2025 AIOT Price Prediction: Expert Analysis and Market Forecast for AI-Powered IoT Devices

Introduction: AIOT's Market Position and Investment Value

OKZOO (AIOT) stands as the world's first urban-scale decentralized environmental data network powered by advanced AIoT machines. Since its launch in August 2025, the project has rapidly established itself as an innovative player in the emerging AIoT sector. As of December 2025, AIOT has achieved a market capitalization of $127.38 million with a circulating supply of 111.2 million tokens, currently trading at $0.12738 per token. This cutting-edge infrastructure project is playing an increasingly critical role in building decentralized environmental monitoring systems across urban environments worldwide.

This article provides a comprehensive analysis of AIOT's price trajectory throughout 2025-2030, integrating historical performance patterns, market supply-and-demand dynamics, ecosystem development milestones, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for market participants.

AIOT Price Analysis Report

I. AIOT Price History Review and Current Market Status

AIOT Historical Price Evolution Trajectory

The AIOT token has experienced significant volatility since its launch on December 21, 2024. The token reached its all-time high (ATH) of $1.85 on September 6, 2025, representing a peak valuation period. Subsequently, the token declined to its all-time low (ATL) of $0.01 on August 30, 2025, marking a substantial market correction.

From its inception to the current trading period, AIOT has demonstrated the typical characteristics of emerging cryptocurrency projects, with considerable price swings reflecting market sentiment shifts and adoption cycles.

AIOT Current Market Status

As of December 21, 2025, AIOT is trading at $0.12738, with a 24-hour trading volume of $110,130.14. The token has experienced a modest decline of -0.29% over the past 24 hours, while showing more pronounced weakness over longer timeframes:

- 1-hour change: -0.01%

- 24-hour change: -0.29%

- 7-day change: -53.99%

- 30-day change: -69.57%

- 1-year change: +26.59%

The token maintains a total market capitalization of $127,380,000 with a fully diluted valuation (FDV) of $127,380,000. Currently, 111,200,000 AIOT tokens are in circulation out of a total supply of 1,000,000,000, representing an 11.12% circulation ratio. The project has accumulated 638,622 token holders across 10 exchanges.

AIOT ranks 1,004 by market capitalization with a market dominance of 0.0039%. The token is currently trading within a 24-hour range of $0.1207 to $0.1309, indicating moderate price volatility.

Click to view current AIOT market price

AIOT Market Sentiment Indicator

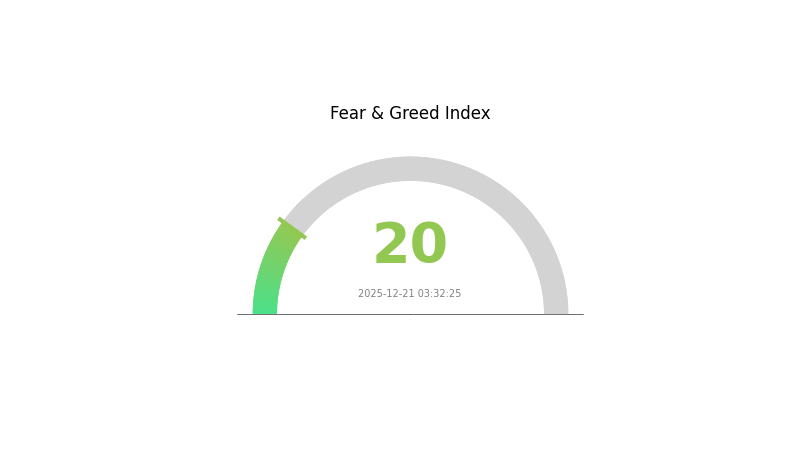

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The AIOT market is currently experiencing extreme fear, with the Fear and Greed Index reaching 20. This exceptionally low reading reflects severe market pessimism and panic sentiment among investors. When fear reaches such extreme levels, it often signals potential buying opportunities for contrarian investors, as markets typically recover after panic-driven selloffs. However, caution is advised as further volatility may persist. Monitor key support levels closely and consider dollar-cost averaging strategies during this period of heightened uncertainty on Gate.com.

AIOT Holdings Distribution

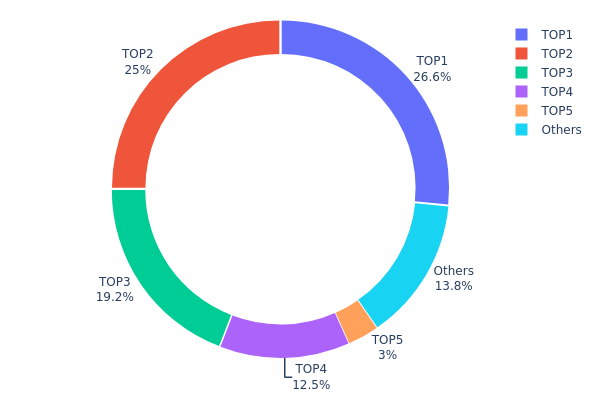

The address holdings distribution chart illustrates the concentration of AIOT tokens across different wallet addresses on the blockchain. By analyzing the top holders and their respective percentages of total supply, this metric reveals the degree of decentralization and potential concentration risks within the token ecosystem. It serves as a critical indicator for assessing market structure stability and identifying potential vulnerabilities to price manipulation or sudden liquidity events.

The current AIOT holdings distribution exhibits significant concentration among top holders. The top four addresses collectively control approximately 83.24% of the circulating supply, with the leading address alone holding 26.59%. The second-largest holder maintains a substantial 25% stake, while the third and fourth positions account for 19.15% and 12.50% respectively. This distribution pattern indicates a moderately concentrated token structure, where decision-making power and market influence are disproportionately held by a limited number of addresses. The remaining addresses outside the top five collectively account for only 16.76% of holdings, with the dispersed "Others" category representing 13.76%.

Such concentration levels present notable implications for market dynamics. The substantial holdings by top addresses create potential risks for price volatility, as coordinated movements by these major stakeholders could trigger significant market fluctuations. Additionally, the concentration may constrain liquidity depth during periods of heightened trading activity. However, the presence of relatively distributed holdings among the top four addresses suggests that no single entity maintains absolute control, which provides some degree of checks against unilateral market manipulation. The token's decentralization profile indicates moderate risk from a governance perspective, requiring continued monitoring of these major holders' activities and intentions.

Click to view current AIOT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x71db...c5eb0c | 265916.67K | 26.59% |

| 2 | 0x48a5...9bba8a | 250000.00K | 25.00% |

| 3 | 0xa8c9...d5d526 | 191566.67K | 19.15% |

| 4 | 0xdfc5...f7851c | 125000.00K | 12.50% |

| 5 | 0x9528...f01466 | 30000.00K | 3.00% |

| - | Others | 137516.67K | 13.76% |

II. Core Factors Influencing AIOT's Future Price

Supply Mechanism

-

Component Cost Reduction: Sensor costs, data processing costs, and broadband costs continue to show declining trends. As AI technology advances and IoT adoption scales, upstream component pricing follows a "volume increase, price decrease" pattern, which positively impacts downstream application market expansion.

-

Historical Pattern: Over the past 20+ years, IoT development has been constrained by technology and cost factors, limiting large-scale adoption. However, as AIoT emerges—combining AI with IoT—the industry is entering a pre-explosion phase with significantly improved cost economics driving market penetration.

-

Current Impact: With sensor costs continuing to decline and transmission infrastructure maturing through 5G deployment, the supply-side economics increasingly favor downstream applications and end-user adoption, supporting sustainable price appreciation in the AIoT service ecosystem.

Institutional and Major Player Dynamics

-

Enterprise Adoption: Major companies are actively implementing AIoT solutions. Amazon Go stores deployed AIoT-powered cashierless checkout systems in 2023, revolutionizing retail operations. Hitachi Ltd. accelerated its global construction business expansion in 2022 using industrial robotics integrated with AIoT systems. Other key players include Dahua Technology (video surveillance solutions), WiseKey International (generative AI integration), and Aspen Technology Inc. (industrial data platforms).

-

Government Policy Support: China established comprehensive policy frameworks starting in 2013, including the 2017 New Generation Artificial Intelligence Development Plan targeting core industry scale exceeding 1 trillion yuan by 2023. The Ministry of Industry and Information Technology issued the 2018-2020 Artificial Intelligence Industry Action Plan, promoting AI and IoT integration with real economy. Additional policies address intelligent connected vehicles, cybersecurity standards, cloud computing adoption, and industrial internet development through 2025.

Macroeconomic Environment

-

Policy-Driven Growth: Government initiatives substantially drive AIOT market expansion. With China classified as the world's largest M2M market, cellular IoT terminal users reached 1.08 billion by October 2020 (growth of 13.9% YoY), with applications in smart manufacturing (19.4% share), smart transportation (19%), and smart public services (22.7%).

-

Inflation Hedge Characteristics: AIOT solutions provide long-term cost reduction through automation and efficiency gains. Decreasing hardware costs combined with rising labor expenses make intelligent automation increasingly attractive during inflationary periods, supporting continued market value growth.

-

Technology-Driven Cost Dynamics: While human labor costs remain elevated, technology improvements create favorable supply-demand dynamics. The narrowing gap between IoT connection growth and revenue growth indicates improving monetization, with carriers shifting evaluation metrics from connection volume to actual revenue and activation, signaling stronger commercial viability.

Technology Development and Ecosystem Building

-

5G Infrastructure Deployment: 5G technology provides high data rates, reduced latency, energy efficiency, and enhanced system capacity for massive device connectivity. Since June 2019, when China's Ministry of Industry and Information Technology issued 5G commercial licenses, deployment has accelerated. 5G base station additions reached significant scale between 2019-2024, supporting expanded AIoT network capabilities and data transmission speeds while reducing connectivity costs.

-

AI Algorithm Advancement: Continuous improvements in neural network optimization, image recognition, and speech recognition enhance AI efficiency. Large-scale data availability from IoT devices combined with improved computing power enables more sophisticated pattern analysis, anomaly detection, and real-time recommendations, driving higher-value applications.

-

Ecosystem Applications: The AIoT industry chain spans hardware/terminals (25% value share), communication services (10%), platform services (10%), and software/system integration/value-added services (55%). Downstream VR/AR applications show strong momentum with predicted compound annual growth rate of 66.78% (2019-2023). Intelligent connected vehicles are projected to reach 72.2 million units globally by 2023 with 9.3% annual growth. Key applications include video surveillance, predictive maintenance, asset management, inventory management, energy consumption optimization, and supply chain management across healthcare, manufacturing, retail, transportation, and logistics sectors.

III. 2025-2030 AIOT Price Forecast

2025 Outlook

- Conservative Forecast: $0.0755–$0.1280

- Neutral Forecast: $0.1279 (average expected level)

- Bullish Forecast: $0.1433 (requires sustained ecosystem adoption and positive market sentiment)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Consolidation with gradual upward trajectory as AIOT ecosystem matures and institutional adoption increases.

- Price Range Forecast:

- 2026: $0.1152–$0.1410 (6% potential upside)

- 2027: $0.1051–$0.1494 (8% potential upside)

- 2028: $0.1107–$0.1654 (12% potential upside)

- Key Catalysts: Expansion of AI-IoT integration use cases, strategic partnerships with major technology platforms, regulatory clarity in key markets, and growing demand from enterprise clients seeking decentralized IoT solutions via Gate.com and other platforms.

2029-2030 Long-term Outlook

- Base Case: $0.1020–$0.1871 with average price around $0.1546 by 2029 (assuming steady adoption curve and moderate market expansion)

- Optimistic Case: $0.1528–$0.1845 by 2030 (assuming accelerated enterprise adoption and breakthrough technological milestones)

- Transformative Case: $0.1845+ (assuming AIOT becomes critical infrastructure in IoT ecosystems, with mainstream institutional participation and global regulatory approval)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.14325 | 0.1279 | 0.07546 | 0 |

| 2026 | 0.141 | 0.13557 | 0.11524 | 6 |

| 2027 | 0.14935 | 0.13829 | 0.1051 | 8 |

| 2028 | 0.16539 | 0.14382 | 0.11074 | 12 |

| 2029 | 0.18707 | 0.1546 | 0.10204 | 21 |

| 2030 | 0.1845 | 0.17084 | 0.09738 | 34 |

OKZOO (AIOT) Professional Investment Strategy and Risk Management Report

IV. AIOT Professional Investment Strategy and Risk Management

AIOT Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Environmental data network enthusiasts, AIoT technology believers, and long-term crypto portfolio holders

-

Operational Recommendations:

- Accumulate during market downturns, particularly when the asset shows significant weakness (AIOT has declined 53.99% in 7 days and 69.57% in 30 days, presenting potential buying opportunities for patient investors)

- Dollar-cost averaging (DCA) approach to reduce timing risk and build positions systematically over 6-12 months

- Monitor project milestones and ecosystem development to validate the long-term thesis of urban-scale decentralized environmental data networks

-

Storage Solutions:

- Use Gate.com Web3 Wallet for secure self-custody of AIOT tokens

- Enable two-factor authentication (2FA) and withdrawal whitelisting for enhanced security

- Consider hardware backup methods for long-term holding positions

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Support and Resistance Levels: Use recent trading range ($0.1207 - $0.1309 in 24h) to identify entry and exit points for swing trading opportunities

- Moving Averages: Apply 20-day and 50-day moving averages to identify trend direction given the extreme volatility (all-time high of $1.85 versus current price of $0.12738)

-

Swing Trading Key Points:

- Capitalize on mean reversion opportunities during periods of extreme decline, as the 7-day and 30-day losses suggest potential oversold conditions

- Monitor trading volume trends (current 24h volume: $110,130.14) to identify breakout opportunities

- Set strict stop-loss orders at 5-7% below entry points to manage downside risk in this highly volatile asset

AIOT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5% - 1% of total crypto portfolio (AIOT is rank 1004 and represents high-risk speculative exposure)

- Active Investors: 2% - 3% of crypto allocation (suitable for those with moderate risk tolerance and research capacity)

- Professional Investors: 3% - 5% of diversified crypto holdings (with dedicated risk monitoring and hedging strategies)

(2) Risk Hedging Solutions

- Stablecoin Reserves: Maintain 40-50% of intended position in USDT or USDC reserves on Gate.com to quickly capitalize on 20%+ price drops

- Profit-Taking Strategy: Establish predetermined price targets to lock in gains during upside volatility (e.g., take profits at $0.20, $0.35, and $0.50)

(3) Secure Storage Solutions

- Gate.com Web3 Wallet Recommendation: Provides direct custody with built-in security features, transaction history tracking, and seamless trading integration

- Custody Options: For larger holdings (>$50,000 equivalent), consider splitting between Gate.com Web3 Wallet for active management and offline storage for cold backup

- Security Considerations:

- Never share private keys or seed phrases

- Verify all transaction addresses before confirming transfers

- Use Gate.com's withdrawal address whitelist feature to prevent unauthorized transfers

- Enable email confirmations for all security-sensitive account changes

V. AIOT Potential Risks and Challenges

AIOT Market Risks

- Extreme Volatility: AIOT has experienced a 99.37% decline from all-time high ($1.85) to current price ($0.12738), representing massive drawdown risk for investors who entered at peak prices

- Low Liquidity: With 24-hour trading volume of only $110,130.14 and market cap of $14,164,656, the asset faces significant liquidity constraints that could amplify price swings during larger trades

- Market Concentration: Only 11.12% of total supply is in circulation (111.2M of 1B tokens), meaning future token unlocks could create selling pressure and dilution risk

AIOT Regulatory Risks

- Environmental Data Classification Uncertainty: Regulatory bodies have not yet clearly defined the legal status of decentralized environmental data networks, creating potential compliance uncertainties

- Regional Restrictions: Different jurisdictions may impose varying restrictions on AIoT-based tokens and data collection mechanisms

- Data Privacy Regulations: Decentralized environmental data collection may face challenges under GDPR, CCPA, and similar privacy frameworks that regulate sensor data handling

AIOT Technology Risks

- Mainnet Execution Risk: As an urban-scale network project, AIOT faces technical challenges in scaling the AIoT device infrastructure across multiple city deployments

- Hardware Dependencies: The project's success depends on reliable performance of distributed AIoT devices, which introduces hardware failure and maintenance risks

- Data Integrity Challenges: Ensuring accurate and tamper-proof environmental data from decentralized sensors requires robust consensus and verification mechanisms that may face technical limitations

VI. Conclusions and Action Recommendations

AIOT Investment Value Assessment

AIOT represents a speculative play on the emerging intersection of environmental monitoring and blockchain technology. While the concept of urban-scale decentralized environmental data networks addresses real-world needs for transparent air quality and climate monitoring, the project faces significant execution risks. The extreme price volatility (from $1.85 ATH to $0.12738 current), combined with steep recent losses (69.57% in 30 days), suggests market participants have significant concerns about near-term viability. The project shows potential for long-term value creation if it successfully deploys functional AIoT networks across major cities, but investors should treat this as a high-risk, speculative position rather than a stable allocation.

AIOT Investment Recommendations

✅ Beginners: Start with minimal exposure (0.25% - 0.5% of crypto portfolio) through Gate.com after thorough research of the project's urban deployment roadmap. Use dollar-cost averaging over 3-6 months rather than lump-sum purchases.

✅ Experienced Investors: Consider 2% - 3% allocation with active position management. Employ technical analysis to identify oversold conditions during market crashes, and establish clear profit-taking targets at 50%, 100%, and 150% gains.

✅ Institutional Investors: Conduct deep due diligence on the project team's AIoT deployment capabilities and urban partnerships before considering 3% - 5% allocation. Require quarterly updates on network expansion, sensor deployments, and data quality metrics.

AIOT Trading Participation Methods

- Spot Trading on Gate.com: Purchase AIOT directly using USDT or stablecoins for long-term holding positions. Gate.com provides real-time price discovery and secure custody options.

- Limit Orders Strategy: Set automated buy orders 20-30% below current price levels to accumulate during market capitulation and panic selling.

- Periodic Portfolio Rebalancing: Review AIOT holdings quarterly and reallocate profits to stable assets if the position exceeds 3% of total crypto portfolio value.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial circumstances. Strongly recommended to consult with professional financial advisors before investing. Never invest more capital than you can afford to lose completely.

FAQ

Is AIOT stock a buy?

Yes, AIOT is recommended as a buy. The project demonstrates strong fundamentals with high-margin SaaS model, 80% recurring revenue, and projected EBITDA margin expansion to 26% by 2027, indicating solid growth potential ahead.

Which AI is best for stock price prediction?

The best AI for stock price prediction combines DDG-DA with TFT hybrid models for superior adaptability and accuracy. HIST and ADARNN also demonstrate strong performance in handling dynamic market conditions and concept drift.

What are analysts' ratings for AIOT?

Analysts rate AIOT with a consensus score of 84.6 out of 100, indicating a generally positive outlook and strong analyst support for the asset.

Is Shieldeum (SDM) a good investment?: Analyzing the potential and risks of this emerging cryptocurrency

Is Clore.ai (CLORE) a good investment?: Analyzing the Potential and Risks of this Emerging AI Token

Is PinGo (PINGO) a good investment?: Analyzing the Potential and Risks of this Emerging Cryptocurrency

2025 PINGO Price Prediction: Analyzing Potential Growth and Market Trends for the Emerging Cryptocurrency

2025 AIOT Price Prediction: Expert Analysis and Market Trends for the Next Generation of Connected Devices

Is Bless (BLESS) a good investment? Comprehensive Analysis of Features, Risks, and Market Potential

Exploring Stablecoin and Bitcoin: Essential Differences and Choosing the Right Option for You

What is XTTA: A Comprehensive Guide to Understanding Cross-Territory Trade Authentication

What is TOKE: A Comprehensive Guide to Understanding the Digital Token Revolution

What is ARIAIP: A Comprehensive Guide to Accessibility and AI-Powered Interactive Protocols

What is FTRB: A Comprehensive Guide to Fixed-Time Reverse Breakout Trading Strategy