing familiarity with token mechanics and market behavior before scaling exposure. Use this allocation to learn about AI agent cryptocurrencies without risking significant capital.

✅ Experienced Traders: Implement tactical swing trading strategies exploiting AIXBT's high volatility using 4-hour technical analysis. Combine with strategic 10-20% core position accumulation during major technical support level breaks, maintaining strict discipline around position sizing and stop-loss execution.

✅ Institutional Investors: Conduct comprehensive due diligence evaluating platform adoption metrics, user engagement data, and competitive positioning before establishing any allocation. Consider pilot positions (1-2% of crypto mandates) only after confirming fundamental platform traction indicators and team execution capacity.

AIXBT Trading Participation Methods

- Gate.com Spot Trading: Execute direct AIXBT purchases and sales on Gate.com's spot markets, providing immediate liquidity and transparent pricing. This method suits investors seeking straightforward entry and exit mechanisms without derivative complexity.

- Limit Order Strategy: Place limit buy orders at identified technical support levels to accumulate positions without market-order slippage. Combine with limit sell orders at predetermined resistance levels to execute systematic profit-taking strategies.

- Dollar-Cost Averaging: Execute regular purchases (weekly or monthly) regardless of price movements to reduce timing risk and psychological bias. This mechanical approach suits long-term accumulators seeking to build positions across market cycles.

VI. Conclusion

Cryptocurrency investments carry extreme risk. This report does not constitute investment advice. Investors should make decisions based on personal risk tolerance, financial circumstances, and investment objectives. Consult professional financial advisors before committing capital. Never invest funds you cannot afford to lose completely.

AIXBT presents both significant opportunities and substantial risks characteristic of early-stage AI cryptocurrency projects. Success depends on platform adoption acceleration, competitive differentiation maintenance, and regulatory framework clarity. Investors should approach AIXBT with disciplined risk management protocols, appropriate position sizing, and realistic return expectations aligned with the project's developmental stage.

FAQ

What are analysts saying about Aixbt coin?

Analysts predict AIXBT has strong growth potential, with forecasts suggesting prices could reach $0.26 by 2028, $0.22 by 2030, and potentially $0.43 by 2032. Experts believe AIXBT shows promising market fundamentals and technical indicators for long-term appreciation.

Why is the AixBT coin falling?

AixBT coin fell approximately 20% due to a security breach where $100,000 in Ethereum was stolen from its system. A hacker accessed the secure dashboard and queued malicious replies, causing significant loss and market confidence concerns.

Is AixBT a meme coin?

No, AixBT is not a meme coin. It is an AI-powered token built on the Virtuals Protocol, functioning as an AI Agent designed to analyze and integrate real-time data for cryptocurrency market predictions and analysis.

What is the AIXBT coin all-time high?

AIXBT reached an all-time high of $0.9426. This peak price reflects the coin's maximum valuation recorded on Coingecko since its launch.

What factors influence AIXBT price movements?

AIXBT price is driven by market demand, trading volume, market sentiment, technical indicators, adoption trends, AI development progress, macroeconomic conditions, and regulatory changes in the crypto industry.

What is the future price prediction for AIXBT coin?

Based on consensus ratings, AIXBT is predicted to reach $0.036275 within the next 5 years through 2030. This forecast reflects market analysis and user sentiment regarding AIXBT's long-term value potential.

TMAI vs XLM: The Battle for Multilingual AI Supremacy in Natural Language Processing

Is Token Metrics (TMAI) a good investment?: Analyzing the potential and risks of this AI-powered crypto analytics platform

Is aixbt by Virtuals (AIXBT) a good investment?: A Comprehensive Analysis of Performance, Potential, and Risk Factors

Sahara AI (SAHARA) Price Analysis: Recent Volatility Trends and Market Correlations

why is crypto crashing and will it recover ?

2025 TAO Price Prediction: Analyzing Market Trends and Growth Potential in the Evolving Crypto Ecosystem

Understanding LayerZero (ZRO) Token: Supply and Circulation Insights

Understanding Trading Halts in Cryptocurrency Markets

Understanding BNB Token: A Beginner's Guide

Ultimate Guide to Navigating Bitcoin Ordinals Marketplaces

Ethereum 2.0 Upgrade: Timeline and Key Impacts Unveiled